Wafer Laser Marking System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436170 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Wafer Laser Marking System Market Size

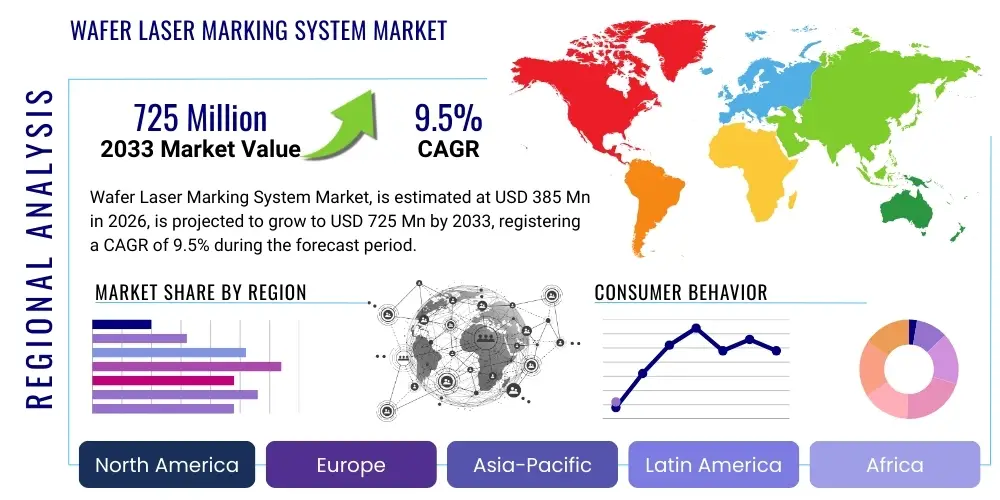

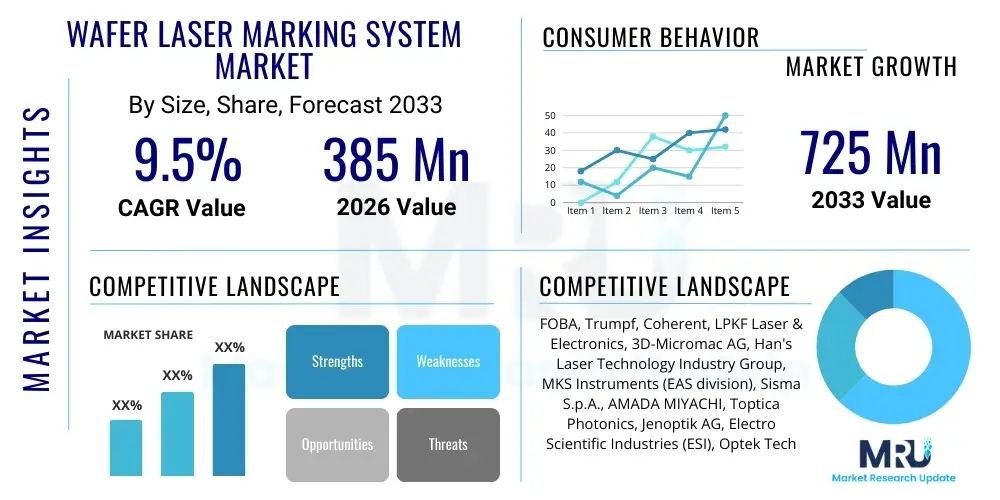

The Wafer Laser Marking System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $385 Million in 2026 and is projected to reach $725 Million by the end of the forecast period in 2033.

Wafer Laser Marking System Market introduction

The Wafer Laser Marking System Market encompasses highly specialized equipment essential for semiconductor fabrication, enabling non-contact, permanent identification codes to be inscribed onto silicon, gallium arsenide (GaAs), and other compound semiconductor wafers. These systems utilize advanced laser technology, primarily fiber, DPSS (Diode-Pumped Solid-State), or ultra-short pulse lasers (pico- and femtosecond), to create machine-readable marks (such as 2D Data Matrix codes or alphanumeric characters) with sub-micron precision, crucial for maintaining wafer integrity and maximizing die yield. The increasing complexity and high value of modern integrated circuits necessitate robust traceability throughout the manufacturing process, from raw ingot slicing to final packaging.

Major applications driving the demand for these systems include front-end processing (before dicing) for unique wafer identification (ID), internal logistics control, and quality assurance in high-volume production facilities (fabs). These systems are engineered to operate in stringent cleanroom environments, demanding high uptime and reliability while ensuring the marking process does not introduce micro-cracks or contaminants that could compromise the delicate semiconductor structure. The move toward smaller feature sizes, epitomized by advanced nodes below 10nm, places immense pressure on marking systems to deliver highly localized energy without heat-affected zones (HAZ).

The core benefits derived from employing cutting-edge wafer laser marking systems include enhanced production efficiency, streamlined inventory management, improved security against counterfeiting, and robust failure analysis capabilities. The primary driving factors are the exponential growth in global semiconductor demand fueled by emerging technologies like 5G infrastructure, Artificial Intelligence (AI), the Internet of Things (IoT), and high-performance computing (HPC). Furthermore, stringent regulatory requirements and industry standards emphasizing comprehensive traceability (e.g., SEMI standards) significantly bolster market expansion, pushing manufacturers to invest in the latest marking technology capable of handling future wafer material and size variations.

Wafer Laser Marking System Market Executive Summary

The Wafer Laser Marking System Market is characterized by intense technological competition and a critical dependence on the capital expenditure cycles of global semiconductor manufacturers (Fabs). Key business trends indicate a strong shift towards ultra-fast and ultra-precise laser sources, specifically femtosecond and picosecond lasers, which minimize thermal stress and damage during the marking process, crucial for high-value 300mm and emerging 450mm wafers. Furthermore, system integration capabilities, allowing seamless connection with Automated Material Handling Systems (AMHS) and Manufacturing Execution Systems (MES), represent a pivotal competitive differentiator. Vendors are also focusing on developing modular systems capable of handling various wafer materials and thickness profiles efficiently, addressing the growing diversification in semiconductor substrates (e.g., SiC, GaN for power electronics).

Regionally, the Asia Pacific (APAC) area dominates the market both in terms of consumption and manufacturing capacity, driven primarily by massive investments in semiconductor fabrication plants across mainland China, South Korea, Taiwan, and Japan. This dominance is intrinsically linked to the concentration of the world’s leading foundry and memory chip producers in the region. North America and Europe, while smaller in absolute market size, represent high-value segments, focusing heavily on R&D, advanced material processing, and specialized compound semiconductors. Regional trends highlight significant government incentives (such as the CHIPS Act in the US and the European Chips Act) aimed at bolstering domestic manufacturing capacity, which is expected to catalyze localized investment in ancillary equipment like laser marking systems during the latter half of the forecast period.

Segment trends reveal that the 300mm wafer size segment maintains the largest market share due to its entrenched position in high-volume memory and logic chip production. However, the 450mm segment, despite delayed deployment, holds substantial future opportunity, requiring entirely new marking system designs optimized for larger dimensions and potentially stricter thermal control protocols. By laser type, fiber lasers remain dominant for standard applications due to cost-effectiveness and reliability, while DPSS and particularly advanced ultra-short pulse lasers are witnessing the fastest adoption rate, driven by requirements for marking sensitive materials where subsurface marking or minimal penetration depth is mandatory for structural integrity and maximized die yield.

AI Impact Analysis on Wafer Laser Marking System Market

Common user questions regarding AI's impact on the Wafer Laser Marking System Market frequently center on how machine learning can improve mark quality verification, optimize laser parameter settings for varied wafer materials, and predict system failures. Users are highly concerned about achieving zero defects in marking, especially as feature sizes shrink and the cost per wafer increases. The consensus expectation is that AI will transition marking systems from simple mechanical inscription tools into intelligent, adaptive quality control units. This involves utilizing deep learning algorithms for real-time image processing of the inscribed codes, ensuring high readability (grade A) and automatically correcting laser pulse sequences based on immediate feedback regarding material response and surface condition variations, thereby drastically reducing scrap rates related to identification errors or subsurface damage. Furthermore, predictive maintenance powered by AI is a significant interest area, promising maximized uptime in 24/7 fabrication environments by forecasting component wear before critical failure.

- Real-Time Quality Assurance: AI-driven vision systems utilizing deep learning for instant verification and grading of 2D codes, ensuring SEMI standard compliance.

- Parameter Auto-Optimization: Machine learning models automatically adjusting laser power, pulse frequency, and focus based on input material properties (e.g., varying doping levels or crystal orientations).

- Predictive Maintenance: AI algorithms analyzing sensor data (vibration, temperature, power consumption) to forecast component degradation and schedule proactive servicing, minimizing unexpected downtime.

- Enhanced Traceability Analytics: Integrating marked data with factory-wide MES using AI to correlate physical wafer marks with processing history and potential failure points, streamlining root cause analysis.

- Defect Prediction and Mitigation: AI identifying subtle, pre-failure subsurface anomalies caused by the marking process, leading to preventative adjustments and higher long-term die yield.

DRO & Impact Forces Of Wafer Laser Marking System Market

The dynamics of the Wafer Laser Marking System Market are shaped by powerful Drivers, inherent Restraints, and transformative Opportunities, collectively known as DRO, which are subject to persistent Impact Forces from the underlying semiconductor industry cycle. The overwhelming driver is the necessity for complete and immutable traceability across the increasingly complex semiconductor supply chain, mandated by both regulatory bodies and end-users demanding authenticated components. This demand is amplified by the unrelenting march toward device miniaturization, which requires laser markers capable of extremely fine resolution marks that do not compromise the surrounding silicon structure. These drivers are heavily impacted by the cyclical nature of semiconductor capital expenditure (CapEx), where investment in marking systems often lags or coincides with major fab expansion announcements.

However, the market faces significant Restraints, most notably the extremely high initial capital cost associated with acquiring advanced laser marking systems, particularly those utilizing ultra-short pulse technology (pico/femtosecond) necessary for advanced nodes. Furthermore, the complexity involved in integrating these high-precision systems into existing automated cleanroom environments presents a technical hurdle. The primary impact force here is the pressure on Return on Investment (ROI) in high-volume manufacturing, necessitating that equipment providers guarantee maximum reliability and yield protection to justify the investment.

Opportunities abound, primarily driven by the transition to larger wafer sizes, specifically the anticipated but gradual rollout of 450mm wafers, which will necessitate completely new, larger-format marking system designs. Another significant opportunity lies in the burgeoning market for specialized compound semiconductors (SiC, GaN, GaAs), requiring customized laser parameters and beam control for marking non-silicon materials without crystalline damage. Furthermore, the integration of Industry 4.0 concepts, including AI for quality control and predictive maintenance, represents a substantial opportunity for vendors capable of delivering smart, connected marking solutions. These forces are amplified by the geopolitical drive for regional self-sufficiency in chip manufacturing, creating localized spikes in demand for integrated equipment.

Segmentation Analysis

The Wafer Laser Marking System Market is comprehensively segmented based on the type of laser employed, the primary application area, and the specific size of the semiconductor wafer being processed. This segmentation reflects the varied technological requirements and end-user needs across the diverse landscape of semiconductor manufacturing. Analysis shows that segmentation by laser type is critical, as the choice between Fiber, DPSS, and ultra-short pulse lasers directly correlates with the sensitivity of the wafer material and the required marking depth and precision. Similarly, application segmentation differentiates systems used for crucial front-end traceability (ID marking) from those deployed later in the packaging or inspection stages.

The largest segments are dictated by production volume, placing the 300mm wafer segment as the current volume leader, closely followed by the 200mm segment which remains robust due to legacy and specialized processes. The fastest growing segments, however, are associated with advanced technology adoption: ultra-short pulse lasers (due to superior yield protection) and the marking systems designed specifically for compound semiconductor applications, reflecting the rise of electric vehicles and 5G power electronics. Understanding these segmental dynamics is vital for manufacturers to tailor their product offerings and strategic investments.

- By Type

- Fiber Laser Marking Systems

- Diode-Pumped Solid-State (DPSS) Laser Marking Systems

- Ultra-Short Pulse (USP) Laser Marking Systems (Pico/Femtosecond)

- Others (CO2, Excimer)

- By Wafer Size

- 200mm Wafer

- 300mm Wafer

- 450mm Wafer (Emerging)

- By Application

- Wafer ID Marking (Front-End Traceability)

- Process Control Marking

- Defect Location Marking

- Subsurface Marking

Value Chain Analysis For Wafer Laser Marking System Market

The value chain for the Wafer Laser Marking System Market is highly structured and begins with the upstream supply of specialized components. This upstream segment is dominated by manufacturers of core laser sources (e.g., resonators, gain media, optics), advanced galvanometer scanning heads, and high-precision motion control systems. Key suppliers in this phase often represent specialized optics or photonics firms providing high-purity components critical for laser reliability and beam quality. The competitiveness at this stage is focused on component lifespan, thermal stability, and maximum power output suitable for industrial applications. Effective supply chain management is crucial, as global constraints on specialized optical components can severely impact the lead times for the final system assemblers.

The midstream involves the core system integrators and Original Equipment Manufacturers (OEMs) who design, assemble, and test the complete laser marking platforms. These companies integrate the laser source, vision system (often high-resolution cameras with advanced lighting), software control, and the mechanical wafer handling robotics (including load ports and end-effectors compatible with SMIF or FOUP standards). Direct distribution channels involve OEMs selling systems directly to large, Tier 1 semiconductor fabrication plants (foundries, IDMs, memory producers) through dedicated sales and technical support teams. This direct approach ensures high-touch service and customized system configuration based on specific cleanroom protocols and MES integration requirements.

The downstream segment encompasses the end-users, primarily semiconductor manufacturers, and the supporting services, including installation, calibration, maintenance, and ongoing technical support. Indirect channels are less common for high-end, custom-configured systems but may include specialized regional distributors or system integrators focusing on smaller labs or specialized compound semiconductor houses. The overall profitability of the value chain is heavily dependent on the post-sales service segment, where high-margin contracts for preventative maintenance and software upgrades provide sustained revenue streams for system providers, reflecting the critical, non-stop operational nature of semiconductor manufacturing.

Wafer Laser Marking System Market Potential Customers

The primary customers for Wafer Laser Marking Systems are organizations engaged in the manufacturing and processing of semiconductor wafers, where traceability and yield management are paramount. Integrated Device Manufacturers (IDMs) and pure-play semiconductor foundries, such as TSMC, Samsung, Intel, and GlobalFoundries, represent the largest volume purchasers. These entities require multiple, high-throughput systems integrated directly into their automated fabrication lines (fabs) handling 200mm and 300mm silicon wafers for logic, memory (DRAM, NAND), and microprocessors. Their purchasing decisions are driven by system reliability, throughput metrics, guaranteed marking quality (readability), and seamless integration with existing factory automation software and hardware.

Beyond the high-volume silicon players, another significant customer segment comprises manufacturers specializing in compound semiconductors, including those producing Gallium Arsenide (GaAs), Silicon Carbide (SiC), and Gallium Nitride (GaN) wafers. These materials are crucial for high-power electronics, RF components (5G), and LEDs. Although the volume is lower than silicon, these customers demand highly specialized ultra-short pulse systems due to the extreme sensitivity of the substrate materials to thermal damage. Furthermore, academic research institutions, university cleanrooms, and specialized semiconductor research labs also constitute potential customers, often requiring flexible, lower-volume systems for process development and experimentation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $385 Million |

| Market Forecast in 2033 | $725 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FOBA, Trumpf, Coherent, LPKF Laser & Electronics, 3D-Micromac AG, Han's Laser Technology Industry Group, MKS Instruments (EAS division), Sisma S.p.A., AMADA MIYACHI, Toptica Photonics, Jenoptik AG, Electro Scientific Industries (ESI), Optek Technology, Laserline GmbH, Mecco Marking & Traceability, MacDermid Alpha Electronics Solutions, Novanta Inc., Keyence Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Laser Marking System Market Key Technology Landscape

The technology landscape of the Wafer Laser Marking System Market is rapidly evolving, driven by the fundamental need to minimize damage while achieving high-contrast, permanent marks at micron or sub-micron scales. The most critical technological shift involves the widespread adoption of Ultra-Short Pulse (USP) lasers, specifically picosecond and femtosecond lasers. These systems operate on the principle of cold ablation, delivering extremely short energy pulses (less than 10 picoseconds) that vaporize the material without significant thermal diffusion to the surrounding substrate. This is essential for marking sensitive silicon and compound semiconductor wafers used in advanced manufacturing nodes (10nm and below) where thermal damage or micro-cracks can severely reduce die yield and overall device performance.

Beyond the laser source itself, high-speed, dynamic focusing, and sophisticated beam steering mechanisms are crucial technological components. Advanced galvanometer systems, coupled with closed-loop feedback mechanisms, ensure precise placement and repeatability of the mark at high throughput rates. Furthermore, integration of high-resolution machine vision systems, often incorporating confocal or proprietary subsurface imaging capabilities, is standard. These vision systems utilize advanced illumination and optics to verify mark quality and readability instantly, ensuring compliance with strict industry standards like SEMI T13 or T7. This capability is enhanced by AI integration for automatic grading and self-correction.

Another significant technology driver is the development of robust software interfaces and communication protocols for factory automation. Modern marking systems must communicate seamlessly with the centralized Manufacturing Execution System (MES) and Automated Material Handling Systems (AMHS) within the cleanroom environment. This involves incorporating advanced SECS/GEM communication standards and specialized software for mark layout generation, ensuring that every wafer mark aligns perfectly with its manufacturing trajectory and traceability data. Future technological advancements are expected to focus on maximizing the size and speed of field-of-view scanning while maintaining nanoscale precision, particularly as 450mm wafer processing approaches commercial reality.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant regional market due to the concentration of the world’s largest foundries, memory producers, and OSAT (Outsourced Semiconductor Assembly and Test) providers in Taiwan, South Korea, China, and Japan. High government spending and continuous investment in new fabrication facilities (fabs) drive immense demand for advanced marking systems. China, in particular, is a rapidly accelerating market due to its national goal of increasing domestic chip production self-sufficiency.

- North America: This region is a leading early adopter of cutting-edge technology, focusing heavily on ultra-short pulse laser systems for R&D, specialized semiconductor manufacturing, and aerospace/defense applications. The region’s market growth is being catalyzed by large-scale government initiatives such as the CHIPS and Science Act, promoting new domestic fab construction and modernization.

- Europe: Characterized by strong competencies in automotive semiconductors, industrial automation, and power electronics (SiC/GaN), Europe demonstrates stable demand for specialized, high-precision laser marking solutions. The European Chips Act is expected to stimulate capital investment, leading to moderate but sustained growth in demand for high-end equipment throughout the forecast period.

- Latin America & Middle East and Africa (LAMEA): These regions currently hold smaller market shares, primarily serving localized assembly and specialized electronics manufacturing operations. Growth in LAMEA is projected to be steady, driven by increasing global supply chain diversification efforts, though the market remains highly dependent on imported technologies and global CapEx trends.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Laser Marking System Market.- FOBA (A part of Danaher Corporation)

- Trumpf (TRUMPF SE + Co. KG)

- Coherent Corp. (Previously II-VI Incorporated)

- LPKF Laser & Electronics AG

- 3D-Micromac AG

- Han's Laser Technology Industry Group Co., Ltd.

- MKS Instruments (EAS division)

- Sisma S.p.A.

- AMADA MIYACHI (A part of AMADA WELD TECH)

- Toptica Photonics AG

- Jenoptik AG

- Electro Scientific Industries (ESI) (A part of MKS Instruments)

- Optek Technology

- Laserline GmbH

- Mecco Marking & Traceability

- MacDermid Alpha Electronics Solutions

- Novanta Inc.

- Keyence Corporation

- Suss MicroTec SE

- InnoLas Laser GmbH

Frequently Asked Questions

Analyze common user questions about the Wafer Laser Marking System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of using femtosecond lasers for wafer marking?

Femtosecond lasers offer the technical advantage of cold ablation, meaning the ultra-short pulse duration minimizes the Heat-Affected Zone (HAZ). This prevents thermal stress, micro-cracking, and subsurface damage, which is critical for maintaining high die yield on sensitive, advanced semiconductor wafers.

How does the Wafer Laser Marking System ensure regulatory compliance?

Systems comply primarily with SEMI standards (e.g., SEMI T13 and T7), which define parameters for permanent marks, traceability data content, and mark readability requirements. Modern systems integrate high-resolution vision verification to grade the mark instantly against these industry standards.

Which wafer size segment currently dominates the market volume?

The 300mm wafer size segment currently dominates the market volume. This is due to its entrenched position as the standard for high-volume manufacturing of advanced logic and memory chips (DRAM/NAND) globally, necessitating continuous investment in supporting equipment.

What role does AI play in improving marking system performance?

AI, specifically deep learning, is utilized for real-time quality assurance by automatically grading the inscribed mark’s readability. It also optimizes laser parameters dynamically based on wafer material feedback and supports predictive maintenance to maximize system uptime and operational efficiency.

What are the key challenges associated with marking SiC and GaN wafers?

The key challenges include the hardness and crystal structure of SiC and GaN, which require precise energy delivery without creating subsurface defects or compromising the material’s electrical properties. This often mandates the use of highly specialized Ultra-Short Pulse (USP) laser sources for delicate processing.

The market analysis indicates a high-growth environment driven by relentless innovation within the semiconductor fabrication space. The increasing complexity of integrated circuits, coupled with global efforts to secure semiconductor supply chains, guarantees sustained investment in precision wafer marking technology. Manufacturers must prioritize system intelligence, ultra-high precision, and integration capabilities to capitalize on this expanding industrial requirement.

Investment trends highlight a shift away from older, thermally impactful laser technologies towards advanced cold ablation methods, reflecting the industry's zero-tolerance policy for yield-reducing process steps. Furthermore, the strategic importance of the APAC region cannot be overstated, though targeted governmental funding in North America and Europe will foster significant regional growth opportunities for localized equipment suppliers specializing in advanced semiconductor materials and processes.

In conclusion, the Wafer Laser Marking System Market is positioned as a foundational technology enabler for the next generation of electronics. Success for market participants will hinge upon their ability to integrate AI-driven quality control, handle emerging substrate materials (SiC, GaN), and prepare scalable solutions for the eventual mass adoption of 450mm wafer processing technology, while maintaining rigorous cleanroom compatibility and uptime metrics crucial for large-scale fabrication facilities globally. This requires continuous R&D investment and close collaboration with Tier 1 semiconductor manufacturers to align product roadmaps with future industry standards.

The imperative for enhanced process control and forensic traceability, crucial elements in preventing counterfeiting and streamlining failure analysis, reinforces the essential nature of these systems. As chips become smaller and more critical to societal infrastructure (from automotive safety to national defense), the permanence and readability of wafer marks transition from a mere operational requirement to a strategic security component, ensuring the integrity and provenance of every die manufactured. This elevated status compels continued technological refinement within the marking industry.

Future market evolution will be shaped by advances in subsurface marking techniques, allowing identification without surface modification, thereby maximizing usable area and preserving surface integrity for subsequent processing steps. This technological advancement, utilizing highly sophisticated beam shaping and focusing optics, represents the pinnacle of non-contact identification and is a key area of focus for R&D departments across leading market players. The competitive landscape will favor firms that successfully navigate the transition toward these advanced marking modalities.

Moreover, the integration challenge remains a dominant factor. Wafer marking systems are not standalone units; they are deeply embedded within complex, highly automated factories. The ability of a vendor's system to communicate flawlessly, adapt instantly to factory schedule changes, and operate autonomously within the AMHS is often a greater determinant of selection than raw marking speed alone. Standardization efforts, particularly through international bodies, are attempting to simplify this integration, but customized solutions often remain the norm for high-volume fabs seeking peak efficiency.

The environmental sustainability aspect is also beginning to influence purchasing decisions, albeit subtly. Fabs are increasingly scrutinizing the energy efficiency and maintenance requirements of capital equipment. Laser marking systems that offer higher efficiency, longer component lifetimes, and reduced chemical waste (compared to older etching methods) gain a competitive edge, aligning with the broader corporate mandates for reducing the carbon footprint of semiconductor manufacturing operations globally.

Finally, the threat of IP infringement and reverse engineering in the highly competitive semiconductor industry places additional requirements on marking systems to offer secure, tamper-proof identification. Techniques such as proprietary code structures or layered marking methods are being explored to enhance security, positioning the marking system as a security checkpoint within the manufacturing process. This convergence of quality control, process traceability, and security underscores the multifaceted role of laser marking technology in the modern semiconductor ecosystem.

The capital expenditure cycle in the semiconductor industry exerts a heavy gravitational pull on the Wafer Laser Marking System Market. Periods of high utilization and aggressive expansion directly translate to increased orders for new marking equipment, while downturns lead to delayed purchases and intense competition among vendors for maintenance contracts. This cyclical volatility demands robust business planning and diversified product lines capable of serving both expansion and modernization projects.

Furthermore, the segmentation by application—moving beyond simple identification to incorporate defect location marking and process control indicators—signals the market's maturity. Marking systems are now utilized not only for tracking the wafer but also for providing real-time visual references tied to critical process data. This enhanced functionality elevates the marking system from a tracking tool to an indispensable component of the quality management system in advanced foundries.

The emerging market for 450mm wafer marking, while still nascent, represents a long-term strategic investment area. The shift to 450mm requires larger mechanical infrastructure and highly stable laser platforms to handle the increased size and weight while maintaining precision across a larger surface area. Successfully developing robust, scalable solutions for this next-generation wafer standard will define market leadership in the 2030s and beyond.

The competition between fiber lasers and DPSS lasers is primarily defined by application cost constraints and required precision. Fiber lasers dominate segments where moderate power and cost-efficiency are critical, typically for 200mm wafers or less sensitive applications. In contrast, DPSS lasers, especially those operating in the UV spectrum, offer superior beam quality necessary for fine-pitch marking on highly advanced 300mm silicon and specialized materials, justifying their higher operational costs through improved yield.

The role of specialized service providers in the ecosystem is also growing. These third-party firms often provide maintenance, calibration, and customized software integration services, particularly for smaller foundries or those running older equipment. The ecosystem includes dedicated optics cleaning services and laser refurbishment firms, highlighting the high-value nature and required precision maintenance of the core components within the marking system infrastructure.

Geopolitical tensions and trade policies have increasingly become significant impact forces. Restrictions on technology transfer, particularly concerning high-precision optics and laser sources, can fragment the market and spur localized, subsidized development of marking technology in specific regions, most notably in China. This trend encourages a parallel evolution of technology stacks, potentially leading to diverging standards in the long term.

The continuous improvement in marking system throughput is a persistent market driver. Fabs require markers that can process wafers quickly without slowing down the highly optimized production line. This pushes vendors to develop higher-speed galvo scanners and faster handling robotics, often necessitating the integration of two or more marking heads within a single system to meet demanding cycle time requirements, reinforcing the importance of modular and scalable system design.

Ultimately, the market for Wafer Laser Marking Systems is a highly specialized, capital-intensive segment entirely dependent on the strategic health and growth trajectory of the global semiconductor industry. The synthesis of ultra-precision photonics, sophisticated robotics, and intelligent software integration defines the competitive edge, enabling manufacturers to meet the stringent demands of modern microchip fabrication while ensuring complete and enduring traceability for every single product unit.

The drive towards sustainable and green manufacturing processes is leading to innovations in laser marking material interaction. Researchers are exploring non-ablative techniques or surface modification methods that use less energy and generate fewer particulates, crucial for maintaining stringent cleanroom air quality standards. This focus on cleaner marking processes contributes to both environmental goals and operational efficiency by reducing the strain on filtration systems.

Furthermore, the criticality of component lifetime and reliability cannot be overstated in this market. Since downtime in a multi-billion-dollar fabrication facility is exorbitantly expensive, equipment vendors are competitively focused on offering Mean Time Between Failure (MTBF) rates that exceed thousands of operational hours. This necessitates over-engineered mechanical and thermal management systems, along with extensive pre-deployment testing and certification processes.

In summary, the Wafer Laser Marking System Market is a bellwether for semiconductor capital expenditure, characterized by continuous technological refinement to meet ever-increasing demands for precision and minimal damage. The future market is intelligent, highly automated, and geographically concentrated in regions dominating global chip production, underpinned by the indispensable need for comprehensive and robust product traceability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager