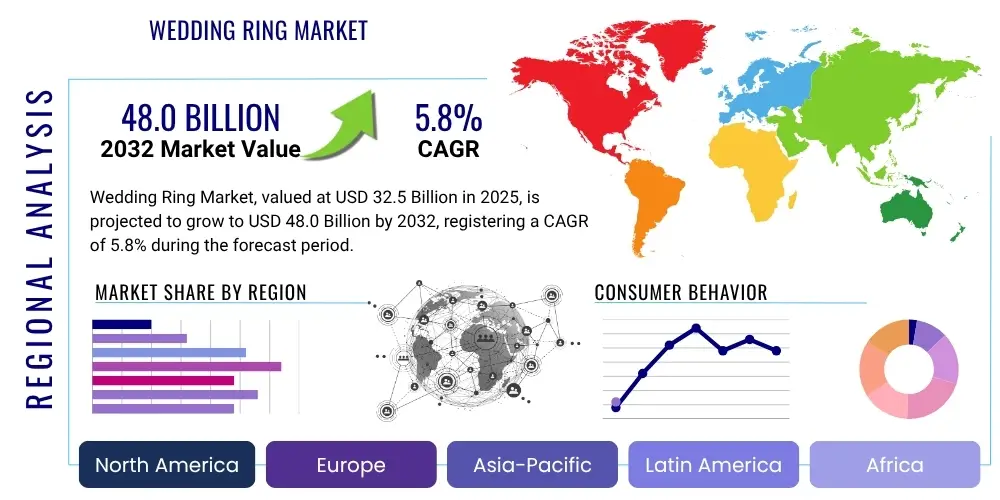

Wedding Ring Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432454 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Wedding Ring Market Size

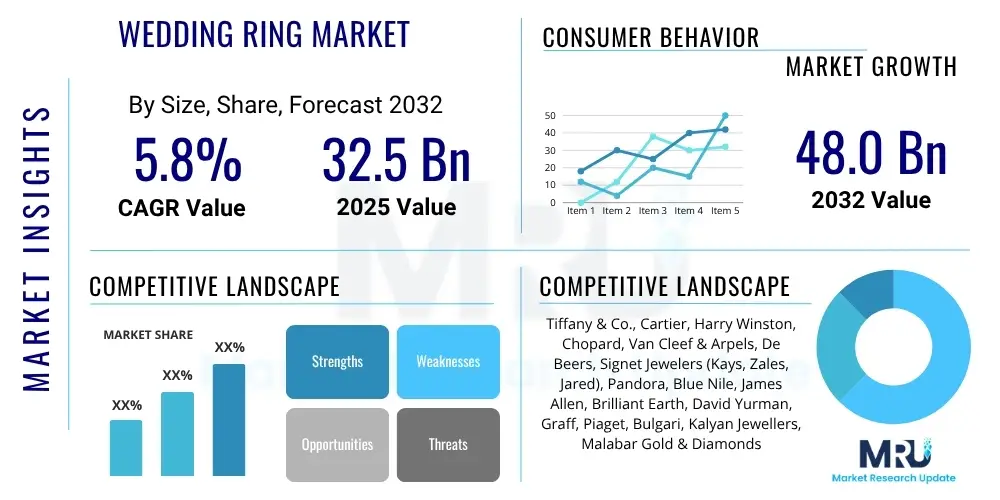

The Wedding Ring Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $26.5 Billion in 2026 and is projected to reach $41.0 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by consistent global marriage rates, coupled with an increasing preference for personalized and high-value jewelry pieces that symbolize enduring commitment, particularly across emerging economies in Asia Pacific.

Wedding Ring Market introduction

The Wedding Ring Market encompasses the global sale and distribution of rings specifically exchanged during marriage ceremonies, symbolizing fidelity and eternity. Products range from traditional bands crafted from precious metals such as gold, platinum, and silver, to contemporary designs featuring diamonds, gemstones, or alternative materials like titanium and tungsten carbide. The evolution of this market is strongly influenced by socio-economic trends, disposable income levels, and changing cultural perceptions regarding luxury and sustainability in personal adornment. Key applications include bridal sets, engagement bands, and eternity rings, catering to both the initial marriage market and anniversary/renewal segments.

Major applications of wedding rings extend beyond the ceremonial exchange; they serve as a powerful identifier of marital status and a significant emotional investment. The enduring benefit of the wedding ring lies in its symbolic permanence, driving consumers toward high-quality, durable materials. Furthermore, the market benefits immensely from the customization trend, where modern couples seek unique designs that reflect individual personalities, pushing manufacturers to innovate in metallurgy and gemology. This segment is characterized by high emotional value and relatively inelastic demand, making it resilient to minor economic fluctuations, especially in the high-end luxury bracket.

Driving factors propelling market expansion include the increasing purchasing power of millennials and Gen Z, who, while valuing tradition, demand ethical sourcing and transparency (especially regarding conflict-free diamonds and recycled metals). Urbanization in developing countries like China and India has accelerated the adoption of Western-style wedding ceremonies, incorporating the symbolic ring exchange. Additionally, sophisticated marketing campaigns by global luxury brands, focusing on emotional storytelling and heritage, continue to reinforce the ring's status as a quintessential element of the wedding industry, further stimulating demand across all price points.

Wedding Ring Market Executive Summary

The Wedding Ring Market is experiencing a paradigm shift characterized by a strong consumer preference for ethical sourcing and customization, directly impacting business trends across the value chain. Global business trends indicate a significant consolidation among major mining and manufacturing entities while simultaneously observing the rapid emergence of direct-to-consumer (D2C) online retailers specializing in transparent supply chains and bespoke design services. The luxury segment is stabilizing after pandemic-related disruptions, prioritizing provenance and craftsmanship, while the mid-range market sees intense competition driven by price sensitivity and material alternatives. Investment in blockchain technology for diamond traceability represents a critical business response to rising consumer demands for authenticity and responsible procurement, becoming a prerequisite for market entry in many luxury segments.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market due to demographic tailwinds, rising middle-class disposable incomes, and the strong cultural emphasis on gifting and lavish weddings, particularly in India and China. North America and Europe maintain dominance in terms of market value and adoption of innovative retail models, such as virtual try-on experiences and AI-driven personalization tools. In contrast, the Middle East and Africa (MEA) market remains robust, driven by tradition, high expenditure on luxury goods, and an unwavering preference for high-carat gold and large diamond settings. Regional success is increasingly tied to effective omni-channel strategies that seamlessly integrate physical boutique experiences with advanced digital platforms.

Segment trends reveal that the 'Platinum' segment is gaining momentum, perceived as more durable and rare than traditional gold in certain Western markets, while 'White Gold' remains a staple globally for its aesthetic compatibility with diamonds. In terms of material, the Lab-Grown Diamond segment is witnessing exponential growth, challenging the historical dominance of natural diamonds by offering comparable quality at a significantly lower environmental and economic cost, appealing strongly to environmentally conscious younger demographics. Distribution is heavily skewing toward the online channel, offering wider inventory access and competitive pricing, though specialized bridal jewelry stores continue to command significant market share for high-value purchases requiring personalized consultation and inspection.

AI Impact Analysis on Wedding Ring Market

User queries regarding AI’s influence on the Wedding Ring Market primarily revolve around three key areas: how AI can personalize the consumer shopping experience, its role in ensuring ethical sourcing and authenticity, and its application in optimizing the design and manufacturing workflow. Consumers are keen to understand if AI can effectively recommend ring styles based on complex factors like personal aesthetic, hand shape, and existing jewelry collection, moving beyond simple demographic segmentation. There is also a strong interest in AI's capacity to verify the origin and characteristics of stones (especially lab-grown versus natural distinction) using machine vision and blockchain linkage. Manufacturers are focused on using AI for predictive trend analysis, inventory management, and maximizing yield during the diamond cutting process, addressing the high cost and sensitivity of raw materials.

The integration of Artificial Intelligence is revolutionizing the retail experience by enabling highly sophisticated virtual try-on applications that use augmented reality (AR) combined with AI algorithms to accurately size and render rings on a customer's hand, drastically reducing the barrier to purchasing high-value items online. Furthermore, AI-powered chatbots and virtual assistants are being deployed to guide customers through the often-complex decision-making process involving metal type, carat weight, cut, color, and clarity (the 4Cs), providing expert-level advice instantaneously, available 24/7. This improves conversion rates and significantly enhances customer satisfaction by demystifying the purchasing journey.

In the backend, AI is vital for supply chain integrity and operational efficiency. Predictive maintenance algorithms minimize downtime in high-precision manufacturing processes, such as CAD/CAM milling and micro-setting. More critically, machine learning models are being utilized to analyze vast datasets relating to gemstone grading, ensuring consistency and detecting potential fraud. By integrating AI with traceability platforms, the industry is building a verifiable provenance record for every component, addressing the ethical concerns of modern consumers and enhancing brand trust in a sector historically fraught with opacity. This technological adoption is setting new standards for transparency and responsible luxury.

- AI-driven personalization engines enhance product recommendations based on visual preferences and historical data.

- Augmented Reality (AR) and AI facilitate realistic virtual try-on experiences, bridging the gap between online and physical shopping.

- Machine learning optimizes inventory management and demand forecasting for seasonal bridal trends.

- AI-powered image recognition improves the accuracy and consistency of diamond grading (the 4Cs).

- Integration of AI with blockchain ensures immutable traceability and verification of ethical sourcing claims.

- Generative AI assists designers in rapidly prototyping novel and highly customized ring concepts (Generative Design).

- Predictive maintenance algorithms reduce operational costs and manufacturing lead times in high-precision jewelry production.

DRO & Impact Forces Of Wedding Ring Market

The Wedding Ring Market is driven by consistent global marriage rates and increasing disposable income, particularly in fast-growing Asian economies, which fosters a persistent demand for traditional symbolic jewelry. Restraints include the high volatility in the prices of precious metals and gemstones, which directly impacts manufacturing costs and retail price points, potentially deterring budget-conscious consumers. Furthermore, heightened scrutiny regarding the ethical sourcing of natural diamonds and consumer preference shifts towards eco-friendly alternatives pose structural challenges to traditional suppliers. Opportunities are vast in the personalization and bespoke design segments, supported by technological advancements like 3D printing, alongside the emerging market acceptance of lab-grown diamonds, which offer sustainable and cost-effective luxury.

The primary driving force remains the intrinsic cultural and emotional significance attached to the wedding ring, reinforced by extensive marketing that links these items with eternal love and commitment. Demographic factors, such as the large population cohort of millennials and Gen Z entering marrying age, ensure sustained market entry. The trend toward experiential luxury also encourages higher spending per purchase, where the ring is seen as a major lifetime investment. Conversely, a significant restraint is the growing concern over environmental, social, and governance (ESG) factors. Consumers are actively researching the provenance of their purchases, making compliance with ethical sourcing standards (such as the Kimberley Process and beyond) a critical barrier to entry and a necessary operational cost for established players.

The market impact forces are categorized by internal dynamics such as brand equity and supply chain efficiency, and external dynamics dominated by consumer activism and technological disruption. The rising prominence of lab-grown diamonds (LGDs) represents a powerful external opportunity, forcing natural diamond mining entities to redefine their value proposition around heritage and rarity. The industry must navigate the delicate balance between maintaining the perceived value of tradition while embracing innovative, transparent, and sustainable practices. Successfully leveraging digitalization for D2C sales and offering verifiable ethical certifications are crucial for market players to maintain relevance and capture growth in the forthcoming period.

Segmentation Analysis

The Wedding Ring Market is extensively segmented based on material, product type, distribution channel, and end-user, reflecting the diverse preferences and purchasing power of the global consumer base. Material segmentation is crucial as it determines both the aesthetic appeal and the cost structure, ranging from high-value segments like Platinum and Natural Diamond to more accessible options utilizing Sterling Silver or alternative metals paired with lab-grown stones. Product type segmentation differentiates between classic wedding bands, engagement rings, and sophisticated bridal sets, each catering to specific purchasing occasions and financial commitments. Analyzing these segments provides strategic insights into consumer behavior, allowing businesses to tailor inventory, pricing, and marketing efforts effectively across varying geographical and socio-economic landscapes.

Distribution channel segmentation is undergoing a rapid evolution, with the traditional specialized retail stores maintaining influence for premium purchases, while online platforms and direct-to-consumer models are capturing the growing segment of younger, digitally native buyers seeking competitive pricing and transparency. The shift toward online platforms is supported by advanced logistics and robust return policies necessary for high-value items. Furthermore, regional segmentation highlights disparities in preferred metal types—for example, a strong preference for 24-karat gold in parts of Asia versus 14-karat white gold and platinum dominance in North America, demanding highly localized product portfolios from global manufacturers. Understanding the interplay between these segmentation variables is essential for generating accurate market forecasts and implementing targeted expansion strategies.

- By Material:

- Gold (10K, 14K, 18K, 24K)

- Platinum

- Silver

- Palladium

- Alternative Metals (Titanium, Tungsten Carbide, Stainless Steel)

- By Stone Type:

- Natural Diamond

- Lab-Grown Diamond (LGD)

- Gemstones (Sapphire, Ruby, Emerald, Moissanite)

- No Stone/Plain Bands

- By Product Type:

- Classic Wedding Bands (Plain, Etched)

- Engagement Rings (Solitaire, Halo, Pave)

- Bridal Sets (Matching Engagement and Wedding Rings)

- Eternity and Anniversary Rings

- By Distribution Channel:

- Offline (Specialty Jewelry Stores, Department Stores, Independent Boutiques)

- Online (E-commerce Platforms, Brand Websites, Online Luxury Retailers)

- By End User:

- Men

- Women

Value Chain Analysis For Wedding Ring Market

The Wedding Ring Market value chain is inherently complex and spans from upstream resource extraction to downstream consumer retail, dictating cost, quality, and ethical compliance at every stage. Upstream activities involve the mining, sourcing, and processing of precious metals (gold, platinum) and rough stones (diamonds, gemstones). This stage is capital-intensive and subject to stringent regulatory oversight, particularly concerning conflict minerals and environmental impact. Key players in this phase focus on securing high-quality raw materials efficiently. The midstream involves high-precision manufacturing, including metal alloying, casting, stone cutting, polishing, and setting. Efficiency in midstream operations is heavily reliant on advanced technology like CAD/CAM and robotic automation to minimize material waste and maintain design consistency, transforming raw inputs into finished jewelry components.

The downstream element of the value chain is focused on marketing, branding, and distribution. Major distribution channels include direct sales through proprietary brand boutiques, wholesale distribution to multi-brand jewelry retailers, and increasingly, direct-to-consumer (D2C) online sales. Direct channels offer manufacturers greater control over pricing and brand messaging but require significant investment in physical retail infrastructure or sophisticated e-commerce platforms. Indirect channels, such as independent jewelers and department stores, provide broader market access but involve margin sharing and less direct interaction with the end consumer. Effective supply chain management, supported by technologies like blockchain for traceability, is crucial here to ensure transparency and build consumer trust.

Direct distribution, particularly via e-commerce, has gained prominence as it offers better price points due to reduced intermediary costs and allows brands to communicate their unique value propositions, especially relating to sustainability or customization. Conversely, the traditional retail model (indirect channel) remains vital for high-value, emotionally charged purchases, as consumers often require personalized consultation, inspection of physical inventory, and assurance from trusted sales personnel. Optimal market penetration often necessitates a sophisticated omni-channel approach that blends the experiential benefits of physical retail with the efficiency and inventory breadth of online platforms, maximizing reach across varied consumer segments.

Wedding Ring Market Potential Customers

The primary segment of potential customers for the Wedding Ring Market includes individuals, predominantly Millennials (aged 27-42) and the advancing cohort of Generation Z (aged 12-26), who are currently reaching or nearing peak marriage age globally. This demographic is characterized by a high digital literacy, a strong preference for personalization, and significant concern regarding environmental and social responsibility. They seek rings that are not just symbols of commitment but also reflections of their personal values, leading to increased demand for ethically sourced materials, conflict-free diamonds, and alternative, sustainable options like lab-grown stones and recycled metals. Their purchasing decisions are heavily influenced by online research, peer reviews, and social media trends, demanding a highly sophisticated digital engagement strategy from vendors.

A secondary, yet highly lucrative, segment includes High-Net-Worth Individuals (HNWIs) and Ultra-High-Net-Worth Individuals (UHNWIs) who drive the demand for bespoke, high-carat, and historically significant designer pieces. This segment values exclusivity, unparalleled craftsmanship, and the prestige associated with established luxury jewelry houses. Their purchasing behavior is less price-sensitive and more focused on investment value, rarity, and personalized client experiences, often involving private viewings and custom design consultations. Marketing efforts targeting this group emphasize heritage, legacy, and certified provenance, ensuring that the luxury narrative is maintained and reinforced through impeccable service.

Furthermore, the market includes customers seeking anniversary rings, vow renewals, or replacements, representing consistent recurring demand. The demographic of second or subsequent marriage participants also forms a substantial customer base, often having greater financial stability and opting for more elaborate or upgraded rings than those purchased during the initial marriage. Targeting these diverse customer segments requires layered marketing strategies: digital transparency and value focus for younger buyers, extreme personalization and exclusivity for the affluent, and emotional messaging centered on enduring commitment for the renewal market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $26.5 Billion |

| Market Forecast in 2033 | $41.0 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tiffany & Co. (LVMH), Signet Jewelers Limited, Chow Tai Fook Jewellery Group, L Brands (Victoria's Secret & Co.), Richemont (Cartier), Luk Fook Holdings, Pandora A/S, Harry Winston (Swatch Group), De Beers Group, Blue Nile, Brilliant Earth, Charles & Colvard, Tacori, Graff Diamonds, Zales, Kay Jewelers, Van Cleef & Arpels, Bvlgari (LVMH), Tanishq (Titan Company), Michael Hill International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wedding Ring Market Key Technology Landscape

The technological landscape of the Wedding Ring Market is rapidly evolving, driven by the need for enhanced customization, ethical verification, and efficient manufacturing processes. Computer-Aided Design (CAD) and Computer-Aided Manufacturing (CAM) systems are foundational, allowing designers to create intricate, precise models that can be directly translated into production molds, vastly reducing prototyping time and manufacturing errors. This is crucial for mass customization, enabling consumers to modify standardized designs or create entirely unique pieces without prohibitive costs. Furthermore, advanced laser welding and micro-setting techniques are enhancing the quality and durability of high-end jewelry, ensuring stones are secured flawlessly even in the most delicate settings.

Additive manufacturing, specifically 3D printing technologies (such as wax printing for investment casting), is revolutionizing the creation of master models. This technology allows for unparalleled geometric complexity that traditional subtractive manufacturing cannot achieve, facilitating the creation of complex filigree work and elaborate hidden details that appeal to the luxury segment seeking unique craftsmanship. The adoption of 3D printing also supports sustainable practices by optimizing material use during the prototyping phase. Simultaneously, the focus on digital storefronts utilizes technologies like Virtual Reality (VR) and Augmented Reality (AR) to provide immersive shopping experiences, allowing consumers to visualize the product accurately and confidently before purchase, thereby mitigating the risk associated with buying high-value items sight unseen.

Perhaps the most significant technological disruption comes from blockchain implementation for supply chain traceability. Given the market's emphasis on provenance and ethics (especially concerning diamonds), blockchain provides an immutable, decentralized ledger to record the journey of metals and stones from mine or laboratory to the final product. This transparency builds critical consumer trust, satisfying the AEO demand for verifiable ethical claims. Additionally, advanced spectroscopes and AI-powered sorting machines are employed to differentiate between natural and lab-grown diamonds with extremely high accuracy, maintaining the integrity of inventory and ensuring correct labeling, a necessary element in a highly scrutinized regulatory environment.

Regional Highlights

The Wedding Ring Market exhibits pronounced regional variances driven by distinct cultural practices, economic maturity, and local preferences for specific metal karats and design aesthetics. North America (USA and Canada) represents a mature market characterized by high consumer spending power, a strong preference for platinum and white gold, and significant adoption of e-commerce channels. The demand here is heavily influenced by trends in bridal fashion, emphasizing larger center stones (solitaires and halos), and a growing acceptance of lab-grown diamonds as a sustainable luxury alternative, positioning the region as a leader in technological retail innovation.

Asia Pacific (APAC), encompassing major economies like China and India, is the primary engine of future market growth. In India, the market is profoundly influenced by cultural traditions favoring high-carat yellow gold (typically 22K) and elaborate design work, viewing jewelry often as a tangible investment. China exhibits a mixed preference, adopting Western-style diamond engagement rings while maintaining a strong demand for classic gold jewelry for traditional ceremonies. Rising disposable incomes and increasing exposure to global luxury brands are accelerating the transition toward higher-value purchases across the region, making it critical for global players to localize their marketing and product offerings effectively.

Europe presents a diverse market structure, with countries like the UK and Germany showing similar preferences to North America (platinum and diamond settings), while Southern European nations often favor white or rose gold. The European market places a strong emphasis on brand heritage, craftsmanship, and verified ethical sourcing, responding well to sustainability narratives and traditional artisan techniques. The Middle East and Africa (MEA) region is characterized by exceptionally high demand for yellow gold, frequently in high purities (21K and 22K), driven by deeply ingrained cultural practices where gold jewelry serves as both ceremonial gift and liquid asset, ensuring robust, stable demand within this high-value segment.

- North America: Leads in market value; high adoption of e-commerce; strong preference for platinum, white gold, and lab-grown diamonds.

- Europe: Focus on brand heritage and craftsmanship; strict ethical sourcing standards; varied national preferences for gold purity and color.

- Asia Pacific (APAC): Fastest growing region; high demand driven by population density and rising income; strong preference for high-carat yellow gold in India; increasing adoption of Western engagement styles in China.

- Latin America: Growing consumer base; influenced by local precious metal availability and religious traditions; gradual shift towards formalized bridal sets.

- Middle East and Africa (MEA): Stable, high-value market; entrenched cultural demand for high-purity yellow gold as investment and adornment; luxury sector dominates procurement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wedding Ring Market.- Tiffany & Co. (LVMH)

- Signet Jewelers Limited

- Chow Tai Fook Jewellery Group

- Richemont (Cartier)

- Luk Fook Holdings

- Pandora A/S

- Harry Winston (Swatch Group)

- De Beers Group (Lightbox)

- Blue Nile (Signet)

- Brilliant Earth

- Charles & Colvard

- Tacori

- Graff Diamonds

- Zales (Signet)

- Kay Jewelers (Signet)

- Van Cleef & Arpels (Richemont)

- Bvlgari (LVMH)

- Tanishq (Titan Company)

- Michael Hill International

- Gemological Institute of America (GIA) - Influential Grading Body

Frequently Asked Questions

Analyze common user questions about the Wedding Ring market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the growing acceptance of lab-grown diamonds in the wedding ring market?

Lab-grown diamonds (LGDs) are gaining acceptance primarily due to their comparable chemical and optical properties to natural diamonds, coupled with a significantly lower price point (often 30-40% less) and a verifiable, sustainable origin. Younger consumers value the reduced environmental footprint and ethical transparency associated with controlled laboratory production, making LGDs a compelling luxury alternative.

How is the volatility of precious metal prices currently impacting wedding ring manufacturers?

High volatility in prices for gold and platinum necessitates sophisticated hedging strategies and flexible inventory management by manufacturers. This volatility often translates to rapid adjustments in retail pricing, potentially squeezing profit margins for mid-market jewelers and driving consumers toward alternative, more stable metals like titanium or tungsten carbide in budget segments.

Which distribution channel is showing the fastest growth rate for wedding ring sales globally?

The Online (E-commerce and D2C) distribution channel is experiencing the fastest growth. This rapid expansion is driven by increased consumer trust in digital transactions, the ability of online retailers to offer vast inventory selection, better price transparency, and the integration of technologies like AR/VR for virtual try-on experiences, mitigating the risk of high-value online purchases.

What role does blockchain technology play in enhancing market trust and ethical sourcing?

Blockchain provides an immutable digital ledger to track the provenance of diamonds and precious metals from their source (mine or lab) through cutting, polishing, and setting. This verifiable, decentralized record establishes end-to-end supply chain transparency, allowing retailers to confidently guarantee ethical and conflict-free sourcing to consumers, thus building essential market trust.

What are the key design trends dominating the wedding ring market for the millennial and Gen Z demographic?

Key trends include personalized and bespoke designs, emphasizing unique stone shapes (e.g., oval, cushion cuts), non-traditional settings (e.g., bezel or tension settings), and mixed metals (e.g., rose gold accents). There is also a strong preference for minimal, stackable bands and vintage-inspired designs that feature intricate detailing and craftsmanship over sheer carat weight.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager