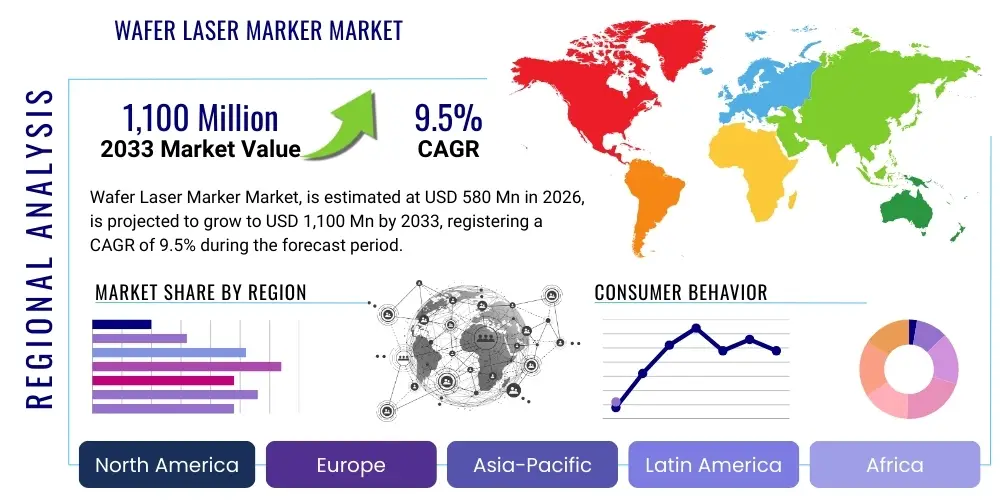

Wafer Laser Marker Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437373 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Wafer Laser Marker Market Size

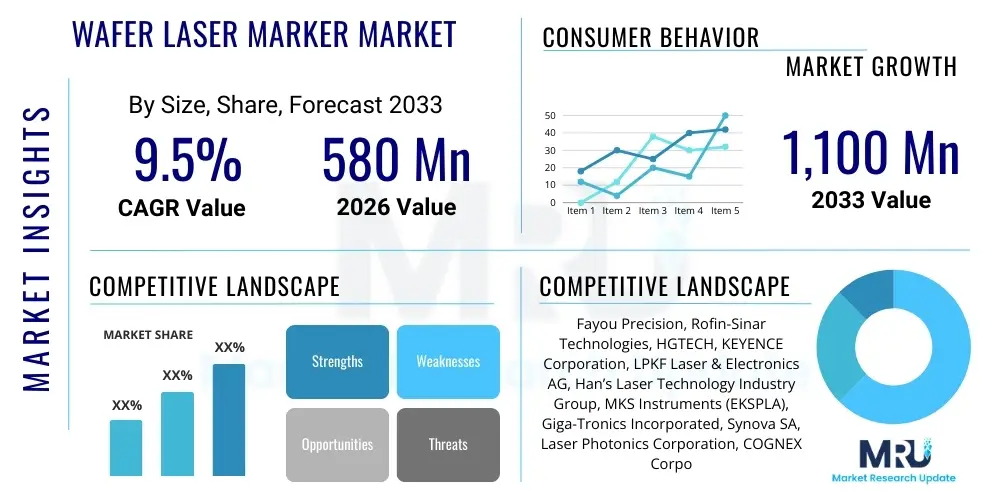

The Wafer Laser Marker Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 580 Million in 2026 and is projected to reach USD 1,100 Million by the end of the forecast period in 2033.

Wafer Laser Marker Market introduction

The Wafer Laser Marker Market encompasses the specialized equipment used for inscribing permanent, high-contrast, and highly accurate identification marks (such as alphanumeric codes, 2D barcodes, or proprietary symbols) onto semiconductor wafers. These marks are crucial for traceability, quality control, inventory management, and process monitoring throughout the complex semiconductor manufacturing lifecycle, from initial silicon processing to final device packaging. The technology typically utilizes high-precision solid-state lasers, including Diode-Pumped Solid-State (DPSS) lasers, fiber lasers, and increasingly, ultrafast lasers (picosecond and femtosecond) to ensure minimal thermal damage to the sensitive wafer material.

The primary application sectors driving demand for these markers include semiconductor fabrication plants (fabs), integrated device manufacturers (IDMs), and outsourced semiconductor assembly and test (OSAT) facilities. Key benefits derived from implementing advanced wafer laser marking systems include enhanced yield rates due to superior traceability, compliance with global industry standards (such as SEMI standards for data matrix marking), and the ability to process increasingly thin and brittle wafers without inducing micro-cracks or affecting electrical properties. Furthermore, modern laser markers offer improved throughput and automation capabilities, seamlessly integrating into high-volume manufacturing lines.

Driving factors for market expansion are fundamentally linked to the proliferation of advanced electronics, including 5G infrastructure, artificial intelligence (AI) hardware, high-performance computing (HPC), and the automotive sector's shift towards electric vehicles (EVs) and autonomous systems. Each of these applications requires increasingly complex, miniaturized, and perfectly traceable semiconductor components, necessitating superior marking solutions. The continuous drive toward higher integration density (Moore’s Law) and the subsequent requirement for marking smaller features on sensitive materials further fuels the adoption of next-generation, non-damaging laser marking technologies, ensuring robust market growth over the forecast period.

Wafer Laser Marker Market Executive Summary

The global Wafer Laser Marker Market exhibits robust growth, primarily fueled by significant investments in new fabrication capacity across Asia Pacific, driven by government subsidies and strategic national initiatives to bolster domestic chip production. Business trends highlight a strong shift toward ultrafast laser systems (picosecond and femtosecond lasers) offering cold ablation characteristics, which minimize heat-affected zones (HAZ) and are critical for marking advanced silicon carbide (SiC) and gallium nitride (GaN) power wafers and extremely thin silicon wafers. Technological specialization is paramount, with leading manufacturers focusing on developing highly automated systems capable of in-line integration and supporting advanced marking techniques like deep UV marking for high-resolution requirements.

Regionally, Asia Pacific dominates the market landscape, largely due to the concentration of major semiconductor manufacturing hubs in countries such as Taiwan, South Korea, China, and Japan, which are aggressively expanding their 300mm wafer production capabilities. North America and Europe, while smaller in production volume, represent critical markets for technological innovation and high-value niche applications, especially in aerospace and high-reliability defense electronics. Segment-wise, the 300mm wafer size segment maintains the largest market share, but the emerging technologies segment, particularly focusing on SiC and GaN materials for power electronics, is projected to demonstrate the fastest growth rate, demanding specialized laser marking solutions suitable for wide-bandgap semiconductors.

The competitive environment is characterized by intense focus on system uptime, reliability, and sophisticated software integration capabilities, including advanced vision systems for mark verification and alignment. Market participants are leveraging strategic collaborations with wafer handling equipment providers to offer integrated, turnkey solutions. Furthermore, increasing regulatory requirements concerning product lifecycle traceability, especially within critical industries, mandate the adoption of high-standard marking solutions, solidifying the continuous demand for precise and durable wafer laser markers across all major end-user verticals.

AI Impact Analysis on Wafer Laser Marker Market

Common user questions regarding AI's influence center on how artificial intelligence can enhance the precision, efficiency, and reliability of the marking process, especially in minimizing defects and optimizing throughput. Users frequently inquire about the feasibility of using machine learning (ML) models for real-time quality inspection of minute laser marks, automated adjustment of laser parameters based on subtle wafer material variations, and predictive maintenance of the marking equipment itself. The key concerns revolve around the integration complexity of AI vision systems with existing fabrication infrastructure and the data required to train robust ML models for high-stakes, high-volume manufacturing environments. Users expect AI to reduce the dependence on human inspection and ensure that every mark is perfectly legible for subsequent automated handling processes.

AI’s primary impact on the Wafer Laser Marker Market is the transition from static, pre-programmed marking processes to adaptive, intelligent operations. AI-driven machine vision systems are becoming indispensable for real-time mark quality verification (MQV), using deep learning algorithms to identify subtle defects, incomplete marks, or distortions that traditional rule-based systems might miss. This significantly enhances traceability reliability, particularly for highly complex 2D codes marked on challenging surfaces like polished silicon or thin film layers. Furthermore, AI is utilized in predictive maintenance, analyzing operational data such as laser power fluctuations, galvanometer speed, and environmental conditions to forecast potential failures, thereby maximizing equipment uptime—a critical factor in high-volume semiconductor fabrication.

The implementation of AI algorithms also facilitates dynamic process optimization. For instance, ML models can be trained on vast datasets correlating wafer material properties (e.g., doping concentration, surface uniformity) with optimal laser power, frequency, and focus settings. This allows the marking system to automatically adjust parameters on-the-fly for each individual wafer or batch, ensuring consistent mark quality across diverse materials and manufacturing conditions, which is essential for specialized wafers like SiC or GaN. This enhanced adaptivity, enabled by AI, positions laser marking systems as smarter tools integrated within the overarching Industry 4.0 framework of the smart factory.

- AI enhances Mark Quality Verification (MQV) using deep learning for defect detection.

- Machine Learning optimizes laser parameters in real-time based on wafer material variations.

- Predictive maintenance driven by AI maximizes equipment uptime and operational efficiency.

- Automated mark placement and alignment are improved using AI-enhanced vision guidance systems.

- AI facilitates compliance tracking by generating comprehensive, auditable quality data for each marked wafer.

DRO & Impact Forces Of Wafer Laser Marker Market

The Wafer Laser Marker Market is primarily driven by the relentless demand for smaller, faster, and higher-density semiconductor devices, which necessitates perfect traceability through precise and non-damaging marking solutions. Restraints include the high initial capital investment required for advanced laser systems and the stringent technical challenge of marking emerging, highly sensitive materials like thin films and wide-bandgap semiconductors without inducing crystal lattice damage. However, opportunities abound in the shift towards 3D integration (e.g., 3D NAND and advanced packaging), demanding specialized deep-marking or side-marking capabilities, and the massive global push for automotive electronics and IoT devices, which require high-reliability marking for long-term field traceability. These forces collectively propel market innovation, with technological advancements focusing heavily on cold ablation techniques to mitigate material damage and ensure component integrity.

Market growth is significantly impacted by external forces, notably regulatory compliance and the geopolitical landscape surrounding semiconductor supply chains. The stringent quality and traceability standards imposed by global automotive and aerospace bodies compel manufacturers to adopt best-in-class marking solutions. The current trend of geopolitical diversification and capacity expansion (such as the CHIPS Act in the US and similar initiatives in the EU) is creating localized demand spikes for new fabrication equipment, including laser markers, as companies establish new production facilities outside traditional Asian manufacturing hubs. These capacity expansions represent direct, measurable market growth drivers that ensure sustained investment in marking infrastructure globally.

Furthermore, the competitive dynamic is heavily influenced by rapid technological obsolescence; companies must continually invest in R&D to provide faster, cleaner, and more adaptable marking solutions. The move towards 450mm wafers (though currently limited) and the acceleration of advanced packaging techniques (e.g., Fan-Out Wafer Level Packaging, FOWLP) are major technological impact forces. FOWLP, in particular, requires unique marking strategies suitable for reconstructed wafers or mold compounds, pushing vendors to develop versatile marking platforms capable of handling heterogeneous materials and complex geometric configurations. Success in this market is intrinsically linked to the ability to integrate seamlessly with robotic wafer handling and factory automation systems.

Segmentation Analysis

The Wafer Laser Marker Market is comprehensively segmented based on technology type, wafer size, application, and end-user industry, providing a granular view of specific market dynamics. The technology segmentation differentiates between traditional marking techniques (e.g., CO2 or YAG lasers for surface marking) and advanced methods, predominantly utilizing solid-state or ultrafast lasers (DPSS, Fiber, Picosecond, Femtosecond). Wafer size remains a critical segmentation factor, with 300mm wafers dominating volume production and 200mm wafers maintaining relevance in legacy systems and specialty components (e.g., MEMS and power electronics). Application segmentation covers both front-side and back-side marking, as well as notch/flat marking essential for orientation control.

The end-user segmentation is diverse, spanning Integrated Device Manufacturers (IDMs) who handle all phases of production in-house, Foundries that specialize in fabrication services, and OSAT companies focused on assembly and testing. The growing demand for specialized markers suitable for emerging wide-bandgap (WBG) materials like silicon carbide (SiC) and gallium nitride (GaN) is establishing a rapidly accelerating niche segment within the application category, distinct from traditional silicon processing. Geographic segmentation confirms Asia Pacific's commanding market leadership due to dense manufacturing activity, followed by North America and Europe, which focus heavily on high-value, specialized marking systems.

Understanding these segments is crucial for strategic planning. For instance, while IDMs prioritize high-throughput, integrated solutions, emerging markets for power electronics demand systems optimized for minimal sub-surface damage on brittle SiC substrates, driving technological preference toward cold ablation lasers. The ongoing standardization efforts by organizations like SEMI continually influence the requirements across all segments, ensuring marks are machine-readable and comply with global traceability standards, driving demand for markers equipped with high-performance vision verification systems.

- By Technology:

- Diode-Pumped Solid-State (DPSS) Lasers

- Fiber Lasers

- Ultrafast Lasers (Picosecond, Femtosecond)

- Deep UV Lasers (for high-resolution, minimal damage)

- By Wafer Size:

- 150mm and Below

- 200mm

- 300mm

- 450mm (Emerging)

- By Application:

- Front-Side Marking

- Back-Side Marking

- Notch/Flat Marking

- By End-User:

- Integrated Device Manufacturers (IDMs)

- Foundries

- Outsourced Semiconductor Assembly and Test (OSAT)

- Specialty Semiconductor Manufacturers (e.g., SiC/GaN)

Value Chain Analysis For Wafer Laser Marker Market

The value chain for the Wafer Laser Marker Market begins with upstream suppliers providing critical components such as specialized laser sources (e.g., fiber oscillators, pump diodes), high-precision galvanometer scanners, advanced optical components (lenses, beam expanders), and industrial PCs/controllers. These components require high reliability and are often sourced from highly specialized global vendors. Upstream efficiency and quality directly influence the performance and cost structure of the final marking system. Maintaining stable relationships with these specialized suppliers, particularly those providing unique ultrafast laser technologies, is a key strategic imperative for system integrators.

The core of the value chain involves the system integrators and original equipment manufacturers (OEMs) who design, assemble, and integrate the complete laser marking solution, including the laser engine, sophisticated vision systems, automated wafer handling mechanisms (using robotics or sorters), and proprietary control software. This stage adds the highest value through intellectual property related to precision engineering, laser process control, and software optimization for specific wafer materials and industry standards (SEMI compliance). Direct sales and post-sales service, including maintenance contracts and spare parts, form a crucial revenue stream for these OEMs.

Downstream, the distribution channel is primarily direct, especially for large-scale fabrication facilities (fabs) that require complex integration and customization. OEMs often employ direct sales forces and application engineers to interface directly with IDMs, Foundries, and OSAT players. Indirect distribution may occur through regional representatives or distributors in smaller emerging markets or for standardized, lower-cost systems. The ultimate users—semiconductor manufacturers—demand continuous technical support and application expertise to ensure the marking process maintains zero impact on device performance, making service and support a critical differentiator in the final stages of the value chain.

Wafer Laser Marker Market Potential Customers

The primary customers and end-users of Wafer Laser Marker systems are entities heavily involved in the semiconductor manufacturing lifecycle, where traceability is mandatory for quality control and process integrity. This includes major Integrated Device Manufacturers (IDMs) such as Intel, Samsung, and Micron, which utilize these systems across their extensive, vertically integrated production lines, from initial wafer processing to final fabrication steps. These IDMs require high-throughput, fully automated, and highly reliable systems capable of seamless integration into their proprietary manufacturing execution systems (MES).

Another crucial customer segment comprises Pure-Play Foundries, including TSMC, GlobalFoundries, and UMC, which fabricate chips for numerous external design houses. Traceability is paramount for foundries to manage vast numbers of distinct customer products simultaneously, making laser marking essential for logistics and process segmentation. Similarly, Outsourced Semiconductor Assembly and Test (OSAT) companies, such as ASE and Amkor, represent significant buyers, particularly for back-side marking and marking associated with advanced packaging steps, ensuring components can be tracked through final assembly.

Furthermore, specialized semiconductor manufacturers focusing on niche, high-growth areas constitute an expanding customer base. This includes companies producing advanced MEMS devices, optoelectronics, and, most significantly, power electronics based on Silicon Carbide (SiC) and Gallium Nitride (GaN). These specialty manufacturers require highly customized laser markers that offer ultra-low damage marking capabilities due to the inherent material sensitivities and high costs associated with WBG substrates. Universities and research institutes involved in semiconductor R&D also occasionally procure smaller, flexible marking systems for prototyping and materials research.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Million |

| Market Forecast in 2033 | USD 1,100 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fayou Precision, Rofin-Sinar Technologies, HGTECH, KEYENCE Corporation, LPKF Laser & Electronics AG, Han’s Laser Technology Industry Group, MKS Instruments (EKSPLA), Giga-Tronics Incorporated, Synova SA, Laser Photonics Corporation, COGNEX Corporation, Trotec Laser GmbH, Trumpf Group, Markem-Imaje, Telesis Technologies Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Laser Marker Market Key Technology Landscape

The technological landscape of the Wafer Laser Marker Market is undergoing continuous evolution, driven by the need for higher precision, faster throughput, and reduced material damage. A pivotal trend is the increasing adoption of ultrafast lasers, specifically picosecond (ps) and femtosecond (fs) pulsed lasers. These systems execute a process known as "cold ablation," where the pulse duration is shorter than the heat diffusion time, preventing significant thermal energy transfer to the surrounding wafer material. This capability is crucial for advanced manufacturing processes involving thin, fragile wafers (less than 100 micrometers thick) and expensive, heat-sensitive wide-bandgap materials like SiC and GaN, ensuring that the marking process does not compromise the electrical integrity of the underlying circuitry or crystal structure.

Another significant area of development is Deep UV (DUV) laser marking technology. DUV lasers operate at shorter wavelengths (typically 355nm or below), allowing for extremely fine focusing and smaller spot sizes. This enables the creation of minute, high-resolution marks essential for the increasingly dense data matrix codes required on advanced 300mm wafers. DUV marking often results in minimal material change compared to infrared or green lasers, which is advantageous for non-contact traceability applications and adherence to strict cleanliness standards within cleanroom environments. The integration of DUV marking capability is becoming a competitive necessity for high-end marker vendors.

Furthermore, the incorporation of advanced machine vision and galvanometer scanning systems is central to the modern market. High-speed, high-accuracy galvanometers enable fast beam positioning essential for high-volume production, while sophisticated vision systems, often utilizing AI and deep learning, are mandatory for real-time verification of the mark quality (MQV). These integrated vision systems ensure the marks conform to SEMI standards (e.g., SEMI T7 and T12) and are perfectly aligned despite slight variations in wafer placement or orientation. The trend is moving towards fully integrated, software-driven marking cells that communicate directly with the fab's central control system, minimizing human intervention and maximizing process control.

Regional Highlights

- Asia Pacific (APAC): APAC is the unequivocally dominant region, holding the largest market share due to the concentration of major semiconductor manufacturing bases in countries like China, Taiwan, South Korea, and Japan. Massive governmental investments and private sector expansion in 300mm wafer fabrication capacity, particularly in China and Taiwan, are driving immense demand for high-throughput, integrated laser marking solutions. The regional market is highly competitive, characterized by rapid technological adoption and price sensitivity, although the demand for high-end systems for advanced packaging (3D ICs) is accelerating.

- North America: North America represents a market focused on high-technology, niche applications, and R&D, particularly within aerospace, defense, and high-performance computing sectors. Driven by initiatives like the CHIPS Act, there is significant ongoing investment in establishing new domestic fabrication facilities, creating substantial new demand for advanced, highly secure traceability systems. North American buyers prioritize precision, system reliability, and cutting-edge cold ablation technologies suitable for new material research and high-reliability components.

- Europe: The European market, while smaller in volume than APAC, is crucial for specialized industrial applications, automotive electronics (especially power semiconductors for EVs), and industrial IoT. Europe is a key center for the development and manufacturing of wide-bandgap materials (SiC/GaN) and advanced manufacturing equipment. This focus on premium, high-reliability components translates into high demand for high-precision, low-damage laser marking systems, often procured directly from specialized European equipment manufacturers.

- Latin America, Middle East, and Africa (MEA): These regions currently hold a smaller share but are characterized by emerging manufacturing centers, primarily focusing on assembly, testing, or niche foundries. Market growth in these areas is often tied to foreign direct investment in localized assembly and test operations. Demand is typically concentrated on cost-effective, reliable marking solutions for standard silicon wafers, though strategic growth in MEA is anticipated following investments in local technology hubs and diversifying economies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Laser Marker Market.- Fayou Precision

- Rofin-Sinar Technologies (Coherent, Inc.)

- HGTECH

- KEYENCE Corporation

- LPKF Laser & Electronics AG

- Han’s Laser Technology Industry Group

- MKS Instruments (EKSPLA)

- Giga-Tronics Incorporated

- Synova SA

- Laser Photonics Corporation

- COGNEX Corporation

- Trotec Laser GmbH

- Trumpf Group

- Markem-Imaje

- Telesis Technologies Inc.

- FOBA Laser Marking + Engraving

- Hitachi High-Tech Corporation

- Jenoptik AG

- DMG MORI CO., LTD.

- InnoLas Solutions GmbH

Frequently Asked Questions

Analyze common user questions about the Wafer Laser Marker market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical difference between ultrafast laser marking and traditional DPSS laser marking for silicon wafers?

The primary technical distinction lies in thermal effect management. Traditional DPSS lasers (nanosecond pulse duration) rely on thermal vaporization, which creates a larger heat-affected zone (HAZ) and can induce stress or micro-cracking in the wafer material, particularly for thin or sensitive substrates. Ultrafast lasers (picosecond/femto-second pulse durations) use "cold ablation," where the laser pulse duration is shorter than the material’s thermal relaxation time. This ablates the material with minimal heat transfer, resulting in extremely clean marks, zero significant HAZ, and superior structural integrity, making them essential for high-value SiC, GaN, and advanced silicon applications.

How do Wafer Laser Markers ensure compliance with international semiconductor traceability standards?

Compliance with international standards, particularly the SEMI standards (e.g., SEMI T7 for Data Matrix Marking and SEMI T12 for 300mm wafer marking), is ensured through integrated, high-performance machine vision systems and validated software. The marker first inscribes the standardized code (typically a 2D Data Matrix or OCR code) and immediately utilizes an integrated camera and vision processing software to verify the mark's quality, readability, contrast, and adherence to specific geometric dimensions. The software logs the verification results, providing auditable proof of compliance and ensuring the mark can be reliably read by automated handling equipment throughout the fabrication process.

What role does marking capability on wide-bandgap (WBG) materials play in market growth?

Marking capability on WBG materials, specifically Silicon Carbide (SiC) and Gallium Nitride (GaN), is a critical driver of market value growth. SiC and GaN are essential for high-efficiency power electronics used in electric vehicles and 5G infrastructure. These materials are significantly harder, more brittle, and more expensive than traditional silicon, making them highly susceptible to laser-induced damage. The inability to mark these wafers without damaging their electrical properties necessitates the use of high-precision, low-damage ultrafast laser markers, driving technological adoption and commanding higher prices for specialized equipment optimized for these high-growth material segments.

What are the key integration challenges facing Wafer Laser Marker systems in fully automated fabs?

Key integration challenges revolve around system communication and throughput synchronization. Markers must seamlessly interface with the central Manufacturing Execution System (MES) and automated material handling systems (AMHS) to receive marking data and report quality verification results in real-time. Specific challenges include achieving zero downtime through robust robotic interfacing, maintaining strict environmental controls (cleanliness class compliance), and synchronizing the marking speed (cycle time) with the wafer sorters and process tools to prevent bottlenecks, which requires sophisticated motion control and customized software integration protocols.

Why is back-side wafer marking becoming increasingly important in advanced packaging?

Back-side marking is gaining importance primarily due to the rise of advanced packaging techniques like Fan-Out Wafer Level Packaging (FOWLP) and 3D stacking. In these complex structures, the front side of the wafer containing the critical circuitry might be obscured, covered by redistribution layers (RDLs), or integrated directly into a stack. Marking the back side ensures permanent, accessible traceability throughout the assembly and test phases. Furthermore, marking the back side reduces the risk of thermal interference or contamination on the sensitive device structures located on the front side, preserving final device performance and reliability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager