Voiceover and Dubbing Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431697 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Voiceover and Dubbing Services Market Size

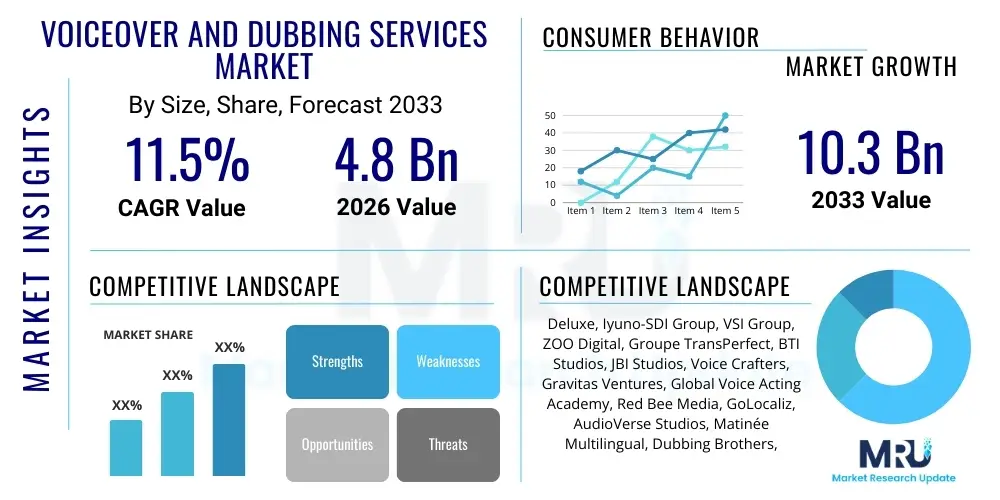

The Voiceover and Dubbing Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033. This robust expansion is fueled by the relentless global proliferation of Over-The-Top (OTT) streaming platforms, the increased production of localized content across media sectors, and the accelerating demand for multilingual corporate and educational materials. Furthermore, technological advancements, including sophisticated neural network-based synthesis, are optimizing production workflows, enabling faster turnaround times, and improving the quality-to-cost ratio, thereby widening the addressable market significantly for content creators aiming for global audience penetration.

Voiceover and Dubbing Services Market introduction

The Voiceover and Dubbing Services Market encompasses the professional linguistic and auditory conversion of media content from one source language into multiple target languages, ensuring cultural relevance and emotional resonance for international audiences. Products within this market include full theatrical dubbing, synchronized voice acting for television series and films, subtitling creation, and narrative voiceovers for documentaries, corporate training modules, video games, and e-learning platforms. Major applications span across the media and entertainment industry, particularly high-demand streaming content, as well as critical sectors like technology, government, and education, which require precise localization for global outreach. The principal benefits of these services are maximized audience engagement, enhanced accessibility compliance, and significant revenue generation through successful globalization strategies. Key driving factors include the mandate for localization by global content distributors, the rise of high-budget, multilingual gaming, and the foundational shift toward digital media consumption globally, necessitating immediate linguistic adaptability across diverse platforms and consumer demographics. This complex ecosystem is further driven by strict adherence to industry standards regarding voice talent selection, acoustic quality, and lip synchronization precision, all of which contribute to the perceived authenticity and overall user experience in localized content, making professional services indispensable even amidst the rise of synthetic alternatives.

Voiceover and Dubbing Services Market Executive Summary

Current business trends highlight a significant consolidation phase, where large media localization providers are acquiring specialized regional studios to establish end-to-end global service capabilities, responding directly to the massive scaling demands of major OTT players and multinational corporations. The market is transitioning toward hybrid models, integrating high-quality human voice talent with scalable AI tools for initial synchronization, quality assurance, and high-volume, lower-budget projects, thereby creating a tiered service offering that optimizes cost and speed without sacrificing essential fidelity. Regionally, North America and Europe currently dominate the market share due to the concentration of major content production studios and the highest expenditure on premium dubbing for cinematic releases and high-profile series, alongside stringent regulatory requirements for accessibility. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, particularly driven by content exports from countries like South Korea, India, and China, coupled with massive localized content consumption within these large, linguistically diverse domestic markets. Segment trends show that the Media & Entertainment category, specifically OTT platforms, remains the dominant application, exhibiting accelerated growth, while the E-Learning and Corporate Training segments are rapidly expanding, leveraging voiceover services to standardize global training curriculum delivery. Furthermore, within the technical segmentation, remote and cloud-based recording solutions are gaining prominence, offering flexibility and reduced logistical overhead compared to traditional studio-based production, reflecting a broader digital transformation across the entire voice production supply chain. This shift necessitates robust cybersecurity protocols and enhanced management of decentralized production teams, which are becoming standard operational requirements for leading market participants maintaining stringent quality control across diverse geographical locations.

AI Impact Analysis on Voiceover and Dubbing Services Market

User queries regarding the impact of Artificial Intelligence primarily revolve around job security for professional voice actors, the ethical implications of voice synthesis using proprietary voice data, and the tangible quality difference between AI-generated dubs and human-led localization. Users frequently ask about the cost savings and scalability offered by AI, questioning when synthetic voices will become indistinguishable from human performances, especially concerning nuanced emotion and comedic timing. The underlying concern is balancing the efficiency gains of AI—like rapid localization and automated synchronization—with the need to preserve artistic integrity and culturally appropriate interpretation, particularly in high-stakes creative content like AAA video games and theatrical films. The resulting consensus suggests that AI is currently functioning as a powerful augmentation tool, handling repetitive tasks and providing efficient first drafts, but the final, high-value quality control and artistic direction remain firmly within the human domain, solidifying a future of human-AI collaboration rather than outright replacement. This technological integration is redefining competitive landscapes, forcing traditional studios to invest heavily in proprietary AI tooling to maintain market relevance and differentiate their service offerings based on the seamless hybridization of artificial and human intelligence, particularly addressing the complex challenges associated with real-time lip-sync adjustments across multiple languages.

- AI-driven automated lip-synchronization significantly reduces post-production time and associated costs.

- Neural network text-to-speech (TTS) synthesis enables rapid creation of temporary placeholder voices and scalable voiceovers for lower-budget corporate training videos and explanatory content.

- Threat of voice cloning technology necessitates robust intellectual property (IP) protection and standardized consent frameworks for voice talent across the industry to mitigate unauthorized use.

- AI tools accelerate the initial localization pipeline, increasing market capacity and addressing the massive, unmet demand for quick content turnaround, especially for daily episodic streaming content.

- The development of emotion-aware synthesis promises higher fidelity and expressiveness in automated voices, narrowing the qualitative gap between human and machine performance in specialized narrative contexts.

- Data collection and model training on large, multilingual datasets are critical for improving regional accent diversity and linguistic accuracy in machine-generated dubs.

- AI integration requires upskilling of localization professionals toward prompt engineering, quality validation of synthesized audio, and specialized human-in-the-loop editing workflows, shifting job roles rather than eliminating them entirely.

DRO & Impact Forces Of Voiceover and Dubbing Services Market

The market is predominantly driven by the exponential growth of global streaming services (OTT), which constantly require vast libraries of original content to be simultaneously released in dozens of languages, alongside the rising globalization of corporate training and e-learning platforms demanding quick and cost-effective localization solutions. Restraints include the persistent challenge of maintaining high-quality, culturally sensitive localization across diverse linguistic nuances, the high initial capital expenditure required for state-of-the-art acoustic studios and specialized software integration, and the shortage of highly skilled, bilingual voice talent and synchronization specialists in high-demand languages. Opportunities lie in the monetization of back catalogs by localizing older content for new international markets, the rapid expansion into specialized niches such as video game localization (where quality demands are extremely high), and the ongoing development of cloud-based, scalable production platforms utilizing advanced AI tools for enhanced efficiency. The key impact forces are the intense competitive pressure among major localization providers to secure large volume contracts, the rapid technological disruption caused by high-fidelity AI voice synthesis threatening traditional pricing models, and the stringent regulatory environment in regions like Europe requiring mandatory accessibility features, including detailed voice tracks for visually impaired audiences. Furthermore, macroeconomic factors, such as fluctuating currency exchange rates across geographically diverse content creation hubs, also impact the overall cost structure and profitability margins for service providers operating on a global scale, adding complexity to contract negotiations and long-term financial planning within the localization value chain.

Segmentation Analysis

The segmentation of the Voiceover and Dubbing Services Market is critical for understanding targeted deployment and specialized service requirements across various industries, reflecting the diverse technical and linguistic demands inherent in global content delivery. This analysis categorizes the market primarily based on Service Type, Language, Application, and Delivery Model, allowing stakeholders to identify high-growth areas and tailor service offerings. The distinction between dubbing, which involves replacing the original language track with a synchronized translated track, and voiceover, which typically lays a translated track over the original audio at a lower volume, dictates the technical complexity, time investment, and associated costs, significantly influencing the service provider's resource allocation and pricing strategy. The growing demand for perfect synchronization in cinematic releases contrasts sharply with the often lower synchronization tolerance in corporate or medical explainer videos, leading to differentiated market pricing and talent utilization across these service types.

Application segmentation reveals that Media and Entertainment, specifically the requirements of major international streaming platforms and cinematic distribution, represent the largest revenue share, demanding premium service quality and rapid turnaround for simultaneous global releases. Conversely, the E-Learning and Corporate segments, while smaller in volume, are experiencing explosive growth due to the immediate need for scalable, consistent, and linguistically accurate internal and external communications across globally dispersed workforces and customer bases. Analyzing the market by language highlights the perennial dominance of English, Spanish, and Mandarin due to the sheer size of their content consumption markets and production volumes, but also underscores the crucial strategic importance of investing in less common, high-value languages (such as specific regional dialects in Africa or Southeast Asia) to unlock niche, underserved markets and achieve true global saturation for platform content. The technological capabilities of service providers, particularly their ability to handle specialized character sets and linguistic complexities, are often the determinant factor in winning these highly specific localization contracts.

Moreover, the segmentation by Delivery Model—traditional studio-based versus remote/cloud-based workflows—is increasingly critical as the industry adapts to decentralized production necessitated by global events and the push for operational efficiency. Cloud-based models offer superior flexibility, allowing specialized voice talent from anywhere in the world to contribute, often reducing travel costs and accelerating the recording process, particularly beneficial for independent content creators and small-to-medium enterprises. However, high-end, acoustically critical projects, such as major feature films or complex audio mixing, still often necessitate the controlled environment and specialized equipment provided by professional studio facilities, ensuring that both delivery models retain essential roles within the overall service landscape, catering to different ends of the quality and budget spectrum within the global market.

- Service Type:

- Dubbing (Full Synchronization)

- Voiceover (Narrative and Partial Sync)

- Audio Description (Accessibility Services)

- Subtitling and Captioning

- Language:

- English

- Spanish

- Mandarin Chinese

- German

- French

- Japanese and Korean

- Arabic

- Other Regional Languages

- Application:

- Media and Entertainment (Film, TV Series, OTT Content)

- Gaming (Video Game Localization)

- E-Learning and Education

- Corporate and Industrial Training

- Advertising and Marketing

- Telecommunications and IT

- Delivery Model:

- Studio-based Production

- Remote/Cloud-based Services

Value Chain Analysis For Voiceover and Dubbing Services Market

The value chain for Voiceover and Dubbing Services begins with Upstream Analysis, which focuses on the core resources and initial inputs necessary for localization. This stage primarily involves the selection and management of professional voice talent—the foundational asset—alongside the procurement of specialized hardware and software, including high-fidelity microphones, acoustic treatment materials, digital audio workstations (DAWs), and proprietary synchronization software. Key upstream activities also encompass intellectual property clearance and securing translation rights, managed by legal teams, and the highly skilled process of transcription and time-coding of the original content. The quality and availability of specialized bilingual script adaptation writers, who ensure cultural nuances are maintained while achieving accurate lip synchronization, are pivotal upstream factors, directly influencing the final product's quality and market reception. Suppliers of AI-powered translation and synchronization tools are increasingly becoming essential upstream partners, providing the technological infrastructure necessary for scalable and rapid deployment, thus fundamentally altering traditional operational dependencies.

Moving into the core service provision, the midstream phase involves the complex processes of script translation and adaptation (often referred to as 'transcreation'), casting, recording in professional or remote studio environments, and meticulous audio mixing and mastering. This phase necessitates rigorous quality control (QC) workflows, often involving multiple rounds of review by native speakers and synchronization specialists, which are crucial for high-profile projects. The downstream analysis focuses on the final delivery and distribution of the localized content. Distribution channels are highly dependent on the target application: for OTT content, delivery involves uploading finished audio files directly to platform content management systems (CMS) via specialized secure portals, often adhering to specific technical metadata standards. For gaming, delivery involves integration testing within the game engine itself, requiring close collaboration with game developers. Direct distribution involves localization vendors working directly with content owners (e.g., Netflix, Disney, major film studios), which accounts for the largest and most valuable segment of the market, characterized by long-term master service agreements (MSAs) and high volume throughput mandates.

Indirect channels involve localization companies partnering with global system integrators or media processing houses that handle the broader technical preparation and distribution logistics for clients who prefer a single point of contact for complex, multi-faceted projects. The effectiveness of the overall value chain relies heavily on seamless data transfer and secure asset management across these stages, particularly given the high value and copyright sensitivity of the original and localized media files. Technological platforms that integrate project management, casting databases, secure remote recording capabilities, and automated QC are increasingly determining competitive advantage by maximizing efficiency and reducing the cycle time from content creation to global market release, thereby optimizing the entire downstream supply chain for rapid, large-scale deployment.

Voiceover and Dubbing Services Market Potential Customers

The primary consumers and end-users of voiceover and dubbing services are dominated by multinational media conglomerates and major streaming service providers, which necessitate continuous, high-volume localization to satisfy global audience demand and comply with regional content quotas. These major buyers—including entities like Netflix, Amazon Prime Video, Disney+, and WarnerMedia—require comprehensive localization packages for thousands of hours of original and syndicated content annually, encompassing film, television series, and documentaries. Their needs are characterized by demands for rapid, simultaneous releases across 50+ languages, strict quality adherence to maintain brand consistency, and high security protocols for managing sensitive, pre-release media assets. The strategic goal of these platforms is market share growth through cultural ubiquity, making localization not merely a cost center but a critical component of their core business strategy and global subscriber acquisition efforts, driving significant investment in premium synchronization services.

Beyond the media behemoths, the second major cohort of potential customers consists of video game developers and publishers, particularly those releasing AAA titles designed for worldwide markets. The localization requirements here are uniquely complex, involving not just narrative dubbing but thousands of lines of contextual dialogue, often requiring specialized voice acting talent capable of performance capture and adherence to dynamic in-game audio specifications. Educational technology (EdTech) companies and major corporate entities (Fortune 500 firms) constitute a rapidly expanding customer segment, utilizing voiceover services extensively for e-learning modules, internal training programs, product demonstrations, and multilingual marketing campaigns. For these corporate clients, the focus is typically on clear, authoritative, and consistent voice quality across various languages, prioritizing informational clarity and deployment scalability over the high artistic synchronization required by entertainment media, often favoring efficient, high-volume AI-assisted workflows.

Furthermore, government agencies, particularly those involved in public information dissemination, international diplomacy, or defense, represent specialized buyers needing voiceover services for informational videos, policy announcements, and public service broadcasts targeting linguistically diverse populations both domestically and abroad. Independent content creators, including high-profile YouTubers and podcast networks aiming for global audience reach, also form a growing, though lower-volume, segment, often relying on specialized agencies or freelance talent utilizing remote recording capabilities. The diverse needs of these customer segments, spanning from artistic high-fidelity requirements to high-volume informational clarity, necessitate a highly adaptable and technologically advanced service ecosystem capable of tailoring its offerings based on customer budget, time-to-market constraints, and final quality benchmarks, ensuring every piece of content resonates effectively with its intended global end-user base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Deluxe, Iyuno-SDI Group, VSI Group, ZOO Digital, Groupe TransPerfect, BTI Studios, JBI Studios, Voice Crafters, Gravitas Ventures, Global Voice Acting Academy, Red Bee Media, GoLocaliz, AudioVerse Studios, Matinée Multilingual, Dubbing Brothers, E-Finity, 1-Stop Media, Pukeko Pictures, Voice Q, Veritonic, 3Play Media, MediaLocate, Gengo, RWS Group, Keywords Studios, Lionbridge. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Voiceover and Dubbing Services Market Key Technology Landscape

The Voiceover and Dubbing Services Market is undergoing a rapid technological evolution driven by the need for speed, scale, and cost reduction without sacrificing creative quality. One of the most impactful technologies is the deployment of sophisticated Neural Text-to-Speech (NTTS) engines, which leverage deep learning models to generate highly naturalistic, human-like voice synthesis that can be trained on a limited set of human voice data. These tools are moving beyond robotic narration to incorporate elements of emotion, pace, and vocal cadence, making them viable for large-scale, non-premium content. Furthermore, specialized Automatic Speech Recognition (ASR) combined with sophisticated machine translation (MT) systems are now integral parts of the pre-production workflow, rapidly generating highly accurate initial scripts, timecodes, and transcription data. This automation significantly reduces the labor-intensive initial stages of localization, allowing human translators and voice directors to focus immediately on creative adaptation and quality assurance, thereby optimizing the entire localization pipeline for massive volume throughput required by high-demand streaming platforms that release hundreds of hours of content monthly.

Crucially, technology related to digital asset management and collaborative cloud-based platforms is transforming operational logistics. Secure, centralized cloud environments are essential for managing multilingual scripts, voice talent databases, proprietary recorded audio assets, and project files across geographically dispersed teams of actors, directors, and sound engineers. These platforms integrate specialized tools for synchronization and lip-sync alignment, such as proprietary software like VoiceQ, which provides visual cues to voice actors in real-time to match the original on-screen performance, ensuring high fidelity dubbing without reliance on manual, frame-by-frame adjustment. The integration of robust security features, including watermarking and strict access control for media assets, is paramount due to the high risk associated with content piracy, especially before global release. The market is increasingly defined by vendors who offer proprietary, secure, end-to-end cloud infrastructure capable of handling large media files and supporting complex, multi-layered synchronization workflows, providing clients with transparency and real-time tracking of localization progress across numerous languages simultaneously.

Another major technological area involves advanced acoustic analysis and quality control automation. AI tools are now being used to analyze the original audio track for subtle nuances in background noise, acoustic characteristics, and equalization settings, ensuring that the dubbed track seamlessly matches the original production's sound design, preventing jarring auditory shifts. Furthermore, automated quality assurance (AQA) tools scan localized audio for timing errors, volume discrepancies, and linguistic inconsistencies, flagging potential issues for human review much faster than traditional manual listening methods. The future technological landscape is trending toward 'voice banking,' where professional actors license their voiceprints for ethical use in synthetic dubbing, allowing companies to offer scalable, legally compliant, and high-quality AI voice models for certain projects. This hybrid approach, combining licensed human voices with AI processing power, promises to unlock new cost efficiencies and market opportunities, particularly for rapid global deployment in time-sensitive marketing or informational content, while navigating the complex legal and ethical considerations surrounding synthetic voice deployment in creative fields.

Regional Highlights

North America currently holds the largest share of the Voiceover and Dubbing Services Market, primarily due to its status as the world's leading exporter of premium content, especially cinematic blockbusters, high-end television series, and AAA video games. The region benefits from a high concentration of major media conglomerates, sophisticated post-production facilities, and the headquarters of the largest OTT platforms, driving continuous demand for comprehensive localization services for global distribution. Furthermore, North America maintains the highest operational spending on cutting-edge localization technology and highly skilled voice talent management systems, setting global benchmarks for quality and turnaround speed. The mature ecosystem necessitates complex technical integration capabilities among localization vendors, who must adhere to the stringent delivery specifications imposed by major US-based distributors. The emphasis in this region is on high-fidelity, high-budget dubbing that meets cinematic standards, reflecting the premium nature of the content being localized.

Europe represents a crucial market, characterized by high demand driven by linguistic diversity (requiring localization into numerous official languages) and strict local content quotas set by various national regulatory bodies, which often mandate dubbing or specific accessibility features. Countries such as the UK, France, Germany, and Spain are major localization hubs, boasting deep talent pools and long-standing dubbing traditions. Germany and Spain, in particular, are known for their high public acceptance of dubbed content for cinema and television, creating a robust, reliable market for synchronization services. The European Union's initiatives regarding digital content distribution and cross-border accessibility further fuel the need for standardized, high-quality localization, including audio description services. The region is also a frontrunner in adopting and regulating AI-based localization tools, balancing technological innovation with necessary protections for creative professionals, making it a critical testbed for future hybrid models.

The Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, driven by two key dynamics: the exploding domestic consumption of localized content within massive markets like China, India, and Southeast Asia, and the growing volume of original content exports, particularly from Korea and Japan, that require high-quality international dubbing. Content consumption in APAC is rapidly shifting to mobile and OTT platforms, necessitating high-speed localization into numerous low-volume, high-complexity regional languages and dialects. This market presents unique challenges related to diverse regulatory environments and intellectual property protection, but the enormous potential for market penetration makes it highly attractive for global localization providers. Investment in local talent and regional production hubs is accelerating across APAC to manage the increasing scale and complexity of localization projects, particularly as gaming localization and e-learning platforms witness exponential user base expansion across the subcontinent and surrounding territories, requiring specialized cultural expertise in addition to linguistic accuracy.

- North America: Dominant market share fueled by major content exporters (US/Canada), high R&D spending on localization technology, and the massive scale requirements of global streaming headquarters.

- Europe: Strong market driven by linguistic fragmentation, established dubbing traditions (especially in Germany/Spain/France), and regulatory mandates promoting content localization and accessibility standards across the EU.

- Asia Pacific (APAC): Highest projected CAGR due to vast, rapidly growing mobile consumption markets (China, India), increasing regional content exports (Korea, Japan), and accelerated investment in localized e-learning and gaming platforms.

- Latin America (LATAM): Significant growth supported by the demand for neutral Spanish and Brazilian Portuguese dubbing for major international releases, serving as a critical gateway market for global media companies targeting Central and South American audiences.

- Middle East and Africa (MEA): Emerging market characterized by complex linguistic requirements (various forms of Arabic), growing internet penetration, and high investment in media infrastructure and localized educational resources, offering specialized opportunities for niche localization vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Voiceover and Dubbing Services Market.- Deluxe

- Iyuno-SDI Group

- VSI Group

- ZOO Digital

- Groupe TransPerfect

- BTI Studios (now part of MediaLocate)

- JBI Studios

- Voice Crafters

- Gravitas Ventures

- Global Voice Acting Academy

- Red Bee Media

- GoLocaliz

- AudioVerse Studios

- Matinée Multilingual

- Dubbing Brothers

- E-Finity

- 1-Stop Media

- Pukeko Pictures

- Voice Q

- Veritonic

- 3Play Media

- MediaLocate

- Gengo (now part of Lionbridge)

- RWS Group

- Keywords Studios

- Lionbridge

Frequently Asked Questions

Analyze common user questions about the Voiceover and Dubbing Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the market growth for professional dubbing services globally?

Market growth is primarily driven by the explosion of global Over-The-Top (OTT) streaming platforms, which mandate simultaneous, multilingual releases of original content. This demand is reinforced by the expansion of international video game localization and the need for localized corporate and educational training materials for global workforces.

How is Artificial Intelligence (AI) impacting the cost structure of dubbing services?

AI, specifically Neural Text-to-Speech (NTTS) and automated synchronization tools, is reducing pre-production time and enabling scalable voiceover for lower-budget content, thereby optimizing costs. While premium cinematic dubbing still relies heavily on human talent, AI acts as a powerful augmentation tool for efficiency in high-volume, non-narrative projects.

Which geographical region exhibits the fastest growth potential in this market?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is due to rapid growth in domestic content consumption, increased content exports, and significant investment in mobile and e-learning platforms across linguistically diverse countries like China, India, and Korea.

What are the key differences between dubbing and voiceover services?

Dubbing involves replacing the original audio track entirely with a translated and meticulously time-synchronized track, striving for realistic lip-sync. Voiceover involves laying the translated narration over the original audio, which remains audible at a lower volume, often used for documentaries, training, or informational content where strict synchronization is less critical.

What is the primary constraint limiting the market’s expansion?

A key constraint is the persistent challenge of securing and managing a sufficiently large pool of highly skilled, bilingual voice talent and synchronization specialists, especially for niche or complex regional languages, coupled with the high quality control demands necessary for premium global content releases.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager