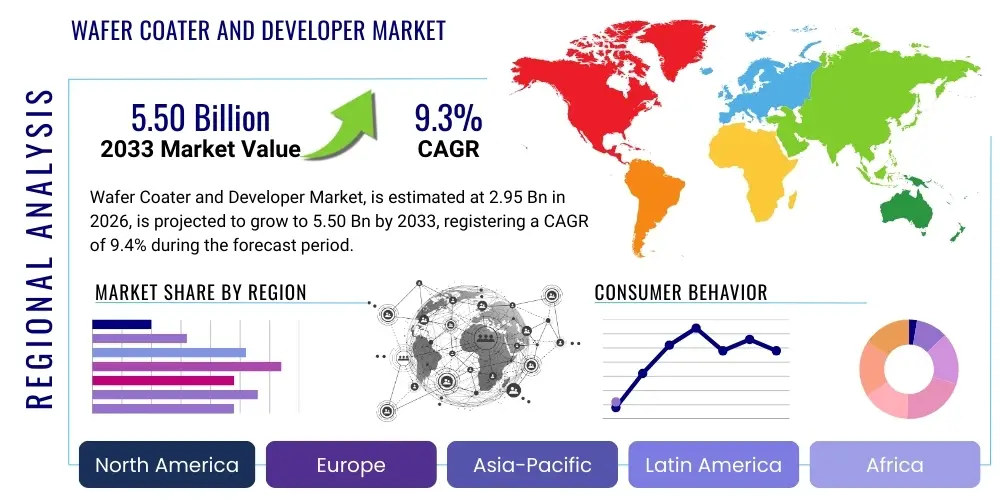

Wafer Coater and Developer Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439292 | Date : Jan, 2026 | Pages : 253 | Region : Global | Publisher : MRU

Wafer Coater and Developer Market Size

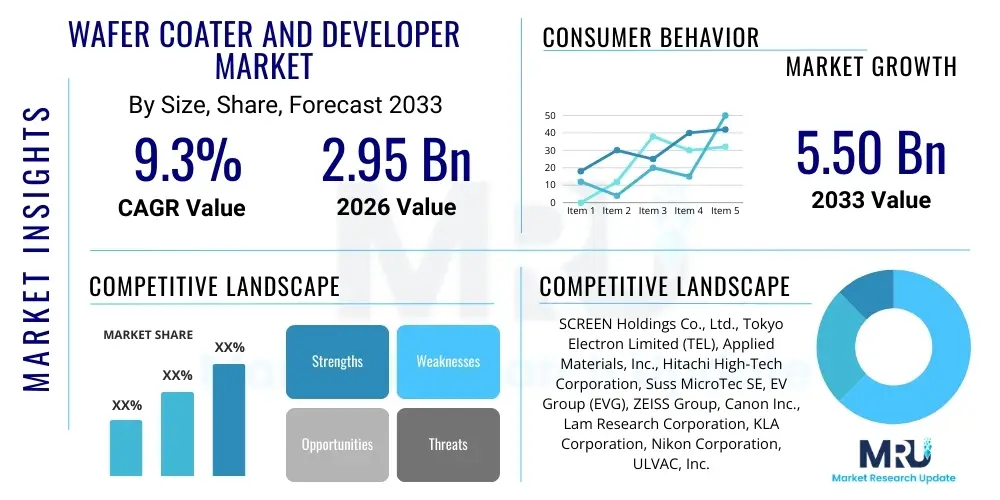

The Wafer Coater and Developer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.35% between 2026 and 2033. The market is estimated at USD 2.95 Billion in 2026 and is projected to reach USD 5.50 Billion by the end of the forecast period in 2033. This robust growth trajectory is significantly underpinned by the escalating global demand for advanced semiconductors across a multitude of applications, necessitating continuous, substantial investments in front-end wafer processing equipment capable of achieving higher precision, greater uniformity, and increased throughput. The market expansion reflects the absolutely critical role these sophisticated systems play in the intricate photolithography steps, which are foundational to integrated circuit fabrication and directly dictate the overall yield, performance, and reliability of modern electronic devices. The consistent, industry-wide push towards further miniaturization, increased device functionality, and the integration of diverse chip architectures serves as a perpetual engine for market evolution and expansion, persistently driving technological advancements in coating and developing capabilities to meet future demands for ever more powerful and efficient microelectronics.

Wafer Coater and Developer Market introduction

The Wafer Coater and Developer Market encompasses critical, highly specialized equipment vital for the precise application of photoresist materials onto semiconductor wafers and their subsequent chemical development processes. These sophisticated systems are fundamental to the photolithography process, which stands as the cornerstone of modern microelectronics fabrication, enabling the transfer of intricate circuit patterns onto silicon or other substrate materials with unparalleled accuracy and fidelity. The market landscape is characterized by continuous innovation aimed at achieving superior coating uniformity, stringent critical dimension control, and enhanced process repeatability, all of which are absolutely essential for manufacturing high-performance integrated circuits that meet the exacting specifications of contemporary electronic devices.

Product descriptions within this market segment include a diverse range of precision machinery, such as advanced spin coater systems, spray coaters, roller coaters, and highly optimized developer units. Spin coaters are widely utilized for their exceptional ability to create extremely thin and uniformly thick photoresist layers through precisely controlled centrifugal force, which is crucial for advanced lithography nodes. Developer systems are meticulously engineered to selectively remove either exposed or unexposed photoresist, precisely revealing the underlying circuit pattern with high contrast and minimal defects. Major applications for these indispensable tools span various critical semiconductor sectors, including the fabrication of Micro-Electro-Mechanical Systems (MEMS), advanced packaging technologies for multi-chip modules and 3D integration, power devices for energy management, and high-density memory and logic chips. These applications uniformly demand stringent process control and robust equipment performance to meet the increasingly exacting specifications of next-generation electronic components.

The myriad benefits offered by cutting-edge wafer coater and developer solutions are absolutely pivotal for the continuous advancement of the entire semiconductor industry. These advantages include significantly improved manufacturing yields through enhanced process control, superior device performance achieved via tighter critical dimension uniformity, and substantially reduced defect rates, all of which directly translate into significant cost savings and faster time-to-market for innovative new products. The market's consistent and robust growth is primarily driven by several overarching factors: the relentless global demand for increasingly powerful, compact, and energy-efficient semiconductor components across all end-use segments; the pervasive proliferation of advanced technologies such as Artificial Intelligence (AI), 5G connectivity, and the rapidly expanding Internet of Things (IoT) ecosystem; and substantial, ongoing investments in new semiconductor fabrication facilities and capacity expansions worldwide. These powerful driving forces collectively compel semiconductor manufacturers to continuously upgrade their equipment to support more complex designs, accommodate smaller feature sizes, and achieve higher throughput, thereby sustaining the market's strong momentum and ensuring its continued technological leadership.

Wafer Coater and Developer Market Executive Summary

The executive summary of the Wafer Coater and Developer Market reveals a remarkably dynamic landscape characterized by sustained growth in business trends, particularly driven by significant and ongoing capital investments in next-generation semiconductor foundries and the burgeoning global demand for highly specialized coating and developing solutions. Market participants are observing an accelerated pace of technological innovation, with a strong focus on enhancing precision, automation, and overall process efficiency. This reflects the industry's imperative to meet the escalating performance requirements for advanced integrated circuits. The competitive environment is intensifying, with leading equipment manufacturers continuously striving to deliver solutions that support smaller feature sizes and more complex device architectures, thereby securing their market position and fostering new growth opportunities.

Regional trends unequivocally position the Asia Pacific (APAC) as the predominant and fastest-growing market for wafer coater and developer systems. This unparalleled dominance is primarily attributable to the overwhelming presence of major semiconductor manufacturing powerhouses in Taiwan, South Korea, China, and Japan, all of which are continuously investing colossal sums in state-of-the-art fabrication facilities and extensive research and development initiatives. North America and Europe also contribute significantly to market expansion, driven by innovation in specialized device fabrication, advanced materials research, and strategic governmental initiatives aimed at bolstering domestic manufacturing capabilities. The evolving geopolitical landscape, including trade policies and an increasing emphasis on supply chain security, is profoundly influencing regional investment patterns and the establishment of new production hubs, further shaping the market's geographical distribution and competitive dynamics.

Segmentation trends within the market underscore a growing preference for advanced equipment meticulously tailored to specific applications and varying wafer dimensions. There is a marked and accelerating increase in demand for coater and developer systems compatible with 300mm and the emerging 450mm wafer sizes, directly reflecting the industry's relentless drive for economies of scale, higher productivity, and reduced cost per chip. Application-wise, segments such as advanced packaging, Micro-Electro-Mechanical Systems (MEMS), and high-power devices are experiencing substantial growth, necessitating specialized equipment solutions to meet their unique processing demands for diverse materials and intricate device structures. Product type trends indicate ongoing, intensive innovation in both spin coater and developer technologies, with a strong focus on achieving ultra-high uniformity, minimizing defects, and ensuring seamless compatibility with next-generation photoresists and process chemicals, thereby ensuring the market remains at the absolute forefront of semiconductor manufacturing excellence and technological advancement.

AI Impact Analysis on Wafer Coater and Developer Market

User inquiries and industry discussions surrounding the profound impact of Artificial Intelligence (AI) on the Wafer Coater and Developer Market predominantly center on how AI can fundamentally transform operational precision, significantly minimize defects, and substantially boost overall manufacturing efficiency within the highly demanding semiconductor fabrication environment. Common user questions probe the sophisticated capabilities of AI to intelligently optimize complex process parameters, predict potential equipment failures with high accuracy before they occur, and dramatically enhance real-time quality control mechanisms within the highly sensitive fabrication processes. Concerns often include the substantial data infrastructure requirements for effectively training robust AI models, the inherent complexities of integrating advanced AI solutions with existing legacy equipment, and the paramount need for robust cybersecurity measures to meticulously protect sensitive operational data. There is a strong and pervasive expectation that AI will profoundly streamline workflows, minimize human intervention in repetitive or error-prone tasks, and ultimately lead to a significant boost in yield rates and a substantial reduction in overall manufacturing costs within semiconductor fabrication plants globally.

The integration of AI technologies is viewed as an absolutely critical enabler for overcoming some of the most persistent and challenging hurdles in semiconductor manufacturing, particularly within the photolithography segment, which is highly sensitive to even minor deviations. By leveraging vast, continuously generated datasets from wafer coating and development processes, AI algorithms possess the unique capability to identify subtle patterns and complex correlations that are often imperceptible to human operators, leading to significantly more precise and adaptive control over film thickness, uniformity, and developing profiles. This data-driven, intelligent approach promises to profoundly enhance process robustness, repeatability, and predictability, all of which are paramount for consistently producing high-quality, high-performance integrated circuits. Furthermore, AI's inherent ability to continuously learn and adapt from ongoing process data allows for dynamic and proactive adjustments, ensuring optimal equipment performance even as material properties, environmental conditions, or process specifications fluctuate, thereby pushing the very boundaries of what is achievable in terms of manufacturing excellence and consistency in microelectronics production.

- Enhanced Predictive Maintenance: AI algorithms analyze vast streams of sensor data from coater and developer systems to accurately forecast potential equipment failures, enabling proactive maintenance scheduling and dramatically minimizing costly unscheduled downtime, thereby maximizing equipment uptime.

- Optimized Process Control: AI intelligently fine-tunes critical coating and developing parameters in real-time, such as spin speed, photoresist dispense volume, and developer concentration, to achieve superior film uniformity, precise critical dimension control, and significantly reduced defect rates across the wafer surface.

- Automated Anomaly Detection: Machine learning models continuously monitor process deviations, instantly identifying subtle anomalies or complex patterns indicative of potential issues that human operators might otherwise overlook, allowing for immediate and targeted corrective actions to prevent yield loss.

- Accelerated Recipe Development: AI-driven simulations and sophisticated data analysis tools assist process engineers in rapidly generating and rigorously optimizing process recipes for new photoresists, larger wafer sizes, or increasingly complex device architectures, thereby drastically shortening research and development cycles.

- Improved Yield Management: AI integrates and analyzes data from multiple fabrication stages, including coating and developing, to accurately identify bottlenecks, intelligently optimize throughput, and provide actionable insights for enhancing overall manufacturing yield and significantly reducing material waste.

- Smart Factory Integration: AI facilitates seamless data exchange, intelligent communication, and synchronized operations between coater and developer systems and other fab equipment, enabling a truly integrated smart factory environment characterized by centralized control and highly optimized resource allocation, enhancing overall operational synergy.

- Advanced Quality Inspection: AI-powered computer vision systems can perform ultra-fast, highly accurate, and consistent post-process inspection of coated and developed wafers, precisely identifying even microscopic defects with high precision and reliability, further improving outgoing quality.

DRO & Impact Forces Of Wafer Coater and Developer Market

The Wafer Coater and Developer Market is profoundly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively shape its trajectory, competitive landscape, and future technological evolution. A primary and overwhelmingly powerful driver is the burgeoning global demand for advanced semiconductors, fueled by the widespread and accelerating adoption of cutting-edge technologies such as 5G connectivity, Artificial Intelligence (AI) across all sectors, the rapidly expanding Internet of Things (IoT) ecosystem, and high-performance computing platforms. These diverse applications collectively necessitate an ever-increasing supply of sophisticated integrated circuits, which in turn mandates continuous, substantial investment in and upgrading of wafer fabrication equipment, including the critical coater and developer systems. Additionally, the relentless industry-wide pursuit of miniaturization, increased transistor density, and the strategic adoption of novel materials directly translates into an urgent need for more precise, capable, and defect-free lithography tools, ensuring superior pattern transfer and stringent defect control at nanometer scales. The expansion of new and evolving end-use cases for semiconductors, such as advanced electric vehicles, sophisticated industrial automation, and personalized healthcare devices, further solidifies the robust demand base for these critical manufacturing systems.

Despite these powerful and accelerating drivers, the market faces notable restraints that can potentially impede its growth and evolution. The most significant of these is the exceptionally high capital expenditure required for acquiring and installing state-of-the-art wafer coater and developer systems. These highly advanced machines represent colossal investments for semiconductor manufacturers, often running into millions of dollars per unit, thereby creating an extremely high barrier to entry for new players and frequently leading to protracted decision-making processes for equipment upgrades and capacity expansions. Furthermore, the inherent and intricate technological complexity of these systems, coupled with the critical need for a highly skilled and specialized workforce for their operation, maintenance, and ongoing optimization, presents significant operational challenges. Geopolitical tensions, volatile trade disputes, and pervasive supply chain vulnerabilities, particularly concerning critical components, advanced materials, and specialized chemicals, also pose significant risks, potentially disrupting production schedules, increasing operational costs, and forcing strategic re-evaluations of manufacturing locations. The substantial research and development (R&D) costs associated with continually developing next-generation lithography processes and advanced equipment solutions further strain manufacturers' resources, adding another layer of restraint to market expansion and innovation.

However, alongside these formidable challenges, numerous compelling opportunities exist that promise to propel the market forward and redefine its future landscape. The emergence of new and rapidly developing markets for semiconductor manufacturing, particularly in developing economies striving to establish domestic production capabilities and achieve technological self-sufficiency, offers substantial growth avenues for equipment providers. Technological advancements in novel materials, such as compound semiconductors, 2D materials like graphene, and advanced photoresist chemistries, present exciting opportunities for specialized coating and developing solutions meticulously tailored to their unique properties and processing requirements. The widespread and accelerating integration of advanced automation, sophisticated robotics, and Artificial Intelligence (AI) into coater and developer systems represents a major opportunity for dramatically enhancing efficiency, precision, and predictive maintenance capabilities, effectively reducing human error and significantly improving overall manufacturing yield. Moreover, the ongoing and intensive development of next-generation lithography technologies, such as Extreme Ultraviolet (EUV) lithography and alternative patterning techniques, creates a continuous and urgent need for compatible, highly integrated, and technologically advanced coater and developer solutions. The market also stands to benefit significantly from strategic collaborations and innovative partnerships between equipment manufacturers, material suppliers, and end-users, fostering accelerated innovation and product development to proactively address future industry demands and maintain a critical competitive edge within the rapidly evolving and intensely competitive semiconductor landscape.

Segmentation Analysis

The Wafer Coater and Developer Market is meticulously segmented to provide a granular and comprehensive understanding of its diverse components, technological variations, and specific application areas. This detailed segmentation allows market participants, investors, and policymakers to critically analyze the market's intricate dynamics, accurately identify high-growth segments, and formulate highly targeted and effective strategic initiatives. The various distinct segments reflect the highly specialized and evolving requirements of modern semiconductor manufacturing, which range from fundamental research and development activities in academic and corporate laboratories to the demanding, high-volume production requirements of leading integrated device manufacturers (IDMs) and dedicated semiconductor foundries worldwide. Such a structured analytical approach is absolutely essential for discerning specific market opportunities, addressing niche demands, and tailoring technological solutions to precisely meet the specialized industry needs effectively and efficiently.

Segmentation by product type critically categorizes the equipment based on its fundamental functional mechanism, with advanced spin coater systems being predominantly utilized for their exceptional ability to achieve ultra-thin and highly uniform photoresist films, which are absolutely crucial for cutting-edge lithography processes at sub-nanometer scales. Spray coaters and roller coaters serve more niche applications where specific coating characteristics, such as thicker films or conformal coverage on irregular surfaces, or particular substrate types are required. Developer systems, an equally critical component of the photolithography process, are further delineated by their development methodologies, such as puddle development, spray development, or immersion techniques, each offering distinct advantages in terms of process control, chemical consumption efficiency, and achieving optimal pattern fidelity. These distinctions highlight the specialized engineering and sophisticated process control involved in tailoring equipment to achieve optimal results for various photoresist chemistries, exposure tools, and intricate patterning requirements across the semiconductor fabrication spectrum.

- By Product Type:

- Spin Coaters: Equipment specifically designed for applying uniform photoresist layers onto wafers using controlled centrifugal force, crucial for advanced lithography.

- Spray Coaters: Systems for applying photoresist or other materials via a controlled spray, often utilized for irregular surfaces, specific film thickness requirements, or compound semiconductors.

- Roller Coaters: Used for applying coatings to larger substrates or specific film thickness needs, particularly in non-IC applications but also for niche semiconductor packaging and display manufacturing.

- Developer Systems: Machinery engineered to precisely remove exposed or unexposed photoresist after lithography, accurately revealing the desired circuit pattern with high fidelity and low defect rates.

- By Wafer Size:

- 100mm Wafer: Smaller wafer sizes, still critically relevant for specific MEMS, power devices, compound semiconductors, and research & development applications.

- 150mm Wafer: Common for legacy devices, specialized MEMS, analog circuits, and some power semiconductor products, maintaining a steady demand.

- 200mm Wafer: Widely used for power semiconductors, analog circuits, microcontrollers, and some logic devices, experiencing sustained demand due to high volume production and mature processes.

- 300mm Wafer: The current industry standard for high-volume manufacturing of advanced logic, memory, and leading-edge microprocessors, representing the largest market segment.

- 450mm Wafer: An emerging wafer size, currently under extensive development for future high-volume manufacturing, promising significant cost reductions per chip and increased throughput.

- By Application:

- Advanced Packaging: Solutions for stacking and connecting multiple chips or components (e.g., 3D ICs, interposers, fan-out WLP), requiring precise coating for redistribution layers and bump formation.

- MEMS (Micro-Electro-Mechanical Systems): Devices combining electrical and mechanical components, needing highly specific coating and developing processes for intricate micro-structures and functional layers.

- Power Devices: Semiconductors used in power conversion and management (e.g., MOSFETs, IGBTs), requiring robust and specialized patterning processes for thick resist layers and high aspect ratios.

- LED Manufacturing: Fabrication of light-emitting diodes, involving coating and patterning of various epitaxial layers and metal contacts on different substrate materials.

- Foundries: Companies that exclusively manufacture integrated circuits for other design companies (fabless firms), demanding highly versatile, high-throughput, and technologically advanced equipment.

- Integrated Device Manufacturers (IDMs): Companies that design, manufacture, and sell their own integrated circuits, requiring comprehensive in-house coating and developing capabilities for their proprietary technologies.

- Research & Development (R&D): Academic institutions and corporate labs developing new materials, processes, and device architectures, requiring flexible and precise equipment for experimental purposes and prototyping.

Value Chain Analysis For Wafer Coater and Developer Market

The value chain for the Wafer Coater and Developer Market is an intricate and highly interdependent network that commences upstream with an array of specialized suppliers and culminates with the demanding end-users in semiconductor fabrication facilities. Upstream activities involve a diverse ecosystem of manufacturers and providers supplying critical raw materials and highly specialized components absolutely essential for the construction and operation of these sophisticated systems. This includes suppliers of high-purity process chemicals such as photoresists, developers, and solvents, which are fundamental to the actual coating and developing processes. Additionally, precision mechanical components like advanced robotics for wafer handling, highly accurate motion control units, and sophisticated optical systems for alignment and inspection are procured from specialized vendors. Complex electronic control systems, proprietary software for process automation and data management, and highly sensitive metrology components also form a significant part of the upstream supply, collectively ensuring the operational precision, reliability, and advanced capabilities of the final equipment systems.

As these meticulously sourced components and materials are integrated, the value moves through the manufacturing and assembly phases, which are predominantly carried out by the core equipment providers within the Wafer Coater and Developer Market. These companies design, engineer, and rigorously test the final systems, often incorporating deeply proprietary technologies and extensive intellectual property derived from years of intensive research and development. Once the equipment is manufactured, the efficiency and reach of the distribution channel become absolutely crucial for successfully reaching the diverse and geographically dispersed global customer base. Distribution primarily occurs through direct sales channels, where equipment manufacturers leverage their specialized sales forces, highly trained application engineers, and dedicated field service teams to engage directly with semiconductor fabrication plants. This direct approach is necessitated by the high-value, extreme complexity, and often custom requirements of the equipment, which frequently involves extensive pre-sales consultation, bespoke customization, and critical post-installation support, including comprehensive training, ongoing maintenance, and rapid technical assistance. Such direct engagement ensures that the equipment precisely meets the unique operational requirements and stringent performance metrics of each individual fabrication facility, fostering long-term partnerships.

While less prevalent for high-end, bespoke systems, indirect distribution channels also play a supplementary role, particularly for standardized or aftermarket components, and in regions where localized representation and support are strategically advantageous. These channels might involve specialized distributors or agents who provide localized sales, service, and support, effectively bridging geographical and logistical gaps for global manufacturers. Downstream analysis of the value chain critically focuses on the end-users, primarily large semiconductor foundries, Integrated Device Manufacturers (IDMs), and specialized fabricators of Micro-Electro-Mechanical Systems (MEMS), power devices, and advanced packaging solutions. These entities integrate the wafer coater and developer systems directly into their complex, high-volume fabrication lines, where the equipment's performance directly impacts crucial metrics such as chip yield, overall quality, manufacturing throughput, and time-to-market. The continuous feedback loop from these demanding downstream users is absolutely vital, actively driving innovation and technological improvements back up the value chain, as equipment manufacturers continuously strive to meet evolving industry standards, address new technological challenges, and satisfy the ever-increasing demands for higher precision, greater efficiency, and more advanced process capabilities across the dynamic semiconductor ecosystem.

Wafer Coater and Developer Market Potential Customers

The Wafer Coater and Developer Market primarily serves a highly specialized, capital-intensive, and technologically sophisticated customer base predominantly within the global semiconductor industry. The largest and most influential segment of potential customers comprises major Integrated Device Manufacturers (IDMs), such as Intel, Samsung, and Micron Technology, who are uniquely involved in the entire semiconductor value chain from chip design to fabrication and final sales. These IDMs require state-of-the-art coater and developer systems to produce their proprietary memory, logic, and microprocessor chips at extremely high volumes and with leading-edge process technologies. Their demand is driven by the imperative for equipment that can seamlessly support the most advanced lithography nodes and achieve superior yields for increasingly complex device architectures, making them absolutely pivotal buyers in the market. The relentless competition in the consumer electronics, data center, and high-performance computing markets continually pushes these customers to invest in the newest, most efficient, and highest precision fabrication tools available.

Another profoundly significant customer segment consists of dedicated semiconductor foundries, including industry giants like TSMC, GlobalFoundries, and UMC. These companies specialize exclusively in manufacturing integrated circuits for a wide array of fabless semiconductor companies and IDMs that strategically outsource their production. Foundries are uniquely characterized by their critical need for highly versatile, robust, and exceptionally high-throughput coater and developer systems capable of processing diverse wafer designs and technologies for numerous clients simultaneously. Their substantial investment decisions are heavily influenced by prevailing market demand for advanced process nodes, the necessity to maintain technological leadership, and the imperative to attract and retain high-value contracts from leading chip designers globally. The ongoing global expansion of foundry capacity, driven by geopolitical considerations, an increasing emphasis on supply chain resilience, and escalating demand for custom chips across various applications, collectively positions them as key drivers of equipment sales and technological adoption.

Beyond these colossal-scale manufacturers, the market also strategically targets specialized fabricators focusing on specific product categories and niche applications. This includes companies heavily involved in advanced packaging solutions, which require exceptionally precise coating and developing for multi-chip modules, interposers, and advanced fan-out wafer-level packaging techniques. Manufacturers of Micro-Electro-Mechanical Systems (MEMS) and high-power devices, while potentially utilizing smaller wafer sizes or specialized substrates, nonetheless demand high-precision coating and developing capabilities meticulously tailored to their unique materials, intricate 3D structures, and distinct processing requirements. Furthermore, academic institutions, cutting-edge research laboratories, and corporate R&D centers represent a crucial segment of potential customers. These entities consistently invest in advanced coater and developer systems for experimental purposes, process development, and the exploration of novel materials and ground-breaking device concepts, often driving the early adoption and refinement of cutting-edge technologies long before they scale to mass production. The collective and diverse needs of these varied end-users underscore the market's unwavering emphasis on precision, versatility, technological advancement, and the ability to adapt to future demands.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.95 Billion |

| Market Forecast in 2033 | USD 5.50 Billion |

| Growth Rate | 9.35% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SCREEN Holdings Co., Ltd., Tokyo Electron Limited (TEL), Applied Materials, Inc., Hitachi High-Tech Corporation, Suss MicroTec SE, EV Group (EVG), ZEISS Group, Canon Inc., Lam Research Corporation, KLA Corporation, Nikon Corporation, ULVAC, Inc., DISCO Corporation, Semes Co., Ltd., FSI International (a part of SCREEN Holdings Co., Ltd.), JSR Corporation (leading photoresist and materials supplier), Merck KGaA (leading photoresist and materials supplier), Avantor (materials supplier), ASML Holding N.V. (indirectly through lithography equipment integration), Veeco Instruments Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Coater and Developer Market Key Technology Landscape

The Wafer Coater and Developer Market's technological landscape is profoundly defined by continuous, intensive innovation and the relentless pursuit of unparalleled precision, exceptional uniformity, and maximized throughput, all of which are absolutely critical for advancing state-of-the-art semiconductor manufacturing processes. At its fundamental core, the technology revolves around advanced spin coating techniques, which meticulously control rotational speed, acceleration profiles, and photoresist dispense volumes to achieve ultra-thin and highly uniform film layers, an indispensable requirement for accurate pattern transfer at sub-nanometer scales in modern lithography. These sophisticated systems incorporate highly specialized process chambers that maintain stringent environmental controls, rigorously minimizing particulate contamination and ensuring optimal process conditions for defect-free fabrication. Developer systems utilize equally advanced methodologies such as puddle development, spray development, or combinations thereof, coupled with precise temperature control and chemical concentration management to selectively remove photoresist and expose the underlying wafer material with exceptional fidelity and minimal defects, ensuring pattern integrity.

Beyond the core coating and developing mechanisms, the market is profoundly characterized by the seamless integration of cutting-edge ancillary technologies that enhance overall system performance and operational efficiency. Advanced robotics and fully automated material handling systems are ubiquitous, ensuring seamless, contamination-free, and high-speed wafer transfer between different processing modules, thereby dramatically enhancing throughput and significantly reducing the potential for human error. In-situ metrology tools, including advanced interferometers, spectroscopic ellipsometers, and optical inspection systems, are increasingly and widely employed for real-time, precise monitoring of film thickness, uniformity, and critical dimensions, allowing for immediate, data-driven process adjustments and superior quality control across every wafer. Sophisticated software platforms are absolutely paramount for comprehensive recipe management, intricate process optimization, extensive data logging, and seamless integration with the fab's overarching manufacturing execution systems (MES), enabling intelligent process flows and adaptive control strategies that maximize yield and efficiency.

The contemporary technological frontier in the Wafer Coater and Developer Market is heavily influenced by the pervasive and rapidly accelerating adoption of Artificial Intelligence (AI) and Machine Learning (ML). These intelligent systems are being robustly deployed for sophisticated predictive maintenance, accurately anticipating equipment failures before they impact production, and for dynamically optimizing complex process parameters based on real-time data analysis, leading to unprecedented levels of precision. AI-driven vision systems are enhancing defect detection and classification with superior accuracy and speed, further improving overall yield management and quality assurance. Furthermore, ongoing research and development efforts are intensely concentrated on developing systems that are fully compatible with next-generation lithography techniques, such as Extreme Ultraviolet (EUV) lithography, which necessitate entirely new materials, precise process control, and tighter management of resist-material interactions. The exploration of novel coating materials and chemistries, alongside the design of equipment supporting larger wafer sizes (e.g., 450mm) and unique substrate types, continues to vigorously drive the technological evolution, ensuring the market remains dynamically aligned with the semiconductor industry's future requirements for producing ever-smaller, more powerful, and highly reliable devices.

Regional Highlights

- Asia Pacific (APAC): Dominant market share due to extensive semiconductor manufacturing hubs in Taiwan (e.g., TSMC, UMC), South Korea (e.g., Samsung, SK Hynix), China (e.g., SMIC, Hua Hong), and Japan (e.g., Kioxia, Renesas), driven by massive investments in new fabrication facilities, continuous capacity expansion, and rapid adoption of advanced process technologies. This region is the undisputed global leader in wafer production and equipment demand.

- North America: Significant contribution from leading Integrated Device Manufacturers (e.g., Intel, Micron) and robust R&D activities, particularly in regions like Silicon Valley and New York. Focuses on cutting-edge process development, specialized device fabrication, and strategic national initiatives to bolster domestic semiconductor manufacturing capabilities and supply chain resilience.

- Europe: Key role in niche markets such as automotive semiconductors, industrial electronics, and advanced research, with countries like Germany, France, and Ireland investing in next-generation manufacturing capabilities and specialized equipment development. Contributes to process innovation and serves specific high-value segments of the global semiconductor industry.

- Latin America: An emerging region with growing investment in electronics assembly and nascent potential for future semiconductor initiatives. Gradually developing its foundational manufacturing ecosystem and attracting initial foreign direct investment, indicating long-term growth prospects for wafer processing equipment.

- Middle East & Africa (MEA): A nascent market with developing opportunities in basic electronics manufacturing and strategic long-term plans for establishing semiconductor development capabilities. Currently limited in front-end wafer fabrication equipment demand but shows potential for future expansion driven by diversification and technological self-sufficiency goals.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Coater and Developer Market.- SCREEN Holdings Co., Ltd.

- Tokyo Electron Limited (TEL)

- Applied Materials, Inc.

- Hitachi High-Tech Corporation

- Suss MicroTec SE

- EV Group (EVG)

- ZEISS Group

- Canon Inc.

- ASML Holding N.V. (Indirect impact through lithography equipment integration)

- Veeco Instruments Inc.

- Lam Research Corporation

- AMEC (Advanced Micro-Fabrication Equipment Inc.)

- KLA Corporation

- Nikon Corporation

- ULVAC, Inc.

- FSI International (a part of SCREEN Holdings Co., Ltd.)

- DISCO Corporation

- Semes Co., Ltd.

- JSR Corporation (leading photoresist and materials supplier, critical to process)

- Merck KGaA (leading photoresist and materials supplier, critical to process)

- Avantor (specialized materials and chemical solutions provider)

- Shin-Etsu Chemical Co., Ltd. (key supplier of silicon wafers and photoresists)

Frequently Asked Questions

What is the primary function of a wafer coater and developer system in semiconductor manufacturing?

A wafer coater system precisely applies a uniform layer of photoresist onto a semiconductor wafer, which is a critical step for photolithography. Subsequently, a developer system selectively removes either the exposed or unexposed photoresist after UV light exposure, accurately revealing the intricate circuit patterns essential for integrated circuit fabrication. These systems are indispensable for achieving the stringent critical dimension control and significant defect reduction required for modern microelectronics production.

How is Artificial Intelligence (AI) transforming the efficiency and capabilities of wafer coating processes?

AI is profoundly impacting wafer coating and developing by enabling advanced predictive maintenance, thereby significantly minimizing unscheduled downtime for equipment. It intelligently optimizes complex process parameters in real-time for superior film uniformity and enhanced defect reduction, automates subtle anomaly detection, and considerably accelerates the development and optimization of new process recipes for diverse materials and designs. This comprehensive integration of AI leads to unprecedented precision, higher manufacturing yields, and substantially reduced operational costs across semiconductor fabrication plants globally.

What are the primary market drivers contributing to the growth of the Wafer Coater and Developer Market?

The main drivers include the escalating global demand for advanced semiconductors, fueled by the widespread adoption of transformative technologies like 5G, Artificial Intelligence, and the Internet of Things, which collectively necessitate continuous and substantial investment in fabrication capabilities. The relentless industry-wide push towards miniaturization and increased transistor density, coupled with the growing adoption of sophisticated advanced packaging solutions, further propels the urgent need for more precise, high-throughput, and technologically capable coating and developing equipment.

Which geographical regions are leading the expansion and technological adoption in the Wafer Coater and Developer Market?

The Asia Pacific (APAC) region, particularly countries like Taiwan, South Korea, China, and Japan, currently holds the dominant market share and is leading the overall market expansion. This is primarily due to extensive and ongoing investments in new semiconductor fabrication plants and the region's robust, well-established semiconductor manufacturing ecosystem. North America and Europe also contribute significantly to the market, driven by advanced R&D initiatives, specialized device fabrication, and strategic national efforts to bolster domestic manufacturing capabilities.

What key technological advancements are currently shaping the future of wafer coater and developer systems?

Key technological advancements include the extensive integration of advanced automation and robotics for improved throughput and reduced human intervention, sophisticated in-situ metrology tools for real-time quality control and process monitoring, and the pervasive adoption of Artificial Intelligence and Machine Learning for intelligent process optimization, predictive maintenance, and highly accurate defect detection. Furthermore, continuous research and development efforts are intensely focused on achieving full compatibility with next-generation lithography techniques (e.g., Extreme Ultraviolet lithography) and supporting novel materials and increasingly larger wafer sizes for future manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager