Wear Resistant Steel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432125 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Wear Resistant Steel Market Size

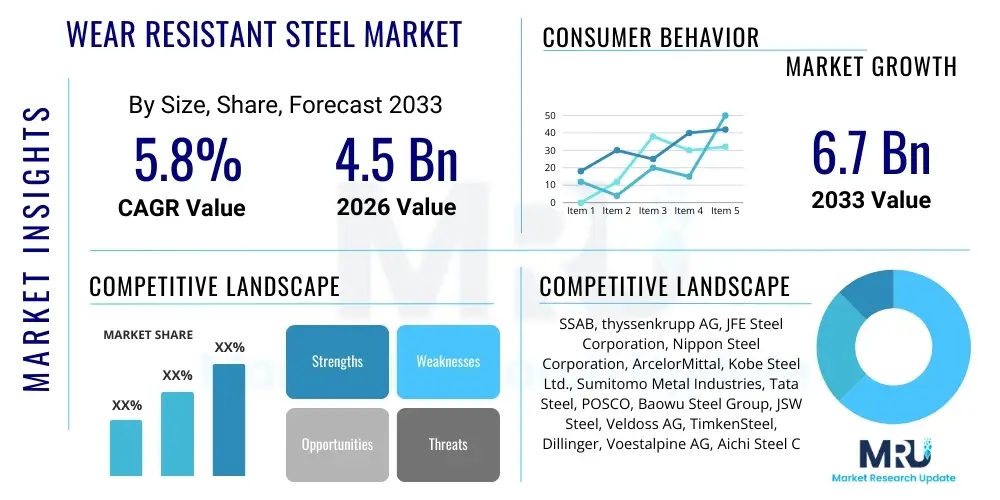

The Wear Resistant Steel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Wear Resistant Steel Market introduction

Wear Resistant Steel (WRS) refers to highly specialized steel alloys engineered to withstand severe abrasive wear, sliding abrasion, impact, and high-stress conditions typically encountered in heavy industrial operations. These materials are characterized by superior hardness and toughness, achieved primarily through specialized alloying elements like chromium, manganese, and nickel, coupled with advanced thermo-mechanical controlled processes (TMCP) or quenching and tempering treatments. The primary goal of WRS is to extend the service life of critical components, minimize downtime, and reduce maintenance costs in abrasive environments.

Major applications of Wear Resistant Steel span the construction, mining, agriculture, cement, and material handling sectors. In mining and construction, WRS is indispensable for manufacturing excavator buckets, bulldozers, dump truck bodies, crushers, and conveyors, where material integrity under constant friction and impact loading is paramount. The increasing global focus on infrastructure development and the revitalization of commodity extraction activities are key drivers reinforcing demand for high-performance WRS solutions, particularly in high-growth regions like Asia Pacific.

The core benefit derived from utilizing Wear Resistant Steel is the significant enhancement in operational efficiency and economic viability of heavy machinery. By offering exceptional resistance to surface degradation, these steels allow equipment to operate longer under harsh conditions, reducing the frequency of component replacement and the associated capital expenditure. Driving factors include the continuous expansion of global mining operations, the necessity for lighter yet stronger materials in mobile equipment, and technological advancements leading to the production of steel grades with even higher hardness while maintaining adequate toughness for structural integrity.

Wear Resistant Steel Market Executive Summary

The Wear Resistant Steel Market exhibits robust growth, driven primarily by favorable macro-economic trends centered on massive global infrastructure projects, especially in emerging economies, and the sustained demand from the revitalized global mining sector. Business trends indicate a shift towards advanced proprietary grades, such as high-strength low-alloy (HSLA) abrasion-resistant steels, which offer a superior strength-to-weight ratio, allowing equipment manufacturers to design more efficient and fuel-economic machinery. Consolidation among major steel producers is intensifying, focusing on intellectual property and specialized treatment capabilities to maintain competitive edges in offering differentiated products customized for specific abrasive environments, ranging from sliding wear in hoppers to impact wear in crushing equipment.

Regional trends clearly position the Asia Pacific (APAC) region as the dominant market, fueled by colossal investments in civil infrastructure, large-scale urbanization projects, and robust domestic manufacturing sectors in China and India. North America and Europe, while mature, demonstrate steady growth driven by strict industrial safety standards, demand for premium high-performance steels in energy infrastructure (oil and gas), and substantial replacement demand for older machinery components. Segments trends highlight the continued dominance of WRS plates due to their extensive use in lining applications and structural components, though the demand for WRS parts used in concrete mixers, asphalt plants, and agricultural machinery is also accelerating, reflecting diversification across end-use industries.

Overall, the market is characterized by a high degree of technological sophistication, with market participants aggressively pursuing improvements in steel processing, notably through advanced cooling and heat treatment techniques to achieve finer microstructure and enhanced properties. The market faces constraints related to the volatility of critical raw material costs, such as ferroalloys, and the need to comply with increasingly stringent environmental regulations regarding energy consumption during steel production. However, strategic opportunities lie in the development of hybrid wear-resistant solutions and the integration of WRS into additive manufacturing processes for customized parts.

AI Impact Analysis on Wear Resistant Steel Market

User queries regarding AI's influence on the Wear Resistant Steel Market frequently revolve around optimizing material composition, predicting component lifespan, improving manufacturing process control, and enhancing supply chain resilience. Key concerns center on how AI-driven simulation can accelerate the development of novel steel alloys with superior wear characteristics and whether machine learning (ML) models can accurately forecast material failure in high-stress, unpredictable environments like deep-pit mining or high-speed crushing operations. Users are seeking quantifiable proof that AI integration leads to direct operational savings and improved steel quality consistency.

The integration of Artificial Intelligence and Machine Learning models is transforming WRS manufacturing from the research and development phase through to end-user maintenance. AI algorithms are fundamentally used to analyze vast datasets pertaining to alloying ratios, thermal histories, and resulting mechanical properties, allowing producers to optimize steel compositions faster than traditional trial-and-error methods. This accelerates the creation of new proprietary grades tailored for specific abrasion types (e.g., wet erosion vs. dry sliding), ensuring the final product meets exacting performance requirements while minimizing material waste and energy input during the complex production stages.

Furthermore, predictive maintenance powered by AI is a significant downstream application. By processing real-time sensor data from heavy machinery (vibration, temperature, operational load), ML models can estimate the remaining useful life (RUL) of WRS components such as bucket teeth, liner plates, and conveyor drums with high precision. This transition from scheduled maintenance to condition-based maintenance drastically reduces unexpected breakdowns and maximizes the utilization time of expensive capital equipment. AI also enhances quality control during manufacturing through automated visual inspection systems and non-destructive testing analysis, ensuring superior and consistent metallurgical structure across large batches of steel plates and fabricated parts.

- AI optimizes material composition and microstructure design, leading to superior WRS grades.

- Machine Learning facilitates predictive maintenance, accurately forecasting component wear and failure (Remaining Useful Life analysis).

- Automated quality control systems utilize AI for faster, more precise non-destructive testing (NDT) of WRS plates.

- AI-driven simulation reduces R&D cycle time for new abrasion-resistant alloy development.

- Predictive modeling enhances supply chain efficiency by optimizing inventory levels of replacement WRS parts based on forecasted operational demands.

DRO & Impact Forces Of Wear Resistant Steel Market

The dynamics of the Wear Resistant Steel market are governed by a complex interplay of internal and external forces summarized by Drivers (D), Restraints (R), Opportunities (O), and overall Impact Forces. The market is primarily propelled by the burgeoning demand for bulk materials across infrastructure, energy, and urbanization projects globally, requiring continuous investment in robust, long-lasting processing machinery. Simultaneously, the persistent focus on operational expenditure reduction compels end-users to seek materials that offer extended service intervals, intrinsically favoring high-quality WRS over standard structural steels. These strong, persistent drivers exert a significant positive impact on market expansion, particularly in emerging economies where large-scale construction activity is reaching peak momentum.

However, the market faces notable restraints, chiefly associated with the highly cyclical nature of the raw materials market, particularly the prices of key alloying elements such as nickel, molybdenum, and ferrochrome, which introduce volatility into production costs and pricing structures. Furthermore, the high energy intensity required for processes like quenching and tempering, coupled with increasingly strict global environmental and carbon emission regulations, puts pressure on manufacturers to adopt cleaner production technologies, potentially escalating capital investment requirements. These restraints necessitate sophisticated risk management strategies and strategic sourcing to maintain stable margins, creating a moderating impact on rapid market growth.

Opportunities for growth are abundant, particularly in the realm of technological advancement, including the adoption of specialized surface treatments like hard-facing and cladding to create hybrid materials offering tailored wear profiles at competitive costs. The development and commercialization of next-generation ultra-high-strength, ultra-wear-resistant steel grades, driven by advanced computational materials science, represent significant avenues for future market expansion. Moreover, the increasing use of specialized WRS in sectors outside traditional heavy industry, such as recycling, waste management, and defense vehicles, opens up niche markets. The overall impact forces are strongly positive, with technological innovation continuously mitigating cost pressures and opening new high-value applications, ensuring steady market progression throughout the forecast period.

Segmentation Analysis

The Wear Resistant Steel Market is primarily segmented based on product type, processing technology, and end-use application. Understanding these segmentations is critical for producers to tailor their offerings to specific industry needs and for end-users to select the optimal material for a defined abrasive environment. The product type segmentation typically separates plates, which constitute the largest market share due to their widespread use in structural linings and heavy equipment bodies, from components and fabricated parts such as wear liners, cutting edges, and bucket teeth. This segmentation reflects the material's form factor and its primary function in the value chain, ranging from bulk material supply to highly specialized, custom-manufactured parts requiring advanced fabrication techniques like welding and bending.

Technology segmentation focuses on the thermal and mechanical treatments applied to achieve superior properties. Quenched and Tempered (Q&T) steel dominates this segment, providing the required balance of high hardness and sufficient toughness essential for dynamic loading environments. However, Thermal Mechanical Controlled Process (TMCP) steel is gaining traction due to its ability to achieve high strength and favorable welding characteristics with reduced energy consumption, appealing to manufacturers seeking cost efficiencies and environmental compliance. The application segmentation demonstrates the widespread utility of WRS, with Mining and Construction representing the foundational demand base, while Cement, Power Generation (especially coal handling), and Material Handling contribute significant, growing demand for specialized abrasion solutions.

- Product Type:

- Wear Plates

- Wear Components (Liners, Cutting Edges, Bars)

- Fabricated Parts

- Processing Technology:

- Quenched and Tempered (Q&T) Steel

- Thermal Mechanical Controlled Process (TMCP) Steel

- High Manganese Steel (Hadfield Steel)

- Chromium Carbide Overlay (CCO) Plate

- Application:

- Mining and Quarrying

- Construction and Infrastructure

- Cement and Aggregate

- Material Handling and Transportation

- Energy (Power Generation)

- Agriculture and Forestry

- Recycling and Waste Management

Value Chain Analysis For Wear Resistant Steel Market

The value chain for the Wear Resistant Steel Market is fundamentally integrated, beginning with the highly capital-intensive upstream segment focused on raw material extraction and production. This stage involves the sourcing of iron ore, coal, and critical ferroalloys (such as manganese, chromium, and molybdenum) necessary for achieving the desired wear resistance properties. Key upstream actors are global mining corporations and ferroalloy producers, whose supply and pricing greatly influence the final cost of WRS. The intermediate stage involves primary steel production—melting, casting, and initial rolling—followed by specialized processing steps like quenching and tempering, which are proprietary and crucial for material performance. Steel mills, characterized by high barriers to entry and intense technological competition, form the core of this middle segment.

The downstream segment encompasses fabrication, distribution, and end-user application. Specialized service centers and fabricators process the bulk WRS plates into final components—cutting, bending, welding, and machining them into ready-to-install parts like liners, buckets, and truck bodies. Distribution channels are varied, including direct sales to large Original Equipment Manufacturers (OEMs), indirect sales through established network distributors for smaller fabricators and maintenance shops, and specialized international trading firms. Direct channels ensure tight quality control and customized solutions for large volume purchasers, while indirect channels provide broader market reach and quicker access to stock material for maintenance, repair, and overhaul (MRO) activities.

End-users, predominantly in the mining, construction, and heavy machinery sectors, represent the final destination. The efficiency and reliability of the distribution network—both direct and indirect—are critical determinants of market success, ensuring rapid delivery of high-quality WRS, minimizing equipment downtime, which can cost thousands of dollars per hour. The trend toward digital platforms and e-commerce for customized WRS component procurement is simplifying the downstream logistics, offering customers enhanced traceability and technical support, further strengthening the relationship between manufacturers and end-users.

Wear Resistant Steel Market Potential Customers

Potential customers for Wear Resistant Steel are defined by sectors requiring equipment that operates under severe conditions of friction, impact, and sliding abrasion. The primary end-users are large-scale mining operations and quarrying companies that utilize heavy machinery—including excavators, draglines, and haul trucks—which require constant maintenance and replacement of WRS components such as bucket liners, crusher jaws, and sieves. These customers prioritize material longevity, minimal change-out frequency, and high-quality fabrication to maintain maximum uptime and productivity, often making decisions based on Total Cost of Ownership (TCO) rather than initial material price.

Another major customer segment includes Original Equipment Manufacturers (OEMs) of heavy construction machinery, agricultural equipment, and industrial plants (cement, aggregate, power generation). OEMs integrate WRS directly into their products during the manufacturing phase to differentiate their machinery through superior durability and performance guarantees. These buyers demand reliable supply chain continuity, standardized quality, and collaborative partnerships for developing customized, lighter, and higher-strength steel grades to enhance machine efficiency and meet evolving industry standards. The maintenance, repair, and overhaul (MRO) market, serviced primarily through distributors and specialized fabricators, also constitutes a significant customer base, supplying necessary replacement parts to keep operational assets running.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SSAB, thyssenkrupp AG, JFE Steel Corporation, Nippon Steel Corporation, ArcelorMittal, Kobe Steel Ltd., Sumitomo Metal Industries, Tata Steel, POSCO, Baowu Steel Group, JSW Steel, Veldoss AG, TimkenSteel, Dillinger, Voestalpine AG, Aichi Steel Corporation, Siderca, Sandvik AB, Kennametal Inc., Hardox Wearparts (SSAB subsidiary) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wear Resistant Steel Market Key Technology Landscape

The Wear Resistant Steel market's technological landscape is characterized by continuous process refinements aimed at simultaneously increasing hardness and maintaining necessary ductility and weldability, crucial performance parameters for heavy-duty applications. The most prevalent core technology remains Quenching and Tempering (Q&T), where steel is heated to high temperatures and rapidly cooled (quenched) to induce a hard martensitic structure, followed by tempering to enhance toughness and stress relief. Innovations in Q&T focus on controlled cooling paths and alloy composition fine-tuning to achieve ultra-high hardness levels (e.g., 600 BHN and above) without compromising the material’s structural integrity during fabrication or operation.

Thermal Mechanical Controlled Process (TMCP) represents a key alternative technology, particularly favored for steels requiring excellent weldability and less distortion. TMCP involves carefully controlling the rolling temperature and deformation during the rolling process, which refines the grain structure and improves mechanical properties directly, often eliminating the need for post-rolling heat treatments. Advances in TMCP are focused on developing high-strength wear-resistant grades that offer significant weight savings in mobile equipment, thereby improving fuel efficiency—a major competitive factor in the construction and transportation sectors. This technology is instrumental in producing the newer generation of high-performance WRS with enhanced environmental profiles due to reduced energy consumption compared to traditional heat treatment lines.

Beyond bulk material processing, surface engineering technologies, such as Hardfacing and Chromium Carbide Overlay (CCO) plating, are crucial for niche applications and repairing worn parts. CCO plates involve welding a wear-resistant alloy layer onto a mild steel substrate, creating a composite material that offers extreme surface hardness combined with the structural support of the base material. Furthermore, powder metallurgy techniques are increasingly being explored for manufacturing small, complex, highly wear-resistant components with intricate geometries, particularly in highly abrasive mining tools and agricultural parts. The integration of advanced computational tools for microstructure prediction and design is accelerating the technological progression within the sector, pushing the boundaries of material performance and customization.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Wear Resistant Steel, underpinned by exponential growth in infrastructure development, massive urbanization projects, and robust mining operations, particularly in China, India, and Southeast Asian nations. The region’s demand is fueled by the need for durable and high-volume processing equipment across the cement, aggregate, and coal power sectors. Government initiatives focusing on public infrastructure upgrades and domestic steel production capacity expansion further solidify APAC’s market dominance, characterized by intense price competition and rapid technology adoption.

- North America: North America represents a mature yet high-value market, driven primarily by replacement cycles for existing heavy machinery, stringent safety standards, and specialized demand from the oil and gas (energy) and recycling industries. The focus here is on premium, proprietary WRS grades that offer superior performance and extended lifespan, translating to reduced operational risk and lower lifetime costs. The market is characterized by strong regulatory oversight requiring certified, high-quality materials and a consistent technological push toward lighter, higher-strength materials to meet emission reduction goals for mobile fleets.

- Europe: The European market demonstrates steady growth, highly influenced by the circular economy, advanced manufacturing, and strict environmental compliance. Demand is robust from the sophisticated recycling and waste management sectors, which require highly abrasion-resistant steels for shredders and handling equipment. Furthermore, European construction and machinery OEMs demand WRS with excellent weldability and high dimensional stability, often favoring advanced TMCP grades. Innovation focuses on sustainable steel production methods and developing products with improved fatigue resistance for complex mechanical applications.

- Latin America: This region is crucial for the WRS market due to its abundant natural resources and significant activity in copper, iron ore, and precious metal mining. Market growth is closely tied to commodity price cycles and foreign direct investment in large mining projects in Brazil, Chile, and Peru. Demand concentrates on large-scale wear plates and liners for mining heavy equipment, where extreme abrasion resistance is critical to maintaining productivity in remote, harsh operating environments.

- Middle East and Africa (MEA): Growth in MEA is heterogeneous. The Middle East segment, particularly the GCC nations, sees demand driven by mega-infrastructure projects, cement production, and port handling facilities. Africa's WRS consumption is heavily dominated by large-scale mineral extraction (diamonds, gold, bauxite). The market typically requires robust, proven WRS solutions that can withstand severe heat and environmental stress, often procured via international suppliers offering comprehensive logistical and technical support packages.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wear Resistant Steel Market.- SSAB

- thyssenkrupp AG

- JFE Steel Corporation

- Nippon Steel Corporation

- ArcelorMittal

- Kobe Steel Ltd.

- Sumitomo Metal Industries

- Tata Steel

- POSCO

- Baowu Steel Group

- JSW Steel

- Veldoss AG

- TimkenSteel

- Dillinger

- Voestalpine AG

- Aichi Steel Corporation

- Siderca

- Sandvik AB

- Kennametal Inc.

- Hardox Wearparts (SSAB subsidiary)

Frequently Asked Questions

Analyze common user questions about the Wear Resistant Steel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Wear Resistant Steel and High-Strength Low-Alloy (HSLA) Steel?

Wear Resistant Steel (WRS) is primarily optimized for surface hardness and abrasion resistance, typically achieved through quenching and tempering to form a hard martensitic structure. HSLA steel, conversely, focuses on high yield strength, good formability, and weldability, prioritizing structural integrity and weight reduction over extreme surface wear resistance.

Which end-use industry contributes most significantly to the demand for Wear Resistant Steel?

The Mining and Quarrying industry is the single largest consumer of Wear Resistant Steel globally. This sector heavily relies on WRS for critical components such as excavator buckets, crusher liners, and chute surfaces that are constantly subjected to severe impact and sliding abrasion from bulk material processing.

How do manufacturers ensure the consistent quality of proprietary Wear Resistant Steel grades?

Manufacturers utilize rigorous quality control measures, including sophisticated chemical analysis, non-destructive testing (NDT) such as ultrasonic inspection, and precise thermal processing (Quenching and Tempering or TMCP) monitored by real-time sensor feedback and often enhanced by AI-driven predictive modeling to ensure optimal microstructure and mechanical properties.

What are the key technological advancements driving innovation in the Wear Resistant Steel Market?

Key advancements include the adoption of advanced thermo-mechanical controlled processes (TMCP) for improved weldability and toughness, the development of ultra-high hardness grades (600+ BHN), and the integration of surface engineering techniques like Chromium Carbide Overlay (CCO) plating for specialized composite wear protection.

Which geographical region is projected to experience the fastest growth in the WRS Market through 2033?

The Asia Pacific (APAC) region is projected to exhibit the fastest market growth, driven by extensive investments in infrastructural development, substantial growth in construction activities, and continuous expansion of mining and manufacturing sectors across countries like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager