Vortex Water Pump Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435670 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Vortex Water Pump Market Size

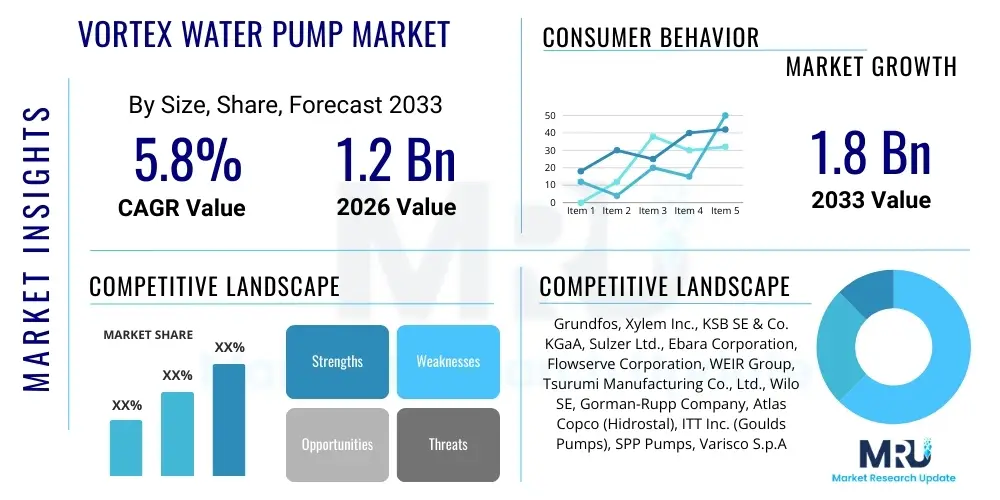

The Vortex Water Pump Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.8 Billion by the end of the forecast period in 2033.

Vortex Water Pump Market introduction

The Vortex Water Pump Market encompasses specialized centrifugal pumps designed to handle fluids containing high concentrations of solids, fibrous materials, or highly viscous media without succumbing to frequent clogging or excessive wear. The defining characteristic of these pumps is the recessed impeller design, which is positioned away from the primary flow path, effectively minimizing direct physical contact with the conveyed material. Instead, the rotation of the impeller generates a powerful, continuous vortex action within the pump casing, effectively pushing the solid-laden fluid from the inlet to the outlet. This non-contact pumping mechanism is vital in mitigating the erosion caused by abrasive solids and preventing the entanglement of long, stringy materials commonly found in untreated sewage and industrial effluent, positioning vortex pumps as essential components in critical fluid management infrastructure worldwide. The operational reliability and reduced maintenance burden offered by this specialized hydraulic design constitute the core value proposition driving robust market penetration across heavy-duty sectors globally.

Major applications of vortex pumps span the entire municipal water cycle, from raw sewage pumping stations and storm water management systems to final effluent transfer and sludge recirculation within centralized treatment plants. Industrially, their robustness makes them indispensable across a wide range of processing environments. For instance, in the pulp and paper industry, they efficiently handle high-consistency stock and fibrous slurries, while in food processing, they manage thick slurries or transport fragile products like raw vegetables or fruit pulp without causing mechanical damage, preserving product integrity. Furthermore, the mining and construction sectors utilize vortex technology extensively for dewatering applications involving heavily silted water or abrasive tailings and slurry management. The market’s resilience is inherently tied to the continuous, non-negotiable need for efficient municipal sanitation and complex industrial processing, ensuring sustained demand irrespective of short-term economic fluctuations. This foundational utility makes the market relatively resistant to cyclical economic downturns.

The product portfolio within the vortex pump market typically ranges significantly in size, material composition, and configuration, catering to diverse operational demands. Small, single-phase submersible pumps are utilized in domestic and light commercial sewage applications, offering easy installation and reduced footprint, particularly crucial in urban environments. Conversely, large, vertical turbine or heavy-duty dry-pit models are engineered for major municipal lift stations or high-volume industrial processing facilities, often featuring specialized materials like high chrome iron or hardened stainless steel to ensure longevity against extreme corrosion and abrasion. The industry is currently witnessing a profound technological push towards developing more energy-efficient pump designs, incorporating advanced hydraulic modeling techniques, such as Computational Fluid Dynamics (CFD), and integrating smart technologies like Variable Frequency Drives (VFDs) and sophisticated IoT sensors to optimize performance, reduce power consumption, and significantly lower the total cost of ownership (TCO) for end-users, thereby further solidifying their long-term market dominance over conventional, less robust alternatives.

Vortex Water Pump Market Executive Summary

The global Vortex Water Pump Market is undergoing a period of sustained, strong expansion, directly influenced by favorable business trends centered on global infrastructure modernization and the accelerating pace of urbanization, particularly across emerging economies. Key business drivers involve the replacement cycle of aging pump systems in established regions like North America and Europe, mandating upgrades to modern, highly energy-efficient vortex designs that comply with stringent environmental and energy consumption standards. Manufacturers are prioritizing strategic investment in Research and Development focused on material science to enhance impeller durability and integrating digitalization for remote monitoring and predictive maintenance. The market performance is characterized by an emphasis on offering integrated pumping solutions, including customized control panels and long-term service agreements, ensuring high uptime and establishing strong, durable customer relationships.

Geographically, the market displays distinct regional trends. The Asia Pacific (APAC) region is projected to be the engine of future growth, capitalizing on massive, government-funded water and sanitation infrastructure projects designed to support burgeoning populations and rapid industrial growth. In contrast, North America and Europe maintain stable, high-value markets where growth is sustained by regulatory push for energy conservation and the demand for premium, smart pump technologies offering superior data analytics and system integration capabilities. Segment trends highlight a pervasive shift towards submersible vortex pumps due to their operational convenience, noise reduction benefits, and streamlined installation process, making them the preferred choice for urban and residential applications. Concurrently, the demand for specialized, high-abrasion resistant materials, such as high-chromium alloys, is escalating within industrial segments like mining and heavy chemical processing.

The overall market trajectory is exceptionally favorable, bolstered by the essential nature of municipal wastewater management, which ensures inelastic demand. The competitive landscape is intensely focused on technological differentiation, especially concerning clog-free performance and operational efficiency. Strategic consolidation, including mergers and acquisitions, is evident as major global players seek to acquire niche technology expertise or expand their geographic footprint into high-growth developing markets. The long-term profitability hinges on the industry’s ability to standardize IoT integration and leverage AI/ML for real-time operational optimization. Success in the forecast period will require manufacturers to effectively balance the high capital cost demands of municipal clients with the technological imperative for energy efficiency and maintenance simplicity, ensuring solutions are robust yet smart.

AI Impact Analysis on Vortex Water Pump Market

Common user questions regarding AI’s influence on the Vortex Water Pump Market primarily concern the translation of theoretical analytical capabilities into tangible operational benefits, such as reduced maintenance costs and verifiable energy savings. Users frequently inquire about the reliability of AI-driven sensor data interpretation for predicting subtle mechanical failures, including bearing degradation or cavitation onset, particularly in remote or inaccessible submersible applications. Furthermore, a substantial query volume revolves around how machine learning algorithms can dynamically optimize pump speed and scheduling, ensuring that assets operate at peak efficiency under fluctuating solids concentration and hydraulic head conditions. The consensus among end-users is that AI represents the pathway to transforming traditional scheduled maintenance protocols into highly efficient, predictive, condition-based strategies, fundamentally optimizing the total lifecycle cost of these essential assets and maximizing system uptime.

The most immediate and pervasive application of Artificial Intelligence involves integrating sophisticated diagnostic algorithms with data streams derived from embedded IoT sensors (measuring vibration, temperature, acoustic emissions, and motor current draw). AI processes this multivariate data far more effectively than traditional SCADA systems, identifying signature patterns indicative of early-stage component wear or hydraulic inefficiencies. This capability enables the transition to true predictive maintenance (PdM), allowing operators to schedule maintenance only when necessary, avoiding unnecessary downtime associated with fixed-interval servicing, and preventing catastrophic failures which can incur massive repair costs and environmental liabilities. This sophisticated data processing acts as a virtual health monitor, ensuring continuous optimal operation and extending the practical life of the pump components, directly contributing to sustainability goals.

Beyond operational maintenance, AI is increasingly influencing the design and engineering phases. Machine learning and generative design platforms are being utilized to rapidly simulate hundreds of impeller and volute casing variations under specific flow and fluid conditions. This computational optimization leads to the design of hydraulically superior vortex geometries that significantly reduce energy losses, improve solid passage capabilities, and enhance overall efficiency beyond what is achievable through traditional iterative design methods. Moreover, AI aids in the calibration of Variable Frequency Drives (VFDs) and pump control logic, learning the specific behaviors of the fluid network to minimize transient pressure fluctuations (water hammer) and stabilize flow, providing a higher level of operational stability and protecting the overall pipeline system integrity. Therefore, AI is not merely a tool for monitoring, but a transformative force shaping both the manufacturing process and the operational standard of modern vortex pumps.

- Enhanced Predictive Maintenance: AI analyzes vibration and temperature data using complex pattern recognition to forecast component wear and catastrophic mechanical failures with high accuracy, moving the industry toward zero unplanned downtime.

- Optimized Energy Management: Machine learning algorithms dynamically adjust Variable Frequency Drive (VFD) settings to optimize pump operation curves based on real-time inflow rates and solids load, ensuring minimal energy consumption per volume of fluid moved.

- Superior System Diagnostics: AI processes integrated multi-sensor data to provide highly granular, actionable diagnostic reports, significantly improving technician efficiency and problem resolution speed.

- Generative Design Optimization: AI assists hydraulic engineers in creating complex, high-efficiency impeller and casing designs tailored for specific solids handling or viscous fluid requirements.

- Remote Monitoring and Control Integration: Cloud-based AI platforms standardize data reporting across multiple pumping stations, enabling centralized monitoring, troubleshooting, and fleet management for municipal users.

DRO & Impact Forces Of Vortex Water Pump Market

The Vortex Water Pump Market is fundamentally characterized by strong systemic drivers anchored in global population trends and regulatory necessities, balanced against inherent restraints associated with technology specialization and capital intensity. Key drivers include the exponential growth in global urban centers, which necessitates extensive upgrades and expansion of municipal wastewater infrastructure capable of handling high-solids sewage loads. This is synergized by increasingly stringent national and international environmental regulations that demand higher efficiency in wastewater treatment and superior control over sludge disposal, pushing operators toward the adoption of reliable vortex technology. Furthermore, the relentless pace of industrial development across mining, chemical, and food processing sectors creates continuous demand for robust pumps resistant to abrasion and clogging, sustaining market momentum.

Despite these powerful drivers, market expansion faces notable constraints. The foremost restraint is the significantly higher initial capital expenditure required for specialized vortex pumps, particularly high-capacity, customized units, compared to simpler, conventional centrifugal alternatives. This high upfront cost can be prohibitive for smaller municipal entities or budget-constrained industrial plants, often leading to temporary delays or the selection of lower-cost, less robust equipment. Additionally, the technical complexity associated with the specialized maintenance, repair, and overhaul (MRO) requirements of precision-engineered vortex pumps necessitates highly trained personnel and specific spare parts inventory, contributing to higher long-term operational complexity, which acts as a market friction point.

Opportunities for exponential growth are substantial, particularly within the specialized segment of infrastructure replacement and refurbishment across developed economies, where aging assets must be modernized with smart, energy-efficient vortex units. The growing global focus on circular economy models, including waste-to-energy conversion and biogas production, creates niche but high-value demands for pumps that can handle highly viscous and biologically active substrates. Analyzing the impact forces, the competitive intensity is high, driven by technological rivalry among global giants focused on clog-free performance. The bargaining power of major buyers (municipal authorities and large EPC firms) remains strong due to the standardized nature of large tenders. Conversely, regulatory pressure, especially concerning mandatory energy efficiency standards (e.g., IE3/IE4 motor standards), acts as a pervasive, positive impact force accelerating the adoption of premium, advanced vortex solutions.

Segmentation Analysis

The segmentation of the Vortex Water Pump Market provides a detailed framework for understanding the diverse requirements and purchasing behaviors across end-user industries and applications. Segmentation by Type (Submersible, Dry-Pit, etc.) is critical as it reflects installation methodology and operational environment—submersible pumps are preferred for flood-prone, confined spaces, while dry-pit pumps offer easier maintenance access. Segmentation by Material (Cast Iron, Stainless Steel, High Chrome Iron) directly addresses the challenges of fluid chemistry and abrasion, dictating the operational life and maintenance frequency of the unit in specific industrial settings, thereby allowing manufacturers to tailor their product offerings precisely.

Furthermore, segmentation by Capacity (Low, Medium, High) determines the market's response to scale, from residential sewage ejectors to massive municipal transfer stations. High-capacity vortex pumps are typically sold through direct sales channels targeting large utility contracts, whereas low and medium-capacity units often move through a robust distribution network serving smaller commercial or light industrial users. Analyzing these segments is essential for accurate market sizing, competitive benchmarking, and aligning sales and marketing strategies with the specific technical needs and procurement processes of different customer groups.

- By Type: Submersible Vortex Pumps, Dry-Pit Vortex Pumps (Close-Coupled and Frame-Mounted), Vertical Vortex Pumps (often associated with turbine installations), Horizontal Vortex Pumps (typically for industrial process applications).

- By Material: Cast Iron (standard municipal use), Stainless Steel (corrosion resistance), High Chrome Iron (extreme abrasion applications), Specialty Alloys (for high-temperature or niche chemical resistance).

- By Capacity: Low Capacity (Up to 100 GPM or 25 m3/h), Medium Capacity (100–500 GPM or 25–125 m3/h), High Capacity (Above 500 GPM or 125 m3/h, typically for major lift stations).

- By Application/End-User: Municipal Wastewater Treatment (the largest segment), Industrial Sludge Handling (covering Chemical Processing, Food & Beverage, Mining, Pulp & Paper, Textile), Construction (dewatering), Agriculture (irrigation and waste management).

Value Chain Analysis For Vortex Water Pump Market

The Vortex Water Pump Value Chain begins with the Upstream Analysis, focusing on the procurement of high-quality raw materials and specialized components, which constitutes a significant portion of the total manufacturing cost. This stage involves securing specialized metals like high-tensile steel, duplex stainless steel, high-chromium alloys, and advanced sealing materials necessary for constructing the robust pump casings, impellers, and shafts capable of enduring abrasive and corrosive environments. The integration of high-efficiency components, particularly IE3 or IE4 compliant electric motors and sophisticated mechanical sealing systems, often sourced from dedicated global suppliers, is critical. Manufacturer profitability is highly dependent on managing the volatility of raw material prices and maintaining robust supply chains for these highly engineered, precision components, ensuring consistent quality and availability.

The Midstream activities involve advanced manufacturing processes, including precision casting, CNC machining, balancing, and rigorous hydraulic testing. Modern manufacturing employs techniques like additive manufacturing for prototyping and complex tooling, and extensive use of simulation (CFD) to validate hydraulic performance before physical production. The key strategic objective at this stage is to achieve zero-defect manufacturing and optimize the total manufacturing lead time. Following production, the pumps enter the Downstream phase through carefully managed distribution channels. Direct sales are predominantly utilized for large-scale municipal or complex industrial projects, enabling direct consultation and customization with engineering procurement and construction (EPC) companies or utility operators. This channel allows manufacturers to provide comprehensive project management and technical support.

Conversely, indirect distribution—involving a network of authorized regional distributors, specialized hydraulic resellers, and system integrators—handles the majority of volume sales for standard and medium-capacity units. These channel partners are crucial for localized inventory holding, immediate response to local tenders, and providing critical installation and localized aftermarket service, including spare parts supply. The service and maintenance segment is a high-margin area, driven by the critical nature of the pumps. Modern value propositions include comprehensive service contracts, condition monitoring (via IoT), and rapid response maintenance teams. Effective management of this integrated distribution and service network is paramount to maintaining high customer satisfaction and maximizing the aftermarket revenue stream, which is essential for long-term profitability.

Vortex Water Pump Market Potential Customers

The core customer base for high-reliability Vortex Water Pumps is concentrated in sectors where fluid conveyance involves a high degree of contamination with solids, fibrous material, or sludge, rendering standard pumping ineffective. The single largest consumer segment is Municipal Water and Wastewater Management Authorities. These organizations require reliable, high-capacity pumps for raw sewage lift stations, headworks, storm water overflow systems, and sludge transfer within treatment processes. These customers are highly sensitive to pump reliability, energy efficiency (due to the 24/7 operation cycle), and regulatory compliance, making procurement decisions based on lowest long-term total cost of ownership (TCO) rather than lowest initial price. They are often subject to public tendering processes, which prioritize proven track records and comprehensive service support.

The Industrial segment represents a highly diverse and specialized customer group. Key industrial buyers include the Pulp and Paper Industry, which uses vortex pumps to handle highly viscous and fibrous stock solutions without tangling; the Food and Beverage sector, requiring gentle pumping of vegetable waste, fruit mash, or process slurries; and the Mining and Extractive Industries, where extremely abrasive slurries, thickeners, and tailings necessitate highly robust, chrome-alloy vortex pumps. These industrial clients prioritize material compatibility (resistance to specific chemicals) and immediate reliability, as pump failure directly translates into production losses. They often purchase customized pumps through specialized engineering firms or system integrators who integrate the pump into a larger, complex process train.

Emerging and specialized customer groups are increasingly important, including companies focused on advanced environmental remediation, dredging operations, and the growing waste-to-energy sector (biogas and anaerobic digestion facilities). These facilities require pumps capable of handling highly corrosive, biologically active, and often extremely viscous substrates, pushing the technological limits of pump design. Manufacturers must demonstrate specialized application expertise and provide high-level engineering consultation to capture these technically demanding market niches. The diversity of these end-user requirements necessitates a broad product portfolio and customized engineering solutions from market leaders.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Grundfos, Xylem Inc., KSB SE & Co. KGaA, Sulzer Ltd., Ebara Corporation, Flowserve Corporation, WEIR Group, Tsurumi Manufacturing Co., Ltd., Wilo SE, Gorman-Rupp Company, Atlas Copco (Hidrostal), ITT Inc. (Goulds Pumps), SPP Pumps, Varisco S.p.A., Flygt (A Xylem Brand), Crane Pumps & Systems, Zoeller Company, Pioneer Pump, Vaughan Company, and Pentair. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Vortex Water Pump Market Key Technology Landscape

The contemporary technology landscape of the Vortex Water Pump Market is defined by a confluence of advanced hydraulic engineering, innovative material science, and the increasing integration of digital intelligence. The core technological advancement remains the continuous refinement of the recessed impeller and volute casing geometry, primarily driven by high-fidelity Computational Fluid Dynamics (CFD) modeling. This rigorous simulation allows engineers to fine-tune the vortex generation mechanism to maximize solids passage efficiency while simultaneously minimizing internal recirculation and friction losses, which translates directly into higher energy efficiency and enhanced resistance to clogging. Key focus areas include developing impellers that maintain adequate hydraulic performance even at lower speeds and incorporating self-cleaning features within the casing design to prevent accumulation of rags or debris in critical areas.

In parallel, material technology plays a crucial role in extending the operational lifespan in abrasive and chemically aggressive environments. There is a strong technological trend towards employing high-chromium white irons and hardened stainless steels, such as duplex and super-duplex grades, specifically in pumps destined for mining tailings or corrosive chemical effluent handling. Furthermore, sophisticated sealing technology, primarily utilizing cartridge mechanical seals with advanced barrier fluid systems, is integral to preventing costly fluid ingress into the motor and ensuring robust operation under high-pressure conditions. The standardization of highly efficient, synchronous reluctance or permanent magnet (PM) motors, coupled with Variable Frequency Drives (VFDs), is no longer optional but a fundamental technological requirement for achieving compliance with global energy consumption benchmarks.

Perhaps the most significant technological evolution is the definitive move towards the Industrial Internet of Things (IIoT) integration. Modern vortex pump systems incorporate arrays of sensors (monitoring vibration, temperature, suction pressure, and power consumption) that communicate data in real-time to edge computing devices and centralized cloud platforms. This data forms the bedrock for sophisticated diagnostics and predictive analytics, often powered by machine learning (as detailed in the AI analysis). This digitalization not only enables remote performance optimization and failure prediction but also allows manufacturers to offer performance-based service contracts, fundamentally altering the service delivery model and transforming the pump from a mechanical device into a smart, networked asset integral to the digitized management of water utilities and industrial plants worldwide.

Regional Highlights

The Vortex Water Pump Market exhibits a heterogeneous geographic structure, with Asia Pacific (APAC) serving as the key driver of global volume growth. The APAC region, led by China and India, is undergoing unprecedented rates of urbanization, requiring rapid and substantial investment in new municipal sanitation and industrial water treatment infrastructure. Government mandates prioritizing clean water access and environmental compliance fuel large-scale tendering processes for medium to high-capacity vortex pump installations. The expansion of manufacturing bases and resource extraction activities in Southeast Asia further accelerates demand for robust, high-durability industrial vortex pumping solutions, positioning this region to capture the highest growth rate over the forecast period, albeit often focusing on cost-effective reliability rather than cutting-edge digital integration.

North America (NA) and Europe represent highly mature, value-centric markets where growth is predominantly driven by replacement demand and regulatory pressure to enhance energy efficiency and system intelligence. In these regions, municipal and industrial users are focused on minimizing operational expenditure (OPEX) and complying with stringent environmental directives, leading to a strong preference for smart pumps integrated with VFDs and advanced condition monitoring technologies. The average selling price (ASP) for vortex pumps in these regions is typically higher, reflecting the demand for premium engineering, customized solutions, and extensive manufacturer service networks. Replacement cycles are critical, as municipalities retire aging, less efficient infrastructure built decades ago and replace it with technologically superior, digitized pumping assets.

Latin America (LATAM) and the Middle East and Africa (MEA) are dynamic emerging markets presenting unique opportunities. In LATAM, demand is significantly spurred by large-scale mining projects requiring heavy-duty vortex pumps for tailings and slurry management, alongside essential urban wastewater infrastructure improvements. The MEA region is characterized by substantial investment in oil and gas processing infrastructure and governmental initiatives aimed at securing water resources, often requiring robust pumps capable of operating reliably in high-temperature or arid environments. While investment cycles in these regions can be less consistent, the long-term underlying need for foundational water and industrial utility infrastructure promises steady growth, especially as manufacturers adapt their products to meet local specifications regarding durability and ease of maintenance in challenging field conditions.

- Asia Pacific (APAC): Dominant in volume growth; driven by massive municipal infrastructure new builds, rapid urbanization, and industrial expansion; focus on high-capacity and reliable medium-cost solutions.

- North America: Market stability maintained by regulated infrastructure replacement, high demand for smart (IoT/AI) and energy-efficient submersible systems, and a focus on reducing TCO through predictive maintenance.

- Europe: Growth influenced by stringent EU environmental and Ecodesign directives, driving high adoption rates of premium, highly efficient pump models and comprehensive lifecycle service contracts across utility sectors.

- Latin America (LATAM): Strong demand stemming from commodity extraction (mining) and necessary public sector upgrades to sanitation systems; growth is sensitive to commodity price fluctuations but robust long-term.

- Middle East & Africa (MEA): Emerging market opportunities linked to large-scale desalination, oil and gas processing, and foundational urban development, prioritizing operational durability and heat tolerance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Vortex Water Pump Market.- Grundfos

- Xylem Inc.

- KSB SE & Co. KGaA

- Sulzer Ltd.

- Ebara Corporation

- Flowserve Corporation

- WEIR Group

- Tsurumi Manufacturing Co., Ltd.

- Wilo SE

- Gorman-Rupp Company

- Atlas Copco (Hidrostal)

- ITT Inc. (Goulds Pumps)

- SPP Pumps

- Varisco S.p.A.

- Flygt (A Xylem Brand)

- Crane Pumps & Systems

- Zoeller Company

- Pioneer Pump

- Vaughan Company

- Pentair

Frequently Asked Questions

Analyze common user questions about the Vortex Water Pump market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the fundamental difference in operation between a vortex pump and a cutter pump?

Vortex pumps operate by creating a swirling action to pass solids through without touching the impeller, preventing clogging and minimizing wear. Cutter pumps utilize a sharpened impeller or separate cutting mechanism to physically shred or macerate solids before pumping. Vortex pumps are preferred when material integrity must be maintained or for handling extremely tough, fibrous material that resists cutting.

How significant is the role of energy efficiency regulations in driving market demand?

Energy efficiency regulations, such as those governing IE3 and IE4 motor standards, are highly significant, particularly in mature markets like Europe and North America. These mandates force the retirement of inefficient, older pumps and drive the adoption of new, optimized vortex designs integrated with VFDs, ensuring lower long-term operational costs for utility providers.

Which end-user segment contributes the highest revenue share to the Vortex Water Pump Market?

The Municipal Wastewater Treatment segment consistently contributes the highest revenue share to the market. This is due to the large-scale requirement for reliable sewage lift stations and sludge handling capabilities across continuous, critical urban infrastructure operations globally.

What impact does the use of high-chrome iron have on vortex pump performance?

The use of high-chrome iron significantly enhances the durability of vortex pump components (impellers and casings) by providing superior resistance to highly abrasive media, such as mining slurries or sand-laden sewage. This reduces erosive wear, drastically extending the service life and decreasing maintenance frequency in demanding industrial applications.

How are manufacturers leveraging IoT technology in modern vortex pumps?

Manufacturers are leveraging IoT by embedding sensors to monitor crucial operational parameters like vibration, temperature, and current draw. This data feeds into cloud platforms, enabling real-time diagnostics, remote performance monitoring, and advanced AI-driven predictive maintenance scheduling, optimizing overall fleet management and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager