Vital Organs Support Systems and Medical Bionics Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432216 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Vital Organs Support Systems and Medical Bionics Market Size

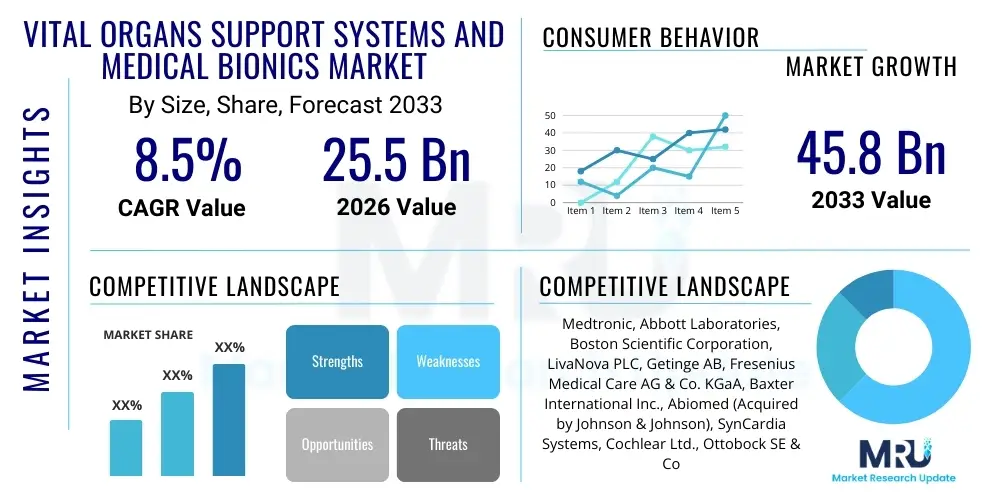

The Vital Organs Support Systems and Medical Bionics Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 45.8 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the rising prevalence of chronic organ failure, increasing global geriatric population demographics, and continuous advancements in bioengineering materials and miniaturization technologies.

Vital Organs Support Systems and Medical Bionics Market introduction

The Vital Organs Support Systems and Medical Bionics Market encompasses sophisticated medical devices designed to temporarily or permanently replace or assist the function of critical human organs such as the heart, lungs, kidneys, and pancreas. This domain is bifurcated into support systems, which include devices like dialysis machines, ECMO (Extracorporeal Membrane Oxygenation) systems, and ventricular assist devices (VADs), and medical bionics, which involves technologically advanced prosthetic and orthotic solutions that interface with the nervous system, such as bionic limbs, artificial cochlear implants, and retinal prostheses. The primary objective of these products is to extend patient life expectancy, improve quality of life following organ failure or severe disability, and serve as a bridging solution until a suitable biological transplant becomes available.

Major applications of these life-sustaining technologies are predominantly found in critical care units, cardiovascular surgery departments, nephrology clinics, and rehabilitation centers. Support systems are indispensable for patients suffering from end-stage renal disease, acute respiratory distress syndrome, or advanced heart failure. Medical bionics, conversely, target functional restoration for individuals with sensory or motor deficits. The key benefits derived from the implementation of these advanced systems include enhanced survival rates for patients with complex medical conditions, reduced reliance on donor organs which face severe scarcity, and the capability for personalized physiological adjustment through integrated sensors and smart algorithms. Furthermore, the integration of biocompatible materials minimizes rejection risks and enhances device longevity, contributing significantly to patient outcomes.

Driving factors propelling market growth are multifaceted, centering on demographic shifts and technological leaps. The rising incidence of lifestyle-related diseases, such as diabetes and hypertension, directly contributes to the increasing burden of kidney and heart failure, necessitating robust support mechanisms. Furthermore, sustained high investments in R&D by medical device manufacturers, particularly focused on developing less invasive implants and fully implantable artificial organs, are expanding the patient pool eligible for these advanced treatments. Regulatory streamlining in key regions for breakthrough devices also accelerates market penetration, establishing a favorable environment for rapid product adoption globally. These combined influences underscore the market's trajectory towards significant valuation growth.

Vital Organs Support Systems and Medical Bionics Market Executive Summary

The market for Vital Organs Support Systems and Medical Bionics is characterized by strong global business trends leaning toward integration and miniaturization. A significant trend involves the shift from external support machinery to fully or partially implantable devices, which drastically improves patient mobility and lifestyle quality. Strategic mergers and acquisitions among established medical technology giants and specialized bionics startups are common, aimed at consolidating technological expertise, particularly in areas like advanced sensors, battery efficiency, and neuromorphic engineering. Furthermore, the increasing emphasis on value-based healthcare models necessitates that these high-cost devices demonstrate superior clinical efficacy and long-term cost savings, driving innovation towards durable and maintenance-friendly products.

Regionally, North America maintains its dominance due to advanced healthcare infrastructure, high reimbursement rates for sophisticated procedures, and significant expenditure on R&D. However, the Asia Pacific (APAC) region is poised to exhibit the highest growth rate, fueled by improving healthcare accessibility, increasing medical tourism, and a burgeoning patient population with chronic diseases, particularly in countries like China and India. Europe also remains a crucial market, driven by favorable regulatory frameworks for medical devices (though currently undergoing review under the MDR) and the presence of leading academic research institutions specializing in biomedical engineering and regenerative medicine. These regional dynamics highlight a market moving towards global accessibility, albeit with sustained innovation leadership retained by developed economies.

Segmentation analysis reveals that the Cardiovascular Support Systems segment, including VADs and total artificial hearts, holds the largest market share, directly correlated with the high prevalence of heart failure globally. Conversely, the Medical Bionics segment, specifically advanced neural and motor prosthetics, is projected to register the fastest growth, benefiting from breakthroughs in brain-computer interfaces (BCIs) and materials science that enhance device functionality and user control. Within the end-user spectrum, hospitals and specialized clinics remain the primary consumption points, yet a growing trend shows specialized ambulatory surgical centers (ASCs) increasingly adopting less complex support systems, driving diversification in distribution channels and point-of-care delivery models.

AI Impact Analysis on Vital Organs Support Systems and Medical Bionics Market

User queries regarding the impact of Artificial Intelligence (AI) in this market frequently revolve around key themes such as the potential for personalized device calibration, concerns over data privacy and security in implanted devices, and the role of AI in improving diagnostic accuracy for device malfunctions. Users are highly interested in how machine learning can optimize device parameters in real-time based on patient physiological feedback, moving beyond static programming. There is also significant anticipation regarding AI's capability to refine surgical procedures involving bionics placement and its potential in accelerating the design and testing phases of next-generation bio-integrated devices.

The implementation of AI algorithms is fundamentally transforming the operational capabilities of vital organ support systems. For instance, in circulatory support devices like VADs, AI can analyze vast streams of hemodynamic data (e.g., blood flow, pressure, and heart rhythm) to predict potential complications such as pump thrombosis or suction events before they become critical. This predictive maintenance capability ensures safer patient management and reduces the frequency of emergency interventions. Similarly, in kidney support, AI optimizes dialysis schedules and fluid removal rates based on continuous physiological monitoring, minimizing stress on the cardiovascular system and enhancing long-term patient outcomes.

In the bionics sector, AI is crucial for translating neural signals into functional movement and sensation. Advanced machine learning models are used to decode complex electrophysiological data generated by the user’s residual nerves or brain activity, allowing for more intuitive, faster, and smoother control of prosthetic limbs or robotic exoskeletons. This sophisticated processing enhances the natural feel and responsiveness of bionic devices, significantly improving functional independence for the end-user. Furthermore, AI contributes to design optimization by simulating material stresses and biocompatibility under various conditions, thereby accelerating the development cycle for durable, next-generation implants.

- AI-driven real-time physiological parameter optimization in VADs and ECMO systems.

- Predictive analytics for early detection of device malfunction or potential complications (e.g., clotting risk).

- Enhanced neural signal decoding for intuitive control of medical bionics (e.g., prosthetic limbs, retinal implants).

- Machine learning applied to image recognition for improved surgical planning and precise device implantation.

- Optimization of manufacturing processes and material testing through computational modeling.

DRO & Impact Forces Of Vital Organs Support Systems and Medical Bionics Market

The market is predominantly driven by increasing global chronic disease prevalence, particularly cardiovascular and renal disorders, coupled with a growing elderly population requiring long-term support solutions. However, stringent regulatory approval processes and the high capital cost associated with these advanced devices pose significant restraints, limiting adoption in resource-constrained settings. The main opportunity lies in the convergence of bioengineering and information technology, enabling the development of personalized, interconnected, and miniature devices. These internal dynamics generate powerful impact forces: the technological force, characterized by rapid breakthroughs in materials science and AI integration, and the economic force, highlighting the challenge of balancing high development costs with the need for broader accessibility and affordable patient care.

Key drivers include substantial investment in infrastructure upgrades in emerging economies and favorable government policies supporting the development of innovative life-saving technologies. The scarcity of suitable donor organs acts as a major catalyst, propelling the demand for reliable mechanical and bionic substitutes. Nevertheless, ethical concerns surrounding the prolonged mechanical existence supported by these devices, alongside risks of mechanical failure and post-implantation infection, serve as persistent restraints that must be addressed through rigorous clinical testing and enhanced material engineering. Furthermore, the complexity of surgical training and the requirement for highly specialized medical staff limit widespread implementation in smaller or less-equipped healthcare facilities.

Opportunities are vast, particularly in the realm of fully bio-integrated systems, where devices mimic biological function seamlessly. The development of remote patient monitoring capabilities, enabled by 5G and IoT integration, offers a pathway for significantly reducing hospitalization time and healthcare costs while maintaining close clinical oversight. This evolution from purely supportive systems to predictive and self-regulating bionics represents the market’s future direction. Overall, the market's trajectory is defined by a strong upward pull from clinical need and innovation, slightly moderated by persistent regulatory and financial hurdles inherent to the highly specialized medical device industry.

Segmentation Analysis

The Vital Organs Support Systems and Medical Bionics Market is meticulously segmented based on the type of organ supported or replaced, the functional principle of the device, and the specific end-user category. This granular segmentation provides critical insights into specific high-growth areas and differential adoption rates across clinical specialties. The market is broadly categorized into External Support Systems, designed for temporary intervention or chronic external use, and Implantable Bionics and Support Devices, intended for long-term internal physiological assistance. Analysis across these segments confirms that technological complexity often correlates directly with higher average selling prices and stronger intellectual property protections, sustaining high-margin profitability for innovators.

The primary segment classification by product type includes Cardiovascular Support Devices (e.g., VADs, Total Artificial Hearts), Renal Support Devices (e.g., Dialysis equipment), Respiratory Support Devices (e.g., ECMO, Ventilators), and Neurobionic Devices (e.g., Deep Brain Stimulators, Neural Prosthetics). Further segmentation by technology type—such as mechanical circulatory assist versus bio-integrated electronic implants—helps stakeholders understand R&D investment flows. Geographically, segmentation assists in tailoring market strategies, recognizing the distinct reimbursement and regulatory environments that dictate product uptake in regions such as North America, Europe, and the rapidly expanding Asia Pacific markets.

The detailed segmentation also tracks adoption rates among diverse end-users, primarily hospitals (which account for the largest share due to complex procedures and capital expenditure), specialized clinics (e.g., nephrology centers), and ambulatory surgical centers. Understanding end-user dynamics is crucial for optimizing distribution channels. For instance, renal support systems see high usage in dedicated dialysis centers, whereas high-end bionic implants are predominantly handled by university hospitals and specialized neurosurgery units. This detailed market map enables manufacturers to focus resources on segments demonstrating maximum unmet clinical needs and highest commercial feasibility.

- Product Type:

- Cardiovascular Support Systems

- Ventricular Assist Devices (VADs) (Left, Right, Bi-VADs)

- Total Artificial Hearts (TAH)

- ECMO Systems (Veno-Arterial, Veno-Venous)

- Renal Support Systems

- Hemodialysis Devices

- Peritoneal Dialysis Devices

- Continuous Renal Replacement Therapy (CRRT) Systems

- Respiratory Support Systems

- Portable Ventilators

- Implantable Lung Assist Devices

- Neurobionic Devices

- Cochlear Implants

- Retinal Implants

- Deep Brain Stimulators (DBS)

- Prosthetic and Orthotic Bionics

- Powered Exoskeletons

- Bionic Limbs (Upper and Lower Extremity)

- Cardiovascular Support Systems

- Technology:

- Mechanical Systems

- Electro-Mechanical Systems

- Bio-integrated Electronic Systems

- Artificial Intelligence (AI) Enabled Systems

- End User:

- Hospitals and Cardiac Centers

- Ambulatory Surgical Centers

- Specialized Clinics (e.g., Nephrology Centers, Rehabilitation Centers)

- Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Vital Organs Support Systems and Medical Bionics Market

The value chain for Vital Organs Support Systems and Medical Bionics is complex, characterized by stringent regulatory oversight and intensive R&D requirements. The upstream activities involve the specialized procurement of high-grade, biocompatible raw materials, including advanced polymers, titanium alloys, ceramics, and microelectronic components. These suppliers must adhere to rigorous quality control standards (e.g., ISO 13485) as material integrity is paramount for device safety and longevity within the human body. Manufacturing is a highly specialized process, often conducted in cleanroom environments, encompassing precision machining, micro-assembly of sensors and power components, and sterile packaging, representing a high barrier to entry due to capital intensity and specialized expertise.

Downstream analysis focuses heavily on clinical trials and validation, which are mandatory steps before market entry, particularly in regions like the US (FDA approval) and Europe (CE Mark). The distribution channel is predominantly indirect, utilizing specialized distributors who possess expertise in handling high-value medical capital equipment and provide technical support to hospitals. Due to the inherent complexity of these devices, direct sales forces are often employed by key manufacturers to engage directly with cardiologists, nephrologists, and biomedical engineers, providing detailed clinical education and maintenance services. The final stage involves the clinical setting—hospitals and specialized centers—where the devices are implanted or utilized, followed by extensive post-market surveillance and device upkeep.

Direct channels, though less frequent for initial device sales, are critical for continuous service, upgrades, and consumables (e.g., dialysis filters, battery packs). Indirect channels facilitate broader geographic reach, especially in emerging markets where local partnerships provide necessary logistical and regulatory navigation. A significant portion of the value is captured during the post-sales service phase, including mandatory device checks, replacement part sales, and software updates. This emphasis on post-sales support highlights the long-term relationship between the manufacturer and the healthcare provider, essential for maintaining clinical efficacy and ensuring device compliance over the patient’s lifetime.

Vital Organs Support Systems and Medical Bionics Market Potential Customers

The primary end-users and buyers of Vital Organs Support Systems and Medical Bionics are institutional healthcare providers facing a growing caseload of patients with chronic and acute organ failure. These include large, academic teaching hospitals and specialized cardiovascular centers that possess the advanced infrastructure and highly trained surgical teams required for implantation procedures like VAD insertion or total artificial heart replacement. These institutions prioritize devices offering high reliability, advanced monitoring capabilities, and strong clinical evidence supporting long-term efficacy, as dictated by rigorous internal purchasing committees and stringent accreditation standards. Purchasing decisions are heavily influenced by clinical outcomes data, total cost of ownership (including consumables and maintenance), and the strength of manufacturer support.

A secondary, yet rapidly expanding, customer base comprises specialized treatment facilities such as standalone nephrology clinics and dedicated rehabilitation centers. Nephrology centers are high-volume buyers of renal support systems, particularly hemodialysis and peritoneal dialysis equipment, where the focus shifts towards efficiency, portability, and patient comfort to support home dialysis programs. Rehabilitation centers, conversely, are key customers for bionic prosthetics and powered exoskeletons, prioritizing ease of use, sophisticated control algorithms, and compatibility with intensive physical therapy regimes aimed at maximizing patient functional independence and integration back into society.

Government procurement bodies and regional public health systems represent another significant customer segment, particularly in markets outside North America. These entities focus on procuring support systems for population-level health initiatives, often prioritizing cost-effectiveness, widespread applicability, and devices that can be efficiently integrated into public healthcare infrastructure. Furthermore, as technology advances, individual patients, particularly those seeking highly specialized bionic solutions (like advanced microprocessor-controlled knees or sensory bionics), often influence purchasing decisions through specialized insurance coverage or out-of-pocket expenditure, driving demand for personalized and aesthetically improved devices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 45.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Medtronic, Abbott Laboratories, Boston Scientific Corporation, LivaNova PLC, Getinge AB, Fresenius Medical Care AG & Co. KGaA, Baxter International Inc., Abiomed (Acquired by Johnson & Johnson), SynCardia Systems, Cochlear Ltd., Ottobock SE & Co. KGaA, Össur, Ekso Bionics, Edwards Lifesciences, Teleflex Incorporated, Bionic Vision Technologies, Carmat, Berlin Heart GmbH, TransMedics, and Nipro Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vital Organs Support Systems and Medical Bionics Market Key Technology Landscape

The technological landscape of the Vital Organs Support Systems and Medical Bionics market is defined by rapid advancements in three core areas: advanced materials science, miniaturization, and bio-integration with digital intelligence. The shift towards durable, biocompatible materials, such as diamond-like carbon coatings and specialized polymer blends, is crucial for reducing thrombosis risk and minimizing the biological foreign body reaction, thereby enhancing the longevity and safety of implanted devices like VADs and total artificial hearts. Furthermore, continuous innovation in high-density, low-power electronics is enabling the creation of smaller, less invasive internal components that require less frequent battery replacement or charging, substantially improving patient quality of life and device efficiency.

Miniaturization and portability are key trends, particularly evident in renal support and respiratory systems. Compact, wearable dialysis units are emerging, offering greater flexibility than traditional in-center treatments. Similarly, advancements in portable ECMO technology are allowing for faster deployment and easier patient transfer. Concurrently, the integration of wireless charging capabilities (transcutaneous energy transfer) eliminates the need for percutaneous drivelines in many cardiac support systems, drastically lowering the risk of infection, which historically has been a major constraint for long-term mechanical support devices. This focus on simplifying patient management and reducing complications is a primary driver of current technological investment.

Perhaps the most transformative technological shift is the application of sophisticated bio-integration and neural interface technologies, primarily in the bionics segment. This includes advanced sensor arrays that can accurately detect complex biological signals (electromyography, neural firing patterns) and sophisticated microprocessors that translate these signals into motor commands for prosthetic limbs or electrical impulses for functional nervous system support (e.g., in cochlear implants and deep brain stimulation). The convergence with AI, allowing devices to "learn" and adapt to individual patient needs and environmental changes, represents the cutting edge, leading to devices that are intuitive, predictive, and truly restorative of biological function rather than merely assistive.

Regional Highlights

- North America: This region consistently dominates the global market, primarily driven by the United States. High prevalence of cardiovascular diseases, diabetes, and end-stage renal disease necessitate advanced intervention. The region benefits from robust healthcare spending, sophisticated infrastructure, and favorable reimbursement policies for high-cost devices. Furthermore, the presence of major global medtech corporations and pioneering research institutions ensures continuous innovation and rapid market adoption of breakthroughs like advanced VADs and personalized bionics. Strict but clear regulatory pathways (FDA) provide high consumer confidence in product safety and efficacy.

- Europe: Europe represents the second-largest market, characterized by mature healthcare systems (e.g., Germany, UK, France) and a high geriatric population demographic demanding long-term care solutions. While regulatory adherence under the Medical Device Regulation (MDR) has presented challenges, it ensures a high standard of clinical evidence. Key market drivers include government initiatives supporting organ donation alternatives and significant investment in clinical research for artificial organs and advanced prosthetics across major EU member states.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This growth is attributable to massive populations, improving economic conditions leading to increased disposable income for healthcare, and rapid development of medical infrastructure in emerging economies like China, India, and South Korea. While access remains a challenge in rural areas, the burgeoning incidence of lifestyle diseases and increasing government efforts to combat organ scarcity are accelerating the adoption of support systems, particularly in the renal and cardiovascular sectors.

- Latin America (LATAM): This region is an emerging market, driven by improving healthcare access in countries such as Brazil and Mexico. The market is highly price-sensitive, often favoring robust, established external support systems (like dialysis machines) over high-cost implantable bionics. Expansion hinges on political stability, foreign direct investment in private healthcare facilities, and addressing the significant disparities in regional healthcare quality and resource allocation.

- Middle East and Africa (MEA): The MEA market shows heterogeneous growth. The Gulf Cooperation Council (GCC) countries exhibit high spending on advanced medical technology due to wealth and specialized centers, driving demand for high-end cardiac and neurobionics. In contrast, many African nations focus primarily on essential, affordable support systems. Infrastructure development and addressing the high burden of chronic disease are key to future market growth across the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vital Organs Support Systems and Medical Bionics Market.- Medtronic

- Abbott Laboratories

- Boston Scientific Corporation

- LivaNova PLC

- Getinge AB

- Fresenius Medical Care AG & Co. KGaA

- Baxter International Inc.

- Abiomed (Acquired by Johnson & Johnson)

- SynCardia Systems

- Cochlear Ltd.

- Ottobock SE & Co. KGaA

- Össur

- Ekso Bionics

- Edwards Lifesciences

- Teleflex Incorporated

- Bionic Vision Technologies

- Carmat

- Berlin Heart GmbH

- TransMedics

- Nipro Corporation

- ResMed

- Zoll Medical Corporation (an Asahi Kasei Group Company)

- Tandem Diabetes Care

- Stryker Corporation

Frequently Asked Questions

Analyze common user questions about the Vital Organs Support Systems and Medical Bionics market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Medical Bionics segment?

The primary growth drivers for the Medical Bionics segment include technological breakthroughs in neural interface technology, the increasing global incidence of trauma and limb loss, and substantial improvements in biocompatibility and miniaturization, enabling devices like advanced bionic limbs and sensory implants to offer near-natural functionality and control.

How does the scarcity of donor organs influence the demand for vital organ support systems?

The critical shortage of viable donor organs directly escalates the demand for mechanical support systems, such as Ventricular Assist Devices (VADs) and artificial lungs (ECMO), which function as crucial bridge-to-transplant or destination therapy options, extending and preserving the lives of patients awaiting transplantation.

What role does Artificial Intelligence (AI) play in improving the efficacy of support systems?

AI significantly enhances efficacy by enabling real-time device calibration and personalized treatment. AI algorithms analyze continuous patient physiological data to predict adverse events, optimize pump speeds in VADs, and refine neural signal decoding in bionics, leading to safer outcomes and more intuitive device performance.

Which geographical region exhibits the highest growth potential for this market?

The Asia Pacific (APAC) region is forecasted to demonstrate the highest Compound Annual Growth Rate (CAGR). This surge is attributed to rapidly modernizing healthcare infrastructure, increasing awareness of advanced treatments, and a massive, growing patient pool suffering from chronic cardiovascular and renal diseases.

What are the major restraints impacting the broader adoption of advanced implantable support devices?

Major restraints include the extremely high initial capital cost of the devices and associated surgical procedures, the complexity of necessary post-operative care, and significant regulatory and clinical trial hurdles that delay market entry and limit widespread commercialization, particularly in emerging economies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager