Volatile Fatty Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434250 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Volatile Fatty Acid Market Size

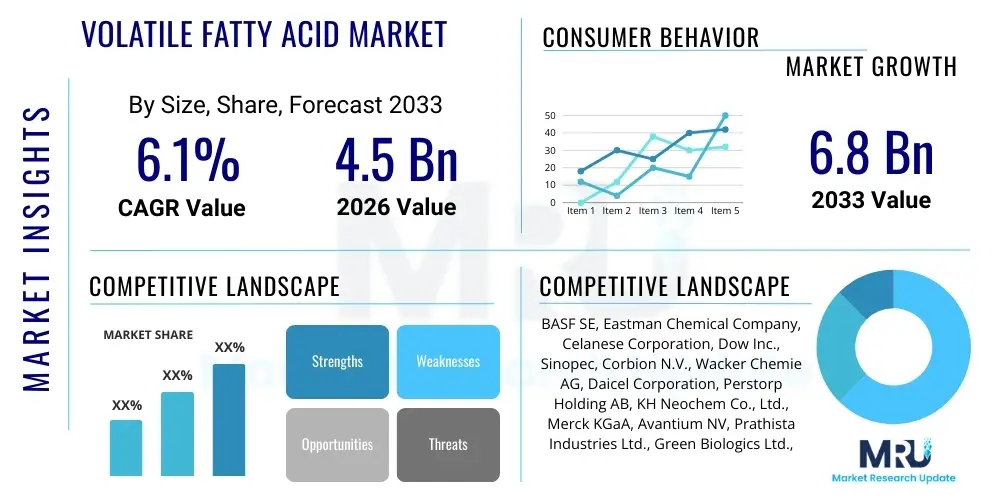

The Volatile Fatty Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.8 Billion by the end of the forecast period in 2033.

Volatile Fatty Acid Market introduction

Volatile Fatty Acids (VFAs) are short-chain saturated fatty acids, primarily including acetic acid, propionic acid, and butyric acid, characterized by their high volatility and ability to act as crucial chemical intermediates. These compounds are fundamental building blocks in the chemical industry, essential for producing a wide array of derivatives used across diverse sectors. VFAs are typically sourced either synthetically from petrochemical feedstocks, such as natural gas or crude oil derivatives, or increasingly through biological fermentation processes utilizing renewable resources. The growing emphasis on sustainable chemistry and the transition towards circular economy models are significantly influencing VFA production methodologies, driving research into efficient bio-based routes that minimize environmental impact and reduce reliance on fossil fuels. The inherent chemical properties of VFAs, including their reactivity and solubility, make them indispensable for manufacturing high-performance materials and complex specialty chemicals.

Major applications of VFAs span the animal nutrition, food and beverage, pharmaceuticals, and polymer industries. In animal feed, VFAs, particularly butyric and propionic acids, function as powerful growth promoters and antimicrobial agents, enhancing gut health in livestock and reducing the necessity for traditional antibiotics, a critical trend driven by global regulatory pressures and consumer demand for antibiotic-free meat. Acetic acid, being the largest volume VFA, is widely used in the production of vinyl acetate monomer (VAM), acetates, and purified terephthalic acid (PTA), key components for plastics, coatings, and textiles. The benefits derived from VFAs include improved product efficiency, enhanced biological system performance, and superior material characteristics. For instance, VFAs used as precursors for biodegradable polymers offer a path toward more sustainable packaging and industrial solutions.

Driving factors for the VFA market expansion are multifaceted, anchored by the rapid growth in the global animal feed sector, particularly in developing economies where livestock production is intensifying to meet rising protein demand. Furthermore, stringent environmental regulations encouraging the substitution of traditional solvents and chemicals with bio-based alternatives are bolstering the demand for bio-derived VFAs. Technological advancements in fermentation techniques, including optimized microbial strains and continuous production systems, are simultaneously lowering production costs and improving yield efficiency, making bio-VFAs increasingly competitive with their synthetic counterparts. The ongoing innovation in polymer science requiring specialized monomers also contributes substantially to market growth, ensuring a stable and expanding consumption base for key VFA derivatives.

Volatile Fatty Acid Market Executive Summary

The Volatile Fatty Acid Market is experiencing robust growth fueled primarily by the burgeoning demand from the animal nutrition sector and the accelerating global shift towards sustainable, bio-based chemicals. Business trends indicate a significant push towards vertical integration and strategic collaborations, especially between fermentation technology providers and large chemical manufacturers, aiming to secure feedstock supply and optimize large-scale bio-VFA production capabilities. Key market players are investing heavily in research and development to diversify VFA sources, exploring alternatives like municipal solid waste, agricultural residues, and wastewater sludge as viable fermentation inputs, positioning the industry for enhanced resource efficiency and circularity. Furthermore, the market is characterized by intense competition regarding derivative pricing, particularly for high-volume products like acetic acid, forcing manufacturers to focus on cost-efficient production methods and application-specific specialty VFA derivatives.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by massive livestock populations, rapid industrialization, and favorable government initiatives promoting bio-chemical manufacturing, particularly in China and India. North America and Europe remain mature markets but are demonstrating stable growth, largely propelled by stringent feed additive regulations encouraging VFA usage over antibiotics and strong regulatory frameworks supporting the bio-economy transition. These regions are the centers for advanced fermentation research and high-value VFA application development, such as specialized pharmaceutical intermediates and advanced bioplastics. Investment flows are notably concentrated in establishing large-scale bio-refineries in APAC to meet local demand and serve as export hubs for high-purity VFA products.

Segment trends reveal that the Acetic Acid segment maintains market dominance due to its ubiquitous application in VAM, esters, and PTA, yet Propionic Acid and Butyric Acid segments are forecast to exhibit higher CAGRs, driven by their critical roles in animal gut health management and specialty pharmaceutical synthesis, respectively. The bio-based source segment is projected to outpace the synthetic segment in terms of growth rate, reflecting the industry's commitment to sustainability and the improved economics of advanced fermentation technologies. Within applications, the Animal Feed segment is the primary demand generator, but the Pharmaceuticals and Food & Beverages segments are also expanding rapidly due to increased regulatory scrutiny on food preservation and a rising global focus on functional ingredients derived from natural sources.

AI Impact Analysis on Volatile Fatty Acid Market

Users commonly question how Artificial Intelligence (AI) can optimize VFA production processes, particularly in complex, variable fermentation environments. Concerns focus on AI's role in predictive quality control, optimizing feedstock utilization from variable sources (like waste streams), and managing the vast amounts of biological and chemical data generated during bio-VFA synthesis. Users expect AI to reduce operational costs, enhance batch consistency, and accelerate the discovery of novel microbial strains capable of higher VFA yields. The key themes revolve around AI-driven process efficiency, data-based strain development, and predictive maintenance within large-scale biorefineries to ensure cost competitiveness against synthetic routes.

- AI-driven fermentation optimization: AI models predict optimal temperature, pH, and nutrient feeding rates, maximizing VFA yield and purity in real-time.

- Predictive maintenance in biorefineries: Machine learning algorithms analyze sensor data to anticipate equipment failure, minimizing costly downtime.

- Accelerated strain engineering: AI and machine learning expedite the screening and modification of microbial consortia for enhanced VFA production pathways.

- Supply chain resilience: AI improves forecasting accuracy for variable bio-feedstock availability and optimizes logistics for VFA distribution.

- Quality control automation: Computer vision and AI analytics ensure high-throughput purity checks, crucial for pharmaceutical and food-grade VFAs.

DRO & Impact Forces Of Volatile Fatty Acid Market

The Volatile Fatty Acid market dynamics are powerfully shaped by internal industry drivers and external regulatory pressures, collectively determining growth trajectory and investment attractiveness. Key market drivers include the accelerating global demand for sustainable food production methods, necessitating the widespread adoption of VFA-based feed additives to replace antibiotics and improve animal productivity. Complementarily, the environmental imperative to shift away from petroleum-based chemicals has provided a substantial tailwind for bio-based VFA manufacturers, attracting significant capital expenditure into new bioprocessing facilities. These forces create a highly dynamic environment where innovation in cost-effective biotechnology offers distinct competitive advantages.

Restraints, however, pose persistent challenges to market expansion. The high volatility of raw material prices, particularly petrochemical feedstocks for synthetic VFAs and carbohydrate sources for bio-based production, can significantly compress operating margins. Furthermore, the complexity and high initial capital investment required for large-scale advanced fermentation facilities act as a substantial barrier to entry for new market participants. Regulatory hurdles, especially concerning the acceptance and approval timelines for new bio-based VFA processes and their derivatives in various jurisdictions, introduce uncertainty and prolonged market entry phases. The perceived inconsistency in supply volume compared to highly stable petrochemical supply chains also restricts large industrial users from fully committing to bio-VFA sources without firm long-term contracts.

Opportunities reside predominantly in technology innovation and market diversification. Advancements in metabolic engineering and synthetic biology are continuously improving the efficiency and yield of microbial cell factories, promising lower production costs and enhanced scalability. Furthermore, the utilization of waste streams (e.g., sewage sludge, industrial wastewater, agricultural residues) as low-cost fermentation inputs presents a dual opportunity: reducing operational expenses and contributing to circular economy goals. Impact forces, such as the increasing consumer preference for natural ingredients (driving demand for bio-VFAs in food preservation) and the global mandate for climate change mitigation (favoring sustainable chemistry), exert pervasive influence, compelling industrial users in all downstream sectors to prioritize VFA products derived from renewable resources and sustainable methodologies, thereby reshaping procurement strategies globally.

Segmentation Analysis

The Volatile Fatty Acid market is comprehensively segmented based on product type, application, and source, allowing for a detailed understanding of consumer preferences and technological capabilities across the industry landscape. Product segmentation highlights the dominance of acetic acid, followed by high-growth specialty VFAs such as propionic acid and butyric acid, each serving distinct functional roles in key end-use industries. Application segmentation confirms the pivotal role of animal nutrition as the largest consumer, while the burgeoning usage in pharmaceuticals and high-performance polymers suggests future growth diversification. Analyzing segmentation by source underscores the strategic shift occurring in the industry, where bio-based production is rapidly gaining market share against traditional synthetic routes, driven by cost improvements in fermentation and strong sustainability mandates.

- By Product Type:

- Acetic Acid

- Propionic Acid

- Butyric Acid

- Valeric Acid

- Other VFAs (Caproic Acid, etc.)

- By Application:

- Animal Feed & Nutrition

- Food & Beverages (Preservatives, Flavoring Agents)

- Chemicals & Intermediates (VAM, Esters, Solvents)

- Pharmaceuticals

- Plastics & Polymers

- Lubricants

- Agrochemicals

- Other Applications

- By Source:

- Synthetic (Petrochemical-based)

- Bio-based (Fermentation-based)

Value Chain Analysis For Volatile Fatty Acid Market

The Volatile Fatty Acid value chain initiates with the procurement of upstream raw materials, which vary significantly based on the production source. For synthetic VFAs, the primary inputs include crude oil derivatives, naphtha, or natural gas, requiring complex chemical synthesis processes like methanol carbonylation (for acetic acid). For bio-based VFAs, the upstream focus is on securing high-volume, cost-effective, and consistent carbohydrate feedstocks, such as molasses, corn syrup, starch, or cellulosic biomass, alongside advanced microbial strains and fermentation media components. Efficient supply chain management at this stage is crucial, as raw material cost often dictates the final price competitiveness of the VFA product, especially in the context of fluctuating global commodity markets. Logistics networks must be robust to handle large volumes of bulky feedstocks required for biorefineries.

The midstream stage involves the actual production and purification processes. This includes advanced fermentation (for bio-VFAs) or complex chemical synthesis (for synthetic VFAs), followed by rigorous separation, purification, and concentration steps to achieve the necessary product purity required for demanding applications like pharmaceuticals or food preservation. Direct distribution channels involve VFA producers selling high volumes directly to major chemical conglomerates, large animal feed manufacturers, or integrated polymer producers through long-term contracts. This model emphasizes bulk efficiency and reliable supply. Indirect distribution channels, utilizing specialized chemical distributors and regional agents, cater to smaller or niche end-users, providing technical support, smaller batch sizes, and regional inventory management, effectively widening the market penetration across fragmented application sectors.

The downstream analysis focuses on the transformation and consumption of VFAs by end-user industries. Major downstream sectors include the animal feed industry (where VFAs are incorporated into supplements and feed mixes), the chemical industry (where VFAs are converted into derivatives like VAM, esters, and anhydrides for paint, adhesive, and coating production), and the plastics sector (where they serve as monomers for specialized polymers). Potential customers are highly diverse, ranging from large multinational pharmaceutical companies requiring high-purity butyric acid derivatives to regional agricultural cooperatives demanding propionic acid for silage preservation. The effectiveness of the value chain is ultimately measured by its ability to deliver consistent quality VFAs at competitive prices, fostering innovation in downstream derivative synthesis, and ensuring compliance with the stringent quality standards of the pharmaceutical and food industries.

Volatile Fatty Acid Market Potential Customers

Potential customers for the Volatile Fatty Acid market represent a broad spectrum of industrial and agricultural enterprises that rely on these chemical building blocks for crucial functional performance in their final products. The primary purchasing demographic comprises large animal nutrition companies and feed premix manufacturers, who utilize propionic and butyric acids extensively to enhance gut integrity, improve nutrient absorption in livestock, and ensure feedstuff preservation, driven by the global imperative to minimize antibiotic use. These buyers prioritize product efficacy, consistency, and compliance with strict food safety regulations, often entering into high-volume, multi-year procurement contracts to stabilize supply and pricing.

A second major customer group includes multinational chemical and polymer producers. These firms require vast quantities of acetic acid and its derivatives (like VAM) for manufacturing coatings, adhesives, films, and engineering plastics. They look for suppliers offering economies of scale, operational reliability, and competitive pricing structures to support their large-scale industrial processes. Furthermore, manufacturers in the textile and construction industries, requiring solvents and precursors derived from VFAs, constitute a substantial portion of the downstream demand. The increasing adoption of bio-based alternatives by these chemical giants signals a growing interest in supply chain sustainability and environmental footprint reduction.

The third significant segment encompasses pharmaceutical and food & beverage companies. In pharmaceuticals, high-purity VFAs serve as intermediates for drug synthesis and specialized solvent applications, necessitating ultra-high purity specifications and rigorous regulatory documentation. Food and beverage buyers, including large flavor houses and processing firms, use VFAs as preservatives, acidulants, and flavoring agents (e.g., acetic acid in vinegar, butyric acid for butter flavoring). These customers are particularly sensitive to purity, traceability, and compliance with global food safety standards like HACCP and FDA guidelines, making supplier qualification processes highly stringent and specialized.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Growth Rate | 6.1% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Eastman Chemical Company, Celanese Corporation, Dow Inc., Sinopec, Corbion N.V., Wacker Chemie AG, Daicel Corporation, Perstorp Holding AB, KH Neochem Co., Ltd., Merck KGaA, Avantium NV, Prathista Industries Ltd., Green Biologics Ltd., Myriant Corporation, Cargill Inc., Novozymes A/S, DuPont de Nemours, Inc., ADM, BP p.l.c. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Volatile Fatty Acid Market Key Technology Landscape

The technological landscape of the Volatile Fatty Acid market is rapidly evolving, driven by the shift towards sustainable, cost-effective production methods. Historically, the synthetic production of high-volume VFAs, particularly acetic acid, relied heavily on mature petrochemical processes such as methanol carbonylation (like the Monsanto and Cativa processes) and hydrocarbon oxidation. These technologies offer high yield and stability but are intrinsically linked to fossil fuel price volatility and carbon emissions. However, the recent focus has strongly shifted towards bio-production technologies, aiming to decouple VFA manufacturing from the petrochemical sector and utilize renewable feedstocks, which is a key area for current research and patent filings across leading chemical manufacturers and specialized biotech firms.

Advanced fermentation technology represents the critical innovation axis for bio-based VFAs. This includes the use of engineered microorganisms, such as specialized bacteria and yeasts (e.g., Clostridia strains), capable of converting diverse carbohydrate sources or even industrial and agricultural waste streams into VFAs under anaerobic or aerobic conditions. Key technological improvements focus on optimizing bioreactor design, transitioning from traditional batch fermentation to continuous fermentation systems to enhance throughput and scalability, and implementing in-situ product removal techniques (like solvent extraction or membrane separation) to prevent product inhibition and improve overall yield purity. These continuous processing improvements are vital for achieving the cost competitiveness required to challenge synthetic VFA production economics.

Furthermore, the integration of cutting-edge analytical and engineering tools is enhancing process control and development. Technologies such as high-throughput screening, metabolic flux analysis, and synthetic biology are accelerating the discovery and optimization of novel microbial pathways, enabling higher specificity for desired VFA types (e.g., increasing butyric acid yield over acetic acid). Downstream processing also benefits from innovation, utilizing advanced chromatographic techniques, crystallization, and energy-efficient distillation methods to meet the stringent purity requirements of specialized applications like food and pharmaceuticals. The confluence of synthetic biology and process engineering is defining the next generation of VFA production, making bio-VFAs a technically and commercially viable alternative across all major segments.

Regional Highlights

The Volatile Fatty Acid market exhibits distinct growth patterns and maturity levels across key geographical regions, influenced by localized regulations, industrial concentration, and agricultural intensity. Asia Pacific (APAC) is currently the dominant and fastest-growing region, driven by its massive and expanding animal husbandry sector, particularly in countries like China, India, and Southeast Asia. The region’s burgeoning population and rising disposable incomes have fueled a substantial increase in meat consumption, directly translating into high demand for VFA feed additives. Furthermore, APAC is becoming a global manufacturing hub for textiles, chemicals, and plastics, consuming large volumes of acetic acid derivatives. Government support for indigenous chemical manufacturing and the establishment of new bio-refineries further underpin APAC's market leadership, often leveraging low-cost renewable feedstocks.

North America and Europe represent mature markets characterized by high environmental consciousness and stringent regulatory frameworks. In these regions, growth is primarily driven by the mandatory phasing out of prophylactic antibiotics in livestock, boosting the substitution of traditional growth promoters with VFAs like propionic and butyric acids. European policies, such as the European Green Deal and related chemical regulations (REACH), strongly encourage the use of bio-based chemicals, leading to significant investment in advanced fermentation technologies and high-purity VFA production focused on specialty applications. These markets are leaders in technological innovation, focusing on utilizing waste streams for VFA production to enhance circularity and sustainability metrics. The high concentration of major chemical producers also ensures stable consumption of high-volume VFAs for polymer and solvent manufacturing.

Latin America and the Middle East & Africa (MEA) are emerging markets for VFAs. Latin America, particularly Brazil and Argentina, possesses large agricultural economies and significant livestock populations, making it a rapidly developing consumer of VFA feed additives. Economic growth and industrialization are increasing regional demand for chemical intermediates. MEA, while currently holding a smaller share, is expected to grow steadily, largely driven by investments in large-scale agricultural projects and expanding food processing industries. Challenges in MEA include infrastructure limitations and reliance on imports, but local manufacturing initiatives aimed at reducing import dependence are gradually improving the market landscape, particularly for domestically focused agricultural applications.

- Asia Pacific (APAC): Market dominance, highest growth rate, driven by massive animal feed sector expansion and high chemical manufacturing output (China, India).

- North America: Mature market, strong regulatory push for antibiotic-free livestock, focus on high-purity pharmaceutical-grade VFAs and advanced bio-based production.

- Europe: Stable growth, driven by environmental mandates (Green Deal) favoring bio-based derivatives, high adoption rate of VFA feed preservatives.

- Latin America (LATAM): Emerging market, significant growth potential due to large agricultural base (Brazil, Argentina), increasing demand for feed supplements.

- Middle East and Africa (MEA): Developing market, gradual growth linked to expanding food processing and agricultural industrialization efforts.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Volatile Fatty Acid Market.- BASF SE

- Eastman Chemical Company

- Celanese Corporation

- Dow Inc.

- Sinopec

- Corbion N.V.

- Wacker Chemie AG

- Daicel Corporation

- Perstorp Holding AB

- KH Neochem Co., Ltd.

- Merck KGaA

- Avantium NV

- Prathista Industries Ltd.

- Green Biologics Ltd.

- Myriant Corporation

- Cargill Inc.

- Novozymes A/S

- DuPont de Nemours, Inc.

- ADM

- BP p.l.c.

Frequently Asked Questions

Analyze common user questions about the Volatile Fatty Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Propionic Acid in the current market?

The primary driver for propionic acid demand is its extensive use as a potent mold inhibitor and preservative in animal feed, grains, and silage. This demand is further amplified globally by stringent regulatory mandates, particularly in Europe and North America, aiming to reduce the reliance on traditional antibiotics in livestock farming, positioning propionic acid as a crucial component for gut health and feed preservation.

How is the shift towards bio-based production impacting the competitiveness of Volatile Fatty Acids?

The shift towards bio-based VFA production, utilizing fermentation of renewable feedstocks and waste streams, significantly enhances the market's sustainability profile and regulatory compliance. While bio-based VFAs historically faced higher production costs, technological advancements in continuous fermentation and microbial engineering are rapidly closing the price gap with petrochemical-based VFAs, improving long-term cost competitiveness and supply stability.

Which geographical region exhibits the highest growth potential for Volatile Fatty Acids through 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential for the VFA market through 2033. This growth is primarily attributable to the substantial expansion of the livestock and aquaculture industries, rapid industrialization, and favorable governmental policies supporting domestic chemical production and bio-economy initiatives, particularly across China and India.

What are the main restraints affecting the large-scale adoption of Volatile Fatty Acid products?

The primary restraints include the volatile nature of raw material pricing, affecting both petrochemical and agricultural feedstocks, which impacts operational margins. Additionally, the substantial initial capital investment required to establish and scale advanced, high-efficiency fermentation facilities presents a significant barrier to entry, potentially slowing the transition fully towards bio-based sources.

Beyond animal feed, what specialized application segment is generating significant new demand for Butyric Acid?

Beyond animal feed, the specialized application segment generating significant new demand for butyric acid is the pharmaceutical industry. Butyric acid derivatives, specifically its esters, are increasingly utilized as highly targeted active pharmaceutical ingredients and intermediates for manufacturing complex drug molecules, capitalizing on their specific biological functions and high purity requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager