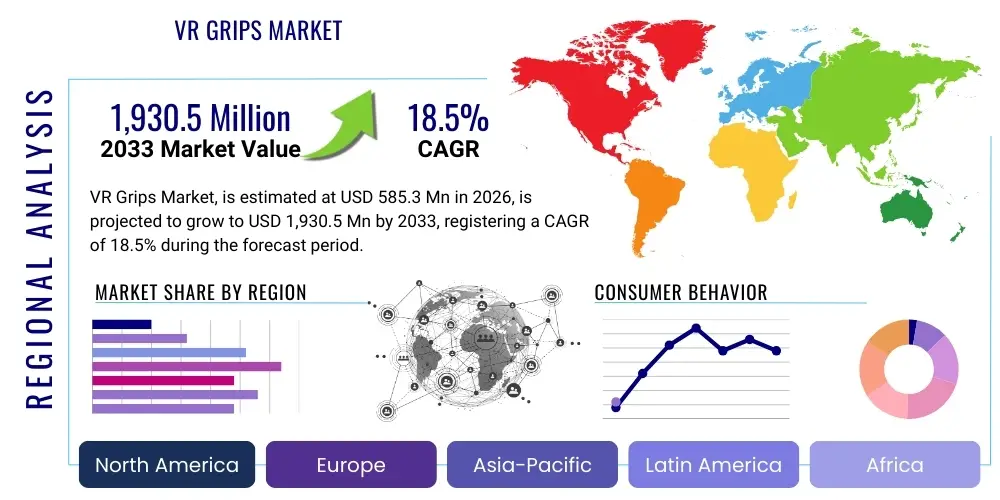

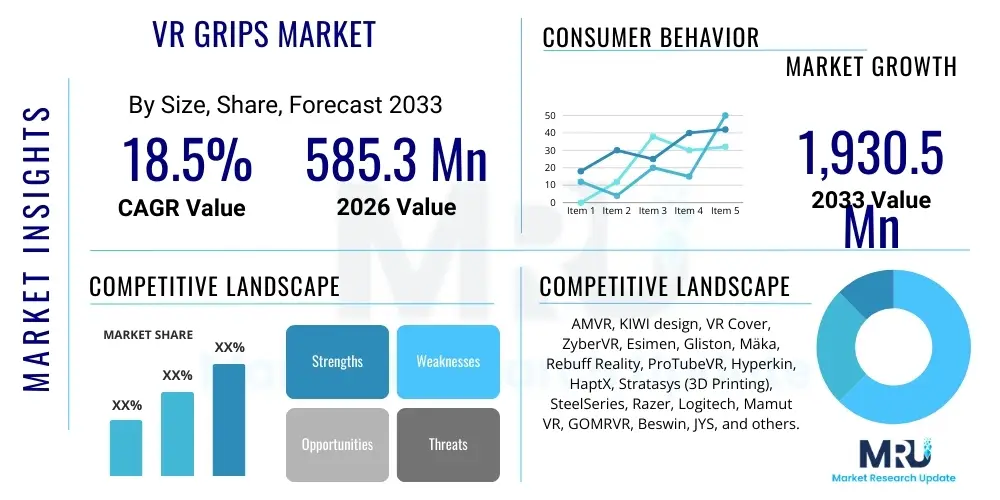

VR Grips Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434596 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

VR Grips Market Size

The VR Grips Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $585.3 Million in 2026 and is projected to reach $1,930.5 Million by the end of the forecast period in 2033.

VR Grips Market introduction

The Virtual Reality (VR) Grips Market encompasses the design, manufacturing, and distribution of specialized accessory products engineered to enhance the user experience of VR controllers. These grips are crucial components, moving beyond simple protective covers to offer ergonomic improvements, superior tactile feedback, enhanced hygiene, and increased durability for high-intensity VR usage, particularly in gaming and professional training applications. The fundamental product concept revolves around improving the physical interaction point between the user and the virtual environment, thereby mitigating issues like slippage, controller damage from impacts, and hand fatigue during extended sessions. The development of VR grips is intrinsically linked to the evolution of VR hardware, necessitating continuous adaptation to new controller designs and ergonomic specifications introduced by major platform providers such as Meta, Valve, and HTC.

Major applications for VR grips span various sectors, dominated currently by consumer VR gaming, where enhanced grip security and comfort directly translate to improved performance and sustained engagement. Beyond the consumer space, these accessories are increasingly adopted in enterprise and simulation environments, including surgical training, military simulation, and industrial design visualization. In these professional settings, the durability, ease of cleaning, and precise fit provided by high-quality grips are paramount to maintaining operational efficiency and safety standards. The growing demand for robust, specialized VR accessories underscores the transition of VR technology from niche entertainment into mainstream professional tools and widespread consumer technology.

The primary driving factors propelling this market include the accelerating adoption rate of standalone VR headsets, which have lowered the barrier to entry for consumers, coupled with the exponential growth in high-fidelity VR gaming content and experiences. Furthermore, continuous innovation in materials science, leading to the development of grips offering improved haptics and thermal regulation, further stimulates consumer upgrades and market penetration. As VR ecosystems mature, the necessity for personalized, protective, and performance-enhancing accessories like VR grips becomes non-negotiable for serious users, securing its position as a vital segment of the broader VR peripheral market.

VR Grips Market Executive Summary

The VR Grips Market is exhibiting robust growth, driven primarily by favorable business trends centered around the increasing affordability and processing power of standalone VR hardware, notably the Meta Quest series, which democratizes access to immersive technology. Key business trends involve intense competition among third-party accessory manufacturers who focus heavily on rapid product development cycles, responding quickly to new controller designs and user-reported ergonomic deficiencies. Strategic market players are capitalizing on niche segments by offering specialized grips featuring integrated battery packs or advanced haptic feedback mechanisms, shifting the market focus from simple protection toward performance enhancement and extended utility. Investment in direct-to-consumer (D2C) channels and strong influencer marketing partnerships are also critical components of the current business landscape, enabling brands to reach highly targeted and engaged consumer bases effectively.

Regionally, North America and Europe currently represent the largest revenue share due to high consumer disposable income, established VR gaming cultures, and the presence of major VR hardware and software developers. However, the Asia Pacific (APAC) region is projected to demonstrate the highest Compound Annual Growth Rate (CAGR) over the forecast period, fueled by rapid urbanization, increasing digitalization, and the rising availability of affordable VR hardware in densely populated markets like China, Japan, and South Korea. These regions are seeing significant growth in VR arcades and location-based entertainment (LBE), which demand durable, hygienic, and easily replaceable VR grips, creating a sustained B2B revenue stream alongside consumer demand.

Segmentation trends indicate a clear preference for grips optimized for the dominant VR platforms, with the Oculus/Meta Quest compatibility segment holding the largest market share. Furthermore, the material segmentation shows a strong consumer trend toward hybrid grips combining the durability of plastics with the comfort and sweat resistance of silicone or specialized foam, balancing protection with ergonomic performance. The application segment continues to be dominated by gaming, but the enterprise and simulation segments are growing rapidly, requiring specialized, ruggedized grips designed for repetitive, high-stress, and clinical environments. This bifurcation demands manufacturers maintain diverse product lines to cater to both high-volume consumer markets and high-margin professional users.

AI Impact Analysis on VR Grips Market

Common user questions regarding AI's impact on the VR Grips Market frequently center on whether AI can optimize ergonomic designs, predict material failure rates, or automate personalized manufacturing. Users are keen to understand if machine learning algorithms are being employed to analyze large datasets of hand sizes, grip styles, and biomechanical stress points during VR usage to create dynamically optimized grip geometries, moving beyond static, one-size-fits-all designs. Concerns also relate to the potential for generative design AI to radically reduce the time needed for prototyping new grips that perfectly match evolving controller specifications, thereby accelerating the accessory launch cycle and intensifying competition among third-party vendors. The overarching expectation is that AI will introduce hyper-personalization, better prediction of user needs (e.g., thermal management requirements), and enhanced quality control through automated inspection systems during manufacturing.

- AI-Driven Generative Design: Utilization of algorithms to rapidly prototype and test thousands of grip designs based on ergonomic efficiency scores and material constraints, significantly reducing the R&D cycle.

- Predictive Material Optimization: Machine learning models analyzing usage data (force, temperature, duration) to predict optimal material composition for durability, sweat absorption, and longevity.

- Customized Manufacturing Automation: AI integration with 3D printing and robotic assembly to enable mass customization of grips based on individual user biometric data captured via proprietary software or third-party scanning apps.

- Quality Control and Defect Detection: Implementing computer vision and AI classifiers in production lines to ensure precision fitting and detect microscopic material flaws or structural weaknesses in high-volume production batches.

- Inventory and Demand Forecasting: Using predictive analytics to forecast demand for specific compatibility grips across various geographic regions, optimizing supply chain logistics and reducing stockouts or overstock situations.

DRO & Impact Forces Of VR Grips Market

The dynamics of the VR Grips Market are shaped by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which collectively define the Impact Forces governing market expansion and evolution. Key drivers include the exponential growth in the global installed base of VR headsets, particularly the high-volume, affordable standalone units, making accessories essential for user comfort and device protection. The cultural shift towards integrating VR into fitness and competitive gaming (esports) further necessitates durable, performance-focused grips. Restraints primarily involve the inherent complexity of maintaining cross-platform compatibility, as manufacturers must continually invest in tooling to accommodate proprietary changes in controller designs, leading to potential inventory obsolescence. Additionally, the fragmented nature of the accessory market results in intense price competition, which can pressure profit margins, particularly for smaller, specialized manufacturers.

Opportunities for market growth are vast, including the expansion into enterprise and institutional verticals, such as specialized simulation and corporate training programs, where the willingness to pay for premium, ruggedized grips is significantly higher than in the consumer sector. Furthermore, the integration of advanced functionality, such as enhanced passive cooling channels, built-in haptic feedback elements (beyond standard controller haptics), or embedded health monitoring sensors within the grip material, represents a high-growth area. The potential for licensing agreements with major VR hardware manufacturers to produce official or co-branded accessories also presents a substantial opportunity for market stabilization and revenue generation.

The core Impact Forces driving strategic decisions involve competitive rivalry based on innovation (e.g., patented anti-slip materials or unique fastening systems), the high bargaining power of large distributors (especially global e-commerce platforms like Amazon), and the constant threat of substitution from alternative solutions (e.g., specialized controller mods or custom 3D-printed solutions). Manufacturers must strategically balance rapid innovation in design and material science with aggressive pricing strategies to maintain visibility and market share in this rapidly evolving and highly competitive consumer electronics accessory ecosystem.

Segmentation Analysis

The VR Grips Market is segmented based on critical factors including the material used (Type), the specific VR headset the grip is designed for (Compatibility), the final use case (Application), and the route to market (Distribution Channel). Analyzing these segments provides essential insights into consumer preferences and strategic investment areas for manufacturers. The segmentation highlights the market's dependence on the success of primary VR platforms and the evolving demands of both high-volume consumer users and specialized professional clients. A deep understanding of these segments allows companies to tailor marketing efforts, optimize supply chains, and focus R&D resources on the most lucrative product categories, such as hybrid materials offering peak comfort and durability.

The market is characterized by a strong dependence on the Compatibility segment, as product efficacy hinges entirely on a precise, secure fit around specific controllers. This necessitates continuous surveillance of the product roadmaps of major hardware manufacturers. Meanwhile, the Application segmentation indicates a clear, growing requirement for industrial-grade grips designed to withstand sterilization and heavy use in enterprise settings, contrasting sharply with the aesthetic and comfort demands of the consumer gaming segment. The interplay between these segments is crucial; for instance, a foam grip might be acceptable for light consumer use, but a ruggedized, easily cleanable hybrid grip is mandated for medical simulation training centers.

- By Type:

- Silicon Grips

- Rubber Grips

- Foam Grips

- Hybrid Grips (Combination of plastic frames and silicone/foam interfaces)

- Specialized Materials (e.g., Anti-microbial, High-friction polymer)

- By Compatibility:

- Oculus/Meta Quest Series Grips

- Valve Index Grips

- HTC Vive Series Grips

- PlayStation VR (PS VR) Grips

- Other Emerging Platforms (e.g., Pico, HP Reverb)

- By Application:

- Gaming and Entertainment

- Training and Simulation (Military, Aviation, Technical)

- Enterprise and Industrial (Design, Collaboration)

- Healthcare and Medical (Surgical Training, Rehabilitation)

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Company Websites)

- Offline Retail (Specialty Electronics Stores, Department Stores)

Value Chain Analysis For VR Grips Market

The value chain for the VR Grips Market begins with upstream activities focused on sourcing raw materials and component manufacturing. Upstream analysis involves the procurement of high-grade polymers, silicone compounds, specialized foam materials (like PU leather foam), and micro-fastening components (straps, buckles). Material quality directly impacts product feel, durability, and anti-slip properties, making strategic supplier relationships crucial. Manufacturers often engage in intensive research into material science to find proprietary compounds that offer a competitive edge in terms of sweat resistance and environmental sustainability. This phase also includes the design and rapid prototyping of molds, which is a significant fixed cost investment sensitive to controller design changes.

Midstream processes involve manufacturing and assembly. This includes injection molding for rigid plastic frames, compression molding for silicone parts, and the integration of soft components like adjustable wrist straps and battery access ports. Quality control at this stage is paramount, focusing on dimensional accuracy to ensure a perfect fit with the VR controllers. The market relies heavily on optimized production processes, often situated in Asia Pacific manufacturing hubs, to achieve economies of scale necessary for competitive pricing in the consumer accessory market. Packaging and branding, while technically midstream, serve as a critical differentiating factor, especially in the online distribution ecosystem where product presentation influences purchasing decisions.

Downstream analysis focuses on distribution channels, encompassing both direct and indirect routes to the end-user. Indirect distribution, dominated by large global e-commerce platforms (Amazon, eBay) and major electronics retailers (Best Buy, MediaMarkt), accounts for the vast majority of sales volumes. These channels offer wide reach but demand competitive pricing and high logistical efficiency. Direct distribution, through proprietary brand websites, allows companies to maintain higher margins, control the customer experience, gather invaluable feedback, and execute targeted loyalty programs. The effectiveness of the value chain is measured by its ability to rapidly move from concept to mass production, adapting immediately to new VR hardware releases while minimizing costs associated with material procurement and complex global logistics.

VR Grips Market Potential Customers

The VR Grips Market targets a diverse group of end-users whose needs vary significantly based on their primary application of VR technology. The largest segment remains the VR Gaming Enthusiast, characterized by individuals who spend significant time (often several hours daily) in immersive gaming environments. These users prioritize comfort, sweat resistance, high tactile feedback, and enhanced wrist security (preventing controller launch during intense gameplay). They seek performance-enhancing grips, often willing to invest in premium accessories that offer unique features like knuckle straps or integrated cooling elements, serving as the core consumer segment driving volume sales.

A second major customer segment includes Enterprise and Institutional Users, such as specialized training facilities (e.g., flight simulation academies, military branches) and healthcare providers utilizing VR for rehabilitation or surgical planning. These buyers prioritize durability, hygienic materials (easily wiped down or sterilized), ruggedized protection against accidental drops, and compatibility with multi-user environments. Their purchasing decisions are often centralized, volume-based, and driven by operational requirements rather than individual preference, creating high-value, long-term contractual opportunities for manufacturers specializing in industrial-grade accessories.

The third significant segment comprises Casual and New VR Users, who primarily seek basic protection for their costly hardware and a minimal level of comfort enhancement. Price sensitivity is higher in this group, and they are typically targeted through bundled offerings or lower-cost, standard silicone grips distributed widely through general e-commerce channels. Understanding the distinct needs and purchasing drivers of these segments—ranging from performance optimization for the enthusiast to operational robustness for the enterprise—is fundamental for effective product development and market penetration strategies within the VR grips ecosystem.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $585.3 Million |

| Market Forecast in 2033 | $1,930.5 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AMVR, KIWI design, VR Cover, ZyberVR, Esimen, Gliston, Mäka, Rebuff Reality, ProTubeVR, Hyperkin, HaptX, Stratasys (3D Printing), SteelSeries, Razer, Logitech, Mamut VR, GOMRVR, Beswin, JYS, and others. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

VR Grips Market Key Technology Landscape

The technological landscape of the VR Grips Market is defined less by radical electronic innovation and more by sophisticated material science and advanced manufacturing processes, primarily focusing on ergonomics and user interface optimization. A significant technological trend is the adoption of advanced polymer chemistry and silicone formulations that offer superior elasticity, durability, and crucial anti-microbial properties, essential for shared or enterprise VR environments. Manufacturers leverage specific material blends to achieve high coefficient of friction, ensuring controllers remain secure even during vigorous, sweat-inducing activity, a critical performance metric for VR grips. Furthermore, the integration of passive ventilation channels and thermally conductive materials is becoming a standard feature to mitigate hand sweating and discomfort during prolonged use, enhancing the overall user retention rate in VR experiences.

Manufacturing technology plays an equally pivotal role, with high-precision injection molding techniques being essential to meet the stringent dimensional tolerances required for a perfect, non-slipping fit with various proprietary controllers. The rapid adoption of 3D printing (Additive Manufacturing), particularly for prototyping and specialized, low-volume custom grips, allows smaller manufacturers to iterate designs quickly and respond faster than traditional tooling methods permit. This agility is key in a market where controller design updates from hardware giants can render existing accessories obsolete almost overnight. Furthermore, the incorporation of advanced fastening systems, such as magnetic clasps or specialized, highly durable Velcro variants, ensures long-term user safety and product longevity, minimizing wear and tear on the securing mechanisms themselves.

Looking ahead, the convergence of passive grip technology with active electronic components represents the next major technological frontier. This includes research into embedding highly flexible, thin-film haptic actuators directly into the grip surface to provide localized and nuanced tactile feedback that supplements the controller’s native haptics, enhancing immersion. Another emerging area is the integration of ultra-low-power biometric sensors within the material to track metrics like heart rate or skin conductance (GSR), allowing VR applications to adapt based on the user's physiological state. While complex and costly, these integrated smart grips promise to transform the accessory from a passive protector into an active input and measurement device, greatly increasing its value proposition, especially in high-fidelity simulation and health tracking applications, thus justifying premium pricing and driving technological competitive advantage.

Regional Highlights

- North America (NA): Dominates the VR Grips market in terms of current revenue, characterized by high consumer spending power and a mature VR ecosystem driven by intense consumer interest in high-end gaming and early adoption of enterprise VR solutions. The US market, in particular, is a hotbed for accessory innovation, benefiting from the close proximity of major tech companies and a high density of specialized VR accessory manufacturers. Demand is skewed towards premium, feature-rich grips (e.g., those with integrated batteries or knuckle straps).

- Europe: Represents a substantial and rapidly growing market, mirroring North America in technological adoption but showing greater regulatory emphasis on product safety and sustainable materials. Key markets like Germany, the UK, and France show strong demand, particularly supported by a booming VR fitness market and growing academic/research use of VR hardware, necessitating durable and hygienic grip solutions suitable for institutional environments.

- Asia Pacific (APAC): Projected to exhibit the fastest CAGR, driven by the sheer volume of middle-class consumers gaining access to affordable standalone VR headsets and the widespread popularity of Location-Based Entertainment (LBE) centers and VR arcades. Markets such as China, Japan, and South Korea are key manufacturing hubs, allowing local companies to rapidly iterate and supply the global market. The demand here is dual-faceted: high-volume, cost-effective grips for LBE, and premium, stylized grips for the growing individual gaming audience.

- Latin America (LATAM): Currently represents a smaller but expanding market, where growth is closely linked to improvements in internet infrastructure and increasing economic stability allowing for greater VR hardware penetration. Price sensitivity remains a key factor, favoring cost-effective, durable grips, often imported from APAC manufacturers. Growth opportunities exist in educational VR implementation.

- Middle East and Africa (MEA): This region is in the nascent stages of VR adoption, with concentrated demand in technologically advanced hubs such as the UAE and Saudi Arabia, primarily driven by large government investment in digital transformation and smart city initiatives, which often incorporate high-end VR simulation and training, creating niche demand for high-specification enterprise-grade grips.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the VR Grips Market.- AMVR

- KIWI design

- VR Cover

- ZyberVR

- Esimen

- Gliston

- Mäka

- Rebuff Reality

- ProTubeVR

- Hyperkin

- HaptX (Focus on advanced tactile interfaces)

- Stratasys (Relevance in custom 3D printed components)

- SteelSeries

- Razer

- Logitech

- Mamut VR

- GOMRVR

- Beswin

- JYS

- TNE

Frequently Asked Questions

Analyze common user questions about the VR Grips market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary materials used in high-performance VR grips?

The primary materials include specialized high-grade silicone for elasticity and sweat resistance, durable plastics (like ABS or polycarbonate) for structural frames, and composite materials (hybrid grips) that often incorporate foam or PU leather for enhanced comfort and ergonomic support.

How significant is the impact of new VR headset releases on the accessory market?

The impact is highly significant, acting as a major market driver and restraint. New headset releases necessitate rapid prototyping and re-tooling by accessory manufacturers to maintain precise compatibility, leading to accelerated product cycles and defining immediate market demand for specific grip compatibility segments.

Which application segment provides the highest growth opportunities for VR grips?

While the Gaming and Entertainment segment holds the largest volume, the Training and Simulation and Enterprise applications offer the highest growth opportunities in terms of value, due to the need for ruggedized, high-durability, and easily sterilized grips that command a premium price point.

What differentiates premium VR grips from standard protective covers?

Premium VR grips offer significant ergonomic improvements (contoured shapes, knuckle straps), advanced material features (anti-microbial or thermal regulation), and often integrate additional functionality, such as battery extensions or enhanced haptic elements, moving beyond basic protection to performance enhancement.

How does the distribution channel structure influence competitive strategy in the VR Grips Market?

The dominance of Online Retail necessitates strategies focused on SEO, high-quality product imagery, competitive pricing, and efficient direct shipping. Manufacturers use specialized distribution (direct websites) to launch niche products and leverage feedback, while high-volume platforms (Amazon) drive mass market penetration and price competition.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager