Weapon Scope Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434818 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Weapon Scope Market Size

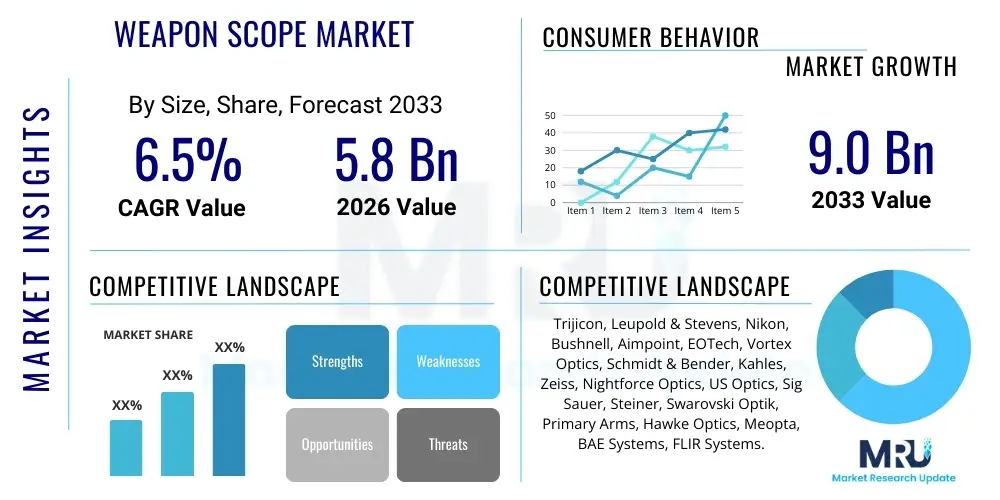

The Weapon Scope Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $9.0 Billion by the end of the forecast period in 2033.

Weapon Scope Market introduction

Weapon scopes, essential tools for precision aiming, encompass a range of optical devices designed to enhance accuracy and target acquisition for firearms. These products vary widely, including traditional telescopic sights, advanced red dot sights, holographic weapon sights, and cutting-edge digital and thermal imaging scopes. Major applications span professional defense and military operations, recreational hunting, and competitive shooting sports. The primary benefit derived from these devices is the substantial improvement in accuracy, especially over long distances or in adverse lighting conditions, thereby increasing operational effectiveness and user safety. The market growth is fundamentally driven by sustained global defense modernizations, rising consumer interest in recreational shooting activities, and continuous technological innovation, particularly the integration of sensor technology and complex digital features into sighting systems, making them increasingly sophisticated and versatile tools for diverse applications.

Weapon Scope Market Executive Summary

The Weapon Scope Market is currently characterized by robust technological advancement and shifting geopolitical dynamics. Key business trends include the increasing focus on miniaturization, lightweight designs, and the integration of smart features such as laser rangefinders and ballistic calculators directly into the scope hardware. Defense spending remains a primary driver, with military organizations globally demanding high-performance thermal and night vision capabilities for situational awareness in complex combat environments. Regionally, North America maintains its dominance due to a large base of recreational hunters and a significant military procurement budget, while the Asia Pacific region is demonstrating the fastest growth, propelled by the modernization efforts of major defense forces like China and India. Segmentation trends indicate that the digital and thermal scope segments are experiencing accelerated adoption rates, though traditional optical telescopic sights still command a large share, reflecting their reliability and cost-effectiveness across civilian applications. Competitive intensity is high, forcing manufacturers to invest heavily in R&D to deliver superior optical clarity and rugged durability compliant with military specifications.

AI Impact Analysis on Weapon Scope Market

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the capabilities of modern weapon scopes, transitioning them from purely optical tools to smart aiming systems. Users are increasingly concerned with how AI can automate complex tasks such as real-time target recognition, automatic ballistic drop compensation (BDC) based on environmental data, and enhanced fusion of sensor data (optical, thermal, and night vision). Common user questions revolve around the reliability of AI-driven shot correction, ethical implications of autonomous target engagement, and the cyber security vulnerabilities associated with connected smart scopes. This analysis suggests a strong market expectation for AI to significantly reduce the cognitive load on the operator, improve first-round hit probability, and provide superior data logging and situational awareness, especially in defense and specialized law enforcement applications.

AI’s influence extends beyond simple calculation; it facilitates predictive maintenance and optimizes power consumption in digital scopes, extending operational field time. Furthermore, machine vision algorithms enable automatic classification of targets (e.g., distinguishing between animals, humans, and vehicles), which is vital for ethical hunting practices and reducing collateral damage in military contexts. However, widespread adoption is currently limited by regulatory hurdles surrounding the military use of autonomous capabilities and the high computational cost required to run sophisticated ML models on compact, field-deployable hardware. Consequently, manufacturers are focused on edge computing solutions—running AI models directly on the scope processor to maintain speed and minimize data latency while enhancing overall accuracy.

The future trajectory suggests that AI will become standard in high-end weapon scopes, offering augmented reality overlays, real-time mapping of wind and atmospheric conditions, and integration with broader networked battle management systems. This necessitates robust user interfaces that can clearly present complex AI-derived data without overwhelming the shooter, solidifying the role of smart optics as critical components of the modern soldier's kit. Manufacturers must balance advanced computational features with user-friendly design and extreme ruggedness to meet the demanding requirements of military and professional users.

- AI enhances Automatic Ballistic Compensation (ABC) by integrating real-time environmental factors (temperature, pressure, humidity).

- Machine learning facilitates advanced target recognition and classification for improved situational awareness.

- AI-powered fusion optics combine thermal, digital, and standard optical views seamlessly for enhanced visibility in degraded conditions.

- Predictive analytics optimize battery life and system performance based on usage patterns.

- Automated zeroing procedures utilize AI to quickly and accurately calibrate the scope to the weapon system.

DRO & Impact Forces Of Weapon Scope Market

The Weapon Scope Market is profoundly influenced by a complex interplay of drivers, restraints, and opportunities, shaping its near-term and long-term trajectory. A primary driver is the pervasive increase in global defense expenditure, particularly focused on modernizing infantry equipment and improving soldier lethality through sophisticated sighting systems, including thermal and night vision capabilities. Simultaneously, the burgeoning popularity of recreational shooting sports and hunting activities, especially in North America and parts of Europe, fuels consistent demand for reliable and high-quality optical scopes. Technological advancements, such as the introduction of digital reticles, smart scopes with onboard processing, and miniaturized components, serve as significant accelerants, continually creating replacement cycles for older, analog equipment and driving higher average selling prices (ASPs) for premium products.

However, the market faces significant restraints that temper its growth potential. High regulatory scrutiny, particularly concerning the export and sale of advanced thermal and military-grade optics (governed by regimes like ITAR and EAR), limits market penetration and complicates international trade for many manufacturers. Furthermore, the high cost associated with advanced thermal and digital night vision scopes often creates a barrier to entry for civilian consumers and smaller defense forces, pushing them toward more traditional, less sophisticated alternatives. The market is also susceptible to geopolitical instability; shifts in military budgets or sudden imposition of trade restrictions can disrupt established supply chains and manufacturing timelines, increasing operational risk for key players.

Opportunities for expansion lie predominantly in emerging economies across the Asia Pacific and Latin America, where defense procurement is undergoing rapid modernization and middle-class disposable income, which supports recreational hunting, is rising. Furthermore, manufacturers have a substantial opportunity to capitalize on the growing demand for specialized scopes for unmanned aerial vehicles (UAVs) and remotely operated weapon stations (ROWS). Developing robust, cost-effective digital scope solutions that integrate seamlessly with existing C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) networks presents a significant area for innovation and market capture, allowing for superior data sharing and coordinated operations across various armed forces platforms.

Segmentation Analysis

The Weapon Scope Market segmentation provides a critical view of product adoption rates and end-user preferences across various technological and application categories. This market is primarily segmented based on the core technology utilized (optical, thermal, digital), the complexity of the product (telescopic, red dot, holographic), and the intended application (military, hunting, law enforcement, target shooting). The analysis highlights a clear dichotomy: while traditional optical scopes dominate the civilian market due to their simplicity and cost, high-growth segments are centered around digital and thermal imaging technology, which are paramount in defense and specialized security sectors requiring all-weather, 24/7 operational capability. Understanding these segments is crucial for strategic planning, allowing manufacturers to tailor R&D investments toward the most lucrative and rapidly evolving sub-markets, particularly those focused on smart features and advanced sensor fusion.

- By Product Type:

- Telescopic Sights (Riflescopes)

- Red Dot Sights

- Holographic Weapon Sights (HWS)

- By Technology:

- Optical Scopes

- Digital Scopes

- Thermal Imaging Scopes

- Night Vision Scopes (Image Intensifier Tube)

- By Application:

- Defense & Military

- Hunting

- Shooting Sports & Target Practice

- Law Enforcement & Security

- By Sales Channel:

- OEM (Original Equipment Manufacturer)

- Aftermarket (Retail/Distribution)

Value Chain Analysis For Weapon Scope Market

The value chain for the Weapon Scope Market is intricate, spanning from highly specialized component manufacturing to complex, restricted distribution channels. The upstream segment is dominated by suppliers of critical raw materials and highly specialized components, including precision optical glass (lenses and prisms), specialized coatings (anti-reflective and scratch-resistant), micro-displays for digital scopes, and highly sensitive thermal sensor arrays (microbolometers). The quality and consistency of these upstream inputs directly dictate the performance, clarity, and durability of the final product. Key risks at this stage include supply chain concentration, especially for high-end optical glass and thermal sensor components, which can be subject to geopolitical trade restrictions and volatility in pricing, compelling manufacturers to secure long-term supplier agreements and occasionally vertically integrate specialized component production.

The core manufacturing and assembly stage involves high-precision machining of scope bodies (often aerospace-grade aluminum), meticulous assembly in cleanroom environments to prevent internal debris, purging with inert gases (like nitrogen or argon) for fog resistance, and rigorous testing for shock and waterproofing. Downstream, the distribution channel is highly bifurcated. Direct sales channels are typically used for large defense contracts, where manufacturers work directly with government procurement agencies or prime contractors to meet specific military specifications (Mil-Spec). This channel requires extensive regulatory compliance and detailed technical support.

The indirect channel caters mainly to civilian, hunting, and sports segments, utilizing specialized distributors, large sporting goods retailers, and a rapidly expanding e-commerce presence. The rise of online sales necessitates strong brand presence and sophisticated digital marketing, as consumers often rely heavily on peer reviews and expert endorsements when purchasing high-value optical equipment. Effective channel management is paramount, as manufacturers must navigate varying regulatory landscapes regarding scope magnification and night vision capabilities across different geographic markets, ensuring compliance while maximizing market reach.

Weapon Scope Market Potential Customers

Potential customers for weapon scopes are highly segmented across three primary categories: the military and defense sector, law enforcement agencies, and the vast civilian market comprising hunters and recreational/competitive shooters. The military and defense sector represents the most lucrative, albeit highly regulated, customer base. These entities prioritize ruggedness, reliability under extreme conditions (shock, temperature variation), and advanced technological features such as thermal fusion, laser rangefinding integration, and compatibility with networked battlefield systems. Procurement cycles are long, based on specific performance standards (e.g., MIL-STD-810G), and often involve large-volume contracts, making them key strategic targets for high-end scope manufacturers specializing in tactical optics.

Law enforcement agencies, including local police departments, SWAT teams, and border patrol units, constitute another critical segment. These customers require robust, yet often less technologically complex and less expensive, solutions compared to the military. Their needs focus on short- to medium-range precision, quick target acquisition (favoring red dot and holographic sights), and reliable performance in urban environments. Customization for specific patrol rifles or non-lethal weapon systems is a frequent requirement, driving demand for versatile mounting systems and intuitive user interfaces that require minimal specialized training.

The civilian market, composed of hunters and sport shooters, is the largest volume purchaser. Hunters require scopes optimized for low-light conditions, durable construction, and high magnification ratios suitable for various game and terrain. Competitive shooters, such as those participating in Precision Rifle Series (PRS) or three-gun competitions, demand scopes with highly precise adjustments, robust zero retention, and complex reticles (e.g., Mil-Dot or Horus style) to facilitate rapid long-range target engagement. This consumer segment is highly price-sensitive but willing to pay premiums for superior brand reputation, clarity, and lifetime warranties, making branding and customer loyalty essential competitive differentiators.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $9.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Trijicon, Leupold & Stevens, Nikon, Bushnell, Aimpoint, EOTech, Vortex Optics, Schmidt & Bender, Kahles, Zeiss, Nightforce Optics, US Optics, Sig Sauer, Steiner, Swarovski Optik, Primary Arms, Hawke Optics, Meopta, BAE Systems, FLIR Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Weapon Scope Market Key Technology Landscape

The Weapon Scope Market is undergoing a rapid technological evolution, driven largely by the shift from purely analog optical systems to sophisticated digital and electro-optical devices. Key advancements center around thermal imaging and night vision technologies, which have become smaller, lighter, and more power-efficient. Uncooled microbolometer technology, in particular, has reduced the cost and size of thermal scopes, making them accessible not only to military organizations but increasingly to serious civilian hunters who require the ability to detect targets based on heat signatures in zero-light or dense foliage conditions. Furthermore, the development of high-resolution digital sensors allows for multi-spectral viewing (e.g., fusing visible light with thermal data), providing unprecedented clarity and situational awareness regardless of environmental conditions.

Another pivotal technological trend is the proliferation of "smart scopes." These devices incorporate internal microprocessors, high-definition displays, and connectivity features such as Wi-Fi and Bluetooth. These features enable automatic recording of video footage, integration with external weather sensors, and the capability to communicate ballistic solutions directly to the scope's reticle display. This digital functionality significantly simplifies complex long-range shooting by automatically compensating for environmental variables and weapon characteristics, thereby dramatically shortening the time required for target engagement and enhancing hit probability for novice and expert shooters alike. The reliance on digital components, however, necessitates ongoing investment in durable, energy-efficient battery solutions.

Optics manufacturing technology is also advancing with the use of enhanced lens coatings and sophisticated glass compositions. Modern scopes utilize exotic low-dispersion (ED) and high-density (HD) glass to minimize chromatic aberration and maximize light transmission, resulting in superior image brightness and color fidelity, which is critical for target identification at extreme ranges. The adoption of advanced manufacturing techniques, such as Computer Numerically Controlled (CNC) machining for scope housing, ensures unparalleled consistency and precision in internal mechanical components, crucial for maintaining zero retention under heavy recoil and adverse operational conditions. These innovations collectively define the high-performance benchmark for military and premium civilian scopes today.

Regional Highlights

The global Weapon Scope Market exhibits distinct growth patterns and customer profiles across major regions, heavily influenced by defense expenditure levels and local firearm regulations. North America, encompassing the United States and Canada, remains the largest and most mature market. The region’s dominance is attributable to its massive civilian population engaged in hunting and shooting sports, coupled with the United States Department of Defense's substantial and consistent procurement budgets for next-generation combat optics. The U.S. market drives innovation, particularly in digital, thermal, and high-precision tactical scopes, and serves as a vital benchmark for global pricing and technological standards. The robust retail environment, supported by major players like Vortex and Leupold, ensures widespread availability and strong aftermarket sales, cementing North America's leadership position in both volume and value.

Europe represents a highly segmented market. Western European countries, such as Germany, the UK, and France, maintain significant demand driven by specialized law enforcement units and a strong, traditionally organized hunting culture demanding high-end, premium optics from European manufacturers like Schmidt & Bender, Zeiss, and Swarovski. Conversely, Eastern European nations, fueled by rising geopolitical tensions and NATO integration, are modernizing their defense forces, leading to increased procurement of military-grade scopes, often imported from U.S. and Israeli suppliers. Strict firearm regulations across much of Europe tend to temper the volume growth of the general civilian market compared to North America, yet the demand remains consistently high for scopes characterized by exceptional optical quality and reliability.

The Asia Pacific (APAC) region is projected to be the fastest-growing market throughout the forecast period. This rapid growth is primarily underpinned by the accelerated military modernization programs undertaken by key countries, notably China, India, and South Korea, which are significantly increasing their defense spending to enhance regional security capabilities and counter geopolitical rivals. These nations are actively seeking advanced indigenous manufacturing capabilities or direct technology transfers to equip their large standing armies with state-of-the-art night vision and thermal sights. While civilian firearm ownership is heavily restricted in many APAC countries, the sheer scale of military procurement activities positions this region as the paramount engine for future market expansion, focused heavily on OEM supply to national defense ministries.

Latin America and the Middle East & Africa (MEA) constitute smaller but strategically important markets. In Latin America, demand is chiefly driven by internal security concerns, resulting in targeted procurement of scopes for special forces and anti-narcotics police units, focusing on reliability and affordability. The MEA market is highly influenced by defense spending of wealthy Gulf nations (e.g., Saudi Arabia, UAE), which prioritize acquiring top-tier tactical optics from Western manufacturers to maintain technological superiority in a volatile region. However, economic volatility and political instability in several MEA countries create variability in defense budgets, leading to episodic but high-value contracts for advanced optical systems.

- North America (Dominant Market): Driven by substantial defense budgets, extensive recreational hunting, and robust competitive shooting infrastructure. Key focus on technological leadership and high-end consumer products.

- Asia Pacific (Fastest Growth): Fueled by large-scale military modernization efforts in countries like China and India, focusing on thermal and digital sighting systems for infantry.

- Europe (Premium Market): Characterized by strong demand for high-quality, premium scopes from established European brands, catering to specialized military units and traditional hunting segments.

- Middle East & Africa (Strategic Defense Procurement): Demand concentrated among high-spending Gulf Cooperation Council (GCC) nations for state-of-the-art tactical and thermal optics, often sourced internationally.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Weapon Scope Market.- Trijicon

- Leupold & Stevens

- Nikon

- Bushnell (Vista Outdoor)

- Aimpoint

- EOTech (L3Harris Technologies)

- Vortex Optics

- Schmidt & Bender GmbH & Co. KG

- Kahles (Swarovski Group)

- Carl Zeiss AG

- Nightforce Optics

- US Optics

- Sig Sauer Electro-Optics

- Steiner (Beretta Holding)

- Swarovski Optik

- Primary Arms

- Hawke Optics

- Meopta - optika, s.r.o.

- BAE Systems (Thermal & Night Vision)

- FLIR Systems (Teledyne Technologies)

Frequently Asked Questions

Analyze common user questions about the Weapon Scope market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for smart scopes in the military sector?

The demand is driven by the necessity for enhanced situational awareness, automated ballistic calculation, and seamless integration into networked battle management systems (C4ISR). Smart scopes minimize human error and significantly improve first-shot hit probability under dynamic combat conditions, making them critical for soldier modernization programs globally.

How do ITAR regulations affect the global supply chain for weapon scopes?

The U.S. International Traffic in Arms Regulations (ITAR) impose stringent restrictions on the export of sensitive military-grade optics, particularly high-performance thermal and night vision devices. This creates complexity and limits the international availability of top-tier technology, forcing non-U.S. manufacturers to develop comparable domestic technologies to compete globally.

Which technology segment is projected to experience the highest growth rate?

The Thermal Imaging Scopes segment is projected to show the highest growth rate. This acceleration is due to falling production costs of uncooled microbolometers, rising military demand for 24/7 detection capabilities, and increasing penetration into the civilian hunting market due to enhanced detection range and capability in adverse weather or zero-light environments.

What are the primary differences between Red Dot and Holographic Weapon Sights?

Red Dot sights typically utilize an LED to project a dot onto a curved lens. Holographic sights (HWS) use a laser to record a 3D image of the reticle within the viewing window. HWS generally offer a finer reticle, are less susceptible to parallax, and remain functional even if the window is partially obscured, making them preferred for close-quarters tactical engagements.

What criteria should consumers use when selecting a high-power telescopic scope for long-range hunting?

Key selection criteria include optical clarity (determined by glass quality and lens coatings), reliable mechanical tracking (precision of turrets and zero retention), high light transmission for low-light performance, and the suitability of the reticle (e.g., first focal plane FFP vs. second focal plane SFP) for the intended maximum shooting distance and ballistic compensation needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager