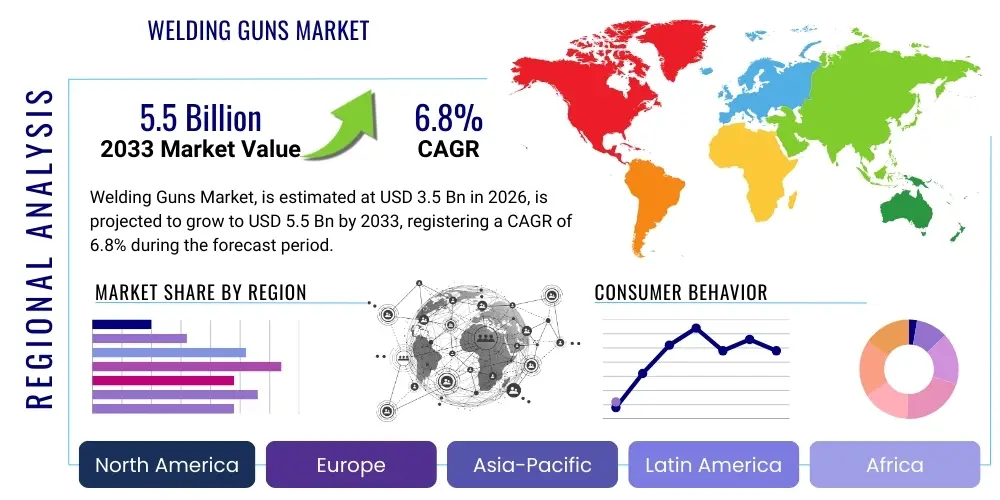

Welding Guns Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437767 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Welding Guns Market Size

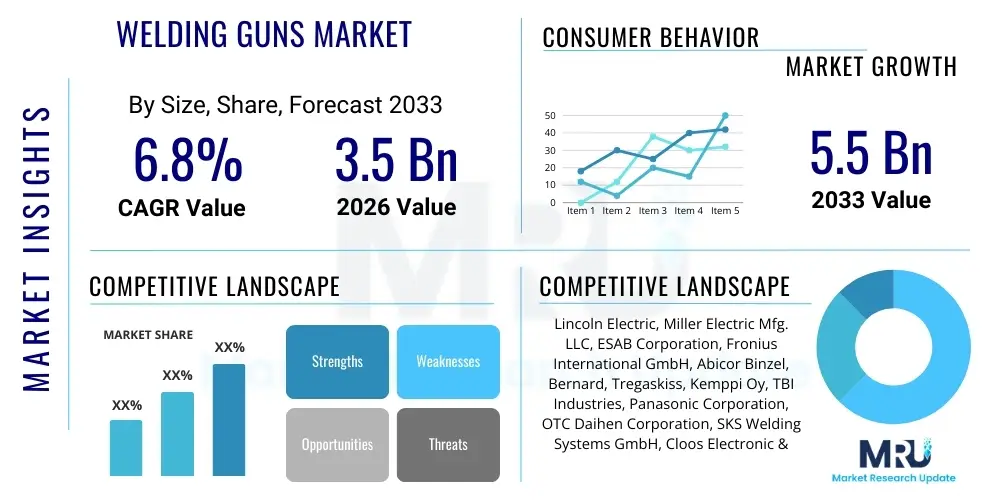

The Welding Guns Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $3.5 Billion in 2026 and is projected to reach $5.5 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating demand for highly efficient, automated, and precision welding solutions across major industrial sectors, particularly automotive manufacturing, heavy fabrication, and energy infrastructure projects worldwide. The continuous push towards reducing manufacturing cycle times and enhancing weld quality necessitates the adoption of advanced welding gun technologies, including robotic and semi-automatic systems that offer superior performance and consistency compared to traditional manual equipment.

Welding Guns Market introduction

The Welding Guns Market encompasses a broad spectrum of equipment utilized to deliver the welding filler material and electrical current or plasma required to join materials, predominantly metals. These tools are indispensable components of any welding operation, serving as the interface between the power source, wire feeder, and the workpiece. Products range from manual MIG (Metal Inert Gas) and TIG (Tungsten Inert Gas) torches to sophisticated, high-duty-cycle robotic welding guns used in high-volume production lines. The primary function is to maintain precision and stability during the welding process, ensuring optimal fusion and structural integrity of the joint.

Major applications of welding guns span critical industries such as automotive assembly, where robotic guns facilitate rapid and consistent spot and seam welding; general manufacturing and heavy fabrication for structural components in construction and shipbuilding; and energy sectors, including oil and gas pipeline construction and renewable energy equipment production. The key benefits derived from modern welding guns include improved ergonomic design reducing operator fatigue, enhanced cooling systems extending product lifespan, and integration capabilities with advanced automation systems. These features collectively contribute to significant improvements in production throughput and the overall quality of manufactured goods, making them vital tools in the global industrial landscape.

Driving factors for this market include rapid industrialization in developing economies, particularly across the Asia Pacific region, increasing adoption of automation and robotic welding cells globally to mitigate skilled labor shortages, and stringent quality control standards in sectors like aerospace and automotive which mandate the use of high-precision equipment. Furthermore, advancements in materials science, requiring specialized welding processes (e.g., aluminum, high-strength low-alloy steels), spur continuous innovation in welding gun design, focusing on improved duty cycles, wire feeding reliability, and lightweight construction materials to optimize performance.

Welding Guns Market Executive Summary

The global Welding Guns Market is witnessing robust business trends marked by intense focus on smart manufacturing integration and the proliferation of robotic welding solutions. Key companies are strategically investing in modular designs and digital integration capabilities to align with Industry 4.0 standards, offering welding guns that can communicate data on performance, temperature, and wear. This trend towards interconnected equipment facilitates predictive maintenance and optimizes operational efficiency across large fabrication facilities. Furthermore, market competition is driving innovation toward lighter, more durable materials for gun components and improved cooling mechanisms, ensuring higher duty cycles and lower total cost of ownership for end-users, especially those engaged in continuous, high-heat welding processes.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, propelled by massive governmental investments in infrastructure, the migration of global manufacturing bases to countries like China, India, and South Korea, and the burgeoning automotive industry across the region. North America and Europe, characterized by high labor costs and advanced technological infrastructure, are leading in the adoption of high-end robotic welding guns and fully automated welding cells, prioritizing precision and minimizing human intervention. Trends in these mature markets also involve a strong emphasis on ergonomic design and safety features, driven by stringent occupational health and safety regulations.

Segmentation trends highlight the increasing dominance of robotic welding guns within the Operation segment, driven by the global shortage of skilled manual welders and the need for repetitive, high-volume production accuracy, particularly in automotive body assembly. By product type, the MIG welding gun segment continues to hold the largest market share due to its versatility and high deposition rates, widely used across general fabrication. However, TIG and Plasma welding guns are seeing specialized growth in high-precision, thin-material applications like aerospace and medical device manufacturing, reflecting a move toward processes that ensure minimal material distortion and superior aesthetic finish.

AI Impact Analysis on Welding Guns Market

Common user questions regarding the impact of AI on the Welding Guns Market predominantly revolve around how AI can enhance autonomous welding operations, improve quality control without human oversight, and optimize the lifespan and performance of the equipment itself. Users are concerned about the implementation costs, the requirement for specialized integration expertise, and how AI-driven systems handle material variability and unpredictable environmental factors. Key expectations focus on achieving 'zero-defect' welding through real-time adjustment capabilities and reducing unexpected downtime by predicting component failures in welding guns. The overarching theme is the transition from automated processes (robotics) to intelligent, adaptive manufacturing (AI integration).

AI is fundamentally transforming the value proposition of welding guns, shifting them from passive tools to active, intelligent endpoints in the welding cell. By leveraging machine learning algorithms applied to sensor data collected from the gun's tip, cable, and cooling system, AI can instantly detect anomalies such as poor penetration, porosity, or excessive spatter, allowing for real-time adjustments to parameters like wire feed speed, voltage, and torch angle. This level of responsiveness significantly minimizes waste and rework, which are critical cost drivers in high-value manufacturing. Furthermore, AI contributes substantially to enhanced safety protocols by monitoring operational deviations that might indicate hazardous conditions, thereby optimizing the entire welding environment.

The integration of AI with robotic welding guns allows manufacturers to execute complex weld paths on non-standardized parts through advanced vision systems and deep learning models. This ability to adapt to minor variances in part fit-up, which traditionally required manual intervention or extensive fixturing, dramatically expands the applicability of robotic welding to low-volume, high-mix production environments. Consequently, AI-enabled welding guns reduce dependency on highly specialized programmers and increase the flexibility and scalability of automated fabrication operations, paving the way for more resilient and decentralized manufacturing supply chains globally.

- Real-time quality monitoring and defect detection via machine learning.

- Predictive maintenance schedules for consumable parts (nozzles, contact tips) extending gun lifespan.

- Optimization of welding parameters (synergic control) based on material feedback and environmental conditions.

- Enhanced path planning and robotic guidance systems for adaptive welding on irregular surfaces.

- Integration with digital twins for simulation and optimization of the welding process parameters.

DRO & Impact Forces Of Welding Guns Market

The market for welding guns is propelled by critical drivers such as the global industrial shift towards automation, particularly within the automotive, heavy machinery, and aerospace sectors seeking precision and consistency in high-volume production. Simultaneously, the persistent and growing shortage of highly skilled welders globally forces companies to invest heavily in semi-automatic and robotic welding systems, making advanced welding guns essential components of this automation strategy. Furthermore, continuous infrastructural development across emerging economies necessitates substantial fabrication work, creating sustained demand for reliable and high-performance welding equipment. Technological advancements, focusing on lightweight, ergonomic designs and improved cooling systems, also act as a driver by enhancing operator comfort and equipment longevity.

Key restraints inhibiting market growth include the high initial capital expenditure associated with sophisticated robotic welding systems and integrated smart welding guns, which often deters small and medium-sized enterprises (SMEs) from rapid adoption. Additionally, the complexity involved in integrating advanced welding guns with existing older infrastructure and power sources can pose significant technical challenges and require substantial training for maintenance personnel, acting as a frictional constraint on widespread deployment. Economic volatility, particularly concerning fluctuating raw material prices (copper, steel, specialized plastics for insulation) used in gun manufacturing, also presents a restraint by impacting production costs and ultimately, the final price of the equipment.

Significant opportunities are emerging from the increasing focus on additive manufacturing and 3D metal printing, where specialized deposition welding guns are required to precisely build up complex metal structures layer by layer. The demand for highly specialized welding guns for exotic materials, such as titanium and advanced aluminum alloys used in electric vehicle (EV) manufacturing and aerospace, offers manufacturers a lucrative niche market for high-value products. The concept of modular welding guns, allowing easy interchangeability of components for diverse applications and rapid field repairs, also presents a substantial market opportunity to improve customer satisfaction and reduce downtime. The strong impact forces exerted by these drivers, restraints, and opportunities are pushing the market towards continuous technological evolution, demanding greater efficiency and connectivity from all new products introduced.

Segmentation Analysis

The Welding Guns Market segmentation provides a detailed framework for understanding market dynamics based on product type, operation mode, and end-use industry. Product segmentation typically includes MIG welding guns, TIG welding torches, and Plasma welding torches, each catering to specific requirements regarding material thickness, required weld quality, and production speed. MIG guns are optimized for speed and high deposition, while TIG torches are favored for high-precision, aesthetic welds on thin materials. Understanding these segments is crucial for manufacturers to tailor their R&D and marketing efforts towards specialized customer needs within various industrial applications, ensuring product features align with operational demands such as duty cycle and heat tolerance.

The segmentation by operation mode—Manual, Semi-Automatic, and Robotic/Automatic—is perhaps the most dynamic area of the market, reflecting the overarching trend of automation. While manual welding guns remain essential for custom jobs, repair work, and field applications, the robotic segment is experiencing exponential growth, driven by investments in high-volume manufacturing lines, particularly in North America and Asia Pacific. Semi-automatic welding guns bridge the gap, offering increased efficiency over manual systems while retaining some operator flexibility, making them popular in general fabrication workshops and medium-scale manufacturing operations where capital expenditure constraints exist.

End-use industry segmentation reveals the market's primary demand drivers, with Automotive and Transportation dominating due to the extensive use of welding in vehicle assembly and ongoing shifts toward electric vehicle manufacturing requiring specific welding techniques for battery packs and lightweight chassis. Construction and Heavy Fabrication, along with Energy (Oil & Gas, Renewables), represent significant stable demand areas, often requiring high-duty-cycle, robust welding guns suitable for harsh environments. The continuous specialization in these sectors mandates that welding gun manufacturers develop highly durable, application-specific products that can withstand challenging operational parameters while maintaining precise performance standards.

- By Type

- MIG Welding Guns/Torches

- TIG Welding Torches

- Plasma Welding Torches

- Submerged Arc Welding (SAW) Torches

- By Operation

- Manual Welding Guns

- Semi-Automatic Welding Guns

- Robotic/Automatic Welding Guns

- By Cooling Method

- Air-Cooled Welding Guns

- Water-Cooled Welding Guns

- By End-Use Industry

- Automotive and Transportation

- Construction and Heavy Fabrication

- Energy (Oil & Gas, Power Generation)

- Aerospace and Defense

- Marine and Shipbuilding

- General Manufacturing

Value Chain Analysis For Welding Guns Market

The value chain for the Welding Guns Market begins with upstream activities, primarily involving the procurement of raw materials such as specialized copper alloys for conductors and contact tips, high-temperature resistant plastics and ceramics for insulators, and various steel grades for structural components and handles. Key upstream relationships involve negotiating reliable supply contracts for these materials, focusing on quality control to ensure conductivity and durability are optimized for high-heat, high-current applications. Manufacturers often maintain integrated vertical operations for critical component fabrication, such as precision machining of contact tips, to safeguard quality and manage proprietary designs, ensuring compliance with strict performance specifications required by high-duty-cycle industrial users.

The manufacturing process involves complex assembly, incorporating advanced cooling systems (both air and water-cooled circuits), ergonomic handle design, and integrating sophisticated control circuitry, especially for robotic and smart welding guns. Distribution channels are varied: direct sales channels are typically employed for large-volume industrial clients, such as major automotive OEMs and dedicated welding automation integrators, allowing for specialized technical consultation and customized product offerings. Indirect channels, encompassing authorized distributors, welding supply houses, and large industrial retailers, facilitate market penetration to SMEs and maintenance, repair, and operations (MRO) markets, ensuring wide geographical coverage and localized inventory availability.

Downstream activities center around maintenance, support, and the provision of high-wear consumables (contact tips, nozzles, liners) that are essential for continuous operation. The profitability of the market is heavily influenced by the recurring revenue generated from these consumables. Welding gun manufacturers actively engage in establishing extensive aftermarket service networks to provide timely technical support and training, which are vital for complex robotic systems. The effectiveness of the distribution channel, combined with the reliability of aftermarket support, directly impacts customer satisfaction and repeat business, solidifying the manufacturer’s position within the competitive end-user industries such as shipbuilding and structural engineering where minimal downtime is paramount.

Welding Guns Market Potential Customers

Potential customers for the Welding Guns Market are fundamentally determined by the scale and nature of their fabrication operations and their level of commitment to automation. The primary end-users are large manufacturing enterprises within the automotive sector, including Tier 1 suppliers and OEMs, who rely on high-duty-cycle robotic welding guns for precision spot and seam welding required in vehicle body construction and chassis assembly. These customers prioritize equipment reliability, integration capability with existing robotic arms (e.g., KUKA, FANUC, ABB), and advanced features like quick-change tips and integrated sensor technology for process monitoring, driving demand for premium, technologically advanced products.

Another major category comprises companies involved in heavy fabrication and infrastructure, such as structural steel manufacturers, pipeline contractors, and shipbuilding yards. These buyers often require robust, highly durable MIG and SAW guns capable of handling high amperage and severe environmental conditions. Their purchasing decisions are highly influenced by the longevity of the equipment, the availability of specialized consumables for thick plate welding, and the ergonomic design features necessary for extended use in often physically demanding settings. The focus here is on maximum uptime and minimized maintenance complexity in harsh industrial environments.

Additionally, small-to-medium enterprises (SMEs) and specialized job shops constitute a vast segment of potential customers, primarily utilizing manual and semi-automatic welding guns for repair, custom fabrication, and lower-volume production runs. These buyers are highly price-sensitive and focused on versatility, requiring guns that can handle multiple materials and processes efficiently, typically procured through local distributors and focusing on reliability and ease of maintenance. The rising demand for specialized welding solutions in niche markets like aerospace (TIG welding of exotic alloys) and medical device manufacturing also creates targeted customer segments requiring extremely high precision and specialized clean-room compatible equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $3.5 Billion |

| Market Forecast in 2033 | $5.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lincoln Electric, Miller Electric Mfg. LLC, ESAB Corporation, Fronius International GmbH, Abicor Binzel, Bernard, Tregaskiss, Kemppi Oy, TBI Industries, Panasonic Corporation, OTC Daihen Corporation, SKS Welding Systems GmbH, Cloos Electronic & Welding Technology, CEBORA SpA, TWECO (Victor Technologies), Hypertherm Inc., Thermal Dynamics, Akyapak Makine San. Ve Tic. A.Ş., Illinois Tool Works (ITW), Denyo Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Welding Guns Market Key Technology Landscape

The technological landscape of the Welding Guns Market is dominated by advancements aimed at enhancing connectivity, ergonomics, and durability, aligning closely with Industry 4.0 principles. A crucial technology is the implementation of smart sensor integration directly within the gun body, particularly in robotic systems. These sensors monitor parameters such as cable tension, temperature, current, voltage fluctuations, and contact tip wear in real-time. This real-time data is essential for enabling predictive maintenance protocols, minimizing unscheduled downtime, and ensuring consistent weld quality, fundamentally transforming routine maintenance from reactive to proactive, leading to substantial operational savings for high-volume manufacturers.

Ergonomics and modularity represent another key technological focus, particularly for manual and semi-automatic welding guns. Manufacturers are utilizing advanced lightweight materials and designing handles that minimize wrist strain and operator fatigue over long shifts. Modular gun designs allow users to quickly swap out front-end components, such as necks and nozzles, to adapt to different welding positions or joint configurations without changing the entire system. Furthermore, advancements in wire feeding mechanisms and liner technologies are reducing friction and tangling, enhancing the reliability of the welding process, which is critical when working with softer filler materials like aluminum or specialized flux-cored wires.

In the high-end robotic segment, the development of integrated blow-hole detection systems and adaptive control algorithms is paramount. These systems often utilize advanced camera and laser profiling technologies mounted directly on or adjacent to the welding gun to monitor the melt pool dynamics and geometry, automatically adjusting power sources through synergic control to maintain optimal bead shape and penetration depth. This level of automated process control is vital for sectors with zero-tolerance for defects, such as aerospace and defense. Furthermore, improved cooling efficiency, often through high-flow water-cooling systems, allows robotic welding guns to operate at much higher duty cycles and amperage settings, essential for demanding applications like heavy plate welding in shipbuilding and construction, thereby pushing the boundaries of automated fabrication capabilities.

Regional Highlights

-

Asia Pacific (APAC): APAC represents the largest and fastest-growing market for welding guns, primarily fueled by rapid industrial expansion, massive infrastructural projects, and the region's position as a global manufacturing hub. Countries like China, India, South Korea, and Japan drive demand across various segments, especially automotive manufacturing and shipbuilding. The region exhibits high uptake of both high-volume, cost-efficient MIG guns and increasingly sophisticated robotic welding cells, driven by supportive government policies promoting automation and foreign direct investment in manufacturing facilities. The sustained growth in population and urbanization necessitates continuous heavy fabrication, ensuring a consistent need for durable and high-performance welding equipment.

-

North America: The North American market is characterized by high technological maturity, stringent quality standards (especially in aerospace and defense), and a high rate of robotic integration, largely due to high labor costs and the aging workforce demographic. Demand is concentrated in advanced, high-precision robotic welding guns equipped with smart sensors and communication capabilities for seamless integration into IIoT (Industrial Internet of Things) platforms. The ongoing resurgence in domestic automotive manufacturing, coupled with investments in oil and gas infrastructure and large-scale renewable energy projects, ensures steady demand for premium, durable, and highly reliable welding systems tailored for efficiency and high duty cycles.

-

Europe: Europe maintains a substantial market share, driven by strong manufacturing sectors in Germany, Italy, and the Nordic countries, focusing heavily on specialized machinery, high-end automotive, and precision engineering. The European market prioritizes sustainability, energy efficiency, and extremely high weld quality, resulting in strong demand for advanced TIG and Plasma torches, alongside robotic MIG systems compliant with strict CE standards. Innovation in this region focuses heavily on ergonomic design, worker safety, and digital integration capabilities, adhering strictly to regional labor regulations and environmental directives, thereby necessitating continuous upgrades to existing welding equipment fleets across major industrial users.

-

Latin America (LATAM) and Middle East & Africa (MEA): These regions show moderate growth, primarily driven by investments in resource extraction (mining, oil & gas), construction, and increasing local manufacturing capabilities. Growth in LATAM is led by Brazil and Mexico, heavily influenced by automotive assembly and infrastructure projects. MEA growth is concentrated in the Gulf Cooperation Council (GCC) countries, focusing on large-scale construction, energy infrastructure development, and diversification initiatives away from oil dependency. Market demand in these regions often focuses on rugged, easy-to-maintain equipment, with increasing interest in semi-automatic welding guns that offer better productivity compared to purely manual systems, balancing cost efficiency with improved operational performance.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Welding Guns Market.- Lincoln Electric Holdings, Inc.

- Miller Electric Mfg. LLC (an ITW Company)

- ESAB Corporation

- Fronius International GmbH

- Abicor Binzel

- Bernard (an ITW Company)

- Tregaskiss (an ITW Company)

- Kemppi Oy

- TBI Industries GmbH

- Panasonic Corporation

- OTC Daihen Corporation

- SKS Welding Systems GmbH

- Cloos Electronic & Welding Technology

- CEBORA SpA

- TWECO (Victor Technologies)

- Hypertherm Inc.

- Thermal Dynamics

- Akyapak Makine San. Ve Tic. A.Ş.

- Illinois Tool Works (ITW)

- Denyo Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Welding Guns market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift towards robotic welding guns?

The primary drivers are the severe global shortage of skilled manual labor, the need for increased production consistency and speed in high-volume industries like automotive, and the mandated high quality standards that robotic systems can reliably meet, minimizing defect rates and material waste.

How does the cooling method impact welding gun performance?

The cooling method (air-cooled vs. water-cooled) is critical for determining the gun's duty cycle. Water-cooled guns handle higher amperages and operate continuously for longer periods without overheating, making them essential for heavy industrial applications and high-duty-cycle robotic welding cells.

Which segment holds the largest share in the Welding Guns Market?

The MIG Welding Guns segment holds the largest market share due to its versatility, applicability across various material thicknesses, and high metal deposition rates, making it the standard choice for general fabrication and heavy manufacturing globally.

What technological innovations are currently impacting welding gun design?

Current technological impacts include the integration of IoT sensors for predictive maintenance, advanced ergonomic designs to reduce operator fatigue in manual guns, and modular component structures for quick customization and simplified in-field servicing, aligning with Industry 4.0 principles.

Why is the Asia Pacific region the fastest-growing market for welding guns?

APAC's accelerated growth is attributed to rapid urbanization, massive government investment in infrastructure development (e.g., railways and construction), and the region's continuous expansion as the central global manufacturing hub for electronics, automotive components, and heavy machinery, driving high demand for new equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager