Web3 Games Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435195 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Web3 Games Market Size

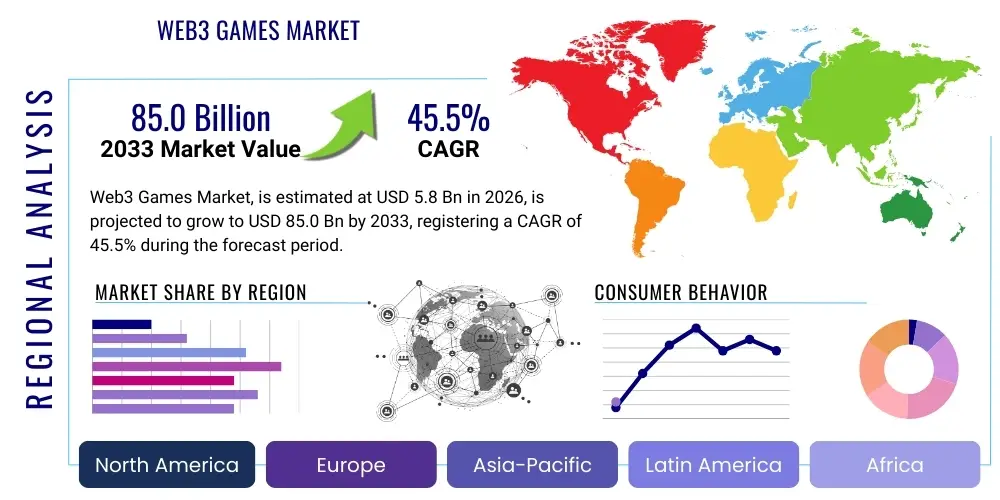

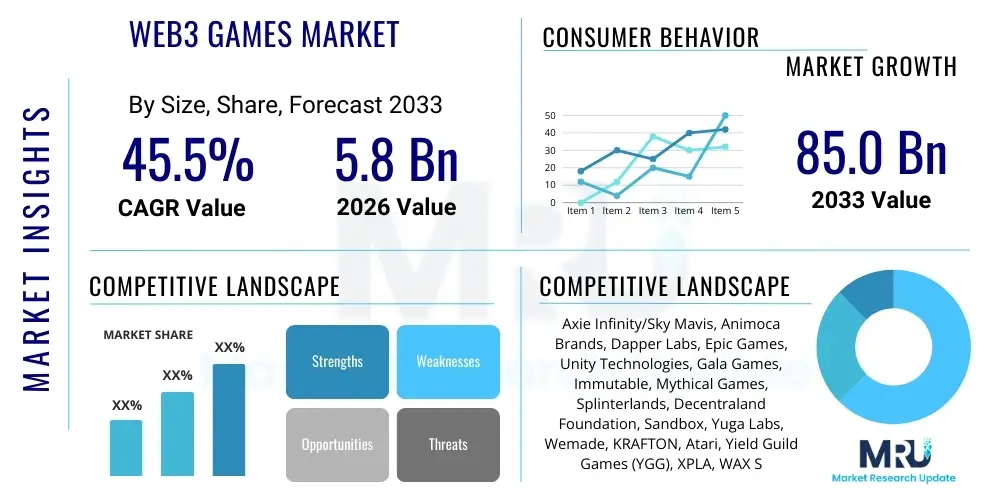

The Web3 Games Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 45.5% between 2026 and 2033. The market is estimated at $5.8 Billion in 2026 and is projected to reach $85.0 Billion by the end of the forecast period in 2033.

Web3 Games Market introduction

The Web3 Games Market represents a revolutionary shift in the digital entertainment landscape, transitioning traditional gaming models towards decentralized ecosystems powered by blockchain technology. Web3 games, often termed 'crypto games' or 'NFT games,' integrate decentralized finance (DeFi) mechanisms and non-fungible tokens (NFTs) to provide players with true ownership of in-game assets, a fundamental departure from the conventional closed economies of Web2 gaming. This market encompasses all activities related to the development, distribution, and consumption of games leveraging blockchain infrastructure, smart contracts, and associated cryptographic assets.

The core product offering in this market involves play-to-earn (P2E) models, where players are rewarded with crypto tokens or NFTs for their participation, time, and skill. Major applications span various genres, including role-playing games (RPGs), strategy games, metaverse experiences, and virtual worlds. Key benefits driving adoption include verifiable digital scarcity, enhanced asset interoperability across different platforms, transparent transaction histories, and the ability for players to monetize their time and effort, transforming gaming from a consumer activity into a value-generating endeavor.

Driving factors underpinning this exponential growth include the increasing mainstream acceptance of blockchain technology, significant venture capital investment flowing into game development studios specializing in Web3, and the global appeal of digital ownership. Furthermore, the increasing sophistication of layer-2 scaling solutions and sidechains (like Polygon and Immutable X) is resolving historical issues related to high transaction fees and slow processing times, making Web3 gaming economically viable and user-friendly for mass adoption. The integration of robust decentralized autonomous organizations (DAOs) also promises a new era of community-driven governance, attracting sophisticated players seeking influence over game development and economic policy.

Web3 Games Market Executive Summary

The Web3 Games Market is experiencing rapid expansion, characterized by transformative business trends focusing heavily on decentralized intellectual property (IP) and player-centric economic models. Key business trends include the shift from singular token economies to multi-token systems designed for greater stability, and the growing incorporation of intellectual property licensing agreements involving major Web2 gaming studios attempting to bridge the gap. Significant venture capital and corporate mergers and acquisitions (M&A) activities underscore investor confidence in the long-term viability of decentralized gaming, prioritizing high-production quality games that mitigate the historical stigma associated with low-quality, speculative P2E titles.

Regionally, the market exhibits divergent adoption rates, with Asia Pacific (APAC) maintaining its dominance, driven by strong early adoption in countries like the Philippines and Vietnam, which have successfully integrated P2E models into local economies. North America and Europe are rapidly catching up, fueled by sophisticated infrastructure, strong developer communities focused on blockchain innovation, and increasing regulatory clarity around digital assets. Regional trends also show a concentration of game studios and blockchain development talent in specific hubs, such as Singapore and the US West Coast, shaping localized content and compliance strategies.

Segment-wise, the market is primarily segmented by platform (PC, Console, Mobile) and by blockchain type (Ethereum, Solana, Polygon, BNB Chain). The Mobile segment is projected to show the highest short-term growth, capitalizing on the vast global smartphone user base and the demand for accessible, frictionless P2E experiences. Furthermore, the segmentation by revenue model—ranging from NFT sales and tokenomics to infrastructure services supporting game development—highlights the diversification of income streams, moving beyond simple transaction fees to comprehensive ecosystem services.

AI Impact Analysis on Web3 Games Market

Common user questions regarding AI’s influence on the Web3 Games Market center primarily on the duality of automation versus decentralization, focusing on how AI can enhance gameplay mechanics, personalize experiences, and optimize in-game economies without compromising the core tenets of verifiable ownership and trustless interaction. Users frequently ask about the potential for AI-driven non-player characters (NPCs) to create more dynamic and realistic game worlds, the role of machine learning in detecting and mitigating sophisticated cheating or botting, and critically, how AI can be leveraged for predictive modeling of token deflation/inflation rates to ensure long-term economic sustainability. Key themes emerging from these inquiries include the expectation that AI should serve as an enhancement layer, improving content generation and security, rather than as a central control mechanism that contradicts decentralization principles.

The integration of artificial intelligence (AI) is set to dramatically reshape the Web3 gaming landscape by increasing content velocity and enhancing player immersion. AI tools are increasingly utilized for procedural content generation (PCG) of massive metaverse environments and complex game assets, reducing development time and cost while offering highly customized experiences. Furthermore, AI-driven analytics are essential for managing the intricate tokenomics of P2E games, enabling developers to monitor asset liquidity, predict economic volatility, and dynamically adjust reward mechanisms to maintain a balanced and sustainable in-game economy, which is crucial for player retention and investment stability.

Beyond content creation and economic management, AI plays a pivotal role in security and player experience optimization. Machine learning algorithms are deployed to identify complex bot behaviors, prevent wash trading of NFTs, and ensure fairness in competitive environments, thereby safeguarding the integrity of decentralized digital economies. The future expansion of the market will heavily rely on decentralized AI (DeAI) frameworks integrated into smart contracts, enabling truly autonomous and adaptive game mechanics that respond to player input without requiring centralized server intervention, further solidifying the trustless nature of Web3 interactions.

- AI-powered Non-Player Characters (NPCs) enhance realism and interactivity in virtual worlds.

- Machine learning optimizes tokenomics, ensuring economic stability and managing inflation/deflation.

- Procedural Content Generation (PCG) accelerates the creation of vast, diverse metaverse assets and environments.

- AI-driven fraud detection enhances security, mitigating sophisticated botting and speculative wash trading of NFTs.

- Decentralized AI (DeAI) frameworks integrate into smart contracts for autonomous and adaptive game logic.

- Personalized gameplay loops and targeted reward systems driven by player behavioral analysis.

DRO & Impact Forces Of Web3 Games Market

The Web3 Games Market is propelled primarily by the driver of true digital ownership and financial incentivization through P2E models, attracting a massive user base seeking economic benefits from gaming. However, market growth is significantly restrained by regulatory uncertainty across major jurisdictions regarding digital assets, and the lingering challenge of high barrier to entry for mainstream gamers due to complex wallet setup and cryptographic processes. Opportunities abound in developing sophisticated infrastructure tools (Layer-2 solutions, dedicated gaming chains) that enhance scalability and reduce friction, coupled with the potential integration of major traditional gaming IPs into blockchain frameworks. These forces combine to create a highly dynamic environment where mass adoption is conditional on solving usability and governance challenges.

Drivers include the widespread adoption of smartphones and high-speed internet, making decentralized applications more accessible globally, and the substantial flow of venture capital investment specifically targeting high-fidelity Web3 game development. The success stories of early flagship P2E games, despite volatility, have validated the model and spurred intense competition among developers to refine sustainable economic loops. Furthermore, the philosophical shift among younger generations towards demanding transparent and equitable digital ecosystems fuels the adoption of DAOs and community governance models within games.

Restraints center on scalability limitations inherent in foundational blockchain technology, which often hinders the high transaction throughput required for complex, real-time gaming experiences. Consumer skepticism regarding token volatility and the proliferation of low-quality or speculative 'rug-pull' projects also erodes trust, complicating mainstream onboarding. Key opportunities lie in cross-chain interoperability solutions, allowing assets to move seamlessly between different game environments, and focusing marketing efforts on demystifying the technology to appeal to the non-crypto native audience. Impact forces, such as technological advancements in zero-knowledge proofs (ZK-proofs) and the increasing involvement of major traditional gaming publishers, exert pressure that accelerates innovation and standardization within the ecosystem.

Segmentation Analysis

The Web3 Games Market is systematically analyzed across several dimensions, primarily categorizing the ecosystem by the type of platform utilized, the underlying blockchain infrastructure employed, the associated revenue generation model, and the geographic concentration of development and consumption. This granular segmentation allows for targeted strategic planning, identifying areas of maximum growth potential, such as the mobile gaming sector, which offers unparalleled reach, and the infrastructure segment, which provides essential scaling solutions necessary for mass adoption. Understanding these segments is crucial for stakeholders positioning themselves within the rapidly evolving decentralized gaming economy.

- By Blockchain Type:

- Ethereum

- BNB Chain

- Polygon

- Solana

- Immutable X

- Others (Flow, Avalanche, Wax)

- By Platform:

- PC/Mac

- Mobile (Android, iOS)

- Console

- Browser-based

- By Genre:

- Action & Adventure

- Role-Playing Games (RPG)

- Strategy & Simulation

- Collectibles & Trading Card Games (TCC/TCG)

- Sports & Racing

- Metaverse & Virtual Worlds

- By Revenue Model:

- Non-Fungible Token (NFT) Sales

- Token Transactions & Fees

- Play-to-Earn (P2E) Rewards

- In-Game Advertising

- Infrastructure Services (SDKs, Wallets)

- By End-User:

- Retail Gamers

- Guilds & Institutional Players

- Developers & Studios

- Investors & Collectors

Value Chain Analysis For Web3 Games Market

The Web3 Games value chain begins with the upstream segment, dominated by blockchain infrastructure providers and middleware developers responsible for creating the foundational technology. This includes Layer 1 and Layer 2 protocols (Ethereum, Polygon, Immutable X) that ensure secure and scalable transaction processing, alongside wallet providers and oracle services. These entities supply the core technological primitives necessary for decentralized functionality, establishing the economic rules and security guarantees upon which games are built.

The midstream segment involves game development studios, content creators, and platform providers. Game studios design the actual interactive experiences, integrating tokenomics and NFT mechanics using provided SDKs and smart contract frameworks. Distribution channels are predominantly indirect, leveraging decentralized application (dApp) stores, proprietary launchpads, and major NFT marketplaces (like OpenSea or Magic Eden) for asset trading. Direct distribution occurs primarily when studios deploy their own dedicated launcher or game-specific marketplace, fostering a closed, yet decentralized, ecosystem for their intellectual property.

The downstream segment focuses heavily on consumption, encompassing retail gamers, professional P2E guilds (like Yield Guild Games), and asset collectors. This segment is supported by ancillary services, including specialized gaming wallets, fiat-to-crypto on-ramps, and educational platforms that help users navigate the complexity of digital ownership. The efficient operation of the value chain relies heavily on seamless integration between these decentralized components, ensuring low latency and high trust for both asset creation (upstream) and consumption (downstream).

Web3 Games Market Potential Customers

The primary potential customers and end-users of Web3 games are bifurcated into two main categories: the existing crypto-native audience seeking financial utility, and the traditional Web2 gamer segment transitioning towards verifiable digital ownership. The crypto-native audience, typically comfortable with complex wallet interactions and token management, is attracted by the play-to-earn mechanics and the potential for asset appreciation. These users often act as early adopters and liquidity providers within new game ecosystems, driving initial token value and market visibility.

The vast market of traditional Web2 gamers represents the largest untapped potential customer base. Attracting these users requires developers to prioritize high-quality graphics, engaging narratives, and low-friction onboarding experiences that mask the underlying complexity of blockchain technology. These customers prioritize entertainment value over pure financial gain but are increasingly receptive to the concept of earning rewards and retaining ownership of items they spend time and money acquiring in traditional closed-loop games. Successful titles will be those that effectively blend AAA gaming quality with subtle, seamless blockchain integration.

Furthermore, specialized institutional buyers, such as gaming guilds, serve as crucial intermediaries, acting as asset managers and scholarship providers. These guilds purchase bulk NFTs and lend them to new players, dramatically lowering the entry barrier for emerging markets and functioning as a scalable mechanism for mass user acquisition. Another critical customer segment includes intellectual property holders and large brands looking to enter the metaverse, using Web3 games as a primary channel for digital product drops, consumer engagement, and developing persistent digital identities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $5.8 Billion |

| Market Forecast in 2033 | $85.0 Billion |

| Growth Rate | 45.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Axie Infinity/Sky Mavis, Animoca Brands, Dapper Labs, Epic Games, Unity Technologies, Gala Games, Immutable, Mythical Games, Splinterlands, Decentraland Foundation, Sandbox, Yuga Labs, Wemade, KRAFTON, Atari, Yield Guild Games (YGG), XPLA, WAX Studios, Enjin. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Web3 Games Market Key Technology Landscape

The Web3 Games market is fundamentally dependent on a diverse array of interconnected blockchain and cryptographic technologies designed to ensure security, transparency, and high performance. At the core are various blockchain protocols, ranging from established Layer 1 chains (like Ethereum and Solana) providing robust security guarantees, to specialized Layer 2 scaling solutions (like Arbitrum and Optimism) and dedicated gaming-focused chains (Immutable X, WAX). These technologies utilize consensus mechanisms such as Proof-of-Stake (PoS) and increasingly, novel delegated PoS variants to process the high volume of micro-transactions inherent in real-time gaming environments while maintaining decentralization.

Critical to the market's functionality are Non-Fungible Tokens (NFTs), primarily based on standards like ERC-721 and ERC-1155, which define the ownership and verifiable scarcity of in-game assets, characters, and land plots. Smart contracts written in languages like Solidity govern all game logic, token distribution, marketplace functionalities, and DAO voting mechanisms, automating complex interactions without the need for central authority. Furthermore, sophisticated tokenomic models, often involving multi-token structures (utility tokens and governance tokens), are implemented via these contracts to manage inflation, reward distribution, and incentivize long-term player loyalty.

Advancements in interoperability and user experience are key technological trends. Wallet technology is evolving rapidly, moving towards non-custodial and social login wallets (Account Abstraction) that simplify onboarding for non-crypto users, mimicking Web2 ease of access. Technologies enabling cross-chain asset bridges allow NFTs and tokens to move between different ecosystems, increasing market liquidity and utility. Finally, zero-knowledge proof (ZKP) technology is emerging as a critical tool for privacy-preserving scalability, allowing transaction verification without revealing sensitive player data, addressing compliance and consumer privacy concerns.

Regional Highlights

The regional dynamics of the Web3 Games market are crucial for understanding global adoption patterns, investment flows, and regulatory pressures. The market exhibits distinct growth trajectories across major geographical segments, influenced by local economic conditions, technological infrastructure, and prevailing regulatory attitudes toward digital assets. While Web3 games are a global phenomenon, specific regions have emerged as foundational hubs for development and consumer engagement, dictating short-term market velocity and long-term strategic focus.

- Asia Pacific (APAC): APAC is the global leader in Web3 gaming adoption, driven by strong P2E acceptance, particularly in Southeast Asian countries like the Philippines, Vietnam, and Indonesia, where digital earnings significantly supplement traditional incomes. South Korea and Japan are major development hubs, focusing on integrating established local gaming IPs (Massive Multiplayer Online Role-Playing Games, MMORPGs) with blockchain technology. The region benefits from a large, mobile-first population accustomed to in-game purchases and digital economies.

- North America: North America is characterized by robust venture capital funding, cutting-edge infrastructure development, and a concentration of major Web3 game studios. The region focuses heavily on creating high-production-value, console-quality titles intended for mass Western appeal. Emphasis is placed on technological innovation, particularly in Layer 2 solutions and metaverse infrastructure, aiming to improve user experience and regulatory compliance.

- Europe: Europe represents a sophisticated but somewhat cautious market, focusing on compliance and sustainability. Countries like the UK, Germany, and Switzerland are developing strong regulatory frameworks while fostering innovation in niche segments like decentralized finance (DeFi) integration within games and environmentally conscious blockchain protocols. The adoption rate is steadily increasing, driven by strong developer talent pools and early integration of blockchain in educational and enterprise applications.

- Latin America (LATAM): LATAM is a high-growth region for Web3 adoption, particularly in countries experiencing high inflation, where crypto rewards offer a valuable financial alternative. Brazil, Argentina, and Mexico are seeing significant activity in player guilds and localized P2E communities. The market is primarily mobile-centric, utilizing Web3 games as both entertainment and a financial tool.

- Middle East and Africa (MEA): MEA presents emerging opportunities, with significant investment from sovereign wealth funds (especially in the UAE and Saudi Arabia) targeting the metaverse and blockchain technology infrastructure. The focus is on establishing regional tech hubs and attracting global developers, often supported by government initiatives to diversify economic dependency away from traditional resources.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Web3 Games Market.- Animoca Brands

- Axie Infinity/Sky Mavis

- Dapper Labs

- Gala Games

- Immutable

- Mythical Games

- The Sandbox

- Decentraland Foundation

- Yuga Labs

- Wemade

- Com2uS Holdings

- KRAFTON

- Ubisoft (Strategic Blockchain Initiatives)

- Square Enix (Strategic Blockchain Division)

- Atari

- Yield Guild Games (YGG)

- Merit Circle

- XPLA

- WAX Studios

- Enjin

Frequently Asked Questions

Analyze common user questions about the Web3 Games market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Web2 and Web3 gaming?

The core difference lies in asset ownership and economic model. Web2 games operate on centralized servers where developers control all in-game assets; players only hold a license to use them. Web3 games use blockchain technology (NFTs) to grant players verifiable, trustless ownership of their assets, enabling true digital scarcity and the ability to trade or monetize these assets outside the game environment through decentralized marketplaces.

How significant is the role of NFTs in the Web3 gaming ecosystem?

NFTs are foundational to Web3 gaming, representing essential in-game items, characters, virtual land, and collectibles. They facilitate the 'own-to-earn' model, providing unique identification and scarcity for digital assets, which drives player investment and participation. The security and liquidity provided by the NFT framework underpin the entire decentralized economic structure of these games.

What are the main challenges facing the mass adoption of Web3 games?

The primary challenges include high barriers to entry for mainstream users due to the complexity of crypto wallets and transaction processes, the historical prevalence of low-quality game titles focused purely on speculation, and persistent issues related to blockchain scalability, resulting in high gas fees and slow transaction confirmations in certain ecosystems. Regulatory uncertainty regarding digital asset classification also remains a hurdle.

Which blockchain networks are currently dominating the Web3 Games market?

While Ethereum remains significant for high-value asset storage, the dominance is shifting towards scalable Layer 2 solutions and specialized sidechains such as Polygon, Immutable X, and dedicated chains like WAX and Solana. These networks offer lower transaction costs and faster throughput, which are essential for supporting the real-time, high-frequency interactions required by typical gaming experiences.

Is the Play-to-Earn (P2E) model economically sustainable in the long term?

Sustainability depends heavily on game design and robust tokenomics. Early P2E models often struggled with inflationary pressure when rewards outpaced value sinks. Modern Web3 games are moving towards more sustainable 'Play-and-Earn' or 'Play-to-Own' models, integrating value sinks (like staking, breeding fees, and consumption of utility tokens) and focusing on high-quality entertainment to ensure that the demand for assets is driven by gameplay enjoyment, rather than solely speculative financial incentives.

This report has been structured to provide a deep, data-informed analysis of the Web3 Games Market, utilizing AEO and GEO principles to maximize informational value and search engine visibility. The content adheres strictly to the required HTML formatting and character limits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager