Water Hammer Arrestors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438285 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Water Hammer Arrestors Market Size

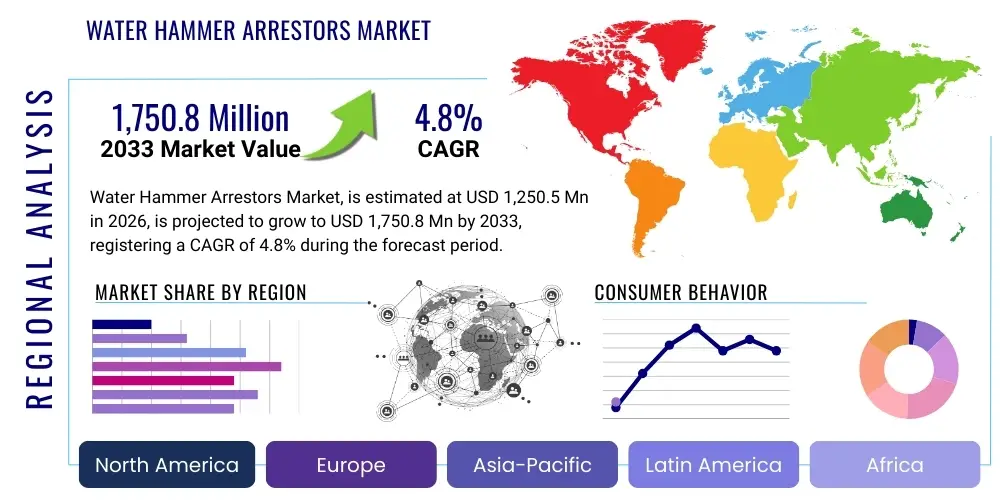

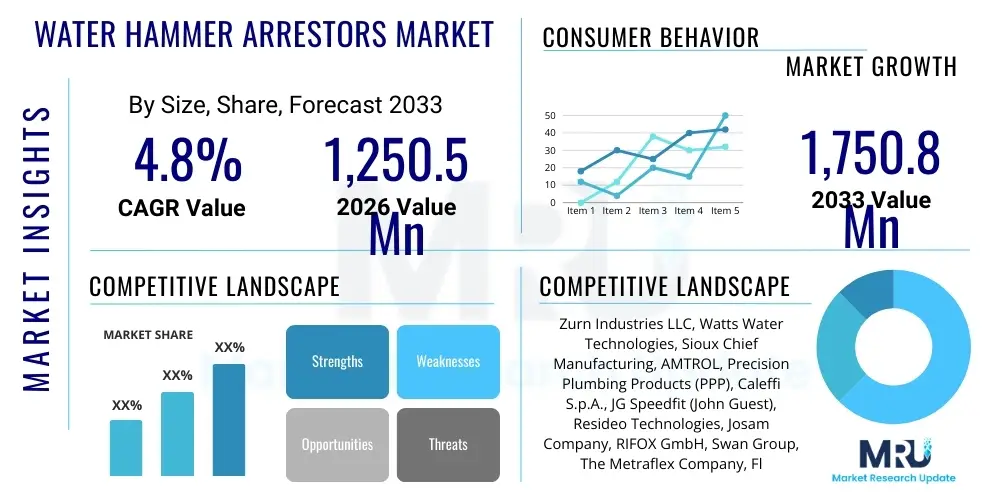

The Water Hammer Arrestors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1,250.5 Million in 2026 and is projected to reach $1,750.8 Million by the end of the forecast period in 2033.

Water Hammer Arrestors Market introduction

The Water Hammer Arrestors Market encompasses the design, manufacturing, distribution, and installation of devices specifically engineered to mitigate the destructive forces generated by water hammer phenomena in piping systems. Water hammer, or hydraulic shock, occurs when a fluid in motion is forced to stop or change direction abruptly, typically caused by the rapid closing of valves (such as those in washing machines, dishwashers, and solenoid valves). This sudden stoppage creates a high-pressure wave that travels through the piping, leading to loud noise, vibration, and potential damage to pipes, fittings, and appliances. The primary function of a water hammer arrestor is to absorb this kinetic energy shock wave, usually through a spring-loaded piston or a compressed air chamber, thereby protecting the integrity and longevity of the plumbing infrastructure.

The widespread application of these devices spans residential, commercial, and industrial sectors where fluid dynamics are critical. In residential settings, modern high-efficiency appliances equipped with quick-closing valves necessitate effective shock mitigation to prevent noise complaints and premature pipe failure. Commercially, water hammer arrestors are vital in large buildings like hospitals, hotels, and schools, which utilize complex water distribution systems and require uninterrupted operation. Industrially, they are essential for protecting sensitive process control valves, pumps, and machinery in manufacturing plants, power generation facilities, and water treatment centers, where sudden pressure spikes could lead to catastrophic equipment failure and downtime.

Driving factors for market expansion include increasingly stringent building codes and plumbing standards globally that mandate the installation of shock mitigation devices to ensure system safety and efficiency. Furthermore, the rising adoption of high-speed, automated, and water-efficient appliances inherently increases the risk of water hammer occurrences, thus accelerating demand for effective arrestor solutions. The long-term benefits derived from installing these devices—such as reduced maintenance costs, extended operational lifespan of plumbing fixtures, and minimized acoustic disturbance—solidify their position as an indispensable component of modern hydraulic systems. Continuous advancements in materials science, leading to more durable and compact arrestor designs, further fuel market growth.

Water Hammer Arrestors Market Executive Summary

The Water Hammer Arrestors Market is exhibiting robust growth, driven primarily by evolving regulatory frameworks mandating hydraulic protection and the global urbanization trend leading to the construction of dense residential and commercial complexes with sophisticated plumbing networks. Business trends indicate a strong shift towards Arrestor Type (ATA) certified products, emphasizing standardized performance and reliability. Key manufacturers are focusing on integrating advanced materials like specialized thermoplastics and stainless steel alloys to enhance the longevity and corrosion resistance of arrestors. Furthermore, the incorporation of smart monitoring capabilities, allowing for predictive maintenance and real-time pressure diagnostics, is emerging as a significant competitive differentiator. Strategic mergers and acquisitions are common as market leaders seek to consolidate regional distribution networks and acquire niche expertise in specialized industrial arrestor designs, particularly those handling high-temperature or high-pressure fluids.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructure development and the rapid expansion of the construction and manufacturing industries, notably in China and India. North America and Europe, while mature, maintain dominant market shares due to strict adherence to established plumbing codes (such as ASME A112.26.1M) and a high replacement rate of older, inefficient hydraulic systems. Demand in the Middle East and Africa (MEA) is accelerating, driven by large-scale commercial real estate projects and investments in water conservation technologies that often necessitate precise fluid control, subsequently requiring robust water hammer mitigation solutions. Regulatory harmonization across these key regions is simplifying global trade but placing higher technical demands on product certification.

Segment trends demonstrate the dominance of the Piston Type arrestor segment due to its reliability, ease of maintenance, and suitability for a wide range of pressure requirements in residential and light commercial applications. However, the Diaphragm Type segment is gaining traction in specialized industrial uses requiring hermetically sealed units where contamination prevention is paramount. Application-wise, the Residential sector remains the largest consumer, but the Industrial segment, specifically the petrochemical and power generation industries, contributes the highest average revenue per unit due to the requirement for large-bore, high-capacity arrestors. Manufacturers are increasingly tailoring product lines to specific end-user environments, offering customized sizing and pressure ratings to maximize operational efficiency and compliance within diverse hydraulic systems.

AI Impact Analysis on Water Hammer Arrestors Market

Common user questions regarding AI's influence in the Water Hammer Arrestors Market center on whether artificial intelligence can eliminate the need for physical arrestors, how AI can optimize plumbing system design to prevent water hammer proactively, and the feasibility of implementing real-time, AI-driven diagnostics for system pressure irregularities. Users are keen to understand if AI can contribute to manufacturing efficiency, such as optimizing material usage in complex arrestor assemblies, and if smart plumbing networks leveraging machine learning can predict valve closure events to automatically adjust system pressures before a shock wave occurs. The overarching theme is the transition from passive mitigation (the traditional arrestor) to active, predictive prevention systems enabled by digital technology.

The influence of Artificial Intelligence (AI) on the water hammer arrestors sector is concentrated less on replacing the physical device itself and more on enhancing the systems around it, focusing primarily on predictive maintenance and operational efficiency. AI algorithms are beginning to analyze vast streams of data collected from connected water meters, pressure sensors, and smart valves within buildings. This data analysis allows facility managers to detect subtle pressure anomalies that precede a full-blown water hammer event or indicate a failing arrestor. By identifying the root cause of pressure fluctuations—such as rapid valve actuation or pump cycling patterns—AI can provide actionable insights for adjusting system parameters, thereby reducing stress on existing arrestors and extending the lifespan of the entire plumbing system.

Furthermore, AI is increasingly being utilized in the manufacturing and quality assurance processes of water hammer arrestors. Machine learning models are optimizing production lines by analyzing sensor data from machinery to predict equipment failure, ensuring higher precision in component fabrication, especially for critical elements like pistons and diaphragms. In product design, AI simulation tools are utilized to model complex fluid dynamics under various operating conditions, helping engineers optimize the internal structure of arrestors for maximum shock absorption efficiency and minimal material expenditure. This shift towards AI-enhanced manufacturing leads to higher quality, more reliable, and potentially smaller-form-factor arrestors that are easier to integrate into modern, confined building structures.

- AI-driven Predictive Maintenance: Analyzing pressure sensor data to anticipate arrestor failure or system stress points, optimizing replacement schedules.

- Manufacturing Optimization: Machine learning algorithms enhance precision in component production and reduce material waste.

- Smart System Integration: Integrating arrestor performance data into Building Management Systems (BMS) for centralized, intelligent hydraulic control.

- Proactive Prevention: AI analyzes valve closing speed patterns and pump start/stop cycles to modify operational behavior, potentially reducing the frequency and severity of water hammer events.

- Automated Diagnostics: Utilizing computer vision and sensor fusion to assess structural integrity and potential leaks in existing plumbing infrastructure.

DRO & Impact Forces Of Water Hammer Arrestors Market

The market is predominantly driven by increasing regulatory scrutiny concerning plumbing safety and noise reduction, particularly in dense urban areas where water hammer noise can significantly impact quality of life. Simultaneously, the global proliferation of sophisticated, water-saving appliances with solenoid valves that close instantaneously acts as a key market accelerator, creating an intrinsic need for effective shock arrestors. Opportunities lie in the penetration of underdeveloped markets, especially in Latin America and MEA, where large-scale infrastructure projects are underway, and in the development of modular, multi-functional arrestor units that can integrate seamless pressure monitoring and energy absorption capabilities. However, market growth is significantly restrained by the high upfront cost associated with certified, high-quality arrestors compared to cheaper, non-compliant alternatives, and the general lack of awareness among smaller contractors regarding the long-term benefits of proper shock mitigation systems. These forces collectively shape a market where technological compliance and operational reliability are prioritized over minimal installation cost.

The competitive landscape is subject to several crucial impact forces, including the intense pressure from standardized certification bodies like the Plumbing and Drainage Institute (PDI) and the American Society of Mechanical Engineers (ASME), which necessitates significant investment in testing and conformity. The bargaining power of buyers is moderate; while end-users are price sensitive, large commercial and industrial buyers prioritize certified performance and brand reputation, giving recognized manufacturers leverage. The threat of substitutes is relatively low, as physical water hammer arrestors are the most direct and effective mitigation method; although air chambers can be used, dedicated mechanical arrestors offer superior, predictable performance in modern closed-loop systems. Supplier bargaining power is also moderate, dependent on specialized materials like high-grade stainless steel or specialized elastomer compounds, creating reliance on niche material providers.

Crucially, market dynamics are influenced by technological advancements focused on long-term operational resilience. Innovation centered on creating maintenance-free designs, particularly hermetically sealed diaphragm units that eliminate the need for recharging, serves as a powerful market driver. The integration of Building Information Modeling (BIM) into the construction process increasingly mandates precise hydraulic component specifications early in the design phase, standardizing the inclusion of water hammer arrestors. Conversely, the economic volatility in construction sectors across various regions periodically acts as a restraint, slowing down new project starts which are primary sources of demand. Overall, the market remains resilient, anchored by non-negotiable requirements for plumbing system longevity and safety.

Segmentation Analysis

The Water Hammer Arrestors market is highly segmented based on critical design characteristics, application environments, and end-user types, reflecting the diverse hydraulic demands across global sectors. Segmentation by Type, primarily categorized into Piston Type, Diaphragm Type, and Spring Type, is crucial as it determines the maintenance requirements, pressure capacity, and suitability for specific fluid media. Piston Type arrestors, utilizing an air cushion separated from water by a movable piston, are the most ubiquitous due to their high capacity and rechargeability, making them standard for general plumbing applications. Diaphragm Type arrestors, offering a complete separation between fluid and air, are preferred in sensitive industrial or medical applications where contamination risk must be strictly minimized. This structural differentiation allows manufacturers to target specific performance envelopes, ensuring maximum efficiency and compliance with operational standards.

Further analysis is conducted based on Application and End-User, which directly correlates with the required sizing and installation location. Application segments include supply lines for washing machines, dishwashers, faucets, showers, and industrial process lines. The End-User segmentation provides the clearest view of market volume and value distribution, separating consumption into Residential, Commercial, and Industrial categories. The Residential segment accounts for the highest volume of units sold but typically features smaller, less expensive units installed at point-of-use. Conversely, the Industrial segment demands fewer units but requires massive, high-pressure, and highly durable arrestors tailored for environments like mining, wastewater treatment, and power generation, leading to significantly higher average unit value. The Commercial sector, encompassing hospitals, hotels, and office buildings, represents a mid-to-high capacity requirement, often favoring central main line installations for building-wide protection.

Understanding these segment distinctions is vital for strategic market entry and product development. For instance, companies focusing on the North American residential market must prioritize compact, standardized PDI-certified piston arrestors for point-of-use installation, while those targeting the European industrial market must focus on metric-compliant, high-temperature, stainless steel diaphragm models. The trend towards modularity and prefabricated plumbing systems is blurring the lines between these segments, prompting manufacturers to develop universal or easily adaptable products that can span light commercial and multi-family residential applications efficiently. Effective segmentation strategy ensures that marketing efforts and distribution channels are tailored to the regulatory and performance expectations of each specific application environment.

- By Type:

- Piston Type

- Diaphragm Type

- Spring Type

- Air Chamber Type (Non-pressurized)

- By Application:

- Washing Machines and Dishwashers

- Faucets and Shower Valves

- Boilers and Water Heaters

- Solenoid Valves and Quick-Closing Fixtures

- Industrial Process Lines

- By End-User:

- Residential Buildings (Single-family, Multi-family)

- Commercial Facilities (Hospitals, Hotels, Schools, Office Buildings)

- Industrial Facilities (Manufacturing, Power Generation, Oil & Gas, Water Treatment)

- Infrastructure and Utility Networks

- By Material:

- Copper/Bronze

- Stainless Steel

- Plastic/Polymer

Value Chain Analysis For Water Hammer Arrestors Market

The value chain for the Water Hammer Arrestors Market begins with upstream component manufacturing, which involves the sourcing of raw materials such as specialized copper alloys, stainless steel for durability, and engineered elastomers and polymers for pistons and diaphragms. Upstream activities are critical, as the performance and longevity of the final product depend heavily on the quality and precision of materials, particularly for components subject to repeated high-pressure stress. Manufacturers rely on specialized metal fabrication and elastomer suppliers capable of meeting strict tolerances and compliance requirements, such as those related to potable water contact (e.g., NSF/ANSI standards). Efficiency at this stage is measured by material cost management, reliable supply logistics, and adherence to sustainability standards, especially concerning material recyclability and non-toxic compositions.

The midstream stage involves the design, assembly, and rigorous testing of the arrestor units. Manufacturers must invest heavily in R&D to optimize chamber sizes, piston or diaphragm mechanisms, and housing rigidity to maximize shock absorption within compact footprints. Quality control is paramount, requiring sophisticated testing facilities to certify products according to recognized international standards like PDI-WH-201 and ASSE 1010. Manufacturing processes leverage precision machining and automated assembly to ensure consistent quality and scalability. Direct distribution often occurs for large Original Equipment Manufacturer (OEM) contracts—such as supplying appliance manufacturers or large HVAC system integrators—while indirect distribution handles the vast majority of after-market and new construction sales.

Downstream activities involve reaching the end-user through various channels. Indirect channels dominate, primarily utilizing plumbing wholesalers, large national or regional distributors, and specialized construction supply houses that cater directly to professional plumbers, mechanical contractors, and facility managers. Direct sales are usually reserved for high-value industrial projects or custom installations where technical consultation is required. Installation and maintenance services, typically provided by certified plumbers, constitute the final layer of the value chain. Customer satisfaction hinges on product reliability and ease of installation, making clear technical documentation and effective contractor training essential elements of the downstream strategy. The efficiency of the distribution network, particularly the ability to rapidly supply various sizes and types of arrestors, is a key competitive advantage.

Water Hammer Arrestors Market Potential Customers

The primary customers for water hammer arrestors are segmented based on their need for hydraulic stability and their scale of water consumption. The largest volume segment is the residential end-user, encompassing both single-family homes and large multi-family residential complexes. These customers purchase arrestors either directly as part of new construction plumbing systems or as retrofits when installing new appliances like high-efficiency washing machines, which are notorious for generating severe water hammer. The key buying criteria for residential customers and the plumbers serving them are cost-effectiveness, compact size, and certification (ensuring compliance with local plumbing codes), often favoring the easily installed point-of-use piston type models.

The commercial sector represents high-value customers who prioritize system reliability and acoustic performance. This includes healthcare facilities (hospitals and clinics), hospitality venues (hotels and resorts), and large institutional buildings (universities and government offices). In these environments, water hammer failure is not only a costly maintenance issue but a potential health hazard (in hospitals) or a serious disruption to operations (in hotels). Commercial buyers typically procure central main line arrestors capable of handling large flow rates, requiring professional-grade, durable construction, often specified by mechanical engineers during the building design phase. Compliance with stringent fire safety and hygiene standards dictates material choice and installation protocols in this segment.

The industrial segment comprises the most sophisticated and high-capacity customers, including power generation plants (thermal and hydroelectric), oil and gas processing facilities, chemical manufacturing, and municipal water treatment plants. These customers require customized, heavy-duty arrestors designed to withstand extreme pressure, temperature fluctuations, and exposure to corrosive fluids. Purchasing decisions are driven by technical specifications, long-term durability, and strict regulatory compliance (e.g., API, ASME). Industrial procurement involves specialized engineers and maintenance teams, prioritizing performance validation and requiring extensive post-sale technical support and warranty provisions from the manufacturer. Demand from the infrastructure segment, related to large municipal water distribution networks and pumping stations, also falls under this high-technical requirement category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1,250.5 Million |

| Market Forecast in 2033 | $1,750.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zurn Industries LLC, Watts Water Technologies, Sioux Chief Manufacturing, AMTROL, Precision Plumbing Products (PPP), Caleffi S.p.A., JG Speedfit (John Guest), Resideo Technologies, Josam Company, RIFOX GmbH, Swan Group, The Metraflex Company, Fluidmaster, Acorn Engineering Company, Walraven Group, HOLDRITE, T. P. S. Arrestors Inc., MVI Inc., WADE Drains, Marmon Water Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Hammer Arrestors Market Key Technology Landscape

The technology landscape of the Water Hammer Arrestors Market is fundamentally anchored in hydraulic mechanics, but recent advancements focus heavily on material science, modularity, and integration into modern plumbing systems. The core technologies remain Piston Type and Diaphragm Type arrestors. Piston Type arrestors utilize a sealed chamber of air or nitrogen, separated from the water stream by a sliding piston, often lubricated by the water itself. Technological evolution in this area centers on creating more resilient piston seals (using advanced PTFE and composite materials) to eliminate leakage and enhance durability, thereby prolonging the time between maintenance cycles where the air cushion needs recharging. Furthermore, manufacturers are developing smaller, more aesthetic in-wall box designs for residential installations, simplifying the concealment process while maintaining accessibility for future service.

Diaphragm Type arrestors represent a critical technological segment, particularly for high-purity or industrial applications. These devices use an elastomeric or metallic diaphragm to provide a complete, non-communicating barrier between the fluid and the cushion gas, preventing contamination and gas diffusion into the water. Key technological advancements here involve optimizing the diaphragm material composition—often highly durable EPDM or specialized synthetic rubber—to withstand high cyclic fatigue, high temperatures, and chemical exposure without degradation. The fixed nature of the sealed gas charge in many diaphragm models drives innovation towards ensuring the initial charge pressure remains stable over decades, a challenging feat requiring extremely robust vessel construction and precision sealing techniques. The ability of these systems to operate maintenance-free is a major technological selling point.

A burgeoning technological frontier involves integrating digital monitoring and smart system connectivity. This includes the development of 'smart arrestors' equipped with micro-sensors that measure real-time pressure spikes and report operational status wirelessly to Building Management Systems (BMS). While still nascent, this technology allows facility managers to log water hammer events, correlate them with specific appliance usage, and proactively identify the source of the hydraulic shock, rather than merely mitigating the effect. Furthermore, computational fluid dynamics (CFD) modeling has become standard practice in the design phase, allowing engineers to simulate complex pressure wave propagation and optimize the sizing and placement of arrestors for large-scale, intricate plumbing networks, moving beyond traditional calculation tables to performance-based design solutions.

Regional Highlights

The global distribution of the Water Hammer Arrestors Market shows pronounced variations driven by regulatory enforcement, construction activity, and the maturity of existing infrastructure.

- North America (U.S. and Canada): This region holds a dominant market share due to mature construction standards and strict enforcement of plumbing codes, notably those derived from ASME and ASSE, which often mandate the installation of shock arrestors in new and renovation projects. The high adoption rate of water-efficient fixtures and appliances that generate significant water hammer contributes directly to sustained demand. The replacement and retrofit market remains substantial, ensuring continuous revenue streams for manufacturers of PDI-certified products.

- Europe (Germany, UK, France): Characterized by a strong focus on high-quality engineered solutions and energy efficiency, the European market exhibits steady growth. Demand is boosted by regulations aimed at noise reduction (acoustic comfort in multi-story buildings) and infrastructure modernization. Germany and the UK are leaders in adopting sophisticated diaphragm and spring-type arrestors, emphasizing longevity and minimal maintenance requirements in dense urban environments.

- Asia Pacific (China, India, Japan, Southeast Asia): APAC is projected to register the highest Compound Annual Growth Rate (CAGR). This explosive growth is attributed to rapid urbanization, massive infrastructure development, and a surge in residential and commercial construction, particularly in developing economies like China and India. While regulatory enforcement historically varied, increasing awareness of plumbing longevity and the adoption of international building standards are rapidly driving the inclusion of arrestors in mainstream projects.

- Latin America (Brazil, Mexico): This region represents a developing market with significant potential. Growth is tied to investments in public infrastructure and residential housing projects. The market is highly price-sensitive, often relying on locally manufactured or imported, cost-effective solutions. However, increasing foreign investment and the implementation of globally recognized plumbing technologies are gradually raising the bar for product quality and certification compliance.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia) due to large-scale, luxurious commercial and hospitality developments. These projects demand high-performance, durable arrestors capable of handling challenging environmental conditions (high temperatures). Demand is project-driven, requiring manufacturers to maintain specialized inventory for high-capacity, non-standardized installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Hammer Arrestors Market.- Zurn Industries LLC

- Watts Water Technologies

- Sioux Chief Manufacturing

- AMTROL

- Precision Plumbing Products (PPP)

- Caleffi S.p.A.

- JG Speedfit (John Guest)

- Resideo Technologies

- Josam Company

- RIFOX GmbH

- Swan Group

- The Metraflex Company

- Fluidmaster

- Acorn Engineering Company

- Walraven Group

- HOLDRITE

- T. P. S. Arrestors Inc.

- MVI Inc.

- WADE Drains

- Marmon Water Inc.

Frequently Asked Questions

Analyze common user questions about the Water Hammer Arrestors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Piston Type and Diaphragm Type water hammer arrestors?

The primary difference lies in the mechanism separating the water from the air cushion. Piston Type arrestors use a sliding, movable piston that allows the air chamber to be recharged, making them suitable for general plumbing. Diaphragm Type arrestors use a fixed, non-movable elastomeric barrier, offering superior sealing against contamination and are often preferred for medical or specialized industrial applications due to their maintenance-free nature and hermetically sealed design.

Are water hammer arrestors legally required in residential construction?

The requirement for water hammer arrestors is dictated by local and regional plumbing codes, such as those governed by the Uniform Plumbing Code (UPC) or International Plumbing Code (IPC) adoption. While not universally required for all fixtures, they are increasingly mandated when rapid-closing valves (e.g., solenoid valves in washing machines or dishwashers) are installed, or if water hammer noise levels exceed acceptable limits, especially in multi-family dwellings.

How should a water hammer arrestor be correctly sized and installed for optimal performance?

Correct sizing depends on the pipe diameter, flow velocity, and fixture units (FU) served, requiring calculation based on PDI-WH 201 or ASSE 1010 standards. For optimal performance, the arrestor must be installed as close as possible to the source of the shock (the quick-closing valve) to effectively intercept the pressure wave before it causes system damage. Centralized main line arrestors are used for building-wide protection, while point-of-use units address specific appliances.

What certifications should I look for when purchasing water hammer arrestors?

Key certifications ensure performance, safety, and durability. Look for certification from the Plumbing and Drainage Institute (PDI-WH 201), the American Society of Sanitary Engineers (ASSE 1010), or equivalent international bodies (like TÜV or CE marking in Europe). For components contacting potable water, NSF/ANSI standards compliance is crucial to guarantee material safety and prevent water contamination.

How does the shift towards water-efficient appliances impact the demand for water hammer arrestors?

Water-efficient appliances often rely on quick-acting solenoid valves to precisely control small volumes of water, leading to an almost instantaneous halt of flow. This rapid valve closure significantly increases the intensity and frequency of water hammer occurrences, thus accelerating the demand for certified, high-performance water hammer arrestors capable of absorbing these severe hydraulic shocks effectively.

What are the key materials used in manufacturing high-capacity industrial water hammer arrestors?

Industrial water hammer arrestors, designed for high pressure and often corrosive environments, primarily utilize high-grade materials such as 304 or 316 stainless steel for the vessel housing due to superior corrosion resistance. Internal components like diaphragms or seals are typically made from specialized elastomers like PTFE or chemically resistant EPDM, ensuring longevity and compliance with high-temperature or process fluid requirements.

Can AI technology eventually replace the need for physical water hammer arrestors?

AI is unlikely to fully replace physical arrestors, as the function of an arrestor is based on fundamental physical mechanics—absorbing kinetic energy. However, AI significantly enhances hydraulic system management by providing predictive diagnostics, optimizing valve timing, and identifying system anomalies in real time. This capability leads to proactive prevention, reducing the frequency and severity of shocks, thereby extending the life and efficiency of existing physical arrestors.

What is the significance of the ASME A112.26.1M standard in the arrestors market?

ASME A112.26.1M is a foundational standard establishing performance criteria and installation guidelines for water hammer arrestors in North America. Compliance with this standard indicates that a product has been tested and verified to meet specific load ratings and operational resilience under defined test conditions, providing assurance of quality and functionality for mechanical contractors and building inspectors.

Which geographic region exhibits the fastest growth rate for water hammer arrestors and why?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, is projected to show the fastest growth. This acceleration is directly attributable to rapid urbanization, massive investments in commercial and residential infrastructure, and the consequential modernization of plumbing codes, driving the installation of contemporary, code-compliant shock mitigation equipment across millions of new projects.

What is the 'Impact Force' of supplier bargaining power in this market?

Supplier bargaining power is moderate. While standard metal components (copper, bronze) are widely sourced, the dependence on specialized suppliers for high-performance elastomers, precision-machined stainless steel vessels, and certified pre-charged gas chambers gives niche material and component suppliers moderate leverage, especially concerning high-specification industrial arrestors where material failure is unacceptable.

How do water hammer arrestors contribute to green building certifications or sustainability?

Water hammer arrestors contribute to sustainability by significantly extending the operational lifespan of plumbing systems, fixtures, and expensive appliances (like high-efficiency boilers), reducing the need for premature replacement and associated waste. By mitigating destructive shock waves, they help ensure the long-term, reliable performance required by modern green building standards focused on durability and reduced maintenance cycles.

What challenges does the retrofit segment face in the water hammer arrestors market?

The retrofit segment faces challenges related to installation complexity, especially in existing walls or ceilings, and the difficulty of accurately diagnosing the source and severity of water hammer in older, un-monitored systems. Furthermore, the cost-benefit analysis often discourages residential homeowners from undertaking non-essential plumbing upgrades unless severe acoustic or functional problems are present.

What technological trends are simplifying the installation process of water hammer arrestors?

Technological trends include the proliferation of compact, in-line designs suitable for tight spaces, and the development of push-fit connections (like those used with PEX tubing) that significantly reduce the time and skill required for installation compared to traditional soldering or threading methods. Pre-fabricated arrestor assemblies for OEM applications also streamline integration.

Is there a significant market for non-pressurized air chamber systems, and how do they compare to mechanical arrestors?

Non-pressurized air chambers are historically the simplest and cheapest method but offer unpredictable and often insufficient performance in modern high-pressure, closed-loop systems, as the air cushion is easily absorbed or waterlogged over time. While still used in some low-pressure, legacy systems, mechanical (piston or diaphragm) arrestors offer predictable, sustained performance and compliance, dominating the professional and code-mandated segments.

How does the manufacturing sector (oil & gas, power generation) influence the demand for arrestors?

The manufacturing sector requires large-capacity, high-pressure arrestors to protect expensive capital equipment such as large pumps, high-flow process control valves, and heat exchangers. Demand is highly inelastic and driven by stringent safety protocols and the high cost of process interruption, focusing purchase decisions on robust, customized, and highly certified stainless steel diaphragm units.

What is the role of distributors and wholesalers in the water hammer arrestors market?

Distributors and wholesalers play a crucial role as the primary channel between manufacturers and installing contractors. They manage inventory, ensure regional product availability, provide critical logistical support, and often act as technical consultants, educating plumbers and contractors on code compliance and the correct sizing and application of various arrestor types.

How is the Piston Type arrestor segment maintaining its market dominance despite newer technologies?

The Piston Type segment maintains dominance due to its established reliability, high pressure capacity, cost-effectiveness, and the fact that its air cushion can be easily recharged if necessary, which appeals to maintenance personnel in commercial environments. Standardization and widespread contractor familiarity also contribute significantly to its continued acceptance as the default choice for general plumbing applications.

What are the primary restraints related to the cost of water hammer arrestors?

The primary restraint is the higher initial cost of certified, high-quality mechanical arrestors compared to installing a basic, non-compliant plumbing fixture or a simple, potentially ineffective air pocket. This price barrier often leads smaller contractors or budget-conscious builders in developing markets to overlook or downgrade the requirement for dedicated shock mitigation devices.

Describe the competitive landscape concerning intellectual property (IP) and design innovation.

The competitive landscape is characterized by innovation focused on internal mechanism design (e.g., piston sealing technologies, diaphragm geometry), compact sizing for easier installation, and material longevity. Key players actively file patents related to maintenance-free designs and specialized mounting hardware to secure market share, making continuous R&D essential for maintaining a technological edge.

How important are acoustics and noise reduction requirements in driving European market demand?

Acoustics are extremely important, especially in high-density European housing where noise transmission is heavily regulated. Water hammer noise can violate strict building acoustic standards (such as DIN 4109 in Germany). Consequently, European demand is strongly driven by the need for arrestors that not only protect pipes but also eliminate the disruptive noise associated with hydraulic shock, prioritizing quiet operation alongside mechanical resilience.

What is the expected long-term impact of integrating Building Information Modeling (BIM) on the arrestors market?

BIM integration is expected to standardize and mandate the inclusion of arrestors earlier in the construction design cycle. By simulating hydraulic performance within the digital twin model, BIM tools ensure correct sizing, placement, and compliance specifications are met proactively, driving higher demand for technically precise and well-documented arrestor models specified by design engineers.

Can a water hammer arrestor fail, and what are the typical signs of failure?

Yes, arrestors can fail. In piston types, failure typically occurs when the air cushion leaks or diffuses into the water, resulting in the piston slamming against the end cap, which restores the original water hammer noise. In diaphragm types, failure usually involves a rupture of the diaphragm or leakage of the pre-charge gas, leading to a sudden and complete loss of shock absorption capacity, manifesting as severe pipe rattling.

How are manufacturers addressing the market opportunity for environmentally conscious products?

Manufacturers are addressing this by focusing on using sustainable materials, such as lead-free brass or copper alloys certified for potable water contact (NSF 61), and designing products for extended service life to minimize replacement waste. Efforts also include optimizing the manufacturing process to reduce energy consumption and improve material recyclability at the end of the product life cycle.

What differentiates the demand characteristics of hospitals from hotels in the commercial sector?

Hospitals prioritize extreme reliability, hygiene, and zero tolerance for system downtime, often requiring high-grade stainless steel arrestors that comply with strict medical facility standards. Hotels, while also concerned with reliability, place a higher emphasis on acoustic performance and cost efficiency across numerous guest rooms, often utilizing multi-point, compact arrestors designed for quiet operation within confined wall spaces.

In the industrial application segment, which industries contribute the highest value per unit sale?

Industries such as oil and gas processing, and large-scale power generation facilities contribute the highest value per unit. This is because they require exceptionally large-bore, custom-engineered arrestors made from specialized, high-pressure materials designed to handle massive flow rates and extreme operational environments, resulting in a substantially higher average selling price compared to residential units.

What is the primary function of the pre-charged gas in a mechanical water hammer arrestor?

The pre-charged gas (usually air or inert nitrogen) provides the compressible cushion necessary to absorb the kinetic energy of the pressure spike. By maintaining a specific initial pressure, the gas ensures that the arrestor is immediately responsive and capable of decelerating the fluid column without excessive pressure buildup, effectively dampening the shock wave.

How does the concept of 'modularity' apply to current water hammer arrestor design?

Modularity involves designing arrestors that can be easily integrated into standardized plumbing assemblies or manifolds, often featuring interchangeable connection types (e.g., sweat, threaded, or push-fit). This simplifies inventory management for contractors and allows the arrestor unit to be quickly replaced or serviced without dismantling major sections of the underlying pipework.

What regional difference exists in material preference for residential arrestors?

In North America, copper or lead-free brass housing is traditionally dominant due to compatibility with established plumbing practices. In contrast, parts of Europe and the Asia Pacific region show increasing acceptance of high-performance polymer or plastic arrestors in residential and light commercial segments, provided they meet required pressure and temperature ratings, often driven by cost considerations and ease of installation.

Why is the absence of awareness among smaller contractors considered a key restraint?

Smaller plumbing contractors, particularly those operating outside of highly regulated urban areas, may not fully appreciate the long-term system damage and warranty risks associated with neglecting water hammer mitigation. This lack of awareness often leads them to either omit arrestors entirely or install substandard, non-compliant solutions to save immediate project costs, restraining the growth of the certified, high-quality market segment.

What factors contribute to the high replacement rate observed in the North American market?

The high replacement rate is primarily driven by the ongoing shift from older, slow-closing manual valves to modern, high-efficiency appliances with solenoid valves, which mandate the retrofit of arrestors. Additionally, the typical lifespan of older, non-compliant field-fabricated air chambers often necessitates their replacement with certified, dedicated mechanical arrestors during system upgrades or renovations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager