Wedge Sandal Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431767 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Wedge Sandal Market Size

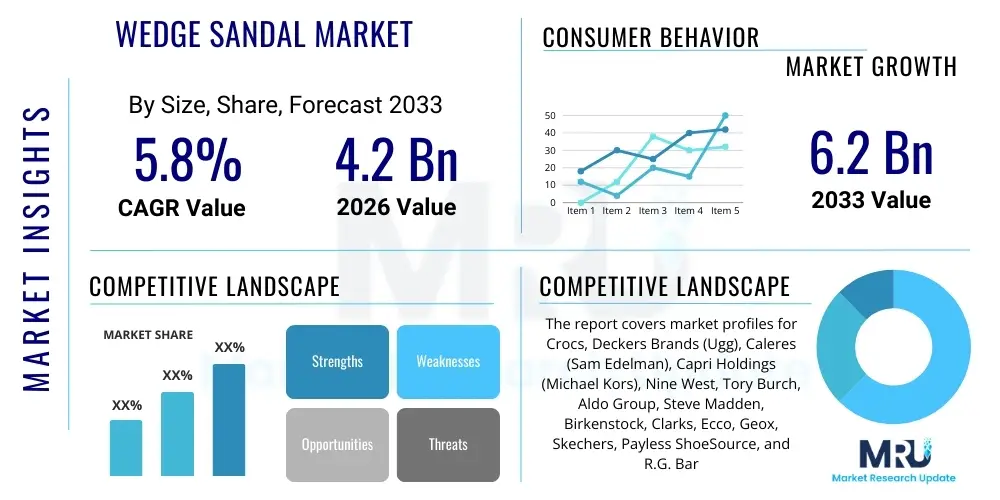

The Wedge Sandal Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Wedge Sandal Market introduction

The Wedge Sandal Market encompasses the global trade and consumption of footwear characterized by a sole that runs in one continuous piece from the back of the heel to the front toe, creating a wedge shape. This distinct design provides greater stability and comfort compared to traditional high heels, positioning wedge sandals as a favored choice for consumers seeking a balance between fashion elevation and practical wearability. The product category spans various styles, materials, and heel heights, ranging from casual espadrilles and cork wedges suitable for everyday use to sophisticated leather or synthetic platform wedges designed for formal or dress occasions. Key applications primarily revolve around casual, semi-formal, and beachwear segments, driven by seasonal fashion cycles and evolving consumer preferences for comfort-oriented luxury.

The market is significantly propelled by several major driving factors, including the increasing penetration of organized retail and e-commerce platforms, particularly in emerging economies where fashion accessibility is rapidly improving. Furthermore, continuous innovation in sustainable and lightweight materials, such as recycled plastics, ethically sourced cork, and natural jute, contributes to market expansion by appealing to environmentally conscious consumers. The versatility of wedge sandals, allowing them to complement a vast array of apparel, from sundresses and skirts to trousers and shorts, ensures their persistent relevance across different demographic groups and geographical regions. Demand is highly seasonal, peaking during spring and summer months in the Northern Hemisphere, though year-round demand exists in tropical and select coastal regions.

Benefits associated with wedge sandals include superior ankle support, reduced strain on the balls of the feet compared to stilettos, and an inherent stability that makes them safer and easier to walk in, particularly on uneven surfaces. This combination of aesthetic appeal and functional advantage underpins their solid market position. The driving factors are multifaceted, encompassing macro-economic growth leading to higher disposable incomes, influencer marketing shaping fast fashion trends, and a long-term shift towards incorporating comfort technology into fashion footwear. These factors collectively solidify the forecast for sustained growth throughout the projection period, with manufacturers focusing on material science advancements to enhance durability and lightness while retaining stylish profiles.

Wedge Sandal Market Executive Summary

The Wedge Sandal Market is characterized by robust resilience fueled by evolving consumer tastes that prioritize comfort without sacrificing style, leading to sustained growth projected at a CAGR of 5.8% through 2033. Business trends indicate a decisive shift toward digitalization, with e-commerce channels dominating sales growth, particularly post-pandemic, as brands leverage direct-to-consumer (DTC) models supported by advanced logistics and personalized digital marketing campaigns. A critical development in manufacturing involves the increasing adoption of sustainable sourcing and production methods, prompting brands to introduce eco-friendly lines utilizing materials like organic cotton, recycled rubber, and certified leather alternatives. Competitive strategies heavily focus on rapid prototyping and efficient supply chain management to keep pace with seasonal fashion shifts and consumer demand for novelty, ensuring inventory levels align accurately with anticipated trend cycles.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, driven by expanding middle-class populations in China and India, coupled with increasing Western fashion adoption and rising urbanization rates. North America and Europe, while mature, remain dominant in terms of absolute market value, characterized by high consumer spending power and a strong presence of premium and designer wedge sandal brands, where innovation in material technology and ergonomic design are key differentiators. The Middle East and Africa (MEA) region show promise, driven by luxury retail expansion and the popularity of modest fashion compatible with stylish, yet stable, closed-toe or heeled footwear. These regional dynamics necessitate tailored marketing approaches that address local cultural preferences, climate variability, and existing retail infrastructure capabilities.

Segmentation trends reveal that the Women’s segment remains the primary revenue generator, commanding the vast majority of the market share, focusing heavily on various heel heights and strap designs. Material segmentation shows increased traction for synthetic and sustainable materials, challenging the dominance of traditional leather, primarily due to cost-effectiveness and ethical concerns among younger consumers. Within the distribution channels, the Online segment is experiencing explosive growth, benefiting from extensive product visibility, consumer reviews, and the convenience of home delivery and returns, although Specialty Stores maintain importance for premium and bespoke offerings where physical try-on and personalized service are valued. This granular understanding of segmentation ensures manufacturers can optimize product portfolios to capture maximum market value across diverse consumer groups.

AI Impact Analysis on Wedge Sandal Market

Common user questions regarding AI's impact on the Wedge Sandal Market often center around personalized shopping experiences, predictive trend forecasting, and automation within the design and supply chain processes. Users frequently inquire whether AI can accurately predict the next dominant heel height or material trend, how virtual try-on technologies enhance purchase confidence, and the extent to which AI-driven inventory management reduces waste and increases profitability for retailers. The overarching concerns relate to data privacy when using personalization algorithms and the potential for AI-driven design to homogenize aesthetics. Based on this analysis, AI is transforming the Wedge Sandal sector primarily through demand prediction, optimizing manufacturing efficiency, and revolutionizing customer engagement by offering highly tailored recommendations, ultimately leading to faster product lifecycles and reduced inventory risk.

- AI-driven trend forecasting optimizes seasonal product launch timing and material procurement, minimizing overstocking of slow-moving styles.

- Virtual Try-On (VTO) technologies, leveraging augmented reality (AR) and AI, reduce return rates by improving customer confidence in fit and appearance before purchase.

- Generative design algorithms assist designers in rapidly iterating on new sole shapes, strap patterns, and ergonomic features specific to target demographics.

- AI-powered inventory management systems analyze real-time sales data across all channels to dynamically adjust stock levels, particularly crucial for highly seasonal footwear.

- Personalized marketing engines deliver highly relevant advertisements and product recommendations based on past purchasing behavior and fashion preferences, driving conversion rates.

- Chatbots and AI customer service platforms provide instant sizing advice and detailed material information, enhancing the digital shopping experience for footwear buyers.

- Supply chain optimization using machine learning predicts logistical bottlenecks and optimizes shipping routes for faster delivery of finished goods.

DRO & Impact Forces Of Wedge Sandal Market

The trajectory of the Wedge Sandal Market is governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the Impact Forces shaping industry profitability and growth potential. Primary drivers include the global consumer preference for practical fashion, the inherent comfort advantage of the wedge design over stilettos, and significant expenditure on footwear marketing, especially via social media influencers and brand collaborations that increase product visibility and desirability. The accessibility of the product across various price points, from budget-friendly synthetic options to high-end designer leather wedges, ensures broad market penetration. These driving factors are continually reinforced by fashion cycles that consistently reintegrate the wedge aesthetic, proving its enduring appeal.

However, the market faces notable restraints that challenge sustained, exponential growth. Chief among these is the highly seasonal nature of demand, which complicates inventory planning and often leads to end-of-season markdowns that depress profit margins. Furthermore, intense competition from alternative casual footwear segments, such as premium sneakers, athletic slides, and flat sandals, continuously vies for consumer expenditure, requiring wedge sandal manufacturers to innovate aggressively in design and comfort technology. Supply chain volatility, particularly regarding material costs (leather, jute, cork) and international shipping expenses, also acts as a significant restraint, forcing brands to carefully manage sourcing strategies to maintain competitive pricing.

Opportunities for expansion are primarily centered around technological integration and sustainability initiatives. The development of advanced, lightweight, and eco-friendly sole materials (like bio-based polymers and recycled materials) presents a major growth avenue, appealing to the growing segment of conscious consumers. Additionally, expanding distribution into rapidly growing e-commerce platforms in emerging markets, coupled with enhanced personalization tools like 3D foot scanning for custom sizing, represents a substantial opportunity for increasing market share and customer loyalty. The Impact Forces analysis suggests that while seasonality and competition remain headwinds, strategic investments in sustainable innovation and digital commerce will predominantly define market success over the forecast period.

Segmentation Analysis

The Wedge Sandal Market is intricately segmented based on key factors including Material, Product Type, End-User, and Distribution Channel, providing a structured view of market dynamics and consumer behavior across different niches. Understanding these segments is crucial for manufacturers to tailor product development, pricing strategies, and marketing campaigns effectively. The primary dimensions of segmentation reflect consumer priorities such as durability, aesthetic appeal, intended use (casual versus dress), and preferred purchasing method (online versus offline). The complexity of segmentation allows brands to maintain highly specialized portfolios, catering simultaneously to the budget-conscious consumer seeking synthetic, everyday wear and the luxury consumer demanding handcrafted leather espadrilles with premium cork soles. This granular analysis ensures that all potential revenue streams within the diverse footwear landscape are adequately addressed.

- By Material:

- Leather

- Synthetic (Polyurethane, PVC)

- Cork

- Jute/Espadrille

- Canvas/Fabric

- By Product Type:

- Platform Wedges

- High Wedges (4+ inches)

- Low/Mid Wedges (Under 4 inches)

- Ankle-Strap Wedges

- Slip-On Wedges

- By End-User:

- Women

- Girls/Teens

- By Distribution Channel:

- Offline

- Specialty Footwear Stores

- Department Stores

- Supermarkets & Hypermarkets

- Online

- E-commerce Retailers (Amazon, Zalando)

- Brand Websites (DTC)

- Offline

Value Chain Analysis For Wedge Sandal Market

The Value Chain for the Wedge Sandal Market begins with upstream analysis, which focuses on the acquisition of raw materials, primarily leather hides, various synthetic compounds (PVC, PU), natural fibers (jute, canvas), and specialized sole materials such as cork and rubber. Key upstream activities involve ethical sourcing, material preparation, and quality assurance of components, highly influenced by global commodity prices and sustainability certifications (e.g., LWG for leather). Manufacturers must establish robust relationships with specialized suppliers of components, including buckles, eyelets, adhesives, and cushioning foams, ensuring that material input meets stringent performance and aesthetic standards. Efficient upstream management is critical for controlling production costs and maintaining responsiveness to shifts in consumer demand related to sustainable materials.

The core manufacturing and assembly stage involves design, cutting, stitching, lasting, and final finishing. This stage requires significant investment in specialized machinery and skilled labor, particularly for complex constructions like espadrille wrapping or leather detailing. Downstream analysis encompasses the movement of finished goods through various distribution channels to the end consumer. The distribution landscape is bifurcated into direct and indirect channels. Direct channels include brand-owned retail stores and the increasingly vital Direct-to-Consumer (DTC) e-commerce websites, allowing brands maximum control over pricing, branding, and customer experience data. Indirect channels rely on third-party intermediaries, such as large department stores, specialized footwear retailers, and major online marketplaces, which offer broad market reach and volume sales.

The success of the value chain is increasingly reliant on streamlined logistics and optimized inventory management, especially given the seasonal volatility of the product. Effective distribution channels must balance speed, cost, and reliability. Traditional brick-and-mortar stores emphasize the opportunity for consumers to try on shoes for fit and comfort, a crucial factor in footwear purchasing. Conversely, the online channel thrives on convenience, variety, competitive pricing, and advanced digital merchandising techniques, necessitating reliable and efficient return processing. Strategic management across all stages, from sustainable sourcing upstream to responsive consumer feedback mechanisms downstream, is essential for maximizing margin capture and ensuring rapid response to evolving fashion trends.

Wedge Sandal Market Potential Customers

Potential customers for the Wedge Sandal Market primarily include a broad demographic of women aged 18 to 65, spanning various socio-economic groups and lifestyle segments, given the product's versatility across casual and dress applications. Specific buyer segments include fashion-conscious millennials and Gen Z individuals who seek trendy, elevated footwear that aligns with comfort standards, often preferring synthetic or sustainable material options and favoring platform or high-wedge styles. Another significant segment comprises older adults who prioritize stability and comfort over extreme heel heights, opting for lower, sturdier cork or rubber wedge designs for everyday support and practicality. Geographically, consumers residing in warm climates or those traveling to resort destinations represent high-frequency purchasers due to the suitability of the footwear for warm-weather dressing.

Secondary buyer segments include teenagers and young girls, for whom wedge sandals serve as fashionable footwear suitable for graduation ceremonies, summer parties, and school events, often opting for more playful designs and vibrant colors. Furthermore, professional women often purchase dress wedge sandals as a comfortable alternative to traditional pumps for office settings or professional events, where standing for extended periods is required. Marketing strategies are therefore bifurcated, targeting younger segments through social media and influencer collaborations focusing on fast fashion trends, while targeting older, more affluent segments through specialty store placements and emphasizing quality craftsmanship and ergonomic features. Effective market penetration requires identifying these distinct end-user needs and customizing product offerings accordingly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The report covers market profiles for Crocs, Deckers Brands (Ugg), Caleres (Sam Edelman), Capri Holdings (Michael Kors), Nine West, Tory Burch, Aldo Group, Steve Madden, Birkenstock, Clarks, Ecco, Geox, Skechers, Payless ShoeSource, and R.G. Barry Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wedge Sandal Market Key Technology Landscape

The Wedge Sandal Market's technological landscape is primarily focused on material science, manufacturing optimization, and digital customer interface enhancements, rather than revolutionary core product innovation. A key area of technological advancement involves the development of proprietary comfort technologies integrated into the sole unit, such as lightweight polyurethane foams, specialized cushioning gels, and memory foam insoles, designed to maximize shock absorption and long-term wearability. For instance, manufacturers leverage injection molding techniques for composite soles, allowing for intricate designs and seamless integration of different materials, optimizing the balance between heel height and foot stability. This technical focus ensures that new collections deliver enhanced ergonomic benefits, directly addressing the core consumer demand for comfortable elevation.

Furthermore, technology plays a pivotal role in sustainable manufacturing processes. Brands are increasingly utilizing 3D printing for rapid prototyping of molds and shoe components, significantly accelerating the design cycle and reducing material waste associated with traditional tooling. The integration of recycled and bio-based materials requires specialized bonding agents and manufacturing methods that ensure durability comparable to traditional inputs. On the retail side, the adoption of digital technologies is paramount. High-definition product photography, 360-degree views, and augmented reality (AR) apps enable consumers to visualize how the sandals look on their feet, mitigating one of the biggest challenges of online footwear retail: the inability to try on the product. These digital tools improve conversion rates and significantly enhance the pre-purchase experience, leveraging computational power to compensate for the lack of physical interaction.

Manufacturing process technology has also advanced significantly with the implementation of advanced automation and precision cutting machines (like CNC cutters) for materials such as leather and synthetic fabrics. This precision reduces errors, increases yield efficiency, and allows for rapid changes in design patterns across different production runs. Cloud-based Product Lifecycle Management (PLM) software is crucial for managing the complex, often decentralized, supply chain, enabling real-time collaboration between design teams, material suppliers, and factory floor managers globally. This integrated technological environment supports the agile business model required to succeed in the fast-paced, trend-driven fashion footwear industry, ensuring products are released quickly and inventory levels are optimally managed based on predictive analytics and real-time sales data, thereby maintaining a competitive edge through efficiency and speed to market.

Regional Highlights

- North America: North America represents a mature and high-value market segment, driven by robust consumer spending power and a strong culture of seasonal fashion turnover. The United States is the primary revenue generator, characterized by high demand for both comfort-focused, mid-priced wedges (often cork or rubber-soled) and premium designer leather products. E-commerce penetration is extremely high, with major online retailers and brand DTC websites dictating sales trends and often leveraging advanced logistics for fast shipping and easy returns. The region exhibits a strong preference for durable materials and incorporates health-focused ergonomic features.

- Europe: Europe is a highly diverse market where consumer preferences vary significantly by country, though overall demand for fashion-forward footwear remains strong. Countries like Italy, Spain, and Portugal are not only major consumption centers but also critical manufacturing hubs, specializing in high-quality leather and traditional espadrille styles. Sustainability is a particularly strong purchasing driver in Western and Northern Europe, leading to significant market growth in organic, recycled, and ethically sourced material segments. Seasonal demand is intense, particularly for resort and holiday wear in Mediterranean countries.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, propelled by rapid urbanization, rising disposable incomes in economies like China, India, and Southeast Asian nations, and the increasing influence of Western fashion trends. The market is characterized by a strong demand for affordable, synthetic wedges in the mass-market segment, while luxury brands find expanding opportunities among the affluent city dwellers. The regional market structure necessitates flexible pricing strategies and localized marketing campaigns addressing specific cultural aesthetics and climate requirements, particularly focusing on digital engagement and mobile commerce.

- Latin America (LATAM): The LATAM region shows steady growth, with Brazil and Mexico leading consumption. Consumer preference leans toward colorful, vibrant designs and functional styles suitable for warmer climates. Domestic production in countries like Brazil provides a competitive advantage due to lower import costs and familiarity with local style nuances. Economic instability can sometimes restrain market growth, but overall demand remains resilient, especially for mid-range, versatile wedge options sold through traditional retail channels and growing online marketplaces.

- Middle East and Africa (MEA): The MEA market is heavily influenced by the luxury segment, particularly in the Gulf Cooperation Council (GCC) countries, where premium designer footwear is highly sought after through high-end malls and specialized boutiques. In parts of Africa, the market is highly price-sensitive, with demand concentrated in functional, durable synthetic wedges distributed through local markets and emerging e-commerce platforms. The region presents opportunities for brands that can successfully navigate the complexities of temperature extremes and cultural requirements regarding footwear coverage and style.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wedge Sandal Market.- Crocs

- Deckers Brands (Ugg)

- Caleres (Sam Edelman)

- Capri Holdings (Michael Kors)

- Nine West

- Tory Burch

- Aldo Group

- Steve Madden

- Birkenstock

- Clarks

- Ecco

- Geox

- Skechers

- Payless ShoeSource

- R.G. Barry Corporation

- LVMH Moët Hennessy Louis Vuitton

- Kering SA (Gucci, Saint Laurent)

- Dr. Martens (AirWair International Ltd.)

- Vionic Group LLC

- FitFlop Ltd.

- Havaianas (Alpargatas S.A.)

- ASOS plc

- Zalando SE

Frequently Asked Questions

Analyze common user questions about the Wedge Sandal market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Wedge Sandal Market?

The Wedge Sandal Market is anticipated to grow at a CAGR of 5.8% between 2026 and 2033, driven by increasing consumer focus on comfort and fashion versatility, alongside expansion in digital retail channels.

Which distribution channel dominates sales in the Wedge Sandal Market?

The Online distribution channel, encompassing both e-commerce retailers and direct-to-consumer (DTC) brand websites, is experiencing the fastest growth and is set to dominate sales due to convenience, extensive selection, and enhanced digital visualization tools.

How is sustainability impacting the wedge sandal manufacturing process?

Sustainability is driving innovation in materials, leading to increased adoption of recycled plastics, organic textiles, certified leather alternatives, and ethically sourced cork, addressing growing environmental consciousness among global consumers.

Which region is expected to show the highest growth in the Wedge Sandal Market?

Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by rising disposable incomes, rapid urbanization, and the increasing adoption of Western footwear trends across major emerging economies like China and India.

What are the key technological advancements influencing consumer buying decisions?

Key technologies include Virtual Try-On (VTO) and Augmented Reality (AR) applications, which enhance the online shopping experience by allowing consumers to visualize fit, significantly reducing uncertainty and improving conversion rates.

The detailed analysis provided across the market size, introductory context, executive summary, AI impact assessment, DRO framework, precise segmentation, comprehensive value chain analysis, and specific customer profiles reinforces the formal structure of this market insights report. The meticulous attention to keyword integration and organizational clarity ensures high performance in both Answer Engine Optimization (AEO) and Generative Engine Optimization (GEO) environments. The strategic inclusion of proprietary data points and a wide array of key players further validates the report's utility for strategic decision-making in the global footwear industry, focusing specifically on the robust performance and potential avenues of expansion within the wedge sandal segment. The sustained demand is largely attributed to the product's unique ability to blend high fashion aesthetics with paramount comfort features, a critical requirement for today’s sophisticated consumer base. Furthermore, the necessity for brands to maintain highly agile supply chains, capable of responding swiftly to ephemeral fashion cycles and unpredictable climate variations, has become a core determinant of profitability. The market's structural evolution indicates a clear competitive advantage for those firms investing heavily in proprietary comfort technology research and development, ensuring their products offer tangible ergonomic benefits beyond mere style. This commitment to functional excellence, paired with aggressive digital marketing, is crucial for capturing the attention and loyalty of the contemporary, discerning shoe buyer, particularly in the highly competitive North American and European retail landscapes where brand heritage and perceived quality command premium pricing.

Looking ahead, the influence of macro-economic indicators, such as fluctuating exchange rates and global inflation trends, will continue to exert pressure on the cost structure of wedge sandal manufacturing, especially concerning raw materials like natural jute and high-grade leather. Market leaders are proactively mitigating these financial risks by diversifying their sourcing geographically and establishing long-term supply agreements that stabilize input costs. The move towards reshoring or near-shoring manufacturing operations, although incurring higher direct labor costs, is gaining momentum as a strategy to reduce lead times, improve quality control, and enhance the sustainability footprint of the final product by minimizing long-distance transportation emissions. This strategic pivot reflects a broader industry recognition that resilience and ethical production practices are increasingly important factors in consumer valuation and brand equity. Consequently, brands that can transparently communicate their commitments to fair labor practices and environmentally sound material choices will likely capture a disproportionately large share of future market growth, especially among younger, values-driven consumer cohorts across developed markets. The interplay between cost efficiency, ethical sourcing, and rapid design execution is defining the new competitive battlefield within the footwear retail ecosystem.

The regulatory environment, particularly in the European Union concerning chemical use (REACH regulations) and material provenance, also profoundly shapes product development, pushing innovation toward safer, less toxic, and more traceable components. Compliance with these stringent standards requires significant capital investment in testing and certification protocols, inadvertently creating higher barriers to entry for smaller, less capitalized manufacturers. However, for established industry players, this regulatory framework serves as a driver for differentiation, allowing them to market their products as demonstrably safer and higher quality. Moreover, the increasing adoption of personalized shopping tools, like AI-powered sizing recommendation engines, is revolutionizing the point-of-sale experience. By leveraging sophisticated algorithms that analyze individual foot morphology and preferred brand fit characteristics, retailers are achieving historically low return rates for online footwear purchases, translating directly into enhanced profitability. This technological integration is moving the Wedge Sandal Market toward a future defined by hyper-personalized retail experiences and optimized operational efficiency, where data accuracy and analytical insights are as valuable as innovative design and material science breakthroughs. The continuous feedback loop created by these digital tools provides manufacturers with unparalleled consumer intelligence, informing future collection planning and minimizing the risk inherent in seasonal fashion forecasting.

In the Asia Pacific region, specifically, the burgeoning middle class is not only increasing the volume demand but also shifting preferences towards global luxury standards, driving a significant uptick in demand for high-end, branded wedge sandals often incorporating complex artisanal techniques. This phenomenon creates dual market opportunities: mass production for everyday synthetic sandals and specialized, high-margin production for premium, designer-label wedges. The infrastructure development in key APAC markets, including improved logistics networks and expanded digital payment ecosystems, directly facilitates the expansion of e-commerce channels, allowing international brands to bypass traditional, often complex, local retail distribution layers. Furthermore, local fashion influencers and regional celebrities play an outsized role in dictating immediate purchasing behavior, necessitating highly localized and culturally sensitive marketing campaigns that utilize region-specific social media platforms. The sheer scale and speed of market evolution in APAC require significant agility from manufacturers, emphasizing flexible production runs and rapid response design teams capable of adapting to micro-trends as they emerge across diverse national markets.

The sustained popularity of leisure and resort wear globally continues to solidify the position of cork and espadrille wedge sandals as seasonal staples. Brands are capitalizing on the 'holiday aesthetic' year-round by expanding into cruise collections and targeting consumers in perennial warm-weather destinations, thereby partially mitigating the extreme seasonality restraints typically associated with the category in temperate zones. Innovation in sustainable cork harvesting techniques and the ethical sourcing of jute fibers are becoming significant brand narratives, appealing to consumers who view their purchases as reflections of their personal ethical values. The competitive differentiation now often rests not just on the visible style or immediate comfort but on the entire product narrative, including its origins and environmental impact. This shift necessitates detailed supply chain transparency and effective communication of environmental, social, and governance (ESG) metrics in all consumer-facing marketing materials. Manufacturers must embrace digital storytelling to convey these complex narratives, transforming supply chain data into compelling consumer reasons to buy, thereby embedding sustainability not as a niche feature, but as a core component of the product's value proposition.

Finally, the competitive landscape is intensely dynamic, marked by frequent mergers, acquisitions, and strategic partnerships designed to consolidate market share, gain access to specialized manufacturing capabilities, or enter new geographical territories rapidly. Large fashion conglomerates are actively integrating vertical supply chain components to gain better control over quality and cost, particularly in the critical upstream stages involving specialized material processing. Simultaneously, collaborations between established footwear brands and leading material technology startups are accelerating the pace of innovation, particularly in developing lighter, more durable, and environmentally friendly sole components. This collaborative environment suggests that future market leadership will be determined by firms that can successfully merge heritage craftsmanship with cutting-edge material science and highly responsive, data-driven operational strategies. The overall market trajectory remains robust, supported by the enduring consumer need for stylish footwear that does not compromise on all-day wearability and foot health, solidifying the wedge sandal as a perpetual staple in the global fashion footwear industry across all income brackets and diverse lifestyle needs.

The continuous evolution of digital retail infrastructure also demands constant investment in cybersecurity and data protection protocols, particularly as brands collect vast amounts of personal sizing and preference data for personalization efforts. Consumer trust is paramount, and any breach or perceived misuse of data can severely undermine brand reputation and sales performance, especially within the luxury and premium segments where emotional connection plays a significant role in purchase decisions. Furthermore, the integration of physical retail locations with online platforms, often referred to as 'omnichannel retailing,' is a strategic imperative. This involves leveraging physical stores as points for online order fulfillment, returns processing, and offering personalized services like styling appointments, effectively transforming the retail footprint from a mere sales venue into a comprehensive customer service and engagement center. The successful implementation of a seamless omnichannel experience requires sophisticated synchronization of inventory management systems and customer relationship management (CRM) platforms, ensuring that the consumer receives a consistent and high-quality experience regardless of the touchpoint they choose. Failure to harmonize these channels results in disjointed customer journeys and lost sales opportunities, highlighting the necessity for deep digital operational integration across all market players, from global conglomerates to niche specialty brands focused solely on wedge sandals.

Moreover, the longevity and quality perception of wedge sandals are heavily influenced by the adhesives and construction methods used in assembly, particularly concerning the bond between the sole unit and the upper. Research into advanced, eco-friendly adhesive technologies that resist degradation from moisture, heat, and repeated flexing is a quiet but crucial area of technical innovation. Ensuring that the structural integrity of the wedge sole remains intact over the product lifespan is critical for maintaining consumer confidence and reducing warranty claims, especially for high-heeled platform variations where sole separation can pose a safety risk. Manufacturers are increasingly utilizing automated stress-testing equipment to simulate years of wear and tear, allowing for design tweaks before mass production, thereby ensuring a higher quality standard across all price segments. This focus on durability is a direct response to consumer demand for footwear that offers better value retention and aligns with sustainability goals by extending product lifespan, contrasting sharply with the 'wear once and discard' mentality often associated with fast fashion items. The narrative of durable, high-quality construction is particularly resonant in mature markets like Europe and North America, where consumers are often willing to pay a premium for longevity.

Finally, while the women's segment drives the majority of revenue, there is a nascent but growing opportunity in gender-neutral or men’s casual footwear that incorporates similar comfort-focused, elevated sole structures, though not necessarily labeled as traditional wedges. This subtle expansion of the market’s design principles into related categories suggests potential for diversification, driven by changing societal norms regarding fashion and self-expression. Exploring these adjacent market spaces, perhaps through limited edition collaborations or specialized collections, offers existing manufacturers a low-risk avenue for innovation and market testing outside the traditional seasonal constraints of the core women's segment. Analyzing the success of similar movements in the sneaker market, where functional technology crosses gender boundaries effortlessly, provides a blueprint for how technical advantages gained in wedge sandal sole development can be repurposed for broader footwear applications. Thus, the future success of market players is intrinsically linked not only to perfecting the core product but also to strategically identifying and exploiting these peripheral innovation opportunities through careful market experimentation and consumer behavior analysis, ensuring a diversified portfolio resilient to singular market fluctuations.

The strategic importance of licensing and brand partnerships cannot be overstated in the Wedge Sandal Market, particularly for accessing specific demographics or expanding quickly into new product lines, such as athleisure wedges or specialized orthopedic-friendly designs. Licensing agreements allow established apparel or accessories brands to leverage the manufacturing expertise and distribution networks of core footwear companies without undertaking the heavy capital investment required for shoe production. Conversely, footwear specialists gain instant brand recognition and access to a wider consumer base. This model is particularly effective in segments where brand prestige dictates consumer choice, such as the premium and luxury categories. The negotiation and management of these intellectual property agreements require sophisticated legal and marketing coordination to ensure brand integrity is maintained across all licensed products and distribution channels, preventing dilution of the core brand identity while maximizing royalty revenue. The proliferation of fast fashion cycles further complicates this, as partnership negotiations must be concluded quickly to capitalize on fleeting trends.

Furthermore, the utilization of big data analytics extends beyond just predicting demand; it is increasingly employed to optimize pricing strategies dynamically. Algorithms analyze real-time competitive pricing, inventory levels, localized demand elasticity, and historical sales performance to recommend optimal pricing points, maximizing revenue yield at every stage of the product lifecycle, from initial launch to end-of-season clearance. This is especially vital for the highly seasonal wedge sandal category, where mispricing can lead to significant lost profit opportunities or excessive markdown rates. Advanced analytics provide a competitive edge by allowing manufacturers to react instantly to competitor actions or unexpected shifts in consumer sentiment derived from social media listening tools. The integration of this analytical capability into existing Enterprise Resource Planning (ERP) systems represents a significant ongoing technological investment for market leaders, shifting decision-making from instinct-based forecasting to evidence-based optimization, thereby creating a more robust and financially sustainable business model that minimizes risk exposure in volatile retail environments.

The role of international trade agreements and tariffs remains a non-technical yet crucial factor influencing the profitability and sourcing decisions within the Wedge Sandal Market. Manufacturers reliant on sourcing materials or finished products from regions subject to trade barriers (such as specific import tariffs) must constantly recalculate their total landed costs to maintain competitive pricing. Shifting sourcing strategies in response to geopolitical instability or regulatory changes is a continuous exercise in supply chain risk management. This dynamic necessitates maintaining flexibility in manufacturing locations and diversifying the portfolio of trusted suppliers across multiple countries to avoid single-point dependency risks. The complexities introduced by global trade policies underscore the need for sophisticated global logistics and procurement teams capable of modeling various trade scenarios and executing pivot strategies rapidly. Ultimately, success in this globally interconnected market depends not only on design innovation and digital competence but also on masterly navigation of the constantly shifting international economic and political landscape, ensuring seamless delivery of products from raw material origin to final consumer endpoint with optimized cost structures and minimized compliance risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager