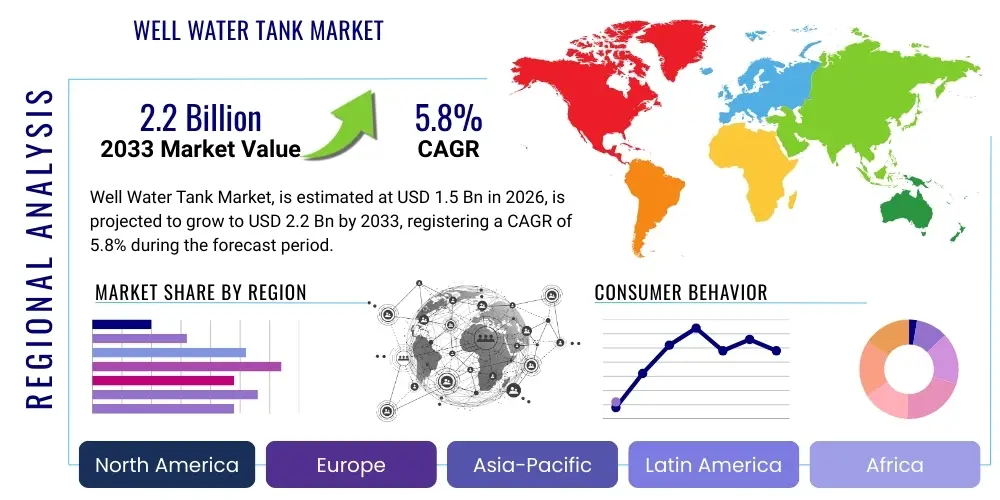

Well Water Tank Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437221 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Well Water Tank Market Size

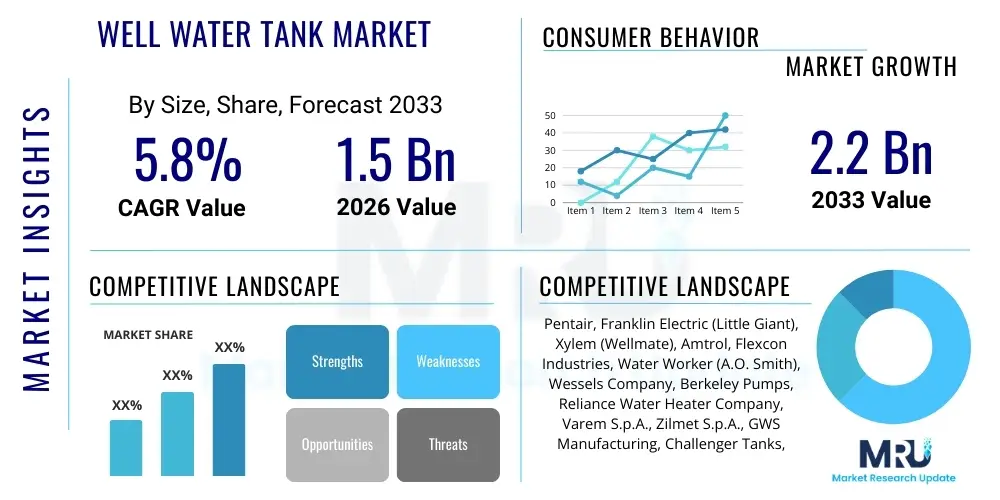

The Well Water Tank Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by the continued reliance on decentralized water systems in rural and suburban areas globally, coupled with a necessary increase in replacement cycles for aging infrastructure.

Well Water Tank Market introduction

The Well Water Tank Market encompasses the manufacturing, distribution, and maintenance of various types of tanks designed to store and manage water drawn from private wells. These tanks, primarily categorized as pressure tanks and atmospheric storage tanks, are crucial components of well water systems, serving the dual function of ensuring consistent water pressure for household and agricultural use and protecting the well pump from excessive cycling. Pressure tanks, which typically use compressed air or a diaphragm/bladder system, maintain system pressure within a specified range, drastically reducing wear and tear on the well pump and ensuring reliable flow rates across multiple fixtures simultaneously. This market serves a wide array of sectors including residential properties, agricultural operations, small commercial enterprises, and off-grid facilities that depend on groundwater sources.

Major applications for well water tanks include residential water supply, where they stabilize pressure for daily activities like showering and appliance use, and irrigation systems in agriculture, where large atmospheric tanks often provide bulk storage necessary for high-demand periods. The primary driving factors supporting market expansion are the persistent urbanization trends leading to expansion into areas lacking municipal water infrastructure, the increasing global population requiring reliable access to clean water, and the stringent health and safety regulations promoting the use of NSF/ANSI certified products. Furthermore, advancements in materials science, particularly the utilization of fiberglass and advanced steel coatings, are enhancing the longevity and performance of modern water tanks, thereby stimulating replacement demand and new installations.

The core benefits derived from integrating well water tanks include extended pump lifespan, energy efficiency through minimized pump starts, and the provision of a small reservoir of water during temporary power outages. The market is characterized by ongoing innovation focused on improving tank durability, efficiency, and system integration. Specifically, the shift towards pre-charged pressure tanks utilizing bladders or diaphragms has significantly reduced maintenance requirements compared to older, traditional air-over-water tanks, further solidifying the necessity of these products in decentralized water management systems worldwide.

Well Water Tank Market Executive Summary

The Well Water Tank Market is currently undergoing a structural transformation driven by sustainability requirements and digital integration. Key business trends indicate a strong preference among consumers and installers for composite and fiberglass tanks over traditional steel, primarily due to superior corrosion resistance and reduced weight, simplifying installation. Manufacturers are heavily investing in automation and lean production methodologies to meet growing demand while controlling material costs, a crucial factor given the volatility of steel prices. Furthermore, the market is experiencing consolidation, with leading players acquiring smaller specialized firms to expand their product portfolios, especially in the smart water management and IoT-enabled tank segments, catering to a niche but rapidly growing demand for remote monitoring capabilities.

Regional trends reveal that the Asia Pacific (APAC) region is poised for the fastest growth, propelled by significant governmental investment in rural infrastructure development, rapid residential construction, and the large-scale adoption of decentralized irrigation systems in countries like India and China. Conversely, North America and Europe, considered mature markets, demonstrate growth mainly through replacement demand and regulatory compliance, particularly related to stricter standards for pressure vessel safety and potable water contact materials. The North American market is specifically focused on high-efficiency pump systems paired with optimally sized pressure tanks to maximize energy savings and reduce homeowner operational costs. Environmental regulations concerning the safe disposal of older, corroded tanks also influence replacement cycles across developed economies.

In terms of segment trends, the Bladder and Diaphragm tank segments dominate the market share, attributed to their minimal maintenance needs and consistent performance compared to older Air-over-Water designs. Application-wise, the Residential segment remains the largest consumer, but the Agricultural segment is demonstrating accelerated growth due to increasing automation in farming and the critical need for reliable water supply for crop irrigation and livestock. Material innovation continues to be a central focus, with companies exploring advanced polymers and composites to offer lighter, stronger, and more durable solutions that offer higher resistance to aggressive water chemistries, thereby addressing common causes of premature tank failure.

AI Impact Analysis on Well Water Tank Market

User queries regarding the impact of AI on the Well Water Tank Market primarily revolve around predictive maintenance, optimization of system efficiency, and integration within broader smart home/smart agriculture ecosystems. Users are keen to understand how AI algorithms can leverage data from integrated sensors (pressure, flow, temperature) to anticipate tank or pump failure, thereby preventing costly downtimes. Concerns also center on how AI can dynamically adjust pump cycles and pressure settings based on real-time water usage patterns or predicted irrigation needs, maximizing energy savings and extending the lifespan of the entire well system. The integration of AI facilitates a shift from reactive repair strategies to highly proactive, data-driven system management, fundamentally altering the service and maintenance landscape for well water infrastructure.

- AI enables predictive maintenance by analyzing pressure fluctuations and pump run-time data, forecasting potential bladder breaches or pump malfunctions.

- Optimized sizing and selection algorithms use household consumption data to recommend the most energy-efficient tank capacity and type for new installations.

- Smart well systems utilize machine learning to dynamically manage pump cycling and variable frequency drives (VFDs), ensuring optimal energy consumption during peak and off-peak demand.

- AI assists in inventory management and supply chain logistics for manufacturers, optimizing production schedules based on regional infrastructure replacement cycles and material availability forecasts.

- Diagnostic platforms powered by AI streamline technical support, allowing installers to rapidly diagnose complex pressure issues remotely based on real-time sensor inputs.

DRO & Impact Forces Of Well Water Tank Market

The Well Water Tank Market is primarily driven by the expansion of residential development into suburban and rural areas lacking centralized utility access and the critical need to replace existing, aging galvanized steel tanks susceptible to internal corrosion and failure. Restraints include the high initial capital investment required for well drilling and system setup, which can deter some potential users, and the ongoing complexity of maintenance required for older air-over-water tank designs. Significant opportunities are emerging from the push toward smart water solutions, integrating IoT sensors into tanks for remote monitoring, and the growing demand for durable, non-corrosive materials like fiberglass and advanced composites. The market dynamics are heavily influenced by the impact forces of material cost volatility (particularly steel and plastic resins), stringent regulatory standards governing potable water contact (NSF/ANSI 61 certification), and the constant need for energy efficiency improvements in pumping systems, which directly necessitate optimized tank performance.

The core drivers sustaining market momentum include the inherent reliability of well water systems during natural disasters or municipal infrastructure failures, providing water security to homeowners and businesses. Furthermore, government subsidies and incentives promoting decentralized agricultural irrigation in developing nations are significantly boosting demand for large-capacity storage tanks. The necessity of maintaining consistent water pressure in modern homes with high-flow fixtures (e.g., multi-head showers, complex filtration systems) also mandates the installation of appropriately sized and high-performance pressure tanks. The continuous degradation of infrastructure installed decades ago in developed economies guarantees a steady pipeline of replacement projects, offering reliable revenue streams for manufacturers and service providers.

However, the market faces significant restraints. Fluctuations in the global price of raw materials, particularly steel plate and polypropylene/butyl rubber used in bladders, directly impact manufacturing costs and consumer pricing, potentially slowing adoption in price-sensitive markets. Additionally, the technical expertise required for correct tank sizing, installation, and pressure settings can be a barrier for general contractors, leading to potential system inefficiencies if not installed by certified professionals. Environmental concerns regarding the disposal of large, non-biodegradable composite tanks at the end of their lifespan also present a regulatory and logistical challenge that the industry is actively addressing through recycling initiatives and the development of more sustainable materials. These opposing forces dictate the pace and direction of technological innovation within the sector.

Segmentation Analysis

The Well Water Tank Market is highly segmented based on tank type, material, capacity, and application, reflecting the diverse requirements of end-users ranging from small residential homes to large-scale agricultural operations. The segmentation is crucial for understanding specific market dynamics, with technological differentiation occurring primarily within the ‘Type’ segment—distinguishing between maintenance-intensive traditional tanks and modern, low-maintenance pre-charged units. Material segments reflect the industry's shift toward corrosion resistance, while the application segments underscore the varying needs for pressure maintenance versus bulk storage across residential, commercial, and agricultural installations.

- By Type:

- Diaphragm Tanks

- Bladder Tanks (Replaceable and Non-Replaceable)

- Air-over-Water (Traditional) Tanks

- Atmospheric Storage Tanks

- By Material:

- Steel (Galvanized, Stainless Steel, Epoxy-Coated)

- Fiberglass/Composite

- Plastic (Polyethylene, Polypropylene)

- By Capacity:

- Small (Under 20 Gallons)

- Medium (20 – 80 Gallons)

- Large (Above 80 Gallons)

- By Application:

- Residential

- Commercial (e.g., Offices, Small Hotels, Restaurants)

- Agricultural (Irrigation and Livestock)

- Industrial/Municipal Backup

Value Chain Analysis For Well Water Tank Market

The Value Chain for the Well Water Tank Market begins with the upstream procurement of essential raw materials, primarily high-grade steel sheets, composite resins (for fiberglass shells), and specialized rubber compounds (butyl rubber or EPDM) for bladders and diaphragms. Upstream activities are critical as material quality directly dictates tank longevity and compliance with potable water safety standards. Suppliers often need to adhere to rigorous quality controls, including specific coating requirements (e.g., epoxy lining) to prevent corrosion. Volatility in commodity prices, especially steel, significantly impacts manufacturing costs, requiring manufacturers to maintain optimized inventory management and strong relationships with specialized material providers to ensure supply consistency and quality assurance.

The midstream phase involves the manufacturing and assembly process. This stage is capital-intensive, requiring specialized machinery for welding, stamping, coating application, and pressure testing. Manufacturers are increasingly adopting automated processes to enhance consistency and volume, particularly in the production of diaphragm and bladder tanks, which require precise internal components assembly. Key activities include shell fabrication, internal lining application, installation of the air-charge valve, and rigorous quality control checks, including burst pressure testing and compliance verification against international standards like ASME and CE marking. Differentiation in this stage is achieved through proprietary coatings and patented bladder designs aimed at maximizing draw-down capacity and minimizing maintenance.

Downstream analysis focuses on distribution and installation. The distribution channel is predominantly indirect, relying heavily on a network of wholesale distributors, plumbing supply houses, and specialized well system installers. Direct sales channels are less common but exist for very large industrial or municipal backup tanks sold directly to engineering procurement and construction (EPC) firms. Installers and well drillers act as the primary decision-makers influencing product choice at the end-user level, favoring brands known for reliability and ease of installation. Aftermarket services, including routine maintenance, pressure adjustments, and replacement of internal components (bladders/diaphragms), constitute a significant part of the downstream revenue stream. Effective distribution logistics, ensuring tanks are available in rural and remote installation locations, are paramount to market success.

Well Water Tank Market Potential Customers

Potential customers for well water tanks span a diverse range of end-users who rely on private or decentralized water sources for their operations. The largest segment remains residential homeowners situated outside municipal water boundaries, particularly those in newly developed suburban or entirely rural locations. These buyers seek reliable, low-maintenance pressure tanks that ensure constant water flow and protect their expensive well pumps from premature failure caused by short cycling. Decision-making for this group is heavily influenced by longevity, warranty duration, and installer recommendations, often prioritizing pre-charged bladder tanks for convenience and performance.

The second major customer group is the Agricultural sector, encompassing farms ranging from small family operations to large industrial crop and livestock producers. These customers require high-capacity atmospheric storage tanks for irrigation reservoirs and bulk water storage, in addition to robust pressure tanks for utility buildings and livestock watering systems. Their needs prioritize volume, durability, and resistance to environmental factors, often demanding specialized tanks that can handle high flow rates over extended periods. Purchasing decisions are frequently driven by total cost of ownership (TCO) and compatibility with existing irrigation pumps and water treatment systems.

Further potential customers include commercial establishments located in rural areas, such as campgrounds, remote resorts, restaurants, and small manufacturing facilities, which require reliable water access but often use standard residential-grade pressure tanks or slightly larger intermediate commercial tanks. Lastly, industrial and governmental entities utilize well water tanks for specialized applications like fire suppression reserves, emergency backup systems, and remote monitoring stations. These buyers demand highly specialized, certified tanks (often ASME stamped) and prioritize safety compliance, extended warranties, and detailed technical support from the manufacturer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pentair, Franklin Electric (Little Giant), Xylem (Wellmate), Amtrol, Flexcon Industries, Water Worker (A.O. Smith), Wessels Company, Berkeley Pumps, Reliance Water Heater Company, Varem S.p.A., Zilmet S.p.A., GWS Manufacturing, Challenger Tanks, Watts Water Technologies, Roth Industries, GRUNDFOS, Aqua-Pure, SHURflo, Dab Pumps, Wilo Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Well Water Tank Market Key Technology Landscape

The technology landscape in the Well Water Tank Market is continuously evolving, moving beyond simple static pressure vessels towards integrated, high-efficiency components. A major area of technological focus is advanced corrosion resistance. For steel tanks, this involves proprietary internal epoxy or poly-lining techniques applied using electrostatically charged processes to ensure complete, uniform coverage, thereby eliminating weak points where rust initiates. For external protection, multi-layered powder coatings and UV-resistant paints are standard. This emphasis on internal and external defense aims to significantly extend the operational life of steel tanks, which historically suffered from failure due to rust ingress, particularly in areas with corrosive groundwater chemistry.

A second critical technological pillar is the utilization of composite materials, particularly fiberglass (often branded as "Wellmate" style tanks). These tanks offer inherent corrosion resistance, eliminating the failure point associated with metal shell breakdown. Furthermore, composite tanks are significantly lighter than steel counterparts, simplifying handling and installation, reducing freight costs, and requiring less specialized equipment for placement. Manufacturers are continually refining the filament winding techniques and resin formulations used in composite tank production to enhance structural integrity and withstand higher operating pressures, making them suitable for demanding industrial and high-flow residential applications.

The third and increasingly dominant technological trend involves digital integration and smart functionality. Modern well water systems are now often paired with variable frequency drives (VFDs) that regulate pump speed based on demand, necessitating tanks compatible with dynamic pressure environments. Beyond VFD compatibility, many new tanks are designed to integrate seamlessly with IoT sensors (e.g., pressure transducers, flow meters, water level indicators). These sensors facilitate real-time monitoring of tank performance and water system health, allowing homeowners and service professionals to receive alerts regarding low pressure, excessive pump cycling, or potential leaks via dedicated mobile applications, thereby facilitating proactive, condition-based maintenance strategies and enhancing overall system efficiency and reliability.

Regional Highlights

Regional variations in the Well Water Tank Market are profound, reflecting differing infrastructure maturity, regulatory environments, and rates of urbanization. North America, comprising the United States and Canada, represents a mature market characterized by high-quality standards and a dominant focus on replacement infrastructure. The U.S. market, specifically, demands high-performance bladder and diaphragm tanks compliant with NSF/ANSI standards for potable water. Growth here is steady, driven by the sustained trend of development in exurban areas and the ongoing need to replace galvanized tanks installed decades ago. The adoption rate of smart well systems, featuring VFDs and remote tank monitoring, is highest in this region, driven by consumer demand for efficiency and convenience.

The Asia Pacific (APAC) region is forecasted to exhibit the highest Compound Annual Growth Rate (CAGR) due to rapid population growth, substantial government investment in rural agricultural infrastructure, and expansive residential construction outside established municipal networks. Countries such as India, China, and Southeast Asian nations are undergoing mass transitions from basic water collection methods to mechanized well systems, necessitating large volumes of both pressure and atmospheric storage tanks. However, this region often sees a preference for lower initial cost solutions, leading to strong demand for standard steel tanks, although awareness and adoption of composite materials are gradually increasing in higher-income segments.

Europe presents a diverse market, dominated by strict regulatory requirements regarding product safety, energy efficiency, and environmental compliance (e.g., REACH regulations). Western European countries prioritize high-efficiency, long-lasting products, favoring high-end steel tanks with premium coatings and composite materials. Replacement cycles are governed by comprehensive legal standards. Conversely, Eastern European nations show strong growth fueled by the modernization of agricultural practices and residential development in previously underserved regions. Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is highly correlated with private investment in mining, oil and gas exploration (requiring remote water solutions), and localized efforts to address severe water scarcity through groundwater extraction.

- North America: Market maturity focused on high-specification replacement and high adoption of smart, VFD-compatible pressure tanks; stringent quality certification (NSF/ANSI).

- Asia Pacific (APAC): Highest growth potential driven by urbanization, massive agricultural water needs, and rural infrastructure development; strong demand for both large storage and standard pressure vessels.

- Europe: Growth driven by strict environmental and safety regulations; emphasis on energy efficiency and premium, long-lasting materials; significant replacement demand in Western economies.

- Latin America: Emerging market growth tied to residential expansion and industrial projects in regions with limited public utilities; price sensitivity often dictates material choices.

- Middle East & Africa (MEA): Growth centered around tackling water scarcity, reliance on deep borewells, and demand from remote construction and resource extraction camps; durability in extreme temperatures is a key requirement.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Well Water Tank Market.- Pentair

- Franklin Electric (Little Giant)

- Xylem (Wellmate)

- Amtrol

- Flexcon Industries

- Water Worker (A.O. Smith)

- Wessels Company

- Berkeley Pumps

- Reliance Water Heater Company

- Varem S.p.A.

- Zilmet S.p.A.

- GWS Manufacturing

- Challenger Tanks

- Watts Water Technologies

- Roth Industries

- GRUNDFOS

- Aqua-Pure

- SHURflo

- Dab Pumps

- Wilo Group

Frequently Asked Questions

Analyze common user questions about the Well Water Tank market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between bladder and diaphragm well water tanks?

Bladder tanks enclose the water in a removable rubber bladder, separating it completely from the tank shell and pressurized air, which maximizes draw-down volume. Diaphragm tanks use a fixed diaphragm to separate water and air, generally offering simpler design but potentially smaller draw-down capacity for the same physical size. Both types significantly reduce water logging compared to older air-over-water tanks.

How often should a well water pressure tank be replaced?

A modern, well-maintained bladder or diaphragm tank typically lasts between 10 to 15 years. Replacement frequency depends heavily on water chemistry, quality of installation, and consistency of pressure maintenance. Premature failure, indicated by constant pump cycling (short cycling), often signals a failed bladder or loss of air charge, necessitating immediate repair or replacement.

What material is recommended for corrosive well water environments?

For highly corrosive environments or water with low pH/high mineral content, fiberglass or composite tanks are strongly recommended. These materials offer superior internal resistance to rust and oxidation compared to standard epoxy-lined steel tanks, ensuring longer lifespan and preventing potential contamination from flaking rust.

What role does the well tank play in pump protection?

The well water tank is essential for pump protection as it provides a reservoir of pressurized water. This reservoir prevents the well pump from starting and stopping constantly (short cycling) every time a small amount of water is used, drastically reducing electrical and mechanical wear and tear, and extending the pump's operational lifespan and energy efficiency.

Is integrating smart technology into a well tank system worthwhile?

Yes, smart technology integration, often via IoT sensors, is highly worthwhile. It allows for continuous remote monitoring of system pressure and flow, enabling predictive maintenance alerts that notify users of potential issues like leaks or loss of air charge before they lead to system failure or excessive pump damage, optimizing performance and reducing emergency repair costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager