Wall Climbing Robot Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432611 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Wall Climbing Robot Market Size

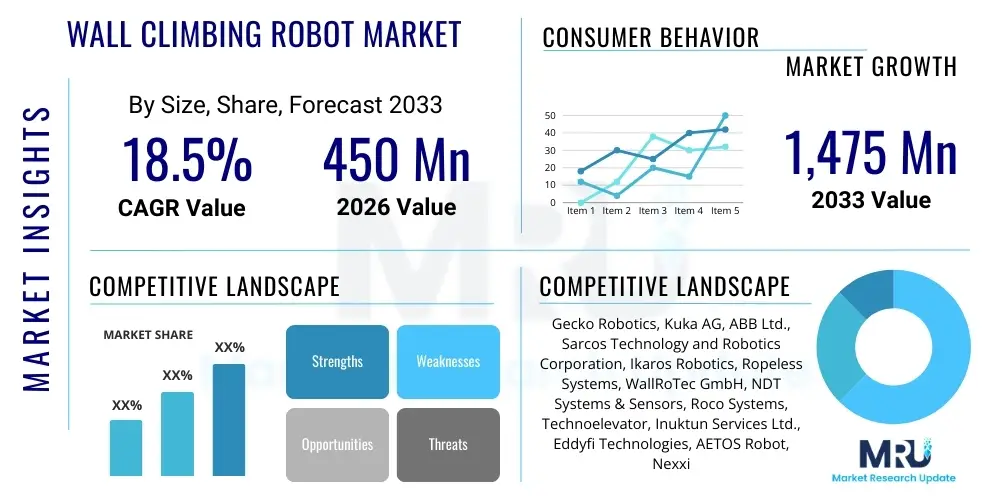

The Wall Climbing Robot Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $1,475 Million by the end of the forecast period in 2033. This substantial growth is driven by increasing infrastructure aging, stringent safety regulations requiring remote inspection, and the decreasing cost and improving efficacy of advanced robotic systems capable of navigating complex vertical and inverted surfaces.

Wall Climbing Robot Market introduction

The Wall Climbing Robot Market encompasses highly specialized robotic systems designed to adhere to and traverse vertical, inclined, or inverted surfaces, enabling automated tasks traditionally performed by human workers at considerable risk and cost. These devices utilize various adhesion mechanisms, including magnetic force, vacuum suction, and bio-inspired gripping technologies, tailored to specific substrate materials like steel, concrete, glass, or composite structures. Key product applications span non-destructive testing (NDT) of critical infrastructure, high-rise building facade cleaning, inspection of wind turbines and pressurized vessels, and surveillance in hazardous environments, offering unparalleled precision and operational continuity compared to conventional methods such as scaffolding or aerial platforms.

Major applications of wall climbing robots are heavily concentrated in the industrial sector, particularly within energy (oil and gas, nuclear, wind power), civil infrastructure (bridges, storage tanks), and construction. The core benefits derived from their adoption include significantly enhanced worker safety by eliminating the need for human presence in dangerous vertical settings, drastic reductions in operational time and associated costs for inspection and maintenance tasks, and the provision of higher quality, quantifiable data necessary for predictive maintenance strategies. The driving factors behind market expansion are multifaceted, including the global push for digitalization in maintenance operations, the growing complexity and sheer scale of modern infrastructure assets, and technological breakthroughs in battery life, locomotion stability, and sensor integration, paving the way for fully autonomous vertical workflows.

Wall Climbing Robot Market Executive Summary

The Wall Climbing Robot Market is experiencing transformative growth, underpinned by critical business trends focusing on integration and automation. Key trends include the transition from manual, line-of-sight operations to fully autonomous vertical inspection missions powered by sophisticated AI algorithms for path planning and defect recognition. Companies are increasingly moving towards Robotics-as-a-Service (RaaS) models, lowering the initial capital expenditure for end-users and accelerating adoption across sectors like infrastructure and manufacturing. Furthermore, partnerships between robotics manufacturers and NDT solution providers are central to delivering integrated data collection and analysis platforms, establishing robust ecosystems that maximize operational value and data utility for asset managers.

Regionally, North America and Europe currently dominate the market share, driven by stringent regulatory environments for infrastructure safety, high labor costs, and significant investment in smart city initiatives and aging asset rehabilitation, particularly within the oil and gas pipeline inspection and wind energy sectors. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid industrialization, massive construction projects in nations like China and India, and the burgeoning demand for automated quality assurance in ship building and large-scale storage tank fabrication. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily focusing on petrochemical facility inspection and remote maintenance solutions for offshore assets.

Segmentation trends highlight a pronounced shift toward magnetic adhesion mechanisms due to their high payload capacity and reliability on ferromagnetic surfaces common in heavy industry. Concurrently, the Inspection and Monitoring application segment retains the largest share, propelled by the urgent necessity for non-invasive structural health monitoring (SHM) to prevent catastrophic failures. The fastest-growing segment is anticipated to be Cleaning and Surface Preparation, driven by the increasing application of robots for hull cleaning in the maritime industry and façade washing of skyscrapers, where vacuum-based suction systems are preferred due to their versatility across different materials. This convergence of technological sophistication and growing application diversity ensures continued market buoyancy.

AI Impact Analysis on Wall Climbing Robot Market

User queries regarding AI's impact on the Wall Climbing Robot Market center primarily on how AI enhances autonomy, improves data quality, and integrates complex sensor data for real-time decision-making. Key themes include the feasibility of full mission autonomy (especially path planning over complex obstacles and heterogeneous surfaces), the ability of machine learning models to accurately identify subtle defects (like hairline cracks or corrosion under insulation) from raw inspection data, and concerns regarding the computational overhead and energy requirements for running sophisticated AI models on board energy-constrained mobile platforms. Users expect AI to transform these robots from mere data acquisition tools into intelligent, adaptive vertical assets capable of self-diagnosis and dynamic task modification based on environmental inputs and mission objectives.

The primary influence of Artificial Intelligence involves transforming raw sensor inputs—such as ultrasonic, infrared, and visual data—into actionable structural health metrics. AI-driven computer vision models are pivotal in detecting, classifying, and quantifying defects with superhuman consistency and speed, overcoming the inherent variability and subjectivity associated with manual visual inspections. Furthermore, reinforcement learning and advanced optimization algorithms are crucial for developing robust navigation capabilities, allowing robots to autonomously determine the most energy-efficient and comprehensive inspection paths on complex, large-scale structures, significantly boosting mission efficiency and coverage completeness.

AI also plays a critical role in enhancing robot longevity and reliability through predictive maintenance and adaptive control. By analyzing operational data (motor load, adhesion pressure, battery performance), AI algorithms can anticipate component failure, scheduling necessary maintenance preemptively. For dynamic tasks like cleaning or welding, AI enables adaptive force control, ensuring optimal contact pressure for effective operation without damaging the underlying substrate. This integration of intelligent sensing, autonomous decision-making, and self-optimization capabilities moves wall climbing robots far beyond simple remote-controlled devices, positioning them as essential components of Industry 4.0 maintenance ecosystems.

- AI enables autonomous path planning and obstacle avoidance on highly irregular surfaces, maximizing coverage and mission safety.

- Machine Learning algorithms significantly improve the accuracy and speed of defect detection (e.g., corrosion, fatigue cracks) from NDT sensor data.

- Predictive maintenance models powered by AI minimize downtime by forecasting component failure based on real-time operational metrics.

- Deep Learning facilitates real-time data fusion from multiple sensors (visual, thermal, ultrasonic) for comprehensive structural health assessments.

- AI optimizes energy consumption and locomotion efficiency, extending operational duration in remote and vertical environments.

- Generative AI tools are used in simulation environments to rapidly test and validate complex robot behaviors before physical deployment.

- Adaptive control systems utilize AI to maintain optimal adhesion and tool contact force regardless of surface heterogeneity.

DRO & Impact Forces Of Wall Climbing Robot Market

The Wall Climbing Robot Market dynamic is characterized by strong Drivers rooted in safety and operational efficiency, moderated by Restraints concerning technological maturity and environmental adaptability, creating substantial Opportunities in emerging industrial sectors. The key market driver is the inherent risk reduction associated with vertical work, pushing companies in high-hazard industries like nuclear energy and construction to adopt automated solutions to meet increasingly stringent global Occupational Safety and Health Administration (OSHA) standards. Complementing this is the economic imperative of increasing asset uptime; robots perform inspections faster and more reliably than traditional methods, translating directly into reduced maintenance expenditures and extended asset life. However, market growth is primarily constrained by the need for customized adhesion systems for non-standard surfaces (e.g., rusty, wet, or porous materials) and the high initial investment required for specialized equipment and training, presenting a significant barrier to entry for smaller enterprises.

Opportunities in this market are vast, centered on expanding applications beyond inspection into complex manipulation, repair, and additive manufacturing (3D printing) on vertical surfaces. Specifically, the integration of wall climbing robots with advanced tooling for non-destructive repair, such as localized patch welding or composite material application, represents a high-value growth avenue. The market also benefits significantly from geopolitical and trade factors, particularly the global investment cycle in renewable energy infrastructure (wind turbine blade inspection) and critical infrastructure refurbishment. Success in capitalizing on these opportunities hinges on achieving full battery parity with wired systems and standardizing communication protocols for seamless integration into existing industrial IoT platforms.

Analysis of Impact Forces using Porter's Five Forces framework reveals moderate to high competitive intensity. The Threat of New Entrants is moderate; while technology requires high R&D investment (a barrier), specialized niche players utilizing bio-inspired technology can quickly enter specific segments (e.g., glass facades). The Bargaining Power of Buyers is high, especially for large industrial conglomerates (e.g., oil majors), who demand highly customized, reliable, and multi-functional solutions, pressuring vendors on both price and performance. The Bargaining Power of Suppliers is low to moderate, depending on the component (low for standard sensors, moderate for highly specialized adhesion materials or advanced motor systems). The Threat of Substitutes is currently moderate but decreasing; traditional methods (scaffolding, drones) are cheaper but inherently less capable of close-contact NDT testing, positioning robots as uniquely essential for certain high-stakes applications. Overall, the intensity of rivalry is driven by differentiation in adhesion technology, payload capacity, and software autonomy.

Segmentation Analysis

The Wall Climbing Robot Market is comprehensively segmented based on the core mechanism enabling vertical adherence, the specific application area, and the target end-user industry. This granular segmentation allows market stakeholders to identify specialized niches and technological requirements unique to different operational environments. The fundamental division lies within the adhesion technology, ranging from highly robust magnetic systems favored in heavy industries to sophisticated vacuum systems suitable for diverse materials, and gripper-based methods utilized for navigating complex structural lattice frameworks. Application segments define the core task performed, with inspection, maintenance, and cleaning constituting the major revenue streams, each requiring different sensor payloads and tooling specifications. Understanding these segment dynamics is crucial for tailored product development and strategic market penetration.

End-user segmentation is critical as it dictates regulatory compliance requirements, operational budgets, and acceptable risk levels. Industries such as Oil & Gas and Nuclear Energy demand the highest levels of certification and reliability due to the critical nature of their assets, often driving demand for explosion-proof and radiation-hardened robots. Conversely, the Construction and Façade Maintenance sectors prioritize speed, cost-efficiency, and versatility across varying building materials. As the market matures, the lines between these segments are blurring, with manufacturers increasingly developing modular, multi-application platforms capable of adapting adhesion methods and payloads to service multiple end-user requirements, reflecting a trend towards greater flexibility and utility in vertical automation solutions.

- By Mechanism:

- Magnetic Adhesion (Used predominantly on steel structures, offering high payload capacity)

- Vacuum Suction (Versatile across smooth, non-ferromagnetic surfaces like concrete, glass, and composites)

- Gripper/Claw Mechanisms (Suitable for truss structures, pipes, and lattice frameworks)

- Bio-inspired/Adhesive/Chemical (Emerging technologies for porous or highly uneven surfaces)

- By Application:

- Inspection and Monitoring (Non-Destructive Testing, Visual Surveys, Structural Health Monitoring)

- Cleaning and Surface Preparation (Façade Cleaning, Ship Hull Maintenance, Surface Grit Blasting)

- Maintenance and Repair (Welding, Painting, Composite Repair, Localized Coating Application)

- Security and Surveillance (High-rise perimeter monitoring, hazardous environment reconnaissance)

- By End-User:

- Oil and Gas (Storage tanks, pipelines, refineries)

- Construction and Infrastructure (Bridges, Dams, High-rise buildings)

- Energy and Utilities (Wind Turbines, Nuclear Reactors, Power Plants)

- Aerospace and Defense (Aircraft inspection, military infrastructure)

- Maritime (Ship hull maintenance, offshore platform inspection)

Value Chain Analysis For Wall Climbing Robot Market

The Value Chain for the Wall Climbing Robot Market begins with Upstream activities focused heavily on specialized component manufacturing and research. This stage involves the procurement of high-performance materials, including lightweight composites and specialized alloys for the chassis, sophisticated micro-motors and actuators for locomotion, and advanced sensor arrays (ultrasonic transducers, thermal cameras, LiDAR) critical for NDT and navigation. Research and development focused on optimizing adhesion mechanisms and power management systems represent the highest value addition at this stage. Key upstream suppliers include specialized material science companies and advanced electronics manufacturers, whose innovation directly impacts the robot's mobility, payload, and operational endurance. Maintaining control over proprietary adhesion technology is a major competitive advantage in this initial phase.

Midstream activities involve the design, assembly, and integration of the final robotic system. This stage requires significant intellectual property related to control algorithms, firmware development for real-time sensor processing, and software interfaces for human operators. Manufacturers differentiate themselves through modular design, ease of deployment, and the sophistication of their mission planning and data processing software packages. The distribution channel is bifurcated: Direct sales are common for highly customized or large-scale implementations to major industrial clients (e.g., national oil companies or military bodies), where specialized training and technical support are paramount. Indirect channels involve utilizing regional distributors, value-added resellers (VARs), and system integrators who bundle the robots with comprehensive service contracts and local technical expertise, particularly beneficial in geographically dispersed markets or for smaller end-users.

Downstream activities center on deployment, data analysis, and service provision, which constitutes a growing portion of market revenue through RaaS models. Potential customers rely heavily on the manufacturer or integrator not only for the hardware but also for accurate data interpretation and reporting, translating raw inspection readings into actionable maintenance reports. Aftermarket services, including routine maintenance, recalibration of NDT sensors, software updates, and customized payload integration, are crucial for long-term customer retention and value extraction. The overall efficiency and profitability of the value chain depend critically on seamless data flow and integration between the hardware, control software, and the end-user's enterprise asset management (EAM) systems.

Wall Climbing Robot Market Potential Customers

The primary end-users and buyers of wall climbing robots are large industrial entities and governmental agencies responsible for the management and maintenance of massive, critical vertical assets where human access is either prohibitively dangerous, excessively costly, or structurally impractical. These customers are defined by their need for regulatory compliance, predictive maintenance capabilities, and the imperative to maximize asset lifespan. Major potential customers include multinational oil and gas corporations requiring periodic inspection of storage tanks and offshore platforms, national energy utilities managing wind farms and nuclear reactor containment vessels, and departments of transportation tasked with the structural integrity assessment of aging bridges and elevated roadways. These entities prioritize reliability, certification (e.g., API, ASME standards compliance), and the capacity to generate auditable, high-resolution inspection reports.

A second major category of potential customers involves specialized service providers, such as third-party inspection firms, industrial cleaning contractors, and construction maintenance companies, particularly those operating in the high-rise and maritime segments. These service providers leverage wall climbing robots to offer competitive, safer, and faster service packages to their clients. For instance, large shipping companies and port operators are increasingly becoming customers for robots utilized in biofouling removal from ship hulls, a vital maintenance activity for fuel efficiency. These buyers often favor robots that are rapidly deployable, easily transportable, and adaptable to a variety of surface conditions and material types, driving demand for vacuum-based and versatile magnetic systems.

Furthermore, governmental bodies, particularly those involved in military logistics and critical infrastructure security, represent a significant, high-value customer base. These applications often focus on surveillance, rapid structural damage assessment following disasters, and maintenance of specialized structures that require minimal operational footprint. The defining characteristics of the purchasing criteria for all these potential customers revolve around Total Cost of Ownership (TCO), demonstrated Mean Time Between Failures (MTBF), adherence to industry-specific data standards, and seamless integration of the robot's data output into existing asset management systems, shifting procurement focus from simply purchasing hardware to acquiring a complete, certified inspection solution.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $1,475 Million |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Gecko Robotics, Kuka AG, ABB Ltd., Sarcos Technology and Robotics Corporation, Ikaros Robotics, Ropeless Systems, WallRoTec GmbH, NDT Systems & Sensors, Roco Systems, Technoelevator, Inuktun Services Ltd., Eddyfi Technologies, AETOS Robot, Nexxis, Boston Dynamics, Cybernetix, Tecnalia. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wall Climbing Robot Market Key Technology Landscape

The technological backbone of the Wall Climbing Robot Market rests on three interdependent pillars: robust adhesion systems, sophisticated navigation and control algorithms, and miniaturized, high-fidelity sensor integration. Adhesion technology remains the most critical determinant of a robot's operational scope, requiring continuous innovation to manage varying surface conditions, including rust, paint coatings, moisture, and temperature fluctuations. Magnetic adhesion systems rely on powerful rare-earth magnets (Neodymium) combined with active flux control to ensure stable movement and load bearing capacity on ferrous metals. Vacuum systems necessitate advanced perimeter sealing materials and efficient power management to maintain necessary differential pressure, crucial for non-metallic substrates like concrete or glass. Emerging technologies are exploring electrostatic and micro-suction methods to enable vertical mobility on highly sensitive or delicate materials, pushing the boundaries of material compatibility and versatility.

Navigation and autonomy technology are rapidly maturing, driven by breakthroughs in simultaneous localization and mapping (SLAM) tailored for non-planar environments. Unlike ground robots, wall climbers must account for gravity and non-isotropic friction, requiring complex six-degree-of-freedom control systems. Key technological developments include the integration of multi-modal sensing—combining Inertial Measurement Units (IMUs), LiDAR, and structured light scanners—to create highly accurate 3D maps of the structure, enabling precision inspection maneuvers and autonomous path planning over complex geometries such as edges, corners, and welds. The shift toward semi-autonomous and fully autonomous operation is also heavily dependent on efficient, decentralized computing architectures embedded within the robot, minimizing reliance on constant external communication links which can be unreliable in industrial settings like shielded tanks or deep offshore environments.

Furthermore, the utility of wall climbing robots is fundamentally linked to the quality and diversity of the payload sensors they can carry. The integration landscape is characterized by the miniaturization of advanced Non-Destructive Testing (NDT) tools, including phased array ultrasonic testing (PAUT), eddy current arrays (ECA), and alternating current field measurement (ACFM) sensors. These sensors must be designed to withstand the harsh vibrational environment inherent to vertical movement while maintaining high measurement accuracy. Power source innovation is equally vital, focusing on high-density, rapidly chargeable lithium polymer batteries and novel power delivery solutions (e.g., tethered power or inductive charging pads) to extend mission endurance and maximize efficiency. The interplay between efficient power, accurate sensors, and stable adhesion defines the competitive edge in the current technology landscape, moving these tools from niche applications to mainstream industrial assets.

Regional Highlights

North America is a dominant force in the Wall Climbing Robot Market, primarily driven by expansive critical infrastructure and the highest concentration of mature energy and utilities sectors globally. The region's market adoption is fueled by stringent safety regulations imposed by bodies such as OSHA and growing concerns over the structural integrity of aging assets, including bridges, dams, and expansive oil and gas pipeline networks. Demand is particularly high for certified NDT inspection robots in the petrochemical and nuclear industries, where reliability and compliance are paramount. Furthermore, high labor costs incentivize rapid automation adoption, positioning the U.S. and Canada at the forefront of implementing RaaS models and investing heavily in advanced robotic maintenance solutions for civil engineering projects and renewable energy installations, particularly large-scale wind farms and solar array inspections. The presence of leading robotics research institutions and major industrial players further consolidates North America’s market leadership.

Europe represents another critical market, characterized by significant early technological adoption and a strong focus on sustainability and facade maintenance. Countries such as Germany, the UK, and France show high demand, especially in the construction sector for cleaning high-rise glass structures and performing critical maintenance on historical or architecturally significant buildings where traditional access methods are restrictive. The European energy sector, with its robust nuclear power base and increasing investment in offshore wind energy, drives demand for magnetic and vacuum robots capable of operating in harsh marine environments and radiation-exposed containment vessels. Strict European Union directives regarding worker safety and environmental protection continually accelerate the replacement of manual procedures with automated vertical inspection systems, emphasizing eco-friendly cleaning and maintenance applications.

Asia Pacific (APAC) is projected to be the fastest-growing region, presenting immense market potential driven by rapid urbanization, substantial investments in infrastructure development, and burgeoning manufacturing capacity. Nations like China, South Korea, and Japan are heavily investing in smart manufacturing, ship building, and petrochemical complexes, creating a massive need for automated inspection and maintenance. The sheer volume and scale of new high-rise construction in major APAC metropolitan areas provide a fertile ground for facade cleaning and quality assurance robots. While initial price sensitivity exists, the long-term benefits of safety and efficiency, coupled with government initiatives promoting industrial automation, are overcoming these barriers, leading to increased adoption in heavy industries and complex manufacturing environments.

Latin America is categorized as an emerging market, where the adoption of wall climbing robots is gaining traction, primarily within the oil and gas and mining sectors. Countries like Brazil and Mexico, with vast reserves and operational facilities, are utilizing robots for internal tank inspection, pipeline exterior health monitoring, and structural assessment of industrial plants to enhance operational safety and comply with international energy standards. Market growth, while slower than in developed regions, is steadily increasing, driven by the need to modernize existing infrastructure and overcome challenges associated with inspecting remote or hazardous vertical assets often encountered in resource extraction industries. The market here is sensitive to economic volatility, but the demonstrated ROI in preventing catastrophic failures acts as a powerful adoption catalyst.

Middle East and Africa (MEA) exhibits strategic demand concentrated primarily in the Gulf Cooperation Council (GCC) states, specifically Saudi Arabia, UAE, and Qatar. This region is dominated by massive infrastructure projects, including large airports, iconic skyscrapers, and extensive desalination and petrochemical facilities. The demand is twofold: first, for advanced inspection robots to maintain the integrity of vital oil and storage infrastructure in harsh desert climates; and second, for high-speed cleaning and maintenance of futuristic, glass-clad high-rise buildings characteristic of Gulf architecture. Due to extreme climate conditions and high project values, there is a strong preference for durable, specialized magnetic and vacuum systems that can operate effectively under high temperatures and prolonged exposure to dust and salinity, emphasizing high reliability and minimal downtime.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wall Climbing Robot Market.- Gecko Robotics

- Kuka AG

- ABB Ltd.

- Sarcos Technology and Robotics Corporation

- Ikaros Robotics

- Ropeless Systems

- WallRoTec GmbH

- NDT Systems & Sensors

- Roco Systems

- Technoelevator

- Inuktun Services Ltd.

- Eddyfi Technologies

- AETOS Robot

- Nexxis

- Boston Dynamics

- Cybernetix

- Tecnalia

- EasyReach Robotics

- VertiGIS

- Skybotix

Frequently Asked Questions

Analyze common user questions about the Wall Climbing Robot market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary adhesion technologies used in wall climbing robots?

The primary adhesion technologies include magnetic systems for ferrous materials (e.g., steel tanks), vacuum suction for smooth, non-ferrous surfaces (e.g., glass and concrete), and specialized gripper mechanisms optimized for lattice structures and pipes. Technology selection depends critically on the substrate and required payload.

Which industries are the largest adopters of wall climbing robots globally?

The largest adopting industries are Oil and Gas, driven by storage tank and pipeline inspection needs, followed closely by Construction and Infrastructure sectors for facade maintenance and structural health monitoring of bridges and high-rise buildings, emphasizing worker safety and regulatory compliance.

How does the integration of AI improve the performance of these robots?

AI integration significantly improves performance by enabling autonomous navigation, optimizing inspection paths, and providing advanced machine learning capabilities for real-time defect recognition and data analysis, translating raw sensor data into actionable maintenance reports with high precision.

What is the main challenge limiting the widespread adoption of vertical climbing robots?

The main challenge is the inherent difficulty in achieving reliable adhesion and locomotion stability on non-ideal surfaces, such as those that are rusty, dirty, or porous. Additionally, the high initial capital investment required for certified, specialized robotic systems acts as a short-term adoption restraint for smaller enterprises.

Are Wall Climbing Robots replacing human maintenance workers entirely?

No, wall climbing robots are primarily designed to augment human capabilities, taking over tasks in environments that are too dangerous, repetitive, or inaccessible for human workers. They enhance safety and data quality, allowing human technicians to focus on data analysis, complex repairs, and strategic decision-making.

What growth opportunity does the Robotics-as-a-Service (RaaS) model offer in this market?

The RaaS model significantly reduces the financial barrier to entry by shifting expenditure from capital investment to operational expenses. This allows smaller companies and asset owners to access sophisticated vertical inspection technology without bearing the costs of ownership, maintenance, and specialized training, thus accelerating market penetration and utility.

How do wall climbing robots contribute to structural health monitoring (SHM)?

They contribute to SHM by providing non-destructive testing (NDT) capabilities, carrying high-resolution sensors like PAUT and thermal cameras directly to critical points on vertical structures. This enables consistent, repeatable data collection necessary for long-term trend analysis and predictive maintenance strategies, significantly extending asset life.

Which regional market is forecast to exhibit the highest CAGR?

The Asia Pacific (APAC) region is forecast to exhibit the highest Compound Annual Growth Rate, driven by rapid urbanization, massive infrastructure development projects, and increasing industrial automation across large economies like China and India.

What key factors drive demand for these robots in the wind energy sector?

Demand in the wind energy sector is driven by the necessity for highly frequent, detailed inspection of turbine blades and towers. Wall climbers can efficiently traverse the smooth, often composite surfaces of large wind turbines to detect micro-cracks and material fatigue, which are critical for maximizing power generation efficiency and safety.

How is the power management challenge being addressed in current robot designs?

Power management is addressed through the utilization of high-density battery technologies (e.g., Li-Po) and significant software optimization to minimize energy consumption during locomotion and standby. Additionally, some heavy-duty robots still utilize specialized tethered power systems or explore innovative approaches like temporary on-surface induction charging pads to maximize operational endurance.

What is the primary function of the vacuum adhesion mechanism?

The vacuum adhesion mechanism generates suction cups or chambers that create a pressure differential, allowing the robot to adhere to non-ferrous surfaces such as glass, concrete, and composite materials. It is highly valued for its versatility across various smooth building materials.

What security applications exist for wall climbing robots?

Security applications include high-rise perimeter surveillance, rapid damage assessment of critical infrastructure following security breaches or natural disasters, and reconnaissance missions in urban canyons or challenging vertical environments where drone deployment might be restricted or less effective.

How do customization requirements influence market competition?

Customization requirements, driven by specific industrial needs (e.g., explosion-proofing, radiation hardening, unique NDT payload integration), intensify market competition. Manufacturers must demonstrate high flexibility and vertical integration capabilities to meet the highly specialized demands of large enterprise buyers, favoring established players with strong R&D resources.

What role do advanced materials play in wall climbing robot design?

Advanced materials, particularly lightweight carbon fiber composites and specialized alloys, are crucial for reducing the robot’s weight while maximizing its structural integrity and payload capacity. Lighter weight improves efficiency, reduces strain on adhesion systems, and extends battery life, which is paramount for mission completion.

What does the term "six-degree-of-freedom control" refer to in vertical robotics?

Six-degree-of-freedom control refers to the robot's ability to move and rotate freely along and around all three axes (X, Y, Z, Yaw, Pitch, Roll). This level of control is necessary for vertical robots to navigate complex, non-planar surfaces, transition between vertical and horizontal planes, and precisely position NDT sensors against the inspection surface.

Why is the oil and gas sector a major driver for this market?

The oil and gas sector is a major driver because it manages vast, critical assets (storage tanks, pressure vessels, pipelines) that require mandatory, frequent, and highly accurate internal and external non-destructive testing, often in hazardous or confined spaces, making automated inspection a vital safety and compliance necessity.

How is the market addressing the issue of surface irregularity for vacuum adhesion?

The market addresses surface irregularity by developing segmented vacuum systems, utilizing advanced flexible rubber or foam seals that conform better to uneven textures, and incorporating active suspension systems that maintain constant, optimal contact pressure across varied terrain, enhancing overall adherence reliability.

What is the significance of integrating ultrasonic testing capabilities?

Integrating ultrasonic testing (UT), especially phased array ultrasonic testing (PAUT), is significant because it allows robots to perform volumetric inspection, detecting subsurface defects, corrosion, and wall thickness measurements that cannot be identified through visual inspection alone. This is essential for structural integrity assessments.

How do Wall Climbing Robots contribute to emissions reduction in maritime applications?

In maritime applications, wall climbing robots contribute to emissions reduction by efficiently removing biofouling (algae, barnacles) from ship hulls. A clean hull significantly reduces hydrodynamic drag, leading to lower fuel consumption and consequently reduced greenhouse gas emissions during vessel operation.

What are the key differences between magnetic and vacuum adhesion robots?

Magnetic robots are limited to ferromagnetic materials but offer very high payload capacity and require less power to maintain adhesion. Vacuum robots are versatile across many materials but are sensitive to surface irregularities and require continuous power to run the suction system, often having a lower payload capacity compared to strong magnetic systems.

In which segment is R&D investment most concentrated?

R&D investment is most concentrated in the development of hybrid adhesion systems that combine different technologies (e.g., magnetic with small grippers or enhanced vacuum seals) to maximize versatility across complex and non-uniform surfaces, alongside significant investment in autonomous software and miniaturized NDT sensors.

What impact do environmental regulations have on market growth?

Environmental regulations, particularly those concerning occupational safety (reducing falls) and minimizing environmental impact (e.g., safer chemical use in cleaning or non-invasive inspection), strongly drive market growth by necessitating the use of safer and more controlled robotic solutions over traditional manual labor methods.

Which application segment is expected to see the highest growth rate?

The Maintenance and Repair application segment is expected to see the highest growth rate, moving beyond simple inspection into tasks like precision spot welding, coating application, and composite repair on vertical structures, representing higher value-add services for end-users.

How do manufacturers ensure data security when performing remote inspections?

Manufacturers ensure data security by employing encrypted data transmission protocols (end-to-end encryption), implementing secure operating systems on the robot, and ensuring compliance with industrial IoT security standards, often integrating with the customer’s existing secure enterprise cloud infrastructure for data storage.

What defines the emerging market opportunity for robots in nuclear energy?

The emerging opportunity in nuclear energy is defined by the critical need for radiation-hardened robots capable of performing NDT inspection and monitoring inside reactor containment vessels and other highly contaminated areas, drastically reducing human exposure and downtime during maintenance outages.

What is the role of the Value-Added Reseller (VAR) in the distribution channel?

VARs play a crucial role by providing localized sales, technical support, training, and integration services, often customizing the robot's sensor payload or software interface to meet specific regional industrial standards before delivering the complete solution to the end-customer.

Why is battery life optimization paramount in this market?

Battery life optimization is paramount because mission time for vertical inspection is often critical, and replacing or recharging a robot mid-climb is operationally difficult and costly. Longer battery life ensures full mission coverage and maximizes the efficiency of the field deployment.

What is the primary constraint related to high initial investment?

The primary constraint is that the initial purchase price for highly specialized, certified, and durable industrial wall climbing robots, coupled with necessary training and supporting software, can be substantial, making the return on investment calculation challenging for organizations with limited operational budgets.

How does the Wall Climbing Robot market benefit from smart city initiatives?

Smart city initiatives drive demand by focusing on advanced structural health monitoring for urban infrastructure (skyscrapers, elevated transport systems) and integrating automated facade cleaning and maintenance services, which require safe, repeatable, and data-rich operational methods.

Which metric is most important for customers when evaluating robot reliability?

The most important metric for customers, especially in critical industries, is the Mean Time Between Failures (MTBF), as reliability on a vertical surface in a high-risk environment is non-negotiable. Low MTBF demonstrates a robot's ruggedness and operational trustworthiness.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager