Wafer Laser Saw Technology Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433886 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Wafer Laser Saw Technology Market Size

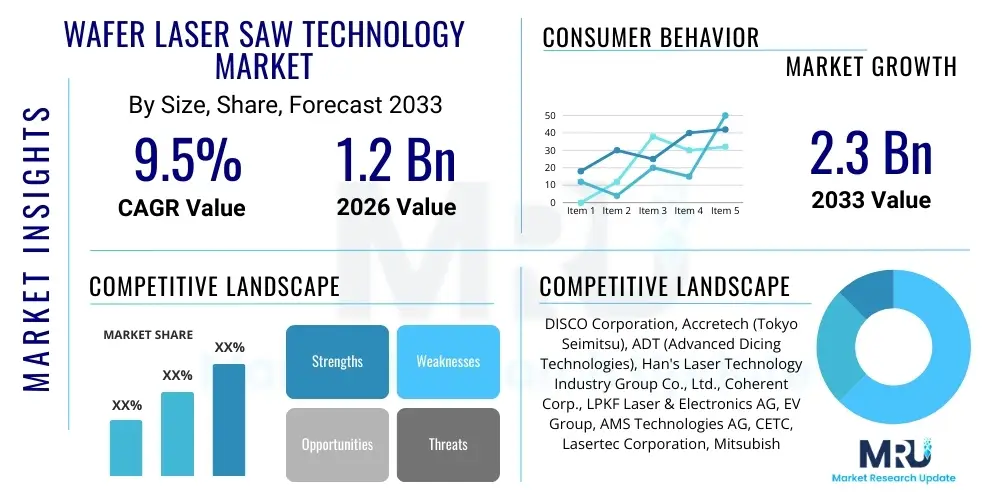

The Wafer Laser Saw Technology Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 2.3 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the relentless miniaturization trend in semiconductor fabrication, requiring ultra-precise and damage-free wafer separation techniques. Traditional mechanical dicing methods are proving insufficient for highly brittle and thin wafers, thus accelerating the adoption of laser sawing technologies across memory, logic, and power device manufacturing sectors globally.

Wafer Laser Saw Technology Market introduction

Wafer Laser Saw Technology encompasses specialized equipment utilized in the backend processing of semiconductor manufacturing, specifically for separating individual integrated circuits (ICs) or dies from a processed silicon or compound semiconductor wafer. This technology employs high-precision lasers, typically solid-state or ultrafast pulsed lasers (like femtosecond or picosecond lasers), to achieve non-contact dicing. Unlike conventional blade dicing, laser sawing minimizes material loss, reduces chipping and microcracks, and allows for much higher throughput, making it indispensable for advanced packaging formats such as 3D integration and wafer-level chip-scale packaging (WLCSP). The primary applications span across consumer electronics, automotive components, industrial automation, and high-performance computing, where reliability and compact size are paramount design considerations.

The core benefit of adopting laser saw technology lies in its ability to handle extremely thin, sensitive, and large-diameter wafers (up to 300mm and increasingly 450mm research) with superior yield rates compared to mechanical alternatives. The key driving factors include the massive global expansion of 5G infrastructure, the burgeoning demand for high-density memory chips (HBM, DDR5), and the stringent quality requirements set by automotive electronics, particularly in Advanced Driver-Assistance Systems (ADAS) and Electric Vehicles (EVs). Furthermore, the push towards utilizing compound semiconductors like SiC and GaN, which are notoriously difficult to dice mechanically, is significantly fueling investment in advanced laser sawing solutions capable of handling these hard materials efficiently and cleanly.

Wafer Laser Saw Technology Market Executive Summary

The Wafer Laser Saw Technology Market is experiencing robust growth fueled by irreversible trends in semiconductor miniaturization, advanced packaging adoption, and the transition to hard, compound materials. Business trends highlight strategic collaborations between equipment manufacturers and leading foundries (TSMC, Samsung, Intel) to co-develop next-generation laser systems, focusing on increasing processing speed and optimizing beam delivery for heterogeneous integration. Regionally, Asia Pacific, particularly Taiwan, South Korea, China, and Japan, dominates the market due to the concentration of major semiconductor fabrication facilities (fabs) and outsourced semiconductor assembly and test (OSAT) providers. Segment trends indicate a strong shift towards ultrafast laser processing (femtosecond/picosecond) over traditional CO2 or nanosecond lasers, driven by the requirement for internal modification dicing and stealth dicing techniques that offer superior edge quality and high-speed processing, particularly for thin wafers used in mobile devices and advanced AI accelerators. This market outlook remains highly positive, contingent on continued capital expenditure within the global semiconductor supply chain.

AI Impact Analysis on Wafer Laser Saw Technology Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are being integrated into the highly specialized Wafer Laser Saw Technology domain, focusing particularly on enhancing precision, yield optimization, and predictive maintenance. Common themes revolve around questions such as the use of AI for real-time defect detection during the dicing process, the potential for ML algorithms to automatically optimize laser parameters (power, pulse duration, scan speed) based on wafer material and thickness variations, and the development of intelligent fault prediction systems that minimize expensive equipment downtime. The consensus expectation is that AI integration will transform laser sawing from a highly manual, empirically tuned process into an autonomous, data-driven operation, significantly boosting operational efficiency, especially as wafer complexity and production volumes escalate in the context of advanced packaging technologies used for AI chips.

- AI-driven image recognition enhances real-time edge quality inspection and defect classification during dicing, improving overall yield.

- Machine Learning models optimize complex laser parameters based on wafer substrate type (Si, SiC, GaN) and desired street width, minimizing material waste.

- Predictive maintenance schedules are generated using AI analysis of equipment sensor data (laser power stability, cooling system performance), reducing unplanned downtime.

- AI facilitates closed-loop feedback systems for automatic alignment correction and positional accuracy adjustment, crucial for 3D stacking and advanced heterogeneous integration.

DRO & Impact Forces Of Wafer Laser Saw Technology Market

The market dynamics for Wafer Laser Saw Technology are powerfully shaped by ongoing technological evolution within the semiconductor industry. Key drivers include the overwhelming need for greater dicing precision dictated by the shrinking die size and increasing demand for advanced packaging (e.g., Fan-Out Wafer Level Packaging, 2.5D/3D integration), which necessitate non-contact, high-accuracy separation methods like stealth dicing. Simultaneously, the restraints revolve primarily around the high initial capital expenditure associated with purchasing and implementing sophisticated laser systems, coupled with the necessity for highly specialized operator training and complex process maintenance. Opportunities abound in the burgeoning adoption of silicon carbide (SiC) and gallium nitride (GaN) wafers for power electronics and RF components, as these extremely hard materials render traditional mechanical sawing impractical, positioning laser technology as the only viable solution. The cumulative impact of these forces suggests a clear market trajectory favoring laser-based solutions, despite the initial cost hurdles, driven by long-term gains in yield and processing capability.

A primary driver is the pervasive trend toward thinner wafers, particularly in the mobile and memory sectors. Wafers below 100 microns are extremely susceptible to damage, chipping, and cracking when subjected to mechanical stress. Laser sawing, especially utilizing stealth dicing methodologies which modify the internal structure rather than ablation, bypasses these issues entirely, ensuring the structural integrity of ultra-thin dies. Furthermore, the rapid industrialization and scaling of semiconductor production in China and Southeast Asia are creating massive demand for high-throughput backend equipment to manage soaring production volumes. This regional investment surge acts as a critical external force accelerating market expansion. The technological push toward heterogeneous integration, where different materials and die sizes are stacked or interconnected, mandates the sub-micron accuracy that only advanced laser sawing systems can reliably deliver.

However, the market faces significant restraints related to technological complexity and operational costs. Laser systems require highly controlled environmental conditions and specialized gas mixtures, adding to operational expenses. Additionally, the development and maintenance of laser recipes specific to various materials, thicknesses, and die geometries demand significant R&D investment from equipment providers and advanced technical skill sets from end-users, posing a barrier to entry for smaller OSATs. Opportunities are substantial in adjacent markets, such as microelectromechanical systems (MEMS) and light-emitting diodes (LEDs), which increasingly rely on complex materials and intricate dicing patterns that are inherently suited for laser processing. The shift toward sustainable manufacturing practices also provides an opportunity, as laser sawing generally produces less particulate waste compared to abrasive mechanical dicing, aligning with global green manufacturing goals.

- Drivers: Miniaturization and advanced packaging trends (2.5D/3D), increasing adoption of thin and brittle wafers, massive demand for wide-bandgap semiconductors (SiC, GaN).

- Restraints: High initial capital investment cost, complexity of laser process parameter optimization, requirement for highly skilled technical maintenance staff.

- Opportunity: Expansion into adjacent markets like MEMS and Photonics, development of faster, more energy-efficient ultrafast laser systems, increasing adoption in emerging markets (India, Vietnam).

- Impact Forces: Technological obsolescence risk for traditional dicing, accelerated R&D focusing on femtosecond laser capabilities, strong competitive intensity among leading equipment providers (Japan and Germany).

Segmentation Analysis

The Wafer Laser Saw Technology Market is comprehensively segmented based on technology type, application, end-user industry, and laser type, providing a detailed view of current adoption patterns and future growth vectors. The segmentation by technology is critical, distinguishing between mechanical dicing (which is increasingly replaced), traditional laser ablation, and advanced laser stealth dicing (LSD) or internal modification techniques. Segmentation by laser type highlights the shift from older CO2 and nanosecond lasers towards advanced ultrafast lasers, specifically picosecond and femtosecond systems, due to their superior ability to minimize heat-affected zones (HAZ) and achieve cleaner cuts on sensitive materials. The application segment reflects the growing complexity of semiconductor components, including memory, logic, power devices, and optoelectronics, each demanding specialized laser processing protocols.

The distinction between different laser types is perhaps the most defining factor in current market evolution. Ultrafast lasers (picosecond and femtosecond) command a premium but offer unparalleled precision required for the latest generation of ICs and advanced wafer thinning processes. These lasers enable non-ablative cutting methods, significantly reducing particulate contamination and improving the structural integrity necessary for subsequent stacking operations in 3D integrated circuits. Furthermore, the end-user segmentation underscores the market dominance of OSAT providers and IDMs (Integrated Device Manufacturers) that heavily invest in this technology to maintain competitive edge in yield and throughput. The growing presence of foundries adopting laser sawing in-house for specialized processes also influences market dynamics.

Analyzing segmentation helps stakeholders understand where future R&D investment will be concentrated. The clear dominance of the memory and logic segments in terms of value reflects the high volume and high-value nature of these chips in modern electronics. Geographically, Asia Pacific remains the central hub for both demand and technological implementation, driven by major manufacturing centers. Strategic planning for equipment manufacturers must therefore prioritize the development of multi-function platforms capable of switching between various dicing modes (full-cut, half-cut, stealth dicing) to cater to the diverse needs presented by the application and substrate segmentations, including silicon, GaAs, and emerging compound materials like SiC.

- By Technology:

- Laser Ablation Dicing

- Laser Stealth Dicing (LSD)

- Laser Grooving and Cleaving

- By Laser Type:

- Picosecond Lasers

- Femtosecond Lasers

- Nanosecond Lasers

- Others (e.g., CO2 Lasers, UV Lasers)

- By Application:

- Memory Devices (DRAM, NAND)

- Logic Devices (CPUs, GPUs, FPGAs)

- Power Devices (SiC, GaN)

- MEMS and Sensors

- Optoelectronics and LEDs

- By End-User:

- Integrated Device Manufacturers (IDMs)

- Outsourced Semiconductor Assembly and Test (OSAT) Providers

- Foundries

Value Chain Analysis For Wafer Laser Saw Technology Market

The value chain for Wafer Laser Saw Technology is highly specialized and spans from core component suppliers to end-product manufacturers. The upstream segment involves critical suppliers of high-precision components, notably laser source manufacturers (e.g., IPG Photonics, Coherent) which provide the actual pulsed laser engines, and specialized optical component providers (lenses, mirrors, beam shaping optics) that define the system's performance. The quality and reliability of these core components directly influence the overall system accuracy and throughput. Midstream activities are dominated by the Original Equipment Manufacturers (OEMs) of the laser sawing machines (e.g., DISCO, EV Group, ADT), who integrate the laser sources, high-speed stages, and vision systems into proprietary, complex processing platforms. These OEMs invest heavily in R&D to develop sophisticated process software and handling capabilities necessary for automated wafer processing.

Downstream activities involve the direct procurement and usage of these systems by key semiconductor ecosystem players. This includes major IDMs like Intel and Samsung, who utilize these machines for in-house backend processing, and, more significantly, large OSAT providers such as ASE and Amkor, who handle high-volume contract dicing and packaging services for fabless companies. The distribution channel is predominantly direct, given the high capital value, complexity, and customization required for laser sawing equipment. Direct sales allow OEMs to provide specialized installation, calibration, and ongoing maintenance support, which is critical for maintaining uptime and process control within cleanroom environments. Indirect distribution, though limited, sometimes occurs through regional technology representatives or specialized distributors who facilitate sales and support in smaller or emerging semiconductor markets.

The overall efficiency of the value chain relies heavily on close collaboration between OEMs and end-users, especially in developing proprietary laser recipes for novel materials (like SiC). The high barriers to entry in the upstream manufacturing of ultra-reliable, high-power femtosecond lasers consolidate power among a few key suppliers, impacting overall equipment costs. Downstream influence is driven by major OSATs demanding higher levels of automation, improved traceability, and integrated metrology features within the sawing equipment to optimize yield in advanced packaging lines. Therefore, the key value addition occurs at the OEM level through intelligent system integration and sophisticated process control software, ensuring that the technology meets the demanding performance requirements of the semiconductor fabrication industry.

Wafer Laser Saw Technology Market Potential Customers

The primary customers for Wafer Laser Saw Technology are entities heavily engaged in the high-volume manufacturing and assembly of semiconductor devices, where precision and yield are paramount. The largest segment of potential customers comprises Outsourced Semiconductor Assembly and Test (OSAT) providers, such as ASE, Amkor Technology, and JCET, which perform outsourced backend processes for hundreds of fabless semiconductor companies. As OSATs handle diverse materials and packaging types, they require versatile, high-throughput laser sawing systems to manage complexity and maintain competitive pricing. Another crucial customer group includes Integrated Device Manufacturers (IDMs) like Intel, Micron, and Samsung, who utilize this technology in their captive fabrication facilities, particularly for proprietary, high-value components (e.g., advanced memory or high-performance processors) where absolute process control is essential for maintaining product quality and intellectual property integrity.

Furthermore, specialized segments within the semiconductor ecosystem represent significant growth potential. This includes manufacturers focusing exclusively on Wide Bandgap (WBG) power semiconductors, such as those producing SiC and GaN devices for electric vehicles and industrial power systems. Since these materials are exceptionally hard and brittle, laser sawing is a mandatory technology, making companies like Infineon, Wolfspeed, and STMicroelectronics key potential buyers. Similarly, companies specializing in Microelectromechanical Systems (MEMS) and advanced sensors, used extensively in automotive and IoT applications, require sophisticated dicing technologies to handle fragile sensor structures and complex material stacks, solidifying their status as highly attractive customers for laser saw OEMs.

The emerging market of advanced photonics and optical components manufacturers is also expanding its reliance on laser technology. These companies, involved in producing components for fiber optics, LiDAR systems, and AR/VR devices, demand ultra-clean cuts and minimal heat damage, which conventional methods cannot deliver. Therefore, the customer base extends beyond traditional silicon processing to include specialized foundries and assembly houses focusing on compound semiconductors and optical substrates. Successful OEMs must tailor their marketing and support strategies to address the distinct performance requirements—whether maximizing throughput for large OSATs or ensuring ultra-high precision for specialized SiC manufacturers—demonstrating deep process knowledge across varied material platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 2.3 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DISCO Corporation, Accretech (Tokyo Seimitsu), ADT (Advanced Dicing Technologies), Han's Laser Technology Industry Group Co., Ltd., Coherent Corp., LPKF Laser & Electronics AG, EV Group, AMS Technologies AG, CETC, Lasertec Corporation, Mitsubishi Electric Corporation, 3D-Micromac AG, SYZ Machine, K&S (Kulicke & Soffa), Suzhou Delong Laser Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wafer Laser Saw Technology Market Key Technology Landscape

The technology landscape of the Wafer Laser Saw market is rapidly transitioning toward ultrafast pulsed laser systems, primarily picosecond and femtosecond lasers, replacing older generation CO2 and nanosecond UV laser processes. This shift is driven by the demand for higher precision and reduced thermal damage (Heat Affected Zone or HAZ) necessary for processing advanced semiconductor materials and ultra-thin wafers. Femtosecond laser technology, in particular, enables "cold processing" where the pulse duration is shorter than the thermal diffusion time into the material, allowing for highly localized material modification without significant thermal stress on the surrounding die structure. This capability is paramount for successful implementation of Laser Stealth Dicing (LSD), a technique that modifies the interior bulk of the silicon wafer along the dicing street, allowing the wafer to be cleaved with minimal mechanical stress, leading to superior edge quality and higher yields.

Another crucial technological development involves integrated metrology and alignment systems. Modern laser saws incorporate advanced vision systems, high-resolution cameras, and in-situ monitoring tools, often enhanced by AI, to ensure precise alignment of the laser path with existing features on the wafer surface, particularly critical for patterned wafers. These systems often feature automatic focusing and drift correction capabilities, necessary for maintaining sub-micron accuracy across large 300mm wafers. Furthermore, the development of multi-beam and parallel processing architectures is key to improving throughput, addressing the industry's need for faster processing times without compromising quality. These advanced platforms utilize sophisticated beam-shaping optics to simultaneously process multiple points along the dicing street or even dice multiple chips simultaneously.

The material handling aspect of laser sawing equipment is also undergoing significant technological refinement. To handle increasingly fragile and warped wafers, advanced systems now integrate non-contact handling mechanisms and specialized chucks that minimize mechanical stress during the dicing process. For compound semiconductor materials like SiC and GaN, unique laser absorption properties necessitate the use of specialized laser wavelengths (often in the green or UV spectrum) combined with optimized pulse repetition rates and fluence settings. The continuous innovation in these areas—ultra-precise laser sources, intelligent process control software, and optimized material handling—defines the competitive edge within the Wafer Laser Saw Technology market, facilitating the manufacturing of the next generation of high-performance and power-efficient semiconductor devices.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market, holding the largest market share in terms of revenue and volume. This region is the epicenter of global semiconductor manufacturing, housing the world's largest IDMs, foundries (TSMC, Samsung), and OSAT providers (ASE, Amkor). Heavy government subsidies and relentless capital investment in advanced manufacturing capacity, particularly in China, Taiwan, South Korea, and Japan, ensure continuous high demand for advanced laser sawing equipment to support memory (NAND/DRAM) and logic chip production.

- North America: Represents a mature yet strategically crucial market, driven by high R&D intensity, the presence of major fabless companies, and a resurgence in domestic manufacturing capacity (e.g., Intel’s expansion, new foundries). Demand focuses on high-precision systems for complex, high-value components, including AI processors, high-performance computing (HPC), and defense applications. North America is a significant source of advanced laser source technology innovation.

- Europe: Exhibits steady growth, primarily driven by the strong presence in automotive electronics, industrial automation, and power semiconductor manufacturing (SiC and GaN). Countries like Germany (major equipment manufacturers) and Italy/France (major power device producers) are critical adoption hubs. European demand is highly focused on quality, reliability, and the use of laser sawing for wide-bandgap materials utilized in EV technology.

- Middle East and Africa (MEA) & Latin America: These regions currently hold smaller market shares but present emerging opportunities. Growth is nascent, tied primarily to localized industrial electronics and government initiatives aimed at establishing regional technology hubs. Investment, particularly in specialized niche applications like solar cell manufacturing and basic packaging operations, is gradually expanding the customer base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wafer Laser Saw Technology Market.- DISCO Corporation

- Accretech (Tokyo Seimitsu)

- ADT (Advanced Dicing Technologies)

- Han's Laser Technology Industry Group Co., Ltd.

- Coherent Corp.

- LPKF Laser & Electronics AG

- EV Group

- AMS Technologies AG

- CETC (China Electronics Technology Group Corporation)

- Lasertec Corporation

- Mitsubishi Electric Corporation

- 3D-Micromac AG

- SYZ Machine (Suzhou)

- K&S (Kulicke & Soffa)

- Suzhou Delong Laser Technology Co., Ltd.

- ASM Pacific Technology (ASMPT)

- Esec (Besi Group)

- Tera-Barrier Films (TBF)

- JPS Group

- Amada Holdings Co., Ltd.

Frequently Asked Questions

What specific advantages does Laser Sawing offer over traditional blade dicing for advanced semiconductor packaging?

Laser sawing provides critical advantages, including non-contact processing, resulting in zero chipping, significantly reduced microcracks, and minimal debris contamination. It allows for ultra-narrow street widths, increasing the number of usable dies per wafer (yield), and is mandatory for successfully dicing extremely thin (<100µm) or brittle wafers and hard materials like SiC and GaN, which mechanical dicing cannot handle effectively.

How is the adoption of SiC and GaN materials impacting the demand for Wafer Laser Saw Technology?

The increasing use of Silicon Carbide (SiC) and Gallium Nitride (GaN) in power electronics (especially EVs) is a primary driver for laser saw market growth. These materials are exceptionally hard, leading to rapid blade wear and potential damage during mechanical dicing. Laser technology, particularly advanced ultrafast lasers, provides the only economically viable, high-yield method for separating these critical wide-bandgap semiconductor devices, guaranteeing market demand expansion.

Which type of laser technology is currently dominating the Wafer Laser Saw Market, and why?

Ultrafast laser systems, specifically picosecond and femtosecond lasers, are rapidly gaining dominance. They facilitate cold ablation or internal modification techniques (Stealth Dicing), minimizing the Heat Affected Zone (HAZ) and thermal stress on sensitive dies. This precision is essential for 3D packaging, high-density memory, and thin wafer processing, offering superior die strength and reliability compared to older nanosecond or CO2 laser systems.

What role does Artificial Intelligence play in optimizing laser dicing processes?

AI is integrated to enhance process control, yield, and automation. Machine Learning algorithms analyze real-time sensor data to automatically adjust laser parameters (power, speed, pulse width) to compensate for material inconsistencies. AI-driven vision systems perform high-speed, accurate defect detection and alignment, crucial for maintaining the stringent quality standards required for heterogeneous integration and stacking processes.

Which geographical region exhibits the highest growth potential in this market over the forecast period?

The Asia Pacific (APAC) region, driven by continuous massive investments in advanced semiconductor manufacturing capacity by key economies (Taiwan, China, South Korea), holds the highest growth potential. APAC's dominance stems from its concentration of major OSAT providers and leading IDMs, coupled with strong governmental support for localization and technological upgrading in backend semiconductor production, necessitating continuous procurement of high-end laser sawing solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager