Visitor Management System Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434508 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Visitor Management System Software Market Size

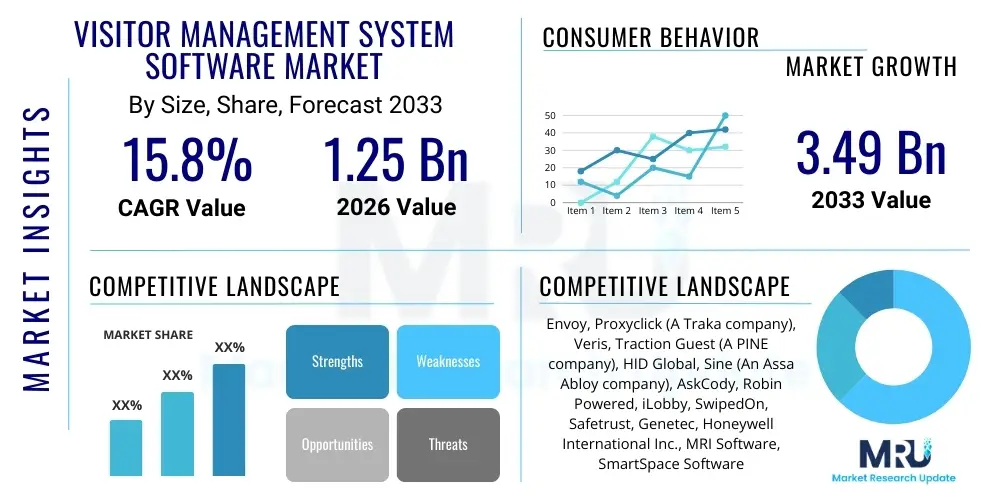

The Visitor Management System Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 3.49 Billion by the end of the forecast period in 2033.

Visitor Management System Software Market introduction

The Visitor Management System (VMS) Software Market encompasses solutions designed to automate, streamline, and secure the process of tracking, registering, and managing visitors entering an organization's premises. These sophisticated systems replace outdated paper logbooks with digital platforms, offering enhanced security, compliance adherence, and operational efficiency. VMS solutions are critical for maintaining a secure environment by accurately recording visitor details, including identification verification, purpose of visit, and tracking their whereabouts while on site, thereby significantly minimizing security risks and enhancing overall accountability across various sectors globally. The scope of VMS has expanded beyond simple check-in to include pre-registration, automated notifications, badge printing, and integration with access control systems.

Major applications of VMS software span across corporate offices, government buildings, educational institutions, healthcare facilities, and manufacturing plants, where the need for stringent access control and compliance monitoring is paramount. Key benefits of implementing these systems include improved visitor experience through faster check-in times, enhanced data accuracy, adherence to regulatory requirements like GDPR or HIPAA regarding visitor data privacy, and the ability to quickly retrieve records during audits or emergency situations. Furthermore, the centralization of visitor data provides valuable insights into facility usage patterns, supporting better resource allocation and security planning across complex organizational structures.

The market is primarily driven by escalating security threats, stringent regulatory compliance mandates globally, and the growing corporate focus on optimizing internal administrative processes. The transition from manual, error-prone processes to automated, touchless, and integrated digital solutions is a fundamental driver. Furthermore, the increasing adoption of cloud-based VMS platforms offers scalability and reduced infrastructure costs, making these solutions accessible to Small and Medium-sized Enterprises (SMEs), which were previously reliant on basic manual logging methods. The integration of advanced technologies like mobile check-in, QR codes, and facial recognition further accelerates market penetration across diverse end-user industries.

Visitor Management System Software Market Executive Summary

The Visitor Management System Software market is experiencing significant growth, primarily fueled by global mandates for workplace safety and digitalization efforts across corporate and industrial sectors. Business trends indicate a strong shift towards cloud-deployed, subscription-based VMS models, offering enhanced scalability and seamless integration with existing Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems. Security remains the paramount concern, driving demand for solutions offering robust identity verification and real-time tracking capabilities, leading vendors to prioritize comprehensive, integrated security ecosystems rather than standalone visitor management tools. Furthermore, the post-pandemic environment has solidified the necessity for contactless and automated check-in procedures, accelerating the adoption of mobile-centric solutions and self-service kiosks.

Regionally, North America maintains the dominant market share due to the early adoption of advanced security technologies, the presence of major VMS vendors, and highly rigorous regulatory landscapes concerning data privacy and facility access. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), driven by rapid industrialization, burgeoning commercial infrastructure development, and increased foreign investments necessitating advanced security protocols in emerging economies like India, China, and Southeast Asian nations. Europe follows a steady growth trajectory, strongly influenced by compliance demands such as the General Data Protection Regulation (GDPR), which necessitates VMS systems with sophisticated data handling and privacy features.

Segmentation trends highlight the dominance of the Cloud segment due to its operational flexibility and lower total cost of ownership (TCO), particularly appealing to SMEs. Conversely, on-premise solutions retain a strong foothold in highly regulated or sensitive environments, such as defense contractors and large financial institutions, where data residency and maximum security control are non-negotiable. By end-user, the Corporate Sector remains the largest consumer, but the Education and Healthcare sectors are exhibiting exponential growth as they implement VMS to manage complex access permissions for students, patients, staff, and external visitors while ensuring compliance with stringent safety and privacy regulations.

AI Impact Analysis on Visitor Management System Software Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) into VMS systems center around enhanced security verification accuracy, the transition to frictionless and touchless entry experiences, and the ethical implications surrounding facial recognition and biometric data storage. Users frequently ask how AI can detect and flag high-risk visitors in real-time, how machine learning (ML) improves the efficiency of pre-registration processes by analyzing access patterns, and what measures are in place to ensure compliance with biometric data privacy laws (e.g., BIPA, GDPR). The overall expectation is that AI will move VMS from a passive logging tool to an active, predictive security component, requiring vendors to clearly communicate data governance protocols and demonstrate measurable improvements in speed, accuracy, and threat detection capabilities.

- Enhanced biometric verification accuracy, leading to reduced false positives and improved security integrity.

- Real-time anomaly detection and risk assessment, flagging suspicious visitor behavior or unusual access attempts.

- Predictive visitor flow management, optimizing resource allocation based on historical data and anticipated traffic volume.

- Automated and touchless check-in processes leveraging facial recognition and voice authentication for seamless entry.

- Machine Learning (ML) optimization of compliance reporting, automatically generating necessary audit trails tailored to specific regulatory requirements.

- Improved personalization of visitor experience, such as dynamic wayfinding and customized host notifications.

DRO & Impact Forces Of Visitor Management System Software Market

The Visitor Management System Software market is principally propelled by the global imperative to enhance physical security and meet increasingly rigorous compliance standards, balanced by adoption challenges related to integration complexity and initial deployment costs. Major drivers include the necessity for audit trails and contact tracing, heightened awareness of corporate espionage risks, and the shift towards sophisticated digital workplaces. Restraints primarily involve concerns over the privacy and security of collected biometric and personal data, particularly in regions with strong regulatory bodies, alongside technical hurdles associated with integrating new VMS platforms with legacy security infrastructure. Opportunities are abundant in the rapid expansion into specialized verticals like industrial manufacturing and logistics, alongside the development of fully integrated, end-to-end access control ecosystems incorporating AI-driven predictive capabilities.

A primary driver for market acceleration is the global rise in security consciousness following geopolitical tensions and increased workplace violence incidents, compelling organizations to implement robust security layers at the entry point. VMS systems serve as the critical first layer of defense, providing verifiable identity confirmation and establishing a secure chain of custody for every visitor. Furthermore, the mandatory requirements for data transparency and compliance, such as the need to demonstrate adherence to specific industry standards (e.g., C-TPAT for logistics, PCI DSS for finance), necessitates automated, tamper-proof record-keeping capabilities that paper systems cannot provide, solidifying VMS as an essential operational investment rather than a luxury security feature.

However, the market faces significant restraints, chiefly concerning data privacy and the integration challenge. The collection of personally identifiable information (PII) and, increasingly, biometric data, exposes organizations to significant legal risk if data breaches occur or if regulatory requirements, such as GDPR or CCPA, are violated. This concern often leads to cautious procurement cycles and preference for on-premise solutions among data-sensitive organizations. Moreover, the integration of modern VMS solutions with disparate legacy systems—including older access control hardware, physical security information management (PSIM) platforms, and existing HR databases—presents substantial technical complexity and high upfront implementation costs, particularly for large enterprises undergoing digital transformation.

The market impact forces are overwhelmingly positive, driven by the expanding scope of VMS application. Opportunities lie in expanding functionalities beyond basic check-in, such as integrating health screening questionnaires, managing contractor compliance documentation (insurance, certifications), and providing sophisticated analytics on facility usage to improve operational efficiency. The growing trend of mobile workforce management and flexible office structures (hybrid work models) necessitates dynamic, scalable VMS platforms that can securely manage varying levels of access permissions for both internal and external users, positioning vendors who offer highly adaptable, cloud-native architectures at a competitive advantage.

Segmentation Analysis

The Visitor Management System Software Market is segmented based on deployment model, organization size, component, and end-user vertical. This structure allows for granular analysis of demand drivers across different operational contexts. The deployment segmentation highlights the foundational shift towards flexible cloud services, while the component breakdown distinguishes between core software features and necessary hardware integrations like kiosks and badge printers. Analysis by organization size reveals diverging needs between large enterprises requiring highly customized, integrated solutions and SMEs prioritizing rapid deployment and cost-effectiveness. The end-user analysis provides critical insights into which verticals are experiencing the most aggressive adoption rates due to specific regulatory or operational requirements.

In terms of deployment, the market is currently dominated by the Cloud-based segment, which offers unparalleled flexibility, scalability, and ease of maintenance, making it highly attractive for multi-site organizations and those adopting a decentralized IT infrastructure model. Cloud deployment minimizes the need for extensive capital expenditure on servers and IT support, relying instead on predictable operational expenditures (OpEx) through subscription fees. Conversely, the On-Premise segment, while requiring higher initial investment and dedicated internal IT management, remains crucial for sectors that handle extremely sensitive data, such as government, defense, and high-security finance, where control over data residency and strict network isolation are mandatory security protocols, ensuring maximum data sovereignty.

Examining the End-User vertical provides crucial insight into specialized market growth. The Corporate sector, encompassing technology firms and large office parks, accounts for the largest market share, driven by the high volume of daily visitors, contractors, and job applicants requiring structured access. However, the Healthcare and Education segments are experiencing the fastest growth rates. Healthcare facilities require robust VMS for patient privacy (HIPAA compliance), managing contractor access to sensitive areas, and handling high volumes of family and service providers. Similarly, educational institutions use VMS to enhance campus security, track student sign-ins/outs, and manage parental and vendor visits efficiently, often integrating with existing student information systems to create a unified security layer.

- By Deployment Model:

- Cloud-based

- On-premise

- By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Component:

- Software

- Hardware (Kiosks, Badge Printers, Scanners)

- Services (Installation, Support, Maintenance)

- By End-User Vertical:

- Corporate

- Healthcare

- Education

- Government and Defense

- Manufacturing and Industrial

- Retail and Real Estate

Value Chain Analysis For Visitor Management System Software Market

The value chain for the VMS software market begins with upstream activities focused on core software development, technological innovation (AI/ML algorithms, biometrics), and strategic partnerships for integration capabilities. Key players in this stage are software developers who invest heavily in R&D to enhance features such as touchless sign-in, compliance reporting modules, and API integrations. The midstream involves platform hosting and distribution, where cloud service providers (AWS, Azure) play a crucial role, alongside specialized distributors and resellers who tailor generic VMS solutions to specific vertical requirements and manage the sales lifecycle, often providing localized support and consultation to end-users on deployment.

Downstream activities center on implementation, post-sales support, and maintenance services, which are critical for customer retention and overall system performance. Implementation often involves integrating the VMS with existing physical security systems (e.g., turnstiles, CCTV, access control) and IT infrastructure (HR databases). Distribution channels are bifurcated into direct sales, primarily used for large enterprise contracts requiring customized solutions and intensive relationship management, and indirect channels, utilizing certified value-added resellers (VARs) and system integrators (SIs). The indirect channel is particularly effective for reaching SMEs and geographically dispersed markets, as VARs provide essential on-the-ground support and expertise, ensuring proper installation of both software and associated hardware components like dedicated check-in kiosks and identity scanners.

The efficiency of the value chain is increasingly reliant on strong cybersecurity provisions throughout the development and deployment phases, given the sensitive nature of the data handled. Vendors must ensure their software is robust against penetration attempts and that data transmission and storage comply with international privacy standards. Optimization of the value chain focuses on reducing the complexity and cost of integration, enabling faster time-to-value for the end-user. This is achieved through modular software design and the proactive development of standardized APIs that facilitate easy connectivity with a broader ecosystem of security and operational software.

Visitor Management System Software Market Potential Customers

Potential customers for Visitor Management System Software are fundamentally any organization, regardless of size or sector, that operates a physical premises requiring controlled and secure access for non-employees. The primary buyers are typically decision-makers within security, facilities management, IT administration, and human resources departments. Large enterprises, including Fortune 500 corporations, represent the most lucrative segment due to their high visitor volume, complex security protocols, and strict regulatory auditing requirements, often requiring tailored, highly scalable, and integrated VMS solutions deployed across multiple global sites.

Secondary high-growth customer segments include highly regulated industries such as healthcare and finance. Hospitals and clinics require VMS to manage visitor flow while protecting patient confidentiality (HIPAA). Financial institutions, including major banks and insurance companies, utilize VMS to meet stringent anti-money laundering and know-your-customer (KYC) requirements by securely logging all external access. Additionally, the increasing need for enhanced safety in educational environments—ranging from K-12 schools to large university campuses—positions them as high-priority potential customers, seeking systems that integrate emergency notification and real-time location tracking capabilities to ensure student and faculty safety.

Furthermore, manufacturing and industrial facilities, particularly those involved in sensitive R&D or handling proprietary information, are rapidly adopting VMS to manage third-party contractors, suppliers, and auditors, ensuring strict adherence to industrial safety standards and protecting intellectual property. The shift toward modernizing commercial real estate (CRE) assets also drives demand, with property management companies implementing unified VMS solutions across multi-tenant buildings to provide tenants with professional, secure, and centralized visitor services, thereby enhancing property value and operational efficiency. The universality of security needs ensures a continuously expanding customer base across all global regions and sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 3.49 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Envoy, Proxyclick (A Traka company), Veris, Traction Guest (A PINE company), HID Global, Sine (An Assa Abloy company), AskCody, Robin Powered, iLobby, SwipedOn, Safetrust, Genetec, Honeywell International Inc., MRI Software, SmartSpace Software Plc, Passage Technology, AlertEnterprise, Splan, Ezy Signin, Vizito. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Visitor Management System Software Market Key Technology Landscape

The technological evolution of the VMS market is centered on automation, integration, and enhanced security via touchless interactions. A primary technological focus is the adoption of advanced biometric verification methods, including facial recognition and fingerprint scanning, moving away from simple ID verification to multi-factor authentication for higher security environments. The implementation of mobile-centric technology, such as QR codes for self-check-in and smartphone applications for pre-registration and host notifications, significantly reduces bottlenecks at entry points and supports efficient management of expected visitors, aligning with global trends toward frictionless access experiences in the modern workplace.

Furthermore, cloud computing infrastructure, particularly Software-as-a-Service (SaaS) models, forms the backbone of modern VMS deployment, enabling real-time data synchronization across multiple global locations and facilitating rapid software updates. Crucially, the VMS ecosystem relies heavily on Application Programming Interfaces (APIs) to seamlessly integrate with broader security and operational platforms, including access control systems (ACS), physical security information management (PSIM) systems, fire safety systems, and internal corporate software like Microsoft Outlook, Slack, and various HR databases. This deep integration transforms VMS from a standalone tool into a critical component of a unified security infrastructure.

The increasing incorporation of Artificial Intelligence (AI) and Machine Learning (ML) algorithms represents the cutting edge of VMS technology. AI is utilized for sophisticated security analysis, including real-time risk assessment based on behavioral patterns or watch lists, and for optimizing user interfaces (UI) based on predictive analysis of visitor flow. Additionally, the rise of the Internet of Things (IoT) contributes to the VMS landscape through smart kiosk technology and connected sensors that provide real-time occupancy data and environmental monitoring, further enhancing situational awareness for facilities and security managers. Future development will focus heavily on achieving full autonomy in visitor processing while maintaining stringent data privacy controls via secure encryption protocols and localized data processing where required by regulation.

Regional Highlights

North America currently holds the largest share in the Visitor Management System Software Market, driven by high technology adoption rates, the mature infrastructure of commercial and corporate real estate, and the presence of numerous global corporations and technology firms based in the US and Canada. Stringent government regulations, particularly concerning workplace safety, security clearances, and data protection (such as various state-level biometric laws), mandate the use of formalized, digital VMS solutions. The region's focus on innovative smart office concepts and integrated security ecosystems further accelerates the deployment of high-end, AI-enabled VMS platforms, particularly within the financial services and technology sectors.

The Asia Pacific (APAC) region is poised for the most rapid growth during the forecast period. This acceleration is attributed to massive investments in commercial and industrial infrastructure across developing economies like China, India, and Southeast Asia, where the digital transformation of manual processes is prioritized. The need to secure sprawling manufacturing campuses, technology parks, and mixed-use commercial developments is fueling demand. While price sensitivity remains a factor, the shift towards cloud-based VMS offers cost-effective scalability, making advanced security features accessible to the burgeoning SME segment in these countries. Furthermore, global companies expanding their operational footprint in APAC require standardized VMS solutions that align with their international security policies.

Europe represents a stable and high-value market, heavily influenced by regulatory compliance, most notably the General Data Protection Regulation (GDPR). European businesses prioritize VMS solutions that offer robust data governance, clear consent management features, and secure data handling mechanisms to avoid severe penalties. Countries such as the UK, Germany, and France show strong adoption across corporate and public sectors. The Middle East and Africa (MEA), while smaller, show promising growth, particularly in the UAE and Saudi Arabia, driven by large-scale government-backed infrastructure projects (e.g., NEOM) and the need for advanced security solutions in energy, government, and tourism sectors. Latin America's market growth is steady, focusing on efficiency and security enhancements in metropolitan corporate centers.

- North America: Market leader; driven by high security standards, strong regulatory framework, and early adoption of AI and biometric technology in corporate and government sectors.

- Asia Pacific (APAC): Fastest growing region; propelled by rapid industrialization, large-scale infrastructure development, and increasing adoption in the burgeoning manufacturing and technology hubs.

- Europe: Mature market focusing intensely on compliance; GDPR adherence dictates demand for VMS with sophisticated data privacy and consent management capabilities.

- Latin America: Steady growth driven by demand for modernized access control in large corporate facilities and educational institutions to combat rising security concerns.

- Middle East and Africa (MEA): Emerging high-growth region; significant public and private investment in advanced security systems across critical national infrastructure and real estate developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Visitor Management System Software Market.- Envoy

- Proxyclick (A Traka company)

- Veris

- Traction Guest (A PINE company)

- HID Global

- Sine (An Assa Abloy company)

- AskCody

- Robin Powered

- iLobby

- SwipedOn

- Safetrust

- Genetec

- Honeywell International Inc.

- MRI Software

- SmartSpace Software Plc

- Passage Technology

- AlertEnterprise

- Splan

- Ezy Signin

- Vizito

Frequently Asked Questions

Analyze common user questions about the Visitor Management System Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Visitor Management System Software Market?

The Visitor Management System Software Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 15.8% between the forecast years of 2026 and 2033, driven primarily by the global demand for enhanced corporate security and digital compliance solutions.

How does AI technology specifically enhance the security features of VMS?

AI technology significantly enhances VMS security by enabling real-time anomaly detection, improving the accuracy of biometric verification (like facial recognition), and automating risk assessment by comparing visitor data against internal watch lists and historical access patterns, creating a proactive defense layer.

Which deployment model dominates the VMS market, and why is it preferred?

The Cloud-based deployment model dominates the VMS market. It is preferred due to its superior scalability, lower total cost of ownership (TCO) compared to on-premise systems, ease of maintenance, and the ability to integrate seamlessly with various other cloud-native operational and security applications.

What major regulatory compliance factors are driving the adoption of VMS in Europe?

The primary driver in Europe is the General Data Protection Regulation (GDPR). Organizations require VMS solutions that ensure transparent and secure handling of Personally Identifiable Information (PII), manage visitor consent for data usage, and provide comprehensive audit trails proving compliance with strict data privacy mandates.

Which end-user segment is anticipated to show the fastest growth in VMS adoption?

The Healthcare and Education sectors are anticipated to show the fastest growth. This is due to the urgent need to manage complex visitor flows, ensure specialized regulatory compliance (e.g., HIPAA in healthcare), and prioritize safety protocols for vulnerable populations such as patients and students.

What is the biggest restraint affecting the widespread adoption of VMS solutions globally?

The most significant restraint is the initial high cost and complexity associated with integrating advanced VMS platforms, particularly those utilizing biometric features, with existing, often disparate or outdated, legacy access control systems and internal IT infrastructure within large, established enterprises.

How do hybrid work models influence the feature requirements for modern VMS software?

Hybrid work models require VMS software to offer greater flexibility in access control, dynamic scheduling integration, and highly reliable remote pre-registration capabilities. Features like capacity management and real-time space utilization tracking become crucial for safely managing fluctuating employee and visitor presence.

What is the significance of API integration within the VMS software market?

API integration is highly significant as it allows VMS systems to function as part of a unified security ecosystem. Integration with HR systems, access control systems, and communication platforms (like Slack or Teams) streamlines workflows, ensures data consistency, and automates processes from initial invite to final departure logging.

In the Value Chain, which segment focuses on localization and tailored solutions for end-users?

The midstream and downstream segments, particularly the role played by Value-Added Resellers (VARs) and System Integrators (SIs), focus on localization. These intermediaries adapt generic VMS products, provide consultation on specific regulatory requirements, and handle the physical installation and integration of hardware components.

What role does touchless technology play in post-pandemic VMS market growth?

Touchless technology, including QR codes, mobile check-in apps, and facial recognition, is critical for post-pandemic VMS growth. It addresses hygiene concerns, significantly speeds up the check-in process, and minimizes physical interaction at entry points, thereby enhancing public health and operational efficiency.

Beyond traditional corporate environments, which emerging sector offers substantial growth potential for VMS vendors?

The Manufacturing and Industrial sector offers substantial emerging potential. These facilities require specialized VMS features to manage complex contractor compliance, verify safety certifications before access is granted, and track personnel movements within high-risk or restricted industrial zones.

What are the key components included in a comprehensive VMS solution?

A comprehensive VMS solution includes core software modules (for registration, logging, and reporting), essential hardware components (such as dedicated check-in kiosks, badge printers, and scanners), and critical services (including installation, custom integration, training, and ongoing technical support and maintenance).

Why is North America the leading region in terms of market size, despite high growth in APAC?

North America leads due to its highly mature security market, significant early adoption of advanced technology, and a massive established base of multinational corporations operating under strict regulatory regimes that necessitate the immediate deployment of sophisticated, high-value VMS platforms.

How are Large Enterprises’ VMS requirements typically different from those of SMEs?

Large Enterprises require highly customized, multi-site, and globally scalable VMS solutions with deep integration capabilities into extensive HR, ERP, and physical security management systems, prioritizing robust centralized data governance and high transaction volume capacity. SMEs often prioritize ease of deployment and cost-effectiveness via standardized cloud subscriptions.

What future technological development is expected to redefine the VMS market experience?

The full integration of Artificial Intelligence for predictive analytics and autonomous visitor processing is expected to redefine the VMS experience. This will allow systems to actively anticipate security risks, dynamically adjust access permissions, and provide personalized visitor journeys with minimal human intervention.

What are the primary benefits of implementing a digital VMS over a traditional paper logbook?

Digital VMS offers enhanced security, instant data retrieval for audits or emergencies, improved accuracy by eliminating illegible handwriting, automation of check-in and notification processes, and adherence to data privacy regulations—all impossible with outdated paper logbooks.

How does the education sector leverage VMS technology for security?

Educational institutions use VMS to securely track and verify all visitors (parents, vendors), manage student late arrivals/early departures, enforce restricted access areas, and rapidly access emergency contact and visitor location data during crisis situations, integrating visitor management with broader campus safety protocols.

What is the core difference between the software and service components of the VMS market?

The software component includes the license and core functionality of the digital platform (e.g., registration, reporting modules). The service component encompasses the human support needed for successful deployment, including initial integration consulting, user training, dedicated ongoing technical support, and critical system maintenance.

In the context of the VMS market, what does the term 'Frictionless Access' mean?

Frictionless Access refers to visitor processes that minimize delays and manual effort, often achieved through technologies like automated facial recognition, pre-approved QR code invitations, or seamless mobile check-in, providing a fast, smooth, and positive entry experience without compromising security.

Which countries are driving the highest growth acceleration within the APAC VMS market?

China, India, and rapidly developing Southeast Asian nations (such as Vietnam and Indonesia) are driving the highest growth acceleration in the APAC VMS market, fueled by massive investments in corporate infrastructure and increasing adoption of international standard security technologies.

Why do high-security sectors still prefer On-premise VMS deployments?

High-security sectors like government and defense prefer On-premise deployments because they offer maximum control over data sovereignty, ensure data residency within internal network firewalls, and allow for completely isolated systems, which is mandatory for handling highly classified or sensitive operational information.

How can VMS software assist organizations with contact tracing requirements?

VMS software maintains detailed, timestamped digital records of every visitor, their entry/exit times, and the host they met. This data can be rapidly accessed and analyzed to identify all individuals who were present in a facility during specific exposure periods, greatly simplifying and streamlining contact tracing efforts.

What is the role of IoT in enhancing the capabilities of Visitor Management Systems?

IoT devices contribute by powering smart check-in kiosks and integrating connected sensors that monitor occupancy levels and environmental conditions within the facility. This integration provides security and facilities managers with real-time operational data to better manage access control and space utilization dynamically.

How does VMS help corporate clients manage third-party contractors and vendors?

VMS systems allow corporate clients to manage third-party access by enforcing mandatory sign-offs on safety protocols, verifying necessary insurance or certification documents upon check-in, assigning specific access rights based on the scope of work, and tracking their duration on site for auditing purposes.

What is the forecast market value for the Visitor Management System Software market by 2033?

The Visitor Management System Software Market is forecasted to reach a value of approximately USD 3.49 Billion by the end of the projection period in 2033, demonstrating substantial compounded growth from the base year.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager