Waterjet Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436447 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Waterjet Machine Market Size

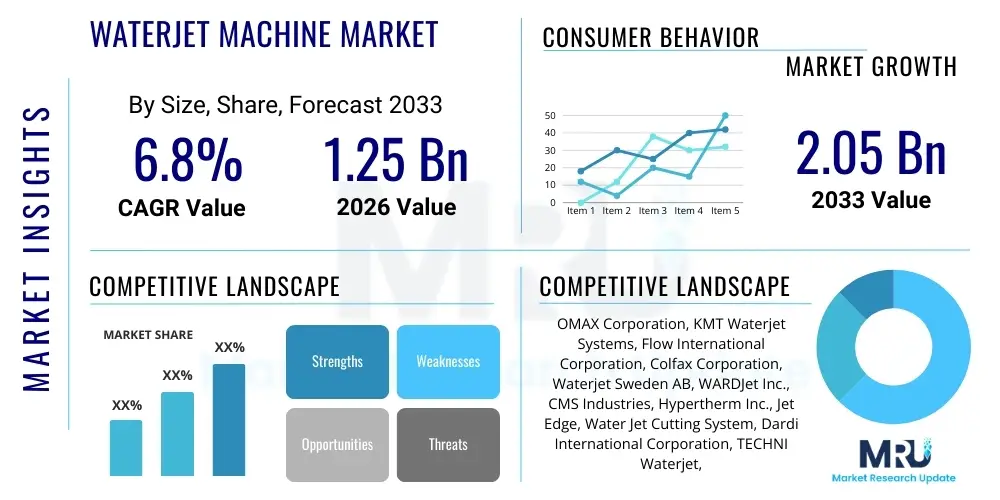

The Waterjet Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 2.05 billion by the end of the forecast period in 2033.

The impressive growth trajectory is primarily attributed to the increasing demand for precision cutting technologies across crucial manufacturing sectors, particularly aerospace and automotive. Waterjet cutting offers unparalleled advantages in material versatility, accommodating everything from highly sensitive composites and laminates to thick metals, without inducing thermal stress or creating a heat-affected zone (HAZ). This capability is critical in modern manufacturing where material integrity is paramount, driving substantial investment in advanced waterjet systems, especially those utilizing ultra-high-pressure (UHP) pump technology.

Furthermore, stringent regulatory requirements concerning environmental safety and waste reduction in industrial processes are bolstering the adoption of waterjet technology. Unlike many conventional machining methods, waterjet cutting minimizes particulate emissions and requires fewer coolants and lubricants, aligning with global sustainability mandates. The continuous innovation in pump efficiency, nozzle lifespan, and motion control systems is also making waterjet machines more cost-effective over their operational life, thereby accelerating market penetration across small and medium enterprises (SMEs) seeking high-quality, flexible fabrication solutions to maintain competitive parity with larger industrial players globally.

Waterjet Machine Market introduction

The Waterjet Machine Market encompasses specialized industrial equipment designed for precision cutting, shaping, and etching various materials using a highly pressurized stream of water, often mixed with abrasive particles like garnet. These sophisticated machines leverage Ultra-High-Pressure (UHP) pumps, typically operating between 60,000 psi and 94,000 psi, to achieve intricate and complex cuts with minimal material waste. The primary products include pure waterjet cutters, which are ideal for soft materials such as rubber, foam, and textiles, and abrasive waterjet cutters, which incorporate abrasives to efficiently process hard materials like metals, ceramics, glass, and composites. The versatility of waterjet technology allows for operation without thermal deformation, making it indispensable in sectors requiring high material integrity.

Major applications of waterjet technology span multiple high-value industries. In the automotive sector, they are used for cutting interior components, chassis parts, and specialized engine seals. The aerospace industry relies heavily on waterjet machines for fabricating complex aircraft parts from titanium, aluminum alloys, and carbon fiber reinforced polymers (CFRPs), where thermal integrity is a non-negotiable requirement. Furthermore, the electronics and medical device manufacturing industries utilize these machines for cutting precise components and intricate surgical tools, capitalizing on the technology's ability to achieve extremely tight tolerances and smooth edge finishes. The key benefit driving market growth is the omni-directional cutting capability coupled with the elimination of post-processing requirements in many scenarios, significantly enhancing overall manufacturing throughput.

Key driving factors propelling the market include the global transition towards advanced composite materials, especially in transportation sectors, which are difficult to machine using traditional methods. The continuous enhancement in automation features, such as five-axis cutting and integration with Computer Numerical Control (CNC) systems, boosts productivity and operational efficiency. The market is also benefiting from the increasing adoption of Industry 4.0 principles, where waterjet machines are integrated into smart factories, enabling real-time monitoring and predictive maintenance. This technological convergence ensures higher uptime and reduced operational costs, further solidifying the waterjet machine's position as a critical asset in modern, high-precision manufacturing environments.

Waterjet Machine Market Executive Summary

The global Waterjet Machine Market is characterized by robust technological advancements focused on higher pressure capabilities, enhanced energy efficiency, and tighter integration with smart manufacturing ecosystems. Current business trends indicate a strong focus on developing hybrid cutting systems that combine waterjet technology with other methods, such as laser or plasma, to optimize production flexibility and process specific, highly complex materials. Geographically, the market expansion is heavily concentrated in Asia Pacific, driven by massive investments in infrastructure development, rapid industrialization, and the establishment of large-scale electronics and automotive manufacturing hubs, particularly in China and India. This regional dominance is forcing global manufacturers to establish localized production and service centers to maintain competitiveness.

Segment trends highlight the abrasive waterjet segment maintaining the largest market share due to its superior capability in processing hard and thick materials essential for heavy engineering and aerospace applications. However, the pure waterjet segment is witnessing accelerated growth, fueled by the rising demand for non-metallic flexible materials in packaging, textiles, and gasket manufacturing. A crucial technological segment driving profitability is the ultra-high-pressure pump category, particularly the direct drive pumps, which offer superior efficiency and lower maintenance requirements compared to traditional intensifier-based pumps, subsequently influencing customer purchasing decisions based on Total Cost of Ownership (TCO). Strategic mergers, acquisitions, and collaborations among key players are common business maneuvers aimed at expanding geographic reach and integrating specialized pump or software technology.

In terms of strategic direction, the market is shifting towards offering comprehensive service contracts and customized solutions tailored to specific end-user requirements, moving beyond simply selling machinery. The emphasis is on integrating advanced software for nesting optimization and remote diagnostics, ensuring maximum material utilization and minimal operational downtime. Companies are also investing heavily in training and certification programs to address the shortage of skilled technicians capable of operating and maintaining these complex, high-pressure systems. Overall, the market remains competitive, propelled by the persistent need for highly accurate, environmentally friendly, and flexible material processing capabilities across the global industrial landscape.

AI Impact Analysis on Waterjet Machine Market

Common user questions regarding AI's influence on the Waterjet Machine Market center on how Artificial Intelligence can improve cutting precision, reduce material wastage, and predict system failures. Users are primarily concerned with the transition cost and complexity involved in integrating AI-driven software with existing CNC waterjet systems, focusing on tangible benefits such as optimized nesting algorithms, which maximize yield from expensive raw materials like aerospace-grade titanium or carbon composites. Furthermore, there is significant interest in AI's role in enabling fully autonomous operation, requiring less human intervention and reducing the dependency on highly specialized operators. The core expectation is that AI will transform waterjet machinery from sophisticated cutting tools into intelligent, self-optimizing manufacturing centers, guaranteeing consistent quality irrespective of material variability or operational conditions.

The introduction of AI is fundamentally restructuring the operational paradigm of waterjet machinery, moving from reactive maintenance to predictive maintenance strategies. AI algorithms analyze continuous data streams from sensors monitoring pump pressure, flow rates, abrasive feeding mechanisms, and nozzle wear. By establishing baseline operational parameters and identifying subtle anomalies, AI can accurately forecast component failure, allowing maintenance to be scheduled precisely when needed, thereby eliminating unscheduled downtime—a critical factor in high-volume production environments. This predictive capability significantly extends the lifespan of expensive UHP components, such as intensifier seals and cutting nozzles, leading to substantial reductions in overall maintenance expenditure and enhancing machine availability.

Moreover, AI is revolutionizing the pre-cutting process through advanced nesting and path optimization software. Traditional nesting often relies on manual or heuristic programming, leading to suboptimal material usage. AI and machine learning (ML) models analyze complex geometric patterns and material characteristics instantaneously to generate the most efficient cutting paths, minimizing kerf waste and maximizing part yield. In complex multi-axis cutting, AI ensures dynamic adjustment of cutting speeds and pressure profiles to maintain consistent edge quality around contours and corners, compensating for inherent system variances or minor material inconsistencies, ultimately guaranteeing superior final product quality and contributing significantly to higher profitability for manufacturers.

- AI enables predictive maintenance by analyzing sensor data for UHP pump failure forecasting.

- Machine learning algorithms optimize cutting path and material nesting, reducing scrap and improving yield by up to 15%.

- AI-powered quality control systems utilize machine vision for real-time edge inspection and deviation correction during the cutting process.

- Enhanced automation through AI facilitates lights-out manufacturing and autonomous machine operation.

- ML models optimize variable cutting parameters (pressure, speed, abrasive flow) based on material density and thickness for consistent cut quality.

DRO & Impact Forces Of Waterjet Machine Market

The Waterjet Machine Market is fundamentally shaped by a confluence of powerful drivers (D), significant restraints (R), and compelling opportunities (O), creating distinct impact forces. The primary drivers include the escalating demand for high-precision manufacturing solutions across industries like aerospace and medical devices, where tight tolerances and zero-thermal-stress processing are mandatory. Furthermore, the inherent versatility of waterjet technology, allowing it to cut virtually any material without specialized tooling changes, provides a powerful competitive edge over traditional cutting methods. However, the market faces constraints, notably the extremely high initial capital investment required for Ultra-High-Pressure (UHP) systems and the ongoing operational costs associated with abrasive materials (garnet) and frequent maintenance of UHP seals. Despite these restraints, substantial opportunities exist in the development of hybrid cutting systems and the increasing adoption within emerging economies that are rapidly industrializing their manufacturing sectors. These forces collectively dictate market expansion, technological focus, and competitive strategies among key players.

Drivers: A primary driver is the widespread adoption of advanced composite materials, particularly carbon fiber reinforced plastics (CFRPs) and specialized alloys in aerospace and defense. These materials are highly susceptible to damage from heat or mechanical stress, making the cold cutting process of waterjet technology indispensable. Additionally, the growing focus on environmental sustainability is favoring waterjet systems, as they generate minimal atmospheric contaminants and reduce the need for hazardous cutting fluids compared to milling or grinding. The increasing sophistication of CNC control systems and the integration of five-axis cutting capabilities further enhance the precision and complexity of parts that can be manufactured, thereby expanding the potential application base across numerous sectors.

Restraints: The most significant restraint is the high upfront cost of UHP waterjet machines, which often deters Small and Medium Enterprises (SMEs) from adoption despite the operational benefits. Maintenance complexity is another major barrier; UHP pumps operate under extreme stress, necessitating specialized, often expensive, replacement parts and skilled maintenance technicians. Furthermore, the operational cost associated with garnet abrasive disposal and recycling, particularly in highly regulated regions, adds to the total cost of ownership, making manufacturers evaluate cost-benefit scenarios critically, especially for materials that can be processed adequately by less expensive methods like plasma or standard laser cutting.

Opportunities: Key opportunities lie in the proliferation of abrasive recycling and management systems that lower operational costs and enhance sustainability, making waterjet cutting more economically viable. The development of intelligent, software-driven waterjet systems, leveraging AI for path optimization and preventative maintenance, promises to significantly reduce downtime and material waste. Moreover, the vast untapped potential in emerging markets in Southeast Asia and Latin America, driven by massive investments in infrastructure and localized manufacturing capacity building, offers substantial avenues for market penetration and sustained revenue growth over the forecast period.

Segmentation Analysis

The Waterjet Machine Market segmentation provides a granular view of market dynamics based on product type, pressure, end-use industry, and application. This analysis is crucial for strategic decision-making, revealing which technological segments are driving growth and which industrial sectors exhibit the highest demand elasticity. The market is primarily bifurcated based on the cutting medium into pure waterjet and abrasive waterjet systems, with the latter dominating due to its broad applicability across hard materials. Further segmentation by pressure type, namely High Pressure (HP) and Ultra-High Pressure (UHP), demonstrates the industry's sustained migration towards UHP systems (60,000 psi and above) for maximum efficiency and precision, necessary for cutting high-performance materials used in critical applications like turbine blades and medical implants. Analyzing these segments helps stakeholders understand the specific technological investments required to capture market share within specialized manufacturing niches.

The segmentation by end-use industry is particularly revealing, highlighting the dominance of the automotive and aerospace sectors, which prioritize precision, non-thermal processing, and complex component fabrication. The market is also segmented by sales channel, distinguishing between direct sales, which are common for large, customized industrial systems, and indirect sales through distributors, often utilized for standardized or smaller models catering to general fabrication shops. The consistent growth across all segments underscores the waterjet machine's fundamental role as a versatile and high-performance fabrication tool. Furthermore, the rise in demand from the stone and tile industry, capitalizing on the ability of waterjets to create intricate patterns and flawless edge cuts, provides a strong minor segment driver for specific machine configurations, such as gantry-style systems.

- By Product Type:

- Abrasive Waterjet Cutting Machine

- Pure Waterjet Cutting Machine

- By Pressure:

- Ultra-High Pressure (UHP) Waterjet Machines (60,000 psi and above)

- High Pressure (HP) Waterjet Machines (below 60,000 psi)

- By End-Use Industry:

- Automotive

- Aerospace & Defense

- Heavy Engineering & Manufacturing

- Stone, Tile, and Glass

- Medical Devices

- Electronics

- Others (Textiles, Food, etc.)

- By Component:

- Pumps (Intensifier, Direct Drive)

- Cutting Heads/Nozzles

- Abrasive Delivery Systems

- Software and Controllers

Value Chain Analysis For Waterjet Machine Market

The value chain of the Waterjet Machine Market begins with upstream activities focused on the procurement of highly specialized, precision components. This includes the sourcing of materials for Ultra-High-Pressure (UHP) pumps, such as specialized ceramics, high-strength stainless steel alloys, and complex sealing materials capable of withstanding extreme pressures and abrasive environments. Key upstream suppliers include manufacturers of intensifier pumps, direct-drive pumps, sophisticated motion control systems, and specialized CNC software developers. The quality and reliability of these upstream components directly impact the machine's performance, durability, and operational lifespan, making supplier relationships highly strategic. Intense research and development in this stage focus on improving pump efficiency and reducing component wear, which are critical cost centers for end-users. The development of advanced garnet abrasives, ensuring optimal cutting speed and finish, also forms a crucial part of the upstream segment.

The midstream segment involves the core manufacturing and assembly of the waterjet systems. Major Original Equipment Manufacturers (OEMs) design, integrate, and assemble the various components, including the cutting table, gantry, UHP system, and sophisticated software interfaces. This stage involves complex engineering to ensure dynamic accuracy, system rigidity, and seamless integration of multi-axis cutting capabilities. Efficiency in this stage is driven by lean manufacturing principles and high-quality control to ensure the integrity of the UHP pathways. Downstream activities focus on distribution, sales, installation, and, most critically, aftermarket services. Due to the high investment nature of the equipment and the need for specialized maintenance, service contracts, spare parts supply, and technical training represent a significant portion of the downstream revenue stream.

Distribution channels in the market are bifurcated into direct and indirect methods. Direct sales are preferred by major global OEMs when dealing with large industrial clients (e.g., aerospace prime contractors) that require highly customized and integrated solutions, allowing for better control over installation and service. Indirect channels involve regional distributors and value-added resellers (VARs) who provide localized sales, technical support, and faster response times for smaller fabrication shops or regional customers. Effective downstream strategy relies heavily on robust service networks capable of quick response times for UHP pump maintenance and component replacement, ensuring high customer satisfaction and repeat business, which is essential given the long lifecycle of these machines.

Waterjet Machine Market Potential Customers

Potential customers for waterjet machine technology are heavily concentrated in industries that demand high material precision, versatility, and non-thermal processing capabilities. The primary end-users are large-scale manufacturing enterprises in the automotive and aerospace sectors. Automotive manufacturers utilize waterjet systems for cutting complex internal engine components, specialized gasket materials, and interior trim plastics and fabrics, valuing the fast turnaround and ability to cut layered or heterogeneous materials. Aerospace manufacturers, however, represent the most critical customer segment, utilizing waterjets almost exclusively for processing sensitive materials such as titanium alloys, Inconel, and various composite structures like CFRPs, where the avoidance of thermal stress and micro-cracking is a non-negotiable quality requirement necessary for flight safety and component durability. These clients prioritize UHP and multi-axis cutting capabilities.

Beyond the core manufacturing giants, the secondary segment of potential customers includes specialized contract manufacturers and fabrication job shops that cater to diverse industries. These smaller entities require flexible machining capabilities to handle a wide range of materials and job sizes, often preferring gantry-style waterjet systems for their adaptability. Furthermore, the electronics and medical device industries are increasingly critical potential customers. Manufacturers of electronics components use pure waterjets for cutting delicate circuit board substrates and plastics, while medical device companies leverage the technology to fabricate precise surgical tools, implants, and intricate components from materials like stainless steel, titanium, and polymers, where contamination and edge quality are paramount concerns. These customers often seek smaller footprint, high-accuracy machines with advanced software integration.

A rapidly expanding customer base is found within the construction, stone, and architectural sectors. These entities use abrasive waterjets for cutting thick glass, shaping intricate ceramic and stone tiles for luxury flooring, and fabricating decorative metal screens. The ability to create complex, smooth-edged geometric shapes with minimal breakage makes waterjet technology superior to traditional tile saws or milling tools in these aesthetic-driven applications. To capture these varied customer segments, manufacturers are developing modular systems that offer varying levels of pressure and automation, ensuring the Total Cost of Ownership aligns with the expected production volumes and precision requirements of each specific end-user category, whether it's a high-volume Tier 1 automotive supplier or a custom architectural fabricator.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.05 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OMAX Corporation, KMT Waterjet Systems, Flow International Corporation, Colfax Corporation, Waterjet Sweden AB, WARDJet Inc., CMS Industries, Hypertherm Inc., Jet Edge, Water Jet Cutting System, Dardi International Corporation, TECHNI Waterjet, Resato International, A&V Waterjet, Bystronic Group, Koike Aronson, Ltd., Waterjet Holdings, Inc., Aqua-Cut Industries, Mitsubishi Electric Corporation, AL-TECH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Waterjet Machine Market Key Technology Landscape

The technological landscape of the Waterjet Machine Market is dominated by advancements in Ultra-High-Pressure (UHP) generation and precision motion control systems. The primary technology driving performance is the UHP pump, which is categorized into intensifier pumps and direct-drive pumps. Intensifier pumps, historically prevalent, rely on a hydraulic cylinder to intensify low-pressure water into extremely high-pressure output, typically reaching 94,000 psi. While robust, they require frequent seal replacement due to the cyclical stresses. Direct-drive pumps, conversely, use crankshafts and plungers to generate pressure directly, offering superior energy efficiency, smoother pressure output, and longer maintenance intervals, making them increasingly popular for high-throughput operations where continuous reliability is paramount. The ongoing innovation in pump sealing technology, using advanced composite materials and specialized ceramics, is a key area of research aimed at extending maintenance cycles and reducing the Total Cost of Ownership.

A second critical technology cluster involves multi-axis cutting and closed-loop control systems. Modern waterjet machines often feature five-axis or even six-axis cutting heads, allowing for complex 3D cuts, beveling, and angled processing, which significantly expands the application scope in aerospace and specialized tool manufacturing. These advanced systems rely on sophisticated Computer Numerical Control (CNC) software integrated with real-time feedback loops (closed-loop control) that monitor and adjust cutting parameters—such as cutting speed, pressure, and abrasive flow—to maintain dimensional accuracy and surface finish regardless of minor variations in material thickness or machine mechanics. The integration of advanced motion control algorithms ensures that the cutting head maintains precise trajectory even at high traversing speeds, which is essential for maximizing productivity while upholding the rigorous quality standards required by modern industry.

Furthermore, the market is undergoing a significant transformation due to the integration of Industry 4.0 enabling technologies. This includes sophisticated software for automated nesting (maximizing material yield), predictive maintenance through embedded IoT sensors, and remote diagnostics capabilities. The cutting head technology itself is also evolving, with improvements in orifice and nozzle design—often utilizing diamond or highly specialized ceramic orifices—to ensure maximum jet coherence and focusing power over extended operational periods. These technological enhancements are crucial for meeting the increasing industry demand for higher cutting speeds and superior edge quality while minimizing abrasive consumption and operational energy use, establishing technology differentiation as a primary competitive tool in the global market.

Regional Highlights

Geographical analysis reveals distinct adoption patterns and growth rates across major global regions, reflecting local manufacturing intensity and technological maturity. North America remains a highly mature and technologically advanced market, dominating in terms of technology adoption, particularly in Ultra-High-Pressure (UHP) and five-axis cutting systems. The region's market strength is anchored by substantial demand from the well-established aerospace and defense industries, particularly in the United States, which require the highest level of precision and non-thermal processing for advanced materials like titanium and composites. The presence of leading waterjet system manufacturers and a strong ecosystem for advanced R&D ensures continued innovation and replacement cycles for older machinery. North American companies are early adopters of AI-driven optimization and smart factory integration, focusing heavily on operational efficiency and reduced material waste.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period, driven by rapid industrialization, massive investments in infrastructure (including automotive manufacturing, shipbuilding, and construction), and the shifting of global manufacturing bases to countries like China, India, and South Korea. The lower labor costs combined with government initiatives promoting domestic manufacturing are fueling significant uptake of waterjet technology, often substituting traditional cutting methods to improve product quality and efficiency. While initial adoption may focus on slightly less advanced High Pressure (HP) or standard abrasive systems, the increasing complexity of manufacturing processes in the region, especially in consumer electronics and electric vehicle (EV) production, is rapidly escalating the demand for UHP and automated systems, making APAC the primary engine of future market expansion.

Europe represents a stable and highly advanced market characterized by a strong emphasis on automation, energy efficiency, and stringent environmental regulations. European demand is primarily concentrated in Germany, Italy, and France, driven by high-end automotive, specialized machine building, and general precision engineering sectors. European manufacturers prioritize environmentally sustainable waterjet solutions, including closed-loop water filtration and abrasive recycling systems. Although the growth rate might be slower compared to APAC, the average selling price (ASP) of machines tends to be higher due to the preference for customized, fully automated, high-precision systems integrated with sophisticated factory management software, reflecting the region's focus on high-value, quality-intensive production processes.

- North America: Market leader due to high adoption in Aerospace & Defense, early technological integration (UHP, 5-axis), and strong focus on automation and precision engineering.

- Asia Pacific (APAC): Fastest-growing region, fueled by rapid industrialization, expansion of automotive and electronics manufacturing, and government investments in infrastructure.

- Europe: Mature market focused on high-precision applications, emphasizing environmental compliance, energy efficiency, and high levels of automation across specialized engineering.

- Latin America (LATAM): Moderate growth driven by construction, infrastructure projects, and increasing local manufacturing capabilities, often utilizing less complex, affordable systems initially.

- Middle East & Africa (MEA): Growth attributed to oil and gas pipeline fabrication, significant construction projects, and emerging defense manufacturing, with demand concentrated in key industrial hubs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Waterjet Machine Market.- OMAX Corporation

- KMT Waterjet Systems

- Flow International Corporation

- Colfax Corporation

- Waterjet Sweden AB

- WARDJet Inc.

- CMS Industries

- Hypertherm Inc.

- Jet Edge

- Water Jet Cutting System

- Dardi International Corporation

- TECHNI Waterjet

- Resato International

- A&V Waterjet

- Bystronic Group

- Koike Aronson, Ltd.

- Waterjet Holdings, Inc.

- Aqua-Cut Industries

- Mitsubishi Electric Corporation

- AL-TECH

Frequently Asked Questions

Analyze common user questions about the Waterjet Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes abrasive waterjet cutting from pure waterjet cutting?

Abrasive waterjet cutting utilizes a mixture of high-pressure water and abrasive particles (typically garnet) to cut hard materials such as metals, stone, and composites, offering maximum material penetration and speed. Pure waterjet cutting uses only water at high pressure and is suited for processing softer materials like foam, rubber, textiles, and gaskets, offering clean cuts without the need for abrasive materials.

What is the primary factor driving the adoption of Ultra-High Pressure (UHP) systems?

The primary factor driving UHP adoption (60,000 psi and above) is the ability to achieve faster cutting speeds and superior dimensional accuracy, particularly when processing thick or challenging materials like aerospace-grade titanium and carbon fiber reinforced polymers (CFRP). Higher pressure results in a tighter stream and cleaner edge quality, reducing post-processing requirements.

How does the total cost of ownership (TCO) compare for waterjet machines versus laser cutters?

While the initial capital cost for waterjet machines, especially UHP models, can be high, their TCO is often favorable for versatile applications. Waterjets handle a wider range of materials, eliminate expensive tooling changes, and avoid the high energy costs associated with high-power lasers. However, waterjets have higher consumable costs related to abrasive material (garnet) and UHP component maintenance compared to operational costs of basic laser systems.

Which end-use industries are the largest consumers of waterjet technology?

The largest consumer sectors are the Aerospace & Defense and Automotive industries. Aerospace relies heavily on the non-thermal cutting capabilities for composites and specialty alloys, ensuring material integrity. Automotive uses the technology for high-volume, precise cutting of both metal components and interior materials.

What impact is Industry 4.0 having on waterjet machine design?

Industry 4.0 integration introduces IoT sensors, AI-driven software, and connectivity features that enable advanced capabilities such as predictive maintenance, remote diagnostics, and automated cutting path optimization (nesting). This transformation reduces unscheduled downtime, minimizes material waste, and enhances overall factory operational efficiency and throughput.

The extensive analysis provided above covers the critical facets of the Waterjet Machine Market, detailing technological drivers, segmentation analysis, competitive landscape, and the influence of emerging technologies such as AI. The market's future growth trajectory is heavily dependent on sustained innovation in UHP pump efficiency and deeper integration into automated smart factory environments globally.

This report serves as a foundational resource for stakeholders seeking to understand the dynamics and strategic opportunities within the high-precision waterjet cutting industry. Continued investment in R&D aimed at reducing the complexity and cost of UHP component maintenance will be pivotal for further market penetration, especially in cost-sensitive industrial segments seeking high-quality, flexible manufacturing solutions.

The increasing focus on sustainable manufacturing practices worldwide provides a substantial tailwind for waterjet technology, which is inherently cleaner than many traditional machining alternatives. As environmental regulations tighten and manufacturers prioritize reducing their ecological footprint, the demand for non-polluting cutting solutions will accelerate, solidifying the market position of advanced waterjet systems across all geographic regions and industrial applications over the forecast period.

Further technological advancements are expected in abrasive recycling systems. Currently, the disposal or management of spent abrasive garnet is a notable operating cost and environmental concern. Innovations leading to highly efficient, cost-effective on-site abrasive recycling units will significantly lower the operating barriers for potential customers, especially SMEs, and contribute to the market’s overall sustainability profile. Manufacturers investing in these circular economy solutions are likely to gain a competitive advantage in environmentally conscious markets, particularly in Europe and parts of North America where regulatory pressures are highest.

The global shift in automotive manufacturing towards electric vehicles (EVs) is generating new demand profiles. EV battery components and lightweight chassis materials often require highly precise, stress-free cutting, which waterjet technology is ideally suited for. This segment represents a strong vertical opportunity, driving the necessity for larger cutting tables and specialized fixturing, optimized for the high volumes and specific material stacks characteristic of battery manufacturing. This transition requires system manufacturers to collaborate closely with Tier 1 and Tier 2 EV suppliers to develop tailored, robust solutions.

In terms of competitive strategy, key market players are increasingly focusing on vertical integration, especially in critical components like UHP pumps and proprietary cutting software. By controlling the supply chain for high-wear parts, companies can better manage quality, reliability, and service responsiveness. This strategy not only ensures a stable supply of essential components but also allows manufacturers to offer superior service contracts and warranties, differentiating their offerings in a highly technical and competitive landscape. The ability to provide comprehensive training and certification programs for complex UHP maintenance is also becoming a crucial non-price determinant in securing large industrial contracts.

The Latin American and Middle Eastern markets, while smaller, present unique opportunities tied to regional economic diversification efforts. In the Middle East, substantial government investment in defense manufacturing and non-oil-related industrial development (Vision 2030 initiatives) is creating new demands for advanced fabrication machinery. Similarly, Latin American countries are modernizing their heavy engineering and mining equipment manufacturing sectors. These regions prioritize ruggedness, ease of maintenance, and strong local technical support, often opting for systems that balance advanced capabilities with reliability in harsh operating conditions, necessitating different product configurations than those preferred in Western Europe or Japan.

Finally, the growing sophistication of CAD/CAM software tailored specifically for waterjet applications is enhancing user accessibility and efficiency. Modern software solutions now incorporate sophisticated algorithms that calculate erosion rates in real-time, predict nozzle deflection, and automatically adjust offset parameters, drastically reducing setup time and the potential for human error. This software evolution is instrumental in making advanced waterjet technology accessible to a broader user base, including smaller job shops that previously lacked the highly specialized engineering expertise required for complex programming and optimization.

This detailed report highlights that the sustained momentum in the Waterjet Machine Market is not only technological but also strategic, driven by global shifts in manufacturing demands for precision, sustainability, and automated efficiency, positioning waterjet technology as a crucial tool for future industrial advancement. The competitive advantage will rest with firms that successfully marry UHP pump reliability with AI-driven operational intelligence and robust global service infrastructure.

The emphasis on minimizing the Heat-Affected Zone (HAZ) remains the cornerstone of waterjet market demand in high-integrity applications. In traditional cutting methods such as laser or plasma, the intense heat can alter the material properties near the cut edge, compromising structural performance, especially in aerospace components. Waterjet's 'cold cutting' process inherently bypasses this limitation, offering a clean, mechanically sound edge that typically requires no secondary machining, thereby streamlining the manufacturing process and significantly reducing overall cycle time and cost for high-value parts, further bolstering its adoption over competing technologies.

Another significant factor influencing market expansion is the capability of waterjet systems to pierce and cut stack laminates—multiple layers of different materials stacked together. This ability is crucial in various sectors, including the production of specialized vehicle armor, multi-layer gaskets, and sandwich panels used in architecture and transport. The precise control over the cutting stream allows simultaneous processing of varied hardness and thickness without delamination or tearing, a feat difficult to achieve consistently with mechanical or thermal cutting methods. This unique capability provides waterjet manufacturers with a specific competitive niche in complex fabrication scenarios.

Furthermore, the development of integrated water recycling and filtration systems is not just an environmental necessity but a cost-saving feature. Waterjet operations consume large volumes of water, and efficient closed-loop systems drastically reduce water consumption, lowering utility costs and mitigating dependence on local water supply constraints. Leading OEMs are now integrating sophisticated multi-stage filtration units that treat the spent water, often making it reusable in the cutting process, enhancing the machine's overall economic and environmental footprint, making the technology more appealing in regions facing water scarcity or high utility tariffs.

The market faces ongoing challenges related to acoustics. Although waterjet cutting is often quieter than mechanical milling, the sound generated by the UHP pump and the cutting process itself, especially in abrasive systems, can exceed occupational exposure limits. Consequently, manufacturers are investing in noise reduction enclosures and pump insulation technologies. Successful mitigation of noise pollution is a key factor for market acceptance in urbanized manufacturing environments and for ensuring compliance with evolving occupational health and safety standards across mature markets like Europe.

In summary, the sophisticated interplay between maximizing pressure for cutting performance, integrating smart technologies for operational efficiency, and innovating for lower maintenance burdens defines the current and future technological landscape of the Waterjet Machine Market. These integrated improvements ensure the technology remains at the forefront of precision, versatile, and sustainable material processing globally.

The market’s reliance on specialized personnel for maintenance, particularly UHP seal replacement and component calibration, continues to be a strategic concern. To address this restraint, manufacturers are increasingly developing modular pump designs that facilitate quicker, less specialized maintenance procedures. Training centers established by leading OEMs globally are attempting to close the skilled labor gap, ensuring that customers have access to qualified technicians who can maximize machine uptime and minimize the risk of costly high-pressure failures. The sophistication of remote diagnostic tools integrated into modern waterjet controllers further assists in preemptive troubleshooting, reducing the need for immediate on-site expert intervention for every minor issue.

The competitive landscape is intensifying, characterized by a mix of specialized waterjet manufacturers (like OMAX and Flow) and large industrial automation conglomerates (like Bystronic and Mitsubishi) who are integrating waterjet offerings into their broader fabrication solution portfolios. This integration strategy allows these large players to offer end-to-end solutions combining punching, laser cutting, and waterjet technologies, meeting diverse customer needs from a single source. This trend compels specialized waterjet companies to focus intensely on their core technological strengths—UHP pump longevity, proprietary software performance, and customer-specific application expertise—to maintain their competitive edge against diversified industrial giants.

Looking ahead, the evolution of abrasive material alternatives is another area of active R&D. While garnet remains the industry standard due to its hardness and low friability, research into synthesized or recycled ceramic abrasives is underway. Success in developing equally effective yet cheaper or more easily recyclable abrasive materials could significantly disrupt the operational cost structure of abrasive waterjet systems, potentially expanding their applicability into high-volume, cost-sensitive production lines currently dominated by cheaper cutting methods. This innovation stream represents a high-potential opportunity for reducing a key variable cost for end-users and improving the overall sustainability of the process.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Waterjet Machine Market Statistics 2025 Analysis By Application (Automotive, Stone & Tiles, Job Shops, Aerospace and Defense), By Type (High Pressure, Low Pressure), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Waterjet Machine Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (High pressure, Low pressure), By Application (Automobile, Stone&tiles, Job shops, Aerospace and defence, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager