Wearable Hidden Camera Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433099 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wearable Hidden Camera Market Size

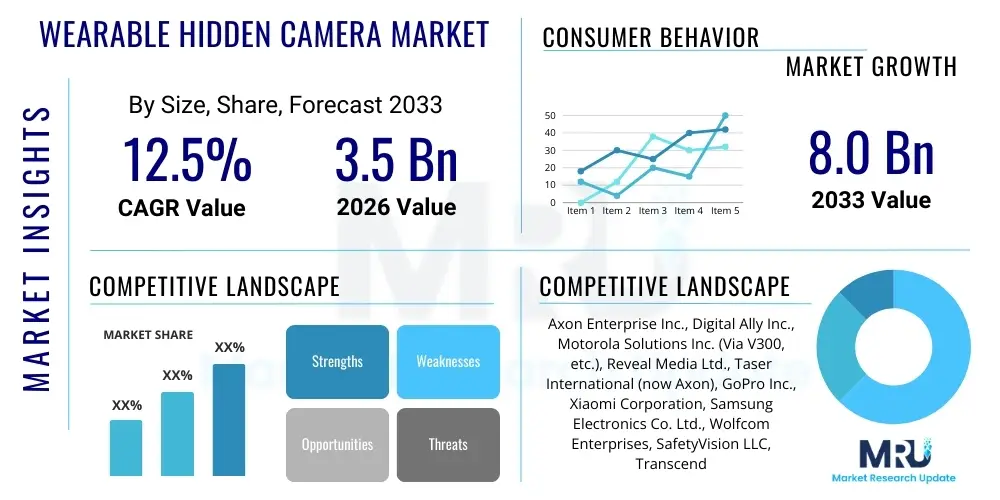

The Wearable Hidden Camera Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 8.0 Billion by the end of the forecast period in 2033.

Wearable Hidden Camera Market introduction

The Wearable Hidden Camera Market encompasses devices designed for discreet video and audio recording, typically integrated into common accessories such as glasses, pens, buttons, or badge holders. These products are characterized by their small form factor, high definition recording capabilities, and focus on covert operation, serving both professional security requirements and personal safety needs. Technological advancements, particularly in sensor miniaturization and battery longevity, have significantly enhanced the functionality and appeal of these devices, moving them beyond rudimentary surveillance tools into sophisticated evidential recording systems.

Major applications of wearable hidden cameras span across various sectors, including law enforcement and military operations, where they function as body-worn cameras (BWCs) for accountability and evidence collection. Furthermore, they are extensively utilized by private security firms for monitoring and asset protection, and by journalists for investigative reporting. The consumer segment uses these cameras primarily for personal safety, recording interactions, and documenting activities discreetly. The core benefit these products offer is the ability to capture reliable, unbiased documentation in real-time scenarios without altering the natural flow of events.

Key driving factors accelerating market expansion include the increasing demand for personal and professional security solutions globally, driven by rising crime rates and geopolitical uncertainties. The proliferation of affordable, high-resolution imaging technology (e.g., 4K sensors) combined with advancements in wireless connectivity (Wi-Fi and Bluetooth) facilitates seamless data transfer and remote monitoring. Additionally, the growing legal acceptance of video evidence captured by these devices in judicial proceedings further validates their utility and drives sustained market growth across both developed and emerging economies.

Wearable Hidden Camera Market Executive Summary

The Wearable Hidden Camera Market exhibits dynamic growth driven by evolving business trends centered around integrated smart technology and robust evidential reliability. A primary business trend involves the shift towards subscription-based cloud storage services accompanying BWC deployments, ensuring secure data management and compliance with stringent retention policies for institutional clients. Furthermore, product innovation focuses heavily on enhancing battery life and integrating edge computing capabilities for real-time analysis, moving processing power closer to the device to improve responsiveness and decrease latency, crucial for high-stakes operational environments.

Regionally, the market shows pronounced growth in the Asia Pacific (APAC), spurred by massive infrastructure development and rapid urbanization requiring enhanced security infrastructure, particularly in commercial and public spaces. North America and Europe remain mature markets, characterized by stringent regulatory frameworks dictating the use and storage of footage, which fuels the demand for high-compliance, certified products suitable for governmental and law enforcement agencies. These regions emphasize data security and privacy features, pushing manufacturers toward adopting advanced encryption standards and GDPR-compliant solutions.

Segment trends highlight the dominance of the Body-Worn Camera (BWC) segment within the application landscape, reflecting significant government procurement contracts globally. Technology-wise, 4K resolution cameras are rapidly replacing HD models due to the improved clarity essential for forensic analysis. The distribution channel is increasingly leveraging specialized B2B distributors who offer integrated installation and maintenance services, moving away from purely retail-focused models, especially for high-value contracts involving large security organizations and policing forces.

AI Impact Analysis on Wearable Hidden Camera Market

User inquiries regarding the impact of Artificial Intelligence on the Wearable Hidden Camera Market frequently revolve around ethical concerns related to constant surveillance and automated identification, the technical feasibility of real-time processing on miniature devices, and the practical applications of enhanced analytics. Users seek clarity on how AI enhances the device's utility beyond mere recording, focusing on capabilities like automated threat detection, facial recognition accuracy, and the influence of AI on power consumption. There is significant concern about maintaining user privacy while leveraging the benefits of automated data analysis, particularly within public safety and consumer segments. The consensus expectation is that AI will transform these passive recording tools into proactive, intelligent security assets capable of selective, prioritized evidence capture.

The integration of sophisticated AI models, often leveraging edge computing architectures, allows wearable hidden cameras to perform complex tasks locally without relying solely on cloud infrastructure. This capability is vital for low-latency applications, enabling real-time detection of anomalies such as unauthorized access, aggressive behavior patterns, or sudden movements that might indicate a threat. For example, AI can significantly reduce the volume of irrelevant footage stored by intelligently tagging and flagging only events that meet pre-defined criteria, thereby optimizing storage costs and speeding up post-incident review processes for law enforcement agencies and security personnel.

Furthermore, AI algorithms are instrumental in enhancing the quality and reliability of evidence. Functions such as image stabilization, low-light enhancement, and automated redaction of sensitive identifying information (like faces of bystanders) for privacy compliance are becoming standard features, driven by AI processing. This not only improves the usability of the captured footage in legal contexts but also addresses key ethical and regulatory challenges associated with continuous video surveillance, positioning AI as a crucial enabler for responsible and effective deployment of wearable hidden camera technology.

- AI enhances real-time threat detection and behavioral analysis directly on the device (Edge AI).

- Automated object tracking and anomaly detection improves the quality of recorded evidence.

- Intelligent data management reduces storage load by selectively recording or tagging relevant events.

- Facial and license plate recognition capabilities are significantly improved for identification purposes.

- AI-driven compression techniques optimize battery life and data transmission efficiency.

- Automated privacy masking and redaction ensure compliance with data protection regulations like GDPR.

- Predictive analytics for situational awareness in high-risk environments is enabled through AI processing.

DRO & Impact Forces Of Wearable Hidden Camera Market

The Wearable Hidden Camera Market is propelled by robust drivers, including global security concerns and technological innovation, while simultaneously being constrained by significant regulatory and ethical hurdles. The primary driver is the widespread need for objective accountability in professional interactions, particularly in policing and security services, which mandates the deployment of Body-Worn Cameras (BWCs). Opportunities are emerging through the integration of 5G connectivity, enabling ultra-low-latency, high-bandwidth data transmission essential for real-time remote surveillance and critical data relay from the field.

However, the market faces considerable restraints, chiefly centered around public perception and stringent privacy legislation. Data protection laws, such as the European Union's General Data Protection Regulation (GDPR) and various state-level regulations in North America, impose strict limits on where, when, and how video data can be collected, stored, and utilized, requiring significant investment in compliance technology. Technical restraints include the persistent challenge of maximizing battery life to support high-resolution recording and continuous operational cycles, coupled with the computational demands of integrated AI processing at the edge.

Impact forces in this market are predominantly driven by technological acceleration and evolving societal expectations regarding surveillance. Miniaturization continues to reduce the size and increase the discretion of cameras, expanding their application scope. Meanwhile, the legal requirement for transparency and accountability acts as a powerful external force, compelling institutions to adopt documented surveillance practices. The convergence of these drivers and restraints creates a market where innovation is heavily moderated by ethical consideration and regulatory compliance, defining the strategic landscape for manufacturers.

Segmentation Analysis

The Wearable Hidden Camera Market is extensively segmented based on key attributes including product type, resolution, application, and distribution channel, allowing for a precise understanding of market dynamics and targeted product development. Product segmentation highlights the diversity of covert forms, from devices seamlessly integrated into garments to those disguised as everyday objects like pens or smart jewelry. Analyzing these segments is critical for stakeholders to identify high-growth niches, particularly the professional BWC segment which differs significantly in requirements and purchasing cycles from consumer-grade personal safety devices.

Resolution segmentation, covering HD, Full HD, and 4K, demonstrates the market's trajectory towards superior image quality driven by forensic requirements where detail is paramount. The increasing affordability of 4K sensors is accelerating this transition, making higher resolution standard across many professional models. Application-based segmentation confirms the dominance of public safety and defense applications, although the commercial security and personal use segments are witnessing rapid adoption fueled by ease of access and price competitiveness.

The segmentation by distribution channel is vital, distinguishing between specialized B2B channels (used for large governmental and enterprise contracts) and B2C channels (like e-commerce and retail stores) that cater to individual consumers and small businesses. The increasing reliance on online platforms (e-commerce) for consumer sales provides manufacturers with direct market access and competitive pricing flexibility, whereas B2B sales rely heavily on certified system integrators providing comprehensive service packages.

- Product Type:

- Body Worn Cameras (BWCs)

- Hidden Cameras Integrated into Accessories (Pens, Glasses, Buttons)

- Modular and Customizable Hidden Cameras

- Resolution:

- HD (720p)

- Full HD (1080p)

- 4K and Above

- Application:

- Law Enforcement and Public Safety

- Defense and Military Operations

- Commercial Security (Retail, Corporate)

- Journalism and Investigative Reporting

- Personal Safety and Consumer Use

- Distribution Channel:

- Online Retail (E-commerce)

- Offline Retail (Specialty Stores, Electronics Stores)

- B2B Distribution/System Integrators

Value Chain Analysis For Wearable Hidden Camera Market

The value chain for the Wearable Hidden Camera Market begins with upstream activities focused on the sourcing and manufacturing of highly specialized components. This includes securing contracts for miniaturized imaging sensors (CMOS/CCD), specialized processors optimized for low power consumption and edge AI, custom optics, and high-density, long-life batteries. Key upstream suppliers often involve global semiconductor manufacturers and specialized optics companies. Effective upstream management is crucial for maintaining competitive pricing and ensuring the incorporation of the latest technological innovations, such as advanced compression codecs and sensor technologies.

The midstream involves device assembly, software development (including AI algorithms and secure data encryption), and rigorous quality control testing to meet international safety and performance standards. Manufacturing often requires cleanroom environments and specialized assembly lines due to the small size and complex integration of components. The integration of proprietary software interfaces for data retrieval, storage management, and compliance features adds significant value at this stage, differentiating premium brands from generic manufacturers.

Downstream activities center on distribution and end-user engagement. Direct channels are often utilized for large governmental or institutional sales, requiring highly tailored solutions and long-term service agreements. Indirect channels, including specialized security equipment distributors and large e-commerce platforms, serve the broader commercial and consumer markets. The value chain concludes with post-sales support, data management services (often cloud-based subscriptions), and maintenance, which represent a growing recurring revenue stream for key market players, particularly in the BWC sector.

Wearable Hidden Camera Market Potential Customers

The primary customer base for the Wearable Hidden Camera Market consists of institutions and individuals with critical needs for reliable, discreet evidence capture and personal accountability. Law enforcement agencies globally represent the largest institutional buyers, utilizing Body-Worn Cameras (BWCs) to increase transparency, mitigate liability, and secure actionable evidence in field operations. Procurement cycles in this segment are long-term and volume-intensive, prioritizing durability, data security compliance, and seamless integration with existing evidence management systems (DEMS).

Private security firms and corporate entities constitute another significant customer segment. These buyers deploy hidden cameras for internal investigations, loss prevention in retail environments, monitoring high-value assets, and ensuring compliance in industrial settings. Their purchasing decisions are driven by ROI, emphasizing features like long battery life, ruggedness, and remote monitoring capabilities to enhance operational oversight and reduce security breaches.

The consumer segment, though fragmented, is rapidly growing, focusing on personal safety and documentation. Potential customers here include individuals concerned about personal security, journalists requiring tools for discreet investigative work, and hobbyists. These buyers are highly price-sensitive but prioritize ease of use, concealment, and basic connectivity features, typically accessing products through direct e-commerce channels or mass-market retailers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 8.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axon Enterprise Inc., Digital Ally Inc., Motorola Solutions Inc. (Via V300, etc.), Reveal Media Ltd., Taser International (now Axon), GoPro Inc., Xiaomi Corporation, Samsung Electronics Co. Ltd., Wolfcom Enterprises, SafetyVision LLC, Transcend Information Inc., Pinnacle Response Ltd., VieVu LLC (now Axon), Pannin Technologies, BodyVision, E-vision (Zhejiang) Technology Co., Ltd., Shenzhen AEE Technology Co., Ltd., Martel Electronics, L.A.W. Tactical, Inc., B-Cam Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wearable Hidden Camera Market Key Technology Landscape

The technological landscape of the Wearable Hidden Camera Market is defined by intense competition in miniaturization, power management, and advanced data processing capabilities. The core technology involves highly efficient CMOS image sensors that can capture high-resolution video in extremely small packages while operating effectively in low-light conditions. Manufacturers are aggressively pursuing advancements in specialized System-on-Chips (SoCs) that integrate video processing, storage management, and wireless communication capabilities, allowing for sustained performance in discreet, battery-operated devices. This drive for efficiency is essential to overcome the principal limitation of wearable technology: battery life.

Another crucial area is connectivity and data security. The shift towards cloud-based evidence management necessitates robust encryption protocols (e.g., AES 256-bit) and secure wireless transmission methods (5G, Wi-Fi 6). Modern wearable cameras are increasingly incorporating GPS and geofencing technology for automated recording activation and location tracking, which is invaluable for situational awareness in public safety applications. Furthermore, the development of secure docking stations that facilitate automated, encrypted data offload upon return to a central station streamlines operational workflows and ensures evidence integrity.

The most transformative technology remains the integration of Artificial Intelligence and Machine Learning (ML). Edge AI processing allows the camera to perform functions such as facial blurring, object detection, and behavioral analysis locally. This selective processing dramatically reduces the volume of data that needs to be transmitted or stored, optimizing both bandwidth and battery consumption. Future developments will focus on bio-feedback integration, enabling cameras to activate based on physiological stress indicators of the wearer, further automating critical event capture.

Regional Highlights

- North America: This region holds a significant market share, characterized by high adoption rates of Body-Worn Cameras (BWCs) driven by federal and state mandates promoting police accountability and transparency. The market is mature, demanding sophisticated features like advanced data encryption, robust cloud integration, and seamless compatibility with established Evidence Management Systems (EMS). Key growth is stimulated by technological refresh cycles and the deployment of AI-enhanced capabilities in law enforcement and private security sectors.

- Europe: The European market demonstrates steady growth but is heavily influenced by the stringent data protection requirements of GDPR. This necessitates specialized product design focusing on automated privacy features (e.g., mandatory face/license plate blurring for bystanders) and strict data sovereignty rules. While public sector adoption of BWCs is strong, the emphasis on regulatory compliance makes the market demanding for manufacturers, favoring certified solutions that prioritize privacy by design.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, substantial investment in smart city infrastructure, and increasing security threats. Countries like China, India, and South Korea are major contributors, witnessing large-scale deployment of wearable cameras for public safety, transportation security, and commercial surveillance. Market expansion here is driven by cost-effective manufacturing capabilities and growing governmental willingness to invest in surveillance technology, often focusing on high-volume, affordable units.

- Latin America (LATAM): Growth in LATAM is primarily motivated by urgent needs for crime reduction and police accountability. The market is emerging, but security instability in several countries drives strong demand from private security services and governmental agencies seeking verifiable evidence capture tools. Challenges include lower infrastructure maturity (e.g., limited high-speed internet in remote areas), necessitating cameras with robust offline storage and reliable battery performance.

- Middle East and Africa (MEA): The MEA region shows increasing adoption, particularly in the Gulf Cooperation Council (GCC) countries, linked to large-scale infrastructure projects, mega-events (like expos and major sporting events), and high-value asset protection. The demand profile focuses on ruggedized, high-durability cameras suitable for extreme temperatures and requiring secure, often localized, data storage solutions due to political sensitivities regarding data handling.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wearable Hidden Camera Market.- Axon Enterprise Inc.

- Digital Ally Inc.

- Motorola Solutions Inc.

- Reveal Media Ltd.

- GoPro Inc.

- Xiaomi Corporation

- Samsung Electronics Co. Ltd.

- Wolfcom Enterprises

- SafetyVision LLC

- Transcend Information Inc.

- Pinnacle Response Ltd.

- B-Cam Ltd.

- Vievu LLC (now Axon)

- Pannin Technologies

- E-vision (Zhejiang) Technology Co., Ltd.

- Shenzhen AEE Technology Co., Ltd.

- Martel Electronics

- L.A.W. Tactical, Inc.

- Hytera Communications Corporation Limited

- Shenzhen Mingsu Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Wearable Hidden Camera market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary legal concerns regarding the use of wearable hidden cameras?

The main legal concern revolves around privacy, consent, and data protection laws (such as GDPR in Europe and state-specific wiretapping laws in the US). Users must ensure they understand the jurisdiction's rules regarding recording audio versus video, public versus private spaces, and the requirements for notifying recorded parties or obtaining consent to maintain the admissibility of evidence.

How does AI technology improve the performance of wearable hidden cameras?

AI improves performance by enabling edge processing for real-time analytics, such as automated threat detection, object tracking, and intelligent event tagging. This reduces the need for constant recording, optimizes battery life, and ensures that only relevant, high-quality evidence is captured and stored, streamlining evidence management workflows.

What are the critical factors determining battery life in professional body-worn cameras?

Critical factors include recording resolution (4K consumes significantly more power than 1080p), the frequency of wireless connectivity (Wi-Fi/Bluetooth/5G usage for live streaming), and the computational load imposed by integrated AI features. Professional models prioritize larger battery packs and optimized, low-power chipsets to achieve 8-12 hours of continuous operational recording.

Which market segment is expected to experience the fastest growth by application?

The Law Enforcement and Public Safety segment is expected to maintain robust growth due to increasing government mandates globally for transparency and accountability. However, the Personal Safety and Consumer Use segment is projected to show the highest Compound Annual Growth Rate (CAGR), driven by the declining cost of high-quality miniature sensors and greater individual concern for personal security.

What role does cloud storage play in the wearable hidden camera ecosystem?

Cloud storage is vital for secure, compliant evidence management (DEMS). It provides scalable, tamper-proof storage solutions required by institutions, ensuring data integrity and adherence to strict chain-of-custody protocols. Subscription-based cloud services also facilitate remote access, data sharing among authorized parties, and automated data retention policies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager