VTE Prevention Static System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432738 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

VTE Prevention Static System Market Size

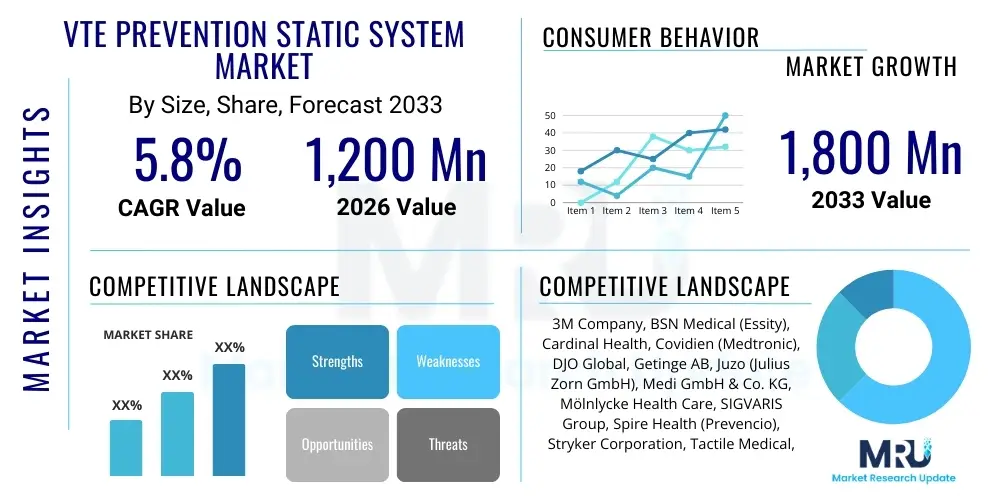

The VTE Prevention Static System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1,200 Million in 2026 and is projected to reach USD 1,800 Million by the end of the forecast period in 2033.

VTE Prevention Static System Market introduction

The VTE Prevention Static System Market encompasses non-pharmacological, passive medical devices designed to mitigate the risk of Venous Thromboembolism (VTE), which includes deep vein thrombosis (DVT) and pulmonary embolism (PE). These static systems primarily rely on applying controlled pressure gradients to the lower extremities, enhancing venous return, and preventing blood stasis, a critical component of Virchow's triad. Key product categories within this market include anti-embolism stockings (AES), graduated compression stockings (GCS), and other passive compression garments used ubiquitously in clinical settings, particularly for patients undergoing surgery, those with limited mobility, or individuals requiring extended bed rest. The effectiveness of static systems is often maximized when used in conjunction with mechanical prophylaxis or pharmacological agents, forming a comprehensive VTE prevention protocol in hospitals worldwide. The fundamental function of these devices is to physically counteract the gravitational pooling of blood in the deep veins, thereby reducing the likelihood of clot formation in high-risk patients.

The driving factors for market growth are intrinsically linked to the increasing prevalence of chronic diseases requiring surgical intervention, the rapidly aging global population which inherently carries a higher VTE risk profile, and heightened awareness regarding hospital-acquired VTE events. Regulatory bodies and healthcare organizations are increasingly mandating adherence to established guidelines for VTE prophylaxis, further stimulating the adoption of static compression systems. Furthermore, the cost-effectiveness and ease of application of static systems, compared to more complex mechanical or pharmaceutical alternatives, make them a preferred foundational layer in numerous prophylactic regimens. Technological advancements, though subtle in the static system segment, focus on improving material breathability, ensuring optimal pressure profiles across different limb sizes, and enhancing patient comfort and compliance during prolonged wear periods, which are crucial aspects influencing clinical outcomes.

Major applications of these systems span critical care units, post-operative recovery, general medicine floors, and long-term care facilities. The benefits are substantial, including a measurable reduction in DVT incidence, minimized patient risk associated with anticoagulant use, and lower overall healthcare expenditure resulting from prevented complications. However, the market faces constraints related to patient compliance issues, the need for accurate sizing to ensure efficacy, and competitive pressure from Dynamic VTE Prevention Systems like Intermittent Pneumatic Compression (IPC) devices. Despite these challenges, the static system remains a cornerstone of VTE prevention, driven by its fundamental physiological effectiveness and established clinical utility in minimizing life-threatening thrombotic events across diverse patient populations globally.

VTE Prevention Static System Market Executive Summary

The VTE Prevention Static System Market is characterized by stable growth, primarily fueled by global demographic shifts, mandatory clinical protocols, and the increasing incidence of cardiovascular and orthopedic surgeries. Business trends indicate a focus on material innovation, shifting towards advanced polymers that offer superior moisture-wicking properties and maintain consistent compression levels over extended periods of use. Key market players are expanding their geographical footprint, particularly in emerging economies where healthcare infrastructure is rapidly improving and surgical volumes are escalating. Consolidation remains a minor theme, with competition often revolving around supply chain efficiencies, bulk purchasing agreements with large hospital networks, and achieving favorable placement in VTE protocol guidelines. Manufacturers are increasingly emphasizing comprehensive educational programs for healthcare providers to ensure correct application and sizing, addressing a critical clinical constraint that affects the overall effectiveness of these static prophylactic measures.

Regional trends highlight North America and Europe as the dominant markets, driven by established reimbursement structures, high surgical throughput, and stringent adherence to VTE prophylaxis guidelines published by bodies such as the American College of Chest Physicians (ACCP). However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR, propelled by rapid urbanization, significant investments in healthcare infrastructure development, and a burgeoning medical tourism sector that increases demand for post-operative care products. Countries like China and India are focal points for future market expansion, presenting both manufacturing advantages and rapidly growing patient bases. Latin America and the Middle East & Africa (MEA) are also demonstrating gradual uptake, contingent upon improvements in healthcare access and the standardization of surgical and medical care protocols across diverse institutions.

Segment trends reveal that the anti-embolism stockings segment holds the largest market share due to its wide applicability across various risk profiles and its endorsement as a standard component of non-pharmacological VTE prevention. The end-user segmentation continues to be dominated by Hospitals and Ambulatory Surgical Centers (ASCs), reflecting the immediate need for prophylaxis in perioperative settings. The revenue split indicates a preference for thigh-high systems over knee-high systems in high-risk patients, although knee-high versions maintain popularity due to higher patient tolerance and easier application. Future growth is anticipated in the home healthcare segment, driven by the increasing shift towards remote patient monitoring and the necessity for extended VTE prophylaxis post-discharge, requiring durable and comfortable static systems for use outside the acute care environment.

AI Impact Analysis on VTE Prevention Static System Market

User queries regarding the impact of Artificial Intelligence (AI) on the VTE Prevention Static System Market frequently center on whether AI can entirely replace static systems, or if it will primarily serve to optimize their deployment and efficacy. Common concerns revolve around how AI can enhance risk stratification for VTE, personalize compression profiles, and improve patient compliance through smart monitoring integration. Users seek clarity on the development of smart garments capable of real-time pressure monitoring and feedback loops managed by AI algorithms, which could potentially bridge the gap between static (passive) and dynamic (active) prevention systems. The key expectation is that AI will transform VTE prophylaxis from a standardized procedure into a personalized medicine approach, reducing device misuse and optimizing resource allocation based on predictive risk modeling specific to each patient's clinical trajectory.

- AI integration into Electronic Health Records (EHR) for enhanced VTE risk scoring, ensuring appropriate patients receive static prophylaxis systems promptly.

- Development of smart textiles embedded with pressure sensors, utilizing AI algorithms to verify correct stocking application and optimal therapeutic compression gradient.

- AI-driven optimization of inventory management and supply chain logistics, ensuring hospitals maintain the correct sizes and types of static systems based on predictive patient flow models.

- Personalized sizing recommendations generated by machine learning models analyzing patient anthropometric data (e.g., limb circumference measurements) to improve the clinical efficacy of compression stockings.

- AI systems monitoring patient movement patterns (when combined with wearable sensors) to assess compliance with static system usage outside of acute care settings, facilitating timely intervention.

DRO & Impact Forces Of VTE Prevention Static System Market

The dynamics of the VTE Prevention Static System Market are governed by a robust interplay of Drivers (D), Restraints (R), Opportunities (O), and associated Impact Forces. The primary drivers include the mandatory implementation of VTE prophylaxis guidelines globally, the rising geriatric population requiring increased surgical and critical care, and the cost-effectiveness of static systems compared to pharmacological intervention, especially in cases where anticoagulation is contraindicated. Restraints largely center on issues of patient non-compliance due to discomfort or perceived inconvenience, difficulties in achieving precise sizing across varied patient populations leading to suboptimal therapeutic outcomes, and the risk of skin irritation or pressure injury associated with prolonged wear. Opportunities lie in expanding usage in outpatient and home healthcare settings, improving material technology for enhanced comfort and compliance, and integrating static systems with digital health platforms for monitoring and educational purposes. The combined impact forces strongly favor market stability and incremental growth, sustained by essential clinical needs and continuous regulatory endorsement of VTE prophylactic measures.

Segmentation Analysis

The VTE Prevention Static System Market is comprehensively segmented based on product type, length, end-user, and distribution channel, providing a granular view of demand patterns and competitive intensity across different facets of the healthcare continuum. Product type segmentation distinguishes between various forms of compression garments, reflecting differences in material composition, pressure gradient engineering, and specific clinical indications. The length segment, dividing products into knee-high and thigh-high variations, is crucial as the choice directly impacts the extent of venous return enhancement and is often dictated by the location of the highest risk area. End-user categorization clearly identifies primary consumption hubs, with hospitals remaining the largest purchaser due to the high volume of acute and surgical patients. These segmentations are critical for manufacturers developing targeted marketing strategies and for healthcare providers seeking the most appropriate and compliant solutions for diverse patient risk profiles.

- By Product Type:

- Anti-Embolism Stockings (AES)

- Graduated Compression Stockings (GCS)

- Other Compression Garments

- By Length:

- Knee-High Systems

- Thigh-High Systems

- By End-User:

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Clinics

- Home Healthcare Settings

- By Distribution Channel:

- Direct Sales

- Retail Pharmacies

- Online Channels

Value Chain Analysis For VTE Prevention Static System Market

The Value Chain for the VTE Prevention Static System Market begins with the upstream sourcing of specialized raw materials, primarily medical-grade elastomers, spandex, nylon, and advanced synthetic fibers designed for precise elasticity and breathability. Raw material suppliers must meet stringent quality standards regarding non-toxicity and durability, as these factors directly affect the clinical performance and patient safety of the final product. Key upstream activities include polymer synthesis and specialized textile manufacturing processes, ensuring the materials can sustain the exact graduated pressure profile required by international clinical standards (e.g., 8-15 mmHg, 15-20 mmHg). Efficiency in the upstream segment is vital, as fluctuations in polymer pricing or quality control issues can significantly impact manufacturing costs and regulatory compliance, making vertical integration or strategic long-term supplier agreements beneficial for major static system manufacturers.

Midstream activities involve the specialized manufacturing and assembly processes, including computerized knitting techniques that ensure the graduated compression profile is accurately maintained throughout the garment's length. Research and Development (R&D) in this stage focuses on enhancing patient comfort, reducing skin shear, and developing antimicrobial finishes. Distribution channels constitute the crucial downstream segment, determining product accessibility. Direct sales to large hospital groups and government health systems allow for bulk procurement and contract negotiations, dominating the acute care market. Indirect channels, including medical device distributors, wholesalers, and specialized retail pharmacies, cater to smaller clinics, ASCs, and the burgeoning home healthcare segment, requiring robust logistical networks capable of managing varied inventory sizes and timely delivery across broad geographies.

The effectiveness of the distribution network, covering both direct engagement with major institutional buyers and indirect market penetration through retail and online platforms, is paramount for maximizing market reach. Post-sales services, though less intensive than mechanical systems, focus primarily on educational support for proper sizing and application training for healthcare staff and patients, minimizing the risk of adverse events and ensuring optimal therapeutic outcomes. The interaction between R&D, manufacturing precision, and efficient distribution defines the competitive advantage within this market, ensuring that compliant, high-quality, and cost-effective VTE static systems are reliably supplied to clinical environments demanding standardized VTE prophylaxis protocols.

VTE Prevention Static System Market Potential Customers

The primary customers and end-users of VTE Prevention Static Systems are institutional healthcare providers and patients requiring extended prophylactic care. Hospitals, particularly those with high volumes of orthopedic, cardiovascular, neurological, and general surgeries, represent the largest customer segment due to the immediate, mandatory need for VTE prophylaxis in perioperative and critical care settings. These institutions prioritize systems that offer proven efficacy, ease of use for nursing staff, and cost-efficiency through bulk purchasing agreements. Ambulatory Surgical Centers (ASCs) are increasingly becoming significant buyers as outpatient procedures expand, necessitating suitable static systems for patients discharged rapidly following minor to moderate surgical interventions, focusing on short-term, effective prophylaxis.

Beyond the institutional setting, individual patients are a growing segment, driven by the expansion of home healthcare and the necessity for continuous prophylaxis following hospital discharge. Patients requiring long-term care due to chronic mobility limitations, such as those in nursing homes or rehabilitation facilities, also constitute a stable customer base. Distributors and wholesalers act as essential intermediaries, stocking and supplying a wide array of static systems to various clinics and retail pharmacies. The purchasing decision criteria across all customer segments emphasize clinical evidence, product quality (durability and sustained compression), adherence to regulatory standards (FDA, CE marking), and patient comfort, which significantly influences compliance rates and, ultimately, clinical success in VTE prevention.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1,200 Million |

| Market Forecast in 2033 | USD 1,800 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, BSN Medical (Essity), Cardinal Health, Covidien (Medtronic), DJO Global, Getinge AB, Juzo (Julius Zorn GmbH), Medi GmbH & Co. KG, Mölnlycke Health Care, SIGVARIS Group, Spire Health (Prevencio), Stryker Corporation, Tactile Medical, THUASNE, Z&Z Medical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

VTE Prevention Static System Market Key Technology Landscape

The technology landscape for VTE Prevention Static Systems, while fundamentally rooted in textile engineering and compression physics, is currently focused on material science advancements and integration capabilities. The primary technology involves specialized circular and flat knitting machines capable of producing textiles with meticulously controlled elasticity and graduated pressure distribution, ensuring the highest pressure is exerted at the ankle and gradually decreases towards the thigh. Recent technological innovations center on incorporating moisture-wicking and antimicrobial fibers, such as silver-impregnated or copper-infused yarns, to enhance patient hygiene, reduce the risk of skin breakdown, and prolong the functional life of the garment. This focus on comfort technology is directly correlated with improved patient compliance, a crucial factor driving therapeutic success, especially in extended-wear scenarios.

A significant area of development involves the exploration of 'smart textiles' that integrate passive electronic components or pressure sensors without transitioning the system entirely into a dynamic category. Although still nascent, this technology aims to provide instantaneous feedback regarding correct donning and sustained pressure maintenance, addressing the persistent clinical challenge of improper application. These innovations leverage conductive fibers and micro-sensing elements woven directly into the fabric, allowing healthcare professionals to verify the efficacy of the static system remotely or via handheld readers. Furthermore, advanced sizing technologies, including 3D scanning and predictive algorithms, are being deployed to ensure a perfect anatomical fit, moving away from purely manual measurement techniques which often introduce human error and compromise the graduated compression profile.

The long-term technological trajectory for VTE static systems involves enhanced sustainability in material sourcing and manufacturing processes, responding to global calls for environmentally responsible medical devices. The blending of synthetic and natural fibers is being explored to maintain pressure performance while improving skin breathability and reducing environmental impact. While static systems inherently lack the complex mechanics of Intermittent Pneumatic Compression (IPC) devices, their continuous evolution through material science, antimicrobial treatment, and subtle digital integration ensures their continued relevance and efficacy as a reliable, foundational non-pharmacological VTE prophylaxis tool in modern clinical practice, supported by robust evidence from numerous randomized controlled trials demonstrating their clear benefit, particularly when used correctly and consistently across high-risk patient populations throughout the acute care episode and into the recovery phase.

Regional Highlights

North America maintains market dominance, primarily due to the established presence of major medical device manufacturers, sophisticated healthcare infrastructure, high incidence of chronic diseases leading to surgery, and strict regulatory adherence to VTE prevention protocols mandated by governmental and institutional bodies. The US healthcare system’s emphasis on reducing hospital-acquired conditions, including VTE, drives significant procurement volumes of static compression systems across all hospital levels. Furthermore, favorable reimbursement policies and high public awareness contribute substantially to the consistent demand across acute and post-acute care settings, reinforcing this region's leadership position in adoption and expenditure.

Europe represents a mature and highly regulated market, with countries like Germany, the UK, and France being key contributors. The presence of universal healthcare systems ensures broad access to VTE prophylaxis tools, and the stringent quality standards set by the European Union necessitate high-quality, clinically proven static systems. Growth in this region is steady, driven by an aging demographic and continuous efforts to standardize VTE risk assessment and management across diverse member states, often leading to competitive tendering processes for bulk institutional supply contracts aimed at maximizing cost-efficiency without compromising clinical efficacy. The emphasis here is often on long-term wearability and patient compliance within the context of chronic disease management.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market globally, propelled by rapidly developing healthcare infrastructure, escalating medical tourism, and a massive, growing patient population undergoing surgical procedures. Economic powerhouses like China and India are investing heavily in modernizing hospital facilities and adopting Western clinical standards, directly boosting the demand for VTE prophylaxis devices. While challenges related to pricing pressure and inconsistent clinical adoption protocols exist, the sheer market size and increasing disposable incomes supporting healthcare expenditure present vast, untapped opportunities for static system manufacturers to establish new market footprints, often through strategic partnerships with local distributors and domestic manufacturing entities.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets exhibiting gradual yet steady growth. In LATAM, market penetration is tied to economic stability and government investment in public health systems, with countries like Brazil and Mexico showing the highest potential due to sizable private healthcare sectors. In MEA, high-quality static systems are mainly concentrated in Gulf Cooperation Council (GCC) countries, supported by well-funded healthcare sectors and high standards in specialized hospitals. However, the broader African continent faces challenges related to infrastructure limitations and lower healthcare spending, making growth contingent upon international aid, philanthropic initiatives, and the development of cost-effective, durable products suitable for diverse clinical environments and logistical constraints.

- North America: Market leader; driven by high surgical volumes, established VTE guidelines, and strong reimbursement structures. Focus on reducing hospital-acquired VTE.

- Europe: Mature market; growth influenced by aging population, standardized national health protocols, and rigorous quality certifications. Emphasis on clinical evidence and cost-efficiency.

- Asia Pacific (APAC): Highest CAGR; accelerated adoption due to infrastructure investment, increasing medical tourism, and expanding access to modern clinical care in urban centers.

- Latin America (LATAM): Growth tied to economic stability; localized market strength in Brazil and Mexico, driven by private sector demand for standardized prophylactic measures.

- Middle East & Africa (MEA): Emerging growth; dominated by high-standard hospitals in GCC nations; requires penetration into lower-tier markets through affordable and scalable solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the VTE Prevention Static System Market.- 3M Company

- BSN Medical (Essity)

- Cardinal Health

- Covidien (Medtronic)

- DJO Global

- Getinge AB

- Juzo (Julius Zorn GmbH)

- Medi GmbH & Co. KG

- Mölnlycke Health Care

- SIGVARIS Group

- Spire Health (Prevencio)

- Stryker Corporation

- Tactile Medical

- THUASNE

- Z&Z Medical

- ArjoHuntleigh

- Baxter International Inc.

- ConvaTec Group Plc

- Smith & Nephew Plc

- Integra LifeSciences Holdings Corporation

Frequently Asked Questions

Analyze common user questions about the VTE Prevention Static System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of VTE Prevention Static Systems?

VTE Prevention Static Systems, such as anti-embolism and graduated compression stockings, function by applying external, controlled pressure gradients to the legs. This pressure facilitates increased blood flow velocity, preventing venous stasis and reducing the risk of Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE) in high-risk patients.

How do static systems compare to Dynamic VTE Prevention Systems (IPC devices)?

Static systems provide continuous, passive compression and are typically more cost-effective and easier to apply than dynamic systems (Intermittent Pneumatic Compression, or IPC). IPC devices use mechanical, cyclic inflation to mimic walking. Static systems are often used as a baseline prophylaxis or when IPC devices are contraindicated or unavailable.

What key factors are driving the growth of the static system market?

Market growth is primarily driven by the mandatory implementation of clinical guidelines for VTE prophylaxis, the increasing volume of major surgeries worldwide, and the demographic shift towards an older population segment, which inherently carries elevated VTE risk.

What are the main challenges affecting patient compliance with compression stockings?

Compliance challenges include patient discomfort, difficulty with application and removal, skin irritation or heat retention, and the necessity for precise sizing, where incorrectly sized garments can either be ineffective or cause adverse dermatological effects.

Which geographical region holds the largest market share for VTE Prevention Static Systems?

North America currently holds the largest market share, attributed to its advanced healthcare infrastructure, high incidence of acute surgical procedures, stringent adherence to VTE risk mitigation protocols, and substantial expenditure on prophylactic medical devices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager