Wafer Grinding Equipment Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440616 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Wafer Grinding Equipment Market Size

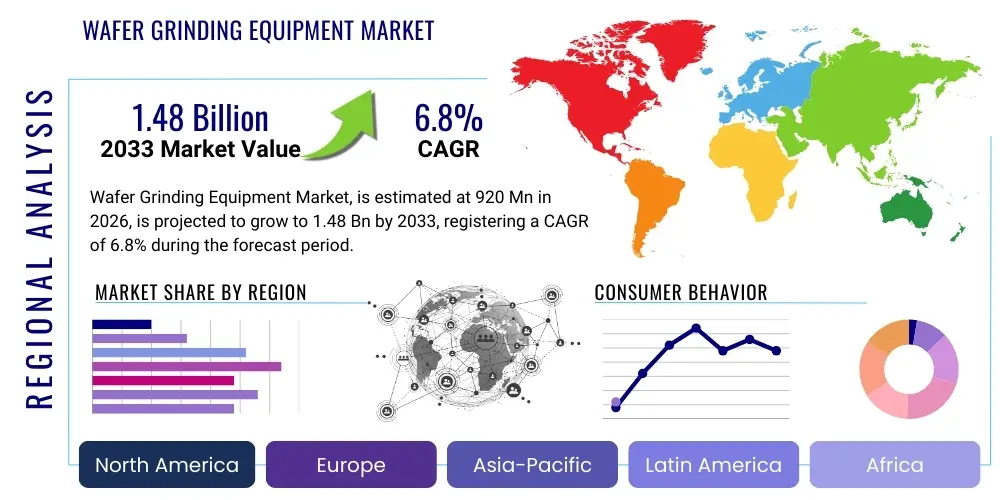

The Wafer Grinding Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 920 million in 2026 and is projected to reach USD 1.48 billion by the end of the forecast period in 2033. This growth trajectory is significantly influenced by the escalating demand for advanced semiconductor devices, the continuous push for miniaturization, and the increasing complexity of integrated circuits, all of which necessitate thinner, more precise wafers. The imperative for superior wafer quality, free from subsurface damage and with exceptional flatness, drives ongoing investment in sophisticated grinding technologies across the global semiconductor industry. Emerging applications in artificial intelligence, 5G communication, and electric vehicles further amplify the need for high-performance power devices and specialized sensors, which rely heavily on precise wafer thinning processes facilitated by advanced grinding equipment, thereby underpinning the robust expansion of this critical market segment.

Wafer Grinding Equipment Market introduction

The Wafer Grinding Equipment Market encompasses the specialized machinery and systems designed for the precise reduction of semiconductor wafer thickness. This critical process is essential in modern semiconductor manufacturing, enabling the creation of thinner wafers that are vital for advanced packaging technologies, improved thermal management, and enhanced electrical performance in integrated circuits. The equipment typically employs abrasive grinding wheels to remove material from the backside of silicon, silicon carbide, gallium nitride, and other semiconductor substrates, achieving precise thickness control and surface characteristics.

These advanced systems are integral to the production of a wide array of electronic components, including high-performance logic and memory chips, sophisticated power devices, micro-electromechanical systems (MEMS), and radio-frequency (RF) components. Key applications extend across various sectors such as consumer electronics, automotive, telecommunications, healthcare, and industrial automation, where the demand for smaller, more powerful, and energy-efficient devices is constantly accelerating. The benefits derived from these technologies include enhanced device functionality through reduced package size and improved signal integrity, greater flexibility in stacking multiple chips, and better heat dissipation for high-power applications, ultimately contributing to the miniaturization and higher performance density of electronic products.

The market's expansion is primarily driven by several key factors. The relentless trend towards device miniaturization, which demands ultra-thin wafers for 3D stacking and advanced packaging (e.g., fan-out wafer-level packaging, 3D ICs), is a major catalyst. Additionally, the proliferation of next-generation technologies like 5G, artificial intelligence, Internet of Things (IoT), and electric vehicles fuels the demand for high-performance power semiconductors and specialized sensors that require stringent wafer thickness control. Furthermore, the increasing adoption of wide bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) for power electronics, which are inherently harder and require specialized grinding solutions, also contributes significantly to market growth. These materials offer superior performance in high-power, high-frequency, and high-temperature environments, making them indispensable for future electronic systems.

Wafer Grinding Equipment Market Executive Summary

The Wafer Grinding Equipment Market is currently experiencing robust growth, propelled by significant advancements in semiconductor manufacturing and an ever-increasing global demand for high-performance electronic devices. Business trends within the market highlight a strong emphasis on automation, precision, and integration capabilities, with manufacturers continually innovating to meet the stringent requirements for ultra-thin wafers and damage-free processing. There is a discernible shift towards equipment that can handle a wider range of wafer materials, including silicon carbide (SiC) and gallium nitride (GaN), crucial for next-generation power electronics and RF applications. Companies are investing heavily in research and development to enhance grinding efficiency, reduce cost of ownership, and improve overall yield for their semiconductor manufacturing clients. Furthermore, strategic collaborations and partnerships between equipment manufacturers and leading foundries or IDMs are becoming more prevalent, aimed at co-developing optimized solutions for future manufacturing nodes and advanced packaging technologies.

Regionally, the Asia Pacific (APAC) continues to dominate the Wafer Grinding Equipment Market, primarily due to the concentration of major semiconductor manufacturing hubs in countries such as Taiwan, South Korea, China, and Japan. These regions are at the forefront of semiconductor production and innovation, driving substantial investments in advanced wafer processing capabilities. North America and Europe also present significant growth opportunities, driven by increasing R&D activities, the expansion of specialty semiconductor manufacturing, and government initiatives aimed at strengthening domestic semiconductor supply chains. Latin America and the Middle East & Africa regions are emerging markets, showing gradual but steady growth as their industrial and technological infrastructures develop, though their overall contribution to the global market remains comparatively smaller. The geopolitical landscape and trade policies are also playing an increasingly critical role in shaping regional investment patterns and supply chain resilience within the semiconductor industry.

In terms of segment trends, the market for fully automatic grinding equipment is projected to witness the highest growth, driven by the imperative for high throughput, reduced human intervention, and enhanced process control in advanced manufacturing environments. The 300mm wafer size segment holds the largest market share, reflecting its widespread adoption in high-volume production of logic and memory devices, while the 450mm segment, though still nascent, represents a future growth opportunity as the industry progresses towards larger wafer sizes for further cost efficiencies. The application segment is predominantly led by logic and memory devices, but power devices and MEMS & RF devices are experiencing accelerated growth, fueled by the rising demand from electric vehicles, renewable energy, and IoT applications. These segments require specific grinding solutions that can handle diverse material properties and intricate device structures, thereby stimulating innovation in specialized equipment designs and process parameters.

AI Impact Analysis on Wafer Grinding Equipment Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to profoundly transform the Wafer Grinding Equipment Market, addressing critical user questions regarding process optimization, predictive maintenance, and quality control. Users are keen to understand how AI can enhance the precision and efficiency of grinding operations, reduce operational costs, and minimize wafer damage, thereby improving overall manufacturing yield. There is a strong expectation that AI will provide solutions for real-time anomaly detection, adaptive process adjustments, and automated troubleshooting, moving beyond traditional rule-based control systems. Furthermore, inquiries often revolve around the ability of AI to analyze vast datasets generated during grinding, such as vibration patterns, acoustic signatures, and metrology data, to identify subtle correlations and optimize parameters that human operators might overlook. The overarching theme is the pursuit of 'smart' grinding equipment that can self-optimize, learn from past operations, and provide actionable insights to preemptively mitigate potential issues, ultimately leading to a more stable, efficient, and cost-effective wafer manufacturing process in an increasingly complex technological landscape.

- Predictive Maintenance: AI algorithms analyze sensor data from grinding equipment (e.g., vibration, temperature, motor current) to predict potential component failures before they occur, enabling proactive maintenance and minimizing unplanned downtime.

- Process Optimization: Machine learning models can analyze real-time grinding parameters, wafer characteristics, and post-grinding metrology data to identify optimal settings for wheel speed, feed rate, and coolant flow, improving grinding efficiency, surface quality, and yield.

- Quality Control and Anomaly Detection: AI-powered vision systems and data analytics can detect microscopic defects, cracks, or subsurface damage on wafers during or immediately after grinding, providing instant feedback and preventing further processing of compromised wafers.

- Adaptive Control: AI enables grinding equipment to adapt dynamically to variations in wafer material properties, incoming wafer thickness, and environmental conditions, ensuring consistent and precise grinding outcomes across different batches.

- Data-Driven Insights: AI and ML facilitate the analysis of large datasets from multiple grinding machines and process steps, offering deeper insights into manufacturing bottlenecks, root causes of defects, and opportunities for continuous process improvement.

- Automated Parameter Tuning: AI can automate the complex task of tuning grinding parameters for new wafer materials or device architectures, significantly reducing setup times and accelerating new product introduction cycles.

DRO & Impact Forces Of Wafer Grinding Equipment Market

The Wafer Grinding Equipment Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, collectively forming the core impact forces that shape its growth trajectory. The primary drivers fueling market expansion include the surging global demand for advanced semiconductor devices, driven by the proliferation of technologies such as 5G, artificial intelligence, the Internet of Things (IoT), and high-performance computing. This demand necessitates an ever-increasing supply of ultra-thin wafers, which are crucial for advanced packaging techniques like 3D IC stacking and wafer-level packaging, directly boosting the need for precise wafer thinning equipment. Furthermore, the continuous trend towards miniaturization in consumer electronics, automotive electronics, and medical devices places a premium on thinner, higher-quality wafers, pushing manufacturers to invest in state-of-the-art grinding solutions capable of achieving sub-micron tolerances and damage-free surfaces. The growing adoption of wide bandgap (WBG) materials like silicon carbide (SiC) and gallium nitride (GaN) for power electronics and RF applications also acts as a significant driver, as these harder materials require specialized and more robust grinding equipment for efficient processing. These fundamental technological shifts and market demands collectively create a strong pull for innovation and investment in the wafer grinding sector.

Despite these powerful drivers, the market faces several notable restraints that can impede its growth. The high capital investment required for acquiring and maintaining advanced wafer grinding equipment is a significant barrier, particularly for smaller manufacturers or those in developing regions. These machines are complex, precision-engineered systems, and their cost contributes substantially to the overall manufacturing overhead in semiconductor fabs. Additionally, the technological complexity involved in achieving ultra-thin wafers with minimal subsurface damage presents ongoing challenges for equipment manufacturers, requiring continuous research and development efforts. The inherent fragility of ultra-thin wafers during handling and processing necessitates highly sophisticated automation and handling systems, increasing both equipment complexity and operational risks. Moreover, geopolitical uncertainties, trade disputes, and supply chain disruptions can impact the availability of critical components and raw materials, as well as influence the investment decisions of semiconductor manufacturers globally. Economic downturns or slowdowns in key end-user markets can also lead to reduced capital expenditure by chipmakers, thereby tempering the growth of the wafer grinding equipment market.

However, the market is also characterized by substantial opportunities that are poised to accelerate its evolution. The emergence of new materials beyond traditional silicon, such as SiC and GaN, for high-power and high-frequency applications, presents a lucrative growth avenue. As these materials gain wider adoption in electric vehicles, renewable energy systems, and 5G infrastructure, the demand for specialized grinding equipment capable of efficiently processing their unique properties will escalate. Furthermore, the increasing focus on automation, Industry 4.0 integration, and smart manufacturing initiatives within the semiconductor industry offers opportunities for equipment manufacturers to innovate with AI and machine learning capabilities for predictive maintenance, process optimization, and enhanced yield management. Developing countries in Southeast Asia and other emerging regions are gradually building their semiconductor manufacturing capabilities, representing new markets for wafer grinding equipment. The ongoing research into advanced packaging technologies, such as heterogeneous integration and chiplets, will continue to drive the need for thinner and more precisely prepared wafers, ensuring a sustained demand for cutting-edge grinding solutions well into the future. These opportunities, coupled with the underlying drivers, are expected to outweigh the restraints, fostering a positive long-term outlook for the Wafer Grinding Equipment Market.

Segmentation Analysis

The Wafer Grinding Equipment Market is meticulously segmented based on various critical parameters, providing a comprehensive view of its intricate structure and diverse dynamics. These segmentations are crucial for understanding market penetration, identifying high-growth areas, and strategizing for competitive advantage. The breakdown by type distinguishes between fully automatic and semi-automatic systems, reflecting the varying levels of automation and throughput required by different manufacturers. Wafer size segmentation categorizes equipment based on the diameter of the wafers they can process, directly correlating with manufacturing scale and technological generations. Application-based segmentation highlights the primary end-uses for the processed wafers, such as logic, memory, power devices, and MEMS, each with distinct processing requirements. Finally, end-user segmentation differentiates between Integrated Device Manufacturers (IDMs), Foundries, and Outsourced Semiconductor Assembly and Test (OSAT) companies, recognizing their unique roles and demands within the semiconductor ecosystem.

- By Type

- Fully Automatic Grinding Equipment: These systems offer high throughput, minimal human intervention, and advanced process control, making them ideal for large-scale, high-volume manufacturing environments where consistency and efficiency are paramount. They often integrate seamlessly with other automated fab processes.

- Semi-Automatic Grinding Equipment: Characterized by a blend of automated and manual operations, these systems provide flexibility and are often preferred by smaller fabs, R&D facilities, or for niche applications where customization and lower capital expenditure are key considerations.

- By Wafer Size

- 200mm Wafer Grinding Equipment: Historically a dominant size, 200mm wafers are still widely used for power devices, analog ICs, MEMS, and specialty semiconductors, ensuring a steady demand for equipment compatible with this dimension.

- 300mm Wafer Grinding Equipment: Representing the industry standard for high-volume production of advanced logic and memory chips, the 300mm segment holds the largest market share and drives significant innovation in grinding technology.

- 450mm Wafer Grinding Equipment: Although still in the R&D and pilot stages, 450mm wafers promise further cost reductions per die, driving long-term development efforts in equipment capable of handling these larger, more complex substrates.

- Other Wafer Sizes: Includes equipment for smaller wafers (e.g., 150mm, 100mm) used in legacy systems or specialized applications, as well as equipment for non-silicon substrates like SiC, GaN, and sapphire, which may come in various non-standard sizes.

- By Application

- Logic & Memory Devices: This segment covers the grinding of wafers used in CPUs, GPUs, DRAM, NAND flash, and other advanced logic and memory ICs, where ultra-thinning is critical for 3D stacking and high-density packaging.

- Power Devices: Encompasses devices like MOSFETs, IGBTs, and diodes, increasingly made on SiC and GaN, requiring precise grinding for thermal management and enhanced electrical characteristics in applications such as electric vehicles and renewable energy.

- MEMS & RF Devices: Includes micro-electromechanical systems (sensors, actuators) and radio-frequency components (filters, amplifiers), which often require specific wafer thicknesses and damage-free surfaces for optimal performance and integration.

- Optoelectronics: Covers devices like LEDs, laser diodes, and optical sensors, where wafer grinding is important for substrate preparation and packaging.

- Other Applications: Includes specialized applications in scientific research, medical devices, and custom integrated circuits.

- By End-User

- IDMs (Integrated Device Manufacturers): Companies that design, manufacture, and sell their own integrated circuits, often owning their fabs and therefore directly investing in grinding equipment for their proprietary processes.

- Foundries: Companies that specialize in manufacturing ICs for other companies based on their designs. Foundries are major purchasers of wafer grinding equipment due to their high-volume, diverse production needs.

- OSATs (Outsourced Semiconductor Assembly and Test): Companies that provide packaging and testing services for semiconductor devices. As advanced packaging increasingly relies on thin wafers, OSATs are also becoming significant users and influencers of grinding equipment technologies.

- Research & Development Institutions: Universities, government labs, and corporate R&D centers that utilize grinding equipment for material science research, process development, and prototyping new semiconductor structures.

Value Chain Analysis For Wafer Grinding Equipment Market

The value chain for the Wafer Grinding Equipment Market is a complex and interconnected network, beginning with the foundational upstream suppliers and extending through to the downstream end-users and their distribution channels. The upstream segment primarily involves manufacturers of critical components and raw materials that are essential for building the sophisticated grinding systems. This includes suppliers of high-precision mechanical components such as spindles, bearings, motors, and robotic arms that enable precise wafer handling and movement. Furthermore, the specialized grinding wheels, abrasive materials, coolants, and chemical solutions used in the grinding process are supplied by a dedicated segment of the materials industry. Control system developers, providing advanced sensors, programmable logic controllers (PLCs), and software for automation and process monitoring, also form a crucial part of the upstream value chain. The quality and innovation of these upstream components directly impact the performance, reliability, and technological capabilities of the final wafer grinding equipment, necessitating strong relationships and rigorous qualification processes between equipment manufacturers and their suppliers.

Moving downstream, the wafer grinding equipment manufacturers themselves integrate these components and materials into complete, high-precision systems. These manufacturers are responsible for the design, assembly, testing, and initial deployment of the grinding machines. Their core expertise lies in developing proprietary grinding technologies, ensuring precise thickness control, minimizing subsurface damage, and optimizing throughput. Once manufactured, these systems are then delivered to a diverse set of end-users within the semiconductor ecosystem. The primary downstream consumers are Integrated Device Manufacturers (IDMs) who produce their own chips, contract foundries that manufacture chips for various clients, and Outsourced Semiconductor Assembly and Test (OSAT) companies that perform crucial post-fab processes, including advanced packaging which heavily relies on ultra-thin wafers. Each of these end-user categories has specific requirements regarding machine capabilities, automation levels, and material compatibility, influencing the types of grinding equipment procured.

The distribution channel for wafer grinding equipment is typically a blend of direct and indirect approaches, tailored to the global and high-value nature of the products. Direct sales are prevalent for major equipment manufacturers, allowing for direct engagement with large IDMs and foundries, facilitating customized solutions, and providing dedicated after-sales support and technical services. This direct relationship is crucial given the complexity and significant investment associated with these machines. Indirect channels involve a network of authorized distributors, sales agents, and regional representatives, particularly in emerging markets or for smaller customers. These partners often provide local sales, installation, maintenance, and spare parts services, ensuring broader market reach and quicker response times. Additionally, specialized service providers offer maintenance contracts, upgrades, and process optimization consulting, further extending the value chain. The overall efficiency and effectiveness of this value chain are critical for ensuring that cutting-edge wafer grinding technology reaches the semiconductor manufacturing floor reliably and supports the continuous innovation in the global electronics industry.

Wafer Grinding Equipment Market Potential Customers

The primary potential customers for wafer grinding equipment are entities deeply embedded within the semiconductor manufacturing ecosystem, ranging from the largest integrated device manufacturers to specialized research and development institutions. These end-users share a common requirement for precise wafer thinning and surface preparation to meet the stringent demands of modern electronic devices. Integrated Device Manufacturers (IDMs) represent a significant customer segment as they control the entire chip production process from design to fabrication, often requiring a wide range of grinding capabilities for their diverse product portfolios, including memory, logic, and analog components. Their investment decisions are typically driven by the need to maintain technological leadership, optimize internal production costs, and ensure consistent quality across their vertically integrated operations. For IDMs, acquiring state-of-the-art grinding equipment is a strategic move to enable next-generation product development and improve manufacturing efficiencies.

Another crucial customer segment consists of semiconductor foundries, which are specialized manufacturing facilities that produce integrated circuits for various fabless semiconductor companies. As foundries operate on a contract manufacturing model, their business success hinges on offering advanced process technologies and high-volume production capabilities. This necessitates continuous investment in the latest wafer processing equipment, including advanced grinding solutions, to handle a diverse range of wafer types and specifications for their global clientele. Foundries are driven by the need to support multiple technology nodes, from mature processes to leading-edge architectures, and therefore require versatile and highly automated grinding systems that can deliver precision, throughput, and reliability under stringent production schedules. Their buying decisions are influenced by factors such as equipment uptime, total cost of ownership, and the ability to process new materials like SiC and GaN, which are increasingly demanded by their customers for power and RF applications.

Furthermore, Outsourced Semiconductor Assembly and Test (OSAT) companies are emerging as increasingly important customers. While traditionally focused on packaging and testing, the evolution of advanced packaging technologies such as 3D ICs, fan-out wafer-level packaging, and chiplets requires wafers to be thinned to extreme tolerances before assembly. OSATs are therefore investing in sophisticated wafer grinding equipment to provide these critical services, enabling their clients to achieve smaller form factors, improved performance, and higher integration densities. Their demand is driven by the imperative to offer comprehensive backend solutions that complement the front-end fabrication processes, thus supporting the entire semiconductor manufacturing flow. Additionally, university research laboratories and corporate R&D centers also represent a niche but important customer base. These institutions acquire grinding equipment for fundamental research in material science, process development, and prototyping of novel semiconductor devices, contributing to future advancements in the industry and often influencing the adoption of new technologies within the broader market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 920 Million |

| Market Forecast in 2033 | USD 1.48 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DISCO Corporation, Tokyo Seimitsu Co., Ltd. (Accretech), K&S (Kulicke & Soffa Industries, Inc.), Ebara Corporation, Revasum, Dynatex International, Lapmaster Wolters, Okamoto Machine Tool Works Ltd., Strasbaugh (a division of SPTS Technologies), Axus Technology, WaferPro (part of GlobalWafers), SpeedFam-IPEC, G&N GMN Paul Müller Industrie GmbH & Co. KG, Suzhou Delphi Laser Co., Ltd., Shenyang Advanced Grinding Co., Ltd., Advanced Micro-Fabrication Equipment Inc. (AMEC) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Grinding Equipment Market Key Technology Landscape

The Wafer Grinding Equipment Market is characterized by a rapidly evolving technological landscape, driven by the relentless pursuit of thinner, flatter, and damage-free wafers crucial for next-generation semiconductor devices. A pivotal technology in this domain is ultra-precision grinding, which utilizes advanced grinding wheel materials and sophisticated control systems to achieve sub-micron level thickness uniformity and surface roughness while minimizing subsurface damage. This precision is vital for high-performance logic and memory chips, as well as for delicate MEMS and power devices. The development of specialized grinding wheels with tailored abrasive sizes, bonding agents, and structures is continuous, often incorporating diamond or other super-hard materials to efficiently process extremely hard substrates like silicon carbide (SiC) and gallium nitride (GaN) with high material removal rates and superior surface quality.

Another significant technological trend is the integration of advanced metrology and in-situ monitoring capabilities directly into the grinding equipment. These systems employ optical sensors, laser interferometers, and eddy current sensors to provide real-time feedback on wafer thickness, flatness, and parallelism during the grinding process. This immediate data allows for dynamic adjustments to grinding parameters, ensuring exceptional accuracy and reducing the need for post-process inspection, thereby improving throughput and yield. Furthermore, the advent of Chemical Mechanical Planarization (CMP) integration, where grinding equipment can be seamlessly linked with subsequent CMP steps, represents a holistic approach to wafer thinning and surface planarization. This integrated process mitigates potential damage from mechanical grinding by following up with a gentle chemical-mechanical polishing step, resulting in atomic-level flatness and defect-free surfaces crucial for advanced lithography and stacking processes.

Beyond the core grinding mechanics, automation and smart manufacturing principles are profoundly influencing the technological landscape. Modern wafer grinding equipment incorporates highly sophisticated robotic wafer handling systems, automated cleaning modules, and intelligent software for recipe management and process control, aligning with Industry 4.0 initiatives. This automation not only enhances throughput and reduces labor costs but also minimizes human error and contamination risks. Furthermore, the adoption of Artificial Intelligence (AI) and Machine Learning (ML) is gaining traction, with these technologies being used for predictive maintenance, real-time process optimization, and anomaly detection. By analyzing vast amounts of sensor data, AI can predict equipment failures, suggest optimal grinding parameters, and identify subtle defects, leading to improved uptime, enhanced grinding efficiency, and higher wafer quality. The convergence of these advanced grinding mechanics, integrated metrology, automation, and AI-driven intelligence defines the cutting-edge technological evolution within the wafer grinding equipment market, enabling the ongoing advancements in the semiconductor industry.

Regional Highlights

- Asia Pacific (APAC): The APAC region stands as the undisputed powerhouse in the Wafer Grinding Equipment Market, primarily driven by the concentration of global semiconductor manufacturing giants in Taiwan, South Korea, China, and Japan. Countries like Taiwan (TSMC, UMC) and South Korea (Samsung, SK Hynix) are at the forefront of advanced logic and memory production, necessitating continuous investment in state-of-the-art grinding equipment for ultra-thin wafers and advanced packaging. China's ambitious drive for self-sufficiency in semiconductor manufacturing, coupled with significant government investment, fuels substantial demand for both domestic and imported grinding solutions. Japan, a hub for advanced materials and equipment suppliers, also maintains a strong presence, contributing to technological innovation and market supply. The rapid expansion of electronics manufacturing, 5G infrastructure, and electric vehicle production across the region further solidifies APAC's dominant position and sustained growth in this market.

- North America: North America represents a mature yet dynamic market, characterized by significant R&D investments, a strong presence of fabless design houses, and a growing emphasis on re-shoring and strengthening domestic semiconductor manufacturing capabilities. The United States, in particular, is witnessing renewed investment in advanced packaging and specialty semiconductor fabs, driven by government incentives and strategic initiatives. Demand for wafer grinding equipment here is propelled by innovation in high-performance computing, AI accelerators, defense, and aerospace applications, often requiring specialized grinding solutions for unique materials and stringent specifications. Leading equipment manufacturers also have a strong R&D base in North America, contributing to technological advancements.

- Europe: The European market for wafer grinding equipment is driven by its strong automotive and industrial sectors, alongside niche strengths in power semiconductors, MEMS, and research. Countries like Germany, France, and Italy are investing in advanced manufacturing capacities for automotive electronics, renewable energy components, and smart industrial systems, which increasingly rely on SiC and GaN power devices requiring precise wafer thinning. While not as dominant in high-volume logic and memory production as APAC, Europe's focus on specialty semiconductors and robust R&D in materials science ensures a steady demand for high-precision grinding solutions and contributes to technological development in the sector.

- Latin America & Middle East and Africa (MEA): These regions represent emerging markets for wafer grinding equipment, with nascent but growing semiconductor industries. Latin America, particularly countries like Brazil and Mexico, is seeing increasing investment in electronics assembly and manufacturing, which could eventually lead to demand for front-end processing equipment. The MEA region, particularly the UAE and Saudi Arabia, is diversifying its economies, with some strategic investments in technology and manufacturing infrastructure. While currently smaller in market share, the long-term potential for growth in industrialization and digitalization initiatives in these regions could gradually contribute to the demand for wafer grinding equipment, especially for more accessible semi-automatic or refurbished systems initially.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Grinding Equipment Market.- DISCO Corporation

- Tokyo Seimitsu Co., Ltd. (Accretech)

- K&S (Kulicke & Soffa Industries, Inc.)

- Ebara Corporation

- Revasum

- Dynatex International

- Lapmaster Wolters

- Okamoto Machine Tool Works Ltd.

- Strasbaugh (a division of SPTS Technologies)

- Axus Technology

- WaferPro (part of GlobalWafers)

- SpeedFam-IPEC

- G&N GMN Paul Müller Industrie GmbH & Co. KG

- Suzhou Delphi Laser Co., Ltd.

- Shenyang Advanced Grinding Co., Ltd.

- Advanced Micro-Fabrication Equipment Inc. (AMEC)

- CETEK Corp.

- Universal Photonics Inc.

- Nissin Machine Works Ltd.

- TOYODA MACHINERY USA (part of JTEKT Corporation)

Frequently Asked Questions

What is wafer grinding equipment and why is it crucial in semiconductor manufacturing?

Wafer grinding equipment refers to highly specialized machinery used to precisely reduce the thickness of semiconductor wafers. This process is crucial because modern electronic devices demand progressively thinner wafers for advanced packaging technologies, improved thermal management, and enhanced electrical performance. By thinning wafers, these machines enable the production of smaller, more powerful, and energy-efficient integrated circuits, directly supporting the miniaturization trend across consumer electronics, automotive, and telecommunications sectors. The equipment ensures uniform thickness, optimal flatness, and minimal subsurface damage, all of which are critical for the subsequent manufacturing steps and the final device reliability.

What are the key drivers propelling the growth of the Wafer Grinding Equipment Market?

The market's growth is primarily driven by the escalating global demand for advanced semiconductor devices, fueled by the proliferation of technologies such as 5G, Artificial Intelligence (AI), the Internet of Things (IoT), and electric vehicles. These applications necessitate ultra-thin wafers for advanced packaging techniques like 3D ICs and fan-out wafer-level packaging. Additionally, the continuous trend towards device miniaturization in consumer electronics and the increasing adoption of wide bandgap (WBG) materials like silicon carbide (SiC) and gallium nitride (GaN) for high-performance power electronics are significant drivers, as these materials require specialized and precise grinding solutions.

How does Artificial Intelligence (AI) impact the Wafer Grinding Equipment Market?

AI is transforming the Wafer Grinding Equipment Market by enhancing process optimization, enabling predictive maintenance, and improving quality control. AI algorithms analyze real-time sensor data to predict equipment failures, allowing for proactive servicing and minimizing downtime. They also optimize grinding parameters to achieve higher precision, better surface quality, and improved yield. AI-powered vision systems detect microscopic defects, while machine learning models provide data-driven insights for continuous process improvement. This integration leads to more efficient, reliable, and cost-effective wafer grinding operations, aligning with Industry 4.0 principles.

Which regions are leading the demand for wafer grinding equipment, and why?

The Asia Pacific (APAC) region is the dominant force in the Wafer Grinding Equipment Market, primarily due to the high concentration of major semiconductor manufacturing hubs in countries like Taiwan, South Korea, China, and Japan. These countries are global leaders in producing advanced logic and memory chips, continuously investing in cutting-edge fabrication facilities that require the latest grinding technologies. North America and Europe also contribute significantly, driven by R&D in specialty semiconductors, automotive electronics, and a focus on strengthening domestic manufacturing capabilities. The sheer volume of semiconductor production and ongoing technological advancements in APAC underpin its market leadership.

What are the primary types of wafer grinding equipment and their applications?

Wafer grinding equipment is primarily segmented into Fully Automatic Grinding Equipment and Semi-Automatic Grinding Equipment. Fully automatic systems are designed for high-volume, continuous production with minimal human intervention, offering superior throughput and consistency, making them ideal for large foundries and IDMs producing logic and memory devices. Semi-automatic systems offer more flexibility and are often favored by smaller fabs, R&D facilities, or for specialized, lower-volume applications where customized processes are required. Both types are essential for thinning wafers used in a broad spectrum of applications, including high-performance computing, power electronics, MEMS, RF devices, and optoelectronics, catering to diverse industry needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager