Water Sampler Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432668 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Water Sampler Market Size

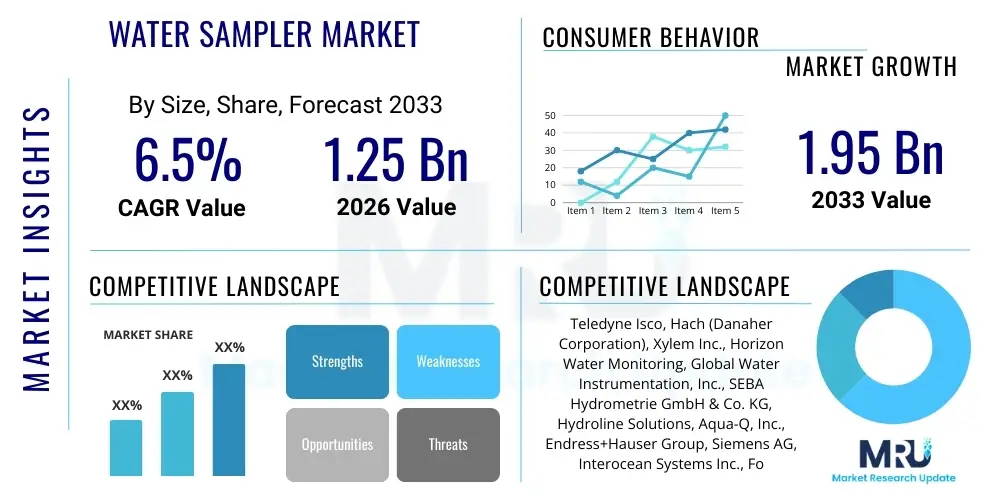

The Water Sampler Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.95 Billion by the end of the forecast period in 2033.

Water Sampler Market introduction

The Water Sampler Market encompasses the production, distribution, and utilization of specialized devices designed to collect representative samples of water from various sources, including rivers, lakes, oceans, wastewater treatment facilities, and drinking water reservoirs. These devices, which range from simple manual tools like grab samplers to sophisticated automated systems, are fundamental instruments in environmental monitoring, regulatory compliance testing, and scientific research. The primary purpose of water sampling is to assess water quality parameters, detect pollutants, and ensure public health and ecological integrity. The essential product categories within this market include automatic samplers, which offer time-based or event-based collection capabilities, and manual samplers, preferred for initial site assessments or specialized depth sampling.

Major applications driving the demand for advanced water sampling technology include stringent industrial discharge regulations, the global increase in water scarcity issues necessitating detailed monitoring of scarce resources, and the continuous need for accurate data to model climate change impacts on aquatic environments. Benefits derived from utilizing high-quality water samplers include reduced human error in sample collection, improved spatial and temporal data resolution, and enhanced compliance with international standards such as ISO and EPA protocols. The reliability and robustness of modern samplers, especially those integrated with telemetry and smart sensor technologies, are pivotal in establishing long-term environmental datasets critical for policy formulation and infrastructure planning.

Key driving factors propelling market expansion involve escalating governmental investments in modernizing water infrastructure and wastewater treatment plants, particularly in developing economies facing rapid urbanization and industrialization. Furthermore, the rising public and regulatory scrutiny regarding emerging contaminants, such as microplastics and per- and polyfluoroalkyl substances (PFAS), mandates the deployment of specialized, contamination-free sampling equipment capable of collecting trace amounts for ultra-sensitive laboratory analysis. Technological advancements focusing on portability, non-contact sampling methods, and integration with real-time data logging capabilities are continually redefining the efficiency and scope of water quality surveillance programs globally, solidifying the market's growth trajectory.

Water Sampler Market Executive Summary

The Water Sampler Market is characterized by robust technological innovation focusing on automation, remote deployment, and data integration, directly addressing the critical needs of environmental compliance and water resource management. Key business trends include a notable shift from traditional manual collection methods toward sophisticated automatic samplers that minimize field labor and enhance data reliability, driven by the requirement for continuous, time-stamped sample records in regulated industries. Furthermore, strategic mergers and acquisitions among established players and specialized sensor technology firms are shaping the competitive landscape, aiming to offer integrated monitoring solutions combining sampling hardware with analytical software and cloud-based data platforms. This integration provides end-users, especially large governmental bodies and multinational industrial operators, with comprehensive tools for managing vast monitoring networks efficiently, thereby consolidating supplier market share.

Geographically, North America and Europe currently dominate the market due to mature regulatory frameworks, high environmental awareness, and substantial existing infrastructure requiring continuous monitoring and upgrades. However, the Asia Pacific region, led by rapidly developing economies such as China and India, is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is primarily fueled by urgent infrastructure development to manage unprecedented levels of industrial pollution and address severe deficits in sanitation and drinking water quality, compelling governments to mandate widespread adoption of modern sampling and testing protocols. Regional trends also show Latin America and the Middle East focusing on specialized samplers for managing unique challenges, such as arid climate water management and complex industrial effluent monitoring in sectors like mining and petrochemicals.

Segmentation analysis reveals that the Automatic Sampler segment holds a commanding market share, valued for its precision in timed or flow-proportional sampling, essential for wastewater compliance reporting. Within end-users, the Government Agencies and Environmental Monitoring sectors remain the largest consumers, utilizing a wide variety of equipment for regulatory oversight of natural waterways and public water supply systems. The fastest-growing segment, however, is likely the specialized category, which includes high-demand products like low-flow groundwater samplers and specialized passive samplers. This growth is directly linked to the increasing complexity of contaminants being studied, demanding tailored sampling approaches that standard automated equipment cannot always fulfill, thus opening lucrative niches for specialized manufacturers focusing on advanced materials and non-conventional collection mechanisms.

AI Impact Analysis on Water Sampler Market

Common user inquiries regarding AI's influence on the Water Sampler Market center around how machine learning can optimize sampling frequency, predict contamination events, and integrate disparate data sources from samplers and real-time sensors. Users frequently ask about the transition from fixed, manual sampling schedules to dynamic, AI-driven sampling campaigns that activate devices only when predictive models indicate a high likelihood of a pollution event or deviation from normal parameters. Concerns often revolve around the initial investment required for AI infrastructure, data security of cloud-integrated sampling networks, and the need for standardized protocols to ensure AI-recommended sampling points are legally valid for regulatory compliance purposes. Expectations are high regarding AI's potential to dramatically reduce operational costs, extend the battery life of remote samplers, and provide unprecedented foresight into water quality degradation trends, moving monitoring from reactive detection to proactive risk mitigation.

The impact of Artificial Intelligence and advanced machine learning algorithms is profoundly enhancing the utility and efficiency of water sampling operations, transitioning the market towards truly smart water management systems. AI is primarily used for optimizing the logistics of sampling, employing predictive analytics based on weather patterns, upstream discharge reports, historical contamination data, and sensor readings to determine the optimal time and location for sample collection. This shift from routine, potentially unnecessary sampling to targeted, event-driven sampling ensures that resources are allocated efficiently, particularly valuable in large-scale municipal or transboundary river monitoring programs where manual coverage is prohibitively expensive and time-consuming. Furthermore, AI helps in validating the integrity of samples collected by cross-referencing metadata, such as temperature and flow rates at the time of collection, against expected norms, flagging any anomalies that might indicate compromised data quality or equipment malfunction.

Beyond logistical optimization, AI is instrumental in post-sampling data processing and interpretation. Machine learning models analyze complex spectral data and chemical fingerprinting derived from lab analysis of the collected samples, rapidly identifying correlation patterns between different pollutants or sources that human analysts might overlook. This capability accelerates the investigative process following a pollution event. For water sampler manufacturers, this means designing instruments that are "AI-ready," featuring advanced telemetry, standardized data output formats (GEO/AEO compatible), and robust internal processors capable of executing basic edge computing tasks. Integrating AI allows samplers to act as intelligent nodes within a larger, interconnected water quality network, contributing to a holistic and resilient monitoring ecosystem that can instantly respond to environmental changes or crises.

- AI-driven Predictive Sampling: Optimizes collection timing based on forecasted flow rates, weather, and pollution risk models.

- Automated Data Validation: Machine learning algorithms analyze sampling metadata to flag potential collection errors or system anomalies.

- Enhanced Anomaly Detection: AI processes high-volume sensor data to trigger automated sampler activation during sudden contamination events.

- Resource Optimization: Reduces unnecessary sampling trips, leading to significant savings in operational costs and carbon footprint.

- Integration with Smart Networks: Facilitates seamless data flow between automated samplers, analytical laboratories, and centralized water management platforms.

DRO & Impact Forces Of Water Sampler Market

The Water Sampler Market is strategically influenced by a dynamic interplay of factors encompassing strict regulatory mandates acting as key drivers, coupled with budgetary and logistical constraints serving as significant restraints, while the burgeoning field of environmental contaminants presents substantial opportunities. The primary impact forces ensuring continuous market growth stem from global initiatives focused on water safety and sustainable development, which necessitate continuous, verifiable data acquisition. Regulatory bodies worldwide, such as the EPA in the US and the European Environment Agency (EEA), continuously update standards for acceptable pollutant levels, forcing industrial and municipal operators to invest in sophisticated, legally defensible sampling technologies capable of meeting low detection limits and high data integrity requirements. The imperative to demonstrate compliance drives persistent demand for high-end automatic and specialized samplers.

A major driver is the accelerating issue of global water scarcity and the pervasive threat of waterborne diseases, particularly in rapidly urbanizing regions, compelling public health organizations to intensify monitoring efforts. This leads to increased procurement of portable, durable samplers for remote field use and integrated systems for distribution network surveillance. Conversely, the market faces significant restraints, including the high initial capital investment required for advanced automated sampling stations, which often include power supplies, refrigeration units, and complex programming interfaces. Furthermore, operational challenges such as the need for highly skilled technicians for maintenance and calibration, potential clogging issues in high-solids environments, and the dependency on reliable communication networks in remote locations pose barriers, particularly for smaller municipalities or organizations with limited technical expertise.

However, the sector is ripe with opportunity due to the expanding research into and regulation of emerging pollutants, including pharmaceuticals, microplastics, and novel industrial chemicals. Developing specialized samplers, such as passive diffusion systems or high-volume filtration units tailored specifically for trace contaminant collection, presents a high-value niche for manufacturers. Technological integration represents a crucial impact force; the convergence of sampling hardware with Internet of Things (IoT) sensors, cloud computing, and real-time visualization software is transforming samplers into indispensable components of comprehensive water intelligence platforms. This integration not only optimizes the sampling process but also creates new revenue streams through data services and sophisticated monitoring contracts, thereby substantially expanding the total addressable market beyond just hardware sales.

Segmentation Analysis

The Water Sampler Market segmentation provides a detailed structure for understanding varied demands across different user groups, applications, and technological requirements. Segmentation is primarily based on the operational mechanism of the equipment (Product Type), the environmental matrix being monitored (Application), and the purchasing entities (End-User). This framework helps manufacturers tailor product development strategies, focusing on optimizing factors like collection reliability, portability, and automation features necessary for specific environmental settings, such as high-turbidity industrial wastewater or pristine, deep-sea research sites. Analyzing these segments is essential for strategic market entry and competitive positioning.

- By Product Type:

- Automatic Samplers (Time-based, Flow-based, Event-based)

- Manual Samplers (Grab Samplers, Depth Samplers, Weighted Samplers)

- Specialized Samplers (Groundwater Samplers, Passive Samplers, Microbial Samplers, Sediment Samplers)

- By Application:

- Environmental Monitoring (Rivers, Lakes, Coastal Waters, Groundwater)

- Wastewater Treatment and Compliance (Municipal and Industrial Effluent)

- Drinking Water Surveillance and Analysis

- Research and Academia

- By End-User:

- Government Agencies and Regulatory Bodies (EPA, State Agencies)

- Environmental Consulting Firms

- Industrial Facilities (Chemical Processing, Oil & Gas, Food & Beverage, Mining)

- Utilities and Water Treatment Plants

- Research Institutions and Universities

Value Chain Analysis For Water Sampler Market

The value chain for the Water Sampler Market initiates with upstream activities involving the sourcing of specialized raw materials, including corrosion-resistant polymers, stainless steel, and advanced electronic components necessary for sensor integration and automated controls. Key upstream challenges involve managing supply chain volatility for sophisticated electronics and ensuring the availability of high-purity materials that do not contaminate the collected water samples, a critical requirement for regulatory compliance. Manufacturers focus heavily on precision engineering and robust quality control during the production phase, as the reliability and accuracy of the sampler directly impact the legality and usability of the collected data. Strategic partnerships with sensor manufacturers, particularly those specializing in pH, dissolved oxygen, and conductivity probes, are vital for providing comprehensive, integrated sampling solutions.

Downstream analysis focuses on distribution, sales, and post-sales services, which are critical differentiators in this technical market. Distribution channels are typically dual: direct sales utilized for large government tenders, specialized research institutions, and major industrial clients requiring custom configurations and detailed technical support; and indirect distribution through a network of specialized environmental equipment distributors and regional dealers who provide localized service, rapid maintenance, and training. The complexity of the equipment necessitates high levels of technical training for both the sales force and field service engineers, often creating barriers to entry for new market participants lacking established global service networks.

Post-sales support, encompassing calibration, maintenance contracts, and the provision of certified spare parts, constitutes a significant revenue stream and directly influences customer loyalty and equipment lifespan. The efficiency of the distribution channel impacts customer satisfaction regarding the rapid deployment of equipment for emergency response monitoring. Direct channels allow for tighter control over product demonstration and technical consultation, while indirect channels provide wider geographical reach. Successful companies invest heavily in comprehensive digital platforms that offer technical documentation, remote diagnostics, and preventative maintenance schedules, thereby optimizing the entire lifecycle of the water sampling equipment and maximizing the return on investment for the end-user.

Water Sampler Market Potential Customers

The potential customers for water sampling equipment are highly diverse but predominantly centered within entities responsible for environmental stewardship, public health protection, and industrial regulatory compliance. End-users fall into distinct categories, each utilizing specialized equipment tailored to their operational needs. Government agencies, including environmental protection bodies (like the EPA, regional water boards) and public health departments, constitute the largest buyer segment. They require robust, high-volume automated samplers for routine compliance monitoring of major waterways, municipal sewage treatment plants, and drinking water sources, demanding verifiable data integrity for legal enforceability.

Industrial facilities, particularly those in chemical manufacturing, oil and gas, mining, and food and beverage sectors, represent another substantial customer base. These entities require samplers, often explosion-proof or specialized for high-temperature/high-solids environments, to monitor their effluent streams rigorously before discharge. Their primary motivation is achieving and demonstrating compliance with industrial discharge permits to avoid hefty fines and operational shutdowns. The complexity of their waste streams often necessitates flow-proportional automated samplers linked directly to their process control systems.

Furthermore, environmental consulting firms act as significant purchasers, acquiring portable, versatile samplers for groundwater assessments, site remediation projects, and compliance audits on behalf of their corporate clients. Research and academia purchase highly specialized, low-contamination samplers for deep-sea research, trace contaminant analysis, and long-term ecological studies. The trend towards integrating samplers with remote monitoring technology appeals directly to water utilities needing efficient management of large, often geographically dispersed, drinking water distribution networks to swiftly detect potential contamination ingress points, thereby safeguarding public supply integrity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.95 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teledyne Isco, Hach (Danaher Corporation), Xylem Inc., Horizon Water Monitoring, Global Water Instrumentation, Inc., SEBA Hydrometrie GmbH & Co. KG, Hydroline Solutions, Aqua-Q, Inc., Endress+Hauser Group, Siemens AG, Interocean Systems Inc., Fondis Electronic, Eureka Water Quality Instruments, ISOLOK, Proactive Environmental Products. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Water Sampler Market Key Technology Landscape

The technological landscape of the Water Sampler Market is rapidly evolving, driven by the need for greater accuracy, reduced human intervention, and seamless data integration. A central technological advancement is the integration of Internet of Things (IoT) connectivity, allowing automated samplers to communicate real-time operational status and sensor data directly to cloud platforms. This enables predictive maintenance, remote troubleshooting, and dynamic adjustment of sampling protocols based on immediate environmental conditions. Modern samplers often feature highly precise peristaltic pumps and inert tubing materials, crucial for ensuring sample integrity, especially when collecting samples for ultra-trace analysis of compounds like PFAS, where contamination from the sampler itself must be meticulously avoided. Battery technology advancements are also critical, enabling longer deployment times for remote, solar-powered units, reducing the logistical burden of frequent site visits.

Another dominant technological trend is the proliferation of multi-parameter sensors directly integrated into the sampling inlet or housing. These sensors measure fundamental parameters (pH, conductivity, temperature, turbidity, ORP) concurrently with sample collection. This integration provides a comprehensive snapshot of the water matrix at the exact moment of sampling, adding contextual metadata vital for data interpretation and compliance documentation. The technological focus is moving toward miniaturization and ruggedization, particularly for groundwater and deep-sea samplers, which require extremely durable, pressure-resistant housings and non-contact collection mechanisms to avoid disturbance of the water column or aquifer. Furthermore, the development of specialized passive samplers (e.g., Polar Organic Chemical Integrative Samplers - POCIS) utilizing sophisticated adsorbent materials represents a significant leap, offering time-weighted average concentrations of pollutants that are difficult to capture through discrete, instantaneous sampling methods.

The convergence of automated sampling with Artificial Intelligence and advanced data analytics platforms is perhaps the most transformative technological shift. AI algorithms analyze historical data and real-time sensor inputs to implement "smart sampling" routines, activating collection only when specific anomalous conditions are met, ensuring samples are collected during contamination peaks rather than merely during routine, potentially uneventful periods. This level of technological sophistication requires high-speed processors within the sampler itself (edge computing) and secure, standardized communication protocols (such as MODBUS or MQTT) to interface reliably with supervisory control and data acquisition (SCADA) systems used by utilities and industrial operators. Manufacturers are now competing on the intelligence and integration capabilities of their samplers, moving beyond mere hardware supply to offering full data-to-decision solutions.

Regional Highlights

- North America (United States and Canada): This region is a mature market characterized by stringent regulatory oversight from agencies like the EPA, driving constant demand for high-end, legally defensible automatic samplers and specialized groundwater monitoring equipment. High expenditure on environmental compliance, extensive research activities focusing on emerging contaminants (e.g., PFAS, microplastics), and the widespread adoption of IoT technology in water utilities ensure continuous investment in state-of-the-art sampling infrastructure. The market here demands high durability, precision, and certification standards.

- Europe (Germany, UK, France, Scandinavia): Driven by the European Union’s Water Framework Directive (WFD) and strict national standards, Europe exhibits strong demand for sophisticated environmental monitoring solutions, particularly for transboundary river systems and coastal waters. Scandinavian countries are leaders in adopting sustainable and low-power remote sampling technologies. The focus is on implementing smart water networks, necessitating samplers that integrate seamlessly with existing digital utility infrastructure and adhere to strict data privacy and standardization mandates.

- Asia Pacific (China, India, Japan, Australia): APAC is the fastest-growing region, propelled by rapid industrialization, acute urban water pollution, and massive government initiatives aimed at upgrading wastewater treatment capacity and ensuring drinking water safety. While initial adoption often favored cost-effective manual options, the need for international compliance and large-scale infrastructure projects in China and India is rapidly accelerating the transition toward mass deployment of automated, high-capacity samplers. Japan and Australia, with mature regulatory environments, focus on advanced research and specialized environmental applications, particularly for drought and resource management.

- Latin America (Brazil, Mexico): Market growth in Latin America is uneven but strong, driven primarily by investments in mining, agriculture, and municipal water expansion. Demand is concentrated on rugged, portable samplers suitable for difficult terrain and challenging access, often relying on international funding or large corporate investments (e.g., oil and gas, metals processing) to upgrade monitoring capabilities, emphasizing reliability under harsh operational conditions.

- Middle East and Africa (MEA): This region presents a unique demand profile focused on sampling in extremely arid conditions and monitoring high-salinity industrial effluent from desalination and petrochemical facilities. Investments are often concentrated in major infrastructure projects funded by Gulf Cooperation Council (GCC) governments or international development agencies, prioritizing samplers that can withstand high temperatures, provide reliable performance for resource conservation efforts, and handle specialized analysis related to produced water and brine discharge.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Water Sampler Market.- Teledyne Isco (A Teledyne Technologies Company)

- Hach (A Danaher Corporation Company)

- Xylem Inc.

- Horizon Water Monitoring

- Global Water Instrumentation, Inc.

- SEBA Hydrometrie GmbH & Co. KG

- Hydroline Solutions

- Aqua-Q, Inc.

- Endress+Hauser Group

- Siemens AG

- Interocean Systems Inc.

- Fondis Electronic

- Eureka Water Quality Instruments

- ISOLOK (Bristol Equipment Company)

- Proactive Environmental Products

- Krohne Messtechnik

- Aquamatic Limited

- Odom Hydrographic Systems (Teledyne Marine)

- Campbell Scientific, Inc.

- Geotech Environmental Equipment, Inc.

Frequently Asked Questions

Analyze common user questions about the Water Sampler market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between automatic and manual water samplers?

Automatic water samplers collect samples autonomously based on pre-set time intervals or flow volume triggers, often incorporating refrigeration and data logging. Manual samplers require direct human operation and are typically used for instantaneous "grab" samples, site reconnaissance, or specialized depth collection in non-automated settings.

How is AI impacting the efficiency of water sampling operations?

AI utilizes predictive analytics, integrating real-time sensor data and environmental models to optimize sampling logistics. This allows for targeted, event-driven sample collection, activating samplers only when a contamination risk is predicted, significantly reducing operational costs and ensuring critical data capture.

Which end-user segment drives the largest demand for automated water samplers?

Government agencies and regulatory bodies, including environmental protection agencies and municipal water utilities, are the largest end-users. They require verifiable, continuous data for wastewater compliance reporting, long-term environmental monitoring of natural resources, and maintaining public drinking water safety standards.

What technological factors are critical for sampling emerging contaminants like PFAS?

For emerging contaminants, critical technological factors include using inert, non-contaminating materials (e.g., non-Teflon components), highly precise low-flow pumping systems, and specialized passive samplers designed to concentrate trace pollutants effectively over a defined deployment period to ensure accurate laboratory analysis.

What is the expected growth rate (CAGR) for the Water Sampler Market through 2033?

The Water Sampler Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.5% from 2026 to 2033, driven by regulatory mandates, infrastructure modernization in developing regions, and the increasing global focus on water quality and security.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager