Warehouse Partitioning Mesh Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432475 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Warehouse Partitioning Mesh Market Size

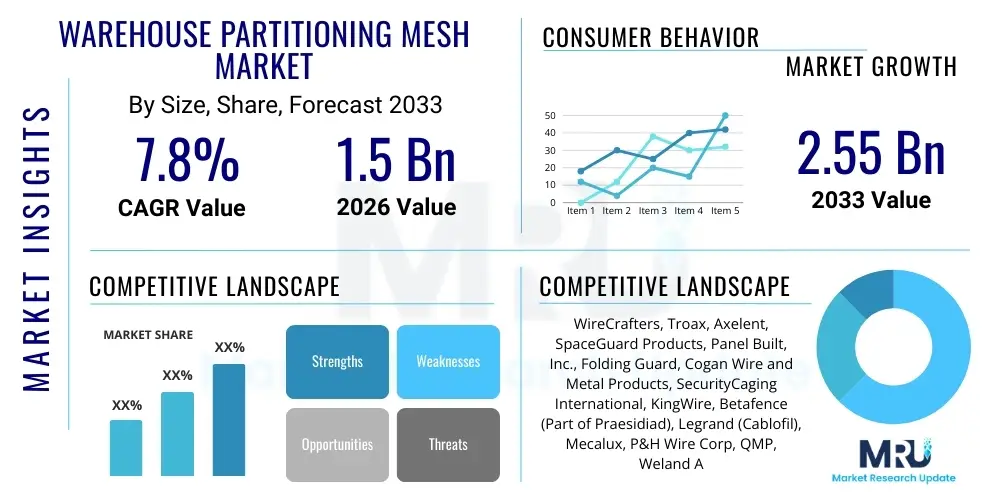

The Warehouse Partitioning Mesh Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Warehouse Partitioning Mesh Market introduction

The Warehouse Partitioning Mesh Market encompasses the fabrication, distribution, and installation of durable wire or steel mesh systems designed to segment internal warehouse spaces. These systems are critical infrastructure components, providing adaptable and modular segregation for inventory control, safety compliance, and enhanced facility security. Partitioning mesh, distinct from solid walls, offers crucial advantages such as visibility, improved ventilation, and fire safety compliance, making it highly favored in modern logistics and distribution centers. The primary product variations include welded wire mesh, woven mesh, and expanded metal panels, tailored to specific security or containment requirements, ranging from simple rack guards to full-scale machine guarding enclosures.

Major applications of warehouse partitioning mesh span machine guarding, secure storage cages for high-value or restricted items (such as pharmaceuticals or electronics), tool cribs, and boundary demarcation between different operational zones (e.g., receiving, picking, packing, and shipping). The inherent flexibility of these modular systems allows warehouses to rapidly reconfigure layouts in response to changing inventory profiles or operational scale requirements. This adaptability is particularly crucial in the fast-paced e-commerce sector, where spatial optimization and efficient workflow separation directly impact fulfillment speed and accuracy.

Driving factors for sustained market growth include stringent occupational safety regulations mandating physical barriers around automated machinery, the global surge in third-party logistics (3PL) requiring highly efficient storage segmentation, and the ongoing modernization of existing warehouse infrastructure worldwide. Furthermore, the increasing adoption of robotics and automated guided vehicles (AGVs) necessitates robust perimeter guarding solutions to ensure worker safety, solidifying the mesh partitioning system as an indispensable safety asset rather than merely a storage accessory.

Warehouse Partitioning Mesh Market Executive Summary

The Warehouse Partitioning Mesh Market is experiencing robust expansion driven primarily by global e-commerce proliferation and heightened regulatory scrutiny concerning workplace safety, particularly around automated systems. Business trends indicate a strong pivot towards modular, customizable mesh systems that integrate seamlessly with smart warehouse technologies, including sensor integration for access control and inventory monitoring. Demand is shifting towards heavy-duty, corrosion-resistant materials capable of enduring high-traffic industrial environments. Key strategic moves by major players involve geographical expansion into emerging APAC markets and the development of quick-install, bolt-together systems to reduce total cost of ownership (TCO) for end-users.

Regional trends highlight North America and Europe as established markets focused on regulatory compliance and technology integration, with significant expenditure on retrofitting existing facilities for automation safety. Conversely, the Asia Pacific region, fueled by massive investment in logistics infrastructure (particularly in China, India, and Southeast Asia), exhibits the highest growth potential, characterized by demand for large-scale installation in newly constructed mega-warehouses and distribution centers. Latin America and MEA show nascent growth, correlated with expanding international trade hubs and increasing adoption of Western safety standards in manufacturing and storage.

Segment trends underscore the dominance of the Welded Wire Mesh segment due to its balance of durability, cost-effectiveness, and visibility. The Application segment is witnessing a rapid increase in demand for Machine Guarding solutions, outpacing general Storage Cages, reflecting the industry's shift towards automation intensity. Furthermore, the 3PL and E-commerce Retail segments remain the largest end-users, consistently demanding scalable and secure segregation solutions essential for managing diverse product inventories and maintaining strict inventory accuracy protocols.

AI Impact Analysis on Warehouse Partitioning Mesh Market

User inquiries regarding AI's impact on the Warehouse Partitioning Mesh Market generally center on whether intelligent systems will render physical barriers obsolete, or conversely, how AI can enhance the utility of mesh structures. Key concerns revolve around optimizing warehouse layouts using AI algorithms, integrating mesh systems with automated surveillance and access control (AI-driven video analytics), and using AI to predict and prevent human-machine collisions, thereby informing the required density and placement of physical partitioning. Expectations are high for AI to transform mesh infrastructure from passive safety features into active components of a smart, interconnected safety ecosystem.

The core influence of AI lies not in replacing physical mesh barriers—which are fundamental legal and physical safety requirements—but in optimizing their deployment and function within the broader logistics environment. AI-powered layout optimization software analyzes operational data (traffic flow, pick routes, hazard zones) to determine the most effective, least intrusive placements for partitioning, maximizing both safety and operational throughput. Furthermore, the integration of smart sensors into mesh panels, managed by AI, facilitates real-time monitoring of structural integrity, unauthorized access attempts, or proximity hazards, transforming static barriers into dynamic risk mitigation tools. This shift enhances the market value proposition by merging physical security with digital intelligence, justifying increased investment in high-specification, AI-ready mesh systems.

Ultimately, AI drives demand for higher quality, technologically adaptable partitioning. As warehouses become "smarter," the need for precise physical demarcation only increases, especially to segregate areas where high-speed robotics operate from human pedestrian zones. AI systems managing robotic fleets rely on clearly defined physical boundaries, often reinforced by mesh, to ensure navigation accuracy and prevent accidental breaches. Thus, AI reinforces the necessity of partitioning mesh while simultaneously pushing manufacturers towards producing modular systems pre-configured for sensor integration and digital mapping.

- AI optimizes mesh placement and layout design based on operational efficiency and hazard mapping.

- Integration of AI-driven video analytics with mesh enclosures enhances perimeter security and access control monitoring.

- Predictive maintenance algorithms use sensor data embedded in mesh systems to forecast potential structural failure or damage.

- AI systems managing Autonomous Mobile Robots (AMRs) rely on mesh barriers to define safe operational zones and segregation boundaries.

- Demand forecasting influenced by AI dictates the flexible reconfiguration of partitioning meshes to accommodate seasonal inventory shifts.

DRO & Impact Forces Of Warehouse Partitioning Mesh Market

The Warehouse Partitioning Mesh Market dynamics are fundamentally shaped by the interplay of regulatory imperatives, technological advancements in logistics, and inherent logistical challenges such as high initial investment costs and customization complexity. The primary driver is the undeniable necessity for enhanced safety and security in increasingly automated warehouse environments, directly correlated with the rise of global e-commerce and 3PL services requiring scalable segregation. Restraints primarily involve the substantial capital expenditure required for large-scale installations and the logistical downtime incurred during complex assembly processes, which can deter smaller or efficiency-focused operations. Opportunities abound in integrating mesh systems with Internet of Things (IoT) technologies and catering to the emerging demand for robust perimeter protection around advanced manufacturing cells.

Impact forces currently skew strongly toward market stimulation. Regulatory compliance (a significant external force) consistently dictates the minimum level of partitioning required, ensuring a foundational demand floor. The shift towards micro-fulfillment centers and urban logistics hubs necessitates smaller, highly customized, and rapidly deployable solutions, pushing manufacturers to innovate in modularity and quick-assembly mechanisms. Furthermore, escalating concerns over inventory shrinkage and internal theft, particularly for high-value goods, reinforce the security aspect of mesh partitions, translating directly into higher demand for specialized security cages equipped with advanced locking systems and monitoring capabilities. These combined forces mandate continuous product evolution to meet both safety mandates and modern operational efficiency requirements.

Technological impact forces are increasingly relevant, as the transition to Industry 4.0 warehousing demands products compatible with robotics and complex conveyor systems. Manufacturers are responding by developing anti-vibration mounting solutions and standardized panel sizes that integrate seamlessly with existing structural elements and automation footprints. The market outlook remains positive as the core functionality—providing robust physical separation and safety compliance—is irreplaceable by software solutions alone, positioning partitioning mesh as a resilient, growth-oriented segment of the overall warehouse automation ecosystem.

Segmentation Analysis

The Warehouse Partitioning Mesh Market is segmented based on material type, application, and end-user industry, reflecting the diverse requirements across the logistics, manufacturing, and retail sectors. Material segmentation is crucial as it determines the product's durability, security level, and cost profile, with steel and wire mesh dominating due to their strength and visibility characteristics. Application segmentation highlights the functional use, ranging from essential storage segregation to highly regulated machine guarding, each requiring specific design specifications and regulatory adherence. End-user classification reveals the core consumers, where the rapid expansion of 3PL providers and e-commerce giants drives the highest volume of installations.

Understanding these segments allows market players to tailor their product offerings and marketing strategies effectively. For instance, manufacturers targeting the Automotive End-User segment must prioritize heavy-duty, impact-resistant partitioning for tool cribs and high-speed robotic welding cells, often requiring specific coating standards. Conversely, suppliers focusing on the Pharmaceutical End-User segment emphasize fine mesh sizing for secure containment and cleanability, often requiring stainless steel or non-corrosive treatments. This intricate segmentation ensures that specialized needs regarding security clearance, hygiene standards, and structural load capacity are adequately met across the industrial landscape.

The Machine Guarding segment is experiencing the fastest growth globally due to mandatory safety requirements surrounding automated machinery (e.g., ANSI/RIA R15.06 standards). This trend necessitates sophisticated, interlocked mesh panels that often include integrated safety switches and light curtains. In contrast, general Storage Cage applications, while mature, maintain consistent demand, primarily focusing on inventory organization and securing bulk or general merchandise within existing rack structures. The overall segmentation structure reflects a robust, differentiated market responsive to specific operational and regulatory needs.

- By Material Type:

- Welded Wire Mesh

- Woven Wire Mesh

- Expanded Metal Mesh

- Plastic/Polymer Mesh (Niche applications)

- By Application:

- Machine Guarding and Perimeter Protection

- Secure Storage Cages and Tool Cribs

- Safety Barriers and Fencing

- Inventory Segregation and Zoning

- Data Center Containment

- By End-User:

- Third-Party Logistics (3PL) Providers

- E-commerce and Retail Distribution Centers

- Manufacturing (Automotive, Heavy Machinery)

- Food & Beverage Industry

- Pharmaceuticals and Healthcare

Value Chain Analysis For Warehouse Partitioning Mesh Market

The value chain for the Warehouse Partitioning Mesh Market commences with upstream activities centered on the procurement and processing of raw materials, primarily steel wire, steel tubing, and high-quality coatings (powder coating or galvanization). Key raw material suppliers often involve large steel mills and wire drawing companies, where quality and commodity price volatility significantly influence the final product cost. Manufacturers focus on fabrication, involving precision welding, bending, cutting, and surface finishing to create standardized and customized modular panels and structural posts. Efficiency in this stage, particularly through automation of the welding process, determines the scalability and speed of supply to meet large project demands.

The midstream phase involves distribution and logistics, predominantly handled through specialized industrial equipment distributors, material handling integrators, and, for major projects, direct sales teams. Distribution channels are crucial because the product involves bulky, high-volume shipping, necessitating efficient regional warehousing and specialized transport logistics. Direct distribution models are often used for highly customized machine guarding solutions requiring pre-installation engineering consultation, ensuring compatibility with robotics or specific regulatory standards. Indirect channels, through large industrial suppliers or catalog houses, cater to standardized products and smaller-scale maintenance or expansion projects.

Downstream analysis focuses on installation and end-user utilization. Installation is often performed by certified third-party contractors or specialized teams from the material handling integrator, particularly for complex perimeter guarding systems involving electrical interlocks and safety circuitry. End-users (e.g., 3PLs, manufacturers) utilize the mesh systems to maximize safety compliance, optimize inventory management, and secure assets. Efficiency gains in this final stage are realized through modular designs that simplify assembly, reduce installation time, and allow for easy future reconfigurations without extensive structural modification, ultimately enhancing the product's long-term value proposition.

Warehouse Partitioning Mesh Market Potential Customers

Potential customers for warehouse partitioning mesh are predominantly large-scale industrial operators characterized by high throughput, extensive inventory, and a mandated adherence to stringent safety protocols. The primary buyers are concentrated within the logistics and distribution sector, notably Third-Party Logistics (3PL) providers and major e-commerce retail giants who require rapid, scalable solutions to segment massive, diverse fulfillment centers. These entities purchase partitioning mesh to separate picking zones from storage areas, create secure high-value goods cages, and establish safe perimeters around high-speed automation equipment, treating the mesh system as an integral part of their supply chain infrastructure investment.

Another significant customer segment is the manufacturing industry, particularly automotive, aerospace, and heavy machinery producers. These end-users prioritize the mesh for machine guarding—critical for compliance with OSHA and international safety standards concerning robotic work cells and fabrication equipment. They often require highly customized, durable solutions capable of withstanding industrial solvents and significant operational wear, placing emphasis on specialized coatings and robust structural integrity. For manufacturers, the mesh serves as a mandatory safety barrier necessary for operational licensure and liability mitigation, making purchasing decisions highly sensitive to regulatory compliance and quality specifications.

Furthermore, specialized sectors such as pharmaceuticals, data centers, and cold chain logistics represent niche but high-value customers. Pharmaceutical companies require partitioning for securing controlled substances and defining cleanroom boundaries, often necessitating stainless steel or non-shedding materials. Data centers use mesh partitioning for co-location security and hot/cold aisle containment, prioritizing airflow visibility and strict access control. These customers typically demand specialized, high-security features beyond general storage, driving demand for premium, customized product lines incorporating advanced locking mechanisms and monitoring capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WireCrafters, Troax, Axelent, SpaceGuard Products, Panel Built, Inc., Folding Guard, Cogan Wire and Metal Products, SecurityCaging International, KingWire, Betafence (Part of Praesidiad), Legrand (Cablofil), Mecalux, P&H Wire Corp, QMP, Weland AB, Bosch Rexroth (Safety Fencing), Fastwall, Storforsolven, Allied Wire & Cable, McJing Industrial |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Warehouse Partitioning Mesh Market Key Technology Landscape

The technology landscape for warehouse partitioning mesh is evolving from simple static barriers to integrated, smart infrastructure components, driven by the demands of Industry 4.0 and automated warehousing. Key technological advancements center around enhancing modularity, improving material resilience, and enabling seamless integration with facility management systems. Modular construction using standardized panel sizes and universal mounting hardware is critical, significantly reducing installation time and facilitating rapid reconfiguration in dynamic warehouse environments. Manufacturers are employing advanced computer-aided design (CAD) and manufacturing (CAM) techniques to ensure high precision in panel production, which is essential for compatibility with high-tolerance automation equipment and sophisticated locking mechanisms.

Material science and surface treatment technologies are equally pivotal. The increasing adoption of outdoor or high-humidity warehouse environments necessitates superior corrosion resistance, driving the use of advanced galvanization processes and durable, multi-layer powder coatings that offer enhanced protection against abrasion, chemical exposure, and rust. Furthermore, the development of lightweight yet high-strength steel alloys allows for the production of panels that are easier to handle and install without compromising structural integrity or load-bearing capacity, a crucial factor in multi-level storage facilities. Technological improvements in wire bending and welding techniques also ensure smoother finishes and safer edges, reducing potential workplace hazards.

Crucially, the rise of smart warehousing has pushed manufacturers to integrate technology directly into the mesh systems. This includes factory pre-drilled holes for mounting IoT sensors, safety light curtains, RFID readers, and access control hardware (keypads, biometric scanners). The integration focuses on creating "active" safety barriers—for example, mesh panels interlocked with machine power supplies, ensuring that operations cease immediately upon opening a guard door. This transition from passive physical protection to active safety management is the defining technological trend currently shaping product development and market competitiveness.

Regional Highlights

- North America: This region dominates the market share, characterized by high adoption rates fueled by rigorous safety regulations (OSHA standards) and massive investment in e-commerce fulfillment centers. The market is mature, focusing heavily on retrofitting existing warehouses with automated machine guarding and high-security storage cages. Key countries like the United States and Canada are leading consumers of premium, technologically integrated mesh solutions, often demanding quick assembly and comprehensive engineering support.

- Europe: A highly regulated market driven by the European Union's Machinery Directive and specific national safety standards. Demand is stable, centered on sophisticated, interlocked machine guarding for manufacturing and advanced logistics hubs in Germany, the UK, and Scandinavia. European manufacturers like Troax and Axelent are global leaders, emphasizing quick-delivery systems, environmental sustainability in material sourcing, and compliance with high safety integrity levels (SIL).

- Asia Pacific (APAC): Expected to register the highest CAGR due to explosive growth in industrialization, logistics infrastructure development, and burgeoning middle-class consumption fueling e-commerce expansion in nations like China, India, Japan, and Southeast Asia. The region is seeing rapid construction of new mega-warehouses, driving substantial volume demand for both basic inventory segregation and advanced robotic perimeter protection, often prioritizing cost-efficiency alongside necessary durability.

- Latin America (LATAM): An emerging market showing consistent growth, primarily concentrated in industrialized zones such as Mexico and Brazil. Market development is linked to foreign direct investment (FDI) in manufacturing and the professionalization of logistics chains. Demand focuses initially on basic safety fencing and robust inventory security solutions, with increasing interest in sophisticated machine guarding as automation adoption accelerates.

- Middle East and Africa (MEA): Growth is tied to diversification efforts away from oil economies, particularly massive government investments in smart city logistics hubs (e.g., UAE, Saudi Arabia) and expansion of regional trade routes. The market emphasizes secure, climate-resistant partitioning mesh, particularly in the UAE for large free-trade zone facilities, requiring products tailored for extreme temperatures and dust resistance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Warehouse Partitioning Mesh Market.- WireCrafters

- Troax

- Axelent

- SpaceGuard Products

- Panel Built, Inc.

- Folding Guard

- Cogan Wire and Metal Products

- SecurityCaging International

- KingWire

- Betafence (Part of Praesidiad)

- Legrand (Cablofil)

- Mecalux

- P&H Wire Corp

- QMP

- Weland AB

- Bosch Rexroth (Safety Fencing)

- Fastwall

- Storforsolven

- Allied Wire & Cable

- McJing Industrial

Frequently Asked Questions

Analyze common user questions about the Warehouse Partitioning Mesh market and generate a concise list of summarized FAQs reflecting key topics and concerns.What primary factors are driving the growth of the Warehouse Partitioning Mesh Market?

The market growth is primarily driven by stringent global safety regulations (like OSHA and European standards) mandating physical barriers around automated machinery, combined with the exponential rise in e-commerce necessitating highly organized and secure inventory segregation in fulfillment centers worldwide.

How does the segmentation by application influence design and material selection?

Application segmentation dictates material choice; for example, Machine Guarding requires heavy-duty, interlocked welded wire mesh for safety compliance and impact resistance, whereas Secure Storage Cages for pharmaceuticals might require fine, often stainless steel mesh for hygiene and high-security locking mechanisms.

What role does technology play in modern warehouse partitioning systems?

Modern partitioning systems are increasingly integrated with smart warehouse technology, featuring pre-drilled specifications for IoT sensor mounting, automated access control hardware, and interlocking safety switches that interface directly with machine automation systems (active safety barriers).

Which geographical region is expected to exhibit the fastest growth?

The Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR) due to extensive investment in new logistics infrastructure, rapid industrial automation adoption, and the substantial expansion of regional e-commerce capabilities, particularly in emerging economies.

What is the typical lifespan and required maintenance for industrial partitioning mesh?

High-quality industrial partitioning mesh typically has a lifespan exceeding 20 years, often requiring minimal maintenance limited to periodic inspection of mounting hardware and hinges, and occasional touch-ups of protective powder coating to maintain corrosion resistance in harsh industrial environments.

Detailed Market Overview and Future Outlook

The Warehouse Partitioning Mesh Market is fundamentally intertwined with the global trends in supply chain optimization and industrial safety compliance, positioning it as a non-discretionary expenditure for modern logistics operations. The sustained migration toward high-density storage solutions, driven by rising land costs and urbanization, increases the necessity for meticulously defined and robust safety zones. The evolution of warehouse design, often incorporating multi-level mezzanines and sophisticated conveyance systems, demands partitioning solutions that offer structural versatility, ease of integration with complex ceiling and floor architecture, and adherence to varying fire safety codes which favor mesh over solid walls due to sprinkler system efficacy and smoke ventilation. This structural requirement ensures that the demand for wire mesh, particularly modular welded systems, remains robust and insulated from typical economic volatility affecting peripheral warehouse investments.

Looking forward, the market’s trajectory will be heavily influenced by advancements in robotics and automation technologies. As warehouses deploy more Autonomous Mobile Robots (AMRs) and automated storage and retrieval systems (AS/RS), the complexity of physical perimeter guarding increases. Manufacturers are expected to prioritize research and development into proprietary locking mechanisms, impact-absorbing panel designs, and standardized interfaces for safety PLCs (Programmable Logic Controllers). Furthermore, the shift towards sustainable industrial practices is influencing material procurement, with a growing emphasis on using recycled steel content and low-Volatile Organic Compound (VOC) powder coatings, providing a long-term competitive edge to suppliers demonstrating robust environmental, social, and governance (ESG) compliance within their manufacturing processes.

The competitive landscape is characterized by a mix of large international specialists (like Troax and Axelent) providing high-specification, standardized European products, and regionally focused American manufacturers (like WireCrafters and SpaceGuard Products) offering tailored domestic solutions. Consolidation activities, particularly among material handling integrators, are impacting the distribution channel, favoring mesh manufacturers who can offer comprehensive solutions spanning design consultation, rapid custom fabrication, and certified installation services. This trend suggests that future market success will rely heavily on end-to-end service capabilities rather than just raw material price competition.

Material Analysis Deep Dive: Performance and Application

The selection of material type—Welded Wire Mesh, Woven Wire Mesh, or Expanded Metal Mesh—is critical and depends on the balance between visibility, security rating, and cost. Welded wire mesh is the market leader due to its superior strength-to-weight ratio, ease of manufacture, and consistent grid pattern, which provides excellent visibility for surveillance and inventory checks while offering robust security. Its applications span general security cages to heavy-duty machine guarding, making it the versatile standard product. The primary technical specification differentiating products in this segment is the gauge of the wire and the size of the mesh opening (e.g., 2” x 2” vs. 2” x 1”), which directly impacts the product's resistance to cutting tools and intrusion attempts.

Woven wire mesh, while less common in general warehouse segregation, is favored in applications requiring extremely fine filtration or highly specific aesthetic qualities, such as specialized tool cribs or facilities where vibration dampening is necessary. The interweaving process results in a slightly more flexible panel structure but is generally higher cost per square foot compared to welded mesh. Expanded metal mesh, created by slitting and stretching sheet metal, offers a dense, robust barrier that is impossible to cut without specialized heavy equipment, making it ideal for the highest security applications where complete visual obstruction is acceptable or required, such as securing precious metals or sensitive defense components.

Surface treatments are an indispensable component of the material analysis, particularly galvanization (hot-dip or electro-galvanization) and specialized powder coatings. Galvanization provides exceptional corrosion resistance for cold chain storage environments, outdoor applications, or facilities exposed to high humidity. Powder coating, applied in a range of industrial colors, enhances visibility (e.g., safety yellow borders) and provides a durable, chemical-resistant finish required in food processing or automotive manufacturing facilities, ensuring compliance with hygiene standards and preventing paint chipping or flaking which could contaminate sensitive goods.

Strategic Imperatives for Manufacturers

To maintain competitive advantage in the expanding Warehouse Partitioning Mesh Market, manufacturers must focus on several strategic imperatives rooted in operational efficiency and market responsiveness. First, enhancing modularity and standardization across product lines is crucial. Developing bolt-together systems with minimal unique components reduces inventory carrying costs for distributors and significantly lowers the complexity and time required for field installation, translating directly into a lower total cost of ownership (TCO) for the end-user. Accelerated, standardized installation becomes a major purchasing factor in large-scale logistics projects where minimizing operational downtime is paramount.

Second, strategic emphasis must be placed on technology integration compatibility. This involves designing products that are explicitly ‘future-proof’ by accommodating the current and anticipated needs of smart warehouses. This means supplying mesh panels pre-engineered for sensor mounting, RFID integration points, and compatible dimensions for standard robot safety envelopes. Collaborating with leading industrial automation firms (e.g., robotics and AGV suppliers) to ensure seamless physical compatibility is becoming a necessary prerequisite for securing contracts in automated facilities.

Finally, geographical expansion, particularly into the high-growth APAC region, requires establishing robust regional manufacturing and distribution hubs. Localizing production reduces substantial freight costs associated with shipping bulky mesh panels internationally and allows manufacturers to respond quicker to local market demands, engineering standards, and customization requests. Establishing strong partnerships with regional 3PLs and local system integrators is essential for building a reliable delivery and installation network capable of handling the rapid volume growth forecasted in these emerging markets.

Regulatory Compliance and Safety Standards Influence

Regulatory compliance acts as a non-negotiable floor for demand in the Warehouse Partitioning Mesh Market, particularly in established markets like North America and Europe. The market is significantly influenced by standards such as OSHA (Occupational Safety and Health Administration) in the U.S., which mandates guarding for moving parts and machinery, and the European Machinery Directive 2006/42/EC, which sets strict technical requirements for safety distances, material strength, and interlocked access systems for machine guarding. Adherence to these standards is not optional; it is a fundamental cost of doing business, ensuring continuous, baseline demand for compliant products.

The trend is moving towards higher Safety Integrity Levels (SILs). Customers are increasingly demanding mesh systems that are certified to specific ISO standards (e.g., ISO 13849 for safety of machinery) and can integrate seamlessly into the facility’s overall risk mitigation strategy. This necessitates that manufacturers provide detailed technical documentation, load-bearing specifications, and compliance certificates with every installation, elevating the barrier to entry for lower-quality suppliers. The consequence is a preference for established suppliers who possess proven track records and comprehensive engineering support to navigate complex regulatory requirements.

Furthermore, sector-specific regulations, such as FDA requirements for pharmaceutical storage or specific fire code mandates, influence the mesh panel specifications. For instance, mesh must not impede fire suppression systems, and access gates must include fail-safe mechanisms ensuring rapid egress in emergencies. This intricate web of safety and operational mandates requires manufacturers to maintain highly specialized engineering teams capable of bespoke compliance solutions, ensuring the mesh is not just a barrier, but a certified safety component within a complex operating environment.

Supply Chain Resilience and Risk Management

The supply chain for warehouse partitioning mesh, reliant heavily on steel and industrial finishing processes, is sensitive to global commodity pricing and geopolitical instability. Risk management in this sector centers on diversifying the sourcing of raw materials, implementing long-term pricing agreements with key suppliers, and maintaining buffer stock of high-demand components like standardized panels and structural posts. The volatility observed in steel prices over recent years necessitates a flexible pricing model and strong hedging strategies to protect manufacturing margins and ensure stable project quotes for customers, who often plan facility expansions years in advance.

Logistics efficiency is another major risk factor. Since mesh panels are bulky and often customized, transport costs can form a significant portion of the total delivered cost. Manufacturers mitigating this risk are investing in optimized packaging techniques, using nested designs where possible, and strategically locating fabrication centers closer to major consumption hubs (i.e., near large distribution clusters in Texas, Ohio, or central Europe). The reliance on third-party freight carriers requires stringent quality control processes to prevent damage during transit, which can delay installation and incur substantial costs for replacement and rework.

The strategic advantage lies with companies that can demonstrate end-to-end control over the supply chain, from certified raw material procurement to final installation. Establishing dedicated, certified installation teams or partnerships with highly reliable integrators reduces the risk of project delays and ensures that safety-critical components are assembled correctly, minimizing liability for the manufacturer and guaranteeing compliance for the end-user. This holistic approach to supply chain management is increasingly viewed as a differentiating factor in competitive bids for large-scale warehouse projects.

Future Market Opportunities in Urban Logistics

Urban logistics and the proliferation of micro-fulfillment centers (MFCs) present a significant, high-growth opportunity for the Warehouse Partitioning Mesh Market. As retailers seek to shorten the "last mile" delivery time, smaller, automated facilities are being built in densely populated areas. These MFCs, characterized by high automation density and extremely limited footprints, require highly customized, space-saving partitioning solutions. The challenge lies in designing mesh systems that are fire-code compliant within smaller, often multi-story, urban buildings and can maximize every square foot of segregated space.

Demand in this segment favors specialized products such as modular, retractable or folding mesh barriers, which can be quickly moved or collapsed to facilitate specific operational needs or maintenance access. Furthermore, the aesthetic quality and reduced acoustic impact become more important in urban settings where logistics hubs might abut residential or commercial areas. Manufacturers developing mesh systems optimized for rapid deployment and designed with low-profile footprints are best positioned to capture this emerging segment.

This shift also opens opportunities for specialized materials, including lightweight composites or highly finished stainless steel, balancing industrial functionality with aesthetic considerations required for urban facilities that sometimes integrate public-facing operations. The ability to supply quick-turnaround, bespoke installations—rather than massive standardized orders—is the key success factor in penetrating the urban logistics sector, requiring highly flexible manufacturing and agile installation teams.

Impact of E-commerce on Security Requirements

The exponential growth of e-commerce has fundamentally reshaped inventory management and security requirements, driving increased demand for high-security partitioning mesh. E-commerce fulfillment centers typically handle a vast diversity of products, ranging from low-value bulk items to high-value electronics, jewelry, or controlled substances, necessitating multiple tiers of security segregation within a single facility. Partitioning mesh provides the crucial physical layer to create secure zones for high-value items, mitigating internal and external theft risks (shrinkage).

The security requirements extend beyond simple theft prevention; they also involve stringent protocols for regulatory compliance, such as securing pharmaceuticals or items requiring specific customs clearance. E-commerce operators are investing heavily in mesh enclosures equipped with advanced security features, including electronic keypad access, biometric scanners, ceiling panels to prevent vertical intrusion, and mesh gauge specifications designed to resist specific cutting tools. The data collected from these secure zones (e.g., access logs and temperature control monitoring) often dictates the precise nature and material of the required mesh enclosure.

Moreover, the high turnover and seasonal volatility inherent in e-commerce require partitioning solutions that are easily expandable, removable, and reconfigurable without significant structural interruption. Modular mesh systems fulfill this need perfectly, allowing fulfillment centers to quickly adjust security perimeters and storage volumes in anticipation of peak seasons (e.g., Black Friday or holiday sales), ensuring security infrastructure remains scalable with operational throughput.

Competitive Landscape Analysis and Key Strategies

The competitive environment in the Warehouse Partitioning Mesh Market is moderately consolidated but highly competitive, characterized by strong regional players and a few global entities. Key players primarily compete on three factors: product quality and compliance (particularly safety certifications), installation speed and complexity (modularity), and comprehensive service offerings (design, engineering, installation). Companies specializing in machine guarding, such as Troax and Axelent, focus on high-end solutions integrated with advanced safety mechanisms and certified to the highest European standards, allowing them to command premium pricing.

Conversely, domestic U.S. manufacturers often leverage regional distribution networks and faster lead times for standard products to compete effectively in the large North American market for general storage and segregation needs. A key emerging strategy involves the vertical integration of services—providing consulting and custom engineering early in the warehouse design phase—to secure large, multi-year contracts. Furthermore, developing strong partnerships with automation integrators (e.g., providers of conveyors and AS/RS systems) ensures that mesh products are specified and included in large automation project bids from the outset, rather than being added as an afterthought.

Mergers and acquisitions remain a relevant competitive strategy, often focused on acquiring companies with niche technological capabilities (e.g., proprietary locking mechanisms) or gaining rapid access to new geographic markets (e.g., European firms acquiring small, established distributors in APAC). The overall trend suggests that sustainable market leadership will belong to firms that successfully blend physical product superiority with advanced digital compatibility and exceptional service delivery across the entire project lifecycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager