Well Tanks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434370 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Well Tanks Market Size

The Well Tanks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 2.9 Billion by the end of the forecast period in 2033.

Well Tanks Market introduction

The Well Tanks Market, comprising pressure vessels designed to store water under pressure for private well systems, plays a critical role in optimizing water pump efficiency and ensuring consistent water supply. These tanks are essential components in rural and decentralized water infrastructure globally, providing hydraulic storage that prevents the well pump from cycling too frequently, thereby extending its lifespan and reducing energy consumption. The core function of a well tank is to absorb pressure fluctuations and maintain a steady flow of water to fixtures, making them indispensable for residential, agricultural, and certain commercial applications reliant on groundwater sources. This market encompasses a range of product types, including traditional air-over-water tanks, and more modern, technically sophisticated diaphragm and bladder tanks, each offering varying levels of efficiency, durability, and cost.

Well tanks are primarily categorized by their construction type, including diaphragm, bladder, and traditional air-over-water (galvanized) tanks, with modern bladder and diaphragm variants dominating due to superior performance characteristics such as minimal maintenance and robust separation of water from air to prevent waterlogging. Major applications span single-family homes, farms utilizing irrigation systems, remote industrial facilities needing independent water supplies, and small community water schemes. The market growth is fundamentally driven by the continuous need for reliable water infrastructure development, particularly in regions experiencing rapid suburbanization or expanding agricultural activities that rely on boreholes and private wells for sustainable water sourcing. Furthermore, regulatory environments increasingly favoring water system efficiency and safety standards are compelling product innovation, especially concerning materials that contact potable water, such as certifications against NSF/ANSI standards.

Key benefits derived from well tank utilization include enhanced system longevity for the entire well pump assembly due to reduced wear and tear from frequent starts, significant energy savings due to optimized pump cycling, and the provision of a stable pressure buffer that minimizes water hammer effects and optimizes water delivery pressure. Driving factors sustaining market momentum include stringent regulations regarding water quality and conservation, the growing global population requiring reliable potable water sources outside municipal networks, and the high replacement cycle demand stemming from the large installed base of older, less efficient well systems across developed economies. Technological advancements leading to corrosion-resistant materials, specifically composite fiberglass and specialized internal coatings, alongside smart tank monitoring systems, are crucially boosting adoption rates and expanding the market's total addressable volume by offering superior reliability and lower long-term operating costs.

Well Tanks Market Executive Summary

The Well Tanks Market demonstrates robust resilience driven primarily by infrastructure renewal, the expansion of decentralized water systems, and consistent demand from the essential residential and agricultural sectors. Current business trends indicate a strong, accelerating shift toward advanced composite and fiberglass tanks. These modern materials offer superior corrosion resistance, extended product longevity, and reduced installation labor due to lighter weight, appealing directly to end-users seeking reduced lifecycle costs and higher system reliability. Market structure is characterized by moderate consolidation among major international manufacturers, such as Pentair, Amtrol, and Xylem, who leverage strategic acquisitions and robust distribution networks to maintain dominance. A crucial emerging trend is the integration of digital monitoring solutions, positioning well tanks as nodes within smart water management ecosystems, thereby enhancing predictive maintenance capabilities and overall system efficiency, particularly in high-value installations.

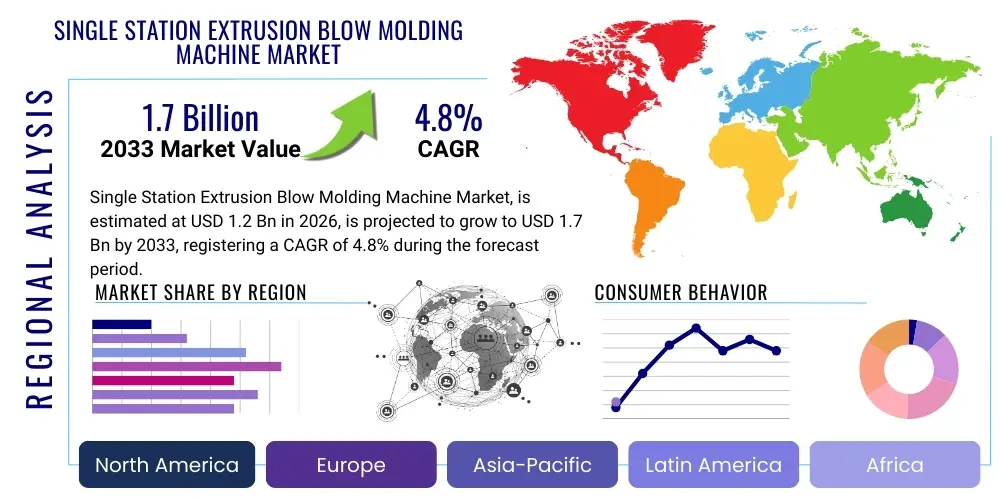

Regionally, North America continues to hold the largest market share, attributable to the extensive installed base of private well systems, high consumer awareness regarding necessary maintenance and replacement schedules, and stringent governmental standards mandating safe and efficient water systems. This region remains the primary incubator for high-end, IoT-enabled tank solutions. Conversely, the Asia Pacific region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR), fueled by demographic shifts, rapid urbanization pressing the limits of centralized infrastructure, and substantial investment in agricultural infrastructure, particularly irrigation systems, across countries like China, India, and Southeast Asian nations. European markets are mature but stable, characterized by intense competition focused on product efficiency, environmental certification, and compliance with the Pressure Equipment Directive (PED), favoring manufacturers with strong adherence to quality and long-term performance guarantees.

Segmentation analysis clearly highlights the dominance and ongoing preference for Bladder and Diaphragm Tanks over the older Air-Over-Water models, a trend propelled by the inherent reliability and low maintenance requirements of the former. The residential sector firmly remains the primary revenue contributor, driven both by new housing developments in suburban and rural settings and by the mandatory replacement of millions of aging tanks globally. Within the capacity segment, the demand for medium-sized tanks (20 to 80 gallons) is consistently high, striking an optimal balance between adequate storage for typical households and farms and practical installation requirements. Strategic imperatives for market players include sustained investment in material science research and development to further enhance tank resistance to varying water chemistries and leveraging digital platforms to offer value-added services like remote system monitoring and optimized maintenance scheduling, thereby building customer loyalty and higher service margins.

AI Impact Analysis on Well Tanks Market

The analysis of common user questions reveals a significant interest in how Artificial Intelligence (AI) and Machine Learning (ML) can introduce intelligence and automation into traditionally analog well water systems. Users frequently inquire about leveraging data analytics from smart sensors to prevent system failures, specifically asking whether AI can detect subtle signs of waterlogging, pump degradation, or impending bladder failure—issues that historically required manual inspection and reactive repairs. The consensus expectation is that AI will shift the focus of well tank maintenance from reactive troubleshooting to highly accurate predictive maintenance, significantly improving reliability and reducing costly emergency service calls. This transformation is highly attractive to end-users seeking 'set-it-and-forget-it' reliability and operational transparency regarding their critical water infrastructure. The adoption curve is expected to be steepest in regions with high labor costs and sophisticated smart home penetration, such as North America and Northern Europe.

AI's influence is also extending into the supply chain and manufacturing segments, providing tangible benefits that drive down overall product costs and increase quality. Manufacturers are investigating the use of AI for quality assurance, employing computer vision systems to inspect the structural integrity of welds, composite filament windings, and epoxy coatings during high-speed production. This implementation aims to significantly reduce manufacturing defects and ensure every tank meets stringent pressure ratings, thus enhancing brand reliability and minimizing costly warranty claims. From a distribution standpoint, AI-driven demand forecasting, informed by regional climate data, agricultural cycles, and housing start statistics, is enabling wholesalers and distributors to optimize inventory levels, minimizing storage costs while ensuring product availability during peak replacement seasons, which is crucial for maximizing operational efficiency and reducing stockouts across the complex distribution channel.

- AI-Powered Predictive Maintenance: Machine learning algorithms analyze continuous sensor data streams (pressure, flow rate, temperature, vibration) to identify anomalies and predict impending tank failures (e.g., diaphragm rupture, waterlogging) days or weeks in advance, enabling scheduled, cost-effective maintenance and minimizing system downtime.

- Optimized Pump Control: AI systems dynamically adjust the pressure switch set points and pump run times based on learned household or agricultural consumption patterns, maximizing the time between cycles and achieving significant energy savings by minimizing high-draw startup events.

- Automated System Diagnostics: AI integration facilitates instantaneous remote diagnostics and self-correction protocols, accurately pinpointing the root cause of pressure loss, pump short-cycling, or unusual usage, streamlining service calls and significantly reducing technician time required on site for troubleshooting.

- Smart Inventory Management and Logistics: AI tools integrate macroeconomic data (e.g., construction forecasts, lumber prices) and local environmental data (e.g., drought severity) to generate precise regional demand forecasts, optimizing distributor inventory holding costs and ensuring highly efficient, just-in-time delivery.

- Enhanced Manufacturing Quality Control: Utilizing computer vision and AI inspection systems during the manufacturing process ensures superior quality assurance of tank material, internal coatings, welding seams, and pressure ratings, leading to near-zero defect rates in production and greater overall product reliability under warranty.

DRO & Impact Forces Of Well Tanks Market

The Well Tanks Market operates under significant external and internal pressures summarized by Drivers, Restraints, and Opportunities (DRO). Key Drivers include the irreplaceable function of well tanks in stabilizing private water systems, ensuring reliable, pressurized flow for consumption and use. The mandated and highly predictable replacement cycle (typically ranging from 7 to 15 years) for the vast installed base of existing tanks across mature markets like North America and Europe provides an underlying, non-cyclical revenue stream. Furthermore, the global imperative for developing decentralized, sustainable water solutions, particularly in rapidly developing and water-scarce regions where centralized infrastructure is lacking, contributes significantly to new market volume. The increasing adoption of high-efficiency agricultural irrigation, which requires large, reliable pressure boosting systems for optimal crop yield, continues to provide a robust demand base for high-capacity tanks. These factors ensure stable foundational demand, independent of major economic swings, as water access is a non-discretionary necessity for residential and agricultural operations.

Restraints currently challenging market expansion involve the high capital expenditure associated with switching to advanced composite and stainless steel tanks, making these premium solutions less accessible in price-sensitive emerging markets where cheaper, less durable alternatives often dominate procurement decisions. Additionally, the industry is vulnerable to significant volatility in the costs of key raw materials, especially steel, petrochemical resins (for composites and bladders), and specialized protective coating materials, which compress manufacturer margins and often necessitate unstable retail pricing. Another structural restraint is the ongoing expansion of municipal water grids into previously rural or suburban areas; while this benefits local communities, it simultaneously eliminates the need for new private well systems, thereby reducing the market's total addressable volume in highly urbanizing zones globally.

Opportunities for sustained growth are concentrated heavily in technological innovation and strategic geographic expansion. The most significant opportunity lies in the burgeoning IoT and AI integration space, allowing manufacturers to create differentiated, value-added products that offer real-time remote monitoring, proactive maintenance alerts, and seamless system management, thereby commanding premium pricing and shifting customer value perception from a simple tank to a smart water asset. Material science offers further avenues, focusing on developing lighter, stronger, and environmentally friendlier tanks (e.g., utilizing enhanced composite layering or advanced, long-life internal linings). Geographically, tapping into the vast, underserved markets in Southeast Asia, Africa, and Latin America through localized production, tailored product lines, or strategic distribution partnerships presents substantial avenues for long-term volume and revenue growth as these regions prioritize critical water infrastructure development.

Segmentation Analysis

A detailed segmentation analysis of the Well Tanks Market provides critical insights into consumer preferences, technological maturity, and areas of high growth potential necessary for strategic planning. Segmenting the market by Type (Bladder, Diaphragm, Air-Over-Water) confirms the industry's sustained, decades-long transition towards sealed, pre-pressurized tanks. Bladder and Diaphragm models dominate because they virtually eliminate the maintenance burden and corrosion issues associated with traditional air-over-water systems, reflecting a clear end-user preference for reliability and low lifecycle costs. This technological shift impacts both the new installation market and the multi-million unit replacement market, where upgrades are increasingly common.

The Capacity segment (Small, Medium, Large) is a direct proxy for application scale and end-user type. Residential housing, the largest volume contributor, predominantly utilizes medium capacity tanks (20 to 80 gallons), tailored to standard household water usage. Conversely, agriculture and industrial facilities, which require high flow rates and continuous supply, drive demand for the large capacity segment (above 80 gallons). Material analysis showcases the ongoing innovation battle between traditional, cost-effective epoxy-coated steel and technologically superior, corrosion-resistant composite materials. Regional differences persist, with North America leading composite adoption due to quality focus, while emerging markets remain sensitive to the higher initial cost of composite solutions, favoring budget-friendly steel variants.

- By Type:

- Bladder Tanks: Dominant in high-end, long-life applications, known for superior air-water separation and ease of membrane replacement; favoured for aggressive water chemistries.

- Diaphragm Tanks: Highly popular and cost-effective solution for standard residential installations; fixed membrane offers robust reliability but typically requires full tank replacement upon membrane failure.

- Air-Over-Water Tanks (Standard/Galvanized): Legacy technology, usage rapidly declining globally due to high maintenance needs, susceptibility to corrosion, and frequent waterlogging issues.

- By Capacity:

- Small Capacity (Up to 20 Gallons): Used for specialized applications like point-of-use systems, pressure booster staging, small cabins, or auxiliary systems.

- Medium Capacity (20 to 80 Gallons): The standard workhorse capacity, catering to the vast majority of single-family residential homes and small farm operations.

- Large Capacity (Above 80 Gallons): Essential for high-demand applications such as large industrial facilities, expansive agricultural irrigation systems, and community water supply schemes.

- By Material:

- Steel Tanks (Epoxy-coated): Most commercially common and cost-effective, relies on internal epoxy coating for corrosion protection; dominant in price-sensitive markets.

- Composite/Fiberglass Tanks: Premium segment, offering complete rust and corrosion resistance, significantly lighter weight, and superior structural integrity; increasingly popular in high-end markets.

- Stainless Steel Tanks: Niche market for applications demanding the highest levels of hygiene and corrosion resistance, often found in food processing, pharmaceutical, or highly acidic water environments.

- By End-User:

- Residential: Largest volume segment; driven by new home construction in non-municipal serviced areas and the continuous, cyclical replacement market.

- Commercial (e.g., Schools, Offices, Hospitality): Requires reliable, often medium to large capacity systems to handle high, fluctuating daily demand; focuses on durability and minimal downtime.

- Industrial (e.g., Manufacturing, Processing): Demands highly specialized, high-pressure rated, and ASME-certified tanks for process water, cooling, and boiler feed systems.

- Agriculture (e.g., Irrigation, Livestock): High-growth segment requiring robust, large capacity tanks to support the high flow rates and continuous operation needed for modern mechanized irrigation and extensive livestock watering systems.

Value Chain Analysis For Well Tanks Market

The Value Chain for the Well Tanks Market is characterized by a strong dependence on specialized raw material suppliers and a complex, multi-tiered distribution system linking manufacturers to installers. The upstream segment involves procurement of critical components: high-grade carbon steel sheets and heads, advanced polymer resins (epoxies, fiberglass filaments) for composite shells, and specialized elastomer compounds (butyl, EPDM) for internal membranes. Success at this stage relies heavily on securing stable, cost-effective supply contracts and ensuring all sourced materials meet strict potable water standards (NSF/ANSI 61). Raw material cost volatility, particularly in steel and oil-derived polymers, presents the biggest upstream challenge, necessitating sophisticated hedging and integrated procurement strategies by major tank manufacturers to maintain stable pricing in a competitive downstream environment.

The core manufacturing process is technologically intensive, requiring specialized equipment for hydroforming the shells, advanced robotic welding processes to ensure absolute pressure integrity, meticulous internal surface preparation, and the critical automated application of multi-layer protective coatings or the precise winding of composite fibers. Quality control is paramount; this stage involves rigorous hydrostatic testing, fatigue cycling, and structural integrity checks to guarantee tanks withstand continuous cycling and meet stringent industry safety certifications (e.g., ASME for pressure vessels, PED in Europe). Manufacturers, such as Xylem and Pentair, invest heavily in highly automated production lines and lean manufacturing principles to maintain consistency and efficiency, essential for competing on a global scale and producing millions of diverse units annually.

Downstream distribution is pivotal for market reach. Direct sales channels are rare and limited, typically reserved for Very Large Capacity Tanks sold directly to major industrial or municipal engineering contractors. The vast majority of residential and agricultural well tanks move through indirect channels. These include specialized plumbing and HVAC wholesalers who carry deep inventory and offer credit terms, supplying local professional contractors and well system installers. Retail channels, such as large home improvement stores, also play a critical role, particularly for smaller capacity, consumer-grade diaphragm tanks. Professional well drillers and plumbing contractors act as the crucial last mile, influencing over 80% of residential product selection through their expertise and installation recommendations, thereby connecting product features and long-term performance directly to end-user satisfaction and system longevity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 2.9 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pentair (including WellMate brand), Amtrol (Worthington Industries), Xylem Inc., Franklin Electric, Flexcon Industries, Wessels Company, Global Water Solutions Ltd. (GWS), Grundfos, Varem S.p.A., Zilmet S.p.A., Challenger Tanks, Water-Right Inc., Aqua-Pure, Caleffi S.p.A., Watts Water Technologies, Zioltek, Swan Group, Flow Control Equipment, Headwater Well Systems, Roth Pump Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Well Tanks Market Key Technology Landscape

The Well Tanks Market is undergoing continuous technological evolution primarily centered on material science, digital integration, and efficiency enhancements, moving away from rudimentary steel vessels towards high-performance, intelligent systems. Material innovation is critical; the shift to advanced composite tanks utilizing high-density polyethylene shells wrapped in continuous fiberglass filaments represents a major technological leap. This composite construction eliminates internal and external corrosion, significantly extending product longevity, reducing lifecycle maintenance, and making the tanks considerably lighter—a significant logistical advantage during installation. Furthermore, specialized internal coatings, such as FDA-approved epoxy linings and high-grade polymer membranes (butyl or EPDM), are technologically refined to prevent water-air absorption, thereby guaranteeing sustained draw-down capacity and optimal system performance throughout the tank's operational life, even with challenging or aggressive water chemistries.

In terms of hydraulic performance, modern technological advancements focus on optimizing the internal geometry of diaphragm and bladder tanks to maximize drawdown—the actual usable volume of water delivered between pump cycles—while often maintaining a more compact footprint than traditional tanks. Improved sealing technologies and proprietary air charge valves ensure the initial pre-charge pressure is maintained for longer periods, drastically reducing the frequency of system checks and manual air addition required by older tank designs. This focus on maximizing hydraulic and energy efficiency is critical, as a highly efficient tank directly correlates to fewer pump starts, which is the most energy-intensive and wear-inducing phase of a submersible pump’s operation, thereby enhancing the sustainability profile of the entire well system.

The most transformative area is the integration of Information Technology (IT) and operational technology (OT) through IoT connectivity. Modern, "smart" well tanks are now optionally equipped with integrated pressure transducers, advanced flow meters, and secure Wi-Fi modules. This digital overlay allows for real-time remote monitoring of critical parameters like pressure status, flow anomalies, water usage patterns, and pump run cycles. AI-enabled cloud platforms process this massive data stream to provide highly accurate predictive maintenance alerts (e.g., notifying the user or installer of short cycling due to impending waterlogging) and allow service providers to diagnose and often troubleshoot problems remotely. This technological convergence is positioning the well tank not just as a passive storage device, but as an active, managed component in a highly efficient, digitally overseen water supply system, commanding premium market prices and opening up lucrative recurring service revenue streams for leading manufacturers and their certified distribution partners.

Regional Highlights

Regional market behavior in the Well Tanks sector is highly differentiated based on market maturity, regulatory rigor, climatic conditions, and underlying infrastructural needs. North America, anchored by the substantial markets of the U.S. and Canada, maintains its position as the established leader in terms of market value. This is characterized by a vast, aging installed base of private and community wells, driving a robust, highly predictable replacement market. Demand here is strongly skewed toward premium, high-efficiency bladder and composite tanks, owing to high consumer willingness to pay for superior durability, reduced maintenance, and energy savings. The region's stringent regulatory landscape, demanding compliance with NSF/ANSI standards for potable water components, further necessitates high-quality manufacturing and material certification, favoring established global brands with advanced, certified product lines.

The Asia Pacific (APAC) region is experiencing a dynamic boom, projected to achieve the highest Compound Annual Growth Rate globally over the forecast period. This accelerated growth is primarily attributed to massive infrastructure investments in decentralized water solutions, necessitated by rapid urbanization and industrial expansion that centralized municipal systems cannot adequately support, particularly across large economies like India, China, and Indonesia. Furthermore, the immense expansion and modernization of commercial agriculture and high-volume irrigation systems are creating substantial, sustained demand for large-capacity, high-durability tanks. While price sensitivity remains a major factor, leading to robust volume demand for cost-effective steel tanks, the increasing awareness of water quality and the high cost of pump replacement is steadily driving up the adoption of higher-performance diaphragm and composite models in major metropolitan peripheries.

- North America (USA, Canada): Market leader by value; dominated by replacement demand; high adoption of premium composite and IoT-enabled tanks; driven by stringent quality standards (NSF/ANSI).

- Asia Pacific (China, India, Southeast Asia): Highest growth potential; rapid industrial and agricultural expansion; significant infrastructure investment driving volume; gradual shift towards higher-quality diaphragm and composite tanks.

- Europe (Germany, UK, Italy): Stable and highly regulated market; strong emphasis on energy efficiency, safety (PED compliance), and preference for durable, long-life materials like specialized steel and high-end composites.

- Latin America (Brazil, Mexico): Emerging market driven by decentralized residential development and large agricultural irrigation projects; characterized by high sensitivity to pricing but increasing demand for robust, reliable medium-capacity solutions.

- Middle East & Africa (MEA): Growth tied to overcoming acute water scarcity challenges; demand focuses on robust, corrosion-resistant tanks capable of operating reliably under severe temperature and environmental conditions; driven by utility and large-scale agricultural and housing projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Well Tanks Market.- Pentair (including WellMate brand)

- Amtrol (a subsidiary of Worthington Industries)

- Xylem Inc.

- Franklin Electric

- Flexcon Industries

- Wessels Company

- Global Water Solutions Ltd. (GWS)

- Grundfos (Integrated systems provider)

- Varem S.p.A.

- Zilmet S.p.A.

- Challenger Tanks

- Water-Right Inc.

- Aqua-Pure (a Cuno/3M brand)

- Caleffi S.p.A.

- Watts Water Technologies

- Zioltek

- Swan Group

- Flow Control Equipment

- Headwater Well Systems

- Roth Pump Company

Frequently Asked Questions

Analyze common user questions about the Well Tanks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the typical lifespan and replacement cost for a residential well pressure tank?

The lifespan of a modern diaphragm or bladder well tank typically ranges from 7 to 15 years, highly dependent on the quality of water, installation integrity, and usage frequency. Advanced composite tanks often reach the higher end of this range. Replacement costs, including the tank and professional installation labor, generally range between USD 400 and USD 1,800 for standard residential models, with pricing varying based on capacity, material choice, and regional labor rates.

How do diaphragm and bladder well tanks differ in operation and maintenance?

Both utilize a synthetic membrane to isolate air and water, preventing waterlogging. The key operational difference is in membrane mobility: Diaphragm tanks have a fixed membrane welded to the shell, while bladder tanks use a replaceable, free-floating bladder. Bladder tanks are often preferred for highly corrosive water or where component replacement rather than full tank replacement is desired, offering superior separation reliability.

What causes a well pressure tank to become 'waterlogged,' and how is this prevented?

Waterlogging occurs when the air cushion inside the tank is gradually absorbed into the well water, leading to a loss of the pressure buffer. This causes the well pump to rapidly cycle (short cycling), leading to pump motor overheating and failure. It is prevented by exclusively using modern diaphragm or bladder tanks, which physically isolate the air charge from the water using a membrane, ensuring sustained pre-charge pressure without manual intervention.

What is the significance of NSF 61 certification for well tanks?

NSF/ANSI Standard 61 is critical as it certifies that the materials used in the construction of the well tank—specifically the internal coatings, bladders, and diaphragms that contact potable water—do not leach harmful contaminants (like lead or heavy metals) into the drinking supply. Compliance is mandatory in many global jurisdictions, ensuring consumer health safety and product reliability for water systems.

How is tank sizing crucial for maximizing pump lifespan and energy efficiency?

Proper sizing determines the adequate 'drawdown' capacity—the usable volume of water delivered before the pump reactivates. A correctly sized tank maximizes the time the pump remains off and minimizes the number of starts and stops per hour. Minimizing these high-current startup cycles is essential for reducing thermal stress on the pump motor, directly extending its lifespan and achieving significant electricity savings over the system's operational period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager