Visual Indicator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432416 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Visual Indicator Market Size

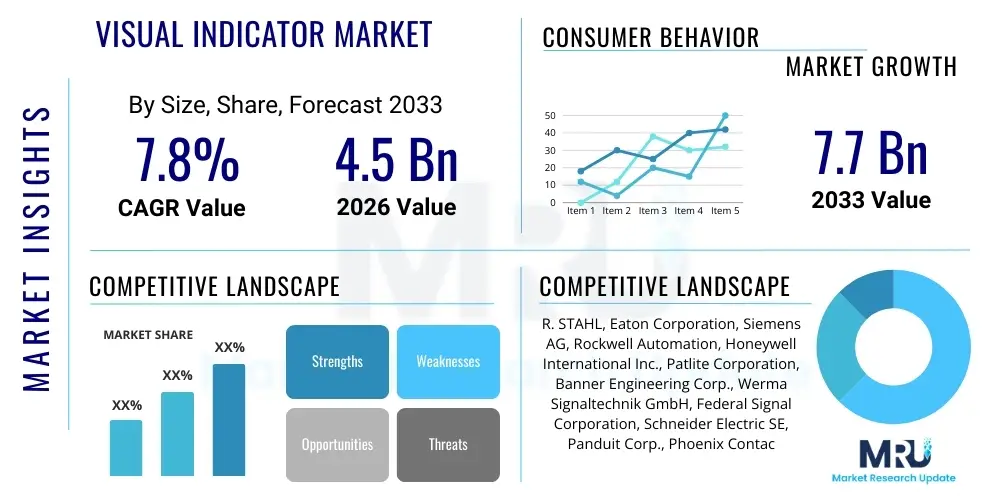

The Visual Indicator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.7 Billion by the end of the forecast period in 2033.

The consistent expansion of the Visual Indicator Market is fundamentally driven by the escalating demand across critical industrial sectors, notably automotive, aerospace, and advanced manufacturing. These sectors increasingly rely on high-fidelity, reliable visual feedback systems to ensure operational safety, process efficiency, and regulatory compliance. Furthermore, the shift towards smart factories (Industry 4.0) necessitates sophisticated Human-Machine Interfaces (HMIs) and advanced signaling devices, pushing manufacturers to integrate newer display technologies, such as micro-LEDs and flexible OLEDs, into industrial control panels and equipment. This technological evolution not only enhances device functionality but also expands the overall addressable market.

Geographically, growth is anticipated to be particularly robust in the Asia Pacific region, fueled by rapid urbanization, significant government investment in infrastructure development, and the massive scale of consumer electronics manufacturing concentrated in countries like China, South Korea, and Japan. Western markets, including North America and Europe, maintain stable demand, primarily focusing on replacing legacy analog systems with digital, energy-efficient visual indicators that comply with stringent environmental standards and offer enhanced diagnostic capabilities. The competitive landscape is characterized by continuous product innovation, focusing on miniaturization, improved energy efficiency, and enhanced durability to withstand harsh operating environments, cementing the market's strong growth trajectory.

Visual Indicator Market introduction

The Visual Indicator Market encompasses a broad spectrum of devices and components designed to provide human operators with immediate, perceptible information regarding the status, operational mode, or condition of a machine, process, or system. These products range from simple pilot lights and light emitting diode (LED) arrays to complex, multi-color display modules, specialized industrial signal towers, and advanced panel meters. The primary function of visual indicators is to improve safety, efficiency, and communication within complex operational environments by converting electrical or electronic signals into easily recognizable visual cues, such as color changes, blinking patterns, or alphanumeric readouts. Major applications span across industrial automation (monitoring assembly lines, machine status), automotive systems (dashboard displays, exterior signaling), medical devices (status indicators on diagnostic equipment), and consumer electronics (power and connectivity status). The core benefits include enhanced situational awareness, reduced human error, quicker response times to fault conditions, and compliance with various international safety standards. Key driving factors propelling market expansion include the global adoption of Industry 4.0 paradigms, the increasing complexity of machinery requiring intuitive diagnostics, and mandatory safety regulations in high-risk sectors like oil and gas, and aerospace manufacturing.

Visual Indicator Market Executive Summary

The Visual Indicator Market demonstrates strong resilience and consistent growth, underscored by profound business trends focusing on digitalization and energy efficiency. Strategic shifts in manufacturing processes, particularly the widespread adoption of lean manufacturing techniques and robotic integration, are driving demand for highly customized, modular, and network-enabled visual signaling devices that can communicate directly with Supervisory Control and Data Acquisition (SCADA) systems and Programmable Logic Controllers (PLCs). Key business trends include the consolidation of supply chains to manage volatility, increased investment in R&D focusing on advanced materials for lens durability, and the integration of Internet of Things (IoT) capabilities into visual indicators, allowing for remote monitoring and predictive maintenance alerts. Companies are actively diversifying their product portfolios to address niche applications requiring specialized protection ratings (e.g., IP67 for washdown environments or explosion-proof certifications).

Regional trends highlight the emergence of the Asia Pacific (APAC) region as the dominant consumer and producer, benefiting from extensive investments in smart infrastructure and the rapid expansion of the electric vehicle (EV) manufacturing ecosystem, where advanced indicator lighting is crucial for both functionality and branding. North America and Europe, characterized by mature industrial bases, prioritize the retrofitting of existing infrastructure with smart, digitally connected indicator systems that offer enhanced diagnostics and energy savings, often spurred by government incentives for industrial modernization. Latin America and the Middle East & Africa (MEA) are witnessing accelerated growth driven by expansion in oil and gas infrastructure and burgeoning domestic manufacturing sectors, emphasizing robust, traditional indicator types capable of surviving harsh climatic conditions.

Segment trends reveal that the LED indicator technology segment maintains market dominance due to its superior longevity, low power consumption, and versatility in color and form factor. However, the advanced display segment, encompassing OLED and micro-LED technologies used in sophisticated HMIs and multi-function panels, is experiencing the fastest growth rate, fueled by demand in high-end automotive cockpits and complex industrial control systems requiring detailed, dynamic visual feedback. Furthermore, the segmentation by application shows that Industrial Automation remains the largest consumer, while the Automotive sector is projected to be the most rapidly evolving segment, driven by new regulatory requirements for external signaling and the increasing complexity of in-cabin notifications, requiring sophisticated, customizable visual solutions.

AI Impact Analysis on Visual Indicator Market

User queries regarding AI's influence on the Visual Indicator Market primarily revolve around automation displacement, predictive maintenance integration, and the shift from simple binary signaling to complex, contextualized visual feedback. Common concerns focus on whether AI-driven diagnostic systems will render traditional human-readable indicators redundant, or conversely, if AI will elevate the complexity of visual feedback required. Analysis indicates that the core theme is augmentation, not replacement. Users expect AI to integrate seamlessly with visual indicators, primarily by optimizing the indicators' function, such as intelligently altering display colors or flashing rates based on predicted failure probability or contextual operational needs, rather than simple status reporting. There is a strong interest in AI-powered human-factor design to ensure visual indicators remain intuitive even when conveying highly complex, synthesized data derived from AI models, thereby reducing cognitive load on operators in highly automated environments.

The integration of Artificial Intelligence transforms the traditional visual indicator from a passive signal transmitter into an active, intelligent communication node within the operational technology (OT) network. AI algorithms analyze massive data streams generated by machinery and processes, synthesizing this information to generate highly contextualized alerts and visualizations. This predictive capability means indicators can signal potential issues hours before a failure occurs, rather than just reporting an immediate fault status. For instance, in manufacturing, an AI system might recognize subtle thermal shifts combined with vibration anomalies and trigger a specific, coded visual alert—perhaps a unique magenta flicker—that mandates immediate, specialized operator intervention, a significant evolution from a standard red "failure" light. This shift enhances the utility and value proposition of high-end visual indicators, making them essential components of AI-driven predictive maintenance strategies.

Furthermore, AI is instrumental in enhancing the energy efficiency and longevity of visual indicator hardware itself. Machine learning models can optimize the dimming curves and usage patterns of LED and display components based on ambient light conditions, operator presence, and criticality of the displayed information, thus extending component lifespans and minimizing power consumption over time. This smart management is particularly crucial in large-scale industrial installations where thousands of indicators operate continuously. The trend moving forward suggests that visual indicators will increasingly feature embedded AI chips or robust network connectivity to process localized data before sending summarized alerts, making them integral elements in decentralized edge computing architectures, ensuring the operator receives the most relevant information with minimal latency.

- AI enables predictive signaling by analyzing operational data, shifting indicators from reactive fault reporting to proactive alert systems.

- AI optimizes display parameters (brightness, color, duration) based on context and environment, improving operator comprehension and reducing cognitive load.

- Integration with industrial IoT platforms allows AI to orchestrate complex visual warning sequences across multiple interconnected machines.

- Machine Learning (ML) improves the reliability and efficiency of visual indicators by optimizing power usage and component lifespan.

- AI-driven HMIs utilize complex visual indicators to convey synthesized diagnostic information derived from advanced data models.

DRO & Impact Forces Of Visual Indicator Market

The Visual Indicator Market is shaped by a robust interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively determine the market's trajectory and the velocity of technological adoption, creating significant Impact Forces. A primary Driver is the increasing stringency of workplace safety regulations globally, particularly in hazardous environments, mandating reliable and highly visible warning systems to minimize accidents and ensure compliance. This is complemented by the widespread digital transformation across manufacturing, healthcare, and infrastructure, necessitating advanced, networked signaling devices compatible with Industry 4.0 architectures. Restraints often center on the high initial cost associated with implementing advanced, high-resolution displays (like industrial-grade OLEDs) and complex signaling towers compared to traditional lamp-based indicators, presenting an adoption barrier for Small and Medium Enterprises (SMEs). Furthermore, challenges related to standardization and interoperability between diverse indicator manufacturers and proprietary industrial control systems sometimes complicate seamless integration, leading to vendor lock-in concerns and increased system complexity, thereby acting as a moderate dampener on explosive growth.

Opportunities for market stakeholders are abundant, particularly in the emerging fields of augmented reality (AR) integration with visual indicators, where real-time operational status can be overlaid onto physical equipment, and the massive market potential stemming from electric vehicle (EV) infrastructure build-out, requiring new charging status and safety indicators. Another significant opportunity lies in developing highly durable, miniaturized, and low-power indicators for portable and wearable diagnostic equipment in the healthcare and defense sectors. The primary Impact Forces affecting the market structure include the increasing demand for customization, forcing manufacturers to move away from mass-produced, standardized components toward configurable, software-defined visual systems; and the intense competition driving rapid product life cycles, demanding continuous innovation in light source technology, lens material durability, and network communication protocols. These forces compel companies to invest heavily in robust R&D pipelines to maintain market share and relevance.

The impact forces also involve significant environmental, social, and governance (ESG) considerations. There is an increasing regulatory push for energy-efficient components, favoring LED and future solid-state lighting technologies over older, high-wattage sources. This environmental imperative acts as both a driver for new product adoption and a restraint on legacy product sales. Socially, the focus on human factors engineering—designing indicators that reduce visual fatigue and are intuitive for a global, multi-lingual workforce—is becoming a competitive differentiator. Geopolitically, the stability of the supply chain for critical raw materials, such as rare earth elements used in certain high-brightness LEDs, continues to be a moderate but persistent risk factor influencing pricing and product availability. Overall, the market remains driven by safety and automation imperatives, tempered by integration complexities and cost sensitivity.

Segmentation Analysis

The Visual Indicator Market is comprehensively segmented based on technology type, application sector, end-user categorization, and geographical regions to provide a nuanced view of market dynamics and opportunity areas. This structured analysis is essential for stakeholders to target specific growth vectors, identify competitive advantages, and tailor product offerings to meet heterogeneous industrial demands. The core segmentation by product type—LEDs, LCD/OLED, and Analog Indicators—reflects the varying levels of technological maturity and performance requirements across different end-use environments. LED indicators dominate volume due to their robustness and cost-effectiveness, while advanced displays like OLEDs capture high-value market segments demanding superior visual fidelity and complex information display capabilities, particularly in sophisticated control rooms and high-end consumer products.

Segmentation by application highlights the vast and diverse use cases for visual indicators, with Industrial Automation and Automotive sectors accounting for the majority of the market revenue. Industrial automation demands indicators that communicate machine status, fault conditions, and operational readiness under harsh physical conditions, often requiring specialized sealing and vibration resistance. The automotive segment, conversely, drives innovation in miniaturization, aesthetic integration, and dynamic signaling (both internal and external lighting). Emerging segments such as medical devices and smart infrastructure are rapidly expanding, fueled by regulatory demands for precise status reporting and remote monitoring capabilities. Analyzing these segments helps forecast where capital expenditure on new industrial and consumer equipment will most significantly impact indicator demand.

Further granularity is achieved through end-user segmentation, typically categorized into Original Equipment Manufacturers (OEMs) and the Aftermarket (MRO - Maintenance, Repair, and Overhaul). OEMs represent consistent, high-volume demand tied directly to new equipment production cycles, favoring standardized, cost-optimized components. The Aftermarket segment focuses on replacement, upgrades, and modernization of existing equipment, often requiring specialized, compatible indicator systems that enhance current functionality, driving demand for smart retrofitting solutions and modular signaling towers. Understanding these user distinctions is crucial for developing effective distribution and pricing strategies across the market ecosystem.

- By Type:

- LED Indicators (Pilot Lights, Panel Mount LEDs)

- LCD/OLED Indicators (Graphical Displays, Segment Displays)

- Analog Indicators (Panel Meters, Gauges)

- Signal Towers and Beacons

- By Application:

- Industrial Automation and Control (Process Control, Machinery Status)

- Automotive (Dashboard, Exterior Lighting, EV Charging Status)

- Consumer Electronics (Device Status, Charging Indicators)

- Healthcare and Medical Devices (Diagnostic Equipment, Monitoring Systems)

- Aerospace and Defense

- Transportation and Logistics

- By End-User:

- Original Equipment Manufacturers (OEMs)

- Aftermarket (MRO and Retrofitting)

- By Region:

- North America (U.S., Canada)

- Europe (Germany, U.K., France)

- Asia Pacific (China, Japan, South Korea)

- Latin America (Brazil, Mexico)

- Middle East and Africa (GCC Countries, South Africa)

Value Chain Analysis For Visual Indicator Market

The Visual Indicator Market value chain is intricate, beginning with the upstream supply of fundamental components, progressing through complex manufacturing and assembly, and culminating in delivery to diverse end-users via multi-layered distribution channels. Upstream analysis focuses heavily on the procurement of core materials, primarily semiconductor components (LED chips, drivers, integrated circuits), display materials (TFT glass, organic compounds for OLEDs), optical plastics (lenses, diffusers), and metals for housing and heat dissipation. Volatility in the semiconductor market and the stable sourcing of high-purity raw materials significantly dictate manufacturing costs and lead times. Key upstream players include specialized component manufacturers who innovate in brightness, energy efficiency, and miniaturization of light sources, setting the technological baseline for the finished products.

Midstream activities involve the design, assembly, integration, and testing of the final indicator products. Manufacturers focus on specialized engineering to meet strict environmental ratings (e.g., IP ratings for dust and water protection, explosion-proof certifications for hazardous areas) and connectivity standards (e.g., compatibility with industrial protocols like Ethernet/IP or Profinet). Downstream analysis addresses the critical step of reaching the diverse end-user base. The primary distribution channel includes both Direct and Indirect methods. Direct sales are common for large volume OEM contracts, especially in the automotive or heavy machinery sectors, allowing manufacturers closer control over integration and quality assurance. Indirect distribution relies heavily on specialized industrial distributors, electrical component wholesalers, and value-added resellers (VARs) who provide localized inventory, technical support, and small-batch MRO supplies to a fragmented industrial customer base.

The increasing complexity of indicators, which now often include microprocessors and network capabilities, has heightened the importance of VARs and system integrators. These entities play a crucial role in adapting generic indicator products to highly specific industrial control panels and interfacing them with complex automation systems, thereby adding significant value post-manufacturing. The efficiency and reliability of these distribution channels, particularly in providing rapid replacement parts and technical expertise, are critical success factors. Furthermore, e-commerce platforms are increasingly utilized for low-volume, standardized indicator components, streamlining procurement for maintenance and repair operations, though high-end industrial products usually still require established B2B relationships and specialized logistics chains.

Visual Indicator Market Potential Customers

Potential customers for Visual Indicator Market products span nearly every sector utilizing machinery, electrical systems, or complex automation processes where the clear communication of status information is mandatory for safety and operation. The largest category of End-Users/Buyers are industrial Original Equipment Manufacturers (OEMs) who integrate indicators into their primary products, such as machine tools, packaging machinery, medical imaging equipment, and large-scale industrial boilers. These OEMs prioritize long-term reliability, specific technical specifications (voltage, mounting style), and competitive volume pricing. Their purchasing decisions are often made years in advance, tied to product development cycles, making them high-volume, long-term contracts for indicator manufacturers.

The second major customer segment is the industrial Maintenance, Repair, and Overhaul (MRO) market, comprised of manufacturing plants, utility operators (power generation, water treatment), and process industries (chemical, oil & gas). These customers require indicators for system upgrades, retrofitting legacy control panels, and immediate replacement of failed components. This segment demands fast delivery, broad product compatibility, and regional availability, typically sourcing through industrial distributors. The Oil & Gas industry, in particular, requires highly specialized indicators certified for explosion-proof (Class 1, Division 1) or intrinsically safe applications, representing a high-value, niche customer base where safety certifications are paramount over cost.

Finally, the rapidly growing Automotive and Transportation sector represents a dynamic customer base. Automotive manufacturers are primary buyers for internal cockpit displays and external LED lighting systems, emphasizing design aesthetics, communication bus integration (e.g., CAN bus), and resistance to thermal stress. Public transit authorities and logistics companies purchase robust indicators for rail signaling, fleet diagnostics, and port machinery status. The convergence of IoT and smart cities initiatives is also creating new potential customers among infrastructure developers requiring durable, weather-resistant indicators for smart street furniture, public charging stations, and dynamic information displays, driving demand for interconnected and remotely manageable visual signaling solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.7 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | R. STAHL, Eaton Corporation, Siemens AG, Rockwell Automation, Honeywell International Inc., Patlite Corporation, Banner Engineering Corp., Werma Signaltechnik GmbH, Federal Signal Corporation, Schneider Electric SE, Panduit Corp., Phoenix Contact, ABB Ltd., Clifford & Snell, Auer Signal GmbH, Dialight PLC, Mouser Electronics, TE Connectivity Ltd., Omron Corporation, IDEC Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Visual Indicator Market Key Technology Landscape

The technological landscape of the Visual Indicator Market is characterized by continuous evolution centered on light source efficiency, display resolution, connectivity standards, and material durability. The dominant technology remains Light Emitting Diode (LED) technology, which has significantly improved in terms of luminous efficiency, color consistency, and thermal management, enabling manufacturers to produce brighter, smaller, and more energy-efficient pilot lights and signal beacons. Innovations in LED drivers and optics allow for highly precise control over flashing patterns and color changes, crucial for conveying complex status information. Recent advancements involve Micro-LED technology, promising even higher brightness and greater pixel density, positioning them for future use in extremely high-definition industrial and automotive displays that require robust performance in various lighting conditions.

A parallel key technology focus is the integration of advanced display technologies, particularly Organic Light-Emitting Diodes (OLEDs) and high-resolution Liquid Crystal Displays (LCDs), into sophisticated industrial Human-Machine Interfaces (HMIs) and smart panels. OLEDs offer superior contrast ratios, faster response times, and thinner form factors, making them ideal for premium automotive and complex medical device interfaces where detailed graphics and multi-line text are necessary. Furthermore, connectivity technologies are paramount, with visual indicators increasingly equipped with embedded network interfaces (Ethernet, Wi-Fi) and compatibility with industrial communication protocols such as IO-Link. This digital integration enables remote diagnostics, centralized control, and synchronization of visual alerts across distributed factory floor systems, moving beyond simple hard-wired status communication.

Material science innovation also plays a vital role, particularly in enhancing the durability and compliance of indicator housings and lenses. Manufacturers are utilizing advanced polycarbonate and specialized resins to achieve higher Ingress Protection (IP) ratings (e.g., IP69K for high-pressure, high-temperature washdowns) and enhanced resistance to UV radiation, chemicals, and vibration. Explosion-proof certification technologies, necessary for use in hazardous areas (HazLoc), involve complex, ruggedized encapsulation designs that prevent internal component ignition from reaching the external atmosphere. These material and structural engineering improvements are essential for the adoption of visual indicators in harsh industrial environments like mining, offshore platforms, and chemical processing plants, ensuring long operational life and adherence to critical safety standards.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to dominate the Visual Indicator Market in terms of both consumption volume and manufacturing output. This dominance is driven by massive governmental investments in smart city infrastructure, the rapid proliferation of electric vehicle manufacturing facilities (especially in China and South Korea), and the continuous expansion of the consumer electronics sector, which relies heavily on miniaturized indicator components. Countries like India and Southeast Asian nations are experiencing accelerated industrial automation adoption, creating high demand for both traditional industrial signaling and modern, networked display units. The region’s competitive manufacturing environment also drives down production costs, affecting global pricing dynamics.

- North America: The North American market is characterized by a high adoption rate of advanced, high-value visual indicator systems, focusing heavily on integration with IoT and AI platforms for predictive maintenance. Key drivers include rigorous industrial safety standards, high capital expenditure in aerospace and defense, and the modernization of aging infrastructure across manufacturing and oil and gas sectors. The market here prioritizes sophisticated, interoperable components that adhere to stringent domestic regulatory frameworks, such as those governing intrinsic safety (e.g., UL certifications). Replacement and retrofit demand for smart indicators in existing large-scale facilities constitute a major revenue stream.

- Europe: Europe maintains a strong position, distinguished by its leadership in implementing Industry 4.0 principles, particularly in Germany's high-tech machinery sector and Italy's specialized manufacturing base. Strict EU environmental and occupational safety directives (e.g., ATEX for hazardous areas) necessitate the use of premium, certified visual indicators. The European market shows a pronounced preference for energy-efficient, long-life LED technology and modular signal towers that can be easily customized and maintained. Furthermore, the substantial automotive manufacturing base, transitioning towards electric mobility, fuels significant demand for advanced interior and exterior visual communication systems.

- Latin America (LATAM): The LATAM market, while smaller, is exhibiting considerable growth driven by foreign direct investment in manufacturing and the expansion of mineral extraction and energy infrastructure, particularly in Brazil and Mexico. Demand is often concentrated on robust, cost-effective indicator solutions suitable for challenging climate conditions and basic industrial automation needs. The primary growth opportunity lies in modernization projects, replacing older incandescent systems with durable, cost-effective LED alternatives as industrial facilities undergo phased digital upgrades.

- Middle East and Africa (MEA): Growth in the MEA region is intrinsically linked to large-scale infrastructure development, especially within the oil and gas, power generation, and construction sectors across the GCC countries. The demand is heavily skewed towards ruggedized, high-durability indicators, signal towers, and explosion-proof models that can withstand extreme heat and highly corrosive environments. Investment volatility in the hydrocarbon sector can impact procurement cycles, but continuous emphasis on safety compliance and expansion of smart city projects maintains steady underlying demand for high-reliability visual signaling systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Visual Indicator Market.- R. STAHL

- Eaton Corporation

- Siemens AG

- Rockwell Automation

- Honeywell International Inc.

- Patlite Corporation

- Banner Engineering Corp.

- Werma Signaltechnik GmbH

- Federal Signal Corporation

- Schneider Electric SE

- Panduit Corp.

- Phoenix Contact

- ABB Ltd.

- Clifford & Snell

- Auer Signal GmbH

- Dialight PLC

- Mouser Electronics

- TE Connectivity Ltd.

- Omron Corporation

- IDEC Corporation

- LumaSense Technologies Inc.

- Maple Systems Inc.

- Vishay Intertechnology, Inc.

- Crouzet Automation

Frequently Asked Questions

Analyze common user questions about the Visual Indicator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for advanced Visual Indicators in industrial settings?

The primary driver is the global implementation of Industry 4.0, necessitating indicators with integrated network connectivity (e.g., IO-Link) and enhanced diagnostic capabilities to facilitate real-time monitoring, predictive maintenance, and seamless communication within complex automated manufacturing environments.

How does the shift to electric vehicles (EVs) impact the Visual Indicator Market?

The EV transition drives demand for specialized indicators in two main areas: sophisticated in-cabin displays and charging status indicators (both vehicle and infrastructure side), requiring high-resolution, durable, and weather-resistant visual signaling devices with stringent aesthetic and functional requirements.

What are the key technological differentiators between LED and OLED indicators in the market?

LED indicators offer superior longevity, cost-effectiveness, and brightness suitable for basic status signaling in harsh environments. OLED indicators, conversely, provide higher contrast, better graphical resolution, and flexibility, making them preferred for complex Human-Machine Interfaces (HMIs) and detailed information display panels.

Which geographical region exhibits the highest growth potential for Visual Indicator adoption?

The Asia Pacific (APAC) region is forecasted to show the highest growth potential, largely fueled by rapid industrialization, large-scale infrastructure projects, and significant governmental investment in smart manufacturing and smart city initiatives across major economies like China and India.

What role does AI play in the future development of visual indicators?

AI is crucial for transforming indicators into intelligent communication nodes, enabling predictive signaling by analyzing data streams to provide contextualized, proactive alerts about impending system failures, thereby significantly enhancing operational safety and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager