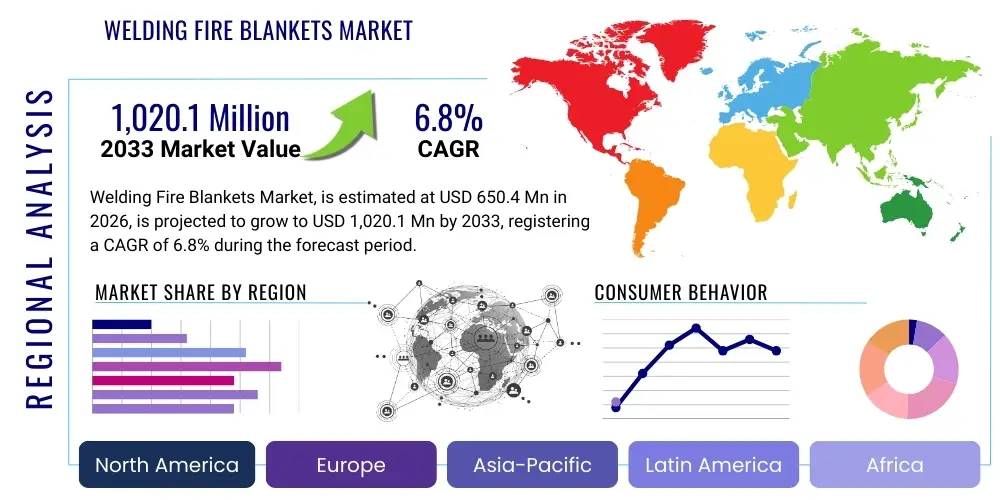

Welding Fire Blankets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436755 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Welding Fire Blankets Market Size

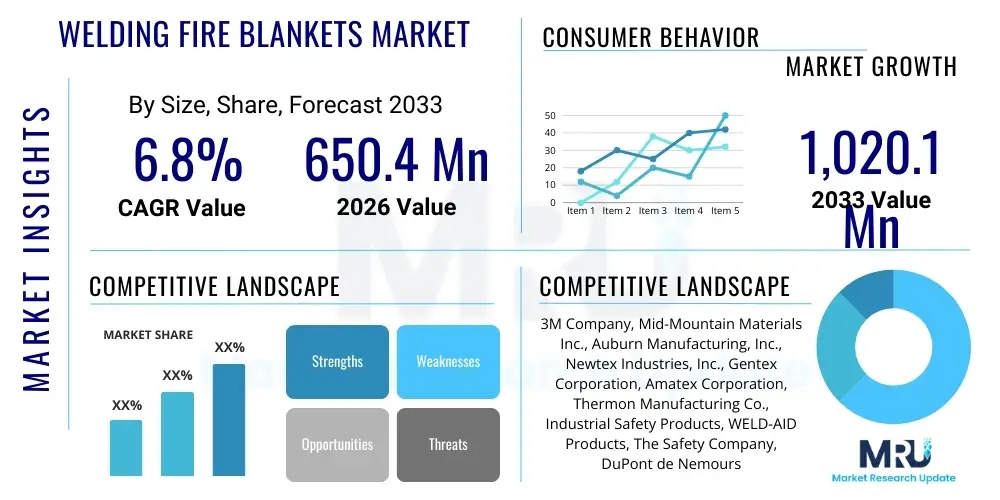

The Welding Fire Blankets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 650.4 Million in 2026 and is projected to reach USD 1,020.1 Million by the end of the forecast period in 2033.

Welding Fire Blankets Market introduction

The global Welding Fire Blankets Market is foundational to modern industrial safety management, serving as an essential component within the broader scope of fire prevention and hot work hazard mitigation. These industrial-grade thermal protection textiles are meticulously engineered to provide a robust physical barrier against extreme heat, intense sparks, molten metal splatter, and welding slag generated during processes such as shielded metal arc welding (SMAW), gas tungsten arc welding (GTAW), and plasma cutting. The strategic deployment of these specialized blankets ensures the protection of expensive machinery, critical infrastructure, sensitive electronic equipment, and nearby flammable materials, thereby preventing catastrophic fire incidents and minimizing operational downtime. The market’s resilience is closely tied to the global adherence to rigorous safety standards, driving continuous demand for certified products that comply with specifications defined by entities like the National Fire Protection Association (NFPA), American National Standards Institute (ANSI), and relevant European Norms (EN ISO). The imperative to reduce workplace liabilities and maintain insurance eligibility further cements the non-discretionary nature of investments in high-quality welding fire blankets, positioning them as critical capital expenditure for risk management across heavy industries globally.

The diversity of applications dictates the complexity of the product portfolio within this market. Welding fire blankets are typically differentiated based on their core fiber material—ranging from cost-effective fiberglass fabrics suitable for light-duty spark control to highly advanced silica and ceramic fiber composites capable of handling continuous direct flame exposure up to 1800°C. Material innovation focuses not only on heat resistance but also on durability and environmental performance, leading to the prevalence of specialty coatings such as high-density silicone rubber, aluminization for radiant heat reflection, and vermiculite treatment for enhanced resistance to molten splash adherence. Furthermore, the physical form factor varies significantly, encompassing heavy-duty blankets for fixed protection, flexible welding curtains for temporary mobile barriers, and specialized thermal pads for localized component protection. Key sectors driving consistent consumption include large-scale oil and gas pipeline construction, automotive body assembly plants, commercial shipbuilding and repair, and extensive structural steel fabrication projects vital for infrastructure development. The increasing complexity of industrial environments necessitates highly specific thermal protection solutions, pushing manufacturers toward customization and modular system designs.

Market expansion is robustly supported by several macroeconomic and regulatory driving factors. Firstly, the exponential growth in global infrastructure spending, particularly in emerging economies, directly translates into increased welding and hot work activity, escalating the requirement for reliable safety measures. Secondly, ongoing regulatory evolution dictates more stringent performance criteria for thermal fabrics, often requiring higher certification levels (e.g., FM approval), forcing the retirement of older, non-compliant safety stock and accelerating the replacement cycle. Thirdly, technological advancements in material science have led to the introduction of lighter, more flexible, yet equally resistant fabrics, enhancing user acceptance and encouraging broader adoption beyond mandatory requirements. Finally, a heightened global awareness concerning the human and economic costs associated with industrial fire accidents is compelling corporations, including small to medium enterprises (SMEs), to prioritize preventative safety equipment investments, expanding the overall addressable market and stimulating demand for both premium and volume-driven product lines.

Welding Fire Blankets Market Executive Summary

The global Welding Fire Blankets Market is undergoing a strategic maturation phase characterized by convergence between escalating regulatory demands and rapid material science innovation. Current business trends indicate a critical migration of demand from standard fiberglass blankets towards high-performance fabrics utilizing pure silica and proprietary ceramic fiber composites, reflecting a market willingness to invest in superior protection for high-hazard industrial environments. Manufacturers are strategically focusing on developing multi-layered and modular thermal barrier systems that offer adaptable protection for complex worksites. Competitive positioning hinges not only on achieving the highest temperature ratings but also on delivering enhanced product attributes such as longevity through abrasion-resistant coatings (e.g., silicone and polyurethane treatments), chemical inertness, and compliance with niche industry standards like marine classification society requirements. Furthermore, sustainability is becoming a peripheral factor, with some R&D focusing on non-asbestos and environmentally safer fiber alternatives, anticipating future chemical restriction legislation and improving workplace health profiles.

Regional market trajectories illustrate distinct growth patterns and maturity levels. North America and Western Europe maintain their position as revenue strongholds, primarily due to established industrial sectors and a non-negotiable compliance culture, driving demand for premium, certified, and specialized thermal textiles. Conversely, the Asia Pacific (APAC) region is forecasted to achieve the highest Compound Annual Growth Rate (CAGR). This acceleration is directly attributable to massive urbanization, significant public and private investment in heavy manufacturing, energy infrastructure, and shipbuilding expansion throughout East and South Asia. The rapid adoption of international safety best practices in major industrial hubs within APAC is transforming it from a price-sensitive market to one increasingly valuing certified quality. Meanwhile, the Middle East and Africa (MEA) market growth is volatile yet substantial, intrinsically linked to the cyclical nature and scale of large-scale oil, gas, and power generation projects, where product resilience to environmental extremes is a key procurement criterion.

Segmentation analysis confirms that end-user demand is heavily concentrated in the Construction and Infrastructure sector globally, driven by the sheer volume of welding operations necessary for structural steel erection and large-scale assembly. However, the highest value segment per unit lies within the Oil & Gas and Aerospace industries, which demand materials capable of withstanding extreme thermal shock and providing continuous protection in high-stakes environments. Technologically, the coated blankets segment—covering all fabrics treated with specialized polymers or mineral compounds—is dominating revenue streams due to the extended service life and functional benefits (like water and oil resistance) that coatings provide. This segmentation profile underscores the dual nature of the market: high volume in general construction and high specification/margin in specialized, safety-critical industrial applications, necessitating manufacturers to maintain diverse product inventories and pricing strategies tailored to specific compliance thresholds and user requirements.

AI Impact Analysis on Welding Fire Blankets Market

Analyzing common user queries reveals a focused interest in how Artificial Intelligence and related digital technologies will transition welding fire blankets from passive safety barriers into active, data-contributing assets within integrated industrial ecosystems. Key user themes revolve around Condition-Based Monitoring (CBM): users are eager to know if AI can assess the degradation state of a blanket—monitoring thermal cycling history, UV exposure, and mechanical damage—to provide a reliable prediction of its remaining useful life, thereby optimizing replacement schedules and mitigating the risk associated with using compromised safety equipment. Furthermore, considerable concern is expressed regarding the integration of these materials into advanced manufacturing processes; specifically, whether AI-driven simulations can optimize the complex chemical recipes for performance coatings or refine high-precision weaving operations to maximize thermal efficiency and minimize fiber variability. The overarching expectation is that AI will enhance not just the safety compliance tracking through digital verification systems (tagging/logging) but also significantly improve the material science behind the product, leading to "smart" thermal fabrics that interact with broader industrial IoT (IIoT) safety frameworks for dynamic hazard management.

- AI-driven predictive maintenance scheduling for thermal textile replacement, minimizing unscheduled failures and optimizing inventory costs.

- Machine learning algorithms optimizing the viscosity and adherence parameters of silicone and vermiculite performance coatings during manufacturing.

- Automated defect detection using computer vision systems trained by AI to identify micro-tears or coating inconsistencies on finished blankets.

- Integration of passive RFID tags linked to AI asset management platforms for enhanced compliance verification and regulatory reporting.

- Simulation and modeling of extreme thermal load scenarios using AI to accelerate R&D cycles for new, high-temperature composite fibers.

- Optimization of supply chain logistics by AI forecasting demand fluctuation based on regional infrastructure project timelines and industrial output indices.

DRO & Impact Forces Of Welding Fire Blankets Market

The strategic dynamics of the Welding Fire Blankets Market are defined by powerful driving forces rooted in regulatory compliance and technological necessity. The primary driver is the non-negotiable global mandate for occupational safety and fire prevention, continuously reinforced by heightened regulatory scrutiny (e.g., stricter revisions to NFPA 51B standards for hot work). This regulatory environment ensures a stable floor of demand. Concurrently, the accelerating industrialization in developing nations and continuous maintenance requirements in mature economies create a vast and consistent end-user base. However, the market faces significant restraints, including the inherent challenge of ensuring correct field application and handling; blankets are often misused, leading to premature degradation and safety failures. A further restraint is the fluctuating cost of specialized raw materials, such as high-purity silica and aramid fibers, which can impact profitability and create pricing volatility, especially for manufacturers dependent on long-term contracts. The competition from lower-cost, non-certified alternatives, particularly in emerging markets, also pressures pricing structures and muddies consumer perception of quality and safety reliability.

Despite the constraints, numerous high-value opportunities exist within the market ecosystem. Foremost among these is the development and commercialization of next-generation material composites, including textiles incorporating nanotechnology for superior thermal barrier performance in thinner formats, which meets the demand for light, flexible, high-specification products in aerospace and precision manufacturing. Secondly, there is an untapped opportunity in developing integrated safety solutions: blankets embedded with sensory or tracking technologies that communicate their status (e.g., excessive temperature exposure, location) to central safety monitoring systems, moving toward active rather than merely passive protection. Finally, targeted expansion into specialized, high-temperature welding applications, such as those found in nuclear decommissioning and specialized refractory repair, offers high-margin potential due to the low volume but extremely high specification requirements. These technological and application-specific opportunities offer manufacturers pathways to premium market differentiation beyond simple temperature rating metrics.

The overall impact forces in this market are notably high and primarily driven by external regulatory factors and internal material science breakthroughs. The mandatory nature of industrial safety compliance acts as a powerful, inelastic driver of demand, guaranteeing market stability even during economic downturns. Success in the market is increasingly defined by the ability to navigate regulatory heterogeneity across international markets (e.g., CE marking vs. UL listing) and to effectively manage the complex supply chain for high-performance fibers. Companies that invest proactively in advanced coating technologies and demonstrate clear product differentiation through third-party safety certification are best positioned to capitalize on opportunities, particularly within the specialized high-temperature segments. The market dynamics favor innovation that simultaneously addresses safety, durability, and total cost of ownership over product lifespan.

Segmentation Analysis

The Welding Fire Blankets Market structure is highly differentiated, relying on precise segmentation across four critical dimensions to cater to the nuanced safety requirements of various industrial processes. The segmentation by Material Type—including traditional fiberglass, advanced silica, high-end ceramic fiber, and specialized aramid fabrics—is fundamental, as it directly correlates with the blanket’s maximum continuous operating temperature and its resistance to specific hazards like molten splash or chemical attack. Secondly, segmentation based on Temperature Resistance allows end-users to precisely match the product to the heat intensity of their hot work (ranging from light grinding sparks up to extreme plasma cutting heat). This critical differentiation prevents catastrophic product failure and ensures compliance with hazard analysis procedures required before commencing hot work.

Further delineation occurs via Product Type, separating non-coated fabrics from those treated with performance-enhancing coatings (silicone, polyurethane, vermiculite). The coated segment dominates revenue due to the added benefits of extended service life, improved handling, and resistance to environmental degradation. Finally, segmentation by End-User Industry (Oil & Gas, Construction, Automotive, Marine) highlights vastly different purchasing behaviors, regulatory burdens, and product specification needs. For example, the Shipbuilding sector requires materials that meet specific low-smoke and non-combustible criteria (e.g., IMO standards), vastly different from the high-volume, general-purpose requirements of the Construction sector. Successful market strategies must leverage these segment insights to optimize product portfolios, pricing strategies, and tailored distribution channels.

- By Material Type:

- Fiberglass (E-Glass, C-Glass)

- High-Purity Silica Fabric

- Ceramic Fiber (HTIW)

- Aramid Fiber (e.g., Kevlar, Nomex blends)

- Pre-oxidized Carbon and Acrylic Fiber Blends

- By Operating Temperature Resistance:

- Low Heat Resistance (Ambient use up to 500°C / 932°F)

- Medium Heat Resistance (Continuous use 500°C - 1000°C / 1832°F)

- Extreme Heat Resistance (Intermittent use above 1000°C / 1832°F)

- By Product Type:

- Silicone Coated Blankets (Single and Double-sided)

- Vermiculite Coated Blankets (Enhanced molten metal resistance)

- Aluminized Coated Blankets (Radiant heat reflection)

- Non-Coated Heavy-Duty Fabrics

- Welding Curtains and Flexible Screens

- By End-User Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Construction and Infrastructure Development (Structural steel, Bridges)

- Automotive and Transportation (Vehicle manufacturing and maintenance)

- Shipbuilding and Marine (Offshore platforms, Vessel repair)

- Heavy Manufacturing and Metal Fabrication

- Power Generation (Nuclear, Fossil Fuel, Renewable energy facilities)

Value Chain Analysis For Welding Fire Blankets Market

The value chain commences with the highly specialized process of raw material procurement and preparation. This upstream segment is characterized by intensive chemical processing and textile engineering, where the purity and composition of materials such as high-grade silica sand (for silica fibers) or specific mineral compounds (for ceramic fibers) are critical determinants of the final product's thermal rating. Key activities involve fiber extrusion, chemical treating to remove impurities, and weaving the fibers into high-density textile rolls. Global market leaders often maintain proprietary control over their fiber treatment processes to ensure specific performance characteristics, such as enhanced flexibility or reduced fiber fly. Strategic supplier relationships with specialized chemical processors are essential, as fluctuations in raw material pricing, particularly petroleum-derived coatings and mined minerals, can significantly impact manufacturing costs and overall market competitiveness.

The midstream phase encompasses the conversion of raw fabric rolls into final fire blanket products. This involves high-precision cutting, edge finishing (typically using specialized Kevlar or stainless steel thread to maintain integrity at high temperatures), and the application of highly technical performance coatings. The coating step is a major value-add activity, often determining the premium pricing of a blanket. Manufacturers must adhere rigorously to quality control checks, ensuring that coating thickness, uniformity, and adherence meet certified standards (e.g., for molten metal resistance). Following fabrication, the finished blankets are certified through independent testing laboratories, a non-negotiable step that verifies compliance with international safety norms such as ISO 11611 or NFPA 701, allowing the product to enter regulated markets.

Distribution and end-user deployment form the downstream segment. The go-to-market strategy usually employs a dual distribution model. Direct sales channels are utilized for large industrial accounts (e.g., major energy companies, government contractors) that require bespoke sizing, detailed technical specifications, and continuous supply agreements. Indirect channels leverage extensive networks of industrial safety equipment distributors, wholesale suppliers, and specialized maintenance, repair, and overhaul (MRO) providers. These indirect partners provide localized inventory, immediate availability, and expertise crucial for serving the fragmented market of SMEs and independent contractors. The effectiveness of the downstream value chain relies heavily on rapid inventory replenishment, comprehensive technical training for distributors, and targeted marketing that clearly communicates the certified temperature rating and application suitability of each blanket type to the end buyer.

Welding Fire Blankets Market Potential Customers

The user base for welding fire blankets is highly segmented based on operational risk profile and regulatory exposure. The most valuable potential customers reside within the heavy industrial sectors, particularly those engaged in critical infrastructure maintenance and high-stakes fabrication. Large integrated oil and gas companies, including both national and international entities (NOCs and IOCs), represent premium customers due to their mandatory safety protocols and continuous hot work requirements on refineries, chemical plants, and offshore platforms. These organizations prioritize blankets rated for extreme heat (silica/ceramic) and demand comprehensive certification and traceability. Similarly, Tier 1 general contractors and engineering firms managing multi-billion dollar infrastructure projects (bridges, power plants, large commercial complexes) are essential buyers, requiring massive volumes of high-quality, certified fire barriers to protect public assets and adhere to strict project timelines and safety auditing requirements.

A second major customer category includes manufacturers and maintenance providers within the Transportation sector. This encompasses major automotive original equipment manufacturers (OEMs) who use fixed thermal barriers in automated welding cells, as well as marine classification societies and shipyards involved in the construction and dry-dock repair of commercial vessels. In the marine segment, customers specifically require products tested for non-combustibility and low smoke toxicity to comply with International Maritime Organization (IMO) fire test procedures, making their purchasing criteria distinct and highly specified. For these customers, product longevity and resistance to challenging environmental factors (salt spray, humidity) are equally important as core thermal protection, leading to higher investments in specialized coated products.

The final, but volumetrically significant, potential customer base consists of small-to-medium enterprises (SMEs) such as independent metal fabricators, plumbing contractors, and local vehicle repair shops. While individual purchases are smaller, the collective volume drives consistent demand for general-purpose and medium-duty fiberglass blankets. These customers are highly sensitive to price and often rely on local distributors or digital marketplaces for procurement. Marketing and distribution strategies targeting this segment must emphasize ease of use, basic regulatory compliance (e.g., spark protection), and favorable pricing. Capturing this fragmented market requires robust e-commerce presence and efficient, localized supply chain management through MRO distribution channels to provide readily available safety consumables.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.4 Million |

| Market Forecast in 2033 | USD 1,020.1 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Mid-Mountain Materials Inc., Auburn Manufacturing, Inc., Newtex Industries, Inc., Gentex Corporation, Amatex Corporation, Thermon Manufacturing Co., Industrial Safety Products, WELD-AID Products, The Safety Company, DuPont de Nemours, Inc., LBA Technical Textiles, Tecni-Vel, Inc., A.W. Chesterton Company, Zippertubing Co., PyroTex Industries GmbH, Morgan Advanced Materials, Darco, Inc., VWR International, LLM Global Safety. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Welding Fire Blankets Market Key Technology Landscape

The technological core of the Welding Fire Blankets Market resides in advanced high-temperature textile engineering and specialized chemical finishing. Leading manufacturers are intensely focused on optimizing the thermal performance of materials like amorphous silica fiber and refractory ceramic fiber (RCF) alternatives. Key technological activities involve optimizing fiber diameter and length to maximize insulation value per unit thickness, crucial for creating effective thermal barriers. Furthermore, the development of proprietary weaving techniques—such as multi-harness satin weaves (8-Harness, 10-Harness)—is essential to improve the blanket’s drape, flexibility, and resistance to fraying, making them easier for workers to deploy effectively in complex, three-dimensional spaces, a key factor in operational safety compliance. Continuous R&D efforts are concentrated on achieving higher-purity material compositions to increase maximum continuous use temperatures while simultaneously reducing associated health risks (e.g., minimizing respirable fiber content in high-temperature insulation wool substitutes).

A second pivotal area of technological advancement involves the application of high-performance coatings. Modern coatings, particularly high-temperature silicone polymers, are chemically engineered to create a durable outer shell that significantly resists molten metal splash adhesion (a critical failure point for non-coated fabrics), abrasion from dragging across rough surfaces, and deterioration from exposure to industrial oils and chemicals. Recent innovations include developing flexible silicone coatings that maintain elasticity across a wide temperature spectrum, preventing cracking and flaking that expose the underlying fiber. Furthermore, the use of passive radiative barriers, such as thin aluminized layers integrated into the coating structure, utilizes fundamental physics to reflect up to 95% of radiant heat, protecting workers and equipment adjacent to the hot work zone, significantly improving overall system performance beyond simple conductive insulation.

The emerging technological frontier integrates digital elements into the traditionally analog product. This involves utilizing advanced manufacturing methods like precision ultrasonic welding and computer-controlled sewing machines to ensure dimensional stability and seam strength. More crucially, the adoption of IIoT-enabling technologies, such as embedding durable, high-temperature resistant RFID chips or unique identification barcodes, is transforming asset management. This allows end-users to digitally track each blanket's usage history, location, last inspection date, and thermal exposure cycles. This digital integration facilitates seamless regulatory audits, ensures that compromised or expired blankets are immediately retired, and provides manufacturers with valuable real-world usage data to inform future material durability testing and product lifecycle expectations, thus optimizing the total cost of ownership for industrial clients.

Regional Highlights

North America maintains a dominant position in terms of market value, underpinned by the region’s mature industrial landscape, stringent regulatory compliance mandates, and high adoption rates of premium, certified thermal textiles. The market here is highly specification-driven, with procurement decisions heavily influenced by recognized standards from organizations like UL (Underwriters Laboratories) and FM Approvals. The United States, in particular, drives substantial demand across the aerospace, automotive, and extensive energy infrastructure sectors (pipelines, refineries). European demand mirrors North America, prioritizing certified safety solutions (EN ISO standards), with strong consumption in heavy machinery manufacturing, chemical processing, and the highly regulated offshore marine sector. Both regions exhibit a high propensity to invest in replacement cycles of silica and aramid fiber blankets, which ensures sustained demand for high-margin, technologically advanced products.

The Asia Pacific (APAC) region is projected to experience the most significant market expansion through 2033. This growth is directly correlated with massive government and private investment in urbanization, transportation networks, and industrial capacity expansion across China, India, and Southeast Asia. The shipbuilding sector in South Korea and China, the construction boom in India, and the proliferation of manufacturing facilities across the region require immense quantities of welding fire blankets for daily operations. While initial market entry often involves price-sensitive standard fiberglass products, increasing awareness of international safety benchmarks and the presence of multinational corporations are accelerating the demand for medium-to-high specification coated blankets. Manufacturers must focus on establishing extensive localized distribution networks and streamlining supply chains to meet the sheer volume requirements of this rapidly industrializing region.

Growth in the Middle East and Africa (MEA) is intrinsically linked to the scale and duration of upstream and downstream oil and gas projects. The market demands robust, heavy-duty blankets capable of performing reliably under extreme ambient temperatures, high UV exposure, and constant exposure to abrasive elements inherent to desert and coastal environments. Procurement in this region often involves large, infrequent tenders driven by major national oil companies (NOCs) and international EPC contractors. Latin America’s market growth, primarily led by Brazil and Mexico, is more diversified, supported by investments in mining, automotive assembly, and renewable energy infrastructure. Both MEA and LATAM represent vital growth opportunities, requiring suppliers to offer durable, specialized products and manage complex logistics and regional certification requirements to effectively penetrate these crucial emerging markets.

- North America: High-value market segment driven by stringent OSHA compliance, requiring specialized silica and ceramic fiber materials for aerospace and energy hot work.

- Europe: Mature market focused on EN/ISO certified products; robust demand from offshore marine and chemical processing sectors demanding superior non-combustible properties.

- Asia Pacific (APAC): Highest volume and growth potential driven by explosive infrastructure and manufacturing expansion; accelerating adoption of international quality standards in shipbuilding and construction.

- Middle East & Africa (MEA): Demand concentrated in high-specification, durable materials for harsh environment performance in extensive oil, gas, and power generation projects.

- Latin America: Steady expansion supported by growth in mining, automotive, and infrastructure sectors, balancing between cost-effective and premium imported safety solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Welding Fire Blankets Market.- 3M Company

- Mid-Mountain Materials Inc.

- Auburn Manufacturing, Inc.

- Newtex Industries, Inc.

- Gentex Corporation

- Amatex Corporation

- Thermon Manufacturing Co.

- Industrial Safety Products

- WELD-AID Products

- The Safety Company

- DuPont de Nemours, Inc.

- LBA Technical Textiles

- Tecni-Vel, Inc.

- A.W. Chesterton Company

- Zippertubing Co.

- PyroTex Industries GmbH

- Morgan Advanced Materials

- Darco, Inc.

- VWR International

- LLM Global Safety

Frequently Asked Questions

Analyze common user questions about the Welding Fire Blankets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials offer the highest temperature resistance in welding fire blankets?

High-purity silica fabric and ceramic fiber materials provide the highest thermal resistance, often exceeding 1000°C (1832°F) for continuous exposure. These materials are mandated for heavy-duty applications involving plasma cutting and prolonged high-heat work, ensuring maximum thermal isolation and protection.

How do certification standards (e.g., NFPA, FM) influence purchasing decisions?

Certification standards are critical, as they validate the blanket’s tested performance under specific thermal loads, transforming the product from a basic textile into a compliant safety solution. Industrial procurement strictly adheres to these certifications (like NFPA 701 or FM Approval) to meet regulatory mandates and minimize liability risks.

What are the primary differences between coated and non-coated welding blankets?

Coated blankets, typically treated with high-temperature silicone or vermiculite, offer significantly superior abrasion resistance, chemical inertness, and resistance to molten metal adhesion. Non-coated blankets are generally lighter and more economical but lack the extended durability required for continuous industrial hot work environments.

What is the expected lifespan of a professional-grade welding fire blanket?

The lifespan varies significantly based on material and use. High-quality coated silica blankets used in controlled environments may last several years, while non-coated fiberglass used in abrasive, high-exposure conditions may require replacement within six to twelve months. Proper handling and usage verification are crucial for maximizing service life.

In what industries is the demand for extreme heat resistance highest?

Industries involved in high-temperature processes, such as petrochemical and oil refining (flare stack maintenance), specialized metal forging, aerospace manufacturing, and power generation facilities (boiler maintenance), exhibit the highest demand for extreme heat resistance blankets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager