Water Resources Consulting Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437603 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Water Resources Consulting Services Market Size

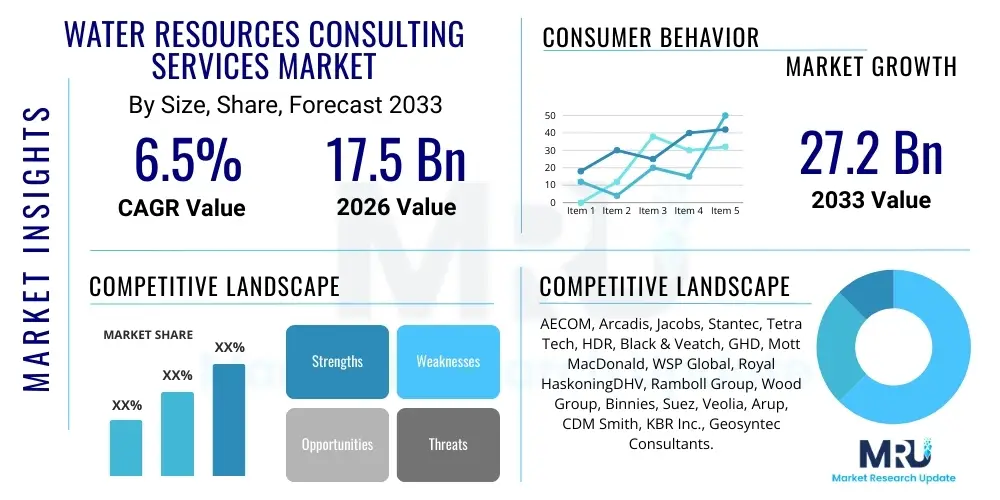

The Water Resources Consulting Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 17.5 Billion in 2026 and is projected to reach USD 27.2 Billion by the end of the forecast period in 2033.

Water Resources Consulting Services Market introduction

The Water Resources Consulting Services Market encompasses specialized professional services focused on the sustainable management, development, and protection of water resources. This includes technical advice, feasibility studies, environmental impact assessments, and engineering design related to hydrology, hydraulics, water quality, and infrastructure. These services are critical for governmental agencies, industrial entities, utility providers, and agricultural sectors seeking solutions for water scarcity, flood mitigation, regulatory compliance, and optimization of water systems. The core product description involves providing data-driven strategies and technical expertise to address complex global water challenges, driven primarily by climate change, population growth, and deteriorating infrastructure across developed and emerging economies.

Major applications of these consulting services span the entire water cycle, from source water protection and large-scale irrigation planning to advanced wastewater treatment and urban drainage systems. Benefits derived by clients include enhanced operational efficiency, reduced regulatory risk, successful implementation of large-scale public works projects, and improved environmental stewardship. These consulting firms act as essential partners in translating scientific data and evolving regulations into actionable engineering and policy solutions, ensuring the long-term viability of water supplies for various human and environmental needs. The increasing complexity of water governance and the necessity for integrated water management planning further solidify the crucial role of expert consultation.

The primary driving factors propelling this market involve stringent environmental regulations mandating water quality standards, the urgent need for infrastructure modernization in regions like North America and Europe, and significant investment in sustainable urban development and climate resilience strategies, particularly in Asia Pacific. The global focus on achieving Sustainable Development Goal (SDG) 6 (Clean Water and Sanitation) also creates sustained demand for planning and implementation expertise.

Water Resources Consulting Services Market Executive Summary

The Water Resources Consulting Services Market is characterized by robust growth, fueled by global imperatives surrounding climate adaptation, water scarcity, and aging infrastructure replacement. Business trends show a strong shift towards digitalization, with consulting firms increasingly integrating advanced modeling, remote sensing, and Big Data analytics into their service offerings to deliver predictive and highly accurate solutions. Furthermore, mergers and acquisitions remain a prevalent strategy among top-tier global consultancies to consolidate specialized expertise, expand geographic reach, and capture lucrative governmental infrastructure contracts. There is also a growing trend towards public-private partnerships (PPPs) in infrastructure development, requiring specialized consultancy for financial structuring and risk assessment.

Regional trends indicate that North America and Europe maintain dominance due to high regulatory requirements, substantial capital expenditure on infrastructure renewal, and established environmental stewardship programs. However, the Asia Pacific region is expected to demonstrate the fastest growth rate, driven by rapid urbanization, massive infrastructural development projects, and the critical need to address widespread water pollution and scarcity issues, particularly in high-growth economies like China, India, and Southeast Asia. Latin America and the Middle East & Africa are showing accelerating demand, mainly focused on developing desalination plants, optimizing agricultural water usage, and implementing drought mitigation strategies.

Segmentation trends highlight that the Water Quality Management and Flood Risk Management segments are experiencing accelerated demand due to intensifying climate-related disasters and heightened public awareness regarding contaminants like PFAS and microplastics. By end-user, the Government & Public Sector remains the largest revenue generator, reflecting sustained investment in large-scale public works. However, the Industrial segment, driven by mandatory compliance and corporate sustainability goals, represents the fastest-growing application area, particularly in heavy water-consuming industries such as energy, mining, and manufacturing. The increasing adoption of circular economy principles is necessitating specialized consulting for industrial water reuse and recycling programs.

AI Impact Analysis on Water Resources Consulting Services Market

Common user questions regarding AI's impact on water resources consulting primarily center on whether artificial intelligence will automate core analytical tasks, reduce the need for field personnel, and improve the accuracy of complex hydrological models. Users frequently inquire about the feasibility of real-time predictive flood forecasting, optimizing reservoir operations using machine learning, and leveraging AI for fast analysis of vast environmental datasets (e.g., satellite imagery, sensor data). The key themes emerging are efficiency gains, predictive capabilities, and cost reduction, alongside concerns about data security, model explainability (XAI), and the necessary upskilling of existing consulting staff to handle these advanced tools. Users expect AI to shift the consulting value proposition from data collection and basic modeling to high-level strategic planning and interpretation of AI-generated insights.

The integration of AI, particularly machine learning and deep learning, is fundamentally transforming how consulting firms approach hydrological modeling, resource allocation, and risk management. AI algorithms significantly enhance the ability to process non-linear environmental data, allowing for far more precise predictions regarding drought severity, water demand fluctuations, and potential system failures than traditional deterministic models. This shift enables consultants to move beyond reactive problem-solving towards proactive resilience planning, offering clients substantial benefits in minimizing operational downtime and ensuring regulatory compliance. The adoption of AI tools is moving from niche applications to becoming a foundational element of advanced consulting services, especially those focused on smart water infrastructure.

Furthermore, AI facilitates advanced asset management by analyzing telemetry data from smart meters, pumps, and sensors across expansive utility networks. This predictive maintenance capability allows consultants to advise clients on optimizing maintenance schedules, drastically reducing non-revenue water (NRW) losses, and extending the lifespan of critical infrastructure components. For water quality monitoring, AI can rapidly identify anomalies and potential contamination sources in real-time sensor streams, providing swift alerts and improving public health protection. This increased reliance on digital twins and advanced analytics elevates the role of the consultant to that of a digital integrator and strategic advisor, requiring proficiency not just in civil engineering but also in data science and computational hydrology.

- AI enhances hydrological modeling accuracy, improving drought and flood forecasting reliability.

- Machine learning optimizes reservoir and network operations, reducing energy consumption and operational costs.

- Predictive maintenance using AI minimizes infrastructure failures and non-revenue water (NRW) losses.

- AI accelerates environmental impact assessment (EIA) processes through automated data synthesis.

- Natural Language Processing (NLP) speeds up regulatory compliance checks and document analysis.

- Digital Twin technology, powered by AI, enables real-time simulation and scenario planning for complex projects.

- Increased demand for consulting services focused on data governance and securing AI systems within water utilities.

DRO & Impact Forces Of Water Resources Consulting Services Market

The Water Resources Consulting Services Market is primarily driven by escalating global water stress, coupled with mandatory governmental regulatory frameworks aimed at environmental protection and sustainable development. Restraints include high initial investment costs associated with advanced consulting technologies (like AI modeling and satellite mapping) and the critical shortage of specialized talent possessing combined expertise in hydrology, engineering, and data science. Opportunities abound in emerging markets focused on rapid urbanization infrastructure development and in developed economies prioritizing climate resilience projects, such as coastal protection and managed aquifer recharge (MAR) schemes. The market is influenced by significant impact forces including political commitment to water security (a major driver) and fluctuating commodity prices affecting the capital expenditure of industrial clients (a potential restraint).

Drivers: Intensifying climate change impacts, manifesting as extreme weather events (prolonged droughts and severe flooding), necessitate specialized consulting for risk assessment, mitigation planning, and resilient infrastructure design. Simultaneously, the vast aging water infrastructure across North America and Western Europe requires massive capital renewal programs, creating sustained demand for engineering design, structural integrity assessments, and project management consulting. Furthermore, increasingly strict mandates concerning water quality, particularly the regulation of emerging contaminants such as pharmaceutical residue and microplastics, compel municipal and industrial clients to seek expert advice for advanced treatment solutions and monitoring strategies, boosting the Water Quality Management segment significantly. Public awareness regarding water stewardship also pressure corporations and governments to ensure transparent and sustainable practices.

Restraints: A significant restraint is the cyclical nature of public sector funding, where governmental budget constraints and shifting political priorities can lead to delayed or canceled large-scale water projects, impacting consulting revenues. Another challenge is the difficulty in standardizing complex environmental data across different jurisdictions and the inherent geographical variability in water resource issues, which limits the scalability of certain solutions. Moreover, the initial reluctance of smaller municipal utilities to adopt high-cost, cutting-edge digital solutions, due to limited technical capacity and budgetary restrictions, acts as a barrier to market penetration for technologically advanced consulting services.

Opportunities: Opportunities lie in leveraging technological advancements like satellite remote sensing and drone technology for cost-effective monitoring and data collection, particularly in remote areas. The global shift toward water reuse and the circular economy opens vast avenues for consulting firms specializing in industrial and municipal recycling systems. Furthermore, the growing focus on energy-water nexus challenges—such as advising clients on reducing the high energy consumption of water treatment and desalination processes—provides a high-value niche. Expanding service lines into advisory roles for securing climate finance and Green Bonds for water infrastructure projects is also a rapidly emerging and lucrative opportunity.

Segmentation Analysis

The Water Resources Consulting Services Market is meticulously segmented based on the type of service provided, the nature of the project undertaken, and the end-user utilizing the expertise. This segmentation allows consulting firms to tailor specialized offerings that address unique client needs, whether they are facing issues related to infrastructure failure, environmental compliance, or strategic resource planning. The primary segmentation criterion is the Service Type, reflecting the specialized technical domain required, such as hydrological modeling, wastewater engineering, or regulatory permitting. The market structure emphasizes the shift towards integrated water management solutions, where clients require a combination of services rather than isolated advice, driving collaboration across different internal divisions within consulting firms.

The market analysis reveals that the largest segment often aligns with mandated compliance and non-discretionary infrastructure spending. For instance, services related to Water Supply Management, which covers foundational planning and engineering for municipal water systems, consistently hold a dominant market share due to continuous population growth and aging asset management requirements globally. Concurrently, the fastest-growing segments are those directly linked to global crises, specifically Flood Risk Management consulting, propelled by the increasing severity and frequency of major storm events requiring complex modeling and climate change adaptation strategies, and Environmental Permitting, driven by the tightening grip of environmental protection laws worldwide.

Understanding these segments is crucial for strategic business development. Consulting firms focusing on the Industrial end-user segment must develop specialized expertise in process water optimization and zero liquid discharge (ZLD) systems, whereas firms targeting the Government & Public Sector must excel in procurement navigation, complex stakeholder engagement, and securing large, multi-year design-build contracts. Geographical factors heavily influence the dominance of certain segments; for example, desalination and efficient irrigation consulting services are highly concentrated in arid regions, while stormwater and drainage consulting dominate densely populated coastal and flood-prone areas.

- By Service Type:

- Water Supply Management (Planning, Distribution Systems, Source Development)

- Water Quality Management (Treatment Optimization, Contaminant Monitoring, Compliance)

- Flood Risk Management (Hydraulic Modeling, Mitigation Planning, Coastal Protection)

- Wastewater Management (Collection Systems, Treatment Plant Design, Reuse Planning)

- Hydrological Consulting (Groundwater Modeling, Surface Water Analysis, Climate Impact Studies)

- Environmental Permitting and Regulatory Compliance

- By Application/End-User:

- Government & Public Sector (Municipal Utilities, Federal Agencies, Local Governments)

- Industrial (Energy & Power, Mining, Manufacturing, Pharmaceuticals)

- Agricultural Sector (Irrigation Planning, Water Use Efficiency)

- Utilities (Publicly and Privately Owned Water and Wastewater Utilities)

- Residential and Commercial Developers

- By Project Type:

- New Infrastructure Development (Greenfield Projects)

- Refurbishment and Rehabilitation (Brownfield Projects, Asset Renewal)

Value Chain Analysis For Water Resources Consulting Services Market

The value chain for Water Resources Consulting Services is primarily structured around intellectual capital and project management expertise, spanning from initial data acquisition and scientific research (upstream) to project execution, monitoring, and ongoing maintenance advisory (downstream). Upstream activities involve gathering foundational data, which includes utilizing highly sophisticated tools such as geographical information systems (GIS), remote sensing technology, hydrogeological mapping, and proprietary modeling software. These activities require significant investment in specialized technical staff and technology platforms. Strategic partnerships with academic institutions and technology providers for cutting-edge research and data analytics are integral components of the upstream value proposition, ensuring consultants maintain a knowledge advantage.

Midstream activities constitute the core service delivery, involving project feasibility studies, environmental impact assessments (EIAs), engineering design (conceptual to detailed), and regulatory negotiation. The distribution channel in this sector is predominantly direct, relying on highly qualified consultants and senior partners directly engaging clients—be they government bodies, industrial CEOs, or utility boards—to tailor complex, high-value contracts. Indirect channels are marginal but include participation in large consortia led by construction or finance firms, where the water consultant provides specialized sub-contracted expertise. The reputation, track record, and technical specialization of the consulting firm are paramount determinants of value capture at this stage.

Downstream activities focus on the implementation phase, including construction oversight, quality assurance, post-project monitoring, and long-term asset performance advisory services. The market is increasingly seeing demand for performance-based contracts and digital solutions like digital twins and continuous operational monitoring systems, solidifying the consultant's role long after physical construction is complete. Value creation is maximized when consulting firms offer an integrated approach, linking initial planning and design seamlessly with operational technology (OT) integration, thereby maximizing client return on investment (ROI) and minimizing project risk across the entire lifecycle of the water resource asset.

Water Resources Consulting Services Market Potential Customers

The primary consumers and buyers of Water Resources Consulting Services are multifaceted, spanning governmental entities, private utilities, and large industrial corporations, all driven by the need to manage water scarcity, ensure compliance, and mitigate environmental risk. The Government & Public Sector, which includes municipal water and wastewater utilities, state environmental agencies, federal water management bodies (e.g., US Army Corps of Engineers, environment ministries), and transportation authorities, represents the largest customer segment. These entities require consulting for large public works projects such as dam safety assessments, regional water master plans, urban flood control, and compliance with national water quality legislation (e.g., the Clean Water Act equivalents globally). Their buying decisions are often driven by legislative mandates, public safety concerns, and competitive bidding processes.

The second major category encompasses Industrial End-Users, particularly those sectors characterized by high water consumption or significant discharge requirements, such as mining, power generation (thermal and nuclear), chemical manufacturing, and food and beverage production. These private sector clients seek consulting to achieve operational efficiency, minimize costs associated with water usage and treatment, adhere to corporate environmental, social, and governance (ESG) goals, and maintain licenses to operate. Consulting needs often revolve around process water optimization, wastewater recycling, implementing Zero Liquid Discharge (ZLD) systems, and managing site-specific environmental liabilities.

The third critical customer segment involves private Water Utilities and Infrastructure Developers who require specialized consulting during the acquisition, expansion, or refurbishment of infrastructure assets. Furthermore, the agricultural sector, increasingly concerned with sustainable practices and water-use efficiency under drought conditions, requires expertise in modern irrigation technology planning, watershed management, and aquifer recharge projects. Potential customers are entities that manage water resources, are regulated by water quality laws, or whose operations are vulnerable to climate change impacts on water supply.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 17.5 Billion |

| Market Forecast in 2033 | USD 27.2 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AECOM, Arcadis, Jacobs, Stantec, Tetra Tech, HDR, Black & Veatch, GHD, Mott MacDonald, WSP Global, Royal HaskoningDHV, Ramboll Group, Wood Group, Binnies, Suez, Veolia, Arup, CDM Smith, KBR Inc., Geosyntec Consultants. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Resources Consulting Services Market Key Technology Landscape

The technological landscape underpinning the Water Resources Consulting Services Market is rapidly evolving, driven by the need for enhanced data precision, predictive capabilities, and cost-effective monitoring. Key technologies include advanced computational hydrology models, specifically 3D groundwater and surface water simulation software (e.g., MODFLOW, HEC-RAS), which allow consultants to accurately predict the behavior of complex water systems under various stress scenarios. These modeling tools are foundational for flood risk assessment and sustainable yield studies. Furthermore, the increasing accessibility of satellite remote sensing (e.g., SWOT mission data) and drone-based aerial mapping provides vast, high-resolution spatial data necessary for watershed planning and rapid assessment of flood or contamination incidents, significantly reducing reliance on costly ground surveys.

A transformative technology is the integration of the Internet of Things (IoT) and pervasive sensor networks within water infrastructure. IoT sensors provide consultants with real-time operational data on flow rates, water quality parameters, and asset condition, enabling the development of "Smart Water" network strategies. This real-time data flow feeds into sophisticated Big Data platforms and Artificial Intelligence (AI) algorithms (as discussed previously) to optimize network pressures, manage dynamic leakage detection, and automate operational responses. The shift towards Digital Twins—virtual replicas of physical water systems—allows consultants to run multiple optimization and resilience scenarios without impacting live operations, representing a major leap in advisory capability and client value.

The market also heavily utilizes Geographical Information Systems (GIS) as a critical platform for data visualization, spatial analysis, and presenting complex hydrological findings to non-technical stakeholders, improving project communication and stakeholder engagement. Advanced laboratory analysis techniques for emerging contaminants, such as non-target screening and high-resolution mass spectrometry, are also essential consulting inputs, particularly for compliance and health risk assessments. Technology utilization is characterized by the convergence of civil engineering principles with advanced computational science, necessitating multi-disciplinary teams within consulting firms.

Regional Highlights

Regional dynamics heavily influence the demand for water resources consulting, reflecting varying climatic conditions, regulatory environments, and levels of infrastructure maturity across the globe. Each region presents distinct challenges and drivers, leading to specialized service requirements.

- North America: This region is a mature market, dominated by the replacement and rehabilitation of critical, aging infrastructure, particularly pipeline networks and water treatment facilities built in the mid-20th century. High regulatory stringency, led by federal and state environmental agencies, drives continuous demand for compliance, water quality testing, and dam safety assessment consulting. The accelerating adoption of smart water technology and robust private sector investment contribute significantly to market expansion. Key focus areas include PFAS mitigation and adaptation to extreme weather variability.

- Europe: Driven primarily by the European Union’s Water Framework Directive (WFD) and the need to achieve climate neutrality targets, consulting services here focus heavily on integrated river basin management, water reuse for agriculture, and urban drainage modeling to manage pluvial flooding. Countries like Germany and the Netherlands are leaders in advanced flood defense and coastal protection consulting. Strict regulations regarding nutrient runoff and chemical contamination ensure steady demand for specialized environmental and hydrological consulting.

- Asia Pacific (APAC): APAC is the fastest-growing region, characterized by massive public and private investment into new infrastructure to support rapid urbanization and industrial expansion, particularly in India, China, and Southeast Asia. The primary consulting demands revolve around securing clean water supplies for densely populated cities, large-scale irrigation projects, wastewater infrastructure development, and combating severe localized water pollution. Geographically, consulting related to transboundary river agreements and Himalayan watershed management is gaining importance.

- Latin America (LATAM): Market growth in LATAM is concentrated around addressing water access inequality, reducing high levels of non-revenue water (NRW) in municipal systems, and implementing resource management plans to handle prolonged drought periods. Brazil and Mexico represent major markets due to their large populations and industrial bases. Consulting expertise is often sought for securing private investment and structuring public-private partnerships (PPPs) for infrastructure upgrades.

- Middle East and Africa (MEA): This region faces acute water scarcity, making consulting services focused on high-efficiency desalination plant design, brine management, groundwater exploration, and highly efficient agricultural irrigation techniques critical. In the Middle East, large-scale governmental investment in water security projects drives the market. African markets, while nascent, show rising demand for basic sanitation infrastructure planning and climate resilience financing advisory services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Resources Consulting Services Market.- AECOM

- Arcadis

- Jacobs

- Stantec

- Tetra Tech

- HDR

- Black & Veatch

- GHD

- Mott MacDonald

- WSP Global

- Royal HaskoningDHV

- Ramboll Group

- Wood Group

- Binnies

- Suez

- Veolia

- Arup

- CDM Smith

- KBR Inc.

- Geosyntec Consultants

Frequently Asked Questions

Analyze common user questions about the Water Resources Consulting Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary segments driving market growth in the Water Resources Consulting sector?

The primary segments driving market growth are Flood Risk Management, propelled by increasing climate change impacts, and Water Quality Management, necessitated by stringent regulatory mandates concerning emerging contaminants like PFAS and microplastics. The transition toward smart water infrastructure also fuels the demand for digital modeling and systems integration consulting.

How is the adoption of Artificial Intelligence (AI) reshaping the delivery of consulting services?

AI is transforming service delivery by enabling predictive modeling for drought and flood events, optimizing water network operations for efficiency, and accelerating environmental data analysis. Consultants now focus more on interpreting AI-generated insights and integrating digital twins rather than relying solely on traditional manual data collection and modeling.

Which geographical region offers the most significant growth opportunities for new market entrants?

The Asia Pacific (APAC) region offers the most significant growth opportunities, driven by massive investments in new urban water infrastructure, rapid industrialization, and urgent needs for pollution control and water security solutions in fast-developing economies such as India and Southeast Asia.

What are the major challenges currently restricting the growth of the Water Resources Consulting Market?

Major restrictions include the cyclical and often unpredictable nature of public funding for infrastructure projects, the high initial capital investment required for deploying advanced digital consulting technologies (AI, remote sensing), and a persistent global shortage of highly specialized professionals in computational hydrology and environmental data science.

What are the key service differentiators sought by municipal and industrial clients?

Clients increasingly seek integrated services that combine engineering design with strategic policy advisory, specialized expertise in securing climate finance (Green Bonds), and proven capabilities in implementing sustainable solutions like water reuse, Zero Liquid Discharge (ZLD), and energy-water nexus optimization to meet stringent ESG targets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager