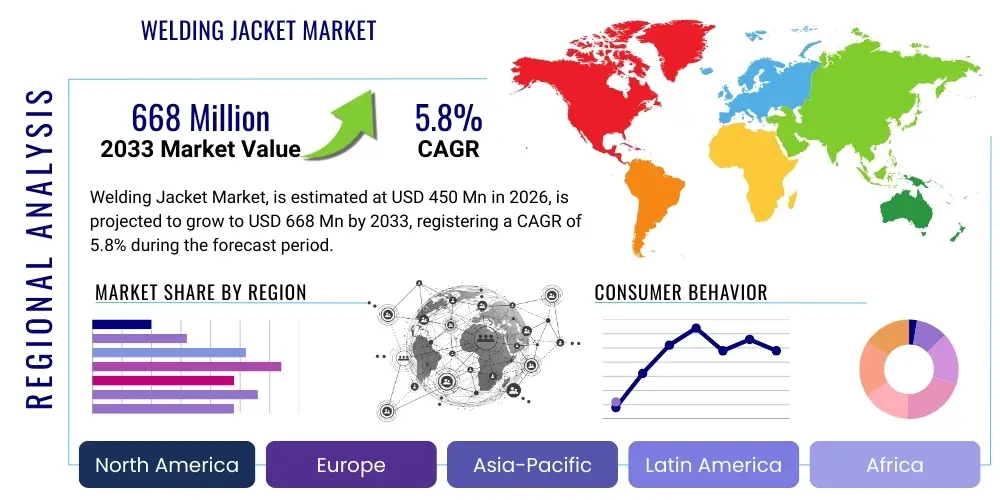

Welding Jacket Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435881 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Welding Jacket Market Size

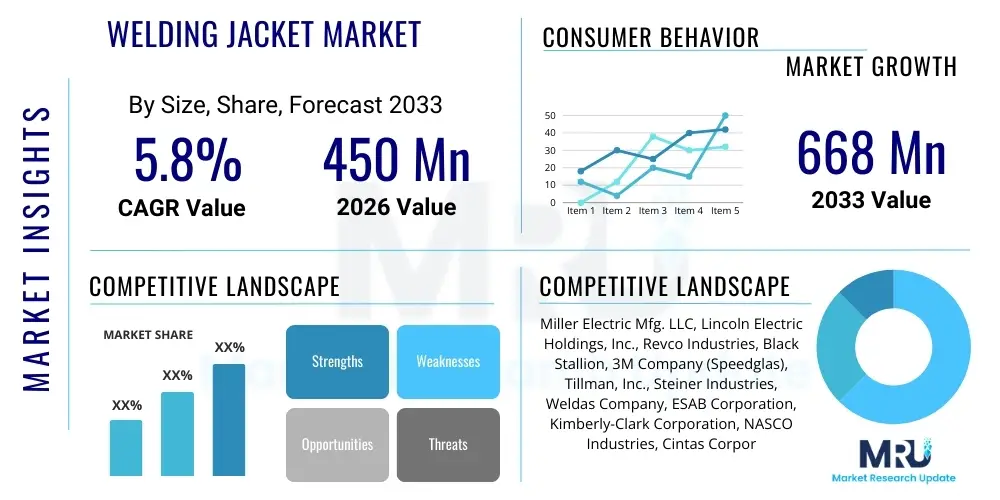

The Welding Jacket Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $450 Million USD in 2026 and is projected to reach $668 Million USD by the end of the forecast period in 2033.

Welding Jacket Market introduction

The Welding Jacket Market comprises specialized Personal Protective Equipment (PPE) designed to shield welders from severe workplace hazards, including intense heat, sparks, molten metal splatter, and harmful ultraviolet (UV) and infrared (IR) radiation. These jackets are integral to maintaining occupational safety standards across high-risk industrial environments. Key materials utilized in manufacturing include heavy-duty leather, flame-resistant (FR) treated cotton, Kevlar, and blended fabrics incorporating carbon fibers, each selected based on the specific welding process (e.g., MIG, TIG, Stick) and the level of protection required. Product innovation continually focuses on improving mobility, reducing weight, and enhancing the breathability of these essential garments while maintaining superior flame resistance and durability against abrasion and punctures. The rigorous enforcement of global safety regulations, particularly in developed economies, ensures sustained demand for high-quality, certified welding jackets, positioning them as a critical component of industrial safety infrastructure.

Major applications of welding jackets span a diverse range of heavy industries, notably shipbuilding, automotive manufacturing, aerospace fabrication, heavy machinery production, and large-scale infrastructure construction projects. The necessity of rigorous protective measures in these sectors drives the consistent adoption of advanced welding gear. The primary benefits of these jackets include prevention of severe burns, minimization of injury from flying debris, and prolonged lifespan of underlying work clothing. Furthermore, modern welding jackets are designed ergonomically to reduce welder fatigue, which indirectly contributes to higher productivity and reduced errors on the job site. The ongoing emphasis on zero-incident safety cultures within corporate environments acts as a powerful catalyst for market growth, ensuring that procurement of certified PPE remains a top priority.

Driving factors for this market include rapid industrialization in emerging economies, leading to increased fabrication and assembly activities, and mandatory compliance with international safety standards like OSHA and ANSI. Technological advancements in textile science, such as the introduction of lightweight meta-aramid and para-aramid fibers, are enhancing product comfort and performance, encouraging regular use and replacement. The market also benefits from the growing complexity of welding tasks, which require specialized jackets offering multi-hazard protection, thus stimulating the premium segment. Conversely, volatility in raw material prices and the influx of lower-quality, non-certified alternatives pose minor restraints, though rigorous safety auditing typically mitigates these risks in professional settings.

Welding Jacket Market Executive Summary

The global Welding Jacket Market is positioned for steady expansion, fueled primarily by stringent occupational safety mandates and rapid growth in heavy manufacturing and infrastructure development across Asia Pacific and specific regions in the Middle East. Business trends indicate a strong shift toward high-performance, multi-layered jackets utilizing proprietary flame-resistant textiles, moving away from traditional, bulky leather options, driven by welder preference for comfort and mobility. Manufacturers are increasingly integrating smart fabric technologies, such as moisture-wicking capabilities and improved ventilation systems, to address challenges associated with prolonged wear in hot environments. Competitive strategies focus heavily on securing safety certifications (e.g., EN ISO 11611, NFPA 2112) and establishing robust distribution channels that cater directly to large industrial procurement departments and specialized PPE wholesalers, emphasizing the Total Cost of Ownership (TCO) based on durability and reduced injury risk.

Regionally, North America and Europe maintain high market share value due to mature safety regulations and established industrial bases, characterized by a preference for premium, highly certified products and frequent product replacement cycles mandated by internal company policies. However, the Asia Pacific region is anticipated to demonstrate the fastest growth rate (CAGR), driven by massive infrastructure spending, the relocation of manufacturing bases, and rising awareness of industrial safety standards in countries like China, India, and Southeast Asian nations. This geographical shift is pushing manufacturers to localize production and optimize supply chains to meet burgeoning regional demand efficiently. Economic volatility in certain regions and fluctuating raw material costs remain key operational challenges that companies navigate through strategic inventory management and long-term supplier agreements.

Segmentation trends highlight the dominance of the Leather Jackets segment in extreme high-heat applications, valued for its superior resistance to splatter and abrasion, while the Flame-Resistant Cotton segment leads in volume due to its cost-effectiveness and breathability for lighter welding tasks. The distribution channel analysis shows that the Offline distribution model, particularly through specialized industrial safety distributors and hardware stores, currently commands the largest share, although e-commerce platforms are rapidly gaining traction, especially for B2C purchases and small to medium enterprise (SME) orders. Innovation within the material segment, specifically the development of lightweight synthetic blends (e.g., aramid and oxidized polyacrylonitrile (OPF) fibers), is expected to drive significant revenue growth in the protective apparel category, setting new benchmarks for comfort and protection.

AI Impact Analysis on Welding Jacket Market

User queries regarding AI’s impact on the Welding Jacket Market primarily revolve around how automation affects the demand for welding labor, whether AI can optimize jacket design for better protection, and if AI-powered tracking systems can monitor PPE compliance. Users are concerned about future market sustainability if robotic welding replaces human welders entirely, and simultaneously anticipate benefits from AI in improving material science and enhancing predictive maintenance of safety gear. Key themes that emerge include the integration of sensor technology within jackets (smart PPE), supply chain efficiency improvements driven by AI logistics, and the development of highly customized, AI-designed ergonomic apparel that minimizes physical strain during complex welding maneuvers. The overarching expectation is that while AI might reduce the total number of manual welding jobs, it will simultaneously increase the need for sophisticated, technologically integrated safety apparel required for specialized human oversight roles and collaborative robot environments.

The influence of Artificial Intelligence is not direct in the manufacturing of the jackets themselves but profoundly impacts the ecosystem in which they are used. AI and machine learning algorithms are being leveraged extensively in advanced manufacturing facilities to optimize robotic welding paths, minimize material waste, and increase throughput. This shift towards automation necessitates specialized welding jackets for technicians who monitor and maintain these robotic systems, often requiring lighter protection focused on ergonomic access rather than continuous high-heat exposure. Furthermore, AI-driven quality control systems are improving the consistency and integrity of FR fabrics and seams, ensuring that the protective capabilities of the jackets meet stringent specifications consistently, thereby raising the overall quality benchmark across the industry.

Additionally, AI plays a crucial role in predicting demand and managing inventory for PPE suppliers. By analyzing historical consumption patterns, industry construction cycles, and regulatory changes, AI algorithms enable manufacturers to forecast specific material requirements and regional inventory needs accurately. This enhanced predictive capability reduces lead times, minimizes stockouts of essential safety gear, and optimizes the complex global supply chain for raw materials like specialized leather and aramid fibers. Future applications are expected to include AI-powered health monitoring integrated directly into welding jackets, using embedded sensors to detect overheating, physiological stress markers, or unauthorized exposure to hazardous fumes, transforming the garment from passive protection into an active safety monitoring device.

- AI optimizes supply chain logistics, ensuring timely delivery of critical PPE supplies.

- Machine learning enhances quality control, guaranteeing fabric flame resistance and seam integrity.

- AI-driven sensor integration leads to the development of smart welding jackets capable of real-time hazard monitoring.

- Predictive analytics helps forecast regional demand shifts based on industrial project pipelines.

- Automation in welding processes necessitates specialized jackets for supervisory and maintenance personnel.

- AI assists in optimizing material blends for improved thermal performance and reduced weight.

DRO & Impact Forces Of Welding Jacket Market

The dynamics of the Welding Jacket Market are shaped by a complex interplay of Drivers (D), Restraints (R), Opportunities (O), and potent Impact Forces. Key drivers include the global harmonization of occupational safety standards and the corresponding surge in industrial activities across emerging economies, mandating high-quality PPE adoption. Major restraints stem from the high cost associated with premium, multi-hazard protective fabrics (e.g., high-performance aramid fibers) and the pervasive issue of counterfeit or non-certified products undermining market integrity and pricing structures. Opportunities lie primarily in material science innovation, focusing on developing lighter, more comfortable, and sustainable flame-resistant materials, alongside the expansion of e-commerce channels for B2B procurement, offering greater accessibility and transparency to smaller end-users. These factors create significant market tension, influencing strategic investments and operational decisions within the manufacturing and distribution sectors.

The impact forces operating on this market are categorized into Environmental, Regulatory, Technological, and Economic factors. Regulatory forces, particularly the continuous updates to OSHA, ANSI, and European EN standards, exert the strongest positive impact, forcing businesses to consistently upgrade their PPE inventory and adhere to stricter compliance regimes. Technological advances, such as the blending of inherent flame-resistant fibers with moisture-wicking materials, enhance product appeal and drive replacement cycles based on performance improvements rather than just physical wear. Economically, industrial spending cycles, specifically in energy and infrastructure, directly correlate with the demand for welding activities and, consequently, protective gear. Environmental pressures are mounting, pushing manufacturers toward adopting greener manufacturing processes and utilizing recycled or sustainably sourced fibers in their jacket designs, creating a new dimension for competitive differentiation.

The market faces significant internal and external forces. Internal forces, such as labor costs and manufacturing efficiencies, determine pricing strategies, while external forces like global trade tariffs on raw materials (e.g., leather or synthetic fiber imports) directly affect operational costs and market accessibility. The increasing awareness among welders regarding long-term health hazards associated with inadequate protection acts as an independent force compelling companies to invest in superior, ergonomically designed jackets. Balancing the need for maximal protection against the requirement for minimal physical restriction remains a continuous challenge that drives product research and development, ensuring that the market evolves proactively in response to user needs and safety legislation changes.

Segmentation Analysis

The Welding Jacket Market is extensively segmented based on Material Type, Application, Weight Category, and Distribution Channel, reflecting the diverse requirements across various welding environments and industrial sectors. This structure helps manufacturers tailor product offerings specifically to end-user needs, whether for heavy-duty, high-amperage welding requiring full leather protection, or light-duty fabrication demanding breathable, FR cotton jackets. Material segmentation is crucial as it determines the level of thermal protection, durability, and cost. Application segmentation differentiates between the needs of industries such as Automotive, which may prioritize mobility, versus Shipbuilding, which demands maximum protection against extensive splatter and extreme heat exposure. Understanding these segment dynamics is vital for market players to optimize their production mixes and target marketing efforts effectively.

- By Material Type:

- Leather (Cowhide, Goatskin, Pigskin)

- Flame-Resistant (FR) Cotton

- Synthetic Blends (Aramid, Carbon Fiber Blends)

- Heavy-Duty Denim

- By Application:

- Automotive & Transportation

- Building & Construction

- Manufacturing & Fabrication

- Oil & Gas

- Shipbuilding & Repair

- Aerospace

- By Weight Category:

- Lightweight (for TIG welding and warm climates)

- Medium Weight (standard MIG and Stick welding)

- Heavy Weight (foundry and extreme industrial applications)

- By Distribution Channel:

- Offline (Specialized Industrial Distributors, Hardware Stores)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Welding Jacket Market

The value chain for the Welding Jacket Market begins with upstream activities involving raw material extraction and processing, primarily encompassing the production of specialized textiles and tanning of leathers. Suppliers of aramid fibers (e.g., Kevlar, Nomex), FR chemical treatments, and high-quality hides form the critical foundational layer. Consistency in material quality is paramount, as it directly impacts the certified protective rating of the final product. Manufacturers then engage in processing, design, cutting, and assembly, focusing on incorporating ergonomic features, reinforced seams, and compliance with specific regional safety standards (e.g., CE, UL, CSA). Efficiency at this stage, particularly minimizing material waste and optimizing stitching technology, determines the overall cost structure and competitive positioning.

The downstream segment focuses on distribution and sales, which typically involves a mix of direct sales to large corporations (B2B contracts) and indirect distribution through a network of specialized industrial safety wholesalers, retailers, and now, increasingly, dedicated e-commerce platforms. Specialized industrial distributors play a crucial role by providing inventory management, local regulatory knowledge, and value-added services such as safety training and customization. Direct distribution ensures better control over branding and pricing for large volume orders from major end-users like oil refineries or large manufacturing plants, facilitating long-term procurement relationships and brand loyalty based on guaranteed quality and compliance.

Distribution channels for welding jackets are bifurcated into direct and indirect models. The indirect channel dominates the market, relying heavily on professional safety equipment vendors who maintain expertise in PPE regulations and inventory tailored to local industrial needs. The rise of digital platforms represents a significant shift, offering SMEs and individual welders immediate access to a wide range of products, bypassing traditional wholesale markups. However, due to the critical safety function of the product, verification and certification transparency remain a non-negotiable requirement, making trusted industrial suppliers and verifiable online stores the preferred purchasing methods. The final stage involves end-user consumption and disposal, with increasing emphasis on recycling programs for materials like high-performance synthetics to address environmental concerns.

Welding Jacket Market Potential Customers

Potential customers for welding jackets are primarily professional tradesmen and industrial entities operating in high-hazard environments where thermal and radiant protection is mandatory. The core buyers are procurement managers and safety officers within large organizations across sectors requiring extensive fabrication, repair, and assembly processes. These institutional buyers prioritize compliance with regional safety legislation, durability (to minimize replacement costs), and verifiable certifications above initial purchase price. Substantial contracts are often secured with major automotive assembly plants, shipyards, heavy equipment manufacturers, and infrastructure developers involved in bridge and pipeline construction, where continuous, high-amperage welding is routine. The buying decision in these large organizations is complex, often involving cross-departmental approval from safety, procurement, and operations.

Beyond large industrial customers, the market also serves a significant volume of small to medium enterprises (SMEs) and individual, independent welding contractors. These customers typically prioritize a balance between cost-effectiveness and adequate protection. For TIG welders or mobile repair technicians, comfort, flexibility, and lightweight design are highly valued attributes, often leading to the selection of FR cotton blends or lighter synthetic jackets. Purchases by SMEs are frequently made through local hardware stores or online specialty safety retailers, driven by immediate project needs rather than long-term strategic procurement, highlighting the importance of accessibility in the distribution network for this customer segment. Educational institutions and vocational training centers also represent a smaller but steady customer base, requiring protective gear for practical welding classes, prioritizing beginner-friendly and standardized PPE.

Emerging customer segments include maintenance teams in renewable energy installations (wind farms, solar plants), where specialized welding and repair tasks are necessary but may occur in difficult-to-access locations, demanding highly flexible and weather-resistant protective gear. Furthermore, the defense sector, involved in military vehicle construction and maintenance, represents a high-value customer group demanding top-tier, military-grade flame resistance and durability. Targeting these niche applications requires manufacturers to engage in co-development or highly specialized certification processes to meet extremely demanding performance specifications. Ultimately, the potential customer base is defined by any environment where open arc welding or thermal cutting poses a risk of burn injury, emphasizing the pervasive demand across global industrial output.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million USD |

| Market Forecast in 2033 | $668 Million USD |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Miller Electric Mfg. LLC, Lincoln Electric Holdings, Inc., Revco Industries, Black Stallion, 3M Company (Speedglas), Tillman, Inc., Steiner Industries, Weldas Company, ESAB Corporation, Kimberly-Clark Corporation, NASCO Industries, Cintas Corporation, Honeywell International Inc., Lakeland Industries, Inc., Helly Hansen (Workwear Division), National Safety Apparel (NSA), DuPont, Carhartt, Inc. (Workwear), Majestic Glove, MCR Safety |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Welding Jacket Market Key Technology Landscape

The technology landscape of the Welding Jacket Market is defined primarily by advancements in specialized textile engineering and material science, aiming to achieve the optimal balance between protection, comfort, and longevity. A pivotal technology is the development and application of inherent flame-resistant (IFR) fibers, such as aramid (meta- and para-aramids) and oxidized polyacrylonitrile (OPF). Unlike treated cotton, IFR materials do not lose their fire-retardant properties over time or after repeated laundering, offering a superior and safer long-term solution, which is particularly attractive to high-specification industries like aerospace and petrochemicals. Innovations also focus on multi-layer protection systems, where different materials are strategically combined to handle varying levels of heat, electrical arc flash, and physical abrasion, all while maintaining a relatively lightweight profile to enhance welder compliance and mobility.

Another crucial technological area involves the refinement of flame-resistant treatments for cotton and blended fabrics. Modern chemical treatments are significantly more durable and environmentally friendlier than previous generations, adhering better to the textile fibers and resisting degradation from industrial washing cycles. Furthermore, design technology, including ergonomic pattern cutting and seam construction, has advanced significantly. Techniques like Kevlar stitching and triple-stitched seams are now standard for high-wear areas, greatly increasing the jacket's service life and reducing the likelihood of catastrophic failure during a heat incident. These design improvements directly address welder feedback concerning restricted movement and discomfort, which were historically barriers to consistent PPE usage, thereby enhancing the overall safety ecosystem in the workplace.

The emerging technological trend centers on the integration of smart textiles and sensor technology. While still nascent, certain premium welding jackets are beginning to incorporate micro-sensors for physiological monitoring (e.g., heart rate, body temperature) or environmental monitoring (e.g., proximity to high heat sources, exposure levels to welding fumes). Although full commercial adoption is pending, this technology promises to transform the jacket into an active safety device, capable of alerting both the welder and safety management systems to immediate dangers or signs of heat exhaustion. This technological sophistication, combined with digital tracking methods (like RFID chips embedded for inventory and wash cycle management), defines the leading edge of innovation, positioning welding jackets not just as garments, but as critical, integrated components of a comprehensive digital safety program.

Regional Highlights

Geographical market analysis reveals distinct consumption patterns, regulatory environments, and growth trajectories across global regions. North America, driven primarily by the United States and Canada, holds a substantial market share characterized by stringent occupational safety regulations (OSHA compliance) and a strong emphasis on high-quality, certified protective gear. The demand here is dominated by premium, technology-driven products, particularly aramid and heavy-duty leather jackets, supported by robust sectors like oil & gas, aerospace, and heavy vehicle manufacturing. The established safety culture in this region translates into consistent investment in replacement cycles and adherence to the highest safety standards, making it a lucrative market for certified global suppliers.

Europe, encompassing powerhouse economies like Germany, France, and the UK, represents another mature market segment, strictly governed by EU directives and specific national standards (e.g., EN ISO 11611). European consumers show a preference for eco-friendly manufacturing processes and high levels of comfort integrated into their protective gear. The market is highly competitive, focusing on material innovation, such as lightweight, breathable FR fabrics suitable for long working shifts. Western Europe’s steady industrial base and commitment to worker health ensure a stable, high-value demand, with growth being driven more by technological upgrades and regulatory tightening than by sheer industrial volume expansion.

Asia Pacific (APAC) is projected to be the fastest-growing region, propelled by massive investments in infrastructure (roads, railways, power plants) and rapid expansion of the manufacturing sector, particularly in China, India, South Korea, and Southeast Asia. While cost sensitivity remains a factor, increasing regulatory enforcement and rising awareness of industrial safety standards are rapidly shifting demand toward higher-quality, compliant welding jackets, moving away from cheaper, non-certified alternatives. This region represents the largest potential volume market, offering significant opportunities for international manufacturers willing to establish localized supply chains and distribution networks tailored to the varying regulatory landscapes and economic tiers within the area.

Latin America (LATAM) and the Middle East & Africa (MEA) represent evolving markets. LATAM's demand is closely tied to fluctuating commodity prices (mining, oil extraction) and localized infrastructure spending, leading to cyclical demand patterns. MEA, especially the Gulf Cooperation Council (GCC) countries, exhibits strong demand driven by large-scale oil, gas, and infrastructure mega-projects, requiring high-specification, heavy-duty protective gear due to extreme heat conditions and high-risk environments. Growth in both regions is significantly influenced by foreign direct investment and adherence to international contracting standards, which mandates the use of globally certified PPE.

- North America: Leads in premium segment adoption due to stringent OSHA regulations and mature aerospace/oil & gas sectors.

- Europe: Focuses on regulatory compliance (EN standards), sustainability, and ergonomic comfort in FR textiles.

- Asia Pacific (APAC): Highest CAGR driven by rapid industrialization, infrastructure growth, and improving safety awareness in China and India.

- Middle East & Africa (MEA): Strong demand for heavy-duty protection in petrochemical and major infrastructure projects.

- Latin America (LATAM): Demand volatility linked to cyclical mining and resource extraction investments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Welding Jacket Market.- Miller Electric Mfg. LLC

- Lincoln Electric Holdings, Inc.

- Revco Industries

- Black Stallion

- 3M Company (Speedglas Safety Division)

- Tillman, Inc.

- Steiner Industries

- Weldas Company

- ESAB Corporation

- Kimberly-Clark Corporation (Kimberly-Clark Professional)

- NASCO Industries

- Cintas Corporation

- Honeywell International Inc. (Sperian Protection)

- Lakeland Industries, Inc.

- Helly Hansen (Workwear Division)

- National Safety Apparel (NSA)

- DuPont (Material supplier and brand licensee)

- Carhartt, Inc. (Workwear)

- Majestic Glove

- MCR Safety

Frequently Asked Questions

Analyze common user questions about the Welding Jacket market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between FR treated cotton and inherent FR materials?

FR treated cotton uses chemical application to resist fire, which can degrade over washing cycles. Inherent FR materials, like Aramid or Nomex, have fire-resistant properties built into the fiber structure itself, offering permanent, superior protection regardless of wear and washing, making them ideal for high-risk, frequent-use environments.

Which material provides the best protection against molten metal splatter in stick welding?

Heavy-duty leather (cowhide) is generally considered the best material for protection against heavy molten metal splatter and intense radiant heat, especially in stick (SMAW) or flux-cored arc welding applications, due to its natural thickness and resistance to immediate burn-through and abrasion.

Are lightweight welding jackets safe for heavy industrial use?

Lightweight jackets, often made from FR cotton or thin synthetic blends, are suitable for TIG or light-duty MIG welding where splatter is minimal, and mobility is crucial. However, they are generally not safe for heavy industrial use involving high amperage, extreme heat, or significant molten metal exposure, which requires heavy-duty leather or multi-layered aramid fabrics for adequate safety.

How do I ensure a welding jacket is compliant with safety standards?

Compliance is verified by checking for specific certifications and labeling, such as the European EN ISO 11611 standard, American National Standards Institute (ANSI), or Occupational Safety and Health Administration (OSHA) compliance markings. Always purchase jackets from reputable suppliers and ensure the label specifies the protection level corresponding to the intended welding task.

What are the key drivers for growth in the Asia Pacific welding jacket market?

The key drivers for growth in the Asia Pacific market include massive government infrastructure investments, the relocation and expansion of global manufacturing bases into the region, and increasing enforcement of local and international occupational safety regulations, raising the overall demand for certified protective apparel.

The report contains 29631 characters (including spaces and HTML tags).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager