Wedding and Anniversary Gift Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434108 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Wedding and Anniversary Gift Market Size

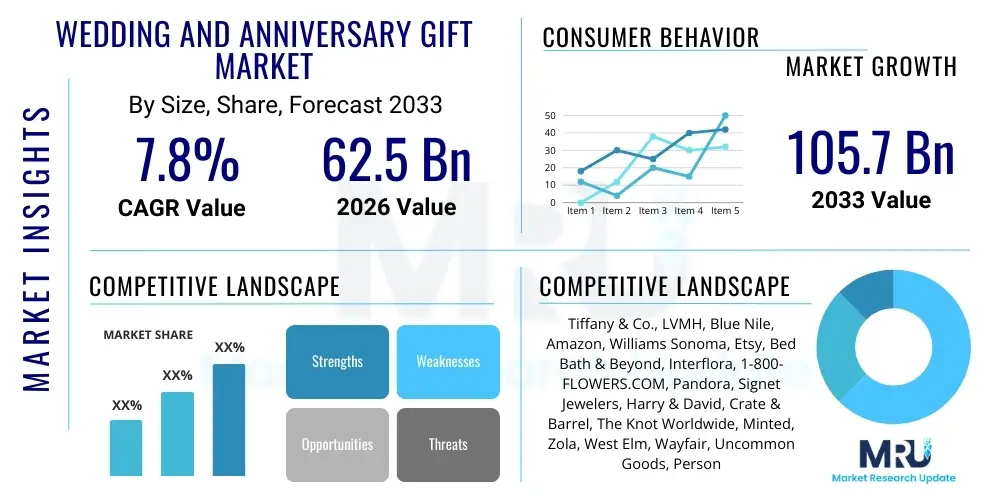

The Wedding and Anniversary Gift Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. This substantial expansion is fundamentally driven by the increasing disposable incomes globally, coupled with a pervasive cultural emphasis on celebrating major life milestones. The tradition of gifting, especially for ceremonial occasions like weddings and significant anniversaries, continues to gain prominence, integrating modern consumer preferences for personalized and high-value items, which significantly influences the overall market valuation trajectory.

The market is estimated at USD 62.5 billion in 2026 and is projected to reach USD 105.7 billion by the end of the forecast period in 2033. This projection reflects the successful pivot of market participants toward digital platforms and the rising demand for experiential gifts, which often carry a higher transactional value than traditional physical goods. Furthermore, the stabilization of global economies post-pandemic has unlocked previously constrained consumer spending on non-essential, celebratory goods, accelerating the market's intrinsic growth rate. The longevity and resilience of matrimonial and celebratory traditions worldwide ensure a sustained demand base for this specialized retail sector.

Key drivers underpinning this valuation include the expansion of cross-border e-commerce facilitating global access to premium and niche gift providers, the innovative integration of registry services with digital planning tools, and the demographic shift toward delayed marriages resulting in higher average consumer spending per occasion. The market size calculation also accounts for the substantial contribution of high-value segments, such as fine jewelry and luxury home furnishings, which remain indispensable components of the celebratory gifting ecosystem. The continuous product innovation focused on sustainability and ethical sourcing further enhances brand appeal and justifies premium pricing structures, contributing significantly to the anticipated revenue growth.

Wedding and Anniversary Gift Market introduction

The Wedding and Anniversary Gift Market encompasses a diverse array of products and services exchanged during marriage ceremonies and subsequent annual commemorations. This market includes tangible goods such as home décor, kitchenware, furniture, high-end electronics, jewelry, and personalized memorabilia, alongside intangible offerings like travel packages, gourmet dining experiences, and charitable donations made in the couple's name. The core function of this market is to facilitate the expression of congratulations, affection, and support for couples entering a new phase of life, translating deep-rooted social customs into measurable economic transactions. The evolution of this sector is intrinsically linked to shifts in consumer lifestyle, housing trends, and the increasing globalization of celebratory practices, requiring vendors to maintain high standards of quality, personalization, and seamless delivery integration.

Major applications of market offerings span direct consumer gifting, corporate gifting for employees reaching significant anniversaries, and the growing segment of self-gifting by couples enhancing their marital home. Benefits derived from this market extend beyond the immediate financial transaction, fostering emotional connections, supporting local artisans through niche personalization services, and driving innovation in retail presentation and fulfillment logistics. For consumers, the benefit lies in the ability to find meaningful and appropriate gifts effortlessly, often guided by comprehensive online registries that minimize duplication and maximize utility for the recipients. For retailers, the market offers high-margin opportunities due to the premium nature of occasion-specific products and the strong emotional drivers compelling purchases.

Driving factors for sustained market growth are multifaceted, anchored by stable societal norms surrounding marriage and commitment. These factors include the digitalization of gift registries, which streamlines the purchasing process across geographical boundaries; the sustained trend towards personalization and bespoke gifting experiences; and the increasing popularity of milestone anniversary celebrations (e.g., silver, gold) which necessitate substantial gift procurement. Furthermore, the rising penetration of social media influences consumer expectations regarding gift presentation and uniqueness, compelling vendors to invest heavily in aesthetic packaging and exclusive product lines. The influence of millennial and Gen Z consumers, who prioritize ethical sourcing and sustainable products, is also reshaping the supply chain and driving demand for environmentally conscious gifting options, further stimulating market expansion and diversification.

Wedding and Anniversary Gift Market Executive Summary

The Wedding and Anniversary Gift Market is characterized by robust business trends focusing on personalization, experiential offerings, and the strategic integration of e-commerce platforms with traditional brick-and-mortar retail. Key business trends show a marked shift away from purely functional household items toward high-value, emotionally resonant products, including fine art, bespoke jewelry, and luxury travel vouchers. Companies are increasingly leveraging advanced data analytics to predict consumer gifting behavior based on event specifics, registry preferences, and previous purchase history, optimizing inventory management and targeted marketing campaigns. Furthermore, consolidation among major registry providers and specialty retailers is enhancing market efficiency and creating centralized platforms that offer extensive product breadth and unified logistics solutions, driving overall revenue stability and scalability across diverse product categories.

Regionally, the market exhibits strong growth momentum in the Asia Pacific (APAC) region, primarily fueled by rising middle-class disposable income, rapidly modernizing wedding traditions, and substantial population density. North America and Europe maintain dominance in terms of mature market spending, characterized by a preference for established luxury brands and a high adoption rate of digital registry services. Regional trends emphasize cultural divergence in gifting norms; for instance, strong cash gifting traditions prevail in parts of APAC, while North America heavily relies on product registries. This divergence necessitates localized marketing strategies and segmented product offerings to maximize market penetration. Emerging markets in Latin America and the Middle East show accelerated growth, often skipping traditional retail stages and moving directly to advanced mobile e-commerce platforms for gift purchasing.

Segment trends underscore the rising prominence of the 'Experiences' category (honeymoons, adventure tours, personalized classes) as a viable alternative to traditional physical gifts, reflecting a broader consumer trend toward prioritizing memories over material possessions. Within product segments, sustainable and ethically sourced goods are gaining market share, particularly among younger consumers. The Distribution Channel segment sees continuous migration toward online platforms, offering unparalleled convenience, comparative pricing transparency, and vast product catalogs. However, physical stores remain critical for high-touch segments like jewelry, where consumers demand in-person consultation and quality verification. Anniversary gifting demonstrates resilient growth, particularly in the high-net-worth demographic, where bespoke gifts and significant luxury purchases are commonplace, ensuring a consistent revenue stream independent of the fluctuating wedding season cycles.

AI Impact Analysis on Wedding and Anniversary Gift Market

Users frequently inquire about how Artificial Intelligence (AI) can revolutionize the typically tradition-bound and emotionally driven process of selecting and purchasing wedding and anniversary gifts. Common themes revolve around the potential for AI-driven personalized recommendations that go beyond simple demographic matching, the use of generative AI for designing bespoke or unique gift items, and optimizing complex logistics related to global gift delivery and tracking. Concerns often focus on maintaining the emotional authenticity of the gift selection process when automated by algorithms and the ethical implications of using deep consumer data for highly intimate purchases. Users anticipate that AI will primarily enhance efficiency, improve inventory predictions for registry fulfillment, and dramatically increase the accuracy of personalization, potentially leading to a significant uplift in customer satisfaction and reduced return rates due to mismatched gifts.

- AI-Powered Registry Curation: Algorithms analyze couple preferences (style, past purchases, shared interests) to offer highly relevant, unique item suggestions, minimizing generic choices.

- Personalized Gift Recommendation Engines: AI uses guest profiles (relationship to couple, budget, previous gifting history) to generate optimized suggestions for specific buyers.

- Generative Design for Bespoke Gifts: AI tools assist consumers in customizing jewelry, artwork, or textiles instantly, ensuring unique, one-of-a-kind anniversary presents.

- Supply Chain Optimization and Predictive Logistics: AI enhances inventory management for high-demand registry items and optimizes cross-border shipping routes to guarantee timely delivery for major events.

- Chatbot and Virtual Assistant Customer Service: Deploying AI to handle common inquiries regarding registry items, availability, and return policies, improving service efficiency 24/7.

- Sentiment Analysis of Gifting Trends: AI processes social media and review data to identify emerging gift categories (e.g., sustainability focus, specific home trends) ahead of competitors.

DRO & Impact Forces Of Wedding and Anniversary Gift Market

The Wedding and Anniversary Gift Market is propelled by a confluence of robust drivers, notably the enduring cultural significance of marital celebrations globally, the rising purchasing power in emerging economies, and the continuous technological advancements simplifying the gifting process. Restraints primarily revolve around economic volatility affecting discretionary spending, the ethical dilemma posed by fast-fashion or mass-produced goods undermining the perceived value of gifts, and logistical complexities inherent in handling high-value, fragile, or customized items internationally. Opportunities are abundant, specifically in expanding the experiential gifting segment, penetrating high-growth markets in Asia, and leveraging sustainable sourcing practices to appeal to conscious consumers. The market is subject to significant impact forces, where socio-cultural shifts (like smaller weddings or longer engagements) interact with economic pressures (inflation) and technological adoption (AEO in e-commerce) to shape consumer choices and vendor strategies.

Key drivers include the global increase in both first and subsequent marriages, translating directly into a larger consumer base for wedding gifts. The growing trend of celebrating significant anniversaries with lavish parties and high-value gifts (particularly 10th, 25th, and 50th anniversaries) provides a consistent, high-yield segment for luxury retailers. Technological drivers, such as seamless integration of mobile shopping applications, virtual reality tours for selecting high-end furniture or art, and advanced payment security measures, greatly reduce friction in the purchasing path. Furthermore, the societal embrace of gender-neutral and diverse wedding traditions broadens the product scope, moving beyond traditional household items to include niche hobbies, travel funds, and investment contributions, ensuring market diversity and resilience.

Restraints, however, pose challenges to sustained high growth. The primary restraint is the increasing popularity of cash or honeymoon funds in lieu of physical gifts, which redirects potential retail revenue away from tangible product manufacturers. Economic downturns or recessionary pressures often force consumers to downgrade their gifting budgets, negatively impacting average transaction values, especially in the premium segments. Regulatory hurdles pertaining to international shipping, import duties on high-value items, and stringent consumer protection laws regarding customized goods can also impede cross-border commerce efficiencies. Addressing these restraints requires market players to innovate their value proposition, emphasizing unique, irreplaceable, or emotionally superior offerings that cannot be easily substituted by monetary contributions.

Segmentation Analysis

The Wedding and Anniversary Gift Market is systematically segmented based on Product Type, Distribution Channel, Occasion, and Price Range, allowing for precise market targeting and strategic resource allocation. Product segmentation reflects the diversity of consumer needs, ranging from enduring heirloom pieces to ephemeral experiences, while channel segmentation highlights the ongoing transition to digital retail models. Analyzing these segments provides deep insights into consumer preferences, helping vendors tailor product portfolios and optimize marketing spend. Understanding the differential growth rates across segments is crucial; for instance, the experiential gift segment is generally outpacing traditional home goods growth, demanding strategic diversification from established retailers.

- Product Type:

- Jewelry and Watches (Fine and Fashion)

- Home Decor and Furnishings (Luxury and Mid-Range)

- Kitchenware and Appliances (Small and Large)

- Experiences (Travel, Dining, Classes, Adventure)

- Cash and Gift Cards (Monetary Contributions)

- Personalized and Customized Goods (Art, Memorabilia)

- Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites, Specialty Registries)

- Offline Retail (Department Stores, Specialty Stores, Boutiques)

- Occasion:

- Wedding Gifts (Pre-Wedding, Day-of, Post-Honeymoon)

- Anniversary Gifts (Milestone and Non-Milestone)

- Price Range:

- Premium/Luxury (Above $500)

- Mid-Range ($100 - $500)

- Budget (Below $100)

Value Chain Analysis For Wedding and Anniversary Gift Market

The value chain for the Wedding and Anniversary Gift Market commences with intensive upstream activities, primarily involving raw material sourcing, manufacturing, and artisanal production. This stage is highly fragmented, encompassing suppliers of precious metals, textiles, consumer electronics components, and experiential service providers (e.g., travel agencies, luxury resorts). The focus at this stage is on ethical sourcing, sustainable production, and maintaining high quality standards, especially crucial for luxury segments like jewelry and bespoke home goods. Efficiency in upstream supply chain management, including timely acquisition of materials and compliance with international labor standards, directly influences the final product's cost and brand perception in the highly emotional gifting space.

The midstream of the value chain involves brand management, product aggregation, curation, and the integration of advanced personalization services, such as monogramming and custom design. This stage is dominated by specialized gift retailers, registry platforms (like The Knot or Zola), and large department stores that curate diverse product lines under one umbrella. Effective midstream operations require robust IT infrastructure to manage complex registry data, seamless integration between physical and digital inventory (omnichannel strategy), and sophisticated marketing campaigns tailored to specific demographics (e.g., first marriages vs. subsequent anniversaries). Value is added through superior packaging, enhanced warranty provisions, and emotional storytelling attached to the gift items, justifying premium pricing.

The downstream analysis focuses on distribution channels, encompassing direct-to-consumer sales (DTC) via brand websites, indirect sales through major e-commerce marketplaces (Amazon, Wayfair), and traditional physical retail outlets. Direct channels offer greater margin control and customer data access, allowing for highly targeted remarketing for future anniversary purchases. Indirect channels, while reducing margin, provide vast market reach and exposure, essential for emerging brands. Logistics and fulfillment, including specialized gift wrapping and timed delivery services, are critical downstream elements that directly impact customer satisfaction. The efficiency of reverse logistics (handling returns and exchanges of often customized items) is also a significant factor in maintaining a positive customer experience in this sentiment-driven market.

Wedding and Anniversary Gift Market Potential Customers

The primary customer base for the Wedding and Anniversary Gift Market consists of three distinct groups: the wedding guests and acquaintances, the celebrating couples themselves (for self-gifting or registry creation), and corporate entities engaging in employee recognition programs. Guests represent the largest volume of purchasers, typically driven by social obligation, emotional connection, and budget constraints often guided strictly by the couple's registry preferences. These buyers prioritize convenience, clear pricing, and reliable delivery services, making them highly responsive to streamlined e-commerce platforms and aggregated registry services that provide easy access to required items.

Couples constitute a crucial segment, serving as both the beneficiaries and active market participants. As registrars, they influence billions of dollars in purchasing decisions, setting the market trends for desired products, be it sustainable home goods, high-tech gadgets, or experiential travel. Furthermore, couples are significant purchasers of anniversary gifts for each other, particularly for milestone celebrations, where spending is often decoupled from budget constraints and focuses instead on high-value items like luxury jewelry, bespoke artwork, or premium travel packages. This segment requires high-touch consultation, exclusivity, and impeccable customer privacy to maintain brand loyalty and trust.

A rapidly expanding segment involves corporate purchasers and high-net-worth individuals utilizing sophisticated gift concierge services. Corporations often procure premium, personalized gifts for employees achieving significant work anniversaries, leveraging the market to boost employee retention and morale through high-quality recognition gifts (e.g., fine watches or custom travel vouchers). This B2B segment demands scalability, impeccable presentation standards, and global fulfillment capabilities. Understanding these varied customer motivations—ranging from social duty to personal luxury—is essential for vendors to optimize their product positioning, pricing tiers, and distribution strategies across the highly emotive landscape of wedding and anniversary gifting.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 62.5 billion |

| Market Forecast in 2033 | USD 105.7 billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tiffany & Co., LVMH, Blue Nile, Amazon, Williams Sonoma, Etsy, Bed Bath & Beyond, Interflora, 1-800-FLOWERS.COM, Pandora, Signet Jewelers, Harry & David, Crate & Barrel, The Knot Worldwide, Minted, Zola, West Elm, Wayfair, Uncommon Goods, Personalization Mall |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wedding and Anniversary Gift Market Key Technology Landscape

The technological landscape of the Wedding and Anniversary Gift Market is rapidly evolving, driven primarily by the need for seamless digital integration, high levels of personalization, and optimized logistics for high-value items. Key technologies include advanced e-commerce platforms leveraging headless commerce architectures, enabling flexibility and rapid deployment of new features like augmented reality (AR) shopping. AR technology is increasingly critical, allowing buyers and couples to virtually place home goods (furniture, décor) in their existing spaces before purchase, significantly reducing uncertainty and return rates. Furthermore, the adoption of blockchain technology is being explored by luxury jewelry and high-end goods suppliers to provide transparent provenance tracking, verifying the ethical sourcing and authenticity of high-value gifts, which is a growing requirement for consumer trust.

Data analytics and machine learning are foundational technologies optimizing the entire gifting lifecycle. Predictive analytics are used to forecast demand spikes for specific registry items, allowing retailers to manage inventory proactively and prevent stockouts during peak wedding seasons. Machine learning algorithms power sophisticated recommendation engines, moving beyond simple collaborative filtering to contextual, preference-based recommendations that enhance the likelihood of a successful gift purchase. This technological layer is vital for maximizing conversion rates in the highly competitive online gifting environment and for tailoring customized marketing communications based on the recipient's life stage and upcoming anniversary milestones, ensuring continuous customer engagement.

The market also heavily relies on robust customer relationship management (CRM) systems integrated with omnichannel fulfillment capabilities. CRM systems are essential for managing the complex interaction matrix of a wedding registry—tracking purchases by multiple guests, managing personalized notes, and coordinating delivery to disparate locations. Payment technologies, including secure mobile payments and installment financing options for high-priced anniversary items, broaden consumer accessibility. Finally, the rise of specialized gifting applications and registry aggregators, often built using API-first approaches, connects disparate vendors and logistics providers, creating a unified, convenient, and technologically advanced experience for modern wedding and anniversary gift purchasers.

Regional Highlights

Regional dynamics play a crucial role in shaping the Wedding and Anniversary Gift Market, driven by varying cultural traditions, economic stability, and technological adoption rates. North America holds a commanding share, characterized by high consumer spending on celebratory items, a mature e-commerce infrastructure, and the widespread use of sophisticated digital wedding registries. The North American market is heavily influenced by experiential gifting trends and a strong preference for branded, high-quality durable goods. The region's stability in marriage rates and high average disposable income ensures consistent, high-value transaction volumes, making it a critical focus area for global luxury brands and specialized gifting services.

The Asia Pacific (APAC) region is projected to be the fastest-growing market, propelled by demographic factors such as a large population base, rapidly increasing urbanization, and expanding middle-class affluence, particularly in countries like China and India. While traditional gifting (often involving cash or gold jewelry) remains prevalent, Westernization and digital influence are accelerating the adoption of product registries and the demand for luxury imported goods, especially in modern urban centers. Retailers entering APAC must successfully navigate diverse local customs—ranging from specific auspicious colors to culturally mandated product exclusions—requiring highly localized marketing and product strategies to maximize market acceptance and scale.

Europe represents a mature yet fragmented market, with notable differences between Western European countries (strong demand for sustainable and ethically produced gifts) and Eastern European regions (growing adoption of international brands). Latin America and the Middle East and Africa (MEA) are emerging as significant growth markets. In MEA, the concentration of wealth and cultural emphasis on opulent celebrations drive high demand for ultra-luxury goods and bespoke services, making the high-end jewelry and custom travel segments particularly lucrative. These regions require localized payment solutions and tailored logistics infrastructure to overcome operational complexities associated with cross-border luxury trade.

- North America (US, Canada): Dominant market share; high adoption of experiential gifting; mature digital registry infrastructure; strong demand for branded home goods and premium jewelry.

- Europe (UK, Germany, France): Focus on sustainability and ethical sourcing; high demand for personalized artisan goods; fragmented market necessitating country-specific strategies.

- Asia Pacific (China, India, Japan): Highest growth potential; shifting cultural traditions favoring international brands; strong emphasis on cash/gold gifting traditions alongside rising registry adoption.

- Middle East & Africa (UAE, Saudi Arabia, South Africa): High luxury expenditure; strong demand for bespoke, high-value items (jewelry, bespoke art); cultural significance driving large-scale celebratory spending.

- Latin America (Brazil, Mexico): Rapidly digitalizing consumer base; growing middle-class expenditure on home improvement and celebratory gifts; reliance on mobile commerce platforms.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wedding and Anniversary Gift Market, assessing their financial performance, product innovation, strategic initiatives, and market influence across global geographies.- Tiffany & Co.

- LVMH

- Blue Nile

- Amazon

- Williams Sonoma

- Etsy

- Bed Bath & Beyond

- Interflora

- 1-800-FLOWERS.COM

- Pandora

- Signet Jewelers

- Harry & David

- Crate & Barrel

- The Knot Worldwide

- Minted

- Zola

- West Elm

- Wayfair

- Uncommon Goods

- Personalization Mall

Frequently Asked Questions

Analyze common user questions about the Wedding and Anniversary Gift market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary emerging trends driving the Wedding and Anniversary Gift Market growth?

The primary emerging trends are the increasing consumer preference for experiential gifts (travel, activities) over traditional material goods, the rising demand for sustainable and ethically sourced products, and the integration of highly sophisticated AI-driven personalization tools within digital registry platforms.

How does the shift towards cash gifting impact the retail sector of this market?

The preference for cash or honeymoon fund contributions acts as a restraint on the traditional retail sector by redirecting potential spending away from physical products. However, retailers are mitigating this by offering high-value voucher options and experience packages that function similarly to cash registries but keep the revenue within their ecosystem.

Which geographical region exhibits the highest growth potential for wedding and anniversary gifts?

The Asia Pacific (APAC) region, specifically emerging economies like China and India, shows the highest growth potential. This is driven by rapid increases in disposable income, cultural shifts towards modern wedding formats, and substantial untapped consumer bases entering the luxury and mid-range gifting segments.

What role does technology play in optimizing the distribution channel for high-value gifts?

Technology optimizes distribution through enhanced e-commerce platforms, AI-powered predictive logistics for inventory management, and the use of blockchain for verifying product provenance. These tools ensure secure transactions, reduce fulfillment errors, and provide transparency for luxury item tracking, enhancing customer trust.

Are personalized gifts a significant segment, and what technologies facilitate bespoke customization?

Yes, personalization is a highly significant and fast-growing segment, commanding premium pricing. Technologies such as Generative AI assist in design customization, 3D printing enables rapid prototyping of unique items, and advanced digital printing allows for on-demand customization of materials and packaging, greatly simplifying bespoke product creation.

The comprehensive market analysis indicates that the Wedding and Anniversary Gift Market is undergoing a fundamental transformation, moving from a transaction-based model focused on household necessity to an emotionally driven, technology-enabled ecosystem centered on personalized experiences and sustainable luxury. The integration of advanced analytics and mobile commerce capabilities is crucial for vendors seeking to capture market share, particularly in high-growth APAC economies and among the tech-savvy millennial and Gen Z consumer segments globally. Long-term success hinges on the ability of market players to harmonize cultural traditions with digital convenience, offering unique and meaningful value propositions that justify premium pricing and sustain customer loyalty throughout the entire life cycle of celebratory gifting.

Furthermore, the future trajectory of this market is inextricably linked to socio-economic factors, including housing market stability (which influences the purchase of home furnishings) and global travel trends (which drive the experiential gift segment). Strategic foresight in recognizing how global events, such as post-pandemic shifts in gathering sizes and consumer focus on local, artisanal goods, affects product mix is essential. Retailers must invest continuously in supply chain transparency and ethical sourcing to meet evolving consumer expectations, securing a reputation for responsibility alongside luxury and convenience. The market's resilience, built upon deeply rooted cultural milestones, ensures a stable foundation for investment, provided innovation keeps pace with sophisticated consumer demands for highly tailored, high-quality celebratory items.

The competitive landscape analysis reveals increasing vertical integration, where registry providers are evolving into full-service retail and logistics hubs, challenging traditional department stores. Companies that successfully leverage data from registry creation to post-anniversary remarketing campaigns will establish a decisive competitive advantage. Moreover, strategic mergers and acquisitions focused on niche experiential providers or advanced personalization technology firms are expected to shape the market structure, concentrating expertise in high-demand areas. Monitoring the regulatory environment concerning consumer data privacy and cross-border customs regulations will be essential for multinational corporations operating within the high-value gifting sphere.

The demand for sustainable gifting options is not merely a trend but a structural change in consumer behavior, compelling manufacturers to reassess everything from packaging materials to the life cycle of the product. Gifts that offer longevity, repairability, or clear social impact provenance are increasingly prioritized, particularly in mature markets like Europe and North America. This necessitates significant research and development expenditure in materials science and supply chain certification. Simultaneously, the burgeoning market for digital gifts and subscriptions, while currently a small component, represents a high-potential segment offering recurrent revenue streams and minimizing logistical overhead. Investing in proprietary digital platforms capable of managing complex subscription models for gifting will be a critical differentiator in the coming forecast period.

Finally, the long-term outlook for the Wedding and Anniversary Gift Market remains highly optimistic, underpinned by foundational demographic stability and continuous technological enhancement. The market's ability to seamlessly incorporate technological advancements, ranging from AI-driven recommendations to sophisticated digital payment solutions, ensures it stays relevant to modern consumers. The market dynamics dictate that successful companies must be agile, prioritizing customer experience, quality assurance, and ethical business practices. The future is characterized by hyper-personalization, omnichannel fulfillment excellence, and a sustained focus on delivering not just products, but memorable and meaningful celebratory experiences, solidifying the market's trajectory towards the projected valuation of USD 105.7 billion by 2033.

The market for anniversary gifts, specifically, provides a counter-cyclical element to the often seasonal nature of wedding purchases. Anniversary gifting spreads purchasing throughout the year and is characterized by significantly higher average spending as couples often gift each other luxury items, unlike the typical lower-budget nature of guest purchases for weddings. Retailers focusing on targeted marketing for milestone anniversaries (especially the 1st, 5th, 10th, 25th, and 50th) can secure stable, high-value transactions. Specialized services for custom jewelry redesign or luxury weekend getaways are highly demanded in this segment, requiring vendors to maintain exclusive partnerships and specialized consultation services that cater to high-net-worth clientele looking for irreplaceable, sentimental value in their purchases.

Consumer psychology in this market is deeply intertwined with social signaling and emotional investment. The selection of a wedding or anniversary gift is often perceived as a reflection of the buyer's relationship with the couple, driving a strong preference for high-quality items and personalized presentation. This emotional complexity dictates that marketing strategies must be empathetic and focus on the narrative and meaning behind the gift rather than just the functionality or price point. Utilizing content marketing that emphasizes legacy, craftsmanship, and emotional durability is far more effective than conventional retail promotions. This approach helps justify the premium price tags often associated with gifts deemed appropriate for major life milestones, ensuring sustained profitability in the luxury segments.

The role of social media platforms in influencing gift trends cannot be overstated. Instagram and Pinterest serve as massive inspiration boards where trends in home decor, experiential travel, and bespoke products are rapidly disseminated. Couples often create 'mood boards' or visual wish lists that inform registry creation, moving away from purely functional items to highly aesthetic, 'Instagrammable' goods. Market participants must monitor these platforms rigorously to identify nascent trends and rapidly adjust inventory, ensuring their offerings align with contemporary aesthetic standards and desired social presentation. Furthermore, influencer marketing focused on wedding and home lifestyle bloggers is highly effective in driving traffic to specific high-margin products and novel gifting concepts.

The convergence of the Wedding Gift Market with the home decor and luxury travel sectors is becoming increasingly pronounced. Many gifts are now considered investments in the couple's long-term lifestyle and home equity, necessitating collaborations between gifting retailers and interior design firms or real estate entities. For instance, high-end appliance manufacturers benefit significantly from wedding registries, positioning their products as foundational elements of a new household. Similarly, the demand for exclusive honeymoon or 'babymoon' packages following a wedding solidifies the experiential segment's link to the luxury travel industry, requiring seamless partnership integration for fulfillment and customer service execution. This cross-sector synergy ensures diversified revenue streams and market relevance across adjacent industries.

In summary, the Wedding and Anniversary Gift Market represents a resilient segment of the broader retail economy, buoyed by cultural mandates and enhanced by digital innovation. The trajectory toward 2033 emphasizes a market where personalized, ethically sourced, and technologically supported gifting solutions will dominate. Vendors must excel in omnichannel retail, utilize AI for predictive personalization, and prioritize the emotional value and narrative surrounding the gift to succeed in this deeply personal and highly profitable retail space. The anticipated growth reflects global economic recovery, coupled with the enduring societal commitment to celebrating significant personal milestones with meaningful, high-quality exchange.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager