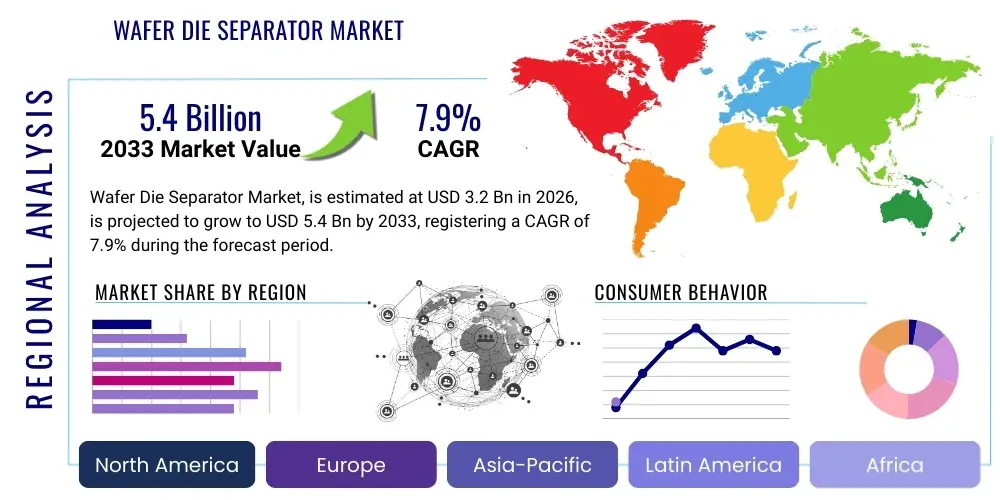

Wafer Die Separator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436839 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Wafer Die Separator Market Size

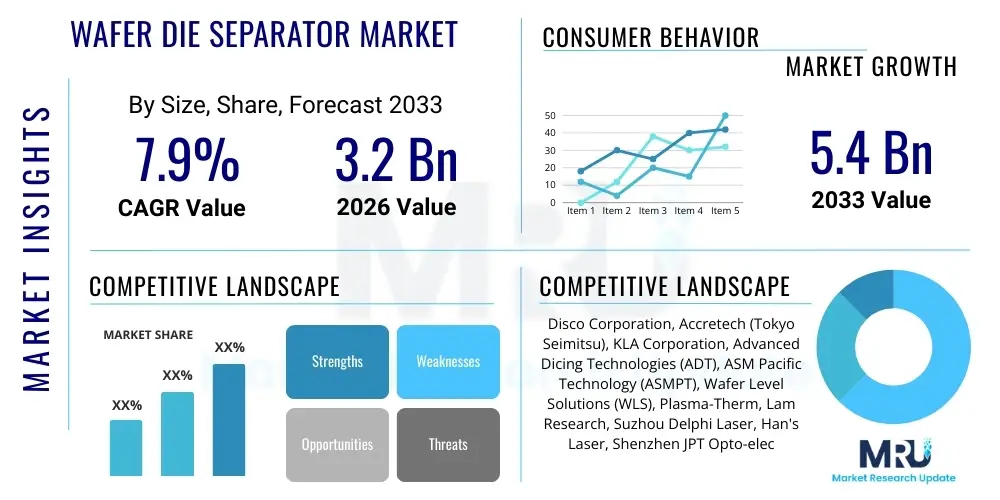

The Wafer Die Separator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% between 2026 and 2033. The market is estimated at USD 3.2 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the relentless push towards miniaturization in semiconductor manufacturing, coupled with the increasing adoption of advanced packaging techniques like 3D stacking and chiplets, which demand superior precision and minimal damage during the die separation process. The escalating global demand for high-performance computing (HPC), AI hardware, and 5G infrastructure directly necessitates higher wafer processing volumes and improved yield rates from die separation technologies.

Wafer Die Separator Market introduction

The Wafer Die Separator Market encompasses the technologies and equipment used in the back-end semiconductor process to accurately and cleanly cut individual integrated circuit dies from a processed semiconductor wafer. This crucial step, often referred to as dicing, ensures that each chip is electrically isolated and structurally sound before packaging. The primary technologies employed include mechanical dicing saws, laser dicing systems (such as stealth dicing and laser ablation), and increasingly, advanced techniques like plasma dicing. The accuracy and efficiency of these separation methods directly influence the overall yield and reliability of the final electronic devices, making them a critical investment area for semiconductor manufacturers globally.

Major applications for wafer die separation span across virtually all sectors utilizing semiconductors, including consumer electronics (smartphones, tablets), automotive (ADAS, infotainment systems), industrial machinery, and telecommunications (5G base stations). The increasing complexity of modern chips, particularly those leveraging heterogeneous integration and stacked architectures, necessitates sophisticated separation tools capable of handling ultra-thin wafers and delicate materials without introducing micro-cracks or debris. The benefits derived from advanced separators include reduced kerf loss (material wasted during cutting), increased throughput, improved die strength, and the ability to process novel materials such as silicon carbide (SiC) and gallium nitride (GaN), which are essential for high-power and high-frequency applications.

Driving factors for this market expansion are multifaceted, anchored by the explosive growth of the Internet of Things (IoT), which mandates billions of new sensor and processing chips, and the transition to advanced nodes (below 7nm) which require specialized, non-contact dicing methods to preserve die integrity. Furthermore, the global trend towards reshoring and building regional semiconductor supply chains, especially in North America and Europe, is fueling significant capital expenditure in advanced manufacturing equipment, including state-of-the-art wafer die separators. The continuous innovation in equipment design, focusing on automation and higher processing speeds, further underpins the market’s sustained growth.

Wafer Die Separator Market Executive Summary

The Wafer Die Separator Market is experiencing robust growth driven by structural shifts in the semiconductor industry, characterized by escalating capital expenditures in fabrication facilities (fabs) and a pivot toward advanced packaging solutions. Business trends indicate a strong focus on automation and integration, with key market players investing heavily in hybrid dicing systems that combine the speed of mechanical sawing with the precision of laser dicing to optimize processing for diverse materials and wafer thicknesses. The strategic alliances between equipment manufacturers (OEMs) and Outsourced Semiconductor Assembly and Test (OSAT) providers are crucial, ensuring that new technologies are rapidly deployed to meet high-volume manufacturing demands, particularly for memory and high-density logic chips.

Regional trends highlight the enduring dominance of the Asia Pacific (APAC) region, spearheaded by manufacturing hubs in Taiwan, South Korea, China, and Japan, which collectively account for the majority of global semiconductor production capacity. APAC remains the largest consumer and innovator in die separation technology due to massive investments by leading foundry and memory manufacturers. However, North America and Europe are showing accelerated growth, spurred by governmental initiatives like the U.S. CHIPS Act and the European Chips Act, which are incentivizing the establishment of advanced packaging capabilities domestically. This geographical diversification is broadening the market opportunity and reducing supply chain risks associated with over-concentration.

Segmentation trends reveal a strong shift toward laser-based dicing technologies, particularly UV and ultra-fast pulsed lasers, which offer non-contact separation, resulting in superior yield for sensitive and ultra-thin wafers critical for 3D packaging. While mechanical dicing remains prevalent for thicker, less demanding substrates, the highest growth rates are observed in the Plasma Dicing segment, favored for its ability to produce highly precise, stress-free separation suitable for MEMS and complex heterogeneous integrated devices. Furthermore, the Logic and Memory applications segments are the primary revenue drivers, reflecting the massive production scale required for data centers, consumer electronics, and AI accelerators.

AI Impact Analysis on Wafer Die Separator Market

User queries regarding the impact of Artificial Intelligence (AI) on the Wafer Die Separator Market primarily revolve around themes of automation efficacy, predictive maintenance for high-value equipment, and optimization of dicing parameters to maximize yield and throughput. Users frequently ask how AI can handle the variability introduced by different wafer types (e.g., SiC vs. Silicon) and minimize material loss (kerf width). There is also significant interest in AI's role in integrating various back-end processes—such as linking dicing quality data back to upstream polishing or deposition steps—to create a truly closed-loop manufacturing environment. Concerns often focus on the complexity and initial cost of implementing AI-driven vision systems and data infrastructure within existing fabrication environments.

The core theme summarizing user expectations is the transition from reactive process control to proactive optimization. AI is expected to move beyond simple fault detection to predictive quality assurance, anticipating potential micro-cracks or chipping before they occur by analyzing real-time sensor data from the dicing blade or laser source. This capability is paramount as wafer costs increase and the tolerance for manufacturing defects shrinks, especially in high-reliability segments like aerospace and autonomous vehicles. AI models are being trained on millions of dicing cycles to identify subtle patterns that human operators or standard statistical process control (SPC) methods often miss, leading to incremental but crucial improvements in manufacturing excellence.

Furthermore, AI-powered vision systems are drastically improving the alignment accuracy required before the dicing process begins. Advanced algorithms can detect minute distortions or topographical irregularities on the wafer surface, automatically adjusting the dicing path in real-time to maintain optimal positioning, thereby reducing the risk of device damage. This enhanced precision is indispensable for processing heterogeneous integrated circuits, where multiple components with differing structures are mounted on the same substrate. The integration of AI also facilitates highly customized process recipes, optimizing power levels, feed rates, and coolant flow based on specific material properties and desired die dimensions.

- AI-driven Predictive Maintenance: Minimizing unplanned downtime of high-cost dicing equipment by forecasting component failure (e.g., blade wear, laser degradation).

- Real-time Yield Optimization: Using machine learning to adjust dicing parameters (speed, power) based on in-situ monitoring data and historical yield metrics.

- Automated Defect Classification: Enhancing the speed and accuracy of identifying post-dicing defects such as chipping, micro-cracks, and kerf contamination through advanced computer vision.

- Closed-Loop Process Control: Integrating data from die separation back into upstream processes (e.g., lithography, etching) for continuous manufacturing improvement and reducing process variability.

- Optimized Tool Path Planning: Utilizing AI algorithms to determine the most efficient and least stressful dicing sequence for complex or highly irregular wafer layouts, minimizing stress propagation.

DRO & Impact Forces Of Wafer Die Separator Market

The Wafer Die Separator Market is dynamically influenced by a synergistic combination of technological mandates, economic pressures, and material science innovations. The primary drivers stem from the fundamental industry requirements for higher density integration and smaller form factors, necessitating extremely precise and low-damage die separation techniques. Restraints predominantly involve the significant capital investment required for adopting advanced laser and plasma dicing systems, coupled with the technical challenges associated with handling next-generation, ultra-thin, and brittle substrates. Opportunities are abundant, particularly in addressing the processing needs of advanced compound semiconductors (SiC, GaN) vital for electric vehicles and renewable energy infrastructure, alongside the booming demand for chiplet-based architectures which rely heavily on high-precision back-end processing. These forces collectively shape the competitive landscape and guide R&D investments among leading equipment providers.

The impact forces operate on several axes: technological advancement, which favors non-contact methods over mechanical sawing; economic scale, which pushes for higher throughput systems while maintaining yield; and regulatory/environmental factors, which increasingly demand processes with lower material waste (reduced kerf width) and energy consumption. The drive for heterogeneous integration, where dissimilar materials and chip types are combined on a single substrate, is a major impact force demanding flexible and versatile separation equipment that can switch between different materials and thicknesses rapidly. Furthermore, geopolitical tensions and supply chain vulnerabilities are compelling semiconductor ecosystems to invest in advanced, resilient localized back-end processing capabilities.

Key impact forces also include the shift towards 300mm and increasingly 450mm wafer sizes, requiring larger, more sophisticated separation equipment capable of managing increased stress and inertia during processing. The development of ultra-thin wafers (less than 50 µm) for high-density memory stacking introduces significant handling and separation challenges, making stealth dicing and plasma etching crucial tools for minimizing wafer breakage and maintaining die integrity. The continual evolution of packaging standards, moving towards high-bandwidth memory (HBM) and fan-out wafer-level packaging (FOWLP), dictates stricter specifications for die edge quality, thereby accelerating the adoption of specialized, high-cost separation solutions.

Segmentation Analysis

The Wafer Die Separator Market is highly segmented based on the type of separation technology utilized, the material being processed, the specific application of the die, and the end-user industry. The technology segmentation is crucial, differentiating between traditional mechanical solutions (dicing saws with blades) and modern non-contact methods (laser dicing, plasma dicing). The preference for specific technology is strongly correlated with the wafer material and required die thickness, with high-end, complex devices increasingly relying on laser and plasma due to their precision and ability to minimize damage. The materials segment is growing rapidly due to the rising market share of compound semiconductors like SiC and GaN, which require high-power laser or etching techniques due to their extreme hardness and thermal properties, making them unsuitable for conventional blade cutting.

Application segmentation reflects the largest demand areas, typically dominated by Memory devices (DRAM, NAND flash), which require high throughput and excellent yield control, and Logic devices (CPUs, GPUs), which demand the highest separation precision due to their complex architecture and high value. The segment for Micro-Electro-Mechanical Systems (MEMS) is also significant, as these devices often feature delicate structures requiring the stress-free processing capability offered by plasma dicing. The distinct requirements of each application category—for instance, the need for deep, vertical cuts in 3D NAND versus minimal subsurface damage in high-speed logic—drive innovation in specialized equipment variants, ensuring vendors offer tailored solutions rather than one-size-fits-all machinery.

Geographically, the market segmentation highlights the Asia Pacific region as the indisputable manufacturing powerhouse, driving high-volume sales of both entry-level mechanical saws and advanced laser systems. However, segmentation by end-user demonstrates a shifting landscape; while pure-play foundries remain the largest customers, the increasing reliance of Integrated Device Manufacturers (IDMs) on advanced packaging (e.g., Intel, Samsung) means they are also making substantial investments in cutting-edge die separation equipment. Furthermore, specialized companies focusing solely on compound semiconductors for power electronics and RF applications form a high-growth niche requiring the most advanced, high-power separation tools.

- Technology Type:

- Mechanical Dicing Saws (Blade Dicing)

- Laser Dicing (Stealth Dicing, Laser Ablation)

- Plasma Dicing (Deep Reactive Ion Etching - DRIE)

- Hybrid Dicing Systems

- Application:

- Memory Devices (DRAM, NAND)

- Logic Devices (CPUs, GPUs, ASICs)

- MEMS and Sensors

- Power Devices (SiC, GaN)

- RF Devices and Optoelectronics

- Wafer Size:

- 150 mm

- 200 mm

- 300 mm and Above

- End-User:

- Foundries

- Integrated Device Manufacturers (IDMs)

- Outsourced Semiconductor Assembly and Test (OSAT) Providers

Value Chain Analysis For Wafer Die Separator Market

The value chain for the Wafer Die Separator Market begins with upstream suppliers providing critical components such as synthetic diamond blades for mechanical saws, high-power, precision lasers (UV, femtosecond) for laser dicing systems, and sophisticated gas handling equipment for plasma dicing machinery. These specialized components represent high-cost inputs where material science and precision engineering determine the final equipment performance. Manufacturers of the die separation equipment then integrate these components with high-precision motion control systems, advanced vision alignment systems, and proprietary software interfaces. The control over intellectual property related to laser beam shaping and plasma etching recipes provides significant competitive advantage in the midstream segment of the value chain, focusing on maximizing throughput and minimizing kerf loss for next-generation wafers.

The downstream segment involves the distribution and direct sales of these large-capital machines to end-users, primarily large-scale semiconductor fabrication plants (fabs), integrated device manufacturers (IDMs), and outsourced semiconductor assembly and test (OSAT) companies. Distribution channels are largely characterized by direct sales, especially for highly customized, advanced systems, due to the need for extensive installation support, detailed process qualification, and ongoing maintenance contracts. Indirect distribution sometimes occurs through regional distributors or systems integrators, particularly in emerging markets or for standardized mechanical dicing equipment. Post-sales service and consumables supply (blades, laser optics, process gases) constitute a crucial and profitable part of the downstream value chain, ensuring high utilization rates for the expensive equipment.

A key trend in the value chain is the increasing collaboration between equipment manufacturers and material suppliers to develop co-optimized processes, especially for difficult-to-dice materials like SiC and GaN. This co-development minimizes the trial-and-error phase at the customer site and accelerates the adoption of new processing techniques. Furthermore, the reliance on high-precision robotics and automation within the equipment necessitates a robust supply chain for complex electromechanical components. The overall structure emphasizes quality control and tight tolerances, as failures in the die separation stage can render millions of dollars worth of processed silicon unusable, placing significant economic pressure on the efficiency and reliability delivered throughout the value chain.

Wafer Die Separator Market Potential Customers

The primary customers in the Wafer Die Separator Market are sophisticated entities operating within the semiconductor manufacturing ecosystem, demanding equipment that offers high throughput, exceptional precision, and process repeatability. Integrated Device Manufacturers (IDMs), such as those producing proprietary microprocessors or memory chips, are major buyers, as they manage the entire semiconductor lifecycle from design through packaging. IDMs require versatile separation tools to handle a variety of wafer types, including logic, memory, and specialized power management devices. The selection criteria for these large firms often prioritize total cost of ownership (TCO), reliability, and the ability of the vendor to provide global technical support and rapid access to spare parts and consumables.

Outsourced Semiconductor Assembly and Test (OSAT) providers represent another massive customer segment. Companies like ASE, Amkor, and SPIL specialize in the back-end processing steps, including dicing, bonding, and packaging, for numerous fabless semiconductor companies. OSATs require highly standardized, scalable, and automated die separation equipment capable of processing high volumes across a multitude of customer specifications and packaging types. For OSATs, throughput maximization and minimized operational costs are critical, driving strong demand for fast, efficient mechanical saws alongside high-precision laser systems for advanced packaging services such as 2.5D/3D integration and wafer-level packaging (WLP).

In addition to these traditional semiconductor players, specialty manufacturers focused on niche markets are rapidly becoming key customers. This includes companies producing MEMS devices (e.g., accelerometers, gyroscopes), specialized power electronics using SiC and GaN wafers for electric vehicle inverters and 5G infrastructure, and advanced photonics companies. These niche players often drive demand for the most technologically advanced (and expensive) separation methods, such as deep reactive ion etching (DRIE) or advanced stealth laser dicing, due to the extreme fragility or hardness of their proprietary materials and the requirement for precise, near-vertical sidewalls necessary for advanced device functionality.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.2 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 7.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Disco Corporation, Accretech (Tokyo Seimitsu), KLA Corporation, Advanced Dicing Technologies (ADT), ASM Pacific Technology (ASMPT), Wafer Level Solutions (WLS), Plasma-Therm, Lam Research, Suzhou Delphi Laser, Han's Laser, Shenzhen JPT Opto-electronics, Greatek Electronics, EV Group (EVG), SUSS MicroTec, Veeco Instruments, SPTS Technologies (KLA), EO Technics, Tokyo Electron Limited (TEL), CETC, Daitron. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Die Separator Market Key Technology Landscape

The technology landscape of the Wafer Die Separator Market is undergoing a rapid transition, moving away from conventional mechanical dicing and toward sophisticated, non-contact methods optimized for handling fragile, thin, and complex semiconductor materials. Mechanical dicing saws, while cost-effective and high-throughput for standard silicon wafers, are limited by inherent mechanical stresses, kerf loss, and blade wear, making them less suitable for advanced nodes and SiC/GaN materials. This technological gap has been filled by advanced laser dicing systems, which use focused laser beams to either ablate the material (laser ablation) or create internal modification layers for clean cleaving (stealth dicing). Stealth dicing, in particular, is highly valued for producing superior die strength and minimal debris, essential for high-reliability applications and ultra-thin wafer handling required in 3D integration.

The emerging frontier is Plasma Dicing (often leveraging Deep Reactive Ion Etching - DRIE), which offers the ultimate solution for achieving zero kerf width (kerfless separation) and completely eliminating mechanical stress and particulate contamination. Plasma dicing involves etching the dicing street chemically using precise masks, producing perfectly vertical and smooth die sidewalls. While this method offers superior precision crucial for high aspect ratio structures and MEMS devices, it demands complex pre-processing steps (masking) and operates at a higher cost and slower speed compared to laser dicing. Therefore, the industry trend is leaning towards hybrid solutions that combine the precision of laser scribing (to define the separation path) with the speed and cleanliness of plasma etching, optimizing the balance between throughput and die quality, particularly for volume production of 3D stacked chips.

Further technological advancements focus on integrating advanced in-situ metrology and inspection systems, often leveraging AI-powered machine vision, directly into the dicing equipment. These integrated systems monitor the separation process in real-time, detecting micro-defects instantaneously and allowing for immediate parameter adjustments. This capability is vital for maintaining high yield rates as device complexity increases. Additionally, research and development efforts are concentrated on ultra-fast pulsed lasers (e.g., femtosecond lasers) which minimize the heat-affected zone (HAZ) during ablation, enabling cleaner cuts in highly temperature-sensitive materials. The future direction involves fully automated, modular die separation platforms that can flexibly switch between different dicing modes (mechanical, laser, plasma) based on the specific requirements of the batch, thereby increasing operational efficiency in high-mix manufacturing environments.

Regional Highlights

Regional dynamics heavily influence the demand and adoption rates for wafer die separation technologies, reflecting the global concentration of semiconductor manufacturing capacity and strategic investments.

- Asia Pacific (APAC): Dominating the global market, APAC, led by China, Taiwan, South Korea, and Japan, accounts for the largest share due to the presence of major foundries (TSMC, Samsung) and OSAT providers (ASE, Amkor). The region’s massive output of memory, logic, and consumer electronics chips drives continuous high-volume demand for advanced dicing solutions, particularly hybrid laser/saw systems and stealth dicing technology to support ultra-thin wafer processing for high-density memory stacking and smartphone components. Government incentives and localized supply chain stability reinforce APAC's position as the primary manufacturing and consumption hub.

- North America: Characterized by high-value R&D, design leadership, and a growing emphasis on re-establishing domestic manufacturing (CHIPS Act). North America shows strong demand for highly specialized die separation equipment, particularly plasma dicing for MEMS, advanced R&D, and processing novel wide-bandgap materials (SiC/GaN) critical for automotive and defense applications. Companies here prioritize innovation, process control, and integrating AI into back-end equipment for yield maximization and process reliability.

- Europe: Driven by strong automotive and industrial sectors, Europe exhibits significant demand for power semiconductor processing equipment, particularly those capable of handling SiC and GaN wafers with high precision. Government and EU initiatives focusing on bolstering the semiconductor supply chain are fueling investment in localized advanced packaging capabilities. The region often favors highly precise, energy-efficient laser-based systems and is a key market for specialized equipment catering to photonics and RF device manufacturing.

- Latin America and Middle East & Africa (LAMEA): These regions currently hold smaller market shares but represent growth opportunities, primarily focused on assembly and test operations for specific regional needs or initial stages of localized manufacturing. Demand here often starts with robust, reliable mechanical dicing systems, gradually transitioning to entry-level laser dicing as local fabrication capabilities mature and the complexity of manufactured chips increases, often servicing local automotive and telecommunications infrastructure projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Die Separator Market.- Disco Corporation

- Accretech (Tokyo Seimitsu)

- KLA Corporation

- Advanced Dicing Technologies (ADT)

- ASM Pacific Technology (ASMPT)

- Wafer Level Solutions (WLS)

- Plasma-Therm

- Lam Research

- Suzhou Delphi Laser

- Han's Laser

- Shenzhen JPT Opto-electronics

- Greatek Electronics

- EV Group (EVG)

- SUSS MicroTec

- Veeco Instruments

- SPTS Technologies (KLA)

- EO Technics

- Tokyo Electron Limited (TEL)

- CETC

- Daitron

Frequently Asked Questions

Analyze common user questions about the Wafer Die Separator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between laser dicing and plasma dicing?

Laser dicing is a thermal process that uses focused light to cut or cleave the wafer (e.g., stealth dicing), offering high speed and flexibility. Plasma dicing is a non-contact chemical etching process (DRIE), providing superior sidewall verticality, zero kerf loss, and extremely low mechanical stress, ideal for ultra-thin wafers and MEMS, though typically slower and requiring pre-processing masks.

How does the shift to SiC and GaN materials impact die separation technology?

The extreme hardness and brittleness of wide-bandgap materials like SiC and GaN render traditional mechanical dicing unsuitable. This shift necessitates the use of high-power, specialized laser dicing systems or innovative hybrid methods to minimize micro-cracking and subsurface damage, driving technological innovation toward high-energy non-contact separation.

Which technology segment exhibits the highest growth rate in the market?

The Plasma Dicing segment, specifically utilized in kerfless die separation, is projected to show the highest growth rate. This is due to its critical role in advanced packaging (3D stacking, chiplets) and the processing of delicate MEMS and sensor devices that require stress-free, high-precision separation results and superior die strength.

What role does Artificial Intelligence play in modern wafer die separation?

AI is increasingly used to optimize the dicing process through predictive maintenance, real-time quality control, and automated alignment. AI-powered vision systems analyze in-situ sensor data to dynamically adjust laser power or blade feed rates, maximizing yield and throughput while minimizing potential defects across diverse wafer materials.

Why is Asia Pacific the largest regional market for Wafer Die Separators?

APAC dominates the market due to its overwhelming concentration of global semiconductor manufacturing capacity, including the world’s largest foundries, memory producers, and OSAT providers. Continuous massive capital expenditure in high-volume production for consumer electronics and 5G infrastructure fuels sustained demand for all classes of die separation equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager