Wearable Medical Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435616 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Wearable Medical Equipment Market Size

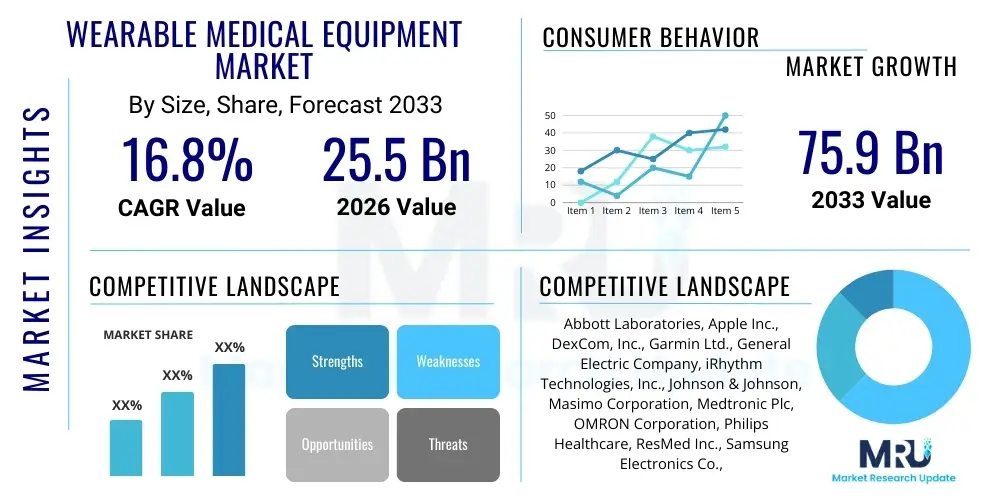

The Wearable Medical Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 75.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating global burden of chronic diseases, coupled with significant technological advancements that enable miniaturization and enhanced accuracy of biosensors, making remote patient monitoring a highly effective and widely adopted healthcare practice.

Wearable Medical Equipment Market introduction

The Wearable Medical Equipment Market encompasses a diverse range of electronic devices designed to be worn on the body—such as fitness trackers, smartwatches, patches, and specialized clinical monitors—that collect physiological data related to health and fitness. These devices serve as crucial tools for continuous monitoring of vital signs, including heart rate, blood pressure, oxygen saturation, body temperature, and glucose levels. The primary goal of these products is to shift healthcare from episodic intervention to proactive, preventive, and personalized management, significantly improving patient outcomes while reducing the necessity for frequent in-person clinical visits. The sophistication of these devices, integrating advanced sensing technology with powerful data processing capabilities, has solidified their role across consumer wellness and regulated clinical diagnostics.

Major applications of wearable medical equipment span across several critical sectors, including remote patient monitoring (RPM), clinical trials, fitness and wellness management, and rehabilitation therapy. RPM is the most significant application, allowing healthcare providers to continuously track patients with chronic conditions suchs as diabetes, cardiovascular disease, and chronic obstructive pulmonary disease (COPD) outside of traditional hospital or clinic settings. Furthermore, these devices are increasingly utilized in sleep monitoring, neurological assessments, and mental health tracking, providing objective data that was previously difficult to capture accurately. The convenience and non-invasive nature of wearable technology contribute significantly to higher patient compliance and more comprehensive data capture, enabling more precise diagnostic and therapeutic decisions.

Key benefits driving the rapid market expansion include enhanced patient engagement through real-time feedback, reduced healthcare expenditure resulting from fewer hospital readmissions and emergency visits, and improved diagnostic accuracy due to the continuous nature of data collection. Furthermore, the driving factors behind market growth are multi-faceted, encompassing the aging global population requiring constant health surveillance, the increasing prevalence of lifestyle diseases, strong investment in digital health infrastructure, and favorable regulatory frameworks supporting telehealth and remote care initiatives. The confluence of these technological, demographic, and regulatory tailwinds ensures sustained growth and integration of wearable medical equipment into mainstream healthcare delivery systems worldwide, fundamentally altering the patient-physician relationship toward greater collaboration and data transparency.

Wearable Medical Equipment Market Executive Summary

The Wearable Medical Equipment Market is characterized by robust business trends centered on strategic partnerships between technology firms and traditional healthcare providers, emphasizing data interoperability and security. A significant trend is the maturation of medical-grade wearables, moving beyond consumer-focused fitness trackers toward FDA-approved diagnostic tools capable of delivering clinical-grade accuracy. Key business models are shifting from outright device sales to subscription-based services that include data analytics, professional monitoring, and personalized coaching, ensuring recurring revenue streams for market players. Furthermore, venture capital investment continues to pour into startups specializing in highly specific sensing technologies, such as continuous glucose monitoring (CGM) patches and advanced electrocardiogram (ECG) monitoring shirts, highlighting a drive toward specialized and minimally invasive solutions.

Regional trends indicate North America currently dominating the market, primarily due to high healthcare expenditure, established digital health infrastructure, and rapid adoption of advanced technologies like AI-driven diagnostics within wearable platforms. However, the Asia Pacific region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period, fueled by massive untapped patient populations, increasing disposable incomes, and proactive government initiatives supporting telehealth deployment, particularly in countries like China, India, and Japan. Europe maintains a strong presence, emphasizing stringent regulatory compliance (e.g., MDR) and widespread adoption through national health systems focused on preventative care and reducing the burden on aging populations, establishing a strong regional market for sophisticated clinical-grade wearables.

Segment trends reveal that monitoring and diagnostic devices, particularly continuous glucose monitors (CGM) and heart rate monitors, constitute the largest segment by revenue, driven by the chronic disease management crisis globally. Therapeutic devices, while smaller in market share, are expected to exhibit high growth, particularly in areas like pain management and respiratory therapy where wearable solutions offer portability and personalized treatment delivery. By application, the home healthcare and remote patient monitoring segments are experiencing the most aggressive growth, reflecting the global trend toward decentralized healthcare. The technology segment is dominated by sensor technology, with advancements in biosensors and microfluidics enabling smaller, more powerful, and more energy-efficient wearable products, critical for long-term patient monitoring compliance and data reliability.

AI Impact Analysis on Wearable Medical Equipment Market

User questions regarding the impact of Artificial Intelligence (AI) on the Wearable Medical Equipment Market often revolve around three central themes: enhancing diagnostic accuracy, ensuring data privacy and security, and the integration of predictive health analytics into personalized care pathways. Common concerns include how AI can effectively filter the massive amounts of data generated by continuous monitoring devices (noise reduction), whether algorithms can reliably detect subtle patterns indicative of serious health events (early warning systems), and the regulatory hurdles associated with using AI for medical decision support. Users also frequently inquire about the feasibility of AI driving truly personalized interventions, such as adjusting medication dosages or recommending behavioral changes based on real-time physiological and contextual data captured by wearables.

The core expectation is that AI will transform wearables from passive data collectors into active, intelligent diagnostic and predictive tools. AI algorithms, particularly machine learning models, are essential for processing the complex, multimodal data streams generated by sensors—ranging from ECG waveforms and sleep patterns to physical activity logs. This capability allows for the detection of anomalies and the prediction of health deteriorations long before they manifest clinically, moving the healthcare paradigm firmly into the realm of true prevention. The integration of deep learning enhances pattern recognition capabilities, significantly improving the sensitivity and specificity of medical alerts, thereby reducing false positives and clinical fatigue for healthcare professionals managing large cohorts of remote patients. The market is thus shifting towards 'smart wearables' where the value lies not just in the hardware, but in the proprietary, clinical-validated AI underpinning the data interpretation.

Furthermore, AI is crucial for optimizing the user experience and ensuring adherence. By using AI to understand individual patient behavior and physiological baselines, wearables can offer highly personalized nudges, alerts, and feedback that are relevant and timely, thereby sustaining long-term user compliance. On the operational side, AI facilitates automated reporting and seamless integration of wearable data into Electronic Health Records (EHRs), streamlining clinical workflows and reducing the administrative burden associated with remote patient monitoring programs. This technological convergence ensures that wearable medical equipment becomes indispensable, not only for consumer wellness but also as a core utility in clinical environments, underpinning the precision medicine movement.

- AI enables real-time anomaly detection and predictive health analytics based on continuous physiological data streams.

- Machine learning algorithms significantly improve the accuracy and reliability of diagnostic outputs from wearable sensors, such as atrial fibrillation detection.

- AI optimizes data filtering and noise reduction, managing the large volume of data generated by long-term continuous monitoring.

- Personalized intervention recommendations (e.g., sleep optimization, exercise adjustments) are driven by AI analyzing individual baselines and behavioral context.

- Integration of AI facilitates automated clinical reporting and enhances interoperability with existing Electronic Health Record (EHR) systems.

- Generative AI models are beginning to be explored for synthesizing patient-specific risk profiles and simulating treatment outcomes based on wearable data.

- Advanced security protocols leverage AI to detect and prevent unauthorized data access, enhancing compliance with health data regulations (e.g., HIPAA, GDPR).

DRO & Impact Forces Of Wearable Medical Equipment Market

The market growth is primarily driven by the escalating global incidence of chronic diseases, such as cardiovascular disorders and diabetes, which necessitate continuous, passive monitoring outside of institutional settings. The opportunity landscape is vast, centering on the integration of advanced technologies like flexible electronics, miniaturized sensors, and sophisticated data analytics platforms, opening new avenues for ultra-personalized and non-invasive diagnostic tools. However, the market faces significant restraints, notably the stringent regulatory pathways required for medical-grade devices, which slow down product innovation cycles, and persistent concerns regarding data privacy, security breaches, and the reliability of data generated by certain consumer-grade devices. The interplay of these factors defines the strategic positioning and growth potential for all stakeholders across the value chain, from component manufacturers to end-use healthcare providers.

Key drivers include the widespread adoption of smartphones and high-speed internet connectivity, which serve as essential conduits for transmitting data from wearables to cloud-based platforms and professional monitoring services. Furthermore, governmental incentives and reimbursement policies across developed economies increasingly support remote patient monitoring (RPM) services, transforming wearables from consumer novelties into revenue-generating clinical tools. The increasing focus on preventative healthcare, driven by rising healthcare costs, mandates solutions that can keep populations healthier and reduce hospitalization rates. This economic necessity combined with demographic pressure (the aging population) creates an irreversible force propelling the adoption of connected medical wearables into daily life, integrating seamlessly into both wellness routines and critical care management protocols, substantially broadening the addressable market.

The impact forces shaping the market involve intense competition among established medical device manufacturers, consumer electronics giants, and specialized health technology startups, leading to rapid product innovation and downward pressure on pricing in certain segments. Regulatory complexity acts as a powerful moderating force, ensuring clinical efficacy and data integrity but also creating significant barriers to entry, particularly for Class II and Class III devices. Opportunities lie heavily in developing integrated solutions that combine diagnostic capabilities with therapeutic delivery, such as closed-loop systems for diabetes management. Successfully navigating the high capital requirements for R&D, establishing robust cybersecurity frameworks, and achieving international regulatory clearances are critical determinants of long-term market success and sustainable growth in this rapidly evolving healthcare technology landscape.

Segmentation Analysis

The Wearable Medical Equipment Market is intricately segmented based on device type, application, technology, end-user, and distribution channel, providing a granular view of market dynamics and identifying specific growth pockets. Device type segmentation distinguishes between monitoring devices (e.g., vital signs monitors, ECG monitors), therapeutic devices (e.g., pain management devices, insulin pumps), and diagnostic devices. The diversity in applications—spanning cardiac monitoring, fitness tracking, sleep disorder management, and neurological monitoring—highlights the versatility of wearable technology in addressing varied health needs. Analyzing these segments is critical for manufacturers to tailor product development, optimize marketing strategies, and allocate resources effectively toward high-potential areas such as remote patient management and preventative health solutions.

- By Device Type:

- Monitoring and Diagnostic Devices

- Vital Signs Monitors (Heart Rate, Temperature, Blood Pressure)

- Electrocardiogram (ECG) Monitors

- Continuous Glucose Monitoring (CGM) Devices

- Fetal and Obstetric Monitors

- Neurological Monitors (e.g., EEG, Sleep Trackers)

- Therapeutic Devices

- Insulin Pumps

- Respiratory Therapy Devices

- Pain Management Devices

- Rehabilitation Devices (e.g., Exoskeletons)

- Monitoring and Diagnostic Devices

- By Application:

- Remote Patient Monitoring (RPM)

- Sports and Fitness

- Home Healthcare

- Chronic Disease Management

- Clinical Trials and Research

- By Technology:

- Sensor Technology (Biosensors, Accelerometers, Gyroscopes)

- Connectivity Technology (Bluetooth, Wi-Fi, NFC, Cellular)

- Data Analytics and Software Platforms

- Display and Interface Technology

- By End-User:

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Home Healthcare Settings

- Fitness and Wellness Centers

Value Chain Analysis For Wearable Medical Equipment Market

The value chain for the Wearable Medical Equipment Market begins with upstream activities focused on raw material procurement, specialized component manufacturing, and core technology development. This phase involves sourcing advanced materials such as flexible substrates, biocompatible polymers, and highly specialized micro-electromechanical systems (MEMS) sensors. Key upstream players include semiconductor manufacturers, sensor developers (e.g., biosensor firms), and battery technology innovators who supply the foundational components necessary for miniaturized, high-performance wearable devices. Efficiency and quality control at this stage are paramount, as the accuracy, battery life, and durability of the final product are highly dependent on the quality of these foundational inputs, necessitating close collaboration between device assemblers and component suppliers to manage supply chain risks.

Midstream activities involve the design, assembly, and software integration of the medical wearable device. This phase includes industrial design (focusing on aesthetics and comfort for user compliance), firmware development, algorithm creation for data processing (often incorporating proprietary AI/ML), and extensive regulatory testing (e.g., FDA clearance, CE marking). Manufacturers must establish sophisticated production lines capable of high-volume manufacturing while adhering to strict quality standards required for medical devices (ISO 13485). Downstream activities primarily encompass distribution, marketing, and post-sale service. Direct and indirect distribution channels are utilized, with indirect channels leveraging pharmacies, medical distributors, and large retail stores for consumer-grade wearables, while direct sales teams are often deployed to engage hospitals, clinics, and large health systems for clinical-grade RPM solutions.

The distribution channels are highly critical, especially the shift towards digital distribution and telehealth platforms. For consumer wearables, e-commerce giants and specialized online health retailers are dominant. However, for medical-grade devices, successful penetration requires partnering with specialized healthcare distributors who possess expertise in logistics, technical support, and navigating complex institutional procurement processes. Furthermore, the provision of robust, ongoing technical support and subscription services for data analytics is a crucial element of the downstream value proposition. These services ensure long-term device functionality, continuous software updates, and reliable data transmission, significantly impacting user retention and the overall clinical effectiveness of the wearable ecosystem, creating a sustained revenue stream beyond the initial device purchase.

Wearable Medical Equipment Market Potential Customers

The primary potential customers and end-users of wearable medical equipment are broadly categorized into clinical institutions and individual consumers, differentiated by the device’s complexity, regulatory status, and application purpose. Clinical end-users include large hospital networks, specialty clinics (cardiology, neurology), and primary care practices that utilize clinical-grade wearables for remote patient monitoring (RPM) and diagnostic purposes. For these institutions, the value proposition centers on reducing healthcare costs associated with readmissions, optimizing staff workflow by automating data collection, and improving patient outcomes through continuous, objective monitoring. The adoption decision here is driven by clinical validation, integration capabilities with existing Electronic Health Records (EHRs), and favorable reimbursement structures for RPM services.

The second major group consists of individual consumers, ranging from active individuals focused on wellness and fitness to patients managing chronic conditions in a home setting. For the wellness segment, the motivation is self-improvement, performance tracking, and basic health awareness, typically utilizing consumer-grade smartwatches and fitness bands. However, the rapidly growing home healthcare segment consists of elderly patients or those with long-term conditions (e.g., Type 2 diabetes, hypertension) who rely on medical-grade devices, such as CGM patches or wearable ECGs, prescribed by a physician. In this segment, ease of use, comfort, and reliability are key purchasing factors, as the user is often not technically adept, and the devices must function seamlessly and passively for long periods.

Additionally, pharmaceutical and biotechnological companies represent a highly valuable potential customer base, utilizing wearables extensively in clinical trials. Wearable devices offer objective, continuous, and high-fidelity data collection for evaluating drug efficacy and patient safety in a decentralized manner, significantly streamlining the trial process. Contract Research Organizations (CROs) also fall within this category, leveraging wearables to enhance patient recruitment and retention in remote trials, providing a clear audit trail of physiological metrics. Thus, potential customers span the entire healthcare ecosystem, from the point of care within a hospital to decentralized monitoring within a clinical research setting, underscoring the universal applicability of wearable health technology.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 75.9 Billion |

| Growth Rate | 16.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Abbott Laboratories, Apple Inc., DexCom, Inc., Garmin Ltd., General Electric Company, iRhythm Technologies, Inc., Johnson & Johnson, Masimo Corporation, Medtronic Plc, OMRON Corporation, Philips Healthcare, ResMed Inc., Samsung Electronics Co., Ltd., Verily Life Sciences, Withings SA, BioTelemetry (Philips), Eko Health, Inc., Boston Scientific Corporation, Biogen, AliveCor, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wearable Medical Equipment Market Key Technology Landscape

The foundational technology driving the Wearable Medical Equipment Market is the advanced development of miniaturized and highly sensitive biosensors. These sensors are crucial for accurately measuring physiological parameters with medical-grade precision outside of a laboratory environment. Key sensor technologies include electrochemical sensors for glucose and lactate monitoring, photoplethysmography (PPG) sensors for heart rate and oxygen saturation (SpO2), and dry electrodes for recording high-fidelity electrocardiogram (ECG) signals. Continuous innovation in materials science, particularly the use of flexible and stretchable electronics, is enabling devices to be integrated into textiles, skin patches, and clothing, significantly improving comfort and long-term adherence while maintaining robust data capture capabilities under various conditions. This focus on material innovation directly addresses the challenge of reducing device size and making them virtually invisible to the user.

Another pivotal technology landscape involves wireless connectivity and data processing infrastructure. The transition from simple Bluetooth connectivity to integrated cellular (LTE/5G) capabilities allows for truly continuous, infrastructure-independent remote patient monitoring, crucial for critical data transmission in real-time. Cloud computing infrastructure forms the backbone of the market, enabling secure storage and complex algorithmic processing of vast quantities of longitudinal patient data. This data infrastructure supports the subsequent application of Artificial Intelligence and Machine Learning models, which analyze the raw sensor data to extract clinically meaningful insights, detect patterns of decline, and generate predictive alerts, moving beyond simple raw data display to sophisticated diagnostic interpretation.

Furthermore, the development of specialized power management systems and extended battery life technologies is critically important, as users demand devices capable of operating for days or weeks without requiring recharging, particularly for therapeutic and critical monitoring applications. Advanced microcontrollers and System-on-Chip (SoC) solutions optimize power consumption while managing multiple sensor inputs simultaneously. Lastly, the focus on interoperability standards, utilizing protocols like HL7 FHIR (Fast Healthcare Interoperability Resources), ensures that data generated by disparate wearable devices can be seamlessly integrated into healthcare providers’ existing Electronic Health Records (EHR) systems, a crucial factor for widespread clinical adoption and the scalability of remote care programs. The convergence of these technological pillars—sensing, connectivity, processing, and power—defines the competitive edge in the medical wearable space.

Regional Highlights

The global Wearable Medical Equipment Market exhibits distinct regional dynamics influenced by healthcare infrastructure, regulatory environment, and consumer adoption rates. North America stands as the dominant market, driven by high disposable income, sophisticated technological adoption, substantial government and private investment in digital health initiatives, and well-established reimbursement codes for Remote Patient Monitoring (RPM) services. The United States, in particular, leads in the deployment of clinical-grade wearables for chronic disease management, particularly in cardiology and diabetes care, leveraging a high concentration of key market players and a robust venture capital ecosystem fueling rapid innovation. The region’s advanced regulatory framework, while stringent, supports the commercialization of cutting-edge diagnostic devices.

- North America: Market leader due to favorable reimbursement policies, high penetration of chronic diseases, and rapid adoption of clinical RPM solutions. Key focus areas include FDA-approved ECG monitoring patches and advanced CGM systems.

- Europe: Characterized by strong emphasis on preventative care and aging populations, supported by national healthcare systems. Adoption is robust across major economies (Germany, UK, France), driven by European Union medical device regulations (MDR) ensuring high standards of safety and performance.

- Asia Pacific (APAC): Expected to be the fastest-growing region, fueled by massive, untapped patient populations, increasing healthcare expenditure, and governmental prioritization of digital health infrastructure expansion, especially in China and India. Consumer adoption of fitness trackers is high, creating a pathway for medical-grade device entry.

- Latin America (LATAM): Emerging market showing steady growth, primarily driven by increasing urbanization and the need for cost-effective monitoring solutions in regions with limited clinical access. Market penetration is currently focused on high-end diagnostics and consumer health monitoring in urban centers.

- Middle East and Africa (MEA): Growth is concentrated in the Gulf Cooperation Council (GCC) countries due to high healthcare investment, technology imports, and a growing incidence of lifestyle diseases like diabetes and obesity. Adoption is still nascent but accelerating through partnerships with global technology providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wearable Medical Equipment Market.- Abbott Laboratories

- Apple Inc.

- DexCom, Inc.

- Garmin Ltd.

- General Electric Company (GE Healthcare)

- iRhythm Technologies, Inc.

- Johnson & Johnson

- Masimo Corporation

- Medtronic Plc

- OMRON Corporation

- Koninklijke Philips N.V. (Philips Healthcare)

- ResMed Inc.

- Samsung Electronics Co., Ltd.

- Verily Life Sciences (Alphabet Inc.)

- Withings SA

- BioTelemetry (Acquired by Philips)

- Eko Health, Inc.

- Boston Scientific Corporation

- Biogen

- AliveCor, Inc.

Frequently Asked Questions

Analyze common user questions about the Wearable Medical Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Wearable Medical Equipment Market?

The Wearable Medical Equipment Market is projected to experience a robust Compound Annual Growth Rate (CAGR) of 16.8% between 2026 and 2033, driven primarily by the rising prevalence of chronic diseases and advancements in remote patient monitoring (RPM) technology and favorable reimbursement policies for digital health services globally.

How does the integration of AI impact the clinical reliability of wearable medical devices?

AI integration significantly enhances clinical reliability by employing machine learning algorithms to process continuous sensor data, filter noise, and detect subtle, complex physiological patterns indicative of early disease onset. This leads to higher diagnostic accuracy and fewer false positive alerts, essential for transforming data into actionable clinical insights for healthcare professionals.

Which device type holds the largest market share in the wearable medical equipment segment?

Monitoring and Diagnostic Devices, particularly continuous glucose monitoring (CGM) devices and advanced ECG monitors, currently hold the largest market share. This dominance is attributed to the critical need for continuous surveillance in managing high-prevalence chronic conditions such as diabetes and cardiovascular diseases in home settings.

What are the primary restraints affecting the expansion of the wearable medical equipment market?

Key restraints include the complexity and time required to achieve regulatory clearances (such as FDA or CE Mark) for medical-grade wearables, persistent security and privacy concerns regarding sensitive health data collected by these devices, and the underlying lack of standardized data interoperability among different vendor platforms and Electronic Health Record (EHR) systems.

What role do wearables play in the shift towards decentralized healthcare?

Wearables are foundational to decentralized healthcare by enabling remote patient monitoring (RPM) outside of traditional clinical settings. They facilitate continuous, passive data collection, allowing clinicians to remotely manage chronic conditions, perform preventative interventions, and reduce hospital readmissions, thereby lowering overall healthcare system costs and improving patient accessibility to care.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager