Waste Recycling and Circular Economy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438120 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Waste Recycling and Circular Economy Market Size

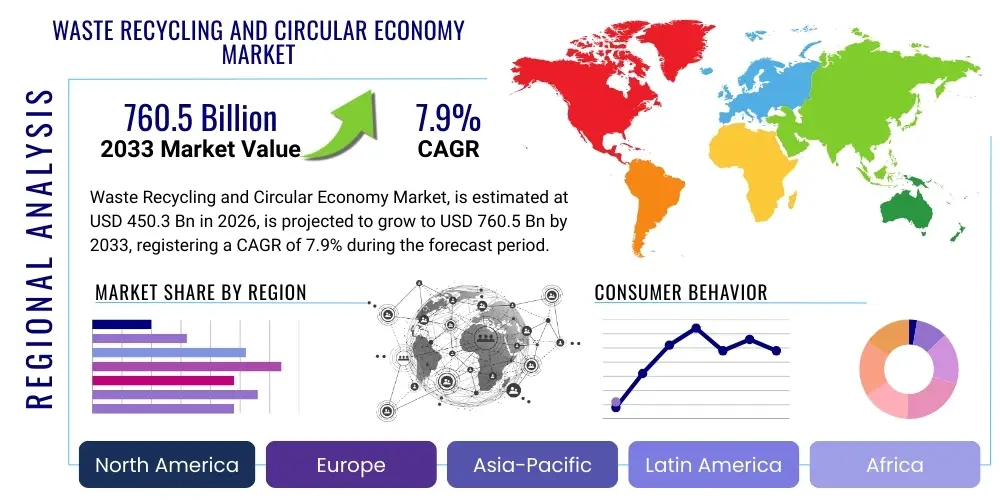

The Waste Recycling and Circular Economy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.9% between 2026 and 2033. The market is estimated at USD 450.3 Billion in 2026 and is projected to reach USD 760.5 Billion by the end of the forecast period in 2033.

Waste Recycling and Circular Economy Market introduction

The Waste Recycling and Circular Economy Market encompasses the entire spectrum of activities aimed at minimizing waste generation, maximizing resource efficiency, and decoupling economic growth from finite resource consumption. This includes the collection, sorting, processing, and transformation of various waste streams—Municipal Solid Waste (MSW), industrial waste, construction and demolition (C&D) waste, and hazardous materials—into high-value secondary raw materials or energy. The core product offering spans advanced material recovery facilities (MRFs), specialized biological treatment plants (composting and anaerobic digestion), thermal conversion technologies (incineration with energy recovery, pyrolysis), and chemical recycling processes designed to return materials like plastics to their original monomer state. Market dynamism is heavily influenced by stringent governmental regulations across regions like the European Union and emerging economies adopting Extended Producer Responsibility (EPR) schemes, mandating higher recycling rates and greater accountability for product lifecycles. This shift is transforming waste from an environmental liability into a vital economic resource, driving substantial investment in infrastructure and technological innovation.

Major applications for recycled and recovered materials are incredibly diverse, spanning high-volume sectors such as packaging (rPET, recycled cardboard), construction (recycled aggregates, asphalt), and automotive manufacturing (recycled metals and plastics). Furthermore, the benefits derived from a robust circular economy are multifaceted and critical for global sustainability goals. These benefits include a significant reduction in greenhouse gas emissions compared to virgin resource extraction, enhanced energy security through Waste-to-Energy (WtE) processes, reduction of landfill dependency, and the creation of resilient domestic supply chains less vulnerable to geopolitical shocks or commodity price volatility. The increasing consumer demand for sustainable products, coupled with corporate commitments to Environment, Social, and and Governance (ESG) criteria, further strengthens the commercial viability of circular models. This economic transition is not merely about managing waste but about fundamentally redesigning production and consumption systems to ensure materials retain their highest value for the longest possible duration.

Key driving factors accelerating market expansion include rapid global urbanization, which generates exponentially higher volumes of waste requiring sophisticated management solutions, and technological advancements in automated sorting (using robotics and AI), which significantly increase recovery efficiency and purity of secondary materials. Policy interventions, particularly carbon pricing mechanisms and landfill taxes, make recycling economically more attractive than disposal. Moreover, significant investment in chemical recycling technologies is unlocking previously unrecyclable plastic waste streams, providing a critical solution to the global plastic crisis. The confluence of regulatory pressure, consumer consciousness, and technological breakthrough is positioning the circular economy not just as an environmental mandate but as a profound structural shift in global industrial metabolism, necessitating massive infrastructure upgrades and digital integration across the entire waste value chain.

Waste Recycling and Circular Economy Market Executive Summary

The Waste Recycling and Circular Economy Market is experiencing robust acceleration driven primarily by governmental mandates pushing ambitious recycling and material recovery targets, significantly reshaping traditional linear waste management models into closed-loop systems. Business trends indicate a definitive move toward vertical integration, where major waste management players are acquiring specialized technology firms focusing on advanced sorting, chemical recycling, and resource digitalization to gain competitive advantages and control the quality of secondary raw materials. Corporate sustainability initiatives, particularly those centered on achieving net-zero goals and adhering to strict ESG metrics, are funneling large private capital into circular infrastructure development and innovative product design for recyclability. Furthermore, the market is characterized by increasing cross-sectoral collaboration between waste processors, material producers, and major brand owners (FMCG, electronics) through Extended Producer Responsibility (EPR) compliance organizations, stabilizing demand and pricing for recycled content and mitigating the historical volatility associated with recovered commodity markets.

Regionally, the market exhibits strong divergence in maturity and growth trajectory. Europe remains the undisputed leader, characterized by the most comprehensive regulatory framework, high landfill diversion rates, and significant political emphasis on the Circular Economy Action Plan, driving innovation in bio-waste treatment and complex plastic recycling. Asia Pacific (APAC) represents the highest growth potential, fueled by massive waste generation volumes in rapidly urbanizing economies like China, India, and Southeast Asia, coupled with increasing environmental awareness and government investments aimed at establishing modern waste infrastructure. North America is accelerating its adoption of circular principles, focusing heavily on technology deployment (AI sorting, pyrolysis) to overcome existing infrastructure gaps and address the challenge of mixed plastics, often spurred by ambitious state-level policies and corporate commitments rather than federal mandates, marking a significant transition from disposal-centric approaches to resource recovery.

Segmentation trends highlight the increasing importance of advanced recycling technologies and specialized waste streams. The Chemical Recycling segment, particularly for mixed plastics, is projected to witness the fastest Compound Annual Growth Rate (CAGR), as it provides a viable solution for materials that mechanical recycling cannot handle, thereby enhancing feedstock availability for high-quality plastic production. By waste type, E-Waste (Waste Electrical and Electronic Equipment) processing is gaining critical prominence due to the high concentration of valuable and critical raw materials (CRMs) it contains, driving the need for sophisticated urban mining techniques and specialized metal recovery facilities. In terms of end-use, the packaging sector remains the largest consumer of recycled materials due to immediate regulatory requirements and brand commitment targets, although the construction and automotive sectors are rapidly increasing their uptake of recovered materials to reduce their embodied carbon footprint and meet evolving standards for sustainable building and manufacturing practices.

AI Impact Analysis on Waste Recycling and Circular Economy Market

Common user questions regarding AI’s influence on the Waste Recycling and Circular Economy Market frequently center on the tangible economic benefits, specifically asking: "How much higher can AI increase sorting purity?" "Can AI efficiently handle complex, multi-material waste streams?" and "What are the investment costs and ROI timeframe for implementing AI robotics in MRFs?" There is also significant interest in the environmental impact, with questions like: "How does AI minimize processing errors and resource loss?" and "Can predictive AI modeling improve resource allocation for municipal collection?" Concerns often relate to the data privacy and infrastructure requirements needed to support vast sensor networks and machine learning models, reflecting a cautious but optimistic outlook toward digitalization. Users generally expect AI to be the primary technology enabling the quantum leap in efficiency required to meet stringent circularity targets, moving waste management from a labor-intensive, error-prone sector to a precise, data-driven industry.

Based on this analysis, the key themes that emerge are the demand for measurable efficiency gains, particularly in the challenging domain of material identification and separation, and the integration of AI tools for proactive, system-wide optimization. Users are looking for verification that AI can solve the 'last mile' problem of recycling, which involves achieving the extremely high purity required for recycled materials to substitute virgin inputs in high-specification manufacturing. The expectation is that sophisticated vision systems, combined with robotic arms trained on vast datasets of material characteristics (e.g., polymer type, color, contamination level), will be indispensable for maximizing recovery rates and minimizing cross-contamination, thus increasing the market value of secondary materials and making recycling infrastructure financially more viable.

Furthermore, the expectation extends beyond physical sorting to the digital twin environment. Predictive maintenance, optimized route planning, and demand forecasting based on real-time data from collection points are high-interest areas. Users anticipate AI models will be used to analyze commodity market fluctuations and feedstock quality, allowing processing facilities to dynamically adjust operations for maximum profitability and resource utilization. The successful integration of AI is seen as crucial for closing material loops, providing the granular traceability and transparency required by regulatory bodies and supply chain partners, effectively turning chaotic waste flows into predictable, manageable resource streams, thereby solidifying the transition toward a fully digitized circular economy framework.

- Enhanced Material Identification: AI-powered optical sorters and robotics use deep learning to identify and separate complex plastic polymers (e.g., PET, HDPE, PP, PVC) with over 98% accuracy, significantly boosting secondary material purity.

- Predictive Maintenance: Machine learning algorithms analyze sensor data from recycling equipment (shredders, conveyors, balers) to predict mechanical failures, minimizing costly downtime and improving operational throughput.

- Logistics Optimization: AI-driven route planning and dynamic bin monitoring optimize collection efficiency, reducing fuel consumption, operational costs, and carbon emissions associated with waste transport.

- Contamination Detection: Real-time analysis of incoming waste streams allows facilities to detect and reject contaminated batches immediately, protecting downstream processes and maintaining high feedstock quality standards.

- Digital Twins and Simulation: AI is used to create virtual models of recycling facilities and city-wide waste flows, allowing operators to simulate various scenarios (e.g., infrastructure expansion, policy changes) to maximize resource recovery and infrastructure ROI.

- Market Pricing Forecasting: Algorithms analyze global commodity prices, supply chain trends, and quality metrics to forecast optimal selling times for recovered materials, maximizing revenue for recycling operations.

DRO & Impact Forces Of Waste Recycling and Circular Economy Market

The Waste Recycling and Circular Economy Market is driven by powerful environmental mandates and socio-economic shifts, counterbalanced by significant operational and financial restraints, while offering substantial opportunities through technological and systemic innovations. Key drivers include accelerating governmental enforcement of Extended Producer Responsibility (EPR) schemes globally, which shifts the financial and physical burden of end-of-life product management onto manufacturers, incentivizing sustainable design and high recycling rates. Furthermore, global climate action and the imperative to decarbonize industries are pushing companies to replace carbon-intensive virgin materials with recycled alternatives, significantly increasing demand for high-quality secondary raw materials. The impact force of changing consumer behavior, favoring brands with verifiable circular practices, also compels corporations to integrate robust recycling programs and transparent supply chains, ensuring long-term market growth regardless of short-term commodity price fluctuations.

However, the market faces significant restraints that temper growth, primarily the high initial capital investment required for modern, highly automated recycling infrastructure, especially for complex streams like specialized plastics and hazardous waste. Furthermore, the volatility of virgin commodity prices often undercuts the economic viability of recycled materials, especially when crude oil prices drop, making the procurement of virgin plastics cheaper than recycled counterparts, a persistent barrier to market stability. Technological limitations remain, particularly in the effective, large-scale sorting and processing of multi-layered, composite materials, which are still often relegated to landfill or incineration due to the difficulty of separation. A crucial restraint in many developing regions is inadequate municipal waste collection infrastructure and a lack of formalized policy frameworks that consistently enforce separation and collection at the source, hindering the flow of clean, high-value feedstock necessary for advanced recycling operations.

Opportunities for market players are immense, centered around the rapid commercialization of advanced technologies such as pyrolysis, gasification, and hydrocracking (chemical recycling), which can effectively process previously unrecyclable waste streams, unlocking billions of dollars in lost material value and creating new revenue streams. The rising focus on critical raw material recovery (CRM) from E-Waste presents a niche but high-value opportunity, driven by increasing global demand for battery components and rare earth elements necessary for the energy transition. Finally, the development of localized, decentralized recycling networks, leveraging digitalization and modular processing units, presents an opportunity to serve remote or underserved markets, reducing transportation costs and increasing the overall resilience of the circular economy ecosystem. These impact forces—regulatory push, technological breakthrough, and infrastructural challenges—define the competitive landscape and strategic direction of the industry over the forecast period.

Segmentation Analysis

The Waste Recycling and Circular Economy Market is segmented across multiple dimensions to reflect the diversity of waste streams, processing methods, and resulting end-use applications, providing clarity on market dynamics and investment priorities. Segmentation by Technology differentiates between traditional high-volume methods (like mechanical recycling) and innovative high-value methods (like chemical and thermal recycling), highlighting the shift towards processing complex materials. Segmentation by Waste Type underscores the varying challenges and economic values associated with Municipal Solid Waste (MSW), industrial byproducts, and high-value streams like E-Waste and hazardous materials. Analyzing the market by End-Use Application reveals the primary consumers of secondary raw materials, driven by sectoral sustainability mandates and recycled content targets, providing crucial insight for feedstock suppliers and infrastructure investors.

- By Technology:

- Mechanical Recycling (Traditional sorting, shredding, washing)

- Biological Recycling (Composting, Anaerobic Digestion)

- Thermal Treatment (Incineration/Waste-to-Energy, Pyrolysis, Gasification)

- Chemical Recycling (Depolymerization, Solvolysis, Hydrolysis)

- By Waste Type:

- Municipal Solid Waste (MSW)

- Industrial & Commercial Waste

- Construction and Demolition (C&D) Waste

- Hazardous Waste

- E-Waste (Waste Electrical and Electronic Equipment)

- Plastics Waste (Polyolefins, PET, PVC, Polystyrene)

- By End-Use Application:

- Packaging

- Construction & Infrastructure

- Automotive & Transportation

- Electronics & Electrical

- Textiles & Apparel

- Agriculture

Value Chain Analysis For Waste Recycling and Circular Economy Market

The value chain of the Waste Recycling and Circular Economy Market is complex and multi-layered, fundamentally differing from traditional linear manufacturing chains by emphasizing closed-loop material flows. The upstream segment involves meticulous product design for longevity and recyclability, followed by the crucial collection and logistics phase, which requires efficient infrastructure (bins, trucks, transfer stations) optimized by digital tools. The quality and purity of feedstock entering the downstream processing facilities are entirely dependent on the efficiency of this upstream collection, typically involving municipal contracts and waste generators. Key upstream activities include source separation initiatives, deposit-return schemes, and the initial pre-sorting required to minimize contamination, which is a significant determinant of the profitability of subsequent recycling operations.

The midstream section constitutes the core processing activities, including Material Recovery Facilities (MRFs) where complex sorting (mechanical, optical, and potentially AI robotics) takes place to segregate materials into distinct commodity streams (paper, metals, plastics, glass). This is followed by specialized recycling steps: mechanical processes (cleaning, grinding, melting), biological treatment (anaerobic digestion for energy), or advanced chemical processes (depolymerization for plastics). The quality assurance measures applied here are paramount, as the secondary raw materials must meet stringent industrial specifications to be accepted as substitutes for virgin materials. Innovations in this stage, particularly in chemical recycling, are pivotal in expanding the range of recoverable waste and increasing the economic viability of the entire system.

The downstream section involves the marketing and distribution of the final recovered products—pellets, aggregates, compost, or regenerated monomers—to manufacturers (end-users). The distribution channel operates through direct sales to large manufacturing firms (e.g., selling rPET pellets directly to bottling companies) or indirectly via commodity traders and brokers who facilitate movement across international boundaries, depending on market demand and regional regulations. Direct distribution provides greater control over pricing and quality communication, fostering stronger long-term partnerships essential for securing reliable uptake of secondary materials. The successful completion of the circular loop relies on robust downstream demand driven by corporate procurement mandates and regulatory requirements for minimum recycled content in finished products, ensuring that recovered materials are pulled back into the industrial system rather than stockpiled or undervalued.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.3 Billion |

| Market Forecast in 2033 | USD 760.5 Billion |

| Growth Rate | 7.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia Environnement S.A., Suez S.A., Waste Management Inc., Republic Services, Covanta Holding Corporation, Biffa Group, Remondis SE & Co. KG, China Everbright Environment Group Ltd., Hitachi Zosen Inova, FCC Environment, Clean Harbors Inc., Advanced Disposal Services, Tana Oy, TOMRA Systems ASA, Stericycle Inc., Renewi plc, TerraCycle, Agilyx, Brightmark Energy, Loop Industries |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waste Recycling and Circular Economy Market Potential Customers

Potential customers and end-users of the Waste Recycling and Circular Economy Market are generally large industrial entities and corporate conglomerates that rely on stable, high-quality material inputs for their manufacturing processes, alongside municipalities and governmental bodies responsible for urban waste management. Primary industrial customers include Fast-Moving Consumer Goods (FMCG) companies, such as multinational beverage and food producers, which are mandated by regulatory targets and brand promises to incorporate increasing levels of recycled content (e.g., rPET, recycled glass) into their packaging formats. The financial and reputational risks associated with non-compliance or failure to meet sustainability commitments drive these buyers to secure long-term, reliable off-take agreements with advanced recycling facilities, making them critical demand anchors for secondary material markets.

Another major category of buyers includes construction and infrastructure development firms, which utilize recycled aggregates, asphalt, and recovered metals to reduce the embodied carbon footprint of large-scale projects, increasingly necessary due to green building standards and public procurement mandates. Furthermore, the automotive and electronics sectors are rapidly becoming high-value customers, driven by the need for light-weighting materials and the critical requirement to recover rare earth elements and precious metals from E-Waste streams to secure strategic supply chains. These sectors demand materials meeting rigorous performance specifications, making them prime customers for chemically recycled plastics and highly pure, recovered metals, often necessitating sophisticated partnerships to ensure material traceability and quality control throughout the recycling process.

In addition to industrial users, institutional buyers such as municipal governments, waste alliances, and public utility companies serve as foundational customers by purchasing Waste-to-Energy (WtE) outputs (electricity and heat) and large volumes of compost or soil amendments derived from biological recycling processes. These governmental entities are also the primary buyers of waste collection, processing, and disposal services itself, awarding lucrative, long-term operational contracts to waste management firms. The shift towards outcome-based contracts that prioritize resource recovery and landfill diversion over simple disposal further aligns the interests of these public customers with the goals of the circular economy, necessitating sophisticated service providers capable of implementing integrated waste management solutions that leverage advanced technologies like AI and specialized material processing units.

Waste Recycling and Circular Economy Market Key Technology Landscape

The Waste Recycling and Circular Economy Market's technological landscape is undergoing a revolutionary transformation, pivoting away from traditional mechanical processing towards sophisticated, digitally-integrated systems designed to handle complex, multi-material waste streams efficiently. Core advancements center around Artificial Intelligence (AI) and robotics, which are critical for enhancing the Material Recovery Facility (MRF) sorting processes. High-speed optical sorters, now integrated with deep learning algorithms, can identify subtle differences in polymer chemistry, color, and density, sorting fractions at speeds and purity levels unattainable by manual labor or older generation technologies. Furthermore, advanced mechanical pre-treatment, including high-efficiency shredders and ballistic separators, ensures optimal material conditioning before tertiary processing, significantly increasing overall system recovery rates and reducing operational costs associated with contamination.

A pivotal technological shift is occurring in the realm of advanced or chemical recycling, particularly for plastics that are incompatible with mechanical methods (e.g., multi-layer films, heavily contaminated materials). Technologies like pyrolysis and gasification break down polymer chains using heat in the absence of oxygen to produce valuable synthetic oils (pyrolysis oil or naphtha), which can be directly fed back into petrochemical cracking units to manufacture new, virgin-quality plastics. This depolymerization approach provides a genuine closed-loop solution, tackling the most challenging plastic waste categories and overcoming the historical purity limitations of mechanical recycling. Investment in these capital-intensive chemical plants is rapidly expanding, establishing a robust link between the waste management sector and the global petrochemical industry, fundamentally changing the sourcing strategy for many polymer producers.

Beyond material processing, digitalization forms the backbone of the efficient circular economy infrastructure. Key technologies include Internet of Things (IoT) sensors embedded in smart bins and fleet management systems, providing real-time data on fill levels and collection routes, optimizing logistics and reducing operational carbon footprint. Blockchain technology is also gaining traction, offering immutable, transparent tracking of materials from generation to final end-use (e.g., tracking recycled plastics to verify their origin for compliance purposes). Furthermore, novel bio-recycling methods, such as utilizing specialized enzymes (enzymatic recycling) to rapidly depolymerize specific plastics like PET under low temperature conditions, offer a less energy-intensive and highly targeted alternative to traditional thermal or chemical methods, signaling a future where biological solutions play an increasing role in complex material breakdown.

Regional Highlights

- Europe: Europe maintains its leadership in the circular economy, heavily influenced by the European Green Deal and the Circular Economy Action Plan, which mandate high recycling rates, ban specific single-use plastics, and enforce strict landfill reduction targets. Germany, the Netherlands, and Scandinavian countries showcase the highest levels of advanced infrastructure, often excelling in bio-waste treatment (anaerobic digestion) and high-efficiency Waste-to-Energy facilities. The region is the global epicenter for the adoption of Extended Producer Responsibility (EPR) legislation across various product categories, securing financial mechanisms necessary for robust recycling systems and driving high demand for secondary raw materials in packaging and construction sectors.

- North America (NA): The North American market, primarily driven by the U.S. and Canada, is characterized by regional variability and an increased focus on technology investment to modernize historically fragmented infrastructure. While federal policy is evolving, state and corporate sustainability goals are the primary catalysts. There is a strong uptake of AI-powered sorting technologies and significant capital expenditure allocated to establishing chemical recycling facilities, particularly in states aiming to address plastic waste challenges. Market growth is concentrated around high-value streams like paper, metals, and increasing volumes of E-Waste processing, shifting away from cheap landfill dependence towards resource recovery.

- Asia Pacific (APAC): APAC is projected as the fastest-growing region, generating the largest volumes of waste globally due to rapid population growth and urbanization across economies like China, India, and Indonesia. Government initiatives, such as China’s "Zero Import" policy for waste and large-scale investment in domestic waste infrastructure, are compelling substantial growth in local processing capacity. The region is seeing rapid deployment of WtE plants and specialized facilities for E-Waste and plastic management, driven by the dual pressures of environmental contamination and the strategic need to secure domestic supply of critical raw materials.

- Latin America (LATAM): Growth in LATAM is primarily focused on formalizing existing informal recycling sectors and investing in basic MSW collection and landfill mitigation strategies. Countries like Brazil and Mexico are implementing environmental regulations and pushing for public-private partnerships to improve infrastructure efficiency and source separation. The market is increasingly adopting mechanical recycling for high-volume streams like plastics and glass, often focusing on localized, accessible solutions to address significant regional disparities in waste management service coverage.

- Middle East and Africa (MEA): The MEA region is characterized by substantial untapped potential, particularly in the Gulf Cooperation Council (GCC) countries, which are diversifying their economies away from hydrocarbon dependence and investing heavily in sustainable urban development. Large-scale infrastructure projects are driving demand for modern waste management solutions, including advanced WtE and sorting facilities. Africa faces major infrastructural deficits, with growth concentrated in commercial and industrial waste sectors, although increasing international aid and government focus on reducing marine plastic pollution are catalyzing pilot projects for localized recycling solutions and circular economy frameworks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waste Recycling and Circular Economy Market.- Veolia Environnement S.A.

- Suez S.A.

- Waste Management Inc.

- Republic Services

- Covanta Holding Corporation

- Biffa Group

- Remondis SE & Co. KG

- China Everbright Environment Group Ltd.

- Hitachi Zosen Inova

- FCC Environment

- Clean Harbors Inc.

- Advanced Disposal Services (Now part of Republic Services)

- Tana Oy

- TOMRA Systems ASA

- Stericycle Inc.

- Renewi plc

- TerraCycle

- Agilyx

- Brightmark Energy

- Loop Industries

Frequently Asked Questions

Analyze common user questions about the Waste Recycling and Circular Economy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor accelerating the growth of the Circular Economy Market?

The primary accelerating factor is the implementation and rigorous enforcement of Extended Producer Responsibility (EPR) legislation, especially across European and developing nations. EPR mandates compel producers to financially and operationally manage the end-of-life cycle of their products, creating a robust, non-volatile market demand for secondary raw materials and driving massive investment in recycling infrastructure and sustainable product design for longevity and easy disassembly.

How is Chemical Recycling impacting the Plastic Waste segment?

Chemical recycling, through technologies like pyrolysis and depolymerization, is critically impacting the plastic waste segment by providing a viable solution for complex, contaminated, and multi-layered plastics that conventional mechanical recycling systems cannot process. This technology converts difficult waste streams back into monomers or high-quality feedstocks (oils) suitable for producing virgin-grade polymers, substantially increasing the overall percentage of plastics that can be diverted from landfill and incineration, thereby enhancing material circularity.

Which geographical region leads the market in terms of policy and technology adoption?

Europe leads the global market in both policy framework and technology adoption, driven by the EU Circular Economy Action Plan and the European Green Deal. European countries, particularly Germany and the Nordic nations, demonstrate superior landfill diversion rates and are pioneers in deploying advanced solutions such as integrated AI sorting, sophisticated bio-waste treatment (Anaerobic Digestion), and mandatory high recycled content targets across key industrial sectors, setting the global benchmark for circularity.

What are the main financial restraints affecting the adoption of circular technologies?

The main financial restraints include the exceedingly high initial capital expenditure (CAPEX) required for building sophisticated recycling infrastructure (e.g., advanced MRFs or chemical recycling plants) and the inherent price volatility of virgin commodities. When oil and primary material prices drop significantly, recycled materials often become temporarily non-competitive on cost, creating uncertainty for investors and hindering the establishment of stable, long-term procurement contracts necessary to sustain high recycling volumes.

How does AI contribute specifically to enhancing material recovery efficiency?

AI contributes by integrating high-speed optical recognition systems and robotic sorting arms that utilize deep learning models to identify and separate different types of materials (especially plastics) with high precision and speed. This capability drastically reduces contamination levels in recovered material streams, ensuring the purity required for secondary raw materials to be adopted by high-specification manufacturing processes, maximizing both recovery rates and the economic value of the resultant commodities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager