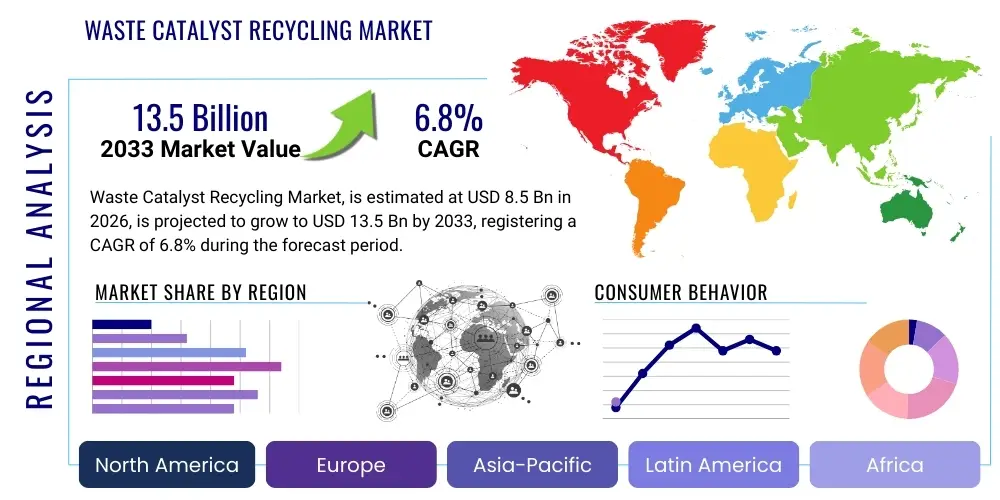

Waste Catalyst Recycling Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436835 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Waste Catalyst Recycling Market Size

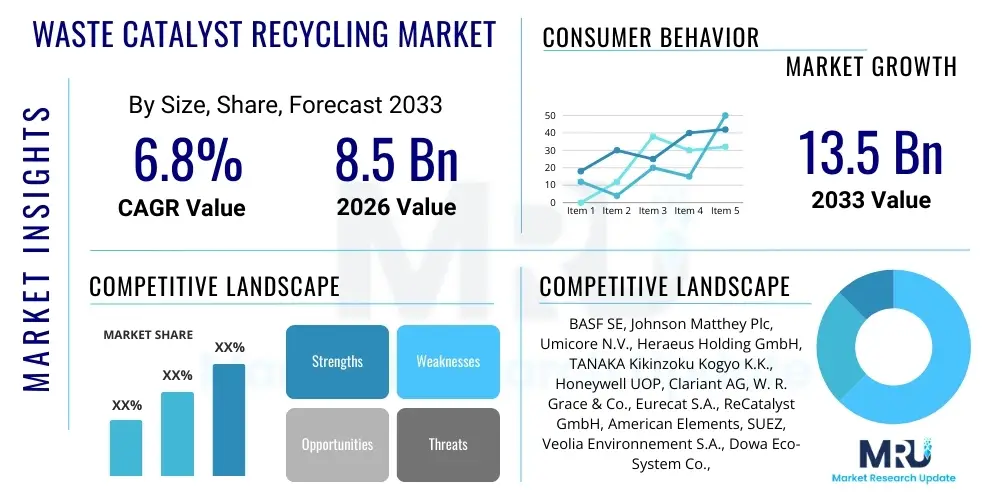

The Waste Catalyst Recycling Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 13.5 Billion by the end of the forecast period in 2033. This growth trajectory is strongly influenced by increasing environmental regulations concerning industrial waste disposal and the soaring demand for Platinum Group Metals (PGMs) and other rare earth elements critical for green technology development, including electric vehicle catalysts and advanced refining processes. The economic incentive derived from high commodity prices for recycled metals further supports this upward trend, making recycling a financially viable and strategically important venture for industrial stakeholders.

Waste Catalyst Recycling Market introduction

The Waste Catalyst Recycling Market encompasses the processes and technologies utilized to recover valuable materials, primarily precious and non-precious metals, from spent catalysts originating from industrial applications such as petrochemical refining, chemical synthesis, and automotive emissions control. Catalysts, which are essential for accelerating chemical reactions without being consumed themselves, eventually lose their efficiency due to deactivation mechanisms like poisoning, coking, or sintering. Responsible and efficient recycling of these deactivated materials prevents the landfilling of hazardous waste and provides a sustainable, circular economy source for critical resources, reducing reliance on environmentally taxing primary mining operations.

Major applications driving the demand for waste catalyst recycling include the automotive sector, where catalytic converters contain significant amounts of Platinum, Palladium, and Rhodium (PGMs); the petroleum refining industry, utilizing catalysts containing Nickel, Vanadium, Molybdenum, and Cobalt; and the chemical industry, which employs a diverse range of metal-based catalysts for manufacturing plastics, pharmaceuticals, and fertilizers. The benefits of recycling extend beyond resource recovery to significant reductions in carbon footprint, decreased regulatory compliance risks associated with hazardous waste transport, and the stabilization of supply chains for high-value metals crucial for high-technology manufacturing. Furthermore, advancements in selective leaching and separation techniques are continually improving the economic viability and efficiency of extracting these residual metals.

The market is primarily driven by stringent environmental mandates in developed economies, particularly regarding PGM usage and hazardous waste management, alongside the inherent volatility and increasing cost of virgin metal sources. Key driving factors also include technological innovations in hydrometallurgy and pyrometallurgy that enhance recovery rates, and the adoption of circular economy principles by large multinational corporations aiming to improve their sustainability profiles. The scarcity of metals like Rhodium and Ruthenium, coupled with geopolitical risks affecting primary supply routes, elevates the strategic importance of securing secondary sources through robust recycling infrastructure, further accelerating market expansion across Asia Pacific and Europe.

Waste Catalyst Recycling Market Executive Summary

The Waste Catalyst Recycling Market is characterized by robust growth, propelled by the intersection of environmental necessity and economic opportunity, with sophisticated hydrometallurgical technologies gaining prominence due to higher selectivity and lower energy consumption compared to traditional pyrometallurgical methods. Business trends indicate strong vertical integration strategies among key players, where mining and chemical companies are acquiring or partnering with recycling specialists to secure feedstock and control the entire value chain from catalyst production to end-of-life recovery. Furthermore, there is a noticeable shift towards customized recycling solutions tailored to complex catalyst matrices, especially in the fine chemicals and specialty polymer sectors, demanding greater analytical precision and process flexibility.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive industrial expansion, particularly in China and India’s petrochemical and automotive manufacturing hubs, creating a substantial volume of spent catalyst waste requiring sophisticated management. Conversely, North America and Europe maintain technological leadership and regulatory stringency, driving innovation in efficient PGM recovery from high-volume automotive sources. Strategic investments are concentrated in establishing advanced processing facilities near major industrial clusters to minimize logistics costs and improve turnaround times, particularly focusing on urban mining of obsolete vehicles for catalytic converters.

Segmentation trends reveal that the PGM segment, driven by the indispensable role of Platinum, Palladium, and Rhodium in emission control systems, remains the largest revenue contributor, consistently benefiting from global vehicle fleet turnover and stringent Euro 7/Tier 3 standards. Concurrently, the refining segment, dealing with Nickel and Vanadium catalysts, is witnessing significant volume growth, driven by the global demand for cleaner fuels and heavier crude oil processing. Technology-wise, hybrid recycling approaches combining initial thermal pretreatment (pyrometallurgy) with subsequent wet chemical refinement (hydrometallurgy) are emerging as the industry standard for optimizing both yield and purity across diverse catalyst types.

AI Impact Analysis on Waste Catalyst Recycling Market

User inquiries regarding AI's role in waste catalyst recycling frequently revolve around optimizing process efficiency, enhancing material sorting precision, and predicting catalyst deactivation rates to improve collection logistics. The key themes summarized from user concerns focus on whether Artificial Intelligence can significantly reduce the currently high energy and chemical consumption associated with recycling processes, particularly in complex hydrometallurgy. Users also express strong expectations regarding AI's capability to analyze real-time spectral and compositional data of mixed catalyst feedstocks, thereby allowing for automated, dynamic adjustment of leaching parameters (acid concentration, temperature, residence time) to maximize metal recovery yields and minimize operational costs. Furthermore, there is considerable interest in AI-powered predictive maintenance models for recycling equipment and advanced algorithms for optimizing reverse logistics chains for spent materials.

The application of sophisticated machine learning models, specifically deep learning neural networks, allows recycling operators to move beyond static, predetermined operational parameters. By training these models on vast datasets comprising feedstock composition variability, temperature fluctuations, and resultant recovery rates, facilities can achieve unparalleled precision. This AI-driven optimization is crucial for handling the increasing heterogeneity of catalyst waste streams, which often contain varied proportions of base metals, support materials, and precious metal concentrations, making traditional process control systems inadequate. AI enables the instantaneous adaptation of chemical inputs, ensuring that the optimal stoichiometric ratio for metal dissolution is maintained at all times, thereby reducing reagent waste and improving overall economic performance.

Beyond process control, AI substantially impacts the front end of the recycling value chain through advanced image recognition and sensor data fusion. Automated sorting systems using hyperspectral imaging coupled with AI algorithms can rapidly and accurately classify different types of spent catalysts, such as distinguishing between high-value PGM automobile catalysts and lower-value Nickel-based hydrotreating catalysts, a separation step vital for efficient batch processing. This technological integration not only accelerates throughput but also drastically improves the purity of the sorted material streams, leading to higher final product quality and reduced contamination risks in subsequent refining steps, solidifying AI as a pivotal technology for future market growth.

- AI-driven optimization of leaching and precipitation parameters in hydrometallurgy, maximizing yield and reducing chemical consumption.

- Predictive modeling for catalyst deactivation cycles, enabling efficient scheduling of catalyst collection and transportation logistics.

- Machine vision and deep learning algorithms enhancing automated sorting and classification of diverse spent catalyst feedstocks.

- Use of reinforcement learning for optimizing furnace temperature profiles and gas flow in pyrometallurgical operations to improve energy efficiency.

- Data analytics platforms providing real-time quality control and traceability throughout the complex multi-stage recycling process.

DRO & Impact Forces Of Waste Catalyst Recycling Market

The Waste Catalyst Recycling Market is profoundly shaped by powerful Driving factors (D), significant Restraints (R), strategic Opportunities (O), and the resulting Impact Forces stemming from environmental and economic pressures. Primary drivers include strict government regulations mandating the recovery of hazardous or valuable materials, particularly in the European Union and North America, combined with the inherent economic advantage of recycling high-value PGMs. Restraints often center on the technical complexity of processing highly mixed and contaminated catalyst feedstocks, the variability in metal content which complicates standardized process application, and the high initial capital investment required for advanced recycling facilities. Opportunities are abundant, especially in developing advanced bio-leaching techniques, expanding recycling infrastructure in emerging industrial economies (APAC), and capitalizing on the burgeoning demand for specialized metals (e.g., lithium, cobalt) in new catalyst formulations.

The economic impact forces are overwhelmingly positive for market growth, driven by the stabilization of metal supply chains and the hedging against volatile virgin metal prices. Since recycled materials generally require less energy for production compared to primary mining and refining, the adoption of recycling serves as a powerful tool for companies seeking to meet Scope 3 emission reduction targets and enhance corporate sustainability reporting. Furthermore, intellectual property surrounding highly efficient, proprietary recycling technologies, especially those offering high selectivity for specific PGMs, acts as a competitive impact force, driving rapid technological improvement and consolidation among market leaders. The regulatory impact force, stemming from international agreements and national waste management directives, compels industries to adopt circular practices, ensuring a steady, mandated supply of spent catalysts into the recycling stream.

Restraints, however, pose significant technical hurdles that moderate growth rates. The diminishing concentration of PGMs in newer automotive catalysts, designed for efficiency, means recyclers must process larger volumes of material for the same yield, increasing operational costs. Additionally, the proliferation of diverse catalyst types used in various chemical processes creates complex metallurgical challenges, often requiring tailored, small-scale batch processing rather than high-volume continuous operations, thereby limiting economies of scale. Overcoming these restraints necessitates sustained investment in R&D to develop flexible, modular recycling plants capable of handling disparate inputs efficiently while ensuring compliance with increasingly stringent air and water quality standards related to recycling effluent.

Segmentation Analysis

The Waste Catalyst Recycling Market segmentation provides critical insights into the distinct revenue streams and operational complexities inherent in the industry, categorizing the market based on the type of metal recovered, the original industrial source of the spent catalyst, and the specific technology employed for recovery. The fundamental goal of this analysis is to delineate where the highest value recovery occurs and which technological methods are best suited for different applications. The dominance of PGM recycling reflects the high intrinsic value of Platinum, Palladium, and Rhodium, while the petrochemical segment contributes the largest volume of waste material, primarily encompassing non-PGM metals such as Nickel, Vanadium, and Molybdenum, requiring different specialized recovery circuits.

Analyzing segmentation by technology highlights the ongoing strategic tension between pyrometallurgy and hydrometallurgy. Pyrometallurgy, involving high-temperature smelting, is effective for large volumes and complex matrices but is energy-intensive and results in lower PGM purity. Conversely, hydrometallurgy, which uses chemical leaching, offers superior selectivity and higher metal purity but can be sensitive to feedstock variability and generates significant volumes of wastewater requiring specialized treatment. The market is increasingly adopting sophisticated hybrid methods, incorporating physical pretreatment (like milling or magnetic separation) before targeted chemical recovery, achieving a balance between high throughput and high purity yields across different feedstock streams.

- By Metal Type:

- Platinum Group Metals (PGMs) (Platinum, Palladium, Rhodium, Ruthenium, Iridium)

- Base Metals (Nickel, Vanadium, Cobalt, Copper, Molybdenum, Zinc)

- Specialty Metals (Rare Earth Elements, Tungsten)

- By Source:

- Automotive Catalysts (Catalytic Converters)

- Petroleum Refining Catalysts (Hydrotreating, FCC, Reforming)

- Chemical and Petrochemical Catalysts (Polymerization, Synthesis)

- Metallurgical and Mining Catalysts

- By Technology:

- Hydrometallurgy

- Pyrometallurgy

- Bio-leaching and Other Technologies

Value Chain Analysis For Waste Catalyst Recycling Market

The value chain for the Waste Catalyst Recycling Market begins with the upstream sourcing and collection of spent catalysts from industrial end-users, which is a critical logistics phase involving specialized waste handling and classification due to regulatory requirements. Upstream activities are dominated by specialized logistics providers and brokers who manage the aggregation, sampling, and assaying of materials before they are transported to processing centers. Accurate assaying is paramount as it determines the market value of the feedstock and the financial arrangement between the waste generator and the recycler. Efficiency in this stage dictates the overall economic viability, emphasizing the need for robust reverse logistics networks and secure, compliant storage solutions across various geographies.

The midstream processing phase encompasses the core recycling technologies, including pretreatment (crushing, grinding, calcination) followed by primary recovery using pyrometallurgy or hydrometallurgy, and subsequent high-purity refining. This phase demands intensive capital investment in specialized equipment, chemical handling infrastructure, and stringent environmental control systems, representing the highest value-add step in the chain. Downstream analysis focuses on the refined metal products, which are typically sold back to original equipment manufacturers (OEMs), catalyst producers, or utilized in industrial commodity markets. The direct channel involves recyclers selling high-purity metals (e.g., 99.99% PGMs) directly to catalyst manufacturers for re-use, while the indirect channel involves sales through metal traders and brokers into the global commodity markets, allowing for greater liquidity and price exposure.

Distribution channels for the final product are highly specialized, relying on secure transport and certified logistics providers for high-value precious metals. Direct distribution channels are often favored by integrated players who recycle waste catalysts and then utilize the recovered metals internally for the manufacture of new catalysts, thus closing the loop entirely and gaining maximum cost efficiency. Indirect channels, essential for smaller or non-integrated recyclers, utilize global commodity exchanges and specialized metal trading houses, which offer global reach but introduce transactional costs. The effectiveness of the distribution channel is highly dependent on certification (e.g., LBMA good delivery standards) and the ability to consistently provide metals meeting stringent purity specifications required by high-technology end-users like the electronics and aerospace industries.

Waste Catalyst Recycling Market Potential Customers

The potential customer base for the Waste Catalyst Recycling Market spans several high-volume industrial sectors that heavily rely on heterogeneous and homogeneous catalysis for their operations, making them both suppliers of spent material and eventual buyers of the recovered products. These end-users are primarily concentrated in sectors mandated by environmental law to responsibly dispose of or recycle their catalytic waste, including the energy, chemical, and automotive manufacturing industries. Specifically, major buyers are chemical producers who require high-purity PGMs for manufacturing specialized compounds, and petroleum refiners needing reliable sources of Nickel and Vanadium to maintain crude oil processing efficiency. These customers prioritize vendors who can demonstrate high recovery rates, environmental compliance, and secure, auditable material handling throughout the recycling process.

Within the automotive sector, major OEMs and their supply chain partners are critical customers, requiring continuous supply of PGMs for new catalytic converters. The increasing production of hybrid and conventional vehicles globally ensures a consistent, high-value demand for recycled Platinum, Palladium, and Rhodium. For these large buyers, securing a long-term supply agreement with a reliable recycler acts as a hedge against the price volatility of primary mined PGMs, offering a strategic competitive advantage. Furthermore, as the world transitions toward stricter emissions standards (like Euro 7), the demand for high-performance, PGM-loaded catalysts increases, consequently reinforcing the recycling market’s importance as a core component of the automotive supply chain strategy.

The refining and petrochemical sectors represent a volume-heavy customer base. Refineries generating spent hydrotreating and fluid catalytic cracking (FCC) catalysts are primary users of recycling services for base metals like Nickel, Molybdenum, and Vanadium. While the value per unit weight is lower than PGMs, the sheer volume of spent material generated globally creates a substantial market. These customers not only recycle to recover value but also to mitigate significant environmental liability associated with the disposal of heavy metal-laden waste. Specialized recycling companies that offer comprehensive cradle-to-grave waste management services, including on-site collection, regulatory documentation, and final metal redemption, are highly favored by these large industrial customers seeking streamlined, risk-mitigated waste management solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 13.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Johnson Matthey Plc, Umicore N.V., Heraeus Holding GmbH, TANAKA Kikinzoku Kogyo K.K., Honeywell UOP, Clariant AG, W. R. Grace & Co., Eurecat S.A., ReCatalyst GmbH, American Elements, SUEZ, Veolia Environnement S.A., Dowa Eco-System Co., Ltd., Ravindra Group, Materion Corporation, Catalytic Solutions, Inc., Recylex S.A., Metalor Technologies SA, TFC Recycling. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waste Catalyst Recycling Market Key Technology Landscape

The technology landscape for Waste Catalyst Recycling is continuously evolving, driven by the need to increase recovery rates, reduce environmental footprint, and process increasingly complex, mixed waste streams efficiently. The two dominant, established technologies are Pyrometallurgy and Hydrometallurgy, each possessing distinct advantages and environmental tradeoffs. Pyrometallurgy, often utilizing smelting in specialized furnaces, is highly effective for large volumes of material and can handle varied impurities, especially for PGM recovery where the spent material is smelted with a collector metal (like copper or lead) to form an alloy. However, this method is energy-intensive, generates significant greenhouse gas emissions, and often results in the loss of base metals through slag formation, prompting the search for cleaner alternatives.

Hydrometallurgy, which involves selective chemical dissolution (leaching) of the metals using strong acids or bases followed by solvent extraction, ion exchange, or precipitation, offers superior selectivity and higher recovery purity, especially for non-PGM catalysts and specialty metals. Recent advancements in hydrometallurgical techniques focus on developing environmentally friendlier, non-cyanide, and low-acid leaching agents, such as thiourea or various bio-extractants, to mitigate the corrosive and hazardous nature of traditional reagents. Furthermore, advanced membrane filtration and electrochemical recovery processes are being integrated downstream to enhance separation efficiency and reduce the volume of liquid waste produced, moving closer to zero-discharge recycling operations.

A burgeoning technological trend is the development and commercialization of Bio-leaching, a novel and environmentally benign approach utilizing microorganisms (such as specific bacteria or fungi) to mobilize or dissolve metals from the spent catalyst matrix. While currently limited by slower kinetics compared to chemical methods, bio-leaching represents a significant long-term opportunity, particularly for low-concentration or difficult-to-process feedstocks, offering lower operational costs and minimal hazardous waste generation. The ultimate direction of the industry favors hybrid approaches, where thermal pretreatment (a form of pyrometallurgy) is used to remove volatile contaminants or concentrate the metals, followed by targeted, precise hydrometallurgical or bio-leaching steps to achieve maximum resource recovery and meet stringent purity requirements for critical elements like Rhodium and Iridium.

Regional Highlights

The Waste Catalyst Recycling Market exhibits distinct regional dynamics driven by differing industrial structures, regulatory frameworks, and metal price exposure, creating varied growth profiles across the globe. North America and Europe currently dominate the market in terms of technological maturity and regulatory compliance, characterized by high PGM recovery rates from advanced automotive catalysts and sophisticated infrastructure for handling complex industrial waste streams. European regulations, particularly the Waste Framework Directive and REACH, impose strict take-back and recycling obligations, ensuring a consistent and high-quality flow of spent material, particularly Platinum-based catalysts from the continent's large diesel fleet, supporting market consolidation and innovation in regional hubs like Germany and Belgium. The established infrastructure and highly developed end-use markets for refined metals give these regions a technological competitive edge.

Asia Pacific (APAC) is projected to be the fastest-growing region throughout the forecast period, driven by rapid urbanization, massive expansion of the automotive sector (especially in China and India), and significant investment in new petrochemical refining capacity. While APAC currently struggles with fragmented and informal recycling practices in some areas, the sheer volume of spent catalyst generated by its rapidly industrializing economy necessitates the development of large-scale, formal recycling facilities. Government initiatives in countries like China, promoting circular economy policies and domestic supply chain security for critical materials like PGMs and Rare Earth Elements (REEs), are attracting substantial foreign direct investment into advanced recycling facilities, moving the region toward global dominance in terms of processed material volume within the next decade.

Latin America, the Middle East, and Africa (MEA) represent emerging markets for waste catalyst recycling. Growth in these regions is primarily spurred by the expansion of the oil and gas sector, leading to increased generation of base metal-laden hydrotreating catalysts (Nickel, Vanadium, Molybdenum). In the MEA region, the concentration of large-scale refineries offers centralized sources of spent material, making large-scale recycling operations economically feasible. However, these regions often face challenges related to political instability, inconsistent regulatory enforcement, and a lack of highly specialized local technical expertise. Consequently, growth is often driven by international recycling companies establishing joint ventures or wholly owned subsidiaries to leverage local resource access while importing necessary advanced technologies and adherence to global environmental standards.

- North America: Market leader in technology adoption; strong regulatory environment (EPA compliance); high concentration of high-value PGM recycling from automotive sources; focus on continuous process optimization and hybrid technology development.

- Europe: Driven by strict EU waste directives and circular economy targets; strong presence of global recycling leaders (Umicore, Johnson Matthey); high recovery rates for industrial catalysts and robust R&D focus on eco-friendly leaching.

- Asia Pacific (APAC): Fastest-growing region due to rapid industrialization, automotive manufacturing boom, and government emphasis on domestic metal supply security (China, India, South Korea); massive volumes of feedstock, but infrastructure standardization is ongoing.

- Latin America (LATAM) & Middle East and Africa (MEA): Growth tied primarily to oil and gas refining expansion; focus on Nickel, Vanadium, and Molybdenum recovery; increasing international investment addressing localized regulatory and logistical challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waste Catalyst Recycling Market.- BASF SE

- Johnson Matthey Plc

- Umicore N.V.

- Heraeus Holding GmbH

- TANAKA Kikinzoku Kogyo K.K.

- Honeywell UOP

- Clariant AG

- W. R. Grace & Co.

- Eurecat S.A.

- ReCatalyst GmbH

- American Elements

- SUEZ

- Veolia Environnement S.A.

- Dowa Eco-System Co., Ltd.

- Ravindra Group

- Materion Corporation

- Catalytic Solutions, Inc.

- Recylex S.A.

- Metalor Technologies SA

- TFC Recycling

Frequently Asked Questions

Analyze common user questions about the Waste Catalyst Recycling market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver of growth in the Waste Catalyst Recycling Market?

The primary driver is the combination of highly volatile and increasing prices for Platinum Group Metals (PGMs) and increasingly stringent global environmental regulations mandating the responsible disposal and recovery of hazardous industrial waste, promoting circular economic models for critical materials.

Which technological method yields the highest metal purity in catalyst recycling?

Hydrometallurgy typically yields the highest metal purity due to its ability to selectively dissolve and separate individual metals (e.g., Rhodium from Platinum) using specific chemical reagents, often followed by specialized refining steps like solvent extraction or ion exchange, crucial for high-specification end-use applications.

How does the automotive sector influence the Waste Catalyst Recycling Market?

The automotive sector is the largest source of high-value spent catalysts (catalytic converters), heavily containing Platinum, Palladium, and Rhodium. Global vehicle turnover and the adoption of stricter emissions standards ensure a consistent, high-volume, and financially lucrative feedstock supply, dominating the PGM segment of the recycling market.

What are the main restraints impacting market expansion globally?

Key restraints include the high capital expenditure required for building specialized processing facilities, the technical complexity and variability of mixed catalyst feedstocks, which complicates standardization, and the regulatory challenges associated with transporting hazardous spent materials across international borders.

Which region is expected to show the fastest growth rate in catalyst recycling?

Asia Pacific (APAC), particularly driven by industrial expansion and automotive growth in China and India, is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This growth is supported by large volumes of industrial waste generation and new government policies promoting local resource efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager