Vitrectomy Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436049 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Vitrectomy Machines Market Size

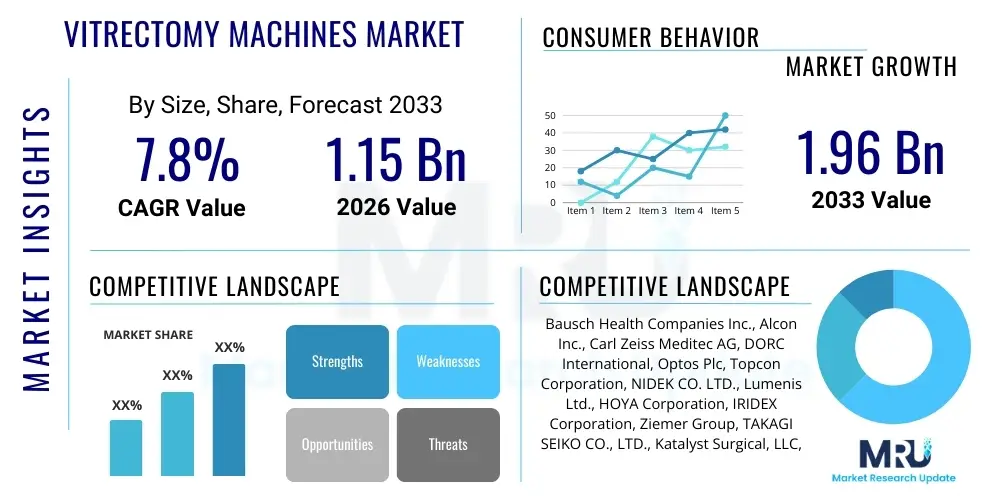

The Vitrectomy Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.15 Billion in 2026 and is projected to reach USD 1.96 Billion by the end of the forecast period in 2033.

Vitrectomy Machines Market introduction

The Vitrectomy Machines Market encompasses highly specialized surgical equipment utilized in ophthalmology for treating complex vitreoretinal disorders, including retinal detachment, macular holes, diabetic retinopathy, and vitreous hemorrhage. These sophisticated systems are engineered to facilitate the surgical removal of the vitreous humor (a gel-like substance filling the eye) and access the retina, enabling precise membrane peeling, photocoagulation, and fluid management. Modern vitrectomy machines integrate high-speed cutters, advanced fluidics control, superior illumination, and wide-angle viewing systems, enhancing safety, efficiency, and outcomes in micro-invasive surgery. The technological evolution towards smaller gauge instruments, such as 25-gauge and 27-gauge systems, has significantly propelled market adoption by reducing incision size and improving patient recovery times.

Product descriptions for these machines often highlight their customizable parameters, which allow surgeons to tailor procedures based on case complexity. Key components include pneumatic or electrically driven cutters capable of up to 10,000 cuts per minute (cpm), integrated laser delivery systems, and sophisticated aspiration pumps (either peristaltic or Venturi). These technical advancements are critical as vitreoretinal surgery demands unparalleled precision and control over intraocular pressure (IOP) to minimize risks of iatrogenic injury. Furthermore, the increasing prevalence of age-related eye diseases and diabetes globally serves as a foundational driver for sustained demand in both established and emerging healthcare markets.

Major applications of vitrectomy machines span therapeutic interventions for retinal detachment repair, diabetic vitrectomy, treating ocular trauma, and managing endophthalmitis. The core benefits provided by these advanced devices include improved visual acuity outcomes, reduced surgical invasiveness, and enhanced stability during complex intraocular maneuvers. Driving factors primarily involve the rapid expansion of the geriatric population susceptible to cataracts and diabetic complications, coupled with continuous innovation focused on integrating digital and robotic assistance features, further solidifying the necessity of these machines in modern eye care centers and specialized ophthalmology hospitals.

- Product Description: Specialized ophthalmological surgical systems integrating high-speed cutters, fluidics control, and advanced illumination for vitreoretinal procedures.

- Major Applications: Retinal detachment, diabetic retinopathy management, macular hole repair, vitreous hemorrhage treatment, and ocular trauma surgery.

- Key Benefits: Enhanced surgical precision, reduced invasiveness (MIVS), improved intraocular pressure stability, and faster post-operative recovery.

- Driving Factors: Rising incidence of chronic retinal diseases, technological migration toward smaller gauge vitrectomy, and increasing ophthalmic surgical infrastructure investment.

Vitrectomy Machines Market Executive Summary

The Vitrectomy Machines Market is experiencing robust growth fueled by pivotal business trends centered around miniaturization, automation, and expanding global healthcare access. Technologically, the shift from traditional 20-gauge systems to micro-incision vitrectomy surgery (MIVS) using 23-, 25-, and 27-gauge platforms dictates the current business landscape, enabling faster procedures and minimal scarring, thereby increasing patient preference for surgical intervention. Key manufacturers are focusing their investment strategies on developing integrated platforms that combine vitrectomy, phacoemulsification, and endolaser capabilities into a single console, streamlining the operating room workflow and offering cost efficiencies to high-volume surgical centers. Furthermore, market competition is intensifying, driven by strategic mergers, acquisitions, and partnerships aimed at strengthening distribution networks and capturing market share in fast-growing regions like Asia Pacific.

Regionally, North America maintains the leading market position due to high healthcare expenditure, established reimbursement policies, and the rapid adoption of sophisticated surgical technologies. However, the Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR), primarily driven by the colossal patient pool suffering from diabetes-related eye complications, improving economic conditions, and government initiatives focused on modernizing ophthalmic care infrastructure, particularly in countries such as China and India. Europe also represents a mature market, characterized by strict regulatory standards and a strong focus on clinical validation of new MIVS technologies, ensuring sustained but stable growth across Western European nations.

Segment trends indicate that the MIVS segment (23-gauge, 25-gauge, and 27-gauge) dominates the market based on product gauge size, reflecting the industry's widespread acceptance of minimally invasive techniques. In terms of end-users, hospitals and large ophthalmic clinics account for the largest share due to the high capital cost of these machines and the required infrastructure for complex vitreoretinal procedures. Technological innovation within fluidics management systems—specifically the transition from traditional linear vacuum control to more sophisticated, flow-based control mechanisms—is a critical trend influencing purchasing decisions, emphasizing safety and control during high-risk surgery. Furthermore, consumables, including surgical packs, probes, and cannulas, represent a lucrative and high-growth segment, driven by the increasing volume of surgical procedures performed globally.

- Business Trends: Consolidation of multi-functional surgical platforms, intense focus on MIVS adoption (25/27 gauge), and increasing utilization of disposable components to ensure sterility and efficiency.

- Regional Trends: Dominance of North America in revenue, fastest growth projected for Asia Pacific due to demographic factors and expanding healthcare access.

- Segments Trends: Continued supremacy of the MIVS category (25-gauge and 27-gauge), steady demand for combined surgical systems (vitrectomy and phaco), and high growth in the consumables and accessories market.

AI Impact Analysis on Vitrectomy Machines Market

Common user inquiries regarding the influence of Artificial Intelligence (AI) on the Vitrectomy Machines Market often center on how AI can enhance surgical precision, automate specific operative steps, and improve preoperative planning and post-operative diagnostics. Users frequently question the role of machine learning in interpreting Optical Coherence Tomography (OCT) images to better guide surgical decision-making, particularly concerning membrane peeling or recognizing subtle retinal pathology that might affect the operative approach. Concerns also revolve around the regulatory pathways and liability associated with AI-driven autonomous features, emphasizing the need for robust verification and validation to ensure patient safety while maximizing the efficiency benefits AI promises in complex vitreoretinal surgeries.

The core themes emerging from user expectations highlight the transformative potential of AI in moving beyond mere instrumentation control toward cognitive assistance. Users anticipate AI integration will lead to smarter fluidics management systems that autonomously adjust vacuum levels based on real-time intraocular pressure monitoring and tissue interaction feedback, thereby minimizing the risk of hypotony or surge. Additionally, there is a strong interest in AI-powered digital assistants that can overlay real-time surgical data, such as anatomical boundaries and optimal cutter paths, onto the surgeon's microscopic view, acting as an advanced intraoperative navigation system, especially beneficial during procedures involving highly distorted or detached retinas.

Ultimately, the expectation is that AI will democratize high-precision vitreoretinal surgery, making outcomes more predictable and less dependent on the individual surgeon's manual dexterity for routine tasks. This includes AI algorithms assisting in the detection of microscopic blood vessels during diabetic vitrectomy to prevent hemorrhage, or optimizing laser settings based on real-time tissue response. While full autonomy is distant, the near-term impact focuses heavily on optimizing workflow, improving safety parameters through predictive monitoring, and enhancing the diagnostic accuracy that precedes and dictates the surgical plan, thus reducing overall operative time and improving the longevity of the surgical system's performance.

- AI integration for real-time intraoperative guidance and automated adjustment of cutter speed and aspiration based on tissue interaction.

- Machine learning algorithms enhancing preoperative diagnostics, specifically interpreting OCT and fundus images to delineate complex pathology.

- Predictive modeling for fluidics management to prevent post-occlusion surge and maintain optimal intraocular pressure stability.

- Augmented reality overlays powered by AI to provide surgeons with precise anatomical mapping and optimal trajectory suggestions during micro-incision procedures.

- Automated documentation and analysis of surgical metrics to optimize efficiency and aid in surgical training and skill development.

DRO & Impact Forces Of Vitrectomy Machines Market

The market for Vitrectomy Machines is significantly influenced by a complex interplay of Drivers, Restraints, Opportunities, and overarching Impact Forces that shape investment and adoption patterns globally. Primary drivers include the massive demographic shift towards an aging global population, which correlates directly with an increased incidence of age-related macular degeneration (AMD), cataracts, and other posterior segment disorders necessitating surgical intervention. Furthermore, the global epidemic of diabetes mellitus continues to escalate, making diabetic retinopathy and its complex surgical management one of the strongest recurring demands for advanced vitrectomy systems, thereby reinforcing market stability and growth projections. Technological innovation, particularly the standardization of MIVS techniques (25-gauge and 27-gauge), provides tangible benefits in terms of patient comfort and surgical efficiency, driving rapid replacement cycles of older, less-efficient equipment in developed markets.

Conversely, significant restraints hinder market growth, most notably the extremely high capital expenditure required for purchasing state-of-the-art vitrectomy consoles, making adoption challenging for small clinics or hospitals in developing economies with limited budgetary allocations. The specialized nature of the procedure also mandates highly skilled vitreoretinal surgeons, leading to a persistent shortage of trained personnel in many regions, which limits the operational capacity of installed machines. Additionally, stringent regulatory requirements and lengthy approval processes, especially in large markets like the United States and Europe, can delay the market entry of new, innovative devices, momentarily dampening the competitive landscape and technological refresh rates. Cost-sensitive markets often rely on refurbished equipment or lower-cost regional alternatives, impacting the revenue potential of premium system manufacturers.

Opportunities for market expansion are abundant, particularly in emerging economies where healthcare infrastructure is rapidly developing and patient access to specialized care is increasing. The convergence of vitrectomy systems with other ophthalmic platforms, such as integrated phaco and laser modules, offers avenues for higher profitability and operational simplification, serving as a key investment area. Furthermore, the untapped potential in developing portable or semi-portable vitrectomy units designed for high-volume surgical missions or remote healthcare settings presents a novel opportunity. Impact forces surrounding this market are dominated by healthcare policy changes, especially reimbursement rates for complex vitreoretinal procedures, and the continuous need for clinical evidence supporting the superior outcomes of MIVS technologies. The influence of leading ophthalmic societies in setting surgical standards and protocols also acts as a profound impact force, rapidly driving adoption of validated innovations across the global professional community.

The primary impact force remains the technological race to achieve higher cutter speeds (exceeding 10,000 cpm) and refine fluidics control (active flow vs. vacuum), as these factors directly correlate with surgical control and minimized trauma. The secondary impact force is the evolving preference for disposable components (probes, fluidics cassettes, tubing) which, while increasing operating costs, significantly enhance safety protocols and minimize the risk of cross-contamination, aligning with stringent hospital safety mandates. These forces collectively compel manufacturers to invest heavily in R&D to maintain competitive advantage and meet the dual demands of precision and cost-efficiency in complex ocular surgery.

- Drivers: Rapidly expanding geriatric population base, increasing global incidence of diabetic retinopathy, successful technological transition to MIVS (25/27 gauge).

- Restraints: High initial capital investment costs, scarcity of highly trained vitreoretinal surgeons, complex and time-consuming regulatory approval processes.

- Opportunity: Expansion into underserved emerging markets (APAC, LATAM), development of integrated multi-functional surgical platforms, focus on automation and robotics assistance.

- Impact Forces: Strict healthcare reimbursement policies influencing purchasing decisions, dominance of MIVS surgical standards established by global ophthalmic professional organizations, and continuous pressure for superior fluidics management safety features.

Segmentation Analysis

The Vitrectomy Machines Market is comprehensively segmented based on product type, technology, application, end-user, and gauge size, offering granular insights into specific market dynamics and growth potential. Analyzing these segments reveals that technological sophistication and procedural invasiveness are key differentiating factors in market value capture. The product segmentation primarily divides the market into comprehensive standalone vitrectomy systems and combined or integrated systems, with the latter showing faster adoption rates due to operational convenience and spatial efficiency in the operating room. The most influential segmentation factor remains the surgical gauge size, where the preference for smaller, minimally invasive instruments directly reflects prevailing clinical practices and patient recovery expectations.

Segmentation by technology delineates systems based on their cutting mechanism—pneumatic versus electric—and the type of aspiration/fluidics control employed, with sophisticated, flow-based fluidics gaining favor for enhanced safety profiles. Application segmentation highlights the dominance of diabetic retinopathy and retinal detachment procedures as core revenue generators, though the use in niche areas like ocular trauma and pediatric vitrectomy is growing steadily. These structural segmentations are crucial for manufacturers to tailor their R&D and marketing strategies, focusing on developing accessories and consumables specifically designed for high-volume procedures and addressing specific end-user needs, such as high procedural throughput required by specialized eye hospitals.

The end-user segment is crucial for understanding procurement patterns; large specialized ophthalmic centers and academic hospitals, due to the complexity and volume of procedures, are the primary purchasers of premium, high-end systems. Ambulatory Surgical Centers (ASCs) represent a high-growth segment, preferring slightly more compact, cost-effective, and easy-to-use models suitable for specialized outpatient procedures. This segmentation confirms that market growth is bifurcated, driven by high-volume specialized centers demanding cutting-edge technology and a rapidly expanding ASC network focused on efficiency and manageable capital investment for routine surgical volumes.

- By Product Type: Standalone Vitrectomy Machines, Integrated Ophthalmic Surgical Systems (combining Vitrectomy, Phacoemulsification, and Endolaser).

- By Technology/Mechanism: Pneumatic Cutter Systems, Electric Cutter Systems, LED/Xenon Illumination Systems, Fluidics Management Systems (Venturi vs. Peristaltic Pump).

- By Application: Diabetic Retinopathy, Retinal Detachment, Macular Hole Surgery, Vitreous Hemorrhage, Ocular Trauma.

- By Gauge Size: 20-Gauge, 23-Gauge, 25-Gauge, 27-Gauge (MIVS Dominant).

- By End User: Hospitals, Ophthalmic Clinics, Ambulatory Surgical Centers (ASCs), Academic and Research Institutes.

Value Chain Analysis For Vitrectomy Machines Market

The value chain for the Vitrectomy Machines Market begins with the upstream activities centered on the procurement and sourcing of highly specialized materials and components, including precision optics, sophisticated electronics for control systems, high-quality polymers for disposable components, and advanced metallurgy for micro-surgical probes and cutters. Key upstream participants are specialized component suppliers who provide critical technologies such as high-speed stepper motors, advanced sensor arrays for pressure and flow monitoring, and proprietary illumination sources (e.g., LED or Xenon). Maintaining stringent quality control and supply chain reliability is paramount in this phase, as the performance and safety of the final surgical system depend heavily on component quality and reliability.

Midstream activities involve the design, assembly, and strict quality assurance of the final vitrectomy console. Manufacturers must adhere to rigorous ISO standards and FDA regulations, focusing heavily on R&D for miniaturization (e.g., 27-gauge technology) and system integration. Distribution channels form the critical link to downstream users. The market relies heavily on specialized direct sales forces, particularly for high-capital equipment sold to large hospitals and academic centers, ensuring comprehensive technical support, training, and ongoing maintenance contracts are provided. Indirect channels, utilizing regional distributors and third-party logistics providers, are more prevalent for consumables and accessory sales, especially in geographically dispersed or emerging markets where direct sales presence is limited.

Downstream activities focus on the end-users—hospitals, ophthalmic centers, and ASCs—where the machine is utilized for complex surgeries. Post-sale support, including software updates, maintenance contracts, and training programs for surgical teams, is essential and often represents a significant ongoing revenue stream for manufacturers. Direct distribution ensures personalized service and easier compliance with clinical feedback loops necessary for product improvement. Indirect distribution, while expanding reach, requires careful management to ensure the integrity of technical support and training standards. The effectiveness of the value chain is measured by the rapid deployment of innovative MIVS technology and the sustained customer satisfaction derived from reliable equipment performance and comprehensive service packages.

Vitrectomy Machines Market Potential Customers

The primary customer base for Vitrectomy Machines consists of healthcare institutions requiring specialized equipment for performing complex posterior segment surgeries. High-volume buyers include large, tertiary care hospitals and specialized ophthalmology departments, which invest in premium, high-throughput systems due to the complexity and diversity of vitreoretinal cases they manage. These institutions often prioritize systems offering the highest cutter speeds, most advanced fluidics control, and integration capabilities (phaco/laser) to maximize operational efficiency and handle severe pathologies like complex retinal detachments and advanced diabetic retinopathy. Their purchasing decisions are highly influenced by clinical data, key opinion leaders (KOLs), and favorable long-term service contracts.

A rapidly expanding segment of potential customers is Ambulatory Surgical Centers (ASCs), particularly those focused solely on ophthalmic procedures. ASCs typically seek moderately priced, reliable, and user-friendly standalone or integrated systems that facilitate high turnaround times for outpatient procedures. While their case mix might include more routine vitrectomies than academic centers, the demand for MIVS capability (25/27 gauge) remains high due to the operational imperative of ensuring quick patient discharge. These centers value reliability, ease of sterilization, and cost-effective consumable supply chains, often favoring systems that minimize training requirements for technical staff.

Additionally, regional ophthalmic clinics and private practices with dedicated vitreoretinal specialists represent significant, albeit smaller, purchasers. In emerging markets, governmental and non-governmental organizations (NGOs) focused on eye health missions and public health initiatives are becoming crucial customers. These organizations often require durable, sometimes mobile, systems that can operate effectively in environments with challenging infrastructure. Furthermore, academic and research institutes constitute a niche market, procuring these machines not only for clinical use but also for training the next generation of vitreoretinal surgeons and conducting clinical trials for new surgical techniques, emphasizing the need for flexible, programmable systems suitable for investigative work.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.15 Billion |

| Market Forecast in 2033 | USD 1.96 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bausch Health Companies Inc., Alcon Inc., Carl Zeiss Meditec AG, DORC International, Optos Plc, Topcon Corporation, NIDEK CO. LTD., Lumenis Ltd., HOYA Corporation, IRIDEX Corporation, Ziemer Group, TAKAGI SEIKO CO., LTD., Katalyst Surgical, LLC, MedOne Surgical Inc., Eyeworx B.V., FCI Ophthalmics, Oertli Instrumente AG, Accutome Inc., Geuder AG, and Appasamy Associates. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vitrectomy Machines Market Key Technology Landscape

The technological landscape of the Vitrectomy Machines Market is defined by relentless innovation aimed at increasing surgical speed, enhancing control, and minimizing tissue trauma. The core technology involves the vitrectomy probe itself, where the primary focus is on maximizing the cuts per minute (cpm). Modern systems commonly exceed 7,500 cpm and are rapidly progressing toward 10,000 cpm or higher, significantly reducing traction on the retina and improving the efficiency of vitreous removal. This high-speed operation requires sophisticated electronic control and often utilizes dual-port cutters that aspirate vitreous through one port while cutting through another, optimizing the flow dynamics and reducing vitreous chatter.

Another crucial technological area is fluidics management, which dictates the stability of the intraocular environment. Earlier systems relied on Venturi pumps, offering rapid vacuum but potentially less control, while current high-end machines often utilize peristaltic pumps combined with advanced digital feedback loops (often integrating AI principles) to provide active, flow-based control. This active fluidics control system dynamically adjusts irrigation and aspiration rates in response to real-time fluctuations in intraocular pressure (IOP), drastically minimizing the risk of post-occlusion surge, which is a major safety concern in micro-incision surgery. Advanced systems often incorporate integrated pressure sensors and proportional aspiration valves to maintain constant and safe IOP throughout the procedure.

Furthermore, illumination and visualization technologies have seen substantial leaps. Modern machines incorporate high-intensity LED or Xenon light sources coupled with wide-angle viewing systems and non-contact visualization methods, providing surgeons with superior clarity and depth perception, especially in the peripheral retina. Emerging technologies include the integration of 3D visualization systems, allowing surgeons to operate while viewing a high-resolution 3D screen rather than through a microscope, potentially reducing fatigue and improving surgical ergonomics. The technological roadmap is clearly directed toward automation, enhanced digital integration, and perfecting MIVS capabilities, ensuring smaller, faster, and safer surgical outcomes.

- High-Speed Cutter Technology: Transitioning from 5,000 cpm to systems exceeding 10,000 cpm (up to 20,000 cpm dual-port) for reduced vitreous traction and increased efficiency.

- Advanced Fluidics Control: Utilization of peristaltic pumps and sophisticated active fluidics monitoring systems for precise intraocular pressure (IOP) stability and surge control.

- Micro-Incision Vitrectomy Surgery (MIVS): Standardization and optimization of 25-gauge and 27-gauge systems, requiring highly specialized, flexible probes and cannulas.

- Integrated Illumination Systems: Use of high-output LED, Xenon, and laser light sources coupled with filters to enhance tissue contrast and reduce phototoxicity.

- Digital and 3D Visualization: Implementation of high-definition digital screens and heads-up 3D visualization systems for improved surgical precision and ergonomics.

Regional Highlights

- North America: This region dominates the global market revenue, primarily driven by high per capita healthcare spending, advanced infrastructure, quick adoption of cutting-edge MIVS technologies (27-gauge), and favorable reimbursement policies for complex vitreoretinal procedures. The presence of major market leaders and a high incidence of diabetic retinopathy and age-related macular degeneration (AMD) solidify its leading position.

- Europe: The European market is mature and characterized by strong governmental focus on healthcare quality and standardized surgical practices. Growth is steady, fueled by robust geriatric populations in Western European countries (Germany, UK, France) and the consistent replacement cycle of existing capital equipment. Strict regulatory compliance (CE marking) is a defining feature.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market due to an enormous and rapidly aging population base, soaring diabetes prevalence, and significant government investments in improving hospital infrastructure, particularly in China, India, and Japan. Increasing medical tourism and improving access to specialized care centers are major accelerating factors.

- Latin America: This region presents significant growth potential, albeit from a lower base, driven by increasing insurance coverage, urbanization, and the establishment of more specialized ophthalmology clinics, especially in Brazil and Mexico. Price sensitivity remains a key factor, leading to higher demand for cost-effective or refurbished systems compared to North America.

- Middle East and Africa (MEA): Growth in the MEA is primarily confined to high-income Gulf Cooperation Council (GCC) countries, supported by large-scale medical city projects and expatriate specialist presence. Market expansion across sub-Saharan Africa is slow but shows opportunity in public health initiatives aimed at addressing preventable blindness.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vitrectomy Machines Market.- Alcon Inc.

- Bausch Health Companies Inc.

- Carl Zeiss Meditec AG

- DORC International

- Topcon Corporation

- NIDEK CO. LTD.

- Lumenis Ltd.

- HOYA Corporation

- IRIDEX Corporation

- Ziemer Group

- TAKAGI SEIKO CO. LTD.

- Katalyst Surgical LLC

- MedOne Surgical Inc.

- Eyeworx B.V.

- FCI Ophthalmics

- Oertli Instrumente AG

- Accutome Inc.

- Geuder AG

- Appasamy Associates

- Optos Plc

Frequently Asked Questions

Analyze common user questions about the Vitrectomy Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high growth rate of the Vitrectomy Machines Market?

The primary driver is the accelerating global prevalence of chronic, age-related vitreoretinal diseases, specifically diabetic retinopathy and age-related macular degeneration (AMD), coupled with the increasing adoption of minimally invasive surgical techniques (MIVS) which enhance patient outcomes.

How are 27-gauge systems impacting the profitability of vitreoretinal surgery?

27-gauge systems facilitate micro-incision vitrectomy surgery (MIVS), reducing incision size, minimizing post-operative recovery time, and potentially allowing for higher surgical throughput, thereby improving procedural efficiency and overall profitability for high-volume surgical centers.

What technological advancement is considered the most critical for surgical safety in modern vitrectomy machines?

Advanced fluidics management systems are the most critical safety technology. These systems, often using peristaltic pumps with active digital feedback, maintain stable intraocular pressure (IOP) and prevent post-occlusion surge, safeguarding the delicate retinal tissue during aspiration and cutting.

Which geographical region is projected to exhibit the fastest market growth, and why?

The Asia Pacific (APAC) region is projected for the fastest growth due to its massive, aging population base, the severe burden of diabetes-related eye conditions, rapidly expanding healthcare infrastructure investments, and improving patient accessibility to specialized ophthalmic care.

What is the difference between a standalone vitrectomy machine and an integrated system?

A standalone machine performs only vitrectomy procedures, while an integrated system combines vitrectomy capabilities with phacoemulsification (for cataract removal) and endolaser functions onto a single console, providing operational versatility and efficiency for combined surgical procedures.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager