Wearable Barcode Scanner Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436772 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Wearable Barcode Scanner Market Size

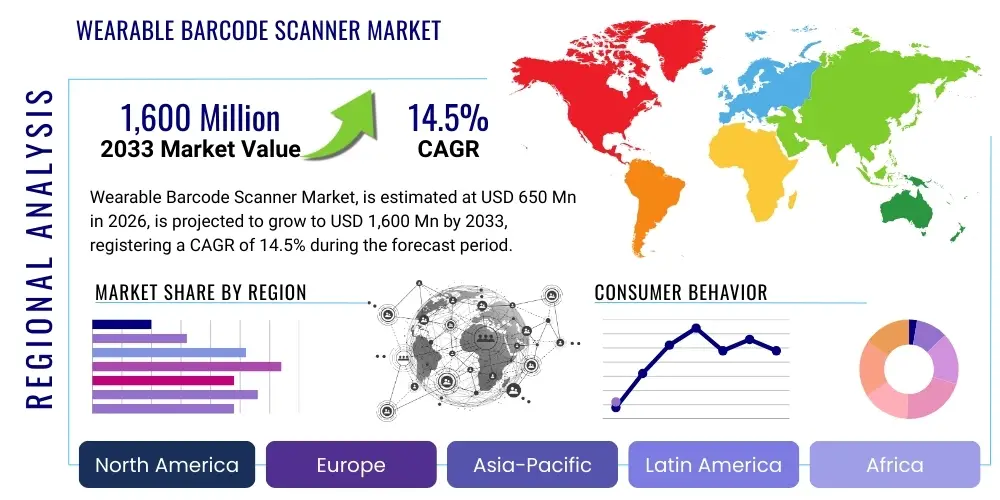

The Wearable Barcode Scanner Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 14.5% between 2026 and 2033. The market is estimated at USD 650 Million in 2026 and is projected to reach USD 1,600 Million by the end of the forecast period in 2033.

Wearable Barcode Scanner Market introduction

The Wearable Barcode Scanner Market encompasses specialized data capture devices integrated into ergonomic forms such as rings, gloves, or wrist mounts, designed to improve efficiency and hands-free operation in various industrial settings. These devices fundamentally replace traditional handheld scanners, allowing operators to maintain two hands free for tasks like picking, packing, sorting, and assembly, leading to significant gains in productivity and accuracy across the supply chain. The primary product description centers on their lightweight design, robust connectivity options (typically Bluetooth), and high-speed data capture capabilities for 1D and 2D barcodes, often incorporating advanced imaging technology for rapid decoding even on damaged labels.

Major applications of wearable barcode scanners are predominantly found in high-throughput environments where speed and mobility are critical, including large-scale e-commerce fulfillment centers, third-party logistics (3PL) warehouses, large retail backrooms for inventory management, and manufacturing lines for quality control and component tracking. These devices are increasingly crucial in environments adopting paperless workflows and striving for real-time inventory visibility. Their intrinsic benefit lies in reducing manual errors and decreasing the physical strain associated with repetitive scanning actions, thereby enhancing overall worker safety and job satisfaction.

Key driving factors accelerating the market growth include the relentless expansion of the global e-commerce sector, which necessitates faster and more efficient warehouse operations; the increasing complexity of supply chains demanding precise item-level tracking; and the ongoing trend toward digitalization and automation within industrial sectors, particularly Manufacturing 4.0 initiatives. Furthermore, technological advancements leading to smaller, lighter, and more powerful scanning engines with extended battery life are making wearable solutions more appealing compared to fixed or handheld alternatives, solidifying their position as essential tools for modern operational logistics.

Wearable Barcode Scanner Market Executive Summary

The Wearable Barcode Scanner Market is characterized by robust business trends centered on integration capability and ergonomic innovation, driven largely by the exponential growth of omnichannel retail and the subsequent strain on fulfillment infrastructure. Companies are strategically investing in developing scanners that offer seamless connectivity with existing Warehouse Management Systems (WMS) and Enterprise Resource Planning (ERP) solutions, moving beyond basic Bluetooth pairing to encompass sophisticated data processing at the edge. A key business trend involves the shift from traditional laser scanning to 2D area imaging technology, which offers greater versatility for capturing QR codes and damaged labels, crucial for global supply chain diversity. Competition remains high, forcing manufacturers to focus on ruggedness, battery optimization, and modular design to capture market share among industrial users.

Regionally, North America and Europe currently dominate the market due to the early and broad adoption of automation technologies, significant presence of leading e-commerce giants, and high labor costs that incentivize efficiency-boosting devices. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapidly industrializing economies like China and India, massive investments in logistics infrastructure, and the emergence of domestic e-commerce platforms scaling rapidly. Regulatory standards concerning worker safety and data handling in developed markets also influence regional trends, pushing for intrinsically safe and highly secure wearable devices.

Segment trends indicate that the Glove Scanner segment is experiencing substantial traction due to its high comfort level and minimal interference with manual dexterity, making it highly suitable for demanding material handling tasks. Simultaneously, within end-use segments, Logistics and Warehousing maintains the largest share, reflecting the foundational need for rapid item processing, while the Healthcare segment shows promising growth, driven by the need for secure patient and medication tracking in clinical environments. The technological transition toward advanced area imaging over older linear imaging continues to define the product landscape, ensuring that new generations of wearable scanners are future-proofed against evolving symbology standards and challenging reading conditions.

AI Impact Analysis on Wearable Barcode Scanner Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) will transform the basic function of data capture and potentially impact the necessity of dedicated wearable scanning hardware. Common themes revolve around AI's ability to improve decoding accuracy on poorly printed or complex labels, automate identification without traditional barcodes (e.g., visual recognition), and provide predictive analytics for operational efficiency directly through the wearable device interface. There is strong user expectation that AI integration will shift the device from being a simple data input tool to a sophisticated decision support system, offering real-time guidance to workers regarding optimal routing, sequencing tasks, and minimizing picking errors before they occur, ultimately streamlining complex fulfillment processes.

The integration of edge AI processing capabilities into wearable scanners is anticipated to be a major technological leap. This allows for immediate local processing of captured images, utilizing deep learning algorithms to enhance image quality, correct skew, and successfully decode barcodes in challenging lighting or angles far faster than traditional firmware allows. Furthermore, AI contributes significantly to predictive maintenance of the scanners themselves, analyzing usage patterns, battery drain, and connectivity issues to preempt potential device failures, thereby maximizing operational uptime. This shift means that future wearable scanners will possess embedded intelligence, making them essential components within a larger, interconnected smart warehouse ecosystem.

The long-term impact involves AI driving hyper-personalization of the user experience, dynamically adjusting the scanner's display and prompt sequence based on the individual worker's performance data and immediate task context, further optimizing hands-free workflows. While AI might eventually pave the way for markerless object recognition solutions, the immediate role of AI is to bolster the reliability, speed, and intelligence of existing barcode capture technology, ensuring that data integrity remains paramount, especially in high-volume, mission-critical applications like pharmaceutical tracing and high-value asset management.

- AI-Enhanced Decoding Algorithms: Improves speed and accuracy for reading damaged, obscured, or complex 2D codes (e.g., DPM codes).

- Predictive Workflow Optimization: Uses ML to analyze worker movements and suggest optimal routes or picking sequences in real-time.

- Visual Data Validation: AI verifies the scanned item against visual confirmation (if equipped with a camera), reducing misplaced item errors.

- Edge Computing Integration: Allows localized, instantaneous data processing and decision-making on the wearable device, reducing reliance on cloud latency.

- Proactive Device Maintenance: Machine learning monitors device health (battery life, scanner wear) and predicts necessary servicing, minimizing downtime.

DRO & Impact Forces Of Wearable Barcode Scanner Market

The market dynamics of wearable barcode scanners are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), all subject to significant Impact Forces stemming from macroeconomic shifts and technological evolution. Key drivers include the overwhelming need for enhanced labor efficiency in fulfillment centers, propelled by the relentless pressure from same-day and next-day delivery mandates across the logistics and retail sectors. Coupled with this is the crucial need for inventory accuracy and the growing global adoption of 2D barcodes (such as QR codes) that require advanced scanning technology, pushing companies away from older, less versatile handheld units. These factors create a strong positive impetus for adopting ergonomic, hands-free solutions across multiple industrial verticals.

However, the market faces notable restraints, primarily centered around high initial deployment costs associated with implementing a comprehensive wearable system, which includes the scanners, charging infrastructure, and necessary software integration into existing WMS environments. Furthermore, integrating new wearable technology into legacy IT systems within established businesses presents significant challenges, often requiring substantial time and financial investment in system upgrades and worker training. User reluctance or discomfort related to wearing devices for long shifts also acts as a constraint, demanding continuous innovation in lightweight and ergonomic designs to improve worker acceptance and long-term compliance.

Opportunities abound, particularly in exploiting the potential of advanced connectivity, such as 5G, which will enable real-time, high-density data transmission from numerous devices concurrently, significantly enhancing operational responsiveness. The expansion into emerging markets, especially within APAC and Latin America, where logistics infrastructure is rapidly maturing, represents a vast untapped customer base. The development of specialized accessories, such as modular smartwatches functioning as scanners or advanced voice-picking integration, also presents lucrative avenues for market growth. The strongest impact force remains competitive differentiation, where manufacturers must continuously innovate on battery longevity, scanning ruggedness, and seamless integration capabilities to maintain relevance in a high-demand, high-efficiency environment.

Segmentation Analysis

The Wearable Barcode Scanner Market is meticulously segmented based on product type, underlying technology, and the end-use industry, reflecting the diverse applications and operational requirements across different sectors. This segmentation provides critical insights into purchasing patterns and technological preferences, allowing manufacturers to tailor their R&D and marketing efforts effectively. Analyzing these segments reveals that the market is fragmenting slightly as highly specialized solutions emerge, catering specifically to niche needs like sterile healthcare environments or extremely rugged outdoor logistics operations, requiring tailored hardware specifications and software capabilities.

From a technological standpoint, the shift toward 2D Area Imagers is the defining feature, driven by the global requirement to read smaller, denser, and more versatile codes (including Data Matrix and QR codes) necessary for complex inventory tracking and compliance mandates, particularly in pharmaceuticals and automotive manufacturing. While Laser and Linear Imagers remain relevant for simpler 1D applications, their market share is progressively declining in high-growth segments where versatility is prioritized over single-function scanning capabilities. This trend underscores a broader market movement toward multi-purpose, future-proofed devices capable of handling evolving logistical demands.

The End-Use Industry segmentation highlights the warehousing and logistics sectors as the foundational demand drivers, given their core dependency on efficient material handling and inventory velocity. However, the fastest growth is anticipated in non-traditional industrial segments such as Healthcare, where strict identification protocols are essential for patient safety, and Food and Beverage manufacturing, where rapid serialization and cold-chain monitoring necessitate durable, high-performance wearable devices. Understanding the nuanced needs—such as the requirement for medical-grade plastics in healthcare or freezer-rated durability in food logistics—is crucial for strategic market penetration.

- Type: Ring Scanners, Glove Scanners, Back-of-Hand Scanners, Head-Mounted Scanners, Wrist/Arm-Mounted Scanners

- Technology: Laser Scanners, Linear Imagers, 2D Area Imagers

- End-Use Industry: Retail and E-commerce, Logistics and Warehousing, Manufacturing, Healthcare, Food and Beverage, Others (e.g., Automotive, Field Services)

Value Chain Analysis For Wearable Barcode Scanner Market

The value chain for the Wearable Barcode Scanner Market begins with upstream activities, primarily involving the sourcing and refinement of specialized components. This includes the acquisition of high-resolution image sensors (for 2D imagers), advanced microprocessors for data decoding and edge processing, robust, lightweight materials (often polymers or specialized alloys) for casing, and high-capacity, durable batteries. Key upstream suppliers are focused on delivering miniaturization without compromising performance, ensuring components meet strict industrial ruggedness standards (IP ratings). Strategic partnerships with chipset manufacturers and optical component specialists are essential at this stage to maintain a technological edge in scanning accuracy and speed.

Midstream activities involve the design, manufacturing, assembly, and rigorous testing of the final wearable products. Manufacturers focus heavily on ergonomic design and integration, ensuring the scanners are comfortable for prolonged use and seamlessly interface with the wearable platform (glove, ring, wrist band). Quality assurance and regulatory compliance (e.g., specific country certifications, safety standards) are critical parts of the manufacturing process. Distribution channels are varied, encompassing direct sales for large enterprise clients seeking custom deployments and significant reliance on indirect channels, such as authorized value-added resellers (VARs) and system integrators who specialize in providing comprehensive WMS and ERP solutions.

Downstream activities focus on sales, deployment, integration, and post-sales support. Direct channels allow for closer customer relationships and tailored service agreements, often utilized when integrating highly customized solutions for global logistics firms. Indirect channels, through VARs and specialized distributors, are crucial for reaching Small and Medium-sized Enterprises (SMEs) and providing localized technical support and training. The lifecycle ends with end-user implementation, where successful adoption hinges on effective training, reliable technical support, and the provision of continuous software updates to maintain compatibility and security within the customer's operational technology environment.

Wearable Barcode Scanner Market Potential Customers

The primary potential customers and end-users of wearable barcode scanners are organizations operating in high-volume, hands-on environments where operational efficiency directly impacts profitability. Large-scale E-commerce and 3PL providers represent the most lucrative customer base, as their daily activities are centered around rapid item retrieval, sorting, and packaging. These buyers prioritize hands-free operation to maximize worker productivity and minimize the chances of errors during peak fulfillment periods. They are typically sophisticated buyers, requiring seamless integration with complex automated material handling systems and advanced reporting features.

Secondary but rapidly growing customer segments include specialized Manufacturing firms, particularly those in automotive assembly and aerospace, utilizing scanners for assembly line tracking, component verification, and quality auditing. In these settings, the devices are integral to maintaining compliance and traceabilty records, often requiring highly robust hardware that can withstand harsh factory conditions. Furthermore, the Healthcare sector, including large hospital networks and pharmaceutical wholesalers, is a significant consumer, utilizing these scanners for patient identification, medication administration verification (bedside scanning), and precise inventory management of high-value medical supplies.

These buyers are characterized by their need for return on investment (ROI) calculations that justify the higher initial cost of wearable devices over traditional handhelds, demonstrating quantifiable gains in speed (e.g., scans per hour) and accuracy (e.g., reduction in picking errors). Purchasing decisions are heavily influenced by device ergonomics, battery longevity suitable for multi-shift operations, and the manufacturer’s ability to provide scalable software tools for remote device management and data aggregation across large fleets of scanners deployed globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650 Million |

| Market Forecast in 2033 | USD 1,600 Million |

| Growth Rate | CAGR 14.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zebra Technologies, Honeywell International, Datalogic S.p.A., SICK AG, Socket Mobile, Opticon Sensors Europe B.V., ProGlove, Unitech Electronics Co., Ltd., Shenzhen Rakinda Technologies, CipherLab Co., Ltd., Casio Computer Co., Ltd., Panasonic Corporation, Keyence Corporation, Code Corporation, Newland Auto-ID Tech, Akses Industrial, Generalscan, M3 Mobile, Bluebird Inc., Barcodes Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wearable Barcode Scanner Market Key Technology Landscape

The technological landscape of the Wearable Barcode Scanner Market is currently dominated by advancements in 2D area imaging, which has largely superseded older laser and linear imaging technologies. This transition is essential as global inventory and logistics increasingly rely on sophisticated symbologies like QR codes and Data Matrix codes, which require high-resolution sensor arrays for reliable capture. Key innovations focus on enhancing the depth of field and motion tolerance of these imagers, ensuring high read rates even when the scanner is moving rapidly or the code is presented in poor light or at a sharp angle. Furthermore, miniaturization of the scanning engine is a constant technological push, allowing for lighter and more compact devices that significantly improve worker comfort and reduce fatigue over long shifts.

Connectivity and power management represent another critical area of technological focus. Modern wearable scanners overwhelmingly rely on low-energy Bluetooth (BLE) for seamless and persistent communication with host devices such as wrist-mounted terminals or industrial tablets. Manufacturers are integrating advanced battery chemistries and sophisticated power management algorithms to deliver multi-shift operational life (10 to 18 hours) without requiring mid-shift recharging, a crucial operational requirement in 24/7 logistics environments. This often involves designing hot-swappable battery systems or utilizing power-saving modes that automatically adjust scanning intensity based on ambient conditions.

The emerging technological frontier involves integrating Augmented Reality (AR) and smart glasses with scanning capabilities. Head-mounted displays, while a smaller segment, are incorporating scanning functions alongside visual workflow guidance, allowing workers to receive task instructions, scan items, and confirm results without shifting visual focus. Additionally, advancements in ruggedization materials, particularly those offering superior resistance to water (high IP ratings), dust, extreme temperatures, and repeated drops, ensure the devices can withstand the rigorous demands of industrial environments, minimizing the total cost of ownership (TCO) for enterprises.

Regional Highlights

- North America: Market Leader Due to E-commerce and Automation Adoption

North America currently holds the largest share of the wearable barcode scanner market, primarily driven by the massive presence of global e-commerce titans and the high labor costs that strongly incentivize automation and efficiency tools. The region exhibits high maturity in supply chain digitization, where large enterprises quickly adopt the latest generations of wearable technology to maintain competitive advantage in logistics speed. The primary demand stems from fulfillment centers and large retail chains implementing omnichannel strategies. Regulatory adherence, particularly regarding pharmaceutical serialization (DSCSA), also drives demand for high-accuracy 2D imaging wearables in the healthcare and logistics segments.

The United States is the central hub for market innovation and consumption in North America, characterized by sophisticated integration requirements and a preference for highly rugged, ergonomically advanced devices. Canadian logistics firms are also rapidly expanding their automation efforts, mirroring trends in the U.S. market. The regional focus remains on utilizing these devices not just for scanning, but as comprehensive data input tools that feed directly into advanced cloud-based WMS, highlighting a demand for robust security features and excellent network reliability.

- Europe: Focus on Industrial Manufacturing and Labor Efficiency

Europe represents a significant market, characterized by strong demand from the automotive, machinery, and general manufacturing sectors, in addition to advanced logistics networks (especially in Germany, the UK, and Benelux). European manufacturers are rapidly adopting Industry 4.0 principles, making wearable scanners essential tools for track-and-trace applications on production lines, quality control, and maintenance verification. The emphasis in this region is often placed on robust data integrity and integration with complex ERP systems, driven by strict EU directives regarding operational transparency and worker safety.

The market growth in Eastern Europe is accelerating as infrastructure investments expand and new distribution centers are established to serve the continent. Western Europe demands premium, long-lasting devices capable of multi-shift operation. Furthermore, the European market shows a higher propensity for specialized wearable solutions, such as ATEX-certified scanners required for use in potentially explosive environments within the chemical and oil & gas industries, demonstrating a focus on specialized industrial applications.

- Asia Pacific (APAC): Fastest Growing Region Driven by E-commerce Scale

The APAC region is projected to register the highest CAGR during the forecast period, fueled by the staggering expansion of domestic e-commerce markets in China, India, and Southeast Asia, coupled with substantial government investments in improving logistics and supply chain infrastructure. The rapid urbanization and increasing consumer spending power necessitates unprecedented speed and scale in fulfillment operations, directly benefiting the wearable scanner market. While initial adoption may involve lower-cost solutions, the market is quickly moving toward sophisticated 2D imagers to handle diverse product lines.

Countries like China and Japan are leading in the manufacturing segment, implementing advanced factory automation where hands-free scanning is mandatory for lean operations. India's burgeoning logistics sector, driven by major e-commerce players, is creating massive greenfield opportunities for wearable technology adoption. The challenge in this region lies in navigating fragmented supply chains and varying infrastructure quality, necessitating flexible deployment models and robust, user-friendly devices that accommodate a multi-lingual workforce.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Opportunities

LATAM and MEA represent emerging markets with substantial long-term potential. Growth is catalyzed by increasing foreign direct investment in retail and logistics infrastructure, particularly in countries like Brazil, Mexico, UAE, and Saudi Arabia. The modernization of ports, warehouses, and distribution networks in the Gulf Cooperation Council (GCC) countries necessitates scalable and efficient data capture technologies. The primary drivers here are efficiency gains and the need to leapfrog older, less efficient technologies.

Adoption rates are currently lower compared to North America and Europe, largely due to capital constraints and slower technological integration timelines. However, as the region’s e-commerce penetration increases and multinational corporations expand their regional footprints, the demand for enterprise-grade wearable barcode scanners is expected to surge, driven by the need to standardize operations and comply with international logistics best practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wearable Barcode Scanner Market.- Zebra Technologies

- Honeywell International

- Datalogic S.p.A.

- SICK AG

- Socket Mobile

- Opticon Sensors Europe B.V.

- ProGlove

- Unitech Electronics Co., Ltd.

- Shenzhen Rakinda Technologies

- CipherLab Co., Ltd.

- Casio Computer Co., Ltd.

- Panasonic Corporation

- Keyence Corporation

- Code Corporation

- Newland Auto-ID Tech

- Akses Industrial

- Generalscan

- M3 Mobile

- Bluebird Inc.

- Barcodes Inc.

Frequently Asked Questions

Analyze common user questions about the Wearable Barcode Scanner market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the high adoption rate of wearable barcode scanners?

The exponential growth of the global e-commerce sector and the critical demand for hands-free operation in high-throughput logistics and warehousing environments are the primary drivers. Wearable scanners significantly increase worker productivity and accuracy by allowing personnel to utilize both hands for material handling, directly reducing picking and packing cycle times.

How do ring scanners compare to glove scanners in terms of operational efficiency?

Ring scanners offer maximum flexibility, fitting directly onto the finger, making them extremely lightweight. Glove scanners integrate the scanning engine directly into the back or side of a glove, offering higher protection and robustness while maintaining connectivity. Glove scanners are generally preferred in high-impact, rugged environments, while ring scanners are favored for rapid, light-duty scanning tasks where minimal obstruction is required.

What technological segment dominates the current market landscape?

The 2D Area Imager technology segment dominates the market. This dominance is due to the increasing need to read complex, smaller symbologies such as QR codes and Data Matrix codes, which are essential for item-level traceability, especially in pharmaceuticals and sophisticated inventory management, a task that traditional laser scanners cannot reliably perform.

What role does Artificial Intelligence play in the next generation of wearable scanners?

AI is being integrated to enhance data accuracy and worker efficiency. AI algorithms improve the scanner's ability to decode challenging or damaged barcodes (AI-enhanced decoding) and are increasingly used for predictive analytics, providing workers with real-time operational guidance and optimizing workflow routes directly through the wearable interface.

Which geographical region is expected to demonstrate the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to massive investments in regional logistics infrastructure, rapid industrialization, and the booming scale and competition within local and international e-commerce platforms across countries like China, India, and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager