Warehousing and Storage Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433437 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Warehousing and Storage Market Size

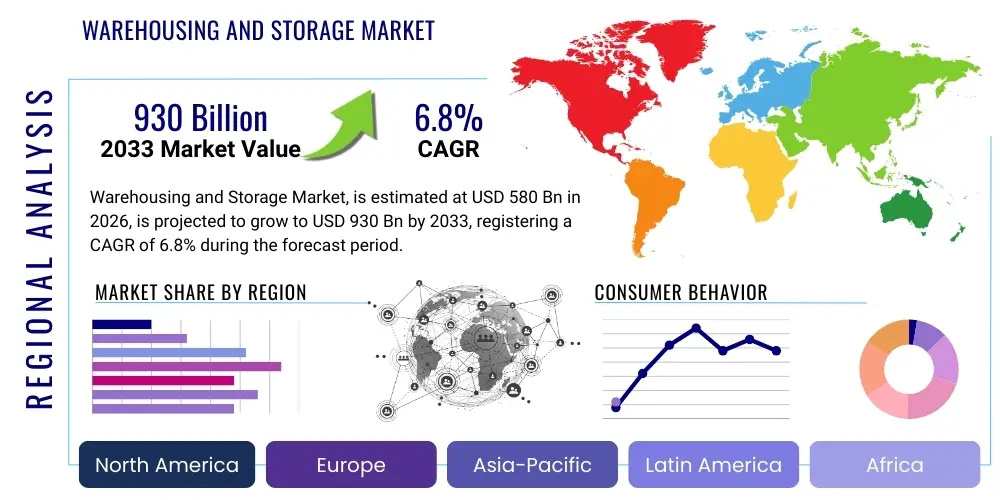

The Warehousing and Storage Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 580 Billion in 2026 and is projected to reach USD 930 Billion by the end of the forecast period in 2033.

Warehousing and Storage Market introduction

The Warehousing and Storage Market encompasses the services and facilities required for storing goods, inventory management, and handling logistical processes across the supply chain continuum. This market segment is crucial for modern commerce, providing essential functions like inventory consolidation, cross-docking, fulfillment operations, and value-added services such as kitting and light assembly. The fundamental product offering revolves around secure space rental, sophisticated inventory management systems (IMS), and efficient material handling equipment, tailored to various product requirements, including temperature-sensitive items (cold storage) and hazardous materials.

Major applications of warehousing and storage services span nearly every sector of the economy, predominantly driven by the robust growth in e-commerce, global trade volumes, and just-in-time (JIT) manufacturing requirements. Retailers rely heavily on distribution centers for timely restocking, while manufacturers utilize warehousing for raw materials, work-in-progress, and finished goods buffer stock. Furthermore, specialized applications in the pharmaceutical and food and beverage sectors necessitate compliance with stringent regulatory standards regarding temperature and hygiene, fueling demand for technologically advanced and compliant storage solutions.

The primary benefits of utilizing professional warehousing services include enhanced supply chain efficiency, reduced operational costs through economies of scale, improved inventory accuracy, and greater flexibility in responding to demand fluctuations. Key driving factors propelling market expansion include the exponential proliferation of online retail, which demands complex last-mile and fulfillment infrastructure; the ongoing globalization of manufacturing networks; and significant technological advancements, particularly the integration of automation and robotics, which enhance throughput capacity and operational reliability across storage facilities worldwide. These macro trends solidify warehousing as a foundational element of the global logistics ecosystem.

Warehousing and Storage Market Executive Summary

The Warehousing and Storage Market is undergoing a rapid transformative phase, characterized by significant investment in digitalization and automation driven by intensified e-commerce demands and chronic labor shortages. Business trends are dominated by the shift from traditional static storage models toward flexible, dynamic fulfillment centers capable of handling high-volume, small-order picking (e.g., micro-fulfillment centers and multi-shuttle systems). Furthermore, sustainability initiatives are gaining prominence, leading to increased demand for green warehousing solutions powered by renewable energy and optimized structural designs that minimize environmental impact, thereby influencing long-term capital expenditure decisions across major logistics providers.

Regional trends indicate that Asia Pacific (APAC) remains the fastest-growing market, primarily fueled by massive consumer bases in China and India and the continuous expansion of manufacturing capacities across Southeast Asia. North America and Europe, while mature, are focusing heavily on modernizing existing infrastructure, with high demand for Grade A facilities located near major urban centers to facilitate efficient urban logistics and same-day delivery services. Regulatory changes concerning trade tariffs and cross-border customs procedures also periodically influence regional investment flows, particularly impacting the demand for bonded and free-trade zone warehousing solutions.

Segment trends reveal that the cold storage segment is experiencing remarkable growth, driven by the specialized needs of the pharmaceutical sector (especially biologics and vaccines) and the expanding market for fresh and frozen foods. Technological segmentation shows a clear acceleration in the adoption of Warehouse Management Systems (WMS) integrated with Artificial Intelligence (AI) for predictive analytics, leading to optimized slotting and labor allocation. The e-commerce end-user segment remains the largest revenue contributor, consistently pushing the boundaries for speed and accuracy in fulfillment operations, thereby necessitating further investment in advanced robotics and automated guided vehicles (AGVs) to maintain competitive advantage.

AI Impact Analysis on Warehousing and Storage Market

Common user questions regarding AI's influence in the warehousing and storage domain frequently center on automation replacement fears, the cost-benefit ratio of implementing complex AI-driven WMS, and the practical challenges of integrating legacy systems with new predictive technologies. Users are keen to understand how AI can move beyond simple automation to provide true strategic value—specifically concerning demand forecasting accuracy, dynamic labor scheduling in variable environments, and optimizing complex robotic pathfinding within large-scale fulfillment centers. The key themes revolve around achieving 'intelligent operations': maximizing throughput without increasing footprint, minimizing inventory errors (shrinkage), and future-proofing facilities against volatile global supply chain disruptions. Users expect AI to deliver quantifiable improvements in inventory visibility and operational resilience.

- AI-powered demand forecasting reduces safety stock requirements and prevents stockouts, leading to capital efficiency.

- Implementation of intelligent Warehouse Management Systems (WMS) for dynamic slotting and inventory placement optimization.

- Utilization of machine learning for predictive maintenance of material handling equipment, minimizing unplanned downtime.

- AI-driven optimization of robotic picking paths and AGV routing in highly automated warehouses, increasing fulfillment speed.

- Enhancement of quality control and inspection through computer vision and deep learning algorithms, reducing manual error rates.

- Intelligent labor management systems (LMS) using AI to predict staffing needs based on real-time order influx and historical data.

- Improved security protocols via AI monitoring of surveillance feeds for anomaly detection and unauthorized access.

DRO & Impact Forces Of Warehousing and Storage Market

The Warehousing and Storage Market dynamics are fundamentally shaped by the interplay of macroeconomic growth, technological feasibility, and infrastructural limitations. Drivers, such as the unstoppable expansion of global e-commerce and the necessity for highly efficient omnichannel retailing strategies, provide constant upward pressure on demand for high-specification warehousing. This is complemented by the ongoing trend toward supply chain resilience, where companies are moving away from purely lean inventory models (JIT) towards 'just-in-case' strategies, requiring greater storage capacity. Opportunities lie significantly in developing urban logistics hubs (micro-fulfillment centers) to address the final-mile challenge and the proliferation of specialized storage (e.g., climate-controlled environments for emerging biological products).

However, significant restraints temper this growth. Chief among these is the escalating cost of industrial land, particularly in densely populated urban and peri-urban areas crucial for rapid delivery, leading to vertical warehousing solutions becoming a necessity rather than an option. Furthermore, the persistent shortage of skilled logistics personnel required to operate and maintain sophisticated automated systems poses a substantial operational bottleneck. Regulatory complexities, especially those pertaining to cross-border logistics and trade sanctions, also introduce operational friction and require specialized compliance infrastructure, increasing complexity and overhead for international operators.

Impact forces are currently dominated by digital transformation. The integration of the Internet of Things (IoT) sensors, robotics, and advanced WMS is radically redefining operational benchmarks, making manual, non-digitized facilities obsolete. Investment in automation is becoming a critical competitive necessity, forcing smaller, traditional players to consolidate or modernize rapidly to meet the service level agreements (SLAs) set by dominant e-commerce and 3PL providers. Geopolitical stability and global container shipping capacity also serve as external impact forces, affecting inventory levels and subsequently influencing short-term demand for temporary storage solutions.

Segmentation Analysis

The Warehousing and Storage Market is segmented based on the type of facility, the mode of ownership, the degree of automation utilized, and the specific end-user industry served. This multilayered segmentation provides strategic clarity for market participants, allowing them to tailor investments in specific functional areas, such as cold chain logistics or highly automated e-commerce fulfillment. Segmentation by service offering, including fulfillment services (pick-pack-ship) versus pure storage rental, is crucial, as value-added services often generate significantly higher margins than simple real estate rental. Understanding these segments is key to predicting future infrastructure requirements, particularly the pivot towards flexible, scalable solutions demanded by fluctuating consumer spending patterns and seasonal peaks.

- By Type:

- General Warehousing

- Cold Storage (Refrigerated and Freezer)

- Bonded Warehouse

- Automated Warehouse

- Climate-Controlled Storage (excluding Cold Chain)

- By Ownership:

- Private Warehousing

- Public Warehousing (3PL/4PL)

- Co-operative Warehousing

- By End-Use Industry:

- Retail and E-commerce

- Manufacturing (Automotive, Heavy Machinery)

- Food and Beverage (F&B)

- Healthcare and Pharmaceutical

- Chemicals and Petroleum

- Electronics and IT Hardware

- By Automation Level:

- Manual Warehouses

- Semi-Automated Warehouses

- Fully Automated Warehouses (including ASRS and Robotics)

Value Chain Analysis For Warehousing and Storage Market

The value chain for the Warehousing and Storage Market initiates with upstream activities focused primarily on infrastructure development and technology supply. This includes industrial real estate developers who acquire land and construct facilities, providers of Material Handling Equipment (MHE) such as forklifts, conveyors, and sophisticated Automated Storage and Retrieval Systems (ASRS), and crucially, the software providers delivering Warehouse Management Systems (WMS) and optimization tools. Upstream efficiency, particularly the speed of constructing state-of-the-art logistics parks and the availability of advanced automation components, directly impacts the midstream service providers' capabilities.

The midstream of the value chain is dominated by warehouse operators, encompassing both dedicated internal logistics departments (private) and third-party logistics (3PL) providers. These operators perform core functions: inventory receiving, storage management, order fulfillment (picking, packing), and value-added services (kitting, labeling, returns processing). Operational excellence in this stage relies heavily on labor productivity, energy efficiency, and the seamless integration of technology to minimize throughput time and error rates. The selection of distribution channel significantly influences cost structure; direct distribution involves the warehouse delivering directly to the end customer (common in B2C e-commerce), while indirect distribution might involve transfer to regional distribution centers or retail stores.

Downstream analysis focuses on the final interaction with the end-user and connecting to the transportation networks. This segment includes last-mile delivery carriers, freight forwarders, and end consumers (B2B or B2C). The quality and speed of warehousing services directly influence downstream customer satisfaction and overall supply chain efficiency. Direct distribution models are increasingly favored in e-commerce due to speed requirements, whereas traditional B2B supply chains often utilize indirect distribution through various layers of intermediaries. Therefore, optimizing the handoff between the storage facility and the transport carrier remains a critical area for efficiency gains across the entire logistical value chain.

Warehousing and Storage Market Potential Customers

Potential customers, or end-users, for warehousing and storage services are diverse, spanning virtually every sector that handles physical goods, but are particularly concentrated within high-volume, demand-sensitive industries. The largest buyer segment is historically the Retail and E-commerce sector, which requires vast, highly scalable, and flexible facilities to manage seasonal peaks and the complex reverse logistics associated with online sales. These customers typically demand high-throughput automated warehouses capable of processing millions of stock-keeping units (SKUs) efficiently, necessitating sophisticated fulfillment services beyond mere physical storage.

The second major group comprises Manufacturing companies, particularly in the Automotive, Electronics, and Machinery industries. These buyers utilize storage for raw materials (inbound logistics), components for just-in-time production, and finished goods distribution (outbound logistics). Their requirements emphasize reliability, traceability, and often, specialized handling for bulky or high-value items, making them key consumers of customized warehousing solutions that integrate seamlessly with production schedules and supply chain visibility platforms.

Furthermore, the Food and Beverage (F&B) and Healthcare/Pharmaceutical sectors represent crucial growth areas for specialized customers. F&B requires extensive capacity in refrigerated and freezer storage (cold chain logistics) due to strict perishability and safety standards. Similarly, pharmaceuticals, especially sensitive biologics and vaccines, necessitate ultra-low temperature storage and compliance with Good Distribution Practices (GDP), driving demand for highly regulated, technology-intensive storage facilities. These specialized buyers are willing to pay a premium for compliance, security, and validated temperature control mechanisms, solidifying their status as highly attractive potential customers within the storage market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 580 Billion |

| Market Forecast in 2033 | USD 930 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prologis, Americold, Lineage Logistics, GXO Logistics, GLP, DHL Supply Chain, FedEx, UPS, Kuehne + Nagel, Rhenus Group, DB Schenker, Nippon Express, C.H. Robinson, CEVA Logistics, Ryder System, Geodis, XPO Logistics, Agility Logistics, Warehouse REIT, SEGRO. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Warehousing and Storage Market Key Technology Landscape

The Warehousing and Storage Market is undergoing profound technological evolution, moving away from conventional manual processes towards sophisticated, integrated digital environments. The foundational technology remains the Warehouse Management System (WMS), which has evolved from basic inventory tracking to highly intelligent platforms leveraging cloud computing, big data analytics, and Artificial Intelligence (AI) to optimize every aspect of warehouse operation, from labor scheduling to dynamic space utilization (slotting). This reliance on advanced WMS is crucial for managing the immense complexity introduced by omnichannel fulfillment, ensuring inventory accuracy across multiple sales channels and locations.

Robotics and physical automation represent the most visible technological shift. This includes the widespread adoption of Automated Guided Vehicles (AGVs) and Autonomous Mobile Robots (AMRs) for transporting goods, as well as high-density storage solutions like Automated Storage and Retrieval Systems (ASRS) and sophisticated shuttle systems that maximize vertical space utilization and minimize retrieval times. Furthermore, robotic picking arms, often utilizing advanced computer vision, are becoming increasingly proficient at handling complex and varied product types, significantly offsetting the impacts of rising labor costs and labor scarcity in developed economies.

A third pillar of the technological landscape involves connectivity and data sensing. The Internet of Things (IoT) is integral, with sensors deployed on equipment, pallets, and facilities to provide real-time data on environmental conditions (temperature, humidity), equipment health (predictive maintenance), and inventory location. This real-time data flow, when integrated with AI-driven analytics, enables predictive decision-making, such as anticipating capacity needs or optimizing energy consumption. Other key technologies include blockchain for enhanced supply chain traceability and Augmented Reality (AR) glasses used for hands-free picking, increasing efficiency and reducing training time for warehouse associates.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by explosive e-commerce penetration, expanding middle-class consumption, and significant foreign direct investment into manufacturing hubs, particularly in Southeast Asian economies like Vietnam and Indonesia. China remains the dominant regional market, investing heavily in smart logistics and high-speed distribution networks. The region’s growth is characterized by a massive demand for logistics infrastructure modernization and cold chain expansion.

- North America: North America holds a substantial market share, defined by the mature demands of the U.S. and Canadian markets. Growth here is primarily driven by the intensification of e-commerce competition, requiring greater near-urban fulfillment capacity. The region is a leader in adopting advanced automation (robotics, ASRS) to combat high labor costs and maintain rapid delivery SLAs. Strategic focus is on large, technologically sophisticated Grade A warehouse facilities.

- Europe: The European market demonstrates steady growth, highly influenced by intra-continental trade and stringent sustainability regulations. Western European countries exhibit high rates of automation adoption, particularly in Germany and the UK, focusing on optimizing existing infrastructure. Eastern and Central Europe are emerging as strategic warehousing hubs due to lower operational costs and advantageous geographical positions linking manufacturing sources with consumer markets.

- Latin America (LATAM): LATAM presents significant potential, though growth is often tempered by infrastructural and economic volatility. Brazil and Mexico are the primary markets, benefiting from increased foreign investment and developing internal e-commerce markets. There is a strong, accelerating need for professional, institutional-grade warehousing services to replace fragmented local solutions.

- Middle East and Africa (MEA): The MEA region is witnessing high-value investments, particularly in the GCC countries (UAE, Saudi Arabia) as part of economic diversification strategies to become global trade and logistics gateways. Demand is driven by large-scale infrastructure projects, emerging e-commerce platforms, and a strategic focus on developing cold chain capabilities to support growing food security initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Warehousing and Storage Market.- Prologis

- Americold

- Lineage Logistics

- GXO Logistics

- GLP

- DHL Supply Chain

- FedEx

- UPS

- Kuehne + Nagel

- Rhenus Group

- DB Schenker

- Nippon Express

- C.H. Robinson

- CEVA Logistics

- Ryder System

- Agility Logistics

- XPO Logistics

- Warehouse REIT

- SEGRO

- Panattoni Development Company

Frequently Asked Questions

Analyze common user questions about the Warehousing and Storage market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Warehousing and Storage Market?

The primary factor driving market growth is the exponential expansion of global e-commerce. This shift in consumer behavior necessitates larger, more complex fulfillment infrastructure, optimized for rapid, small-parcel delivery and efficient returns processing (reverse logistics), compelling logistics providers to invest heavily in automated warehouse solutions near population centers to meet demanding service level agreements (SLAs).

How does automation specifically impact warehouse labor requirements?

Automation, including the deployment of Automated Guided Vehicles (AGVs) and robotic systems, fundamentally shifts labor requirements from physically demanding manual tasks to specialized roles focused on system maintenance, data analysis, and technical oversight. While automation reduces the need for general labor in repetitive tasks like transport and retrieval, it increases the demand for highly skilled technicians and software engineers to manage the complex technology ecosystem, thereby altering the labor profile rather than eliminating it entirely.

What role does cold storage play in the overall market growth?

Cold storage is a high-growth segment, playing a critical role due to global increases in frozen and chilled food consumption and the specialized logistics required by the rapidly expanding pharmaceutical sector, particularly for temperature-sensitive biologics and vaccines. This segment demands specialized infrastructure, higher capital investment, and rigorous regulatory compliance (e.g., GDP), positioning it as a key driver of high-value service offerings within the broader warehousing market.

What are the key technological challenges facing warehouse operators today?

Key technological challenges include the seamless integration of disparate systems (WMS, ERP, automation hardware) into a unified platform, the high initial capital expenditure required for advanced automation and robotics, and ensuring robust cybersecurity protocols to protect sensitive inventory and supply chain data. Overcoming the complexity of deploying and maintaining highly intelligent, interconnected systems remains a significant operational barrier.

Which geographical region is expected to dominate market expansion through 2033?

The Asia Pacific (APAC) region is projected to dominate market expansion through 2033, fueled by its large and rapidly growing consumer base, substantial manufacturing output, and continued governmental investment in developing modern logistics infrastructure. Countries like China, India, and Vietnam are at the forefront of this growth, driving unprecedented demand for logistics space and the subsequent need for advanced warehousing and fulfillment services across the continent.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- E-commerce Fulfillment Services Market Statistics 2025 Analysis By Application (Automotive, Beauty & Personal Care, Books & Stationery, Consumer Electronics, Healthcare, Clothing & Footwear, Home & Kitchen Application, Sports & Leisure), By Type (Warehousing and Storage Fulfillment Services, Bundling Fulfillment Services, Shipping Fulfillment Services), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Chemical Warehousing and Storage Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Solids, Liquids), By Application (Pharmaceutical Industry, Pesticide Industry, Chemical Industry, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager