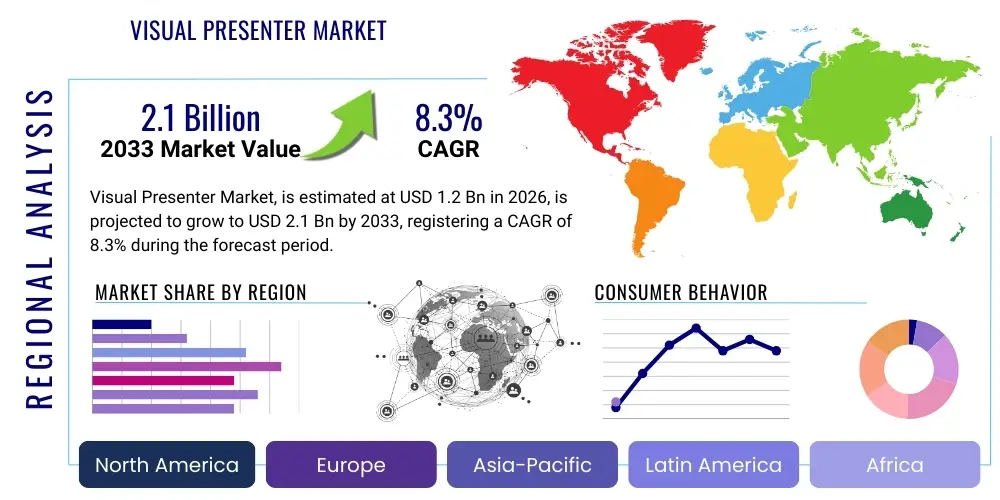

Visual Presenter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439135 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Visual Presenter Market Size

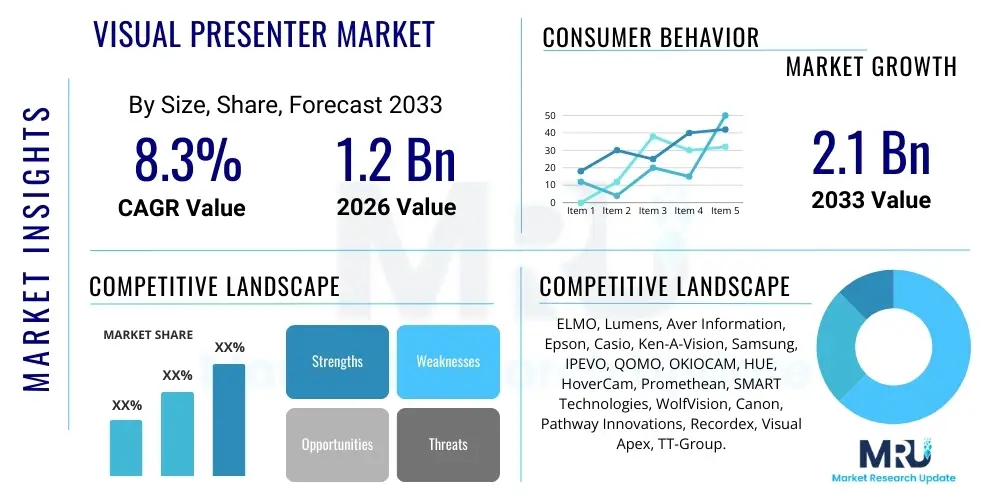

The Visual Presenter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.3% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.1 Billion by the end of the forecast period in 2033.

Visual Presenter Market introduction

The Visual Presenter Market, often referred to as document camera market, encompasses advanced technological devices used for capturing and displaying real-time images of three-dimensional objects, documents, and transparencies onto a large screen or projection system. These devices serve as essential tools in educational, corporate, and governmental sectors, bridging the gap between traditional physical material and digital display environments. Unlike opaque or overhead projectors, modern visual presenters offer superior resolution, flexible articulation arms, and integration capabilities with interactive whiteboards and video conferencing systems, making them central to modern pedagogical and professional communication methodologies.

The core product description revolves around a high-resolution camera mounted on a stand, often equipped with advanced features such as optical and digital zoom, internal storage, specialized lighting systems, and connectivity options including HDMI, USB, and wireless capabilities. Major applications span from K-12 and higher education, where they facilitate practical demonstrations and enhance classroom engagement, to corporate training rooms and conference centers, where they are utilized for displaying detailed product samples, blueprints, or physical documents during presentations. The versatility and immediacy of sharing physical items in a large digital format drive their continued relevance despite the proliferation of purely digital content creation tools.

Key benefits driving market expansion include enhanced audience engagement through dynamic display, simplified content sharing without the need for prior digital scanning, and improved clarity and accessibility of intricate visual information. The market is primarily driven by global governmental initiatives emphasizing digital learning infrastructure development, the ongoing technological upgrades in meeting rooms and collaborative spaces, and the inherent simplicity and user-friendliness of modern document cameras compared to older projection technologies. Furthermore, the hybrid learning and working models adopted post-2020 have significantly accelerated the demand for high-quality visual aids capable of seamless integration into virtual presentation environments.

Visual Presenter Market Executive Summary

The Visual Presenter Market is characterized by robust growth, primarily propelled by the sustained investment in EdTech infrastructure globally, particularly in emerging economies focusing on digitalization of classrooms. Business trends indicate a strong competitive focus on product differentiation through advanced connectivity features, higher optical zoom capabilities, and compact, portable designs catering to flexible teaching environments and traveling professionals. Key manufacturers are increasingly embedding software capabilities, suchg as annotation tools and recording features, to provide an integrated visual communication platform rather than just a capture device. This shift towards software-defined functionality is reshaping purchasing decisions and driving average selling prices upwards for premium models.

Regionally, North America and Europe currently hold the largest market shares due to early adoption of advanced educational technology and established corporate spending on meeting room technology upgrades. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by massive public and private investments in education sector modernization across countries like China, India, and Southeast Asian nations. Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, driven by government tenders seeking cost-effective solutions for enhancing university and vocational training centers. The regional dynamics reflect a maturity-driven replacement cycle in developed markets versus a foundational infrastructure installation cycle in developing ones.

Segmentation trends highlight the increasing dominance of portable visual presenters over fixed/desktop models, reflecting the demand for flexibility in hybrid environments. Technology-wise, the convergence of high-definition (HD) and ultra-high-definition (UHD) capture capabilities is becoming standard, alongside integrated wireless transmission protocols, making deployment simpler and cleaner. The Education segment remains the unequivocal leader in terms of market volume, while the Corporate segment shows rapid growth in terms of value, driven by premium purchases of high-specification models suitable for boardroom presentations and video conferencing setups demanding impeccable image quality and rapid deployment capabilities.

AI Impact Analysis on Visual Presenter Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Visual Presenter market predominantly center on automation, enhanced image processing, and integration with intelligent classroom systems. Users frequently ask if AI will make traditional document cameras obsolete, or conversely, how AI can augment their functionality. The key themes revolve around expectations for automated focusing and object tracking, seamless integration into AI-driven learning management systems (LMS), and the potential for real-time analysis of displayed content (e.g., grading handwritten notes or recognizing physical objects for context). Concerns often include data privacy associated with AI processing classroom interactions and the cost implication of incorporating sophisticated AI hardware into peripherals.

- AI-powered auto-focus and auto-correction capabilities enhance image clarity and reduce presenter setup time.

- Real-time object recognition allows visual presenters to identify physical items (e.g., lab equipment, biological samples) and link them to digital resources or definitions instantly.

- Integration with AI-driven learning analytics platforms enables automated tracking of physical documents displayed during instruction for compliance or assessment purposes.

- Advanced image processing algorithms utilize AI to enhance low-light performance and stabilize footage, crucial for hybrid/remote broadcasting.

- Automated content captioning and transcription of annotations made on physical documents displayed via the presenter improve accessibility and archival processes.

- Predictive maintenance driven by embedded AI monitors device health and anticipates potential hardware failures, maximizing classroom uptime.

DRO & Impact Forces Of Visual Presenter Market

The Visual Presenter market is shaped by a critical interplay of Drivers, Restraints, and Opportunities (DRO). The primary driver is the pervasive adoption of hybrid learning models and the global push for digital classroom environments, requiring reliable tools to bridge the physical and digital realms. Alongside this, technological advancements leading to higher resolution cameras, better connectivity, and portability are compelling factors for replacement cycles in mature markets. These drivers create a positive impact force, ensuring sustained demand across educational and business sectors globally, prioritizing interactive and visually rich communication.

Conversely, the market faces significant restraints. The increasing affordability and proliferation of alternative digital capture devices, such as high-resolution smartphone cameras, tablets, and specialized overhead scanning equipment, pose competitive challenges, particularly for low-end visual presenters. Furthermore, the integration complexities and interoperability issues between various visual presenter brands and existing IT infrastructure (e.g., proprietary software requirements) can deter institutional buyers, especially those with stringent IT policies or limited technical support capabilities. These restraints manifest as moderate friction against market acceleration, pushing manufacturers toward standardization and universal compatibility.

Opportunities for growth are concentrated in the development of specialized, highly integrated models tailored for specific verticals like healthcare (telemedicine consultations) and manufacturing (quality control inspection documentation). Furthermore, leveraging wireless connectivity standards and cloud-based features that enable direct content sharing and archival without the need for a host computer presents a substantial avenue for market differentiation and expansion. The overarching impact forces dictate that innovation centered on connectivity, simplicity, and specialized applications will be key to overcoming competitive alternatives and realizing the projected market growth.

Segmentation Analysis

The Visual Presenter market segmentation provides a comprehensive view of market dynamics based on distinct product characteristics, technological features, and end-user applications. Understanding these segments is crucial for manufacturers to target specific demographic needs and for investors to assess high-growth areas. The market is fundamentally segmented by the camera’s mechanism (Fixed vs. Portable), the magnification method (Optical Zoom vs. Digital Zoom), and the key institutional applications (Education, Corporate, Government, Healthcare). This multi-dimensional segmentation allows for precise market sizing and forecasting, reflecting diverse operational requirements from high-mobility, low-cost educational solutions to sophisticated, high-fidelity corporate presentation systems.

- By Type:

- Portable Visual Presenters (High demand due to flexibility and hybrid environment needs)

- Fixed/Desktop Visual Presenters (Traditional setup for dedicated classrooms and lecture halls)

- By Technology:

- Optical Zoom Visual Presenters (Higher quality magnification, less pixelation)

- Digital Zoom Visual Presenters (Software-based magnification, cost-effective)

- By Resolution:

- HD (720p, 1080p)

- UHD (4K and above)

- By End-User:

- Education (K-12, Higher Education)

- Corporate/Business (Boardrooms, Training Centers)

- Government and Public Sector

- Healthcare and Medical Training

- By Distribution Channel:

- Online Retail

- Offline Channels (Distributors, Direct Sales)

Value Chain Analysis For Visual Presenter Market

The value chain for the Visual Presenter market begins with upstream analysis, focusing on the procurement and supply of critical components. Key upstream activities involve sourcing high-resolution CMOS/CCD sensors, optical lens assemblies (which significantly impact quality and cost), microcontrollers, and specialized software development kits (SDKs) for image processing and connectivity protocols. Suppliers in this phase, often specialized component manufacturers in East Asia, hold significant bargaining power, particularly for high-end optical components. Efficiency in the upstream segment dictates the final product quality and manufacturing cost structure.

Midstream activities involve core manufacturing, assembly, software integration, and quality control. This phase is characterized by intense competition among Original Equipment Manufacturers (OEMs) who strive for efficient production scale and robust quality assurance processes. Post-manufacturing, the downstream analysis focuses on the distribution network. This market utilizes a dual channel approach: indirect sales via specialized IT and AV equipment distributors, integrators targeting institutional buyers (schools, corporations), and large e-commerce platforms for consumer-grade portable models. Direct sales channels are often employed by market leaders to secure major government or institutional tenders, providing personalized integration services and large-volume discounts.

The efficiency of the distribution channel is paramount for market penetration. Indirect channels rely on value-added resellers (VARs) who provide installation and training, particularly critical for educational institutions requiring seamless integration with existing classroom technology like interactive whiteboards and projectors. Direct channels offer better margin control and deeper customer relationship management for large contracts. Both channels must handle logistics efficiently, ensuring global reach and timely delivery, especially to educational sectors where purchasing cycles are often aligned with academic years. The overall value chain success hinges on maintaining high component quality while optimizing distribution to diverse global markets.

Visual Presenter Market Potential Customers

The primary customer base for the Visual Presenter market is broadly categorized into institutions requiring dynamic visual aid for instruction, demonstration, or presentation. The largest segment by volume remains the Education sector, encompassing K-12 schools, vocational training centers, and higher education universities globally. These institutions utilize visual presenters daily for everything from illustrating complex mathematical problems and conducting science experiments in real-time to displaying historical artifacts or documents, making learning material immediate and accessible to large student groups.

The Corporate/Business sector represents the second most significant segment, prioritizing high-resolution visual presenters for boardroom presentations, internal training sessions, and crucial client meetings where physical prototypes, blueprints, or contracts need simultaneous large-screen display. The demand here leans towards sophisticated, wireless models capable of integrating seamlessly into modern video conferencing stacks. Furthermore, sectors like Government (military training, public hearings), Healthcare (medical school training, surgical documentation), and Law (evidence presentation) also constitute vital end-users, requiring durable, reliable devices that meet specific regulatory standards for documentation and archival purposes. These institutional buyers value reliability, security features, and comprehensive after-sales support over simple cost-effectiveness, driving the premium market segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.1 Billion |

| Growth Rate | 8.3% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ELMO, Lumens, Aver Information, Epson, Casio, Ken-A-Vision, Samsung, IPEVO, QOMO, OKIOCAM, HUE, HoverCam, Promethean, SMART Technologies, WolfVision, Canon, Pathway Innovations, Recordex, Visual Apex, TT-Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Visual Presenter Market Key Technology Landscape

The technological landscape of the Visual Presenter market is rapidly evolving, driven primarily by improvements in camera sensor technology and seamless digital connectivity. The shift from traditional analog output to high-definition (HD) and ultra-high-definition (UHD or 4K) resolution CMOS sensors is the most critical technological advancement, ensuring superior image fidelity necessary for displaying minute details in scientific or technical presentations. Furthermore, the integration of advanced optics, specifically high optical zoom ratios (up to 20x optical zoom), distinguishes high-end visual presenters from basic digital alternatives, offering lossless magnification essential for detailed inspections and large lecture halls. This focus on optical performance remains a core differentiator.

Connectivity and software integration represent the second pillar of technological advancement. Modern visual presenters prioritize wireless functionality (Wi-Fi and Bluetooth) for easy setup and integration into network environments, minimizing cable clutter in technologically advanced classrooms and meeting rooms. USB 3.0 and HDMI outputs are standard for high-speed data transfer and direct display connection. Beyond hardware, the proprietary software suites bundled with these devices now include features like annotation tools, split-screen viewing, video recording capabilities, and direct compatibility with major video conferencing platforms (e.g., Zoom, Teams), effectively transforming the visual presenter into a centralized capture and editing station.

Emerging technologies focus on portability and enhanced user experience. Manufacturers are adopting flexible, multi-jointed arms and lightweight designs, facilitated by miniaturization of internal components, making deployment effortless across multiple locations. Touch-control interfaces and integration with Artificial Intelligence (AI) for features like automatic skew correction, real-time object identification, and enhanced image stabilization are also gaining traction. These technological strides ensure that the visual presenter remains a relevant and highly functional tool in the increasingly complex and decentralized landscape of modern visual communication and educational delivery.

Regional Highlights

The global Visual Presenter market exhibits varied growth trajectories across key geographical regions, reflecting differences in educational infrastructure spending, corporate technology adoption rates, and regulatory policies related to digital content sharing.

- North America: This region holds a significant market share, characterized by high technological maturity, extensive public and private funding for educational technology (EdTech), and a strong corporate sector that regularly updates meeting and training facilities. The US and Canada are early adopters of 4K and wireless visual presenters, focusing heavily on integration with existing SMART systems and hybrid learning platforms.

- Europe: Western European countries, particularly Germany, the UK, and France, represent a mature market with steady growth driven by replacement cycles and the push for digital transformation in educational institutes following EU mandates. Emphasis is placed on robust, long-lasting products that comply with strict data protection regulations.

- Asia Pacific (APAC): APAC is the fastest-growing market globally. Rapid urbanization, increasing government budgets allocated to education modernization in large developing economies like China and India, and the sheer volume of educational institutions drive explosive growth. Demand is high for both cost-effective portable models (for remote/rural learning) and high-specification devices for elite universities.

- Latin America (LATAM): Growth in LATAM is primarily driven by government initiatives to standardize classroom technology across public school systems. Price sensitivity is higher here, leading to a strong demand for reliable, mid-range visual presenters with essential connectivity features. Brazil and Mexico are key markets due to their large populations and educational reforms.

- Middle East and Africa (MEA): This region is experiencing moderate growth, spurred by heavy investment in specialized higher education facilities and corporate infrastructure in the GCC states (e.g., UAE, Saudi Arabia). The African market is nascent but shows potential, especially in vocational training centers focused on enhancing practical demonstration capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Visual Presenter Market.- ELMO (HITECH CORPORATION)

- Lumens Digital Optics Inc.

- Aver Information Inc.

- Epson Corporation

- Casio Computer Co., Ltd.

- Ken-A-Vision Manufacturing Co., Inc.

- Samsung Electronics Co., Ltd. (Specific product lines)

- IPEVO Inc.

- QOMO HiteVision LLC

- OKIOCAM

- HUE

- HoverCam (Pathway Innovations)

- Promethean World Ltd. (Offering integrated solutions)

- SMART Technologies

- WolfVision GmbH

- Canon Inc. (Specific document scanner/presenter lines)

- Recordex USA Inc.

- Visual Apex

- TT-Group

- Newline Interactive

Frequently Asked Questions

Analyze common user questions about the Visual Presenter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Optical Zoom and Digital Zoom in visual presenters?

Optical zoom utilizes physical lens movement to magnify the image, resulting in lossless clarity and high fidelity, which is essential for capturing intricate details like fine print or biological specimens. Digital zoom electronically crops and enlarges a portion of the image sensor data, often leading to pixelation or reduced image quality. Optical zoom is generally preferred in professional and advanced educational settings.

Are visual presenters still necessary given the rise of interactive whiteboards and tablets?

Yes, visual presenters remain highly necessary because they specialize in bridging physical objects to the digital world. While tablets handle digital content creation, visual presenters are uniquely optimized for real-time demonstration of three-dimensional objects, physical documents, handwriting, or experiments, functionalities that interactive whiteboards and tablets cannot easily replicate with the same clarity and speed.

Which end-user segment drives the highest demand for Visual Presenters globally?

The Education segment, including K-12 and higher education institutions, represents the largest volume driver for visual presenters globally. This sustained demand is fueled by the continued need for reliable, versatile tools that enhance classroom engagement and facilitate dynamic, interactive instruction based on physical materials and documents.

What are the key integration features users seek in modern visual presenters?

Users prioritize seamless wireless connectivity (Wi-Fi, Bluetooth), direct compatibility with major video conferencing platforms (Zoom, Teams), and software that offers integrated annotation, recording, and cloud storage capabilities. Easy integration with existing Learning Management Systems (LMS) and interactive displays is crucial for institutional adoption.

How does the shift to hybrid learning impact the Visual Presenter Market?

The shift to hybrid learning significantly boosts the demand for high-quality, portable visual presenters with robust streaming capabilities. These devices are essential for ensuring that students participating remotely receive clear, high-resolution views of physical demonstrations happening in the classroom, maintaining equity in visual instruction across physical and virtual participants.

The Visual Presenter Market's trajectory is deeply intertwined with global investments in digital infrastructure, particularly within educational frameworks. As technology progresses, the distinction between a simple document camera and a sophisticated, multi-functional communication hub continues to blur, positioning visual presenters as indispensable components of the modern collaborative environment. The convergence of high-definition capture, simplified wireless protocols, and forthcoming AI integration confirms the market's strong future growth potential. Manufacturers who focus on user experience, cross-platform compatibility, and durable, flexible designs will capture the largest share of this expanding market, particularly in the high-growth APAC region and the technologically mature but replacement-driven North American and European markets. Strategic focus on specialized applications, such as medical and industrial documentation, will unlock significant niche market opportunities, ensuring robust market value expansion through 2033.

In summary, the transition towards comprehensive digital ecosystems demands tools that facilitate real-time interaction with physical content, a role perfectly filled by advanced visual presenters. The competitive landscape is forcing innovation in compactness and software integration, moving the product category beyond a simple projection tool into an essential collaborative device. Stakeholders should note the rising importance of cybersecurity features and data handling protocols, especially in government and education sectors, which often purchase via rigorous procurement processes. Furthermore, sustainability and energy efficiency are becoming secondary purchasing criteria, influencing design and material choices among leading vendors aiming for institutional tenders with environmental considerations.

The core technological battleground remains centered on resolving the trade-off between portability and high optical performance. While portable units offer flexibility, fixed units traditionally deliver superior image stability and higher optical zoom. Market success increasingly belongs to firms that minimize this performance gap, offering lightweight units that do not compromise on 4K resolution and high-ratio optical magnification, ensuring they are suitable for both mobile and fixed installation requirements across all major end-user verticals. This persistent innovation cycle ensures the product’s longevity against competing digital alternatives and supports the projected CAGR expansion.

The market also faces macroeconomic influences, including fluctuating currency exchange rates impacting component costs, especially for memory and sensor technology sourced from specific global hubs. Geopolitical tensions can disrupt supply chains, necessitating robust sourcing strategies and diversification among Tier 1 suppliers. However, the inelastic demand from the education sector, which operates on fixed budgetary cycles and critical upgrade schedules, provides a stabilizing element against broader economic volatility, particularly in developed regions where budget allocation for EdTech is prioritized.

Investment patterns reflect confidence in the sector’s resilience. Venture capital and private equity interest remain high, targeting innovative startups focused on visual capture software and cloud integration services complementary to visual presenters. Acquisition activities often center on companies possessing strong proprietary software or established distribution networks within niche institutional markets. This financial activity signals a robust underlying belief in the fundamental utility and long-term relevance of the visual presenter as a necessary tool for visualization and real-time document sharing across diverse professional and educational settings worldwide, solidifying the market's positive outlook for the forecast period.

Looking ahead, the next generation of visual presenters is anticipated to feature heightened environmental awareness in their design, incorporating recycled materials and low-power consumption modes. This responds to global trends toward corporate social responsibility (CSR) and helps institutions meet their own environmental procurement targets. Furthermore, enhanced security features, including internal encryption for stored recordings and user authentication protocols, will be essential for satisfying privacy requirements in sensitive environments like healthcare and government facilities. The holistic product offering must now encompass hardware quality, software intelligence, seamless integration, and ethical design principles to meet the sophisticated demands of the modern institutional buyer, driving the market toward a more integrated, intelligent, and sustainable future.

The rise of micro-presenters, extremely compact and often USB-powered devices, presents a unique segmentation opportunity. While they lack the powerful optics of professional units, their ultra-portability and low cost make them highly appealing for individual educators, students, and small business users seeking an entry-level solution for basic document sharing or remote tutoring. This low-end market volume contributes significantly to overall unit shipments, though not necessarily to total market value, which is dominated by high-end 4K/Optical Zoom devices purchased by corporate and tertiary education institutions. Understanding this dual-market structure is vital for segment-specific marketing and pricing strategies. The sustained dual demand—high specification for institutions and high portability for individuals—ensures market stability and diverse revenue streams for major players.

Another crucial technological element driving demand is the need for devices that function optimally in varied lighting conditions. High-quality visual presenters include proprietary image processing technologies and often built-in LED lighting systems to compensate for poor classroom lighting, ensuring consistent image quality regardless of environmental factors. This reliability is a key factor cited by educational administrators when selecting systems for widespread deployment, differentiating professional-grade products from consumer electronics alternatives. The investment in robust optics and lighting circuitry contributes substantially to the manufacturing cost but provides a necessary competitive advantage in institutional bidding processes.

Furthermore, the maintenance and support infrastructure surrounding visual presenters are becoming increasingly digitized. Manufacturers are offering advanced diagnostics tools, often accessible via cloud platforms, allowing IT administrators to remotely monitor device health, update firmware, and troubleshoot issues across an entire fleet of installed units. This reduction in the total cost of ownership (TCO) through improved manageability and minimized downtime is a major selling point, particularly for large school districts or multinational corporations, reinforcing the long-term value proposition of investing in established brands with comprehensive support ecosystems.

The impact of augmented reality (AR) technologies is beginning to influence the conceptualization of the next generation of visual presenters. While still nascent, the potential to overlay digital information (like text, diagrams, or 3D models) onto the real-time physical image captured by the presenter could revolutionize technical training and educational demonstration. For instance, a presenter could capture an engine part, and the accompanying software could instantaneously project digital annotations identifying components directly onto the screen. This integration promises to create highly immersive and information-rich presentations, further securing the visual presenter's role in the advanced EdTech landscape.

Lastly, the competitive landscape is also seeing shifts based on strategic alliances. Partnerships between visual presenter manufacturers and providers of collaborative software or interactive display solutions (e.g., interactive flat panels) are crucial for creating integrated, seamless solutions. These strategic alignments ensure that the visual presenter functions as a central, integrated peripheral rather than a standalone device, maximizing its utility within a sophisticated AV environment. Such alliances are critical for maintaining market relevance and securing larger contracts requiring full-suite technology deployments, underscoring the market’s pivot towards solution-based selling over isolated hardware transactions.

The educational sector's continuous evolution, fueled by pedagogical shifts towards active learning and demonstration-based instruction, serves as an ongoing stimulus for market growth. Educators increasingly rely on visual presenters to facilitate object-based learning, where students interact directly with physical materials while the entire class observes the details on a screen. This method has proven effective in STEM fields and vocational training, where abstract concepts must be grounded in tangible reality. Consequently, product development is being steered towards features that support collaborative and hands-on activities, such as dual-camera views or wider capture areas, specifically addressing classroom workflow requirements.

The adoption rate in emerging economies is heavily contingent on government procurement cycles and subsidized programs aimed at closing the digital divide. These markets often favor rugged, durable designs that can withstand harsh environmental conditions and heavy daily use in resource-constrained settings. The success of manufacturers in these regions relies on their ability to offer robust hardware coupled with low maintenance requirements and competitive pricing structures tailored to large-scale institutional purchasing mandates. This emphasizes the importance of tiered product lines catering to varying budget constraints globally.

In the corporate realm, visual presenters are playing an increasing role in agile workplace setups. With meeting spaces becoming modular and frequently repurposed, the demand for quick-deploy, high-quality visual aids is paramount. Modern corporate presenters are expected to offer instantaneous startup times and frictionless compatibility with proprietary network security protocols. The focus here is less on educational annotation features and more on professional aesthetic, silent operation, and high security—ensuring the captured content (often sensitive business documents or prototypes) is handled securely throughout the presentation workflow. This premium segment continues to command high average selling prices due to these sophisticated requirements.

The market faces a unique challenge from software-only solutions attempting to replicate the functionality of a document camera using smartphone or tablet cameras paired with dedicated apps. While these provide a low-cost entry point, they consistently fail to match the specialized features of dedicated visual presenters, such as powerful optical zoom, specific lighting control, stable positioning via mechanical arms, and seamless integration with dedicated projection equipment. The dedicated hardware advantage, particularly in terms of image quality and stability for prolonged viewing, sustains the professional market segment against these low-fidelity, software-based competitive threats.

Finally, the long-term sustainability of the visual presenter market is linked to its adaptability within the evolving Internet of Things (IoT) landscape. Future models are expected to integrate further into centralized classroom and meeting room management systems, providing granular data on usage patterns, energy consumption, and connectivity status. This integration enhances institutional asset management and optimizes resource deployment, moving the visual presenter from a simple peripheral device to an interconnected node within a larger smart technology ecosystem. This strategic evolution will be key to maintaining high growth rates in developed markets experiencing replacement cycles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager