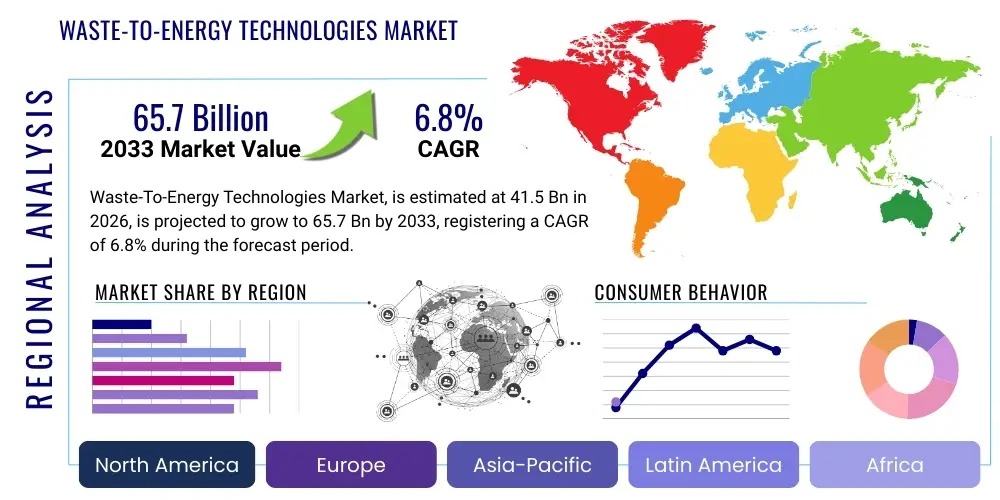

Waste-To-Energy Technologies Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440595 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Waste-To-Energy Technologies Market Size

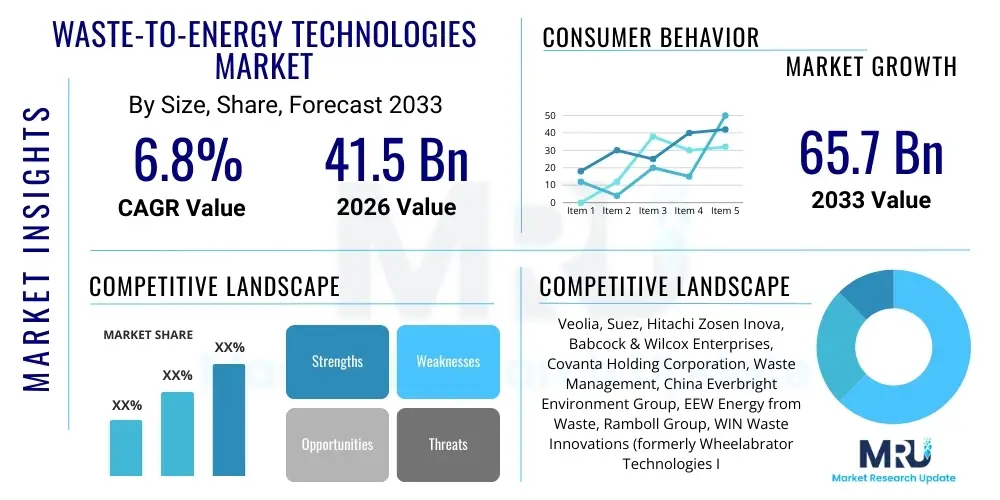

The Waste-To-Energy Technologies Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 41.5 billion in 2026 and is projected to reach USD 65.7 billion by the end of the forecast period in 2033. This growth trajectory is underpinned by an escalating global waste generation coupled with increasing demands for sustainable energy solutions, driving investments in advanced waste valorization processes across diverse economies.

Waste-To-Energy Technologies Market introduction

The Waste-To-Energy (WTE) Technologies Market encompasses a range of processes that convert non-recyclable waste materials into usable forms of energy, such as electricity, heat, or fuel. These technologies play a pivotal role in sustainable waste management by simultaneously addressing the challenges of waste disposal and energy scarcity. Products within this market include advanced incineration systems, gasification plants, pyrolysis reactors, anaerobic digestion facilities, and landfill gas recovery systems, each designed to process different types of waste streams and generate distinct energy outputs. Major applications span municipal waste treatment, industrial waste processing, and agricultural waste management, serving sectors that require both efficient waste disposal and renewable energy production. The primary benefits of WTE technologies include significant waste volume reduction, decreased reliance on landfills, production of clean energy, reduction in greenhouse gas emissions compared to traditional landfilling, and the potential for resource recovery. Key driving factors propelling market expansion are the rapidly increasing global population and urbanization, leading to unprecedented volumes of waste generation; a growing focus on environmental sustainability and circular economy principles; supportive government policies and regulatory frameworks promoting renewable energy and waste diversion; and the continuous advancement in WTE conversion technologies that enhance efficiency and reduce emissions, making them more economically and environmentally viable.

Waste-To-Energy Technologies Market Executive Summary

The Waste-To-Energy Technologies Market is experiencing robust growth, driven by an intricate interplay of macro and micro-economic factors, translating into significant business, regional, and segment trends. From a business perspective, there is a pronounced shift towards integrating advanced automation and digital solutions within WTE plants, optimizing operational efficiency and predictive maintenance. Furthermore, strategic partnerships and mergers among technology providers, waste management companies, and energy utilities are becoming more common, aiming to offer integrated, end-to-end solutions and leverage combined expertise for large-scale projects. Investments in research and development are concentrated on enhancing conversion efficiencies, reducing emissions, and developing modular, decentralized WTE systems suitable for smaller communities or industrial sites. Regionally, Asia Pacific stands out as a dominant and rapidly expanding market, fueled by massive urbanization, burgeoning waste volumes, and proactive governmental initiatives in countries like China, India, and Japan. Europe, a mature market, continues to innovate with stringent environmental regulations and a strong emphasis on circular economy models, driving advancements in emissions control and energy recovery. North America is witnessing renewed interest due to infrastructure modernization efforts and a push towards energy independence and waste diversion from landfills. Segment-wise, incineration, particularly advanced grate combustion and fluidized bed technologies, remains a significant contributor due to its proven efficacy and scalability, though newer thermochemical technologies like gasification and pyrolysis are gaining traction for their ability to produce higher-value energy carriers like syngas and liquid fuels. The anaerobic digestion segment is also expanding rapidly, driven by the increasing focus on organic waste treatment and biogas production for both power generation and vehicle fuel. These trends collectively underscore a dynamic market landscape poised for continued innovation and substantial investment in sustainable waste and energy infrastructure.

AI Impact Analysis on Waste-To-Energy Technologies Market

User inquiries concerning AI's influence on the Waste-To-Energy Technologies Market frequently revolve around optimizing operational efficiency, enhancing predictive maintenance capabilities, and improving resource recovery processes. Stakeholders are particularly interested in how AI can contribute to better feedstock management by analyzing waste composition, thereby optimizing the conversion process for maximum energy output and minimal emissions. Another common theme is the role of AI in real-time monitoring and control of WTE facilities, addressing potential operational disruptions before they occur and ensuring compliance with stringent environmental regulations. Users also inquire about AI's potential to facilitate the integration of WTE plants into broader smart grid systems and its capacity to manage complex data streams generated by various sensors within a WTE facility, leading to more informed decision-making and performance improvements.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to significantly transform the Waste-To-Energy (WTE) sector, ushering in an era of unprecedented efficiency, reliability, and environmental performance. AI algorithms can analyze vast datasets from sensors, operational logs, and external factors like weather patterns to predict equipment failures, optimize combustion parameters, and enhance overall plant stability. This predictive capability translates into reduced downtime, lower maintenance costs, and improved energy recovery rates. Furthermore, AI-driven systems can provide sophisticated real-time control over processes such as waste sorting, pre-treatment, and combustion, adapting to varying waste compositions to maintain optimal operational conditions and ensure consistent energy output, while simultaneously minimizing the formation of pollutants and maximizing resource utilization.

Moreover, AI's analytical prowess extends to strategic planning and market integration for WTE facilities. By forecasting waste generation trends and energy demands, AI can assist in the optimal sizing and siting of new WTE plants, and in developing more resilient energy supply strategies. It can also enhance the value chain by identifying opportunities for co-generation and district heating systems, and by optimizing the recycling and recovery of valuable by-products such as bottom ash and fly ash. The ability of AI to model complex scenarios and simulate different operational strategies will empower operators to make more data-driven decisions, leading to a more sustainable, profitable, and environmentally responsible WTE industry.

- Enhanced Operational Efficiency: AI algorithms optimize combustion processes by analyzing real-time waste composition, ensuring maximum energy output and reduced fuel consumption.

- Predictive Maintenance: Machine learning models predict equipment failures before they occur, minimizing downtime and extending the lifespan of critical machinery through proactive maintenance.

- Improved Emission Control: AI-powered systems monitor and adjust parameters to ensure compliance with environmental regulations, reducing pollutant emissions through precise control.

- Waste Stream Characterization: AI vision systems can accurately sort and characterize waste, improving the quality of feedstock and increasing the efficiency of the WTE process.

- Resource Recovery Optimization: AI helps identify and recover valuable materials from ash and other by-products, enhancing the circular economy aspect of WTE.

- Grid Integration and Energy Management: AI facilitates seamless integration of WTE-generated power into smart grids, optimizing energy distribution and balancing supply with demand.

- Process Automation and Control: Automated systems leverage AI for real-time adjustments, maintaining optimal operating conditions despite variations in waste input.

- Safety Enhancements: AI can monitor plant conditions for anomalies, alerting operators to potential hazards and improving overall workplace safety.

- Data-Driven Decision Making: Advanced analytics provide actionable insights into plant performance, enabling operators to make informed decisions for continuous improvement.

- Supply Chain Optimization: AI can predict waste generation patterns and logistics needs, optimizing waste collection and delivery schedules to WTE facilities.

DRO & Impact Forces Of Waste-To-Energy Technologies Market

The Waste-To-Energy (WTE) Technologies Market is shaped by a confluence of influential factors categorized as Drivers, Restraints, and Opportunities (DRO), collectively defining its impact forces and future trajectory. The primary drivers include the escalating global waste generation rates, propelled by urbanization and population growth, which exert immense pressure on existing landfill capacities and necessitate alternative disposal methods. Simultaneously, the increasing demand for renewable energy sources to mitigate climate change and enhance energy security provides a strong impetus for WTE adoption, aligning with global decarbonization goals. Favorable government policies, incentives, and regulatory frameworks, such as carbon pricing and renewable energy mandates, further stimulate investment in WTE projects. Additionally, growing public and corporate awareness regarding environmental sustainability and circular economy principles is fostering greater acceptance and demand for waste valorization technologies that convert waste into valuable energy and resources, rather than simply disposing of it.

Conversely, several significant restraints impede the market's full potential. The high capital expenditure required for the construction and commissioning of WTE plants presents a substantial financial barrier, particularly in developing economies where access to funding may be limited. Public perception issues, often stemming from concerns about air emissions, land use, and the "not in my backyard" (NIMBY) syndrome, can lead to opposition and delays in project development. Competition from other established and emerging renewable energy sources, such as solar and wind power, which often have lower perceived environmental risks and increasingly competitive costs, can divert investment away from WTE. Furthermore, regulatory complexities and the lengthy permitting processes, coupled with the variability in waste composition and quality across different regions, add layers of operational challenges and financial risk to WTE projects, making them more difficult to implement and sustain efficiently over the long term. Addressing these restraints effectively will require technological innovation, robust public engagement strategies, and supportive policy environments that reduce financial barriers and streamline regulatory procedures for WTE developments.

Despite these challenges, the Waste-To-Energy market is replete with significant opportunities. Emerging economies in Asia Pacific, Latin America, and Africa, characterized by rapidly growing populations and inadequate waste management infrastructure, represent vast untapped markets for WTE solutions. The global push towards a circular economy provides a fertile ground for WTE technologies that not only generate energy but also facilitate resource recovery from waste, such as metals from ash or nutrient-rich digestate from anaerobic digestion. Innovations in pre-treatment technologies, such as advanced sorting and mechanical biological treatment (MBT), enhance the quality of WTE feedstock, improving efficiency and reducing emissions. Moreover, the integration of WTE plants into smart city initiatives, providing decentralized energy and heating solutions, and the potential for co-location with industrial facilities to utilize waste heat, offer pathways for greater economic viability and sustainability. As technological advancements continue to address emissions concerns and improve efficiency, and as global energy and waste crises intensify, WTE is increasingly positioned as an indispensable component of integrated resource management strategies, attracting new investments and fostering sustainable urban development.

Segmentation Analysis

The Waste-To-Energy Technologies Market is broadly segmented based on several critical parameters, including the type of technology employed, the specific waste types processed, the applications of the generated energy, and the end-user industries. This comprehensive segmentation helps in understanding the diverse landscape of WTE solutions available and the specific needs they cater to across different regions and economic contexts. Each segment represents distinct market dynamics, technological maturity levels, and growth opportunities, reflecting the varied approaches to converting waste into valuable energy resources. The market's structure reflects a continuous evolution driven by technological innovation, regulatory mandates, and shifting waste management paradigms globally. Analyzing these segments provides a nuanced perspective on market trends, competitive positioning, and future investment areas, highlighting the increasing specialization and diversification within the WTE sector to address complex waste streams and energy demands effectively.

- By Technology

- Incineration

- Mass Burn

- Refuse-Derived Fuel (RDF)

- Modular Incineration

- Gasification

- Pyrolysis

- Anaerobic Digestion

- Landfill Gas Recovery

- Plasma Arc Gasification

- Combined Heat and Power (CHP)

- Incineration

- By Waste Type

- Municipal Solid Waste (MSW)

- Industrial Waste

- Agricultural Waste

- Hazardous Waste

- Biomass

- Commercial Waste

- By Application

- Power Generation

- Heat Generation

- Combined Heat and Power (CHP)

- Syngas Production

- Fuel Production (Biofuels, Hydrogen)

- District Heating/Cooling

- By End-User

- Utilities

- Independent Power Producers (IPPs)

- Municipalities & Local Governments

- Industrial Facilities (e.g., Chemical, Manufacturing, Food & Beverage)

- Commercial Enterprises

- Waste Management Companies

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Australia, Rest of Asia Pacific)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (South Africa, Saudi Arabia, UAE, Rest of MEA)

Value Chain Analysis For Waste-To-Energy Technologies Market

The value chain for the Waste-To-Energy Technologies Market is an intricate network encompassing several critical stages, from waste generation and collection (upstream) to energy distribution and by-product utilization (downstream). Upstream activities primarily involve the generation, collection, and initial processing of waste. This includes municipal waste collection services, industrial waste management, and agricultural waste aggregation. The efficiency of this stage is paramount, as it dictates the quantity and quality of feedstock available for WTE plants. Waste sorting, pre-treatment (such as shredding, drying, and removal of non-combustible materials), and transportation are crucial steps that optimize the waste stream for energy conversion, ensuring consistency and maximizing the calorific value. Innovations in waste sorting technologies and logistics are continuously improving the effectiveness of these upstream processes, reducing impurities and enhancing the overall viability of WTE projects by preparing suitable fuel for the thermal or biological conversion processes that follow.

The core of the value chain involves the WTE facility itself, where the waste conversion technologies are applied. This includes the engineering, procurement, and construction (EPC) of the plant, followed by its operation and maintenance. Technology providers, such as manufacturers of incinerators, gasifiers, pyrolysis reactors, and anaerobic digesters, play a central role here, offering specialized equipment and technical expertise. This stage is responsible for transforming waste into energy carriers like electricity, steam, syngas, or biogas. Downstream activities focus on the distribution and utilization of the generated energy and the management of residual products. Energy distribution channels include connection to national power grids, supply of steam for district heating or industrial processes, and the use of biogas for vehicle fuel or direct combustion. The efficient integration into existing energy infrastructures is key to monetizing the energy output effectively. Furthermore, the handling and beneficial reuse of by-products, such as bottom ash for construction materials or nutrient-rich digestate as fertilizer, represent additional value recovery streams that enhance the overall sustainability and economic profile of WTE projects, closing the loop on resource management.

Distribution channels for WTE-derived energy and by-products can be both direct and indirect. Direct channels involve power purchase agreements (PPAs) with utility companies for electricity, or direct supply contracts for heat/steam to nearby industrial parks or district heating networks. In some cases, WTE plants might also directly supply compressed natural gas (CNG) or liquefied natural gas (LNG) derived from biogas to transport sectors. Indirect channels typically involve intermediaries. For instance, grid operators act as indirect distributors of electricity, integrating WTE output with other sources. Similarly, for by-products like bottom ash, intermediaries in the construction materials sector might process and distribute them for various applications. The complexity of these channels requires robust logistical planning, regulatory compliance, and strong contractual agreements to ensure reliable delivery and maximize financial returns. Understanding and optimizing these direct and indirect distribution pathways are crucial for the commercial success and long-term sustainability of Waste-To-Energy projects, ensuring that the valuable outputs are effectively utilized and contribute to the circular economy.

Waste-To-Energy Technologies Market Potential Customers

The Waste-To-Energy Technologies Market serves a diverse range of potential customers, primarily driven by their need for efficient waste management solutions, reliable energy sources, and adherence to environmental sustainability goals. Municipalities and local governments represent a foundational customer segment. Facing escalating waste generation from urban populations and dwindling landfill space, these entities seek WTE solutions to reduce waste volumes, minimize environmental impact, and generate revenue from energy sales. Their primary motivation is public service, focusing on sustainable waste disposal and contributing to local energy security. Industrial facilities across various sectors, including chemical, manufacturing, food and beverage, and pulp and paper, constitute another significant customer base. These industries often generate substantial volumes of process-specific waste and can leverage WTE technologies to manage their waste streams on-site, reduce disposal costs, and generate captive power or heat for their operations, thereby enhancing energy independence and operational efficiency. The integration of WTE solutions enables them to meet stringent environmental regulations and demonstrate corporate social responsibility.

Utilities and Independent Power Producers (IPPs) are key potential customers, primarily interested in WTE as a source of baseload renewable energy. For utilities, WTE provides a stable and predictable power supply that complements intermittent renewable sources like solar and wind, contributing to grid stability and diversity of energy portfolios. IPPs, often driven by profit motives and renewable energy mandates, invest in WTE projects to capitalize on long-term power purchase agreements (PPAs) and government incentives for sustainable energy generation. Their focus is on the economic viability and scalability of WTE plants, ensuring a consistent return on investment. Furthermore, private waste management companies, which handle vast quantities of municipal and industrial waste, are increasingly integrating WTE technologies into their service offerings. For these companies, WTE facilities represent a strategic asset that allows them to move beyond traditional landfilling, offering comprehensive waste-to-resource solutions to their clients, thereby expanding their market reach and improving their competitive advantage. They often act as developers, operators, or partners in WTE projects, driven by both environmental responsibility and business growth opportunities in the circular economy.

Beyond these primary segments, emerging customer groups include large commercial enterprises, educational institutions, and even healthcare facilities that generate significant waste and have specific energy needs. These entities are increasingly exploring smaller-scale or modular WTE solutions to manage their localized waste streams, reduce their carbon footprint, and generate energy for their own consumption, aligning with their sustainability goals and potentially achieving cost savings. Additionally, developers of smart cities and eco-industrial parks are potential customers, as they aim to integrate WTE plants as central components of their closed-loop resource management strategies, providing decentralized energy, heat, and waste processing capabilities within a defined ecosystem. The appeal to these diverse customers lies in the ability of WTE technologies to offer a multi-faceted solution that simultaneously addresses waste disposal challenges, provides a reliable energy source, reduces greenhouse gas emissions, and supports broader sustainability and circular economy objectives, making it an attractive proposition across a broad spectrum of economic and governmental entities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 41.5 billion |

| Market Forecast in 2033 | USD 65.7 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Veolia, Suez, Hitachi Zosen Inova, Babcock & Wilcox Enterprises, Covanta Holding Corporation, Waste Management, China Everbright Environment Group, EEW Energy from Waste, Ramboll Group, WIN Waste Innovations (formerly Wheelabrator Technologies Inc.), Acciona, Keppel Seghers, Martin GmbH, Mitsubishi Heavy Industries, JFE Engineering Corporation, Thermax Limited, Xcel Energy, Waste Connections, Plasco Energy Group, Fortum Oyj. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waste-To-Energy Technologies Market Key Technology Landscape

The Waste-To-Energy Technologies Market is characterized by a diverse and evolving landscape of conversion processes, each tailored to different waste types and desired energy outputs. Incineration, particularly mass burn and refuse-derived fuel (RDF) combustion, remains the most established and widely deployed technology. Modern incineration plants are equipped with advanced flue gas treatment systems to meet stringent emission standards, efficiently converting pre-processed or raw municipal solid waste into high-temperature steam for electricity generation and district heating. Alongside large-scale plants, modular incineration technologies are emerging, offering decentralized solutions for smaller communities or industrial sites. These thermal conversion methods have a proven track record of significant waste volume reduction and reliable energy production, making them a cornerstone of many integrated waste management strategies globally, especially where land for landfills is scarce and energy demand is high.

Beyond traditional incineration, advanced thermochemical technologies like gasification and pyrolysis are gaining significant traction due to their ability to produce higher-value energy carriers and reduce environmental footprints. Gasification involves heating waste in a low-oxygen environment to produce syngas, a versatile fuel that can be used for power generation, chemical synthesis, or liquid fuel production. Pyrolysis, on the other hand, thermally decomposes waste in the complete absence of oxygen, yielding char, pyrolytic oil, and non-condensable gases, all of which have potential energy or material recovery applications. Plasma arc gasification, an even more advanced variant, uses extremely high temperatures generated by a plasma torch to break down waste into its elemental components, resulting in a clean syngas and an inert vitrified slag, offering superior waste destruction and minimal environmental impact. These technologies are particularly attractive for processing mixed waste streams, including hazardous and industrial wastes, and align well with the growing emphasis on circular economy principles by enabling comprehensive resource recovery and minimizing residual waste.

Biological and biochemical WTE technologies, primarily anaerobic digestion and landfill gas recovery, form another crucial segment of the market, focusing on organic waste streams. Anaerobic digestion processes organic waste (e.g., food waste, agricultural residues, sewage sludge) in an oxygen-free environment to produce biogas, a methane-rich gas that can be used for electricity, heat, or upgraded to biomethane for vehicle fuel or grid injection. Landfill gas recovery captures methane and carbon dioxide emitted from decomposing organic matter in landfills, preventing potent greenhouse gases from entering the atmosphere and converting them into a usable energy source. These biological methods are environmentally friendly, operate at lower temperatures, and often produce valuable by-products like digestate, which can be used as a soil conditioner. The integration of advanced pre-treatment technologies, such as mechanical biological treatment (MBT), further enhances the efficiency and environmental performance of all WTE systems by preparing homogenized, higher-quality feedstock, removing recyclables, and reducing moisture content. This continuous innovation across thermal, thermochemical, and biological pathways underscores the dynamic nature of the WTE technology landscape, striving for greater efficiency, lower emissions, and broader applicability to diverse waste challenges worldwide.

Regional Highlights

- Asia Pacific (APAC): This region is projected to be the largest and fastest-growing market for Waste-To-Energy technologies, primarily driven by rapid urbanization, massive population growth, and the subsequent exponential increase in municipal and industrial waste generation. Countries like China, India, Japan, South Korea, and Australia are heavily investing in WTE plants to address severe landfill scarcity and meet burgeoning energy demands. Favorable government policies promoting waste reduction and renewable energy, coupled with strong economic growth, make APAC a hub for WTE development.

- Europe: As a mature market, Europe continues to lead in WTE innovation and implementation, characterized by stringent environmental regulations and a strong commitment to circular economy principles. Countries such as Germany, the UK, France, Sweden, and Denmark boast high WTE penetration rates, with a focus on advanced incineration with highly efficient energy recovery (especially combined heat and power - CHP) and strict emission controls. The region is also at the forefront of developing thermochemical technologies like gasification and pyrolysis.

- North America (U.S. & Canada): The North American market is experiencing renewed interest in WTE, driven by the declining availability of landfill space, increasing disposal costs, and a growing emphasis on renewable energy and waste diversion targets. While historically slower in adoption compared to Europe, the U.S. and Canada are seeing investments in modernizing existing facilities and exploring new projects, particularly in states and provinces with high population densities and progressive environmental policies.

- Latin America: This region presents significant growth potential, albeit from a lower base, as many countries grapple with inadequate waste management infrastructure and growing waste volumes. Brazil, Mexico, and Argentina are emerging markets for WTE, with increasing governmental and private sector interest in adopting sustainable waste disposal methods that also generate energy. Challenges include financial constraints and regulatory complexities, but the need for solutions is pressing.

- Middle East & Africa (MEA): The MEA region is poised for substantial growth in the WTE market, propelled by rapid urbanization, economic diversification efforts, and ambitious sustainability agendas. Countries like UAE, Saudi Arabia, and South Africa are initiating large-scale WTE projects to manage increasing waste generation and reduce reliance on fossil fuels. Investments in advanced WTE technologies are driven by a strong commitment to environmental protection and resource efficiency in this dynamic region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waste-To-Energy Technologies Market.- Veolia Environnement S.A.

- Suez S.A.

- Hitachi Zosen Inova AG

- Babcock & Wilcox Enterprises, Inc.

- Covanta Holding Corporation

- Waste Management, Inc.

- China Everbright Environment Group Ltd.

- EEW Energy from Waste GmbH

- Ramboll Group A/S

- WIN Waste Innovations (formerly Wheelabrator Technologies Inc.)

- Acciona S.A.

- Keppel Seghers (a subsidiary of Keppel Corporation Limited)

- Martin GmbH

- Mitsubishi Heavy Industries, Ltd.

- JFE Engineering Corporation

- Thermax Limited

- Xcel Energy Inc.

- Waste Connections, Inc.

- Plasco Energy Group Inc.

- Fortum Oyj

Frequently Asked Questions

Analyze common user questions about the Waste-To-Energy Technologies market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary benefits of Waste-To-Energy (WTE) technologies for waste management?

WTE technologies offer multi-faceted benefits, including significant reduction in landfill volume, production of renewable energy (electricity, heat, fuel), lower greenhouse gas emissions compared to landfilling, and resource recovery from waste streams. They provide a sustainable alternative for waste disposal while contributing to energy security and environmental protection.

How do modern Waste-To-Energy plants address environmental concerns, particularly regarding air emissions?

Modern WTE plants employ advanced flue gas treatment systems, including scrubbers, bag filters, and selective catalytic reduction (SCR) technologies, to meticulously remove pollutants such as dioxins, furans, heavy metals, and acid gases. These systems ensure that emissions meet and often surpass stringent international environmental standards, minimizing their impact on air quality.

What types of waste can be processed by Waste-To-Energy technologies?

WTE technologies can process a wide array of waste types, including municipal solid waste (MSW), industrial waste, agricultural waste (biomass), and even certain hazardous wastes. Specific technologies are optimized for different waste compositions; for example, anaerobic digestion is ideal for organic waste, while advanced incineration handles mixed MSW effectively.

What are the key financial considerations and challenges for developing Waste-To-Energy projects?

Key financial considerations include high upfront capital investment for construction, operational and maintenance costs, and securing long-term waste supply contracts. Challenges often involve obtaining financing, managing project risks, achieving attractive power purchase agreement (PPA) rates, and navigating varying subsidies or carbon credits across different regions.

How do Waste-To-Energy technologies contribute to the circular economy?

WTE technologies play a vital role in the circular economy by converting non-recyclable waste into valuable resources (energy) and recovering materials. For instance, metals can be extracted from bottom ash, and nutrient-rich digestate from anaerobic digestion can be used as fertilizer, reducing reliance on virgin materials and fostering resource efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager