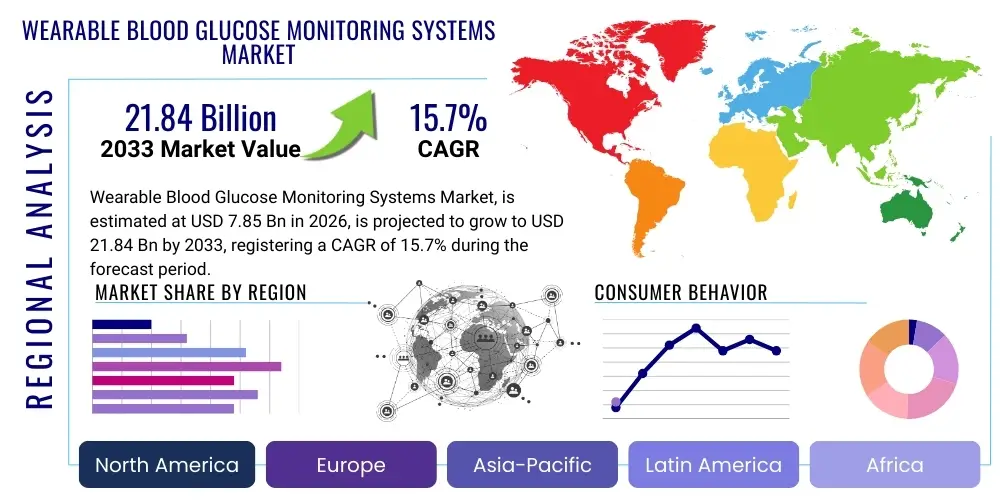

Wearable Blood Glucose Monitoring Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436935 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Wearable Blood Glucose Monitoring Systems Market Size

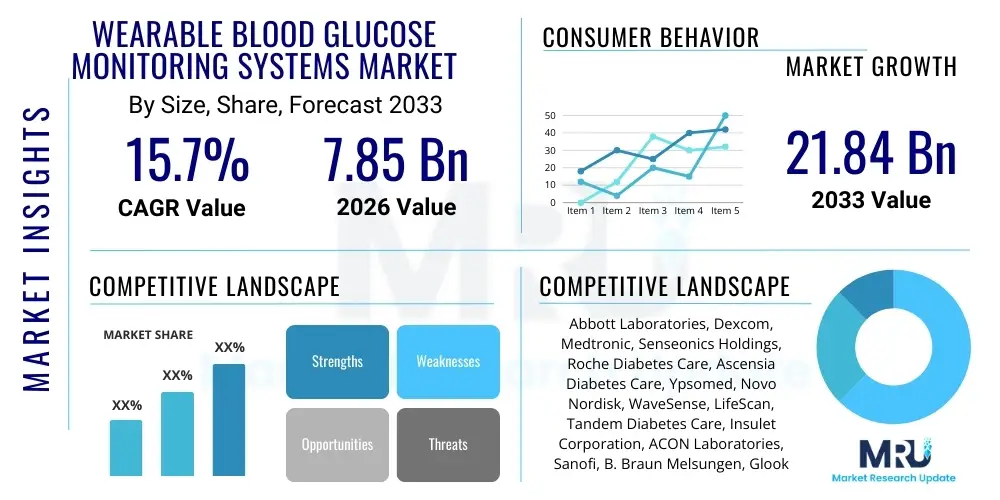

The Wearable Blood Glucose Monitoring Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.7% between 2026 and 2033. The market is estimated at USD 7.85 Billion in 2026 and is projected to reach USD 21.84 Billion by the end of the forecast period in 2033.

Wearable Blood Glucose Monitoring Systems Market introduction

The Wearable Blood Glucose Monitoring (WBGM) Systems Market encompasses advanced medical devices designed for continuous, minimally invasive, or non-invasive tracking of blood glucose levels in patients, primarily those diagnosed with Type 1 and Type 2 diabetes. These systems typically consist of a sensor worn on the body (usually the arm or abdomen), a transmitter, and a display or receiver (often a smartphone application) that provides real-time glucose readings. Unlike traditional finger-prick blood glucose meters, WBGM systems, particularly Continuous Glucose Monitors (CGMs), offer a comprehensive profile of glucose fluctuations throughout the day and night, significantly enhancing glycemic control and reducing the risk of hypo- or hyperglycemia events. The fundamental technological shift driving this market is the move towards patient convenience, actionable data, and integration into daily life.

The primary applications of WBGM systems revolve around personalized diabetes management, enabling patients and healthcare providers (HCPs) to make timely and informed therapeutic adjustments, including insulin dosing and dietary planning. Major benefits include superior data density, trend visibility, automated alerts for dangerous glucose levels, and improved Quality of Life (QoL) for diabetic patients by eliminating multiple painful daily finger pricks. These benefits translate directly into better health outcomes, reducing long-term diabetes-related complications such as neuropathy, retinopathy, and cardiovascular issues. The seamless integration of these devices with software platforms also facilitates remote patient monitoring (RPM) and telehealth services, widening the accessibility of specialized diabetes care.

Key driving factors propelling the growth of this market include the escalating global prevalence of diabetes, largely attributable to sedentary lifestyles and aging populations, coupled with increasing governmental and private sector investments in preventative and continuous monitoring healthcare technologies. Furthermore, technological breakthroughs leading to smaller, more accurate, and longer-lasting sensors, alongside the consumer demand for non-invasive or completely painless glucose sensing solutions, are crucial market accelerators. Regulatory approvals for integrating CGMs into closed-loop insulin delivery systems (artificial pancreas systems) further solidify the essential role of WBGM technology in modern endocrinology and chronic disease management.

Wearable Blood Glucose Monitoring Systems Market Executive Summary

The Wearable Blood Glucose Monitoring Systems Market is characterized by robust commercial activity, driven predominantly by the shift from traditional self-monitoring of blood glucose (SMBG) to Continuous Glucose Monitoring (CGM). Business trends indicate aggressive mergers, acquisitions, and strategic collaborations focused on technology licensing and distribution expansion, particularly targeting emerging markets. A critical trend is the expanding reimbursement coverage for CGM systems, moving beyond intensive insulin users (Type 1 diabetes) to include basal insulin users and even Type 2 diabetes patients not requiring insulin, drastically increasing the accessible patient pool. Furthermore, major market players are heavily investing in integrating their wearable devices with advanced predictive algorithms and cloud-based data analytics to provide actionable insights for patients and clinicians, transitioning from simple monitoring tools to comprehensive disease management platforms.

Regionally, North America remains the dominant market segment due to high diabetes prevalence, significant consumer awareness, high healthcare expenditure, and favorable reimbursement policies established by major payers like Medicare and private insurers. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by improving healthcare infrastructure, a vast underserved diabetic population, and increasing penetration of affordable smartphone-enabled monitoring solutions, particularly in China and India. European growth is sustained by supportive governmental initiatives promoting digital health adoption and established universal healthcare systems providing broad access to advanced medical devices.

Segmentation trends highlight the increasing preference for the sensor component segment, which accounts for the largest revenue share due to the required disposable nature of the sensor technology, necessitating repetitive purchases. By application, the Type 1 Diabetes segment currently holds the majority share, yet the Type 2 Diabetes segment is rapidly expanding and represents the greatest opportunity for future market penetration. The major product shift involves the development and anticipated commercialization of truly non-invasive monitoring devices (e.g., based on optical or sweat analysis), which, upon successful regulatory clearance, are expected to disrupt the current dominance of minimally invasive CGM patch sensors, fundamentally reshaping competitive landscapes and patient adoption rates globally.

AI Impact Analysis on Wearable Blood Glucose Monitoring Systems Market

Analysis of common user questions regarding AI's influence on the Wearable Blood Glucose Monitoring Systems Market reveals strong interest centered on accuracy enhancement, predictive modeling, and system integration. Users frequently inquire about how AI can refine raw sensor data to provide clinical-grade accuracy, especially during periods of rapid glucose fluctuation or signal noise. Key expectations revolve around AI-driven predictive analytics that can forecast hypoglycemic or hyperglycemic events minutes or hours in advance, allowing for proactive intervention rather than reactive treatment. There is also significant user curiosity concerning the use of sophisticated algorithms to personalize insulin dosing recommendations and seamlessly integrate CGM data with other health metrics (e.g., activity, sleep) via smartphone apps, creating a holistic digital health ecosystem. The collective concern, however, often touches on data privacy, the reliability of autonomous decision-making in closed-loop systems, and ensuring equitable access to these high-tech solutions.

AI is fundamentally transforming the utility and efficacy of WBGM systems by moving them beyond simple data collection devices. Machine learning algorithms are now being deployed to identify individual physiological patterns, adjusting for variables such as meal composition, exercise intensity, and stress, which previously required extensive manual logging. This personalization capability allows the system to fine-tune alerts and predictions specific to the user’s metabolic response, thereby minimizing alarm fatigue and increasing adherence to monitoring protocols. Furthermore, AI facilitates the sophisticated integration necessary for hybrid and fully automated closed-loop insulin delivery systems, where the algorithm processes CGM data and automatically instructs an insulin pump, forming the core technology of the artificial pancreas.

The computational power provided by AI also significantly benefits the manufacturing and calibration processes of WBGM sensors. Advanced statistical models are used during sensor development to compensate for biological drift and variability across different skin types and environmental conditions, leading to more stable and reliable long-term performance. For healthcare providers, AI tools are streamlining complex data visualization and interpretation, converting vast datasets into concise, actionable summaries (like Ambulatory Glucose Profiles or AGPs), improving clinical efficiency and enhancing communication between patient and doctor. This systematic application of AI ensures that WBGM systems evolve into essential tools for personalized medicine rather than just diagnostic aids.

- Enhanced accuracy and noise reduction in sensor readings through machine learning recalibration.

- Predictive analytics for forecasting glucose excursions (hypoglycemia/hyperglycemia) hours in advance.

- Personalized insulin dosing recommendations and automated closed-loop system control (Artificial Pancreas).

- Integration of glucose data with lifestyle factors (sleep, activity, nutrition) for holistic health modeling.

- Improved remote patient monitoring dashboards for clinicians, summarizing complex data into actionable insights.

- Optimization of alert systems to reduce alarm fatigue while maintaining safety parameters.

DRO & Impact Forces Of Wearable Blood Glucose Monitoring Systems Market

The Wearable Blood Glucose Monitoring Systems Market is heavily influenced by dynamic drivers, persistent restraints, and significant opportunities that shape its growth trajectory. The primary driver is the exponentially increasing global prevalence of diabetes, which establishes a fundamental and growing need for continuous monitoring solutions. This is powerfully complemented by strong governmental support for preventative health technologies, leading to expanded reimbursement coverage for advanced monitoring systems across developed economies. Simultaneously, advancements in miniaturization, coupled with improved sensor longevity and accuracy, make these devices increasingly appealing and functional for a broader demographic. These drivers create a compelling environment for sustained market expansion, pushing innovation towards greater accessibility and ease of use.

However, the market faces notable restraints, chiefly the high initial cost of some Continuous Glucose Monitoring (CGM) systems and the ongoing recurring expense associated with disposable sensors, which remains a financial barrier for low- and middle-income populations. Furthermore, despite significant improvements, concerns persist regarding the accuracy and reliability of measurements, particularly in non-invasive technologies still under development, and the time lag between interstitial fluid glucose readings and actual blood glucose levels. Regulatory hurdles, especially the stringent requirements set by bodies like the FDA and CE, present a time-consuming and costly challenge for new entrants aiming to commercialize novel, non-invasive technologies. Addressing these cost and accuracy concerns is paramount for achieving mass market adoption.

The future market opportunity lies predominantly in the successful development and commercialization of genuinely non-invasive glucose monitoring devices that eliminate the need for skin penetration entirely, unlocking the large segment of pre-diabetic and wellness-focused consumers. Another significant opportunity is the integration of WBGM systems into broader Remote Patient Monitoring (RPM) and telehealth frameworks, leveraging 5G connectivity and cloud computing to facilitate proactive disease management across vast geographical distances. Expanding the user base beyond Type 1 diabetes patients to include the massive, yet less intensively monitored, Type 2 diabetes population, and even into fitness and lifestyle monitoring, represents the most expansive growth trajectory for the coming decade, further supported by the push towards value-based healthcare models.

Segmentation Analysis

The Wearable Blood Glucose Monitoring Systems Market is systematically segmented based on product type, component, application, and end-user, providing a granular view of revenue streams and growth pockets. Product segmentation primarily divides the market into Continuous Glucose Monitoring (CGM) Systems and Flash Glucose Monitoring (FGM) Systems, with CGM currently holding the dominant share due to its comprehensive, real-time data streaming capabilities and integration potential with automated insulin delivery. Component segmentation is vital, as it identifies the sensor, transmitter, and receiver/display segments, where the disposable sensor component consistently generates the largest volume and value of revenue due to required frequent replacement. These foundational segments help stakeholders tailor product development and marketing efforts to address the distinct needs of each market area.

Application analysis delineates market demand across Type 1 Diabetes (T1D), Type 2 Diabetes (T2D), and pre-diabetes monitoring. While T1D management currently accounts for the core revenue base due to the critical need for continuous monitoring in these highly insulin-dependent individuals, the T2D segment is expected to exhibit the highest CAGR. This rapid growth is fueled by increasing incidence rates and the recognition that better glucose tracking can significantly mitigate long-term complications in T2D patients, supported by expanding insurance coverage. End-user segmentation focuses on distribution channels and final points of consumption, including hospitals, clinics, diagnostic centers, home care settings, and retail pharmacies, with home care settings dominating due to the self-management nature of the technology.

The strategic importance of segmentation lies in understanding the shift in technological preferences and end-user requirements. For instance, the demand for integrated systems that communicate seamlessly with smartwatches and mobile platforms is driving innovation in the transmitter and receiver components. Furthermore, the push towards achieving non-invasive monitoring is expected to create an entirely new sub-segment under product type, fundamentally altering the competitive dynamics currently centered around minimally invasive solutions. Identifying the rapidly growing T2D segment as the primary target for future sales penetration allows companies to focus R&D on solutions that are cost-effective, user-friendly, and specifically tailored for less intensive monitoring needs.

- Product Type: Continuous Glucose Monitoring (CGM) Systems, Flash Glucose Monitoring (FGM) Systems, Non-Invasive Glucose Monitoring Devices (Emerging)

- Component: Sensors (Disposable), Transmitters and Receivers, Software/Apps

- Application: Type 1 Diabetes Management, Type 2 Diabetes Management, Gestational Diabetes, Pre-diabetes and Wellness Monitoring

- End-User: Hospitals and Clinics, Diagnostic Centers, Home Care Settings, Retail Pharmacies and Online Channels

Value Chain Analysis For Wearable Blood Glucose Monitoring Systems Market

The value chain for the Wearable Blood Glucose Monitoring Systems Market begins with robust upstream activities focused on the procurement and development of highly specialized materials and core technological components. This segment involves suppliers of biosensors (enzymes, membranes, electrochemical components), microelectronics (semiconductors, microprocessors, batteries), and biocompatible materials for housing and adhesive patches. Key upstream activities include intensive R&D to enhance sensor longevity, stability, and selectivity, alongside rigorous quality control processes for micro-manufacturing. The complexity and precision required for these components mean that suppliers often operate in highly niche, specialized sectors, giving them significant bargaining power, which impacts the final device cost.

The middle segment of the value chain encompasses the original equipment manufacturers (OEMs) responsible for device assembly, calibration, software development, and integration. This stage involves sophisticated processes like miniature circuit integration, sterile packaging, and developing user-friendly mobile applications and cloud platforms for data storage and analysis. Compliance with international medical device regulations (e.g., ISO 13485, FDA 510(k) clearance) is critical at this manufacturing stage. The success of major market players is often defined by their ability to optimize these manufacturing processes while continuously iterating on software updates to enhance user experience and interoperability with other digital health tools.

Downstream activities involve the distribution channel and the final interaction with the end-users. Distribution is multifaceted, incorporating both direct and indirect models. Direct channels involve sales teams targeting major hospital networks, endocrinology clinics, and large integrated delivery networks (IDNs). Indirect channels leverage third-party logistics (3PL) providers, specialized medical distributors, and increasingly, major retail pharmacy chains and e-commerce platforms, particularly for routine sensor refills. The growing prevalence of home care settings and the shift towards patient self-management means that retail and online channels are becoming increasingly critical for accessibility and convenience. Successful downstream management requires efficient inventory tracking and deep engagement with payers to secure favorable reimbursement status, ensuring patients can afford the recurring supply costs.

Wearable Blood Glucose Monitoring Systems Market Potential Customers

The primary and most critical segment of potential customers for Wearable Blood Glucose Monitoring Systems comprises individuals diagnosed with diabetes, encompassing Type 1, Type 2, and gestational diabetes patients. Within this group, customers requiring intensive insulin therapy, typically Type 1 patients and a significant subset of Type 2 patients, represent the highest-value market due to their medical necessity for continuous, real-time glucose surveillance. These buyers prioritize accuracy, minimal intrusion, reliable alarm functions, and seamless integration with insulin pumps or pens. The decision-making process for these patients is heavily influenced by endocrinologists, diabetes educators, and crucially, insurance coverage and out-of-pocket costs, making them highly receptive to solutions that demonstrate superior clinical outcomes and reimbursement ease.

A rapidly expanding secondary customer segment includes healthcare institutions such as hospitals, specialized endocrinology clinics, and long-term care facilities. These organizational buyers utilize WBGM systems not only for individual patient care but also for optimizing workflows, standardizing care protocols, and participating in clinical trials. For institutional buyers, criteria such as device interoperability with Electronic Health Records (EHRs), reliability, bulk purchasing discounts, and comprehensive technical support are paramount. The use of these systems in hospitals is accelerating, particularly for managing glucose levels in critically ill patients where tight glycemic control is essential to improve prognosis and reduce complication rates.

Finally, a significant emerging customer base consists of wellness-conscious consumers, athletes, and individuals categorized as pre-diabetic or metabolically challenged, who are seeking non-invasive or convenient monitoring for lifestyle optimization and preventative health. This segment is less reliant on insurance reimbursement and places a high value on discretion, design aesthetics, and the integration of glucose data with fitness trackers and performance metrics. While currently accessing the market primarily through cash payment and pilot programs, the eventual launch of truly non-invasive, consumer-grade WBGM systems will unlock this vast population, shifting the customer landscape from purely clinical management to preventative health and bio-hacking, driven by personal financial outlay rather than medical prescription.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.85 Billion |

| Market Forecast in 2033 | USD 21.84 Billion |

| Growth Rate | 15.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Dexcom, Medtronic, Senseonics Holdings, Roche Diabetes Care, Ascensia Diabetes Care, Ypsomed, Novo Nordisk, WaveSense, LifeScan, Tandem Diabetes Care, Insulet Corporation, ACON Laboratories, Sanofi, B. Braun Melsungen, Glooko, POGO Automatic, Beta Bionics, Viacyte, Nemaura Medical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wearable Blood Glucose Monitoring Systems Market Key Technology Landscape

The current technological landscape of the Wearable Blood Glucose Monitoring Systems Market is primarily dominated by electrochemical, enzyme-based Continuous Glucose Monitors (CGMs). These systems utilize a miniature sensor inserted just beneath the skin into the interstitial fluid (ISF), where glucose oxidase immobilized on the sensor tip reacts with glucose to generate an electrochemical signal proportional to the glucose concentration. Major technological advancements in this field are centered on extending sensor wear time (currently 10 to 14 days), reducing the required calibration frequency, and minimizing the size and profile of the transmitter for enhanced discretion and user comfort. The push towards enhanced data security and interoperability using secure Bluetooth protocols is also critical, enabling reliable data transfer to smartphones, insulin pumps, and cloud-based platforms for telehealth services.

The most transformative area of innovation involves non-invasive glucose monitoring (NIGM) technologies, which seek to eliminate the need for skin penetration entirely. Several competing non-invasive approaches are under rigorous development, including optical sensing (using near-infrared spectroscopy or Raman spectroscopy to analyze skin or tissue components), thermal sensing, and micro-needle patch technology (which minimally pierces the skin surface without accessing the dermis). Although these technologies promise revolutionary convenience, they face significant hurdles regarding clinical accuracy validation, particularly in compensating for variations caused by skin tone, temperature, and movement. Achieving regulatory approval for an accurate, non-invasive device is viewed as the "holy grail" of this market, promising to open the floodgates for general consumer use beyond clinical necessity.

Furthermore, the evolution of software platforms and data integration tools constitutes a core technological pillar. Modern WBGM systems rely on sophisticated algorithms, often utilizing AI and machine learning, not just for predictive analytics but also for improving sensor performance and filtering noise. The ability to integrate CGM data seamlessly into Artificial Pancreas (AP) systems—which link the monitor directly to an automated insulin pump—represents the pinnacle of current application technology. Key technical standards, such as adherence to interoperability protocols (e.g., Tidepool Loop framework), are vital for ensuring that devices from different manufacturers can communicate effectively, supporting the patient's choice and enabling holistic digital diabetes management ecosystems.

Regional Highlights

- North America: Dominant Market Share and Innovation Hub

North America, particularly the United States, commands the largest market share in the WBGM sector, driven by a high prevalence of both Type 1 and Type 2 diabetes and highly advanced healthcare infrastructure. The region benefits from substantial investments in R&D, leading to rapid adoption of the latest CGM technology and closed-loop systems. Favorable and expanding reimbursement coverage, particularly from Medicare and Medicaid, significantly reduces the financial burden on patients, promoting high market penetration. The consumer’s high awareness of chronic disease management technologies and a highly competitive regulatory environment also accelerate the time-to-market for innovative products, establishing North America as the primary hub for technological commercialization. - Europe: Steady Growth and Strong Regulatory Support

The European market sustains steady, robust growth, supported by national healthcare systems in countries like the UK, Germany, and France that are increasingly prioritizing and reimbursing CGM systems for broader patient populations, including Type 2 diabetes patients who are not intensely managed with insulin. European regulatory bodies, such as the European Medicines Agency (EMA), have generally shown receptiveness to innovative medical devices, often allowing for faster initial market entry compared to the US. Growth in Europe is further propelled by initiatives aimed at digitizing healthcare and integrating diabetes data into centralized patient record systems, fostering widespread utilization across both hospital and primary care settings. - Asia Pacific (APAC): Fastest Growing Market with Untapped Potential

The Asia Pacific region is forecast to be the fastest-growing market globally, primarily due to the massive, underserved patient pool, especially in high-population countries like China and India, which account for a significant portion of the world's diabetic population. While historically hindered by lower per capita healthcare spending and limited insurance coverage for premium medical devices, market dynamics are rapidly shifting. Increasing disposable incomes, improving access to private healthcare, and local manufacturing initiatives focused on developing more affordable, localized solutions are driving rapid adoption. Furthermore, the high reliance on mobile technology across APAC facilitates the swift uptake of smartphone-enabled monitoring systems, bypassing the need for dedicated receiver devices and fueling growth in the home care segment. - Latin America, Middle East, and Africa (LAMEA): Emerging Adoption

The LAMEA region represents an emerging market characterized by significant variability in healthcare accessibility and economic stability. Market growth is gradually accelerating, particularly in countries with higher healthcare expenditure, such as Brazil, Saudi Arabia, and South Africa. Adoption is constrained by limited reimbursement policies and the high cost of imported devices. However, rising awareness of diabetes complications and concerted efforts by global manufacturers to establish distribution partnerships and offer tiered pricing strategies are slowly improving the availability of WBGM systems in key metropolitan areas, targeting affluent and private healthcare sectors first, before broader public coverage expands.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wearable Blood Glucose Monitoring Systems Market.- Abbott Laboratories

- Dexcom, Inc.

- Medtronic plc

- Senseonics Holdings, Inc.

- F. Hoffmann-La Roche Ltd (Roche Diabetes Care)

- Ascensia Diabetes Care Holdings AG

- Ypsomed AG

- Novo Nordisk A/S

- WaveSense (A subsidiary of Promiseg Diagnostics)

- LifeScan, Inc.

- Tandem Diabetes Care, Inc.

- Insulet Corporation

- ACON Laboratories, Inc.

- Sanofi S.A.

- B. Braun Melsungen AG

- Glooko, Inc.

- POGO Automatic (Intuity Medical)

- Beta Bionics, Inc.

- Viacyte, Inc. (A subsidiary of Vertex Pharmaceuticals)

- Nemaura Medical Inc.

Frequently Asked Questions

Analyze common user questions about the Wearable Blood Glucose Monitoring Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between CGM and traditional BGM systems?

Continuous Glucose Monitoring (CGM) systems provide automated, real-time glucose readings every few minutes, tracking trends and patterns throughout the day and night using a minimally invasive sensor. Traditional Blood Glucose Monitoring (BGM) systems, or finger-prick meters, provide only a single, snapshot reading at the moment of testing.

Are Wearable Blood Glucose Monitoring Systems fully non-invasive yet?

While the majority of commercially successful Wearable Blood Glucose Monitoring Systems (CGMs) are minimally invasive (requiring a small, temporary sensor insertion), several companies are in late-stage development of truly non-invasive devices utilizing technologies like optical sensing. These non-invasive products are not yet widely available for clinical use.

Which factors are driving the rapid growth of the Wearable BGM market?

Market growth is primarily driven by the surging global prevalence of diabetes, the increasing adoption of telehealth and remote patient monitoring, and significantly enhanced reimbursement coverage for Continuous Glucose Monitoring (CGM) across major developed healthcare systems, encouraging broader patient access.

How does AI technology enhance the performance of wearable glucose monitors?

Artificial Intelligence (AI) algorithms enhance performance by improving predictive analytics, allowing systems to forecast dangerous glucose trends hours in advance. AI also refines sensor accuracy by filtering signal noise and enables sophisticated integration necessary for automated insulin delivery in closed-loop systems.

What are the main restraints hindering mass adoption of WBGM systems?

The chief restraints are the high recurring costs of disposable sensors, which pose a financial barrier for uninsured or under-reimbursed patient populations, and lingering concerns regarding the clinical accuracy and regulatory clearance timelines for next-generation non-invasive monitoring technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager