Wastewater Grinders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434204 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wastewater Grinders Market Size

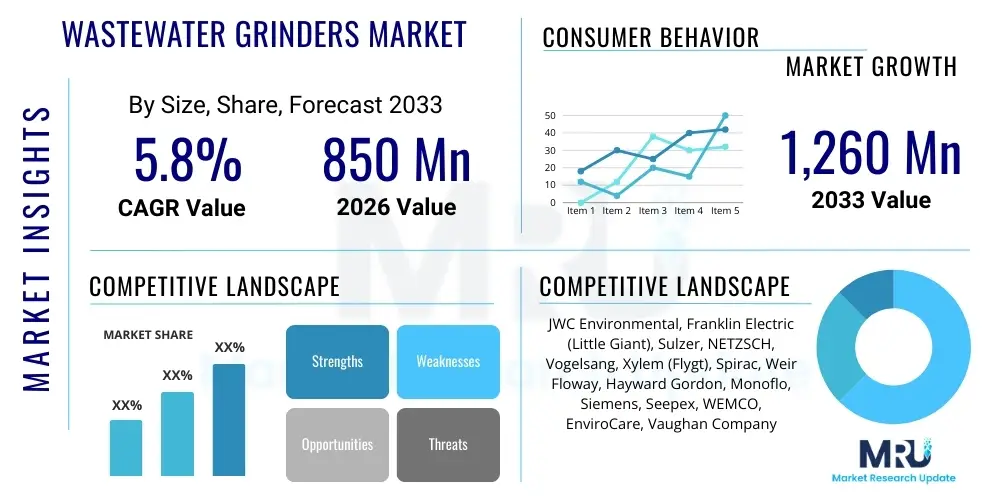

The Wastewater Grinders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $850 million in 2026 and is projected to reach $1,260 million by the end of the forecast period in 2033.

Wastewater Grinders Market introduction

The Wastewater Grinders Market encompasses the manufacturing, distribution, and servicing of specialized equipment designed to reduce the size of solid materials found in municipal and industrial wastewater streams. These essential devices prevent clogging, protect downstream pumps and treatment equipment, and ensure the efficient flow of sewage systems. Product descriptions typically highlight robust construction, high torque capabilities, and dual-shaft or twin-shaft configurations tailored for challenging environments where fibrous materials, rags, plastics, and debris are prevalent. The primary function is comminution, transforming large, potentially damaging solids into smaller, manageable particles that can be processed effectively by subsequent treatment stages, thereby reducing maintenance costs and operational downtime across the entire wastewater infrastructure.

Major applications of wastewater grinders are extensive, spanning municipal sewage treatment plants, pumping stations, correctional facilities, commercial buildings, food processing industries, and various manufacturing facilities that discharge high-solids effluent. The inherent benefits of employing these grinders include enhanced system reliability, increased longevity of pumps and pipes, and improved adherence to environmental discharge regulations. They act as a critical first line of defense in protecting capital-intensive machinery like centrifugal pumps and fine screens from catastrophic failure caused by large non-biodegradable solids. The operational benefits translate directly into cost savings through reduced emergency maintenance and minimized labor requirements associated with manual clog removal.

The market is primarily driven by escalating global urbanization, leading to increased volumes of wastewater generation, coupled with stringent environmental regulations mandating effective sewage management and solids reduction. Furthermore, the proliferation of disposable, non-flushable products entering municipal sewer systems—often referred to as “flushable wipes”—necessitates more powerful and reliable grinding technologies. Ongoing infrastructure upgrades and replacements in developed economies, alongside rapid construction of new treatment facilities in emerging markets, solidify the demand landscape. Technological advancements, focusing on enhanced monitoring, automation, and energy efficiency, also serve as significant market drivers, pushing utility providers towards adopting newer, high-performance grinder models.

Wastewater Grinders Market Executive Summary

The Wastewater Grinders Market demonstrates resilient growth, underpinned by non-discretionary spending on water and sanitation infrastructure globally. Current business trends indicate a strong shift towards intelligent grinding solutions integrating remote monitoring and predictive maintenance features to optimize operational efficiency and minimize unexpected failures. Manufacturers are focusing on developing modular, easily serviceable designs and incorporating specialized alloy components resistant to corrosion and abrasion, thereby addressing the demanding conditions prevalent in sewage applications. Investment in research and development is concentrated on optimizing cutter geometry and hydraulic efficiency to handle the increasing prevalence of challenging solids, particularly in municipal applications where fat, oil, and grease (FOG) build-up complicates traditional grinding processes.

Regionally, North America and Europe maintain maturity, characterized by high replacement demand driven by aging infrastructure and strict regulatory compliance standards regarding discharge quality and equipment reliability. The Asia Pacific region, however, is emerging as the fastest-growing market segment, fueled by rapid industrialization, massive investments in new urban sanitation projects, particularly in countries like China and India, and increasing awareness regarding the importance of effective preliminary treatment. Latin America and the Middle East and Africa are also showing potential, driven by privatization of water utilities and necessary infrastructure development to support growing populations and expanding industrial bases, especially in energy and resource processing sectors that produce complex waste streams.

Segmentation trends highlight the dominance of dual-shaft grinders due to their superior handling capacity and efficiency in high-flow environments, though submersible grinders are seeing increased adoption for specific applications within pumping stations. End-user segmentation remains focused on the municipal sector, which accounts for the largest share, yet the industrial sector, specifically food and beverage processing and chemical manufacturing, is accelerating its adoption rates due to strict pre-treatment requirements and the need to protect proprietary process equipment. The market also observes an increasing demand for rental and service contracts, signaling a shift in operational strategies among utilities focused on outsourced maintenance and performance guarantees rather than outright capital expenditure on equipment management.

AI Impact Analysis on Wastewater Grinders Market

User queries regarding AI’s impact on the Wastewater Grinders Market primarily revolve around predictive maintenance capabilities, optimization of operational efficiency, and the integration of smart controls within existing sewage infrastructure. Users are keen to understand how machine learning can analyze sensor data (torque, vibration, current draw) to forecast potential mechanical failure, thereby minimizing unplanned downtime, which is costly in continuous flow operations. Key themes include the implementation of Digital Twins for simulating grinder performance under varying load conditions, the use of AI algorithms for adjusting cutter speeds and directions automatically based on real-time solids composition, and the potential for AI-driven remote diagnostics that reduce the need for manual, hazardous inspections in confined spaces. The primary expectation is that AI will transform reactive maintenance into proactive asset management, extending equipment lifespan and ensuring regulatory compliance through consistently optimized solids processing.

- AI enables predictive maintenance by analyzing torque signatures, vibration patterns, and motor current data, forecasting equipment failure 90 days in advance.

- Machine learning algorithms optimize grinder operational parameters (speed, direction) instantaneously based on real-time inflow characteristics and solids loading, maximizing efficiency.

- Integration of Digital Twins allows for the simulation of high-stress scenarios (e.g., severe ragging events) to test control strategies and improve system robustness without interrupting service.

- AI-driven automated reporting systems enhance regulatory compliance documentation by providing detailed logs of solids reduction performance and energy consumption over time.

- Remote diagnostic tools utilize AI to pinpoint the exact nature and location of mechanical anomalies, significantly reducing troubleshooting time and required site visits.

DRO & Impact Forces Of Wastewater Grinders Market

The Wastewater Grinders Market is significantly shaped by robust regulatory mandates (Drivers) promoting environmental protection and wastewater quality standards globally, creating a continuous demand floor for effective pre-treatment equipment. This positive momentum is balanced by notable constraints (Restraints), particularly the high initial capital investment required for specialized, heavy-duty grinding equipment, and budget limitations in smaller municipal utility districts. Opportunities (Opportunity) arise from the expanding adoption of smart water technologies and the urgent need for infrastructure resilience against increasing volumes of non-biodegradable debris entering sewer systems. These dynamic factors collectively exert substantial Impact Forces on market participants, compelling manufacturers to innovate around efficiency, durability, and cost-effectiveness while utilities prioritize long-term asset reliability and compliance.

Drivers include accelerating urbanization rates, which proportionally increase wastewater volume and complexity, alongside the critical necessity for protecting capital-intensive downstream equipment such as membranes and fine screens in modern treatment facilities. Furthermore, the global issue of "flushable" wipes and personal hygiene products clogging pump stations has necessitated the replacement of older, less capable grinders with high-torque, robust dual-shaft systems specifically designed to handle these modern, challenging solids. Restraints primarily involve the operational challenges associated with abrasive materials causing premature wear on cutters, the significant energy consumption associated with high-power grinding, and the often-lengthy procurement cycles within public utility sectors. These factors necessitate continuous innovation in materials science and power efficiency to maintain market competitiveness and address customer total cost of ownership (TCO) concerns.

Opportunities are clearly visible in the rapidly expanding industrial wastewater sector, especially in facilities requiring strict pre-treatment before discharging into municipal systems, such as breweries, dairies, and meat processing plants. The shift toward sustainable water management and resource recovery further presents avenues for grinders integrated into biosolids processing lines. The combination of stringent regulations (Force 1), increasing solid waste complexity (Force 2), and technological advancements in monitoring and control (Force 3) generates high impact forces, pushing market vendors toward offering integrated service solutions rather than mere hardware sales. This comprehensive approach, encompassing installation, maintenance, and performance guarantees, is essential for securing long-term contracts and establishing market dominance.

Segmentation Analysis

The Wastewater Grinders Market segmentation provides a granular view of demand across various product types, operational characteristics, and end-user applications. Key criteria for segmentation include the type of grinding mechanism (single-shaft, dual-shaft, three-shaft), the installation method (channel/in-line, submersible), the power capacity, and the primary application sector (municipal or industrial). Understanding these segments is crucial for manufacturers to tailor product specifications, focusing on torque output, screen size reduction capacity, and suitability for specific waste streams, such as high-grease content or extremely fibrous material.

The market is primarily differentiated based on the severity of the application. Dual-shaft grinders, known for their high cutting force and resilience against jamming, command the largest market share, particularly in high-volume municipal pump stations. Conversely, single-shaft models, often termed comminutors, are sometimes favored in less challenging, lower-flow applications or as specialized units. Geographically, the segmentation reflects the varying levels of infrastructure maturity and the pace of regulatory enforcement across regions, with established markets focusing on replacement and upgrades, and developing markets driving new infrastructure installs.

- By Type:

- Dual-Shaft Grinders

- Single-Shaft Grinders (Comminutors)

- Three-Shaft Grinders

- Muffin Monster Type Grinders

- By Installation:

- Channel Grinders (Open Channel)

- In-Line Grinders (Pressurized Pipe)

- Submersible Grinders

- By Application/End-User:

- Municipal Wastewater Treatment Facilities

- Municipal Pumping Stations

- Industrial Wastewater Treatment (Food & Beverage, Chemical, Pulp & Paper, Energy)

- Commercial/Institutional (Hospitals, Correctional Facilities)

- By Power Capacity:

- Low Power (Below 5 HP)

- Medium Power (5 HP to 20 HP)

- High Power (Above 20 HP)

Value Chain Analysis For Wastewater Grinders Market

The value chain for the Wastewater Grinders Market begins with the upstream suppliers responsible for sourcing high-quality raw materials, including specialized steel alloys (e.g., tool steel, stainless steel) required for manufacturing durable cutter stacks and robust housing components. Given the abrasive and corrosive environment of wastewater, material quality and metallurgy are critical competitive differentiators. Key upstream activities involve precision casting, machining, and material testing to ensure component longevity and operational reliability, as component failure due to wear can lead to severe operational disruptions for end-users. Strong relationships with suppliers specializing in wear-resistant coatings and advanced seals are essential for manufacturers to maintain product quality and control production costs efficiently.

The midstream phase focuses on manufacturing, assembly, and quality control. This stage involves complex engineering tasks, including designing optimized cutter stack geometry, developing high-torque gearbox mechanisms, and integrating sophisticated electrical controls, often incorporating VFDs (Variable Frequency Drives) for optimized energy use. Successful manufacturers leverage proprietary designs and patents related to cutter technology and sealing systems. After manufacturing, the downstream segment handles distribution. Due to the high-value and technically complex nature of the equipment, distribution predominantly occurs through specialized channel partners, engineering procurement and construction (EPC) firms, and direct sales teams with deep technical expertise in fluid dynamics and sewage infrastructure. These channels provide necessary pre-sales consultation, site assessment, and integration services, ensuring the correct grinder is selected and installed for the specific application environment.

The distribution channel is characterized by a mix of direct and indirect sales strategies. Direct sales are often utilized for large-scale municipal contracts or custom industrial solutions where detailed technical consultation and performance guarantees are required. Indirect distribution relies heavily on professional distributors and system integrators who can bundle the grinders with other wastewater components (pumps, controls, screens) and provide regional support. Aftermarket services, including spare parts supply (cutters, seals), maintenance contracts, and technical support, form a crucial component of the value chain, often representing a significant source of recurring revenue. The effectiveness of this service network dictates customer retention and long-term asset performance, highlighting the importance of robust post-sales support infrastructure.

Wastewater Grinders Market Potential Customers

The primary customers for wastewater grinders are entities responsible for managing and treating municipal, industrial, and commercial effluent streams where the presence of large solids poses a threat to hydraulic and mechanical integrity. Municipal authorities, city water departments, and private utility operators constitute the largest segment of potential customers, purchasing grinders for installation in lift stations, headworks of treatment plants, and remote collection systems to protect critical pump assets from ragging and debris accumulation. These customers prioritize reliability, compliance with strict procurement specifications, and low total cost of ownership (TCO) due to the long operational life required for public infrastructure investments.

Industrial users represent a growing segment, driven by the need for pre-treatment to comply with municipal discharge limits or to protect proprietary in-house process equipment. Key industrial sectors include food and beverage processing (e.g., rendering, brewing, dairies), which often deal with heavy organic solids and fibrous waste; chemical processing plants handling specific chemical-resistant materials; and the pulp and paper industry dealing with high volumes of fibrous materials. These industrial buyers seek grinders that can withstand specific chemical or temperature challenges while delivering consistent particle size reduction necessary for subsequent processes like membrane filtration or anaerobic digestion systems.

Additional potential customers include institutional facilities such as large hospitals, universities, prisons, and correctional facilities, which often experience high volumes of non-standard refuse entering the sewer system, leading to chronic clogging issues in their localized plumbing and pumping infrastructure. Furthermore, engineering consulting firms and EPC contractors are crucial indirect buyers, as they specify and procure grinding equipment on behalf of both municipal and industrial end-users during the planning and construction phases of new or upgraded wastewater infrastructure projects. Therefore, targeting both the direct end-user and the influential specification market is critical for market success.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850 million |

| Market Forecast in 2033 | $1,260 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | JWC Environmental, Franklin Electric (Little Giant), Sulzer, NETZSCH, Vogelsang, Xylem (Flygt), Spirac, Weir Floway, Hayward Gordon, Monoflo, Siemens, Seepex, WEMCO, EnviroCare, Vaughan Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wastewater Grinders Market Key Technology Landscape

The technology landscape within the Wastewater Grinders Market is characterized by continuous advancements aimed at enhancing throughput efficiency, reducing energy consumption, and improving operational resilience against increasingly challenging materials, particularly the prevalence of modern, non-woven solids. A major technological focus is the optimization of cutter stack geometry, including the development of hardened, precision-ground, and dynamically-indexed cutters made from highly wear-resistant materials like proprietary alloy steels or specialized carbide inserts. These innovations are critical for maintaining effective solids size reduction over extended periods without frequent, expensive replacements. Furthermore, manufacturers are integrating sophisticated sealing systems, such as mechanical seals with internal flushing mechanisms, to prevent premature seal failure caused by grit and debris penetration, a common issue in submersible applications.

The control and monitoring technology segment represents another crucial area of innovation. Modern wastewater grinders are increasingly equipped with advanced instrumentation, including high-accuracy torque transducers, vibration sensors, and real-time current monitoring devices. These sensors feed data back to integrated Variable Frequency Drives (VFDs) and Programmable Logic Controllers (PLCs), allowing for dynamic adjustment of grinder speed and rotation direction (auto-reversing or cycling) to prevent jamming and clear rags or debris automatically. This self-cleaning or anti-jamming functionality drastically improves operational reliability and reduces the need for manual intervention, especially in remote pumping stations where maintenance accessibility is limited.

Furthermore, connectivity and integration are pivotal technological trends. Many new models incorporate smart connectivity features, enabling remote monitoring and data logging through SCADA systems or cloud-based platforms. This IoT integration facilitates predictive maintenance strategies, allowing utility managers to analyze performance trends, schedule necessary interventions before catastrophic failure, and benchmark the energy efficiency of multiple units across a network. The adoption of robust gearboxes designed to handle extreme peak torque loads, coupled with energy-efficient motor technologies (e.g., IE3 or IE4 efficiency ratings), ensures that modern grinders meet both performance demands and evolving sustainability standards concerning energy footprint within the water industry.

Regional Highlights

Regional dynamics play a significant role in shaping the demand, technology adoption rates, and competitive intensity within the Wastewater Grinders Market, reflecting variations in regulatory maturity, infrastructure investment cycles, and local wastewater characteristics.

- North America (US and Canada): This region is a mature, high-value market characterized by robust regulatory enforcement, significant investment in infrastructure replacement (due to aging systems), and high demand for advanced, high-performance dual-shaft grinders. The presence of challenging debris, particularly disposable wipes, drives consistent demand for high-torque solutions and sophisticated monitoring technology. Utilities prioritize TCO and reliability, leading to high adoption rates of products incorporating predictive maintenance capabilities.

- Europe (Germany, UK, France): Europe maintains a strong focus on environmental sustainability and energy efficiency, driving demand for technologically advanced grinders with low power consumption and high material durability. The replacement market is strong, supplemented by stringent EU directives regarding wastewater treatment quality. Western Europe shows high adoption of in-line and channel grinders featuring remote diagnostics and sophisticated control integration.

- Asia Pacific (APAC) (China, India, Japan): APAC is the fastest-growing region, fueled by massive government investments in new urban infrastructure and industrial expansion. China and India, in particular, are rapidly constructing new sewage treatment facilities to accommodate sprawling populations and industrial complexes, resulting in high demand for new installation of both municipal and industrial grinders. Price sensitivity is higher in some emerging APAC markets, though quality and durability requirements are rapidly increasing.

- Latin America (Brazil, Mexico): The market here is characterized by infrastructure modernization projects and increasing privatization of water utilities. Demand is primarily driven by essential needs to protect new pumping stations and address severe clogging issues in rapidly developing urban areas. Procurement is often linked to large, multi-year government or development bank-funded water management programs.

- Middle East and Africa (MEA): Growth is primarily concentrated in Gulf Cooperation Council (GCC) countries due to massive construction and desalination projects requiring high-quality pretreatment. The region faces unique challenges related to high temperatures and specific industrial effluents (e.g., oil and gas). Adoption is accelerating as governments seek to improve water management security and efficiency across their expanding infrastructure networks.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wastewater Grinders Market.- JWC Environmental

- Franklin Electric (Little Giant)

- Sulzer

- NETZSCH

- Vogelsang

- Xylem (Flygt)

- Spirac

- Weir Floway

- Hayward Gordon

- Monoflo

- Siemens

- Seepex

- WEMCO

- EnviroCare

- Vaughan Company

- Tsurumi Manufacturing Co., Ltd.

- Ebara Corporation

- ITT Goulds Pumps

- Komline-Sanderson

- Alfa Laval

Frequently Asked Questions

Analyze common user questions about the Wastewater Grinders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary differences between dual-shaft and single-shaft wastewater grinders?

Dual-shaft grinders employ two counter-rotating shafts with interleaved cutters, offering high torque and jamming resistance, making them ideal for high-solids municipal applications. Single-shaft grinders, often called comminutors, typically use a single rotating drum with cutting teeth, suitable for lower flow rates and less severe debris but are often considered less effective against modern, tough solids like disposable wipes.

How does the adoption of smart technology impact the operational efficiency of wastewater grinders?

Smart technology, including integrated VFDs, sensors, and remote monitoring systems, significantly enhances operational efficiency by enabling predictive maintenance. This allows utility operators to remotely adjust speed, automatically reverse rotations to clear jams, and forecast wear patterns, minimizing costly unplanned downtime and optimizing energy consumption based on real-time load requirements.

Which end-user segment drives the largest market demand for wastewater grinders globally?

The Municipal Wastewater Treatment sector consistently drives the largest market demand for grinders. This includes installations in municipal headworks, lift stations, and major pumping facilities, driven by stringent regulatory compliance mandates and the critical necessity to protect downstream infrastructure from rags, plastics, and other non-biodegradable debris commonly found in public sewer systems.

What are the key materials used in manufacturing grinder cutters to ensure longevity?

Cutter durability is achieved primarily through the use of highly specialized, heat-treated alloy steels, often featuring high chrome or nickel content for enhanced corrosion resistance. Many manufacturers also utilize proprietary tool steels or incorporate carbide inserts and specialized surface hardening techniques to maximize abrasion resistance and maintain sharp cutting edges over extended operational periods in abrasive sewage environments.

What major regulatory factors influence the growth of the Wastewater Grinders Market?

The market growth is heavily influenced by strict governmental regulations regarding pre-treatment standards and effluent discharge quality, particularly in North America and Europe. Regulations mandate effective solids reduction to protect waterways, reduce infrastructure failure risks, and ensure the operational integrity of treatment facilities, necessitating the continuous installation and upgrade of high-performance grinding equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager