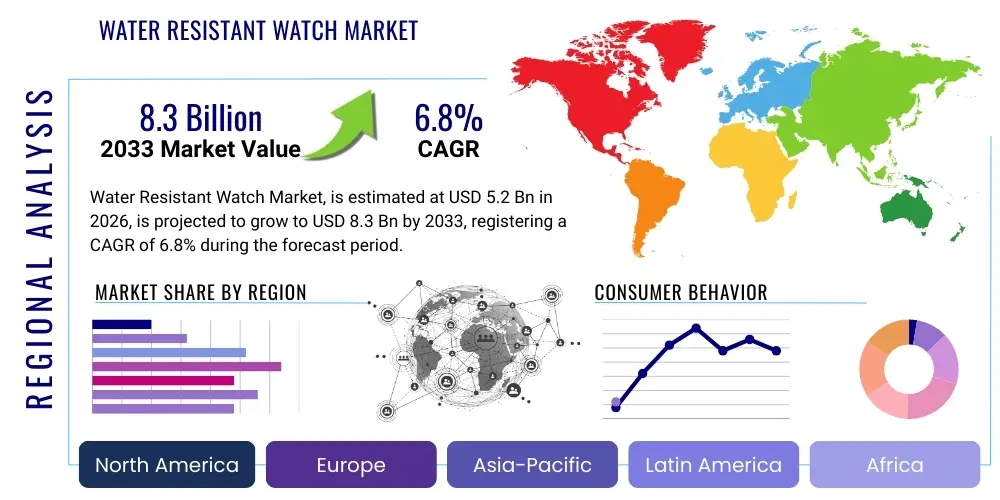

Water Resistant Watch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437124 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Water Resistant Watch Market Size

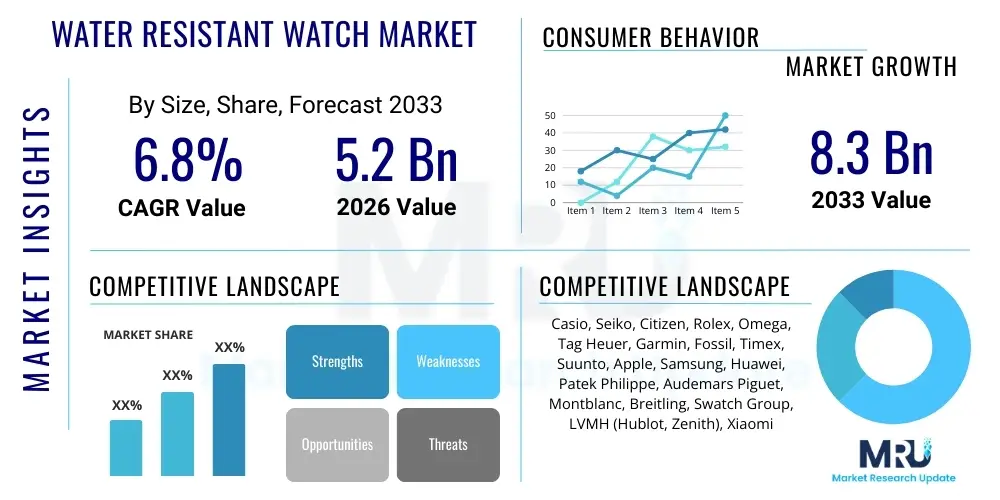

The Water Resistant Watch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $5.2 Billion in 2026 and is projected to reach $8.3 Billion by the end of the forecast period in 2033.

Water Resistant Watch Market introduction

The Water Resistant Watch Market encompasses a wide range of timepieces designed to withstand the ingress of water under specified conditions, typically measured in atmospheres (ATM) or meters (m). This market spans across diverse product categories, from affordable consumer digital watches rated for basic splash resistance (30m) to high-end, professional dive watches (300m+) utilizing advanced sealing technologies, helium escape valves, and specialized material composites like ceramics and specialized stainless steels. The core appeal of water resistance lies in enhancing the durability and utility of the watch, making it suitable for daily wear, swimming, and professional aquatic activities. Key applications extend beyond mere timekeeping, positioning these devices as essential accessories for sports enthusiasts, military personnel, and luxury collectors seeking reliability and longevity. The continuous innovation in gasket materials, case construction, and crown sealing mechanisms drives market differentiation and consumer interest, particularly in segments integrating smart functionality where environmental protection is paramount for electronic components.

Major applications for water resistant watches are segmented primarily by resistance depth. Watches rated at 50m to 100m target the general consumer who requires protection against accidental submersion or recreational swimming, dominating the mass-market and fashion segments. Conversely, the high-performance segment, characterized by 200m or greater resistance, serves specialized applications such as professional scuba diving, marine engineering, and competitive watersports. The increasing popularity of outdoor and adventure tourism, coupled with a renewed appreciation for mechanical timepieces known for their robust build, contributes significantly to sustained demand. Furthermore, the convergence of traditional watchmaking expertise with cutting-edge smart technology necessitates superior water resistance standards, as consumers expect their wearable electronics to function flawlessly in various environments. This integration accelerates the market growth, pushing manufacturers to adopt rigorous testing and quality assurance protocols to maintain consumer trust and comply with international standards like ISO 6425 for dive watches.

The primary driving factors fueling the market growth include rising disposable incomes in emerging economies, aggressive marketing campaigns emphasizing durability and adventure, and technological advancements that make high levels of water resistance more accessible in thinner and lighter designs. Benefits derived by consumers include peace of mind regarding product longevity, versatility in use regardless of weather conditions or activity type, and, in the premium segment, the acquisition of a timepiece that retains significant aesthetic and financial value over time. Moreover, the shift in consumer preference towards durable, multi-functional accessories that seamlessly blend fashion, technology, and rugged performance underscores the intrinsic value proposition of water resistant watches in the contemporary consumer landscape. The market dynamic is characterized by intense competition between established Swiss luxury brands, Japanese mass-market leaders, and technology giants dominating the smart wearable category, all vying to set new benchmarks for water resistance and reliability.

Water Resistant Watch Market Executive Summary

The Water Resistant Watch Market is experiencing dynamic shifts characterized by heightened demand in the luxury mechanical segment and rapid innovation within the smart wearable space. Business trends indicate a strong polarization, where heritage brands leverage historical credibility and material exclusivity to justify premium pricing for mechanical dive watches, while technology companies focus on enhancing water resistance in smartwatches to facilitate health monitoring during aquatic activities. A crucial trend involves sustainability; manufacturers are increasingly using recycled metals and durable, non-toxic materials, aligning with growing consumer environmental consciousness. Furthermore, direct-to-consumer (D2C) channels are gaining traction, allowing niche micro-brands specializing in robust, affordable water-resistant watches to compete effectively with established giants by offering bespoke features and enhanced transparency in material sourcing. Overall business success hinges on balancing traditional craftsmanship with digital integration and robust environmental performance.

Regionally, the market displays distinct consumption patterns. Asia Pacific (APAC), particularly China and India, represents the fastest-growing market due to rapid urbanization, expanding middle-class populations, and a cultural affinity for status symbols, driving demand across all price points, especially for Japanese and Swiss brands. North America and Europe remain mature markets, characterized by high penetration of smartwatches and a strong, enduring preference for luxury and vintage mechanical water-resistant models. Demand in these regions is stable, often driven by replacement cycles and collecting habits. The Middle East and Africa (MEA) show nascent growth, primarily concentrated in urban centers, fueled by tourism, high net worth individuals seeking luxury acquisitions, and the functional requirement for durable watches suited to hot, coastal climates. The regional dynamics necessitate tailored distribution strategies, focusing on e-commerce optimization in APAC and specialized retail experiences in North America and Europe.

Segment trends highlight the dominance of the Digital and Smart watch segments by volume, propelled by their multi-functionality and accessible pricing structure. These segments are continually pushing the boundaries of water resistance relative to their form factor and electronic complexity. Conversely, the Mechanical segment, although smaller in volume, leads in value, driven by high average selling prices (ASP) in the 200m+ rating category, catering to enthusiasts and collectors. The 100m to 200m water resistance rating is currently the sweet spot for mass-market conventional watches, providing adequate safety margin for daily use without significant cost overheads associated with deep-dive certifications. Movement towards ultra-durable, low-maintenance materials like titanium and high-grade ceramics is observed across all value segments, indicating a market preference for long-term robustness and scratch resistance, positioning durability as a non-negotiable consumer expectation.

AI Impact Analysis on Water Resistant Watch Market

Common user questions regarding AI's influence on the Water Resistant Watch Market often revolve around design personalization, manufacturing efficiency, and predictive maintenance. Users frequently ask if AI can design a custom case geometry that maximizes water resistance while minimizing weight, or how AI diagnostics can monitor the integrity of seals and gaskets over the watch’s lifespan. There is significant concern about whether AI-driven quality control can replace traditional human inspection methods, and whether predictive modeling can accurately determine the lifespan and necessary service intervals for complex mechanical movements, especially those exposed to frequent high-pressure environments. The underlying theme is the expectation that AI should lead to higher quality, faster design cycles, and tailored durability specifications, moving beyond merely automating existing production steps to fundamentally rethinking watch engineering based on optimal performance under stress.

The integration of Artificial Intelligence primarily impacts the market through enhanced product development and streamlined manufacturing processes. AI algorithms are being utilized to simulate fluid dynamics and pressure distribution, allowing engineers to iteratively test thousands of case designs, material combinations, and gasket geometries in a fraction of the time required by traditional physical prototyping. This drastically accelerates the time-to-market for new models with superior water resistance ratings. Moreover, in the luxury sector, AI assists in optimizing complex machining paths for components, ensuring micrometer-level precision necessary for perfect seal alignment and integrity, minimizing the margin for human error in critical assembly stages. This analytical capability translates directly into higher yield rates for professional-grade dive watches and reinforces brand claims regarding technical superiority and reliability, a critical factor in consumer purchasing decisions for high-value items.

Beyond manufacturing, AI significantly influences retail and customer experience, particularly for smart water-resistant watches. AI-driven data analytics help manufacturers understand how consumers actually use their water-resistant features—identifying typical depths, frequencies of immersion, and correlated failure points. This data informs future design iterations and allows for highly personalized marketing. For smartwatches, AI is crucial for optimizing power consumption during aquatic modes, ensuring prolonged battery life while maintaining continuous sensor readings (e.g., heart rate while swimming). Furthermore, AI chatbots and virtual assistants provide immediate, accurate product information regarding specific water resistance limits, warranty coverage for water damage, and maintenance recommendations, thereby improving customer service and reducing instances of misuse stemming from misunderstandings about ATM ratings versus practical diving depths.

- AI-optimized fluid dynamics simulation accelerates design of high-pressure resistant cases and crowns.

- Predictive maintenance algorithms analyze wear patterns in mechanical components and seals, scheduling proactive servicing.

- Computer Vision systems enhance quality control, detecting microscopic flaws in gaskets and sealing surfaces far beyond human capability.

- Generative design tools create novel, lightweight internal structures that maintain exceptional structural rigidity for deep-sea models.

- AI-driven supply chain management optimizes material procurement, reducing costs for specialized alloys and high-performance elastomers.

- Personalized marketing and product recommendations based on user-reported aquatic activity levels and environment.

- Smartwatch software utilizes AI to manage sensor data integrity and battery life during prolonged water exposure.

DRO & Impact Forces Of Water Resistant Watch Market

The market dynamics are governed by strong drivers centered around consumer lifestyle shifts and technological improvements, counterbalanced by inherent material and cost restraints, with ample opportunities stemming from new market penetrations and cross-industry collaborations. Key drivers include the global fitness and wellness trend, which mandates durable, waterproof wearables for tracking activities like swimming and surfing, coupled with the enduring appeal of luxury dive watches as investment pieces and status symbols. However, the market is restrained by the high cost of achieving certified deep-water resistance (200m+), requiring specialized alloys, complex testing infrastructure, and precise assembly, making these watches expensive for the average consumer. Another restraint is the rapid obsolescence of smart devices, where electronic components may fail despite physical water resistance, leading to shorter replacement cycles compared to traditional watches. Opportunities exist primarily in miniaturizing water resistance technology for non-traditional form factors, expanding into customized professional gear markets, and utilizing advanced polymers and composite materials to achieve high performance at lower production costs. These forces collectively shape the competitive landscape and influence strategic investments across the value chain, pushing innovation in both aesthetic design and functional integrity.

Drivers are particularly potent in the mid-to-high segments. The rise of international standards (like ISO 6425) elevates consumer confidence, making certified dive watches highly desirable. Furthermore, the convergence of fashion and functionality ensures that water resistance is not just a feature but a design element, emphasized by marketing narratives linking watches to exploration and endurance. Increased globalization of commerce has made high-quality Swiss and Japanese timepieces more accessible to emerging markets where durability is highly valued due to environmental factors and activity levels. Conversely, the primary restraints center on manufacturing complexity and consumer confusion. Many consumers misunderstand the difference between 'water resistance' and 'waterproof,' often leading to product misuse and subsequent dissatisfaction. The high capital expenditure required for automated, contamination-free assembly lines necessary to build watches with reliable, long-term seals acts as a barrier to entry for new competitors in the high-performance categories. Moreover, the environmental impact of battery disposal and component sourcing for smart water-resistant watches is an emerging restraint requiring proactive technological solutions.

Opportunities for significant market expansion are focused on integrating water resistance into other wearable technologies, such as medical monitoring devices and specialized industrial trackers, where reliability in harsh environments is critical. Material science presents a massive opportunity, particularly in developing non-metallic components (like advanced ceramics and carbon fiber composites) that offer comparable or superior pressure resistance to traditional steel and titanium but are lighter and impervious to corrosion. The shift towards sustainable manufacturing practices and modular design (allowing easier replacement of gaskets and seals) offers a strategic advantage. Impact forces, such as changing international trade regulations and fluctuating commodity prices for precious metals and specialized alloys (e.g., 316L stainless steel, Grade 5 Titanium), exert external pressure on pricing and supply chain resilience. The most significant long-term impact force is the continued blurring of lines between traditional watchmaking and the tech sector, forcing established players to innovate or risk losing market share to tech giants who prioritize software integration alongside physical robustness. The overall market trajectory indicates a positive growth outlook, contingent upon the industry's ability to minimize restraints related to cost and complexity while capitalizing on opportunities presented by material and digital integration.

Segmentation Analysis

The Water Resistant Watch Market is highly heterogeneous, primarily segmented based on Movement Type, Water Resistance Rating, Distribution Channel, and End-User. This granular segmentation allows manufacturers to tailor marketing strategies and product specifications to precise consumer needs, ranging from the casual user needing splash protection to the professional diver requiring certified performance at extreme depths. The market structure reflects a clear bifurcation between the traditional timekeeping segment (Quartz and Mechanical) focusing on reliability and heritage, and the high-growth segment (Digital and Smart) prioritizing multi-functionality and connectivity. Analyzing these segments is crucial for understanding pricing tiers, competitive dynamics, and future technological investment areas, such as enhancing the water integrity of intricate electronic interfaces.

The segmentation by Water Resistance Rating is perhaps the most critical determinant of a product's target market and cost structure. Ratings of 30m to 50m typically define the fashion and basic utility watch segments, characterized by high volume and lower ASPs. The crucial transition occurs at 100m, marking the threshold for reliable recreational swimming. The premium and specialty markets are dominated by 200m and above ratings, where manufacturing complexity and certification costs escalate significantly. Furthermore, the segmentation by Distribution Channel—Offline (authorized dealers, brick-and-mortar stores) versus Online (e-commerce platforms, brand websites)—reflects differing consumer preferences. Luxury and mechanical watches still rely heavily on the experiential aspect of offline retail, while smartwatches and affordable digital models thrive in the efficiency of the online marketplace, benefiting from detailed specifications and user reviews.

Segmentation also reveals key consumer behavior patterns. The End-User segment (Men, Women, Unisex) dictates sizing, aesthetic design, and specific functionality. While men’s watches traditionally dominated the high-resistance categories, there is a growing trend for robust, yet aesthetically refined, women's water-resistant watches. The convergence of technology means the unisex category is expanding, particularly within the smart and sports watch domain, focusing purely on functional performance. Successful market penetration requires an understanding of cross-segment influences; for example, a high-end Mechanical watch with a 300m rating (high resistance) targeting the Men’s End-User through Offline channels represents a completely different marketing challenge and pricing strategy than a Digital Smartwatch with a 50m rating targeting the Unisex End-User primarily through Online platforms.

- By Movement Type

- Mechanical (Automatic/Manual)

- Quartz

- Digital

- Smart/Connected

- By Water Resistance Rating

- Up to 50 Meters (Splash/Shallow Swimming)

- 50 – 100 Meters (Recreational Swimming)

- 100 – 200 Meters (Snorkeling/Water Sports)

- 200 Meters and Above (Diving/Professional Use)

- By End-User

- Men

- Women

- Unisex/Sports

- Kids

- By Distribution Channel

- Offline Retail (Specialty Stores, Authorized Dealers, Department Stores)

- Online Retail (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Water Resistant Watch Market

The value chain for the Water Resistant Watch Market is complex, involving highly specialized upstream material suppliers, precision component manufacturers, core assembly operations, and multifaceted downstream distribution networks. Upstream activities are dominated by specialized suppliers of high-grade raw materials crucial for ensuring seal integrity and corrosion resistance, including precision manufacturers of watch movements (e.g., ETA, Miyota, Sellita), specialized rubber or elastomer suppliers for gaskets and O-rings (which are critical for water resistance), and metal fabricators providing corrosion-resistant alloys like surgical-grade 316L stainless steel, titanium, and specialized ceramics. The quality and consistency of these upstream inputs directly determine the maximum achievable water resistance rating and the longevity of the timepiece. Supply chain resilience, particularly for proprietary sealing materials and high-precision machinery, is a constant operational challenge, especially for luxury brands that emphasize Swiss or Japanese origins.

The midstream section involves the core manufacturing and assembly processes, characterized by high-precision machining, stringent quality control, and specialized sealing technology implementation. Water resistance assembly requires cleanroom environments to prevent micro-contamination of sealing surfaces and pressure testing equipment to certify the watch rating (hydrostatic pressure testing). Direct distribution channels involve the manufacturer selling directly to the end consumer, often through flagship stores or brand-controlled e-commerce sites, which allows for maximum margin control and immediate customer feedback capture. Indirect distribution relies on a tiered system involving wholesalers, national distributors, and authorized multi-brand retailers or department stores. This indirect approach provides wider geographic reach, particularly in fragmented international markets, but necessitates greater margin sharing and robust relationship management to ensure brand consistency and counter grey market activities.

Downstream analysis focuses on logistics, marketing, and the end-user sales experience. For water resistant watches, effective downstream activities include providing comprehensive warranty coverage that explicitly addresses water damage within certified limits, educating consumers about the distinction between static pressure ratings and dynamic use, and offering specialized maintenance services (e.g., periodic replacement of gaskets and pressure testing). The proliferation of online review platforms has made the downstream phase critical, as product reliability, particularly concerning water resistance, is immediately shared and scrutinized globally. The direct channel offers better control over the narrative and pricing, supporting the premium positioning of luxury dive watches. Conversely, the indirect channel is vital for mass-market adoption, leveraging the established footprint and consumer traffic of major retailers and e-commerce giants. Effective inventory management across both direct and indirect channels is necessary to manage demand volatility across seasonal activities like summer sports and holiday gift-giving, where demand for water resistant models peaks.

Water Resistant Watch Market Potential Customers

Potential customers for the Water Resistant Watch Market are highly diverse, spanning utilitarian users, sports enthusiasts, luxury collectors, and tech-savvy consumers. The primary end-users are individuals requiring robust, reliable timekeeping during active use, including professional divers, marine scientists, sailors, and military personnel, where water resistance is a mission-critical feature, not just a luxury. A broader and rapidly expanding segment includes fitness enthusiasts, swimmers, triathletes, and general outdoor adventurers who seek seamless tracking and durable performance regardless of weather or activity conditions. This segment is particularly sensitive to the cost-to-performance ratio and drives demand for the mid-range 100m to 200m mechanical and high-end smartwatches. These buyers prioritize features like integrated GPS, health monitoring sensors, and connectivity alongside reliable water sealing.

The luxury segment represents another critical customer base. These buyers are typically high-net-worth individuals and collectors who view high-end water-resistant watches (e.g., luxury dive watches from established Swiss houses) as tangible assets combining horological craftsmanship with inherent durability. For these customers, the purchase trigger is often linked to brand heritage, material exclusivity (such as unique metals or proprietary ceramic alloys), certified depth ratings (e.g., 500m or 1000m overkill ratings), and the history associated with iconic models. Purchase decisions in this segment are less influenced by connectivity features and more by mechanical engineering, finishing quality, and investment potential. Targeted marketing towards this group emphasizes exclusivity, serviceability, and historical provenance, often utilizing authorized dealers and exclusive boutique environments to facilitate the sale.

The mass-market/general consumer segment forms the base of the market volume. These customers seek affordable, everyday watches (often digital or quartz) that can withstand daily environmental hazards like rain, accidental spills, and hand washing (30m to 50m resistance). This group includes students, office workers, and families, primarily seeking convenience and longevity without the need for specialized diving capabilities. For smartwatches, the end-user is often defined by brand ecosystem loyalty (e.g., Apple, Samsung, Garmin users) where water resistance is a necessary, expected feature that facilitates the continuous use of health and communication functions. Effective engagement with this diverse customer landscape requires segmented product offerings, clear articulation of water resistance capabilities (using simplified terms rather than technical jargon), and robust warranty support to manage potential customer service issues related to water ingress.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.2 Billion |

| Market Forecast in 2033 | $8.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Casio, Seiko, Citizen, Rolex, Omega, Tag Heuer, Garmin, Fossil, Timex, Suunto, Apple, Samsung, Huawei, Patek Philippe, Audemars Piguet, Montblanc, Breitling, Swatch Group, LVMH (Hublot, Zenith), Xiaomi |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Resistant Watch Market Key Technology Landscape

The technological landscape of the Water Resistant Watch Market is undergoing rapid evolution, driven primarily by advancements in material science, precision engineering, and the integration of electronic components. Core technology revolves around case construction, sealing mechanisms, and crystal attachment methods. Modern water-resistant watches utilize superior materials such as specialized high-density ceramics (zirconium oxide), aerospace-grade titanium, and proprietary stainless steel alloys (like 904L steel used by certain luxury brands) that offer enhanced corrosion resistance to saltwater and superior structural integrity under extreme pressure. Furthermore, sophisticated manufacturing techniques, including computer numerical control (CNC) machining and laser welding, ensure tolerances are minimized, which is essential for maintaining perfect sealing surfaces. The use of sapphire crystals with anti-reflective coatings, often significantly thicker in dive watches, is crucial for pressure resistance and scratch durability, enhancing both functionality and perceived value.

Sealing technology represents the heart of water resistance innovation. Traditional rubber or nitrile O-rings are being supplemented or replaced by advanced elastomers and highly resilient synthetic polymers that maintain elasticity and seal integrity across vast temperature ranges and prolonged submersion cycles. Key technologies include the triple-lock crown system, specialized helium escape valves (essential for saturation diving to equalize internal and external pressure during decompression), and enhanced caseback sealing designs (screw-down systems with proprietary gaskets). For smartwatches, the challenge is magnified by the need to seal not only the case but also numerous openings for sensors, charging pins, and speakers. Manufacturers are innovating through proprietary acoustic barriers and hydrophobic membranes that allow sound transmission while blocking water ingress, alongside wireless charging systems that eliminate exposed electrical contacts, significantly improving long-term water resistance reliability for everyday use.

The future technology landscape is focused on self-healing materials and miniaturization. Researchers are exploring polymers that can automatically reseal microscopic breaches, potentially offering unprecedented levels of durability and reduced maintenance requirements. Furthermore, advancements in Micro-Electro-Mechanical Systems (MEMS) are allowing for the creation of smaller, more reliable internal components, facilitating slimmer case designs that still achieve high depth ratings. The application of sophisticated bonding agents and proprietary pressure-testing apparatus utilizing advanced sensor technology is becoming standard practice to certify and validate high water resistance ratings with greater efficiency and accuracy than historical methods. These technological efforts aim to overcome the inherent trade-off between watch complexity, thinness, and ultimate depth rating, ensuring water resistance becomes a fundamental, reliable feature across all segments of the watch market, irrespective of movement type or price point, thus significantly driving consumer confidence and market expansion.

Regional Highlights

- Asia Pacific (APAC): APAC is the engine of market growth, characterized by dual demand for luxury collectibles (driven by high-net-worth individuals in China, Japan, and Singapore) and high-volume smartwatches/digital watches (driven by India and Southeast Asia's young, tech-savvy populations). Japan, specifically, holds significance due to its strong heritage brands (Seiko, Citizen, Casio) which are global leaders in high-performance quartz and mechanical water-resistant technology. The region's coastal lifestyle and high levels of outdoor participation also contribute to sustained demand for durable, water-safe wearables. E-commerce penetration is exceptionally high, necessitating localized digital marketing strategies focused on performance specifications and brand authenticity.

- North America: This is a mature market driven primarily by the high penetration of smartwatches (Apple Watch, Garmin) where water resistance (often 50m to 100m) is a baseline expectation for fitness tracking. The conventional watch segment sees strong sales of mid-range mechanical dive watches, particularly among younger consumers valuing brand heritage and rugged aesthetics. Marketing focuses on durability, brand history, and sports endorsements, with consumers generally willing to pay a premium for guaranteed certification and robust warranties. Military and professional dive communities also represent stable, albeit niche, high-value customer bases.

- Europe: Europe, particularly Switzerland, Germany, and the UK, remains the global epicenter for luxury and mechanical water-resistant watches. The market is dominated by traditional luxury brands (Rolex, Omega, Breitling) that heavily emphasize heritage, certified performance (ISO 6425), and artisanal quality. Consumer behavior is highly segmented; there is strong interest in collectible, historically significant dive watches, alongside robust demand for functional, aesthetically appealing watches for sailing and coastal leisure activities. Regulatory compliance, particularly concerning material sourcing and environmental standards, plays a critical role in market strategy here.

- Latin America (LATAM): The LATAM market is characterized by increasing urbanization and gradual rising disposable incomes, driving moderate but steady growth. Demand is predominantly concentrated in the entry-to-mid-level quartz and digital segments, with strong preference for global brands offering robust durability in variable climates. Import tariffs and currency fluctuations significantly impact pricing, making accessible brands with strong local distribution networks key to success. Brazil and Mexico are leading the regional consumption, increasingly adopting smartwatches as affordable communication and fitness tools that require water resistance.

- Middle East and Africa (MEA): This region displays significant growth potential, concentrated around affluent Gulf Cooperation Council (GCC) countries where luxury watch consumption is extremely high. High humidity and heat necessitate superior material performance and sealing. The demand is heavily skewed towards high-end Swiss mechanical dive watches as status symbols, often purchased through luxury retail hubs. In contrast, emerging African markets prioritize affordability and extreme durability in harsh operational environments, driving demand for robust digital and quartz models from brands like Casio and Timex.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Resistant Watch Market.- Casio Computer Co., Ltd.

- Seiko Group Corporation

- Citizen Watch Co., Ltd.

- Rolex SA

- Omega SA (The Swatch Group)

- Tag Heuer (LVMH)

- Garmin Ltd.

- Fossil Group, Inc.

- Timex Group USA, Inc.

- Suunto Oy

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Huawei Technologies Co., Ltd.

- Patek Philippe SA

- Audemars Piguet Holding SA

- Montblanc International GmbH (Richemont Group)

- Breitling SA

- Swatch Group (Longines, Tissot, Blancpain)

- LVMH Moët Hennessy Louis Vuitton SE (Zenith, Hublot)

- Xiaomi Corporation

Frequently Asked Questions

Analyze common user questions about the Water Resistant Watch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between 30m, 100m, and 200m water resistance ratings?

30m (3 ATM) resistance is splash-proof and suitable for accidental rain exposure, but not immersion. 100m (10 ATM) is generally acceptable for recreational swimming and snorkeling. 200m (20 ATM) and above is recommended for professional watersports and scuba diving, adhering often to ISO 6425 standards for guaranteed reliability under sustained pressure and dynamic movement.

Do I need to service my water resistant watch to maintain its depth rating?

Yes, regular servicing is essential. Gaskets and seals, which provide water resistance, degrade and lose elasticity over time, particularly when exposed to heat, chemicals, or frequent pressure changes. Experts recommend pressure testing and seal replacement every 2 to 5 years, especially for dive watches, to ensure the original depth rating is maintained.

Are smartwatches as reliably water resistant as traditional mechanical dive watches?

Smartwatches offer reliable water resistance (typically 50m to 100m) for most fitness and recreational swimming, but often cannot match the extreme depth ratings (200m+) and long-term certified structural integrity of mechanical dive watches designed specifically for saturation diving, due to the complexity of sealing numerous electronic ports and sensors.

What materials are best for preventing corrosion in saltwater environments?

High-grade stainless steel alloys (like 316L or 904L), titanium (Grade 2 or Grade 5), and advanced ceramic composites are preferred for saltwater environments. Titanium is highly prized for its low density, superior strength-to-weight ratio, and absolute immunity to corrosion and pitting caused by seawater.

Does the use of a screw-down crown significantly enhance a watch's water resistance?

A screw-down crown substantially enhances water resistance by compressing a gasket against the case tube, creating a stronger mechanical seal than a standard push-pull crown. This feature is fundamental in watches rated 100m and above, providing critical protection against water ingress during dynamic use or deep submersion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager