Wall Mount Enclosure Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432539 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Wall Mount Enclosure Market Size

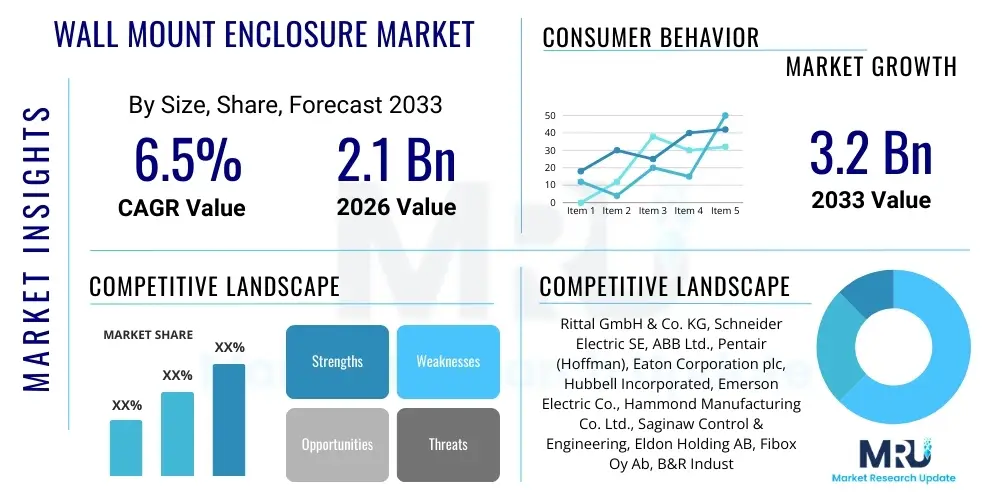

The Wall Mount Enclosure Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.2 Billion by the end of the forecast period in 2033.

Wall Mount Enclosure Market introduction

The Wall Mount Enclosure Market encompasses protective housing solutions designed to secure electrical, electronic, and data communication equipment by mounting them directly onto vertical surfaces. These enclosures are critical components in industrial, commercial, and residential settings, providing necessary protection against environmental hazards such as dust, moisture, corrosive chemicals, and physical impact. The primary function is to safeguard sensitive internal components, ensuring compliance with safety standards (like NEMA and IP ratings) and maintaining operational continuity for crucial infrastructure. The robustness and material choice—ranging from galvanized steel and stainless steel to polycarbonate and fiberglass—determine their suitability for diverse demanding environments, from clean room facilities to harsh outdoor installations.

Wall mount enclosures are extensively utilized in major applications including industrial automation systems, telecommunication networks, data processing centers (edge computing nodes), and smart grid infrastructure. Their compact form factor and ease of installation make them ideal for environments where floor space is limited, providing organized and centralized housing for control systems, power distribution units, networking switches, and fiber optic splice points. The demand trajectory is strongly correlated with the expansion of industrial IoT (IIoT), the rapid deployment of 5G networks, and the continued automation across various manufacturing sectors globally, all of which require decentralized yet protected electronic housing.

Key benefits driving market growth include enhanced equipment longevity due to superior environmental protection, simplified maintenance access through features like hinged doors and quick-release latches, and improved regulatory compliance, particularly concerning electromagnetic compatibility (EMC) and personnel safety. Furthermore, driving factors involve increasing capital expenditure in factory modernization, the necessity for robust cybersecurity measures (as secure housing is the first line of defense for physical network infrastructure), and the widespread adoption of decentralized control architectures across utility and infrastructure sectors. The ongoing shift toward smart city initiatives also necessitates a larger volume of compact, protected edge computing hardware housed within wall mount systems.

Wall Mount Enclosure Market Executive Summary

The Wall Mount Enclosure Market is experiencing robust growth driven primarily by accelerating industrial digitization, the proliferation of edge computing infrastructures, and rising stringent regulatory requirements concerning equipment protection in hazardous locations. Business trends indicate a strong move toward highly customized and modular enclosure solutions that offer quick assembly, thermal management optimization, and advanced security features, such as biometric access or networked monitoring. Key manufacturers are focusing on integrating materials science innovations, particularly high-performance polymers and lightweight alloys, to improve ingress protection (IP) ratings while reducing overall system weight and installation complexity, catering specifically to the fast-paced installation needs of telecom and IIoT deployment projects.

Regionally, the Asia Pacific (APAC) market dominates the growth trajectory, fueled by massive infrastructure investments in China and India, rapid expansion of manufacturing capabilities, and extensive 5G network rollouts requiring thousands of protected base station control units. North America and Europe maintain significant market share, characterized by high demand for specialized, high-specification enclosures necessary for sophisticated industrial automation (Industry 4.0) and highly regulated environments like pharmaceutical manufacturing and nuclear facilities. The market in Latin America and MEA is witnessing steady growth, driven by investments in renewable energy infrastructure and urbanization projects that require reliable electrical distribution housing.

Segment trends highlight the increasing prominence of stainless steel enclosures, particularly in food and beverage processing, pharmaceuticals, and chemical industries where sanitation and corrosion resistance are paramount. Technology-wise, enclosures incorporating advanced thermal management solutions, such as integrated fans, heat exchangers, and cooling units, are gaining traction to manage the heat generated by densely packed high-performance network equipment used in edge data centers. Furthermore, the plastic/fiberglass segment is showing accelerated growth due to its cost-effectiveness, lighter weight, and inherent insulation properties, making it preferred for outdoor telecommunication junction boxes and utility metering applications where conductivity must be avoided.

AI Impact Analysis on Wall Mount Enclosure Market

Common user questions regarding AI’s impact on wall mount enclosures often revolve around how smart technology influences design, maintenance, and material requirements. Users frequently inquire about the integration of sensors for predictive maintenance, the necessity for enhanced thermal management due to high-density AI hardware (GPUs/TPUs) housed within compact enclosures, and whether AI-driven manufacturing processes can lead to more customized or optimized enclosure designs. This user concern summary indicates a core focus on the shift from passive protective housing to active, intelligent infrastructure components capable of self-monitoring and optimized cooling, driven by the massive computing power required for edge AI applications being deployed in these very enclosures.

The rise of edge AI inference engines and small-scale machine learning data processing deployed outside traditional data centers directly influences the enclosure market. AI applications demand high processing power, which in turn generates substantial heat within confined spaces. This necessitates fundamental redesigns of standard wall mount units to incorporate sophisticated active cooling mechanisms, including intelligent fan control systems and specialized airflow optimization features. Furthermore, the complexity of deploying and monitoring these remote AI systems drives the need for "smart enclosures" equipped with environmental sensors (temperature, humidity, vibration) and networked connectivity (IIoT gateways) that can transmit real-time data back for AI-driven operational analysis and predictive maintenance scheduling.

AI also impacts the manufacturing side, leading to improvements in supply chain efficiency and product customization. AI algorithms are used in advanced computer-aided design (CAD) to simulate real-world environmental stress, optimizing material usage and structural integrity before physical prototyping, thus accelerating time-to-market for specialized enclosures (e.g., custom IP-rated units for hazardous areas). The implementation of AI-powered quality control systems in fabrication facilities minimizes defects in critical welding and sealing processes, ensuring that the manufactured enclosures consistently meet the required NEMA and IP standards, which is vital for high-stakes industrial and military applications.

- AI-driven Predictive Maintenance: Integration of sensors for monitoring enclosure health (vibration, thermal runaway, door status), allowing for condition-based servicing.

- Enhanced Thermal Management: Demand for enclosures optimized for high heat loads generated by AI/ML computing hardware at the edge, requiring integrated liquid cooling loops or intelligent active ventilation.

- Optimized Design and Customization: Use of generative design AI to rapidly develop structurally optimized, material-efficient, and application-specific enclosure configurations.

- Physical Security Integration: Deployment of AI-powered video analytics or facial recognition systems built into the enclosure structure for heightened access control in remote installations.

- Smart Edge Deployment: Enclosures acting as integrated gateways for processing local data, often housing the specialized hardware required for AI inference models in industrial settings.

DRO & Impact Forces Of Wall Mount Enclosure Market

The Wall Mount Enclosure Market is fundamentally shaped by several distinct dynamics: Drivers (D), Restraints (R), Opportunities (O), and the overarching Impact Forces influencing these elements. A key driver is the relentless pace of industrial automation and the resultant proliferation of control systems requiring rugged protection outside clean data center environments. This is coupled with increasingly rigorous safety regulations (such as explosion protection standards like ATEX and IECEx) that mandate high-integrity housing for electrical components in hazardous locations. The primary constraint, however, often relates to material costs fluctuations, particularly for high-grade stainless steel or specialized protective coatings, alongside the technical complexity and lead times associated with highly customized, compliant enclosure fabrication.

Significant opportunities exist in emerging sectors like decentralized renewable energy generation (solar farms, wind power), where sensitive monitoring and power conversion equipment must be housed outdoors, demanding specialized NEMA 4X or IP66/67 rated enclosures with superior UV and corrosion resistance. Furthermore, the rapid global expansion of 5G infrastructure provides a massive opportunity for compact, thermally efficient wall mount units designed specifically for radio access network (RAN) equipment and backhaul fiber termination points. Manufacturers focusing on smart features, such as integrated climate control and IoT connectivity for remote monitoring, are best positioned to capitalize on these new market demands, particularly in the smart city and industrial IoT landscapes.

The impact forces driving this market include technological innovation, regulatory pressure, and macroeconomic capital expenditure cycles. The force of technological innovation constantly pushes toward lighter, stronger materials and modular designs that accommodate diverse internal configurations quickly. Regulatory forces continually demand higher safety standards, particularly concerning electromagnetic interference (EMI) shielding and personnel safety (arc flash protection), compelling end-users to upgrade legacy infrastructure with certified enclosures. Finally, global capital expenditure cycles, especially in manufacturing and utility sectors, directly determine the volume of new project deployments that require the procurement of thousands of specialized wall mount enclosures, thereby linking market performance to overall economic health and industrial investment levels.

Segmentation Analysis

The Wall Mount Enclosure Market is highly diversified, segmented across various parameters including the material used, the physical type or configuration, the application environment, and the end-use industry vertical. Understanding these segmentations is critical for manufacturers to tailor their product offerings to specific operational demands, which range from basic dust protection in commercial environments to highly specialized explosion-proof enclosures in oil and gas refineries. The segmentation breakdown provides a granular view of demand drivers, revealing that high-growth segments often align with sectors experiencing high levels of regulatory oversight and rapid technological advancement, such as telecommunications infrastructure and advanced automation systems requiring superior environmental protection.

Material composition remains a foundational differentiator, influencing cost, weight, and environmental performance. While metal enclosures (primarily steel and aluminum) dominate industrial applications due to strength and excellent EMI shielding, non-metallic options (fiberglass and polycarbonate) are gaining ground in highly corrosive outdoor settings or applications requiring non-conductive housing. Segmentation by application type highlights demand concentration: for instance, IT and Networking demands specific thermal management features and physical security, whereas Industrial Automation requires robustness and quick maintenance access via hinged doors and modular internal mounting plates. The complexity and value associated with an enclosure often increase significantly when moving from general-purpose utility use to highly specialized industrial control applications.

The geographical segmentation reflects differing rates of industrialization and infrastructure maturity. Developed markets prioritize replacement cycles and high-specification, customized solutions, driven by Industry 4.0 adoption. Conversely, emerging markets are focused on large-volume, standard-specification enclosures for foundational infrastructure rollouts like electrical distribution and basic telecommunications expansion. This diverse segmentation structure underscores the market's adaptability, allowing manufacturers to serve niche high-margin segments (e.g., healthcare clean room enclosures) while simultaneously competing in high-volume, standardized segments (e.g., commercial networking cabinets), necessitating a flexible production and distribution strategy.

- By Material:

- Metal (Stainless Steel, Carbon Steel, Aluminum)

- Non-metallic (Fiberglass, Polycarbonate, ABS)

- By Type:

- Single Door Enclosures

- Double Door Enclosures

- Sloped Top Enclosures (Hygiene-focused)

- Window/Viewing Panel Enclosures

- Modular Enclosures

- By Protection Rating:

- NEMA Rated (NEMA 1, 3R, 4, 4X, 12)

- IP Rated (IP55, IP66, IP67)

- Hazardous Location/Explosion Proof (ATEX/IECEx certified)

- By Application:

- Industrial Automation and Control

- IT and Networking (Edge Data Centers)

- Telecommunications (5G Infrastructure, Fiber Distribution)

- Power Distribution and Utility

- Security and Surveillance Systems

- By End-use Vertical:

- Manufacturing (Automotive, Food & Beverage)

- Oil & Gas and Chemical

- Energy and Utility

- Healthcare and Pharmaceutical

- Transportation (Rail, Road)

Value Chain Analysis For Wall Mount Enclosure Market

The value chain for the Wall Mount Enclosure Market begins with the upstream segment, dominated by raw material suppliers providing specialized metals (steel, aluminum, alloys) and high-performance polymers (polycarbonate, fiberglass resins). Material quality, particularly corrosion resistance and structural strength, dictates the final product's IP/NEMA rating and subsequent market applicability. Key activities at this stage include sourcing high-grade materials, precision cutting, stamping, and specialized surface preparation, such as galvanization or powder coating, which adds significant value by enhancing the enclosure's durability and aesthetic finish. Efficiency in material procurement and waste minimization are crucial competitive advantages in this segment.

The midstream involves the core manufacturing process, where fabrication, welding, assembly, and integration take place. This stage is highly skill-intensive, requiring specialized machinery for precise sealing techniques and quality control to ensure strict adherence to international standards (UL, CE, NEMA). Manufacturers often specialize in specific enclosure types—for example, focusing entirely on sanitary stainless steel units for the food industry or explosion-proof enclosures for chemical processing. Downstream activities involve distribution channels, which are typically bifurcated into direct sales to large OEM system integrators and indirect sales through a network of specialized electrical wholesalers, industrial distributors, and catalog resellers who provide localized inventory and technical support to smaller end-users and contractors.

The effective distribution channel management is paramount to market penetration. Direct distribution is favored for large, complex projects requiring high customization and engineering collaboration, such as large-scale factory automation projects or national telecom rollouts. Indirect channels, through specialized distributors like Grainger or Rexel, handle the bulk of standardized, off-the-shelf product sales, providing essential last-mile delivery and technical service. Customer service and post-sale technical support, including assistance with configuration and compliance documentation, form the final, crucial component of the value chain, ensuring high customer retention and driving repeat business, especially among system integrators who rely on consistent product quality and reliable supply.

Wall Mount Enclosure Market Potential Customers

Potential customers for wall mount enclosures span a vast array of industries, primarily comprising End-Users (who install and operate the equipment) and System Integrators/OEMs (who purchase the enclosures as components within larger engineered solutions). Major End-Users include manufacturing facilities (automotive, machinery, consumer goods) requiring protected housing for Programmable Logic Controllers (PLCs), Variable Frequency Drives (VFDs), and HMI panels used in production lines. Utility companies, encompassing power generation, transmission, and water treatment, are significant buyers, needing robust, weather-resistant enclosures for metering, switching gear, and SCADA control systems deployed across distributed infrastructure assets.

Beyond traditional industrial sectors, the rapidly growing technology and communications sectors represent a critical customer base. Telecommunication service providers (Telcos) rely on compact wall mount units to house fiber optic splicing trays, 5G small cell radio equipment, and necessary power backup systems, often requiring specialized thermal management and anti-vandalism features for street-side deployment. Similarly, developers and operators of edge computing facilities and micro-data centers are high-value customers, demanding high-density, secure, and environmentally controlled wall mount cabinets capable of housing servers and network switches in non-traditional IT spaces like factory floors or retail backrooms, necessitating superior cooling and EMI shielding performance.

Furthermore, the building automation and commercial infrastructure sector, including large hospitals, universities, commercial office complexes, and transportation hubs, regularly procures these enclosures. These customers use them to protect fire alarm control panels, surveillance system hubs, climate control devices, and access control hardware. The purchasing decision for these customers is often based on installation ease, aesthetic integration (especially in public-facing areas), adherence to local building codes, and the long-term reliability provided by certified IP/NEMA ratings, ensuring minimal operational downtime and compliance with safety regulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rittal GmbH & Co. KG, Schneider Electric SE, ABB Ltd., Pentair (Hoffman), Eaton Corporation plc, Hubbell Incorporated, Emerson Electric Co., Hammond Manufacturing Co. Ltd., Saginaw Control & Engineering, Eldon Holding AB, Fibox Oy Ab, B&R Industrial Automation GmbH, Adalet, Bud Industries Inc., nVent Electric plc, Legrand SA, TE Connectivity Ltd., APW Enclosures, Allied Moulded Products Inc., Apex Enclosures. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wall Mount Enclosure Market Key Technology Landscape

The technology landscape for the Wall Mount Enclosure Market is shifting from static physical protection toward integrated, intelligent infrastructure components. A primary focus involves advanced material science, particularly the development of specialized coatings and alloys that enhance corrosion resistance and thermal dissipation capabilities without significantly increasing weight or cost. Key innovations include specialized polyester powder coatings that offer exceptional resistance to UV radiation and saltwater environments, making them ideal for coastal and outdoor telecom applications. Furthermore, there is a push towards lightweight aluminum and high-strength plastic composites that maintain high IP ratings while simplifying handling and installation processes compared to heavy-gauge steel counterparts.

Thermal management is another crucial technological area. As networking and control equipment housed within wall mount enclosures becomes denser and generates more heat—especially with the rise of edge computing—passive ventilation is often insufficient. Consequently, the market is seeing increased adoption of active cooling technologies tailored for compact spaces, including highly efficient fan and filter systems, air-to-air heat exchangers, and small, high-performance climate control units (mini split AC units specifically designed for enclosures). These systems often integrate smart controls that modulate cooling output based on internal temperature sensors, optimizing energy consumption and extending the lifespan of the internal electronics.

Additionally, the integration of digital features defines the cutting edge of enclosure technology. This includes pre-installed IoT sensors for remote monitoring of environmental conditions (temperature, humidity, door access, shock detection) and networked power management systems that allow facility managers to monitor the status of decentralized assets remotely. Modular design technology is also prevalent, utilizing standardized panel inserts, universal mounting rails, and quick-lock mechanisms (like quarter-turn locks and concealed hinges) to dramatically reduce installation and modification time, facilitating rapid deployment in industrial retrofit projects and reducing overall total cost of ownership (TCO) for end-users.

Regional Highlights

The global Wall Mount Enclosure Market exhibits diverse characteristics across key geographical regions, heavily influenced by regional infrastructure spending, industrial maturity, and regulatory environments. North America, including the United States and Canada, represents a mature market characterized by stringent safety and environmental standards (NEMA, UL). Demand here is driven by large-scale modernization projects across critical infrastructure, notably in oil and gas, utility smart grid deployment, and the rapid establishment of edge data centers in secondary markets. Customers in this region prioritize high-specification products, custom engineering services, and compliance documentation, leading to a strong demand for NEMA 4X stainless steel enclosures and specialized solutions for hazardous locations, maintaining high average selling prices (ASPs).

Asia Pacific (APAC) is the dominant and fastest-growing region, primarily fueled by unprecedented industrial expansion, massive urbanization, and extensive government investment in telecom and transport infrastructure across China, India, and Southeast Asian nations. The region sees huge volumes of demand for standard carbon steel and non-metallic enclosures for electrical distribution and communication networks, alongside growing demand for specialized products driven by the adoption of Industry 4.0 standards in Japanese, South Korean, and increasingly Chinese manufacturing hubs. The competitive landscape in APAC is intense, focusing on scalable production and localized supply chains to meet the accelerating pace of infrastructure deployment, particularly in emerging economies where new factories and utility projects are constant.

Europe holds a significant market share, distinguished by its focus on sustainability, advanced industrial automation (Industry 4.0 adoption in Germany and Nordic countries), and high regulatory focus on electromagnetic compatibility (EMC) and environmental protection (IP ratings). European demand favors highly modular, energy-efficient enclosures, often incorporating advanced climate control systems to comply with strict energy consumption standards. The market in the Middle East and Africa (MEA) and Latin America (LATAM) is showing consistent, high-potential growth, primarily linked to ongoing public utility projects, diversification away from oil economies (MEA), and heavy investment in renewable energy generation, which necessitates robust, outdoor-rated (IP66/67) enclosures capable of withstanding extreme environmental conditions like high temperatures, dust storms, and seismic activity.

- North America (NA): Dominant segment driven by high technological adoption in critical infrastructure, strict adherence to NEMA standards, high demand for certified explosion-proof enclosures in the energy sector, and robust replacement cycles in mature manufacturing industries.

- Europe: Characterized by high demand for modular, highly customizable enclosures supporting advanced Industry 4.0 initiatives; strong preference for energy-efficient climate control solutions and enclosures meeting stringent CE and environmental safety directives.

- Asia Pacific (APAC): Highest growth market due to massive investments in 5G infrastructure, industrial capacity expansion in China and India, and extensive urbanization projects; high volume consumption of both metallic and non-metallic standardized enclosures.

- Latin America (LATAM): Growth driven by investments in modernization of outdated utility grids, development of renewable energy projects (wind and solar), and expansion of manufacturing bases; increasing need for robust, cost-effective industrial solutions.

- Middle East & Africa (MEA): Growth tied to significant government-led infrastructure projects (NEOM, Saudi Vision 2030), demanding enclosures resistant to extreme heat and dust, particularly for utility and telecommunications network deployment in remote, harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wall Mount Enclosure Market.- Rittal GmbH & Co. KG

- Schneider Electric SE

- ABB Ltd.

- Pentair (Hoffman)

- Eaton Corporation plc

- Hubbell Incorporated

- Emerson Electric Co.

- Hammond Manufacturing Co. Ltd.

- Saginaw Control & Engineering

- Eldon Holding AB

- Fibox Oy Ab

- B&R Industrial Automation GmbH

- Adalet

- Bud Industries Inc.

- nVent Electric plc

- Legrand SA

- TE Connectivity Ltd.

- APW Enclosures

- Allied Moulded Products Inc.

- Apex Enclosures

Frequently Asked Questions

Analyze common user questions about the Wall Mount Enclosure market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the demand for Wall Mount Enclosures in the Industrial IoT (IIoT) sector?

Demand is primarily driven by the need to house and protect decentralized control systems, sensors, and edge computing hardware deployed directly on the factory floor or in remote locations. Wall mount enclosures provide necessary IP/NEMA protection against dust, vibration, and temperature extremes, ensuring the reliability and uptime critical for IIoT data collection and process control.

How do NEMA and IP ratings influence the purchasing decision for Wall Mount Enclosures?

NEMA (North American) and IP (International) ratings are critical as they define the enclosure's protective capability against environmental ingress (water, dust) and external hazards. Purchasers select ratings based strictly on the deployment environment; for instance, NEMA 4X or IP66 is typically mandated for washdown or corrosive outdoor applications like food processing or coastal telecommunications.

Which materials are seeing the fastest growth in the Wall Mount Enclosure Market?

While carbon steel remains the largest segment by volume, high-grade stainless steel (304/316) is seeing accelerated value growth due to its application in hygiene-sensitive industries (Pharma, F&B). Non-metallic materials like polycarbonate and fiberglass are growing rapidly for outdoor and corrosive environments due to their lightweight, cost-effectiveness, and inherent insulation properties.

What role does thermal management play in modern Wall Mount Enclosures for edge computing applications?

Thermal management is paramount because edge computing hardware (servers, 5G base stations) generates significant heat in a small, sealed space. Modern enclosures integrate advanced climate control technologies, such as smart heat exchangers and air conditioners, to prevent overheating and maintain optimum operating temperatures, thus ensuring the longevity and performance of high-density electronic components.

How is the 5G rollout impacting the Wall Mount Enclosure market design requirements?

The 5G rollout requires a massive volume of compact, often aesthetically discrete, wall mount enclosures to house small cell equipment and fiber optic distribution units. Design requirements emphasize superior ingress protection (outdoor readiness), robust physical security against tampering, and optimized dimensions for street furniture or pole mounting, often necessitating non-metallic or specialized aluminum housings.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager