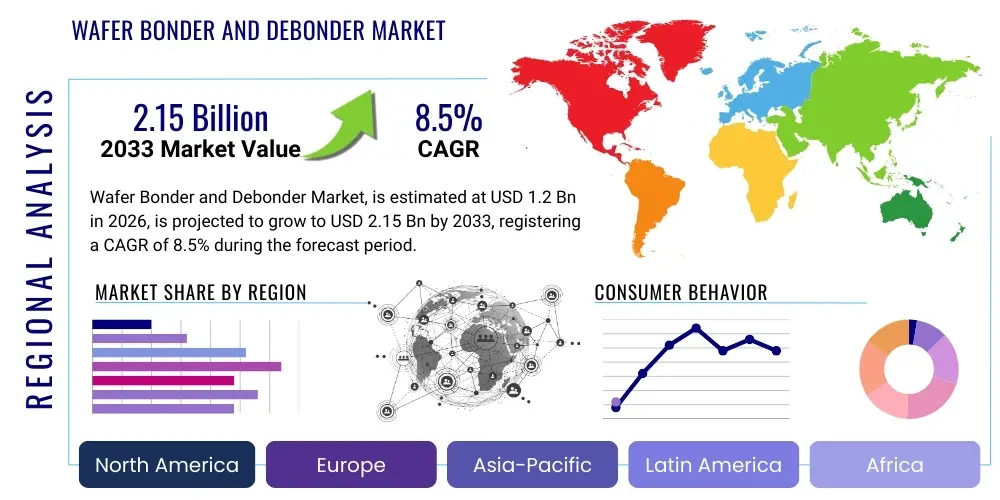

Wafer Bonder and Debonder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437543 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wafer Bonder and Debonder Market Size

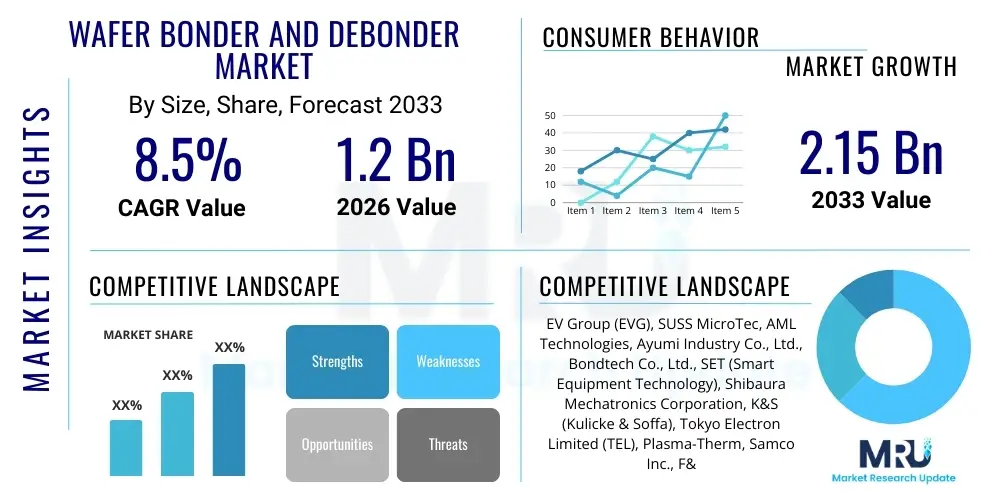

The Wafer Bonder and Debonder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.15 Billion by the end of the forecast period in 2033.

Wafer Bonder and Debonder Market introduction

The Wafer Bonder and Debonder Market encompasses specialized semiconductor manufacturing equipment crucial for advanced packaging and 3D integration technologies. Wafer bonders are high-precision tools utilized to permanently attach two or more wafers together under controlled conditions of pressure, temperature, and environment, facilitating processes like wafer-level packaging (WLP), 3D integration (3D ICs), microelectromechanical systems (MEMS), and specialized sensor fabrication. Debonders, conversely, are essential for separating temporarily bonded wafers, particularly after thinning, processing, or transfer steps, ensuring the structural integrity of thin substrates is maintained throughout the process flow. This symbiotic relationship between bonding and debonding technologies forms the backbone of heterogeneous integration, enabling device miniaturization and performance enhancement across the semiconductor value chain.

Key applications driving the demand for these systems include the fabrication of advanced memory devices, high-performance computing (HPC) components, radio frequency (RF) devices, and automotive electronics. Wafer bonding techniques, such as fusion bonding, anodic bonding, and temporary bonding, are selected based on the specific material sets and application requirements. The inherent benefits of utilizing robust bonding and controlled debonding solutions include improved device density, enhanced thermal dissipation, reduced interconnection length, and the ability to integrate dissimilar materials and components onto a single package. As the industry transitions towards smaller nodes and more complex architectures, the reliability and throughput offered by next-generation bonding and debonding equipment become critical factors for foundry and OSAT service providers.

The market is primarily driven by the relentless expansion of consumer electronics demanding greater functionality in compact form factors, the increasing adoption of 3D stacked technologies for superior performance, and the pervasive integration of MEMS and sensor technology across industrial and healthcare sectors. Additionally, the shift towards heterogeneous integration, moving beyond traditional 2D scaling limits, necessitates sophisticated temporary bonding materials and laser-assisted debonding solutions that provide high yield and minimal substrate stress. The necessity for high-volume manufacturing capabilities for advanced packaging further cements the foundational role of wafer bonding and debonding systems in the global semiconductor ecosystem.

Wafer Bonder and Debonder Market Executive Summary

The Wafer Bonder and Debonder Market demonstrates robust growth, propelled by sustained global investment in semiconductor fabrication facilities (Fabs) and the accelerating transition to advanced packaging platforms such as fan-out wafer-level packaging (FO-WLP) and 2.5D/3D stacking. Business trends indicate a strong focus on automation and integration, with key market players prioritizing solutions that offer high alignment accuracy, increased throughput, and flexibility to handle diverse wafer materials, including silicon, glass, and compound semiconductors. The shift towards higher temperature and chemically stable temporary bonding adhesives, coupled with advanced thermal or UV release debonding mechanisms, is a significant technical trend impacting market strategy. Furthermore, manufacturers are increasingly offering hybrid bonding solutions, which are critical for achieving ultra-fine pitch interconnects necessary for next-generation AI accelerators and data center processors.

Regional trends highlight the Asia Pacific (APAC) region, particularly China, Taiwan, South Korea, and Japan, as the dominant growth engine, attributed to the concentration of major semiconductor manufacturing hubs and outsourced semiconductor assembly and test (OSAT) service providers. Government initiatives supporting domestic semiconductor production, particularly in China, are fueling substantial capital expenditure on bonding and debonding equipment. North America and Europe continue to maintain leadership in high-end R&D and specialized applications like MEMS and photonics, driving demand for highly customized, low-volume, high-precision bonding tools. The geopolitical landscape is influencing supply chain diversification, leading to increased investment in localized manufacturing capabilities across multiple regions, subsequently stimulating equipment procurement.

Segment trends reveal that permanent bonding, especially fusion bonding and hybrid bonding, is experiencing rapid uptake due to its essential role in 3D integration and complex sensing devices. In terms of application, the 3D IC segment commands significant revenue share, followed closely by MEMS and sensor manufacturing, reflecting the widespread adoption of these components in automotive and IoT devices. The Temporary Bonding/Debonding segment is also witnessing vigorous growth, driven by the need for advanced process handling of ultra-thin wafers (less than 50 µm) during back-end-of-line (BEOL) processes. Equipment type analysis shows automated, high-throughput systems gaining preference over manual or semi-automated tools, underscoring the industry's focus on maximizing yield and reducing human error in complex fabrication steps.

AI Impact Analysis on Wafer Bonder and Debonder Market

User queries regarding AI's influence in the Wafer Bonder and Debonder Market primarily center on how artificial intelligence can enhance equipment precision, predictive maintenance capabilities, and overall process yield. Users frequently ask about the role of machine learning in optimizing bonding parameters (temperature, pressure, alignment) to compensate for material variations, thereby minimizing defects like voids or misalignment. Another dominant theme is the potential for AI-driven anomaly detection and predictive failure analysis within these highly complex electromechanical systems, focusing on minimizing unplanned downtime in critical high-volume manufacturing environments. Expectations are high that AI integration will transform these tools from purely operational systems into intelligent, self-optimizing assets capable of autonomous process correction, significantly boosting manufacturing efficiency and consistency for advanced packaging applications.

The application of sophisticated machine vision and deep learning algorithms is fundamentally changing the quality control and metrology aspects of wafer bonding. AI-powered inspection systems can rapidly analyze microscopic defects, identify subtle misalignment issues far faster and more accurately than human operators, and learn from millions of data points across various process runs. This capability is paramount in hybrid bonding, where interconnect pitch tolerances are in the sub-micron range. By utilizing sensor data from temperature, pressure, and vacuum systems, machine learning models can predict equipment wear or drift, scheduling proactive maintenance cycles (predictive maintenance) rather than reactive fixes. This shift minimizes costly production interruptions and increases the overall equipment effectiveness (OEE).

Furthermore, AI is instrumental in streamlining the development cycle of new bonding recipes. Traditional process development involves extensive trial-and-error, which is costly and time-consuming. AI-driven simulation and optimization tools allow engineers to model the behavior of different materials and bonding interfaces under various conditions virtually. This significantly accelerates the time-to-market for new semiconductor products requiring novel packaging techniques. Ultimately, AI integration in wafer bonding and debonding equipment is transitioning these capital-intensive tools toward a fully automated, adaptive manufacturing paradigm, directly supporting the high-volume production demands spurred by AI applications themselves, such as neural network processors and sophisticated memory stacks.

- AI enhances bonding alignment accuracy through advanced machine vision systems.

- Machine learning optimizes process parameters (pressure, temperature) in real-time to minimize defects.

- Predictive maintenance algorithms reduce unplanned downtime and maximize equipment utilization (OEE).

- Deep learning facilitates rapid defect detection and classification for quality control, especially in hybrid bonding.

- AI simulations accelerate the development and optimization of new bonding and debonding recipes.

- Automation driven by AI reduces dependence on manual calibration and operator variability.

DRO & Impact Forces Of Wafer Bonder and Debonder Market

The Wafer Bonder and Debonder Market dynamics are shaped by a complex interplay of positive growth stimuli and inherent technical and economic challenges, alongside emerging opportunities for diversification. The primary drivers include the exponential growth in demand for high-performance computing (HPC) and AI hardware, which necessitates 3D integration and heterogeneous packaging, directly relying on advanced bonding techniques like hybrid bonding. Restraints largely center on the extremely high capital cost of advanced bonding equipment, the stringent requirements for cleanroom environments and process control, and the technical complexity associated with handling ultra-thin wafers prone to warping or breakage during the debonding process. Opportunities are abundant in the expansion into new material substrates beyond silicon, such as glass and compound semiconductors, and the development of cost-effective temporary bonding solutions compatible with extreme processing temperatures for emerging power electronics and automotive applications.

Impact forces delineate the intensity of competitive rivalry and the influence of external market pressures. The threat of new entrants is moderate due to the high barrier to entry associated with intellectual property, required precision engineering, and long qualification cycles within foundries and OSATs. However, supplier bargaining power remains high, as the market is dominated by a few specialized equipment manufacturers globally. Buyer bargaining power is also significant, particularly for Tier 1 semiconductor manufacturers who demand customized, high-throughput solutions and often dictate technical specifications. Technological advancement, driven by Moore's Law and its packaging equivalents, acts as a pivotal impact force, continually compelling manufacturers to innovate thinner, faster, and more precise bonding and debonding solutions to stay relevant in the rapidly evolving semiconductor landscape.

Specifically, the technical challenge of ensuring thermal stability and minimizing chemical residue during temporary bonding and debonding processes presents a continuous hurdle. Developing universal temporary adhesives that can withstand high processing temperatures without compromising subsequent manufacturing steps is a major technical restraint. Conversely, the opportunity presented by the growth of automotive electronics, particularly in Advanced Driver-Assistance Systems (ADAS) and electric vehicle (EV) power modules, requires specialized die-attach and wafer bonding technologies for robust sensor and power device packaging. This demand for reliability under harsh operating conditions provides a clear avenue for market expansion and product differentiation for leading equipment providers.

Segmentation Analysis

The Wafer Bonder and Debonder Market is segmented comprehensively based on Equipment Type, Bonding Type, Application, and End-User, reflecting the diverse technological requirements across the semiconductor manufacturing ecosystem. Equipment type segmentation differentiates between Automated, Semi-automated, and Manual systems, with automated systems commanding the highest market share due to the demand for consistent, high-volume production environments. Bonding type is perhaps the most critical segmentation, distinguishing between Permanent Bonding (including fusion, hybrid, and eutectic bonding) and Temporary Bonding/Debonding. Permanent bonding technologies are integral to structural 3D integration and hermetic sealing of MEMS, while temporary bonding is vital for handling ultra-thin wafers during back-end processes.

Application segmentation reflects the end-use sectors driving demand. This includes the manufacturing of 3D ICs, MEMS and Sensors (e.g., pressure sensors, accelerometers), CMOS Image Sensors (CIS), and Advanced Packaging (including WLP and 2.5D integration). The 3D IC and Advanced Packaging segments exhibit the highest growth rates, driven by their necessity in high-density memory and logic components. End-User analysis categorizes the market primarily into Foundries/IDMs (Integrated Device Manufacturers), OSATs (Outsourced Semiconductor Assembly and Test Providers), and Research & Development Institutes. OSATs, driven by global outsourcing trends, are major consumers of high-throughput automated bonding and debonding systems, although Foundries/IDMs lead in early adoption of cutting-edge hybrid bonding technologies.

- By Equipment Type:

- Automated Systems

- Semi-automated Systems

- Manual Systems

- By Bonding Type:

- Permanent Bonding (Fusion Bonding, Anodic Bonding, Eutectic Bonding, Hybrid Bonding)

- Temporary Bonding and Debonding (Thermal Release, UV Release, Laser Release, Mechanical Release)

- By Application:

- 3D Integrated Circuits (3D ICs)

- Microelectromechanical Systems (MEMS) and Sensors

- CMOS Image Sensors (CIS)

- Advanced Packaging (WLP, 2.5D, Fan-Out)

- Power Devices and LED Manufacturing

- By End-User:

- Foundries and IDMs

- OSAT Providers

- Research & Development Institutes

Value Chain Analysis For Wafer Bonder and Debonder Market

The value chain for the Wafer Bonder and Debonder Market begins with upstream activities dominated by critical component suppliers and specialized material providers. Upstream analysis involves manufacturers of high-precision mechanics, optical alignment systems (e.g., machine vision components), vacuum technology, and advanced thermal management modules. The performance and reliability of the final bonding and debonding equipment are highly dependent on the quality and integration capabilities of these specialized sub-systems. Furthermore, the development and supply of temporary bonding adhesives, release layers, and specialized plasma treatment chemicals constitute a vital part of the upstream segment, directly influencing the process window and yield of temporary bonding applications.

The core of the value chain is the equipment manufacturing stage, where major market players design, assemble, and integrate the complex bonding and debonding platforms. This stage involves significant R&D investment focused on enhancing alignment accuracy (often sub-micron level), increasing throughput (wafers per hour), and developing proprietary bonding methodologies (such as high-vacuum fusion bonding or laser debonding). Direct sales and distribution channels involve equipment manufacturers selling directly to large Foundries, IDMs, and Tier 1 OSATs, leveraging specialized sales engineers and application support teams. This direct approach is essential given the high cost and complexity of the machinery, requiring customized installation and extensive post-sales support, including process optimization consulting.

Downstream analysis focuses on the end-users and the applications driving demand. These include Foundries utilizing the equipment to manufacture cutting-edge microprocessors, memory chips, and specialized sensors, and OSATs providing assembly and packaging services globally. Indirect distribution channels, though less common for high-end bonders, might involve regional distributors or system integrators focusing on smaller R&D labs or niche markets like compound semiconductor manufacturing. The final value captured is realized when the bonded or debonded wafers proceed to subsequent steps in the semiconductor fabrication process, ultimately enabling the production of sophisticated electronic devices demanded by consumer, industrial, and automotive markets globally. Strong collaboration between equipment vendors and end-users on process optimization is crucial for efficient value creation.

Wafer Bonder and Debonder Market Potential Customers

Potential customers for Wafer Bonder and Debonder equipment are primarily defined by their roles in the semiconductor and microelectronics fabrication pipeline, encompassing entities requiring high-precision wafer processing for 3D integration, advanced packaging, or microdevice manufacturing. The largest cohort of buyers includes global Integrated Device Manufacturers (IDMs) and leading Foundries, such as TSMC, Intel, and Samsung, who utilize these systems for internal production of complex logic, memory devices, and specialized components like CMOS Image Sensors (CIS). These customers require the highest levels of automation, process control, and guaranteed alignment accuracy to maintain high yields in cutting-edge fabrication nodes, often driving the demand for customized hybrid bonding solutions.

A second major customer base comprises Outsourced Semiconductor Assembly and Test (OSAT) providers, including companies like ASE Technology Holding, Amkor Technology, and JCET Group. OSATs leverage bonding and debonding equipment to execute high-volume, cost-effective advanced packaging services for a wide range of fabless semiconductor companies. Their purchasing decisions are heavily influenced by equipment throughput, reliability, and the versatility to handle diverse packaging requirements, particularly in fan-out and 2.5D interposer integration, making them key consumers of automated temporary bonding and mass transfer systems.

The third group includes specialized device manufacturers and R&D institutions. This segment focuses on niche applications such as Microelectromechanical Systems (MEMS), photonics, biomedical sensors, and compound semiconductor devices (e.g., GaAs, GaN, SiC). Customers in this area, including aerospace manufacturers, specialized sensor companies, and academic research labs, typically prioritize process flexibility, small-batch handling capabilities, and unique bonding techniques (e.g., anodic bonding for glass) over sheer throughput. These buyers often seek semi-automated or modular systems capable of accommodating diverse material stacks and experimental bonding procedures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.15 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | EV Group (EVG), SUSS MicroTec, AML Technologies, Ayumi Industry Co., Ltd., Bondtech Co., Ltd., SET (Smart Equipment Technology), Shibaura Mechatronics Corporation, K&S (Kulicke & Soffa), Tokyo Electron Limited (TEL), Plasma-Therm, Samco Inc., F&K Delvotec Bondtechnik GmbH, Veeco Instruments, Besi (BE Semiconductor Industries), Ulvac, Inc., CETC, Shinkawa, Dongfang Jingyuan Electron, WaferPro. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Bonder and Debonder Market Key Technology Landscape

The technology landscape of the Wafer Bonder and Debonder Market is characterized by intense innovation focused on achieving higher alignment accuracy and reliable interfaces between diverse materials. A cornerstone technology is Hybrid Bonding, which combines direct metal bonding (e.g., copper-copper) with dielectric bonding, allowing for extremely fine pitch interconnections (below 10 µm) essential for high-bandwidth 3D stacked memory and logic chips. This process typically requires ultra-clean surfaces, often achieved through pre-bonding plasma activation, and operates under stringent vacuum or controlled atmospheric conditions. The success of next-generation high-performance computing components is intrinsically linked to the yield and robustness provided by hybrid bonding platforms, making this area a primary R&D focus for leading equipment manufacturers like EV Group and SUSS MicroTec.

Another crucial technological area is Temporary Bonding and Debonding (TBD) systems, which are indispensable for processing ultra-thin wafers (under 50 µm) that lack sufficient mechanical strength for standard handling. TBD systems involve bonding the device wafer to a rigid carrier substrate using a high-performance adhesive, followed by back-end processes such as grinding and metallization, and finally, controlled debonding. Key TBD technologies include laser release, where a laser pulse focused through a transparent carrier breaks down the release layer; thermal release, which uses heat to weaken the adhesive; and UV release. Laser debonding is gaining traction due to its minimal thermal stress transfer to the device layer and high throughput capabilities, addressing concerns about warpage and device damage prevalent with thinner substrates.

Furthermore, the integration of advanced metrology and closed-loop control systems defines the cutting edge of current technology. High-resolution infrared (IR) cameras and sophisticated optical inspection tools are used for real-time monitoring of alignment and bond quality. Advanced software incorporating AI and machine learning is utilized to automatically adjust process parameters to compensate for wafer thickness variations, thermal expansion mismatches, and equipment drift, ensuring process uniformity across large production runs. The convergence of high-precision mechanical handling, advanced optical systems, and intelligent process control forms the core competitive advantage in offering best-in-class wafer bonding and debonding solutions to the global semiconductor industry, particularly as integration complexity continues to escalate.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant region, accounting for the largest market share and demonstrating the fastest growth rate. This supremacy is rooted in the region's concentration of global semiconductor manufacturing capacity, including the world's largest foundries (Taiwan, South Korea) and a significant number of OSAT providers (China, Malaysia). Continuous government support for local semiconductor supply chains, coupled with massive capital expenditure by leading industry players to expand 3D IC and advanced packaging capacity, ensures sustained high demand for both automated permanent and temporary bonding systems. Japan, though facing global market share shifts, remains critical due to the presence of key equipment and material suppliers.

- North America: North America holds a substantial position driven primarily by technological innovation, specialized R&D, and the manufacturing requirements of high-performance computing (HPC), aerospace, and defense electronics. While mass production capacity might trail APAC, this region leads in the adoption and development of cutting-edge technologies like direct copper-to-copper hybrid bonding and advanced photonics integration. The recent push for supply chain resilience (e.g., the CHIPS Act) is stimulating domestic expansion of wafer fabrication facilities, resulting in significant projected growth for local equipment procurement over the forecast period.

- Europe: Europe represents a mature market focusing heavily on specific high-value segments, particularly MEMS, specialized sensor manufacturing for automotive applications, and power electronics (SiC/GaN). European market growth is steady, supported by established players in automotive electronics and industrial automation who require highly reliable and robust bonding solutions, such as anodic and eutectic bonding. Key drivers include government and EU-funded initiatives aimed at bolstering microelectronics production and maintaining technological leadership in critical areas like smart systems and advanced materials research.

- Latin America, Middle East, and Africa (MEA): These regions currently hold a relatively minor share of the global market, with demand primarily concentrated among localized assembly operations, niche electronics manufacturing, and academic research institutions. While growth is slow compared to APAC, emerging initiatives in countries like Israel and the UAE, aimed at diversifying their economies through technology and establishing small-scale high-tech manufacturing, offer long-term potential for increased adoption of entry-level and semi-automated wafer bonding equipment, especially for specialized sensing devices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Bonder and Debonder Market.- EV Group (EVG)

- SUSS MicroTec

- AML Technologies

- Ayumi Industry Co., Ltd.

- Bondtech Co., Ltd.

- SET (Smart Equipment Technology)

- Shibaura Mechatronics Corporation

- K&S (Kulicke & Soffa)

- Tokyo Electron Limited (TEL)

- Plasma-Therm

- Samco Inc.

- F&K Delvotec Bondtechnik GmbH

- Veeco Instruments

- Besi (BE Semiconductor Industries)

- Ulvac, Inc.

- CETC

- Shinkawa

- Dongfang Jingyuan Electron

- WaferPro

Frequently Asked Questions

Analyze common user questions about the Wafer Bonder and Debonder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is hybrid bonding and why is it crucial for 3D ICs?

Hybrid bonding is an advanced permanent bonding technique that simultaneously connects metal pads (typically copper) and surrounding dielectric layers at ultra-fine pitches (sub-10 µm). It is crucial for 3D ICs because it enables high-density, high-speed vertical interconnects necessary for maximizing bandwidth and reducing power consumption in advanced logic and memory stacks, supporting devices like AI accelerators and high-performance processors.

How does temporary bonding and debonding (TBD) facilitate thin wafer handling?

TBD uses an adhesive to temporarily attach a thin, fragile device wafer to a thick, robust carrier wafer. This carrier provides mechanical stability, allowing the ultra-thin device wafer (often <50 µm) to withstand rigorous back-end processes such as grinding, polishing, and metallization without breaking or warping. Debonding then releases the processed thin wafer with minimal stress.

Which regions drive the highest demand for wafer bonding equipment?

The Asia Pacific (APAC) region, driven by major semiconductor manufacturing clusters in Taiwan, South Korea, and China, dominates the demand for wafer bonding and debonding equipment. This dominance is due to the concentration of global foundries and OSAT providers heavily investing in advanced packaging capabilities (2.5D/3D integration).

What are the key technological restraints limiting market growth?

Key restraints include the extremely high capital investment required for automated bonding systems, the stringent technical challenge of achieving perfect alignment repeatability below 1 µm, and the complexity associated with developing temporary bonding adhesives that maintain thermal stability under high-temperature processing while remaining easily releasable.

How is AI integrating into wafer bonder equipment?

AI is integrating through advanced machine vision systems for sub-micron alignment optimization, predictive maintenance algorithms to minimize unplanned equipment downtime, and machine learning models that automatically fine-tune bonding parameters based on real-time sensor feedback, thereby enhancing yield and process stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager