Water Flange Gasket Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434333 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Water Flange Gasket Market Size

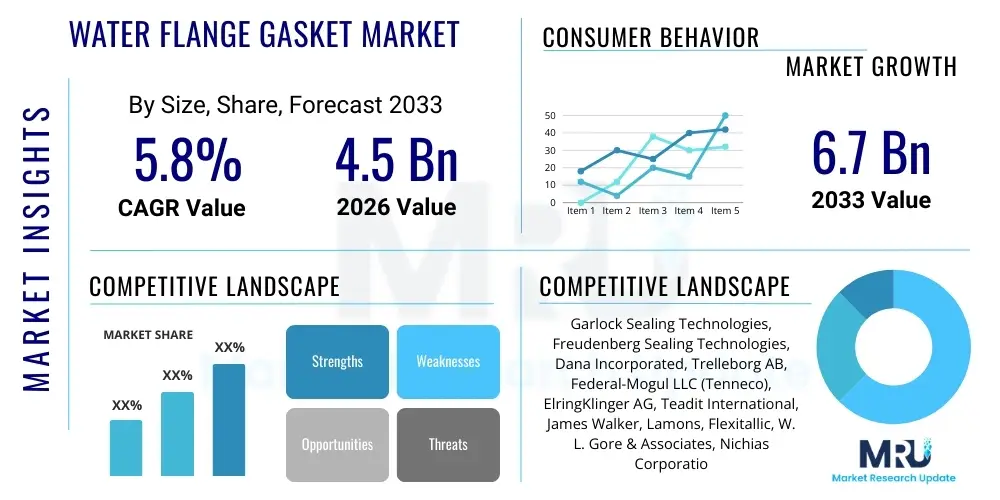

The Water Flange Gasket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally underpinned by the sustained demand from the automotive sector, where water flange gaskets are critical components ensuring the integrity and efficient operation of cooling systems and engine blocks. Furthermore, the robust expansion of industrial infrastructure, particularly in emerging economies, necessitates reliable sealing solutions for water transport and processing applications, contributing significantly to market value accretion.

The resilience of the aftermarket segment plays a crucial role in stabilizing market valuation. As the global vehicle parc ages, the need for replacement gaskets in cooling system maintenance and repair increases steadily. Simultaneously, the manufacturing sector, including HVAC, marine, and power generation, depends on high-performance sealing materials to prevent leakages in complex fluid systems, driving demand for specialized and durable gasket types such as those made from high-grade PTFE or fluorocarbons. Innovation in material science, focusing on enhanced thermal resistance and chemical compatibility, is expected to unlock premium pricing opportunities and propel revenue growth over the forecast horizon.

Water Flange Gasket Market introduction

The Water Flange Gasket Market encompasses the manufacturing, distribution, and sale of specialized sealing components designed to prevent fluid leakage at the connection points, or flanges, within water handling systems. These gaskets are essential in applications ranging from automotive engines, where they seal the coolant pathways between components like the water pump and the engine block, to industrial piping systems and infrastructure projects. The primary function of these gaskets is to maintain a tight seal under varying conditions of pressure, temperature, and exposure to corrosive agents, ensuring system efficiency and preventing catastrophic failures or environmental contamination. Key materials utilized in manufacturing include various elastomers like EPDM, NBR, and silicone, alongside specialized materials such as compressed non-asbestos fiber (CNAF) and PTFE, selected based on the specific performance requirements of the end application.

Major applications of water flange gaskets span across the automotive original equipment manufacturer (OEM) and aftermarket segments, industrial machinery, marine engineering, and extensive commercial HVAC (Heating, Ventilation, and Air Conditioning) systems. In the automotive industry, the efficiency and reliability of the engine cooling circuit are directly dependent on the quality of these gaskets. Beyond transportation, the industrial sector relies heavily on these components in water treatment plants, power generation facilities, and chemical processing units to ensure fluid containment. The benefits derived from high-quality water flange gaskets include extended equipment lifespan, minimized maintenance downtime, improved energy efficiency by preventing leaks, and enhanced operational safety. These components are, therefore, fundamental to the operational integrity of complex fluid handling infrastructure globally.

Driving factors fueling market growth are intrinsically linked to global industrialization, urbanization, and continuous expansion in vehicle production, particularly in Asia Pacific nations. Mandatory regulatory standards related to emissions control and environmental safety also compel manufacturers to utilize superior sealing solutions that guarantee zero leakage. Furthermore, the persistent need for repairs and replacements due to the inherent wear and tear of existing infrastructure significantly drives the aftermarket segment. Technological advancements focused on developing gaskets with superior temperature and chemical resistance, enabling their use in demanding next-generation cooling systems, further stimulate market development and adoption across diverse industry verticals.

Water Flange Gasket Market Executive Summary

The global Water Flange Gasket Market is characterized by steady growth driven predominantly by the expansion of the automotive sector, coupled with critical infrastructure maintenance requirements worldwide. Business trends indicate a strong move towards performance-based manufacturing, where Tier 1 suppliers are investing heavily in material science R&D to deliver customized sealing solutions capable of withstanding the increasing thermal and mechanical stresses associated with modern, downsized engines and complex industrial machinery. The competition remains fierce, focusing on product durability, cost-effectiveness, and compliance with stringent international quality certifications. Strategic mergers, acquisitions, and long-term supply agreements with major OEMs are key commercial strategies deployed by market leaders to secure dominant market share and stabilize revenue streams amidst fluctuating raw material prices.

Regional trends highlight the Asia Pacific (APAC) as the undisputed engine of market growth, owing to massive vehicle production volumes in China, India, and Southeast Asian nations, alongside rapid infrastructure development and expansion of manufacturing bases. North America and Europe, while mature markets, maintain strong demand, particularly for high-specification, premium gaskets driven by strict environmental regulations and high expectations for vehicle lifespan and industrial operational efficiency. These regions emphasize advanced manufacturing processes and digital integration to optimize supply chains and inventory management. The Middle East and Africa (MEA) and Latin America are emerging as attractive markets, spurred by investments in energy infrastructure and automotive assembly plants, albeit facing challenges related to economic volatility and standardized regulatory frameworks.

Segment trends reveal that the Elastomer segment, particularly EPDM and Silicone, dominates the market by volume due to their cost-efficiency and excellent temperature resistance, crucial for cooling system applications. However, the PTFE and Graphite segments are exhibiting above-average growth rates, propelled by demand from specialized industrial sectors requiring high chemical inertness and extreme pressure capabilities. In terms of application, the OEM segment holds the largest revenue share, intrinsically linked to new vehicle sales, while the Aftermarket segment guarantees consistent, long-term stability for manufacturers. There is a discernible trend toward smaller, more precise, and application-specific gasket designs to accommodate compact engine layouts and modular industrial equipment, necessitating tighter manufacturing tolerances and advanced inspection technologies.

AI Impact Analysis on Water Flange Gasket Market

Common user questions regarding AI's influence on the Water Flange Gasket Market frequently revolve around optimizing production efficiency, ensuring consistent quality, and predicting component failure. Users seek to understand if Artificial Intelligence and Machine Learning (ML) can streamline the complex molding and cutting processes, reduce material waste, and enhance the lifespan of the gaskets themselves. Concerns often center on the capital investment required for implementing sophisticated AI-driven inspection systems and the necessary technical expertise to manage predictive maintenance models within traditional manufacturing settings. The overall expectation is that AI will primarily revolutionize the manufacturing floor by enabling hyper-precise quality control and minimizing unscheduled downtime through sophisticated operational analytics, ultimately driving down costs and improving product reliability.

The application of AI is already beginning to transform the design and manufacturing lifecycle of water flange gaskets. In the R&D phase, ML algorithms are used to simulate the performance of new material compounds under varied operational stresses, significantly reducing the time and cost associated with traditional physical testing. On the production line, Computer Vision systems powered by Deep Learning are replacing human inspectors, detecting micro-defects, dimensional inconsistencies, and surface irregularities with unparalleled speed and accuracy. This shift guarantees a higher outgoing quality level, which is crucial for safety-critical components in automotive and high-pressure industrial applications.

Furthermore, AI algorithms are playing a pivotal role in optimizing supply chain management, particularly concerning volatile raw material procurement (like specialized rubbers and polymers). Predictive analytics forecast material needs, adjust inventory levels based on real-time order flows, and help mitigate risks associated with price fluctuations or supply bottlenecks. By integrating sensor data from production machinery, ML models can predict equipment failure hours or even days in advance, scheduling maintenance proactively and ensuring uninterrupted production of gaskets, thereby offering a significant competitive advantage to early adopters in the sealing solutions market.

- AI-driven predictive maintenance optimizes machine uptime, reducing production bottlenecks and ensuring consistent output of high-volume gaskets.

- Machine learning algorithms accelerate material science R&D by simulating performance characteristics under extreme temperature and pressure conditions.

- Advanced computer vision systems enable 100% automated quality control, identifying dimensional and surface flaws undetectable by conventional methods.

- AI optimizes complex material mixing and molding processes, minimizing scrap rates and improving overall material yield efficiency.

- Predictive analytics enhance supply chain resilience by forecasting raw material price volatility and optimizing inventory storage across global manufacturing sites.

DRO & Impact Forces Of Water Flange Gasket Market

The dynamics of the Water Flange Gasket Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming the critical Impact Forces that dictate strategic decision-making and market trajectory. Primary drivers include the continuous growth in global automotive production, where every vehicle requires multiple specialized flange gaskets for cooling and fluid systems, and the burgeoning industrial demand spurred by investments in water treatment infrastructure, oil and gas pipelines, and HVAC systems. The mandatory replacement cycle in the vast automotive aftermarket, driven by the aging vehicle fleet worldwide, provides consistent underlying revenue stability. These positive forces compel manufacturers to increase output and invest in process automation.

However, the market faces significant restraints. Volatility in the price of key raw materials, particularly synthetic rubber polymers, fluoropolymers, and certain metal components used in reinforced gaskets, directly impacts manufacturing costs and profit margins. Furthermore, the rapid global transition towards Electric Vehicles (EVs) poses a long-term challenge to the traditional automotive gasket segment, as EVs typically have drastically simplified cooling systems compared to Internal Combustion Engine (ICE) vehicles, potentially reducing the volume demand for certain types of engine-specific gaskets. Regulatory compliance burdens, particularly concerning REACH in Europe and similar global directives regarding chemical usage, also impose constraints on material selection and production standardization, requiring costly reformulation efforts.

Opportunities for growth are concentrated in the development and commercialization of high-performance, next-generation sealing materials specifically engineered for challenging environments, such as high-temperature applications in hydrogen fuel cells or corrosive industrial fluids. The increasing focus on sustainability and lightweighting in the automotive sector presents opportunities for innovative, thinner, and more durable composite gaskets. Furthermore, strategic market penetration in developing regions that are undergoing rapid industrialization and are highly dependent on imported technologies offers substantial avenues for geographic expansion. The key impact force remains the delicate balance between meeting stringent OEM specifications for high performance and managing cost pressures stemming from fluctuating raw material availability and geopolitical trade complexities.

Segmentation Analysis

The Water Flange Gasket Market is systematically segmented based on Material Type, Application, and End-User Industry, allowing for granular analysis of demand patterns and technological requirements across various domains. The segmentation by Material Type is critical, differentiating product performance based on tolerance to temperature, pressure, and chemical exposure. Key materials include elastomers (like EPDM, NBR, and Silicone), which dominate in volume for general cooling applications due to their elasticity and cost-effectiveness, and non-metallic composites (such as PTFE and Graphite), which cater to high-performance industrial sealing needs. The Application segmentation distinguishes between the initial demand generated by Original Equipment Manufacturers (OEMs) and the sustained, long-term demand from the Aftermarket (MRO), which drives steady volume sales.

Segmentation by End-User Industry further refines the analysis, identifying major consumption centers such as the Automotive sector (which includes passenger and commercial vehicles), the Industrial sector (encompassing HVAC, power generation, and chemical processing), and the Marine sector. Each industry imposes unique demands on gasket specifications; for example, automotive applications demand thermal cycling resistance and compactness, whereas industrial water treatment systems require high chemical compatibility and long service intervals. Understanding these segment-specific requirements is paramount for manufacturers tailoring their product portfolio and distribution strategies, enabling targeted innovation towards niche, high-margin applications while maintaining efficiency in high-volume production for standard segments.

- By Material Type:

- Elastomers (EPDM, NBR, Silicone)

- Compressed Non-Asbestos Fiber (CNAF)

- Graphite

- Polytetrafluoroethylene (PTFE)

- Metallic and Semi-Metallic (Reinforced)

- By Application:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement/MRO)

- By End-User Industry:

- Automotive (Passenger Cars, Commercial Vehicles)

- Industrial (Pumps and Valves, HVAC, Water Treatment)

- Power Generation

- Marine and Aerospace

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Water Flange Gasket Market

The Water Flange Gasket market value chain is initiated at the upstream segment, which involves the procurement and processing of fundamental raw materials, primarily synthetic rubber (e.g., ethylene propylene diene monomer or nitrile butadiene rubber), specialized polymers (PTFE, fluorocarbons), fillers, and chemical additives necessary for vulcanization or molding. High dependency on petrochemical derivatives exposes the upstream segment to crude oil price volatility. Key activities at this stage include refining, compounding, and primary material formulation. Manufacturers must maintain robust relationships with major chemical and polymer suppliers to ensure quality control and stable input pricing, as the cost of raw material significantly dictates the final product profitability. Technical expertise in material blending and preparation is a defining competitive factor upstream.

The midstream involves the core manufacturing process, where formulated materials are transformed into finished gaskets through precision cutting, compression molding, injection molding, or specialized automated die-cutting techniques. This segment is characterized by significant capital investment in machinery, quality assurance systems, and process automation. Leading manufacturers utilize advanced techniques like waterjet cutting and automated vision inspection systems to meet the extremely tight dimensional tolerances required by OEMs. Efficiency in manufacturing, reducing scrap material, and achieving economies of scale are vital for competitive positioning. The development of proprietary manufacturing methods and high-precision tooling adds significant value in this stage, differentiating premium suppliers from commodity producers.

The downstream distribution channels link manufacturers to the end-users. Direct distribution is common for high-volume OEM contracts in the automotive and major industrial sectors, enabling tighter collaboration on design specifications and just-in-time delivery. Indirect distribution is highly prevalent in the aftermarket segment, relying on a vast network of authorized distributors, independent spare parts retailers, and MRO service providers. Effective inventory management and rapid fulfillment capabilities are essential in the indirect channel to serve decentralized maintenance demand. The efficiency and geographic reach of the distribution network directly impact market accessibility and brand penetration, particularly in complex global markets where regional regulatory compliance and logistical challenges vary significantly, necessitating sophisticated warehousing and tracking systems.

Water Flange Gasket Market Potential Customers

The primary consumers and end-users of water flange gaskets are broadly categorized into three major groups: Original Equipment Manufacturers (OEMs), Maintenance, Repair, and Operations (MRO) providers, and specialized industrial facilities. Automotive OEMs constitute the largest volume buyer, incorporating these gaskets into newly manufactured vehicles, including passenger cars, heavy-duty trucks, and construction equipment. These buyers demand products that meet precise geometric specifications, withstand rigorous thermal cycling tests, and adhere to strict quality control standards, making supplier reliability and technical support critical selection criteria. Long-term contracts and strategic partnerships are characteristic of this relationship, focusing on consistent supply of components integral to cooling and engine management systems.

The second major customer group encompasses the expansive aftermarket segment, which includes independent garages, authorized service centers, and spare parts wholesalers globally. These customers drive replacement demand, seeking durable, cost-effective, and readily available gaskets for vehicle and equipment repair. The product life cycle and wear patterns of existing infrastructure ensure a continuous flow of demand from the MRO segment, making brand reputation and wide distribution coverage essential for success. This segment is typically more price-sensitive than the OEM market, balancing quality with immediate availability. The high volume of aging vehicles requiring cooling system overhauls further solidifies this segment's importance.

Finally, various specialized industrial entities represent crucial potential customers, including major power generation plants (thermal and nuclear), water treatment facilities, chemical processing industries, and large-scale commercial HVAC system installers. These customers require highly specialized gaskets, often resistant to extreme temperatures, high pressures, and caustic chemicals beyond standard water applications. Procurement decisions in this sector are heavily weighted toward material certification, documented proof of performance, and compliance with industry-specific safety standards. The complexity and criticality of the applications mean these industrial users often invest in premium, high-specification products that guarantee long service intervals and operational reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Garlock Sealing Technologies, Freudenberg Sealing Technologies, Dana Incorporated, Trelleborg AB, Federal-Mogul LLC (Tenneco), ElringKlinger AG, Teadit International, James Walker, Lamons, Flexitallic, W. L. Gore & Associates, Nichias Corporation, Klinger Group, Flowserve Corporation, Nippon Pillar Packing Co., Ltd., Burgmann Industries, Donit Tesnit, Victor Reinz (Dana), SKF Group, Interface Performance Materials. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Flange Gasket Market Key Technology Landscape

The manufacturing technology landscape for the Water Flange Gasket market is evolving rapidly, driven by the need for higher precision, greater material consistency, and cost-efficient production methods to meet stringent OEM demands. A cornerstone of modern production is the utilization of advanced Computer Numerical Control (CNC) cutting technology, specifically waterjet and laser cutting, which enables the manufacture of complex gasket geometries with exceptionally tight tolerances and zero material deformation. These precision methods are replacing traditional die-cutting for complex, low-volume, or specialized high-performance materials, significantly improving material utilization and reducing lead times for custom orders. Furthermore, sophisticated injection and compression molding techniques, especially for elastomer-based gaskets, are continually refined to ensure perfect curing cycles and consistent material density, which directly translates to improved sealing performance under dynamic loads and thermal shock.

Material science innovation represents another crucial technological area. Manufacturers are actively developing multi-layer composite gaskets and integrated sealing systems that combine different materials—such as metal cores with elastomer beads or PTFE layers—to achieve superior sealing integrity and longevity. This is particularly relevant in modern engine designs that operate at higher temperatures and pressures than previous generations. Techniques like advanced material compounding, utilizing nanofillers and specialized chemical agents, are enhancing the chemical resistance, heat deflection temperatures, and mechanical resilience of standard elastomeric materials, making them suitable for aggressive cooling media and demanding industrial applications. The push towards lightweighting, particularly in the automotive industry, drives the need for thinner gaskets that maintain or even exceed the performance of their bulkier predecessors.

Moreover, the integration of automation and digitalization, often termed Industry 4.0, is profoundly impacting the sector. Automated handling systems, robotic material loading, and continuous process monitoring are standardizing production and minimizing human error. Crucially, non-contact measurement and testing technologies, including high-speed 3D scanning and integrated vision systems, are employed for 100% quality inspection during the final stages of manufacturing. These technologies ensure that every gasket leaving the facility meets the exact specifications required by the end-user, thereby minimizing warranty claims and enhancing brand reliability. The ability to collect and analyze this real-time production data feeds back into continuous process improvement, which is fundamental to maintaining competitiveness in a price-sensitive yet quality-critical market segment.

Regional Highlights

The global Water Flange Gasket Market exhibits distinct regional consumption and production characteristics. Asia Pacific (APAC) dominates the market both in terms of production capacity and consumption volume, primarily fueled by the massive automotive manufacturing hubs in China, India, Japan, and South Korea. Rapid urbanization, large-scale infrastructure projects, and the expansion of the industrial base, including power generation and water treatment facilities, contribute significantly to sustained high demand across the region. The aftermarket in APAC is rapidly maturing, providing a consistent revenue stream for replacement components as the regional vehicle parc grows exponentially.

North America and Europe represent mature markets characterized by stringent quality standards and a high demand for premium, technologically advanced gasket solutions. The North American market is strongly influenced by the large light vehicle and heavy-duty truck manufacturing sectors, alongside substantial industrial maintenance requirements in the energy and chemical processing industries. European demand is governed by strict environmental and safety regulations, pushing manufacturers toward innovative, high-durability, and often custom-engineered sealing solutions. While volume growth is steadier than in APAC, the focus here is on value addition through advanced material integration and extended product life cycles.

Latin America (LATAM) and the Middle East and Africa (MEA) are characterized as high-growth, emerging markets. LATAM's growth is tied to local automotive assembly operations and infrastructure modernization initiatives, creating specific demand niches. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, shows strong demand driven by significant investments in oil and gas infrastructure, desalination plants, and commercial construction projects, necessitating robust sealing products capable of handling extreme heat and corrosive conditions associated with regional industrial activities.

- Asia Pacific (APAC): Market dominance driven by high volumes of automotive OEM production and rapid infrastructure development, particularly in China and India.

- North America: Focus on high-performance, durable gaskets for large vehicle fleets and critical industrial infrastructure, emphasizing regulatory compliance and quality.

- Europe: Demand concentrated on specialized, high-specification products driven by strict EU environmental directives and advanced material requirements for complex machinery.

- Latin America (LATAM): Emerging market growth linked to localized vehicle assembly and burgeoning utility and water management projects.

- Middle East & Africa (MEA): High growth potential fueled by large-scale energy sector projects and construction activities requiring gaskets capable of extreme temperature tolerance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Flange Gasket Market.- Garlock Sealing Technologies

- Freudenberg Sealing Technologies

- Dana Incorporated (Victor Reinz)

- Trelleborg AB

- Federal-Mogul LLC (Tenneco)

- ElringKlinger AG

- Teadit International

- James Walker

- Lamons

- Flexitallic

- W. L. Gore & Associates

- Nichias Corporation

- Klinger Group

- Flowserve Corporation

- Nippon Pillar Packing Co., Ltd.

- Burgmann Industries

- Donit Tesnit

- SKF Group

- Interface Performance Materials

- Mezger Inc.

Frequently Asked Questions

Analyze common user questions about the Water Flange Gasket market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) of the Water Flange Gasket Market?

The Water Flange Gasket Market is projected to experience a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033, driven primarily by sustained demand from the global automotive cooling systems and industrial maintenance sectors.

Which material segment holds the largest share in the Water Flange Gasket market?

Elastomer materials, including EPDM and NBR, dominate the market volume segment due to their excellent balance of flexibility, cost-effectiveness, and adequate temperature resistance for standard automotive and industrial water systems.

How is the transition to Electric Vehicles (EVs) affecting demand for Water Flange Gaskets?

The shift towards EVs presents a long-term restraint, as EVs utilize simplified cooling systems compared to Internal Combustion Engine (ICE) vehicles, potentially reducing the overall volume demand for certain traditional engine-block gaskets. However, specialized thermal management gaskets for battery packs offer new opportunities.

Which geographical region is the primary driver of market expansion?

The Asia Pacific (APAC) region is the primary driver of market expansion, attributed to its massive manufacturing base for automotive OEMs, rapid industrialization, and extensive infrastructure development projects requiring reliable sealing solutions.

What role does AI play in the manufacturing of water flange gaskets?

AI is increasingly used for advanced quality control through automated vision inspection systems, optimizing material formulation processes via simulation, and implementing predictive maintenance protocols to maximize manufacturing machine uptime and reduce defects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager