VR and 360 Video Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433649 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

VR and 360 Video Market Size

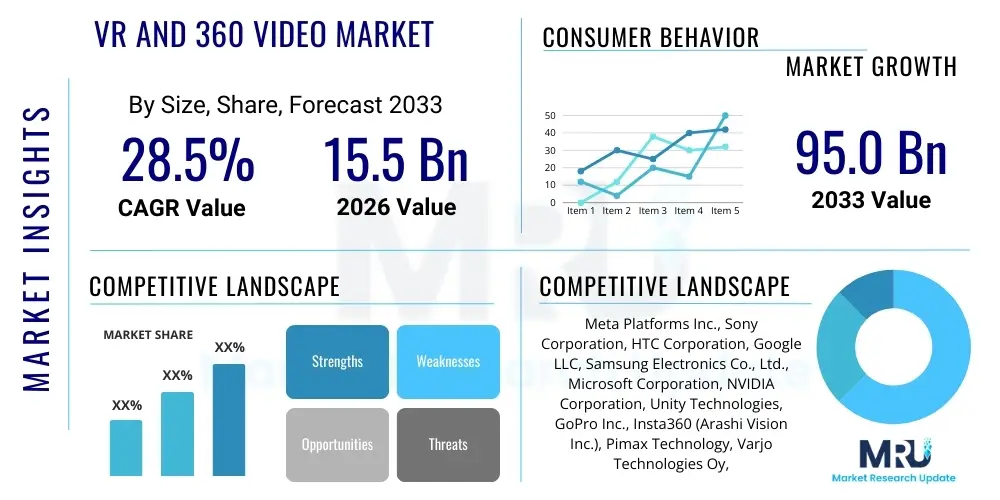

The VR and 360 Video Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 28.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 95.0 Billion by the end of the forecast period in 2033.

VR and 360 Video Market introduction

The Virtual Reality (VR) and 360 Video Market encompasses the comprehensive ecosystem of technologies, hardware, software platforms, and specialized content services dedicated to delivering highly immersive, digitally simulated, or panoramic visual experiences. This market represents a paradigm shift from traditional two-dimensional media consumption, aiming to achieve true presence—the psychological sensation of being physically present in a virtual or remote environment. VR technology primarily utilizes sophisticated Head-Mounted Displays (HMDs) that incorporate advanced optics, high-resolution displays, and precise positional tracking systems to deliver stereoscopic visuals and interactive capabilities, effectively isolating the user in a simulated world. Conversely, 360 video leverages omnidirectional camera arrays and specialized post-processing techniques to capture real-world scenes in their entirety, offering viewers passive or semi-interactive exploration of the captured environment, often delivered via mobile devices or entry-level HMDs.

Core products defining the competitive landscape include high-fidelity standalone VR headsets, which are becoming increasingly lightweight and powerful, alongside professional-grade, multi-sensor 360-degree cameras capable of capturing 8K resolution video or higher. The supporting infrastructure involves complex software solutions, such as game engines (Unity, Unreal Engine) optimized for spatial computing, content distribution marketplaces (Meta Quest Store, SteamVR), and specialized enterprise platforms for simulation and collaboration. Major applications span critical sectors: sophisticated training simulations for aerospace and surgical procedures, immersive educational content offering virtual field trips and complex scientific visualization, advanced design and prototyping in the automotive and architectural sectors, and, most visibly, highly engaging interactive entertainment and gaming. The versatility of the technology allows for its deployment across consumer, enterprise, governmental, and academic verticals, confirming its status as a core component of the next digital computing platform, offering tangible value beyond simple media consumption.

The principal benefits driving the adoption of VR and 360 video technology are manifold and rooted in enhanced efficacy and efficiency. For enterprises, benefits include superior knowledge retention in training, the ability to safely rehearse high-risk scenarios, and reduced travel and logistical costs associated with in-person collaboration or inspection. For consumers, the technology offers unmatched levels of entertainment immersion and social connectivity within shared virtual spaces. Key driving factors propelling this market expansion include exponential improvements in display technology (Micro-OLED, higher pixel per degree), significant reduction in hardware form factors due to advanced optics (pancake lenses), massive R&D investments by technology giants aiming to build out the 'Metaverse,' and the essential rollout of 5G infrastructure, which facilitates low-latency, high-quality cloud-rendered VR experiences. Furthermore, the sustained demand for effective remote work and learning solutions following global events has significantly solidified the market's trajectory towards mass adoption and institutional integration.

This comprehensive market introduction highlights not only the technological foundation of VR and 360 video but also contextualizes its commercial relevance. The market is transitioning from a niche technology reliant on external tethering to a powerful, standalone computing platform capable of displacing traditional methods of interaction, training, and content consumption. This transition is characterized by increasing hardware accessibility, diminishing physiological discomfort, and a rapidly maturing ecosystem of high-value content, addressing diverse consumer and business needs globally while promising a fundamentally new medium for digital interaction and commerce.

VR and 360 Video Market Executive Summary

The VR and 360 Video Market is navigating a phase of accelerated commercial maturity, characterized by distinct shifts in business strategies, regional performance, and segmentation dominance. Business trends are heavily influenced by a strategic arms race among the largest technology conglomerates, notably Meta, Apple, and Microsoft, to establish proprietary operating systems and content ecosystems that lock in developers and consumers, defining the foundational architecture of the spatial internet. This intense competition is driving unprecedented levels of investment into R&D, particularly focused on achieving 'pass-through' mixed reality capabilities that seamlessly blend virtual content with the real world, thereby expanding the utility of HMDs beyond gaming and into daily productivity tools. A notable business trend involves the rapid consolidation of content studios and specialized software providers by hardware manufacturers seeking to ensure a continuous stream of exclusive, compelling applications, validating content as the key determinant of ecosystem success. Furthermore, the market is witnessing a financial pivot, with hardware profitability increasingly taking a backseat to generating long-term, high-margin revenue through software subscriptions, professional licensing, and platform transaction fees, reflecting a shift to a service-oriented business model.

Regional trends analysis reveals a dynamic geographic landscape where North America, capitalizing on established technological infrastructure and a dense population of early adopters and sophisticated corporate buyers, maintains revenue leadership, particularly in high-value enterprise and defense contracts requiring custom simulation solutions. The significant growth narrative, however, is centered in the Asia Pacific (APAC) region. APAC’s explosive growth is sustained by rapid urbanization, massive investment in 5G networks, and the prevalence of Location-Based Entertainment (LBE) centers, especially in developing economies where VR adoption often bypasses traditional computing platforms. China and South Korea are instrumental in driving both hardware manufacturing efficiencies and consumer appetite for mobile VR gaming. Europe is differentiated by strong integration into industrial workflows (Industry 4.0), utilizing VR for precision engineering, remote assistance, and large-scale architectural visualization, supported by strong institutional and academic research collaboration, focusing on ethical and regulatory compliance of virtual environments, especially concerning worker safety and data handling.

Segmentation trends underscore the market’s maturation beyond purely entertainment applications. While consumer spending on VR gaming remains a foundational segment, the fastest growing and most profitable segment lies within Enterprise Applications, specifically in simulation, collaborative design, and remote maintenance. Within the component breakdown, Software and Services are set to eclipse Hardware in terms of long-term value creation, driven by recurring subscription models for professional training platforms (e.g., medical simulation licenses) and the increasing complexity of necessary content creation tools. Hardware innovation is migrating from simply increasing resolution to improving user comfort and enhancing peripheral features like eye tracking and full-body haptics, transforming the technology into a less intrusive, more practical tool. This executive overview confirms that the market trajectory is firmly established toward ubiquitous enterprise adoption, supported by specialized content monetization and intensified platform competition, transforming the VR/360 video sector into a foundational technology layer for global commerce and communication and yielding substantial gains throughout the forecast period.

AI Impact Analysis on VR and 360 Video Market

User interest regarding the convergence of Artificial Intelligence (AI) with the VR and 360 Video Market centers intensely on the scalability and personalization of immersive experiences. Common queries include: "How can AI reduce the immense time and cost of building vast, detailed virtual worlds?" and "Will AI make NPCs feel genuinely intelligent and reactive?" The core user expectation is that AI will serve as the indispensable efficiency layer, automating resource-intensive tasks such as generating realistic textures, optimizing complex physics interactions, and adapting narrative paths dynamically. Users are also concerned with how AI can optimize hardware performance, specifically by enabling techniques like foveated rendering with perfect accuracy, thereby making high-fidelity experiences accessible on less powerful, standalone devices. The general thematic summary reveals that stakeholders anticipate AI transforming VR content creation from a manual, bespoke craft into an automated, highly scalable process capable of delivering hyper-personalized, ultra-realistic experiences at a fraction of the traditional cost, which will be essential for meeting the enormous content demands of the burgeoning Metaverse.

AI's influence is profound in two primary operational areas: content creation and real-time optimization. In content creation, Generative Adversarial Networks (GANs) and large-scale foundation models (like large language and image models) are accelerating asset generation. Developers are utilizing AI for procedural generation of terrain, architecture, and environmental details that would traditionally take months of artistic labor, instantly populating complex scenes with contextually appropriate elements. This not only speeds up development pipelines but also facilitates the creation of unique, non-repeatable virtual instances, crucial for persistent online worlds, allowing for rapid iteration and deployment. For 360 video, AI-driven computer vision algorithms are essential for automating complex tasks like multi-camera calibration, dynamic stitching that corrects for lens distortion and parallax in motion, and intelligent object removal or enhancement in post-production, leading to broadcast-quality 360 content with significantly reduced reliance on time-consuming manual editing processes.

Furthermore, AI significantly enhances the realism and immersion through intelligent interaction and hardware performance. Machine learning algorithms analyze user biometrics (gaze direction, heart rate, physical movements) collected via integrated sensors, enabling truly personalized adaptive experiences. For instance, an AI can dynamically adjust the difficulty of a training simulation or modify the narrative tension of a game based on the user's observed stress levels or engagement metrics. This level of responsiveness makes the interaction feel deeply natural and tailored to individual psychological states. On the technical side, AI powers foveated rendering systems by predicting the exact focal point of the user's eye and allocating maximum processing power only to that specific area, achieving significant power efficiency and enabling much higher effective resolutions without increasing computational load—a critical breakthrough for battery-powered standalone headsets and a key differentiator in maintaining physiological comfort during long sessions.

- AI-Powered Procedural Content Generation (PCG): Rapidly building vast, detailed virtual environments and assets through algorithmic generation, minimizing manual labor and enabling dynamic world creation.

- Intelligent Non-Player Characters (NPCs): Utilizing sophisticated Large Language Models (LLMs) and behavioral cloning to provide dynamic, contextually aware, and convincing conversational interactions, greatly enhancing social and narrative realism.

- Automated 360 Video Processing: Machine learning algorithms for flawless multi-camera stitching, depth map generation for volumetric content, and automated environmental awareness within the video, streamlining complex post-production workflows.

- Foveated Rendering Optimization: AI predicting and tracking the user’s gaze in real-time to optimize rendering quality and energy consumption on mobile VR processors, crucial for standalone device longevity and fidelity.

- Adaptive and Personalized Experiences: Real-time adjustment of environment, narrative, or difficulty based on analysis of user physiological and behavioral data (e.g., eye tracking, galvanic skin response) to maximize engagement and training efficacy.

- Spatial Audio Enhancement: AI algorithms improving 3D sound localization and environmental reflection modeling for more accurate and believable audio immersion, a key component of presence.

- Optimization of Codec and Streaming: Machine learning utilized to create highly efficient, quality-preserving compression codecs and adaptive bit-rate streaming protocols for 360 video over variable bandwidth, essential for 5G-enabled cloud VR services.

DRO & Impact Forces Of VR and 360 Video Market

The trajectory of the VR and 360 Video Market is defined by a rigorous balance between potent market drivers, entrenched restraints, emerging opportunities, and fundamental impact forces. Primary drivers include the massive technological leaps in core hardware components, specifically the development of high-resolution, lightweight displays and highly efficient, dedicated mobile processors (e.g., Qualcomm Snapdragon XR series). These advancements have collectively reduced latency and enhanced visual fidelity, addressing key historic pain points like motion blur and low frame rates. Economically, the substantial, long-term strategic commitments by global technology leaders (the Metaverse vision) ensure continuous capital infusion, accelerating product cycles and driving down component costs through economies of scale. Furthermore, the undeniable effectiveness of VR training in quantifiable cost reduction, risk mitigation, and safety improvements across high-stakes industries like energy, defense, and healthcare serves as a paramount commercial driver that provides stable revenue streams irrespective of consumer spending fluctuations.

Despite these accelerators, the market faces significant restraints that slow mass adoption. The high initial purchase price of professional-grade HMDs and 360 cameras remains a critical barrier for average consumers and smaller enterprises, compounded by the required investment in powerful ancillary computing hardware for tethered solutions, although standalone units are mitigating this. A persistent technical restraint is the prevalence of Motion Sickness (Simulator Sickness) for a subset of the population, often linked to the Vestibular-Ocular Reflex mismatch caused by minor latency or visual inconsistencies, which limits long-term usage and remains a critical R&D focus area. Content fragmentation—the lack of standardized development platforms and proprietary ecosystem lock-in—impedes seamless content portability and reduces consumer confidence. Finally, concerns surrounding user privacy and data security within persistent, shared virtual environments pose serious regulatory and consumer trust challenges, requiring robust, transparent ethical frameworks.

Compelling opportunities are positioned to counteract these restraints and unlock new growth avenues. The widespread global rollout of high-speed 5G and future 6G networks creates the technical backbone necessary for Cloud VR/360 streaming, effectively decoupling high-performance rendering from local hardware cost. This democratization of access is a transformative opportunity for emerging markets and resource-constrained educational settings. The expansion into niche B2B applications, such as remote collaboration, digital twins for industrial monitoring, and high-precision data visualization, offers stable, high-margin revenue streams independent of consumer entertainment cycles, emphasizing long-term licensed software. Furthermore, the integration of VR/360 capabilities into existing platforms, such as web browsers (WebXR) and standard mobile devices, vastly expands the potential install base and encourages casual content consumption, minimizing the need for dedicated, specialized hardware ownership for introductory experiences.

Critical impact forces shape the competitive dynamics and regulatory future of the market. The competitive landscape is intensely platform-driven; the winner of the "Metaverse OS" race will dictate future standards and monetization models, acting as a gravitational force for all developers and service providers. Societally, the rapid evolution of ethical standards regarding virtual identity, digital harassment, and data ownership in immersive environments is a major impact force necessitating proactive regulatory guidance and clear platform accountability. Technologically, the ongoing pressure to achieve "retinal resolution" and near-zero latency (below 7ms) is an impact force that dictates the pace of component innovation and system design, ensuring that user experience continuously improves to match real-world perceptual expectations, driving the sustained CAGR projected through 2033.

Segmentation Analysis

The structure of the VR and 360 Video Market is best understood through its segmentation, which clearly delineates areas of investment, revenue potential, and technological specialization. Segmentation by Component—Hardware, Software, and Services—shows a crucial shift. Historically, hardware (HMDs, controllers, cameras) generated the bulk of revenue, but as components become more standardized and production scales, their prices fall. The growth engine is rapidly transferring to the Software segment, which includes operating systems, content creation tools (SDKs/APIs), and consumer/enterprise content libraries. The Services segment, covering custom application development, maintenance, system integration, and enterprise consulting for large-scale deployments, is growing rapidly due to the specialized nature of industrial and medical VR requirements, demanding bespoke solutions that command premium pricing and long-term contracts.

Analyzing the market by Application reveals a transition from consumer novelty to established enterprise utility. While Gaming & Entertainment remains crucial for driving innovation and volume sales, segments such as Healthcare (especially surgical training and remote patient interaction), Education (virtual labs and distance learning), and Enterprise Training (simulations for maintenance, safety, and operational excellence) are exhibiting superior long-term growth and stable revenue streams based on measurable Return on Investment (ROI). This application shift highlights the market’s maturity, indicating that businesses now view VR not as experimental technology but as an essential tool for modernization and efficiency gains, particularly in areas where physical training is impractical, dangerous, or excessively expensive, driving massive adoption in vertical sectors.

Further granularity is achieved through segmenting by End-User and Deployment Model. The Enterprise end-user segment—comprising large corporations and SMEs—is prioritizing Cloud-Based deployment models. Cloud VR reduces the high capital expenditure associated with purchasing and maintaining powerful localized computing systems, making complex simulations accessible via lightweight terminals and high-speed network connections, thereby lowering entry barriers significantly. Conversely, the Consumer segment relies heavily on standalone hardware, demanding optimization for portability and ease of use, though hybrid models utilizing cloud streaming for performance boosts are becoming common. This segmentation insight is vital for market players to tailor their product offerings, whether focusing on high-margin, bespoke enterprise software licensing or high-volume, cost-effective consumer hardware and platform monetization strategies.

- Component: Hardware (Head-Mounted Displays, 360 Cameras, Sensors, Input Devices), Software (Content Creation Engines, Platform OS, Distribution Marketplaces, Analytics Tools, Simulation Software), Services (Custom Content Development, System Integration, Technical Support, Consulting, Managed Cloud Services).

- Technology: Non-Immersive (Desktop-based viewing), Semi-Immersive (Projected displays, CAVE systems), Fully Immersive (High-fidelity HMDs with positional tracking, enabling a true sense of presence).

- Application: Gaming & Entertainment (Console, PC, Mobile VR, Social VR), Healthcare (Surgical Simulation, Pain Management, Mental Health Therapy, Rehabilitation), Education & Training (Virtual Classrooms, Technical Skill Acquisition, Scientific Modeling), Retail & E-commerce (Virtual Showrooms, Product Visualization, Remote Shopping), Media & Marketing (360 Advertising, Virtual Events, Interactive Storytelling), Aerospace & Defense (Flight Simulation, Maintenance Procedures, Tactical Training), Real Estate & Architecture (Virtual Tours, BIM Visualization, Collaborative Design Review).

- End-User: Consumer (Individual Buyers, Home Users), Enterprise (Manufacturing, Tech, Automotive, Financial Services, Telecommunications), Government & Public Sector (Defense, Emergency Services, Urban Planning, Public Education).

- Deployment Model: Cloud-Based (SaaS/Streaming VR, utilizing remote rendering infrastructure), On-Premise (Local installation for high-security, high-performance, or dedicated training facility requirements).

Value Chain Analysis For VR and 360 Video Market

The VR and 360 Video value chain initiates at the upstream level with foundational technology providers. This segment is characterized by highly specialized manufacturing and critical intellectual property ownership, focusing on core enablers: advanced semiconductor fabrication (custom SoCs from companies like Qualcomm and NVIDIA tailored for spatial computing, minimizing latency and maximizing power efficiency), high-density display technology (Micro-OLED, QLED from Samsung and Sony, offering enhanced clarity and fast response times), and precision optical components (pancake lenses, specialized prisms that reduce bulk and improve FoV). Upstream analysis reveals that bottlenecks often occur here, as innovation in display fidelity and battery efficiency directly governs the form factor and performance ceiling of subsequent hardware. Control over patented display and chip architectures grants significant leverage to these foundational suppliers, often dictating market differentiation.

The midstream comprises Original Equipment Manufacturers (OEMs) and platform developers. OEMs assemble components into final products (HMDs, cameras, peripherals) and are responsible for industrial design, ergonomic considerations, and thermal management. Platform developers, such as Meta and Unity, provide the operating system, SDKs, and development tools necessary for content creation, standardizing the interaction layer. This middle layer is highly competitive, as platform dominance translates directly into content ecosystem control and subsequent monetization via developer fees and content sales. Integration complexity, especially ensuring seamless sensor fusion, ultra-low-latency rendering, and multi-user networking capabilities, is the key value addition in the midstream segment, requiring sophisticated software engineering and ecosystem governance.

Downstream activities include content creation, distribution, and end-user engagement. Content creators—ranging from major studios producing AAA VR games to specialized enterprise firms building certified industrial simulations—generate the essential intellectual property that drives hardware sales and user retention. Distribution channels are highly fragmented yet strategically vital, involving direct digital storefronts (Direct-to-Consumer), established PC gaming platforms (SteamVR), mobile app stores, and complex B2B licensing agreements facilitated by systems integrators (Indirect channel partners). The shift toward subscription-based access models for enterprise training content is fundamentally revolutionizing the downstream revenue structure, moving away from single-purchase content licensing to continuous service delivery and update models, demanding robust cloud infrastructure for effective and secure delivery to global clients.

VR and 360 Video Market Potential Customers

The potential customer base for VR and 360 video solutions is exceptionally broad and segmented by their core motivation, which falls into two main categories: experiential entertainment or functional productivity. The consumer segment, primarily driven by the desire for advanced entertainment, seeks immersive gaming, interactive fitness applications, and social presence within digital worlds. These buyers are highly sensitive to price point, ease of use (favoring standalone and wireless solutions), and the depth and exclusivity of the content library. They are the target for high-volume, standardized hardware offerings and platform subscription services, representing a massive but often fluctuating demand curve dependent on the release of 'killer apps' and price drops.

The enterprise customer base, however, offers greater revenue stability, long-term contracts, and higher margins. This segment includes major corporations in manufacturing, energy, telecommunications, and transportation, whose key buyers are training managers, operational technology (OT) specialists, and R&D departments. Their motivations are strictly functional: reduction in training costs, enhancement of safety compliance, accelerated skill transfer, and minimization of expensive physical asset downtime through digital twin modeling. For example, large energy firms utilize 360 video for remote site inspection and VR for high-fidelity, hazardous emergency scenario training. These customers demand customized, highly accurate, secure, and certifiable solutions, often requiring on-premise integration or specialized cloud hosting that adheres to stringent industry regulations (e.g., medical device certifications).

Furthermore, institutional customers—spanning governmental defense agencies, public education systems, and major university research centers—form another high-value customer group. These institutions require the absolute highest fidelity and performance for applications like military flight simulators or complex scientific visualization models. They often procure solutions through complex bidding processes and require vendors capable of providing long-term support, system integration, and robust certification. The core appeal to these diverse potential customers is the technology's capability to deliver experiences that are otherwise impossible, too dangerous, or prohibitively expensive in the physical world, firmly positioning VR and 360 video as a foundational productivity tool and strategic investment rather than just a media format.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 95.0 Billion |

| Growth Rate | 28.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Meta Platforms Inc., Sony Corporation, HTC Corporation, Google LLC, Samsung Electronics Co., Ltd., Microsoft Corporation, NVIDIA Corporation, Unity Technologies, GoPro Inc., Insta360 (Arashi Vision Inc.), Pimax Technology, Varjo Technologies Oy, Magic Leap, HP Inc., Lenovo Group Ltd., Qualcomm Technologies, Adobe Systems Inc., Cisco Systems Inc., EON Reality, Vuzix Corporation, Pico Interactive, and Valve Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

VR and 360 Video Market Key Technology Landscape

The technological core of the VR and 360 Video Market is defined by relentless innovation aimed at erasing the perceived boundary between the physical and virtual worlds. Display technology is paramount, shifting rapidly towards Micro-OLED and Mini-LED panels that offer significantly higher pixel densities (Pixel Per Degree, PPD) and near-instantaneous refresh rates, effectively eliminating the persistent "screen door effect" and minimizing motion blur—two primary contributors to user discomfort. Parallel advancements in optical systems, specifically the integration of thin, multi-element pancake lenses, are crucial, allowing HMDs to achieve wider fields of view and dramatically reducing the device’s physical depth and weight, making prolonged use comfortable and practical for enterprise applications and facilitating all-day productivity use cases, moving beyond restrictive gaming sessions.

Positional tracking and interaction technologies are also undergoing transformation. Inside-out tracking, leveraging sophisticated Simultaneous Localization and Mapping (SLAM) algorithms coupled with integrated cameras, is the industry standard, eliminating the need for external base stations and enhancing mobility. Furthermore, the integration of advanced sensors such as precision eye-tracking modules allows for crucial functions like foveated rendering, which optimizes GPU utilization by only fully rendering the small area the user is directly viewing, saving immense processing power. Hand tracking, utilizing computer vision, and facial expression tracking are augmenting traditional controllers, enabling more natural, intuitive social interactions and productivity workflows within virtual spaces, which is essential for collaborative enterprise applications and realistic social VR platforms, thereby enhancing the sense of co-presence.

In the 360 video domain, key technologies revolve around capture fidelity and efficient delivery. Volumetric video capture, which uses multiple camera arrays to record three-dimensional data rather than just 2D pixels, is enabling truly interactive 360 content where viewers can subtly shift their perspective, leading to six degrees of freedom (6DoF) viewing capabilities in traditionally passive media. Post-production efficiency relies heavily on deep learning algorithms for real-time stitching, automated color grading, and parallax correction, ensuring seamless visual quality across the spherical capture. The widespread adoption of optimized compression standards and streaming protocols, leveraging 5G capabilities, is necessary to deliver 8K and higher resolution 360 content with the ultra-low latency required for live events and high-demand professional viewing applications without compromising visual fidelity or user comfort during streaming.

The final crucial component is the underlying software infrastructure, encompassing proprietary operating systems specifically designed for spatial computing and high-performance game engines. These engines must efficiently handle complex physics, lighting models, and multiplayer networking at exceptionally high frame rates to maintain immersion. The synergy between these hardware and software technologies, optimized through AI processing, is what fundamentally drives the transition of VR and 360 video from a nascent industry into a viable, foundational computing platform, supporting both high-fidelity entertainment and mission-critical professional workflows while aggressively pursuing the goal of lightweight, all-day wearable computing.

Regional Highlights

Regional market highlights reveal distinct growth catalysts and adoption patterns shaped by economic development, regulatory frameworks, and cultural consumption habits. The VR and 360 Video market exhibits diverse maturity levels across geographical segments, requiring tailored market strategies for success.

North America: This region maintains its position as the market powerhouse, primarily due to the high concentration of technology innovation hubs, extensive capital availability, and aggressive investment by major global players (e.g., Silicon Valley ecosystems). North America leads in the high-fidelity segment, particularly in enterprise (aerospace, defense, medical simulation) and premium consumer VR gaming, characterized by high Average Selling Prices (ASPs) for professional solutions. Robust digital infrastructure and a culture of early tech adoption facilitate rapid deployment of new hardware generations and sophisticated content platforms. The region’s focus is increasingly shifting toward mixed reality solutions and the establishment of scalable corporate Metaverse platforms, driving significant growth in software and services revenue.

Asia Pacific (APAC): APAC is undeniably the engine of future market growth, distinguished by the highest expected CAGR. This explosive expansion is driven by unparalleled access to low-cost manufacturing capabilities, which rapidly brings down hardware prices, and massive consumer demand, especially in China, Japan, and South Korea. Key drivers include mobile VR adoption, massive success in the competitive gaming market, and supportive government initiatives for technology implementation in education. Crucially, the deployment of 5G infrastructure is more advanced in several APAC nations, enabling widespread cloud-based VR services and high-quality 360 video streaming for social and educational consumption, positioning it as the global volume market leader for both hardware units and consumer content consumption.

Europe: The European market displays strong vertical integration, particularly within Industry 4.0 sectors, utilizing VR for sophisticated industrial training, remote factory floor assistance, and automotive design collaboration. Countries like Germany and the UK show high investment in B2B applications, valuing efficiency and safety improvements highly, often seeking certified European vendors. Europe is also a leader in regulating digital environments, with GDPR influencing data privacy practices for all virtual platform operators, fostering a high-trust environment for secure enterprise deployments and placing emphasis on ethical design principles in immersive technology development.

Latin America (LATAM) and Middle East & Africa (MEA): These regions are emerging markets characterized by strong governmental pushes toward digital transformation and diversification away from traditional industries. In MEA, particularly the Gulf Cooperation Council (GCC) nations, large-scale projects related to smart city development, urban planning, and architectural visualization utilize high-fidelity VR solutions extensively, often facilitated by government procurement. LATAM sees adoption driven by accessibility needs in education and remote healthcare, often relying on cloud solutions to overcome infrastructural limitations and hardware cost barriers, demonstrating strong potential for localized content development and public sector adoption.

- United States: Dominant in enterprise spending, R&D, and platform competition, setting global standards for high-end VR technology and defense simulations.

- China: Unmatched growth in consumer volume, mobile VR, and LBE, acting as the global manufacturing hub for VR components and headsets, leading in consumer adoption rates.

- Germany: Strong focus on high-precision industrial applications (simulation, engineering), maximizing efficiency in the manufacturing sector (Industry 4.0).

- Japan and South Korea: Pioneer in high-quality gaming, advanced consumer electronics, with significant integration into robotics and medical visualization, underpinned by advanced telecommunications infrastructure.

- Middle East (UAE, Saudi Arabia): High governmental procurement for infrastructure planning, defense, and large-scale entertainment projects, prioritizing high-fidelity visualization solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the VR and 360 Video Market.- Meta Platforms Inc.

- Sony Corporation

- HTC Corporation

- Google LLC

- Samsung Electronics Co., Ltd.

- Microsoft Corporation

- NVIDIA Corporation

- Unity Technologies

- GoPro Inc.

- Insta360 (Arashi Vision Inc.)

- Pimax Technology

- Varjo Technologies Oy

- Magic Leap

- HP Inc.

- Lenovo Group Ltd.

- Qualcomm Technologies

- Adobe Systems Inc.

- Cisco Systems Inc.

- EON Reality

- Vuzix Corporation

- Pico Interactive

- Valve Corporation

Frequently Asked Questions

Analyze common user questions about the VR and 360 Video market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current acceleration in VR and 360 Video adoption?

The primary acceleration factors are the decreasing cost and increased performance of standalone HMDs, enabling high-fidelity experiences without external hardware. Significant investment in the Metaverse concept by major technology companies, coupled with the proven efficacy of VR for specialized enterprise training and remote collaboration, is translating the technology from a niche product into a mainstream business tool, fundamentally expanding its addressable market and utility across all economic sectors.

How significant is the role of 5G in the future growth of the immersive market?

5G connectivity is crucial as it provides the low latency and high bandwidth necessary for Cloud VR (rendering content remotely and streaming it to lightweight headsets). This dramatically lowers the barrier to entry by reducing the need for expensive local processing power, facilitating the deployment of complex, high-resolution 360 content and large-scale enterprise simulations globally, thereby democratizing access to high-end immersive experiences, especially in emerging markets.

Which industry application currently offers the highest Return on Investment (ROI) for VR technology?

The Healthcare and Enterprise Training sectors offer the highest quantifiable ROI. VR simulations allow medical professionals to practice complex surgeries or industrial workers to train on hazardous machinery repeatedly without risk, significantly reducing costs associated with physical prototypes, travel, and potential safety incidents, while ensuring accelerated skill acquisition and superior knowledge retention compared to traditional methods, leading to rapid financial payback.

What are the main technological restraints hindering mass consumer adoption of VR?

Major restraints include high upfront hardware costs for premium experiences, the complexity of content creation leading to fragmentation across proprietary platforms, and persistent physiological discomforts such as motion sickness (simulator sickness). Hardware manufacturers are mitigating this through enhanced optics, higher refresh rates, and advanced tracking technology, but it remains a barrier for universal acceptance and necessitates continuous improvement in core display and tracking systems.

How is Artificial Intelligence (AI) influencing the creation of VR and 360 content?

AI is transforming content creation through procedural generation, allowing developers to create massive, diverse virtual environments rapidly and automatically, significantly lowering production costs and time. For 360 video, AI algorithms ensure seamless stitching of complex multi-camera footage and optimize adaptive streaming protocols, making content production faster, more efficient, and more visually realistic while minimizing bandwidth requirements for consumers and improving overall viewing quality.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager