Weissbier Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439138 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Weissbier Market Size

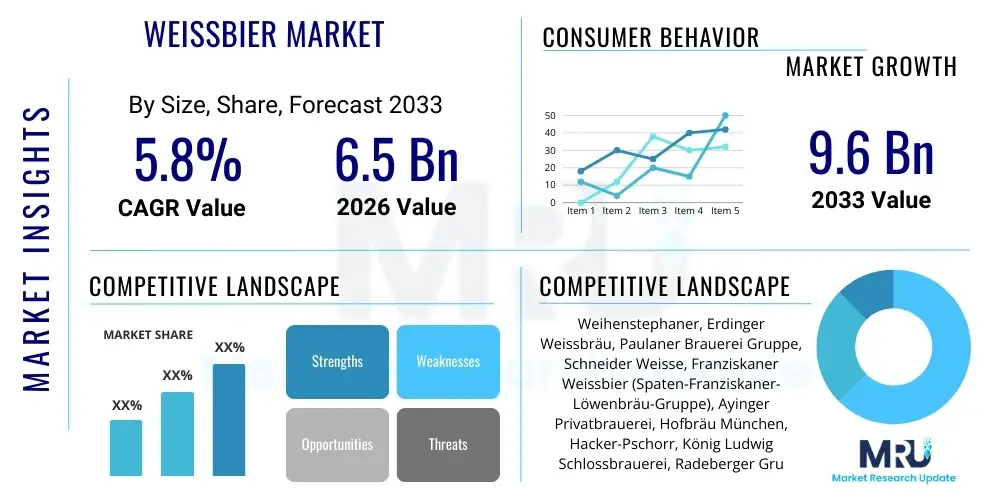

The Weissbier Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Weissbier Market introduction

The Weissbier market encompasses the production, distribution, and consumption of traditional German wheat beers, known for their high proportion of malted wheat, cloudy appearance, and distinctive fruity and phenolic flavor profile derived from specialized yeast strains. This category, often referred to as Hefeweizen (yeast wheat) or Weizenbier, appeals to consumers seeking authentic, flavorful, and sessionable craft beverage alternatives. The product is traditionally characterized by notes of banana and clove, although modern variants include crystal weissbier, dark weissbier (Dunkelweizen), and filtered versions (Kristallweizen). The primary applications span across traditional on-trade channels such as bars and restaurants, and off-trade channels including supermarkets and specialty liquor stores, catering extensively to social consumption, fine dining pairing, and personal enjoyment.

Major applications of Weissbier are deeply rooted in the food service sector, where its light body and complex flavors make it an excellent pairing for various cuisines, particularly traditional Bavarian fare but increasingly integrated into fusion and contemporary food menus globally. The growth is strongly driven by the globalization of beer culture and increasing consumer demand for premium and differentiated alcoholic beverages. Key benefits associated with Weissbier include its perceived authenticity, relatively lower ABV compared to some other craft styles, and its suitability for diverse climates and occasions. Furthermore, the inherent focus on natural ingredients, adhering to the German Reinheitsgebot (Purity Law) in many productions, enhances its appeal to health-conscious consumers who prioritize ingredient transparency and traditional brewing methods.

Driving factors propelling the market expansion include the premiumization trend within the beverage industry, where consumers are willing to pay more for high-quality, specialty beers with provenance. The successful expansion of major European brewers into international markets, particularly Asia Pacific and North America, is significantly contributing to visibility and accessibility. Moreover, the rise of specialized craft breweries globally, which often incorporate traditional European styles like Weissbier into their repertoire, is accelerating market penetration. The continuous innovation in non-alcoholic or low-alcohol Weissbier variants is also capturing new demographic segments, ensuring sustained market relevance in regions increasingly focused on moderate consumption habits and health and wellness trends.

Weissbier Market Executive Summary

The Weissbier market is undergoing transformative shifts driven by global business trends focused on sustainability, digitalization, and localized production. Business trends highlight a strong movement towards premium packaging, leveraging digital marketing platforms to emphasize heritage and craftsmanship. Brewers are increasingly investing in sustainable sourcing of malt and hops and adopting eco-friendly brewing processes, which resonate strongly with Millennial and Gen Z consumers. Mergers and acquisitions remain prevalent, allowing larger conglomerates to absorb regional craft brands, thereby consolidating distribution networks and expanding market reach globally while introducing traditional European styles to new consumer bases outside of core European markets.

Regional trends indicate Europe, specifically Germany and neighboring countries, maintaining its position as the bedrock of consumption and innovation, though growth rates are stabilizing compared to nascent markets. North America exhibits robust growth, primarily driven by the expanding local craft beer scene and the successful adoption of classic German styles by American brewers, alongside strong import volumes. The Asia Pacific (APAC) region is emerging as a significant growth engine, fueled by rapid urbanization, rising disposable incomes, and the introduction of Western drinking culture, particularly in countries like China, Japan, and Australia, where Weissbier is seen as a novel, sophisticated imported product. Latin America, while smaller, shows potential through increasing sophistication of consumer palates.

Segment trends underscore the dominance of the conventional Hefeweizen segment, yet strong growth is observed in specialty categories. The Dunkelweizen (dark wheat beer) segment is gaining traction among consumers seeking richer, maltier flavors, especially during cooler seasons. Furthermore, the burgeoning non-alcoholic and low-alcohol Weissbier segment is outpacing the growth of traditional variants in several developed markets, responding directly to public health campaigns and consumer lifestyle changes advocating for moderation. Distribution channel analysis indicates that the off-trade segment (retail and e-commerce) is rapidly gaining share over the on-trade, accelerated partly by post-pandemic shifts in consumption habits and the convenience offered by online retail platforms specializing in craft and imported beers.

AI Impact Analysis on Weissbier Market

User queries regarding the impact of AI on the Weissbier market predominantly center on optimizing production efficiency, enhancing consumer personalization, and improving supply chain resilience. Key themes include how machine learning algorithms can predict consumer preferences for specific flavor profiles (e.g., clove vs. banana notes) and adjust fermentation processes accordingly. Consumers and industry stakeholders are also concerned with the traceability of high-quality ingredients, particularly specialty wheat malts and yeasts, using AI-driven blockchain solutions. Expectations revolve around AI's ability to streamline quality control, minimize batch variation, and assist smaller craft breweries in competing with large-scale producers by offering data-driven insights into inventory management and market demand forecasting.

The deployment of Artificial Intelligence in brewing is fundamentally changing how raw materials are assessed and processed. Advanced sensor technology integrated with AI algorithms can monitor fermentation kinetics in real-time, detecting subtle variations in temperature, pressure, and chemical composition faster than traditional methods. This precision is vital for Weissbier, where the distinct flavor profile relies heavily on tightly controlled yeast performance. AI-driven quality assurance systems ensure that the specific aromatic compounds characteristic of the style are consistently achieved across different production sites and batches, significantly reducing waste and maintaining brand consistency, which is a critical success factor for global brands.

Furthermore, the commercial and marketing aspects of the Weissbier market are heavily leveraging AI for customer engagement and predictive analytics. AI tools analyze vast datasets encompassing sales history, regional seasonal trends, social media sentiment, and demographic data to optimize distribution routes and promotional timing. This targeted marketing ensures that seasonal Weissbier variants (like stronger variants for winter festivals or lighter options for summer consumption) are introduced at the optimal moment in specific geographical markets. Such optimization enhances the effectiveness of marketing spend and improves inventory turnover rates for brewers and distributors alike, ultimately driving profitability in a highly competitive market segment.

- AI optimizes fermentation protocols to ensure consistent banana/clove ester profiles.

- Machine learning models enhance supply chain visibility, forecasting demand for specialty malted wheat.

- AI-powered sensory analysis improves quality control and identifies off-flavors instantly.

- Personalized digital marketing campaigns driven by AI target niche Weissbier enthusiasts.

- Predictive maintenance schedules for brewing equipment reduce downtime and operational costs.

DRO & Impact Forces Of Weissbier Market

The Weissbier market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the Impact Forces within the industry. The primary driver is the accelerating consumer shift towards premium and craft beverages, favoring traditional, high-quality styles like Weissbier over mass-market lagers. Opportunities arise from expanding into non-traditional markets, particularly Asia and Latin America, and capitalizing on the growth of the non-alcoholic segment. However, the market faces significant restraints, chiefly high raw material costs, particularly quality malted wheat and specialized yeast cultures, coupled with stringent regulatory standards in key production regions like Europe, which necessitates continuous compliance and increases operational complexity.

The market is strongly impacted by the perceived authenticity and heritage associated with German brewing traditions. This heritage acts as a powerful driver, attracting consumers who value provenance. Yet, regulatory hurdles, particularly concerning international trade tariffs and varying labeling requirements across regions, restrain rapid globalization for smaller producers. The environmental impact force is increasingly significant; consumers demand sustainable brewing practices, pushing companies to invest in water conservation and renewable energy sources. Failure to meet these environmental standards can severely impact brand reputation and market access in environmentally conscious regions.

Opportunities for growth are abundant through product innovation, moving beyond standard Hefeweizen into experimental variations such as fruit-infused or barrel-aged Weissbiers, catering to an evolving consumer palate constantly seeking novelty. The threat of substitutes, particularly competitive craft beer styles (IPAs, sours) and other alternative alcoholic beverages (hard seltzers, ciders), exerts a strong impact force. To mitigate this threat, Weissbier producers must continuously invest in brand differentiation, emphasizing the unique mouthfeel and historical depth of the style. The bargaining power of suppliers, especially for high-quality specialty malt required for authentic taste, remains moderate to high, influencing overall production costs and market pricing strategies.

Segmentation Analysis

The Weissbier market is meticulously segmented based on Style, Distribution Channel, and Alcohol Content, reflecting the diverse consumer preferences and market dynamics across geographies. Understanding these segments is crucial for brewers and marketers to tailor production, optimize distribution, and execute effective promotional strategies. The segmentation by Style, encompassing Hefeweizen, Dunkelweizen, and Kristallweizen, reveals preferences for either the traditional cloudy yeast suspension or the filtered clarity, influencing consumer choice based on perceived lightness and occasion suitability. Segmentation by distribution channel categorizes sales into on-trade (restaurants, bars) and off-trade (retail, e-commerce), highlighting the ongoing shift towards retail dominance accelerated by changes in purchasing habits and the expansion of online platforms for specialized alcohol.

Further granularity is achieved through the segmentation by Alcohol Content, distinguishing between standard alcoholic Weissbier, which forms the historical bulk of the market, and the rapidly expanding non-alcoholic (NA) or low-alcohol (Lo-No) variants. This non-alcoholic segment is particularly crucial in regions prioritizing health and wellness, providing an authentic taste experience without the associated alcohol content. The interplay between these segments determines where investment in new product development and manufacturing optimization is most needed, ensuring that product offerings align precisely with consumer demand trends, such as the increased preference for refreshing, low-ABV options suitable for daytime consumption or post-activity refreshment.

Geographical segmentation, while not listed as a primary internal segment, is inherently vital, differentiating demand intensity across core European markets, high-growth North American craft markets, and emerging Asian consumer bases. The segmentation analysis confirms that product diversification, especially into the non-alcoholic space, along with robust off-trade distribution infrastructure, are key strategic imperatives for sustaining competitive advantage in the forecast period. Monitoring the relative growth rates of Dunkelweizen versus Hefeweizen also offers predictive insight into evolving flavor preferences towards richer or lighter styles in specific seasonal markets.

- By Style:

- Hefeweizen (Standard)

- Dunkelweizen (Dark)

- Kristallweizen (Filtered)

- Weizenbock (Strong)

- By Distribution Channel:

- On-Trade (Hotels, Restaurants, Bars)

- Off-Trade (Retail, Supermarkets, Online Stores)

- By Alcohol Content:

- Alcoholic (Standard ABV)

- Non-Alcoholic (NA) and Low-Alcohol (Lo-No)

Value Chain Analysis For Weissbier Market

The Weissbier market value chain begins with intensive upstream analysis, focusing heavily on the sourcing of high-quality raw materials crucial for achieving the characteristic flavor profile. This includes specialized wheat malt (often proprietary strains), barley malt, specific brewing yeasts (responsible for the clove and banana esters), and water. Upstream activities involve agricultural partnerships, malting processes, and quality assurance to meet the strict standards required for brewing authentic Weissbier. Suppliers of specialty yeast and malts wield significant influence due to the unique requirements of the style, making long-term procurement contracts and vertical integration important strategies for brewers to secure reliable input and control quality parameters rigorously.

Midstream processing involves brewing, fermentation, conditioning, and packaging. The brewing process for Weissbier is distinct, requiring precise temperature control during mash conversion to optimize starch breakdown and specialized fermentation techniques that cultivate the desired phenolic and ester compounds. Packaging, which includes bottles, cans, and kegs, must ensure the preservation of the beer's freshness and carbonation profile, which is typically higher than standard lagers. This segment demands high capital investment in state-of-the-art breweries and quality control labs. Efficiency in this stage, driven by automation and process optimization, is paramount to maintaining competitive pricing while adhering to the quality expectations associated with premium imported beers.

Downstream activities involve distribution channels, encompassing both direct sales and indirect networks. Direct distribution involves brewers selling directly to consumers or retailers, often through brewery taprooms or dedicated online platforms, providing higher margins and direct consumer feedback. Indirect distribution utilizes wholesalers, distributors, and importers who manage the complex logistics of getting perishable goods to the fragmented retail and food service sectors globally. The rise of e-commerce has significantly streamlined the indirect channel, enabling specialty beers to reach previously inaccessible markets. Effective supply chain management and cold chain logistics are critical to preserving the product integrity from the production line to the final point of sale, especially for a delicate, yeast-rich beer like Hefeweizen.

Weissbier Market Potential Customers

The primary potential customers for the Weissbier market are diversified across demographic and psychographic segments, but generally fall into two main categories: consumers seeking authentic European heritage beverages and modern craft beer enthusiasts looking for diverse flavor profiles. The core consumer base includes individuals aged 30 to 55 who often possess mid-to-high disposable incomes and appreciate the traditional quality and history associated with German brewing. This segment frequently purchases Weissbier for social gatherings, pairings with international cuisine, and as a preferred choice in upscale restaurants and specialty bars, prioritizing brand loyalty to established Bavarian breweries.

A rapidly growing segment of potential customers comprises young adults (21-35) who are active participants in the modern craft beer movement. These consumers are adventurous, seeking novelty, and are highly receptive to imported and traditional styles as part of their exploration of beer complexity. For this demographic, Weissbier, especially variants like Weizenbock or experimental interpretations by local craft breweries, offers a unique textural and flavor experience distinct from the prevailing hop-centric styles like IPAs. This group is also the main driver for the adoption of non-alcoholic Weissbier, viewing it as a sophisticated, flavorful alternative for occasions where alcohol consumption is restricted or undesirable, aligning with health-conscious lifestyle trends.

Institutional buyers represent another significant customer base, encompassing the hospitality sector, including premium hotels, fine dining establishments, and dedicated beer halls, which stock Weissbier to offer variety and cater to specific culinary requirements. Furthermore, specialized retail outlets, high-end supermarkets, and dedicated online alcohol retailers are crucial B2B customers, focused on curating a diverse selection of imported and specialty beers to meet the increasing demand from the end-consumer segments. Targeting these institutional buyers requires robust sales support, attractive margin structures, and consistent product supply, emphasizing the premium quality and high shelf appeal of the product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Weihenstephaner, Erdinger Weissbräu, Paulaner Brauerei Gruppe, Schneider Weisse, Franziskaner Weissbier (Spaten-Franziskaner-Löwenbräu-Gruppe), Ayinger Privatbrauerei, Hofbräu München, Hacker-Pschorr, König Ludwig Schlossbrauerei, Radeberger Gruppe, Tucher Bräu, Boston Beer Company, Sierra Nevada Brewing Co., Anheuser-Busch InBev, Heineken NV, MillerCoors, Full Sail Brewing Company, Pinkus Müller, Privatbrauerei Eder & Heylands, Brauerei Heller-Trum. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Weissbier Market Key Technology Landscape

The technological landscape in the Weissbier market is evolving, driven primarily by the need for enhanced process control, quality consistency, and sustainability. Modern breweries utilize sophisticated Process Analytical Technology (PAT) to monitor critical parameters during mashing and fermentation, specifically focusing on temperature fluctuations crucial for yeast health and flavor production. Automated clean-in-place (CIP) systems ensure microbiological stability, minimizing the risk of contamination which is especially vital for traditional, unfiltered Weissbier styles that rely on yeast viability. Advanced centrifuge and filtration technologies are also key for producing Kristallweizen (filtered wheat beer), ensuring clarity without compromising the delicate malt profile.

The packaging segment employs high-speed filling lines and advanced oxygen scavenging technologies to maximize shelf life and prevent oxidation, a common quality concern for wheat beers. In terms of sustainability, breweries are adopting energy-efficient boiling and cooling systems, coupled with advanced water treatment and recovery technologies to reduce the significant water footprint of brewing. Smart brewery management systems integrate IoT sensors across the production floor, providing real-time data on resource consumption and operational efficiency, thereby enabling brewers to adhere to stringent environmental regulations and meet consumer demand for sustainable products.

Furthermore, technology plays a critical role in supply chain management and consumer engagement. Blockchain technology is beginning to be explored for enhancing transparency and traceability of raw materials, assuring consumers of the German Purity Law (Reinheitsgebot) compliance or specific organic certifications. On the consumer-facing side, advanced data analytics and e-commerce platforms enable direct-to-consumer sales and highly targeted marketing. Virtual Reality (VR) and Augmented Reality (AR) technologies are also being utilized, particularly by heritage brands, to offer virtual brewery tours and enhance the storytelling around the centuries-old tradition of Weissbier brewing, connecting modern consumers with the historical authenticity of the product.

Regional Highlights

Regional variations significantly influence market performance and strategic focus for Weissbier producers. Europe remains the most established and dominant region, serving as both the largest consumer base and the primary center for innovation and tradition, particularly driven by high consumption in Germany and Austria. However, the European market is nearing maturity, leading major players to focus on product premiumization and export strategies to drive incremental growth. Eastern European markets are emerging with increasing appreciation for high-quality imported styles, presenting targeted growth pockets within the continent.

North America, led by the United States, represents the fastest-growing region in terms of craft segment adoption. While imports from traditional German breweries remain strong, domestic craft brewers have successfully incorporated Weissbier into their seasonal and year-round offerings, adapting the style to local tastes, sometimes incorporating regional ingredients. The American consumer’s penchant for experimentation and their willingness to pay a premium for specialty beers provide a robust environment for both imported and domestically brewed Weissbier varieties, driving high-value growth.

Asia Pacific (APAC) is characterized by immense future growth potential, driven by rapidly growing middle-class populations, Westernization of consumer habits, and increasing awareness of international beer styles. Countries like China and India, with massive populations, are prioritizing imported premium products, positioning Weissbier as a sophisticated, high-end alternative to local lagers. Distribution complexity remains a challenge, necessitating strategic partnerships and investments in cold chain logistics, but the long-term demographic and economic trends signal APAC as the key region for volume expansion throughout the forecast period.

- Europe: Core market dominance, driven by Germany (Bavaria), focuses on traditional Hefeweizen and quality preservation.

- North America (US & Canada): High growth area fueled by strong domestic craft brewing adoption and premium import demand.

- Asia Pacific (China, Australia): Emerging high-potential region characterized by rapid urbanization and premiumization trends driving import growth.

- Latin America: Developing market with increasing sophistication, favorable for imported specialty beers in major urban centers.

- Middle East & Africa (MEA): Niche market focused primarily on non-alcoholic Weissbier offerings due to regional consumption restrictions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Weissbier Market.- Weihenstephaner

- Erdinger Weissbräu

- Paulaner Brauerei Gruppe

- Schneider Weisse

- Franziskaner Weissbier (Spaten-Franziskaner-Löwenbräu-Gruppe)

- Ayinger Privatbrauerei

- Hofbräu München

- Hacker-Pschorr

- König Ludwig Schlossbrauerei

- Radeberger Gruppe

- Tucher Bräu

- Boston Beer Company

- Sierra Nevada Brewing Co.

- Anheuser-Busch InBev

- Heineken NV

- Bitburger Brewery Group

- Brauerei Heller-Trum (Schlenkerla)

- Full Sail Brewing Company

- Pinkus Müller

- Grolsch Brewery (part of Asahi Group)

Frequently Asked Questions

Analyze common user questions about the Weissbier market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Weissbier market globally?

The primary factor driving global market growth is the accelerating consumer demand for premium, authentic, and high-quality craft beer styles. Consumers are increasingly willing to pay a premium for specialty beverages with strong heritage and distinctive flavor profiles, positioning traditional Weissbier favorably against mass-market alternatives. Additionally, the expansion of the non-alcoholic segment significantly contributes to market expansion by catering to health-conscious consumers.

How does the non-alcoholic Weissbier segment influence overall market trends?

The non-alcoholic (NA) Weissbier segment is a critical growth area, exhibiting significantly higher growth rates than traditional alcoholic variants in several key markets. This segment addresses increasing consumer focus on health and moderation, offering the unique flavor and mouthfeel of traditional wheat beer without the alcohol content, attracting new demographics and ensuring the style remains relevant in health-focused beverage strategies.

Which geographical region holds the highest growth potential for Weissbier producers?

While Europe remains the largest established market, the Asia Pacific (APAC) region, particularly countries like China and Australia, holds the highest long-term growth potential. This growth is fueled by increasing disposable incomes, rapid adoption of imported premium Western beverages, and expanding distribution networks targeting the urban, affluent consumer base seeking sophisticated and novel beer experiences.

What are the key technical challenges in brewing consistent quality Weissbier?

The key technical challenge lies in maintaining strict control over the fermentation process, as the unique flavor profile (clove and banana notes) is heavily dependent on specific yeast strains and precise temperature management. Brewers must utilize advanced Process Analytical Technology (PAT) and quality assurance protocols to minimize batch variation and ensure the consistent expression of volatile phenolic and ester compounds essential to the authentic Weissbier taste.

What are the key differences between Hefeweizen, Dunkelweizen, and Kristallweizen?

Hefeweizen is the standard, unfiltered Weissbier characterized by its cloudy appearance due to suspended yeast and wheat proteins. Dunkelweizen is the dark variant, utilizing specialty roasted or colored malts to impart richer, maltier, and sometimes caramel or cocoa notes, maintaining the traditional cloudiness. Kristallweizen is filtered to remove the yeast and sediment, resulting in a brilliant, clear appearance, often perceived as lighter and crisper than its Hefeweizen counterpart.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager