Wellness and Mental Health Apps Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432291 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Wellness and Mental Health Apps Market Size

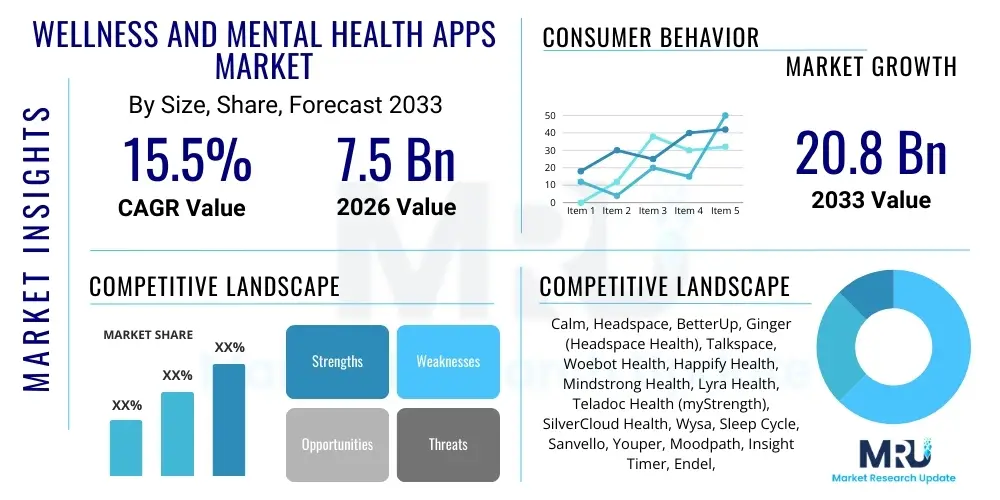

The Wellness and Mental Health Apps Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 7.5 Billion in 2026 and is projected to reach USD 20.8 Billion by the end of the forecast period in 2033.

Wellness and Mental Health Apps Market introduction

The Wellness and Mental Health Apps Market encompasses mobile applications and digital platforms designed to support users in managing their emotional, psychological, and overall well-being. These tools leverage technology, including artificial intelligence and biometric data, to offer personalized services such as guided meditation, sleep tracking, cognitive behavioral therapy (CBT) programs, mood monitoring, and virtual coaching. The core product category includes specialized apps for stress reduction, mindfulness practice, anxiety management, depression support, and addiction recovery, transitioning the delivery of mental health services from strictly clinical settings to accessible, on-demand digital environments. These platforms often serve as supplementary resources or primary intervention tools, depending on the severity of user needs and regulatory approval. The increasing recognition of mental health parity in healthcare systems worldwide significantly fuels the demand for these accessible solutions.

Major applications for these apps span across consumer, enterprise, and clinical settings. Consumers utilize them for personal development, stress reduction, and improving sleep quality, integrating mental fitness into their daily routines. Enterprises increasingly adopt these platforms as part of employee wellness programs, aiming to reduce absenteeism, improve productivity, and enhance overall workforce morale, recognizing the direct link between mental well-being and corporate performance. Clinicians and healthcare providers use these apps for remote patient monitoring, offering digital therapeutic interventions, and gathering real-world evidence (RWE) to supplement traditional therapy, thereby expanding the reach and continuity of care beyond physical office visits. The widespread adoption of smartphones and the increasing acceptance of digital health solutions across all demographics further solidify the market's robust growth trajectory.

The market growth is primarily driven by the escalating global prevalence of mental health disorders, including anxiety and depression, exacerbated by societal pressures and recent global health crises. Additionally, the diminishing stigma associated with seeking psychological help, particularly among younger populations, encourages the adoption of discrete and convenient digital tools. Benefits derived from these applications include immediate accessibility, cost-effectiveness compared to traditional therapy, and personalization capabilities enabled by advanced algorithms. Furthermore, technological advancements, such as the seamless integration with wearables and sophisticated machine learning models that can predict mood shifts or potential crises, continuously enhance the efficacy and user engagement of these digital wellness solutions.

Wellness and Mental Health Apps Market Executive Summary

The Wellness and Mental Health Apps Market is experiencing dynamic shifts, characterized by robust investment in clinical validation and the integration of sophisticated AI for personalization, positioning the sector as a critical component of preventative healthcare. Business trends highlight a movement toward subscription-based, premium models that offer deeper content and personalized coaching, moving away from simple ad-supported free versions. Strategic partnerships between technology developers and large healthcare systems or insurers are increasing, aimed at validating efficacy and securing reimbursement coverage, thereby establishing these apps as credible medical devices. Mergers and acquisitions are frequent, as established players seek to consolidate specialized technologies, particularly those focusing on regulated digital therapeutics (DTx) that require FDA or equivalent approval, signaling a maturity and formalization of the digital mental health ecosystem.

Regional trends indicate North America currently dominates the market, driven by high consumer awareness, favorable reimbursement policies, and a strong presence of key technology developers and venture capital funding. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by massive population bases, increasing access to high-speed internet, and governments in countries like India and China actively promoting digital health initiatives to address significant mental healthcare deficits. Europe demonstrates steady growth, highly influenced by regulatory environments such as GDPR, which mandates strict data privacy, shaping the operational frameworks for app developers, focusing on secure and compliant user experiences, especially within public health systems like the NHS.

Segmentation trends reveal that the 'Meditation and Mindfulness' segment, while mature, continues to hold a substantial market share, acting as a gateway for new users. The most rapid growth is observed in the 'Digital Therapeutics' and 'Mood Monitoring/Tracking' segments, which are leveraging advanced data analytics to provide clinically relevant interventions. Demand for apps focused on specific populations, such as corporate wellness tools or programs tailored for adolescent mental health, is also accelerating. Furthermore, the shift from pure consumer-focused apps to those integrated directly into clinical workflows, offering verifiable outcomes and real-time data sharing with healthcare providers, represents a significant structural change in the market dynamics, emphasizing efficacy and integration over sheer volume of content.

AI Impact Analysis on Wellness and Mental Health Apps Market

Analysis of common user questions related to the impact of AI in the Wellness and Mental Health Apps Market reveals significant user interest and simultaneous concern revolving around personalization, privacy, and clinical efficacy. Users frequently ask if AI-driven chatbots are truly empathetic, how their highly sensitive mood data is protected, and whether an AI coach can replace a human therapist. The consensus theme centers on achieving a balance: users expect AI to deliver highly tailored content, personalized coping mechanisms, and proactive crisis alerts, leading to better outcomes than generic apps. However, a major concern is the ethical deployment of AI, particularly regarding algorithmic bias, data misuse, and the potential for over-reliance on technology for deeply personal and clinical needs. Users are looking for transparency regarding how AI models are trained and validated to ensure the recommendations are safe and clinically appropriate, emphasizing that AI should augment, not replace, human connection and professional judgment in mental health care.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the delivery and capability of mental health apps. AI engines analyze vast amounts of user data, including journaling entries, biometric inputs from wearables (like heart rate variability and sleep patterns), and usage behavior, to create highly granular user profiles. This advanced profiling allows apps to deliver personalized interventions, ensuring that guided meditations or CBT modules are timed and customized to the user's specific state of mind, predicted stress levels, or historical adherence patterns. AI also powers natural language processing (NLP) in conversational interfaces, enabling therapeutic chatbots to offer support, triage symptoms, and maintain continuous engagement, significantly enhancing the scalability of emotional support without requiring constant human oversight.

The evolution of AI within this market is shifting the focus from simple engagement to verifiable clinical outcomes. Advanced AI models are now being used to predict the onset of depressive episodes or anxiety attacks based on subtle changes in speech patterns or typing speed, moving the field towards truly preventative mental healthcare. This predictive capability is vital for high-risk populations. Moreover, AI aids developers in managing the ethical complexities of mental health data, ensuring anonymization and adherence to privacy regulations like HIPAA and GDPR. The future success of these apps heavily relies on their ability to demonstrate that AI-driven interventions lead to statistically significant improvements in well-being metrics, fostering trust among consumers, clinicians, and regulatory bodies.

- AI enables deep personalization of therapeutic content and pacing for optimized engagement.

- Natural Language Processing (NLP) powers therapeutic chatbots, providing scalable, instantaneous emotional support and basic triage.

- Machine Learning (ML) algorithms analyze biometric and behavioral data to predict mood shifts and potential crisis events proactively.

- AI assists in the clinical validation process by identifying effective usage patterns and generating real-world evidence (RWE).

- Increased risk of algorithmic bias and data privacy breaches, driving demand for explainable AI (XAI) and stringent data governance.

- AI facilitates automated reporting and data sharing with human therapists, enhancing hybrid care models.

DRO & Impact Forces Of Wellness and Mental Health Apps Market

The dynamics of the Wellness and Mental Health Apps Market are shaped by powerful Drivers (D), significant Restraints (R), and compelling Opportunities (O), which collectively generate critical Impact Forces on market growth and direction. The core driver is the increasing global prevalence of stress, anxiety, and other mental disorders coupled with the severe shortage of licensed mental health professionals, creating a clear supply-demand gap that digital solutions are perfectly positioned to fill. Restraints primarily revolve around regulatory uncertainty, particularly concerning data privacy and the clinical validation required for digital therapeutics to be accepted and reimbursed by established healthcare systems. Opportunities are vast, centered on leveraging AI, integrating with enterprise wellness programs, and expanding into underserved regions like APAC and Latin America, where basic access to psychological support is critically low. The resulting impact forces push the market toward higher clinical rigor, greater data security standardization, and a necessary integration with traditional healthcare channels to ensure credibility and long-term sustainability.

Drivers: A primary driver is the widespread consumerization of health, catalyzed by the ubiquitous ownership of mobile devices and the normalization of tracking personal data, including emotional and physiological states. Furthermore, the COVID-19 pandemic acted as a major accelerator, pushing mental health concerns into the public spotlight and forcing rapid adoption of remote care solutions across all demographics. Corporate interest in employee mental resilience, driven by evidence linking psychological distress to decreased productivity and higher healthcare costs, has also become a significant factor, leading to large-scale B2B contracts for mental wellness platforms. Technological advancement in sensor accuracy, coupled with improved battery life and processing power in smartphones, enables more nuanced and effective biometric tracking within these applications, enhancing their clinical relevance and user value proposition.

Restraints: The market faces several critical restraints, most notably the challenge of demonstrating clinical efficacy compared to traditional, in-person therapy. Many consumer-grade apps lack rigorous scientific validation, leading to skepticism among clinicians and payers. Data security and privacy are perpetual concerns, as these apps handle highly sensitive personal health information (PHI); breaches can severely erode user trust and lead to regulatory penalties, particularly under stringent frameworks like HIPAA in the US or GDPR in Europe. Another significant hurdle is user attrition; maintaining long-term engagement remains difficult, as motivation often wanes after initial use, leading to high churn rates and affecting the continuity of care necessary for therapeutic outcomes. Finally, the fragmented regulatory landscape complicates international expansion, requiring customized validation and compliance strategies for different national markets.

Opportunities: Opportunities abound in the development of sophisticated digital therapeutics (DTx) that gain formal regulatory approval (e.g., FDA clearance) to treat specific conditions like insomnia, PTSD, or chronic pain, positioning them for insurance reimbursement and clinical acceptance. The expansion of offerings into hybrid care models, seamlessly blending digital self-help with access to human coaching or licensed therapists via telehealth features, represents a lucrative avenue. Additionally, penetrating specialized markets, such as offering apps tailored for specific chronic conditions (e.g., diabetes management with integrated depression screening) or military veteran support, allows for targeted marketing and maximized therapeutic impact. Leveraging interoperability standards to integrate app data directly into Electronic Health Records (EHRs) is a critical opportunity to make these platforms an essential part of the broader healthcare ecosystem.

Segmentation Analysis

The Wellness and Mental Health Apps Market is meticulously segmented based on key functional attributes, application type, subscription models, and age demographics, reflecting the diversity of user needs and delivery mechanisms. Segmentation provides a critical framework for understanding market demand, enabling developers to target specific pain points—from generalized stress relief through mindfulness to clinical interventions requiring professional oversight. The growth of specialized segments, such as those focusing on regulated digital therapeutics, indicates a market evolution from general wellness tools towards clinically validated healthcare solutions, attracting significant investment and scrutiny regarding efficacy and integration into established medical pathways.

Analyzing the market through segments based on deployment type, such as cloud-based versus on-premise (often within healthcare systems), reveals varying security and integration needs across enterprise and clinical customers. Furthermore, breaking down the market by end-user, covering large enterprises for B2B wellness programs, individual consumers, and clinical practices, helps pinpoint the most lucrative distribution channels. This granular view is essential for strategic planning, identifying areas where technological innovation and regulatory compliance can unlock new revenue streams, especially in underserved segments like geriatric mental health or tailored pediatric psychological support.

- By Operating System:

- iOS

- Android

- Other (e.g., Web-based, specialized platforms)

- By Application Type:

- Meditation and Mindfulness (Stress reduction, Sleep enhancement)

- Anxiety and Depression Management

- Mental Health Tracking and Monitoring (Mood tracking)

- Digital Therapeutics (DTx)

- Substance Abuse and Addiction Recovery

- By Subscription Model:

- Free (Freemium)

- Paid (Subscription)

- By Deployment Model:

- Cloud-based

- On-premise/Hybrid

- By End-User:

- Consumers

- Healthcare Providers (Hospitals, Clinics)

- Employers/Corporate Wellness Programs

- Pharmaceutical Companies

Value Chain Analysis For Wellness and Mental Health Apps Market

The Value Chain of the Wellness and Mental Health Apps Market begins with the upstream activities centered on core technology development and clinical research. This includes the development of sophisticated algorithms (AI/ML/NLP), secure data infrastructure (cloud services), and the crucial clinical validation process, often involving partnerships with research institutions and licensed therapists to establish efficacy. Successful upstream activities focus on creating evidence-based content and highly personalized user experiences, ensuring that the therapeutic claims are scientifically substantiated and comply with evolving healthcare standards. Key participants at this stage include specialized software developers, data scientists, and clinical psychologists who design the interventions.

The downstream segment focuses heavily on user acquisition, distribution, and continuous engagement. Distribution channels are dominated by direct-to-consumer (D2C) sales via app stores (Apple App Store, Google Play Store), which require intensive marketing, SEO, and user interface (UI) optimization. Indirect channels are increasingly important, involving partnerships with insurance providers (payers), large employers (B2B wellness packages), and healthcare systems (EHR integration). The sustainability of the value chain is maintained through ongoing customer support, continuous content updates, and data security maintenance, all vital for retaining paying subscribers and ensuring the platform remains clinically relevant and technologically competitive.

The primary distribution method remains digital, though the influence of indirect channels is growing. Direct distribution allows providers greater control over branding and pricing but requires large marketing spends. Indirect distribution, especially through B2B models or integration with established Electronic Health Records (EHRs), offers rapid scaling and immediate credibility, moving the apps from optional consumer tools to recognized elements of formal patient care pathways. Establishing robust interoperability and ensuring HIPAA/GDPR compliant data transfer across the distribution network is crucial for tapping into the lucrative clinical and enterprise markets, marking a significant transition from relying solely on consumer discretionary spending to securing stable, reimbursed revenues.

Wellness and Mental Health Apps Market Potential Customers

Potential customers for the Wellness and Mental Health Apps Market span a broad demographic range, united by the increasing recognition of the need for accessible mental health support and proactive self-care. The largest segment is the individual consumer (D2C market), particularly Millennials and Gen Z, who are highly digital-native, comfortable discussing mental well-being, and seeking flexible, on-demand tools for stress management, sleep improvement, and general anxiety reduction. These users prioritize convenience, affordability (often through freemium or low-cost subscription models), and personalization. The successful acquisition of these consumers hinges on effective app store optimization, compelling content, and strong social proof or peer recommendations.

A rapidly expanding customer base lies within the corporate sector, including large multinational organizations and SMEs, procuring these apps for their employees as part of mandatory or voluntary Employee Assistance Programs (EAPs) and broader wellness initiatives. These organizational buyers are focused on measurable outcomes, such as reductions in stress-related absenteeism, improved productivity scores, and demonstrable return on investment (ROI). For this segment, apps must offer scalable enterprise dashboards, robust data privacy assurances, and integration capabilities with existing HR and benefits platforms, prioritizing B2B customized subscription packages over individual sales.

Furthermore, the clinical and governmental segments represent high-value potential customers, driven by the need for validated digital therapeutics (DTx) to supplement or replace traditional care. Healthcare providers (hospitals, psychiatrists, primary care physicians) and insurance payers seek FDA-approved or clinically certified apps that can be prescribed, covered by insurance, and seamlessly integrated into clinical workflows via EHRs. These customers demand the highest level of evidence-based validation, security compliance, and proven interoperability, viewing the app not just as a wellness tool but as a regulated medical device capable of generating clinical-grade data for remote patient monitoring and treatment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 7.5 Billion |

| Market Forecast in 2033 | USD 20.8 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Calm, Headspace, BetterUp, Ginger (Headspace Health), Talkspace, Woebot Health, Happify Health, Mindstrong Health, Lyra Health, Teladoc Health (myStrength), SilverCloud Health, Wysa, Sleep Cycle, Sanvello, Youper, Moodpath, Insight Timer, Endel, Feel, Neuroflow |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wellness and Mental Health Apps Market Key Technology Landscape

The technological landscape of the Wellness and Mental Health Apps Market is rapidly evolving, driven primarily by the maturation of artificial intelligence, advancements in biometric sensor technology, and the development of sophisticated platforms for seamless integration with clinical systems. Key technologies include machine learning (ML) algorithms used for predictive modeling, analyzing subtle changes in user behavior, voice cadence, and physiological data to anticipate psychological distress before it becomes acute. Natural Language Processing (NLP) is foundational for conversational AI and therapeutic chatbots, enabling them to understand emotional context, provide relevant coping strategies, and maintain a high degree of personalization, thus democratizing access to immediate emotional support and basic cognitive restructuring exercises.

Integration with Internet of Things (IoT) devices, particularly wearables like smartwatches and fitness trackers, is crucial. This technology allows apps to continuously gather passive data, such as heart rate variability (HRV), sleep duration and quality, and daily activity levels, which serve as objective markers for stress and anxiety. The secure transmission and aggregation of this sensitive biometric data necessitate robust, compliant cloud infrastructure, often leveraging technologies like blockchain for enhanced data integrity and user control over their personal health information. The interoperability challenge is being addressed through API-driven architectures, ensuring that app data can flow securely into Electronic Health Records (EHRs) used by human clinicians, supporting hybrid care models.

Furthermore, technologies enabling true digital therapeutics (DTx) are increasingly prominent. This involves using sophisticated, often proprietary, software programs that deliver evidence-based therapeutic interventions directly to the patient, requiring regulatory clearance akin to traditional pharmaceutical or medical devices. These platforms often incorporate gamification and virtual reality (VR) elements to enhance engagement, making therapy more interactive and immersive, particularly effective for treating phobias or certain types of anxiety disorders. The development of clinical-grade data security protocols and compliance frameworks (e.g., adherence to ISO 27001 standards) is a non-negotiable technological requirement for penetrating the high-value B2B and clinical segments of the market.

Regional Highlights

Regional dynamics significantly influence the adoption and maturity of the Wellness and Mental Health Apps Market, reflecting varying healthcare structures, regulatory environments, and cultural attitudes toward mental health. North America, encompassing the United States and Canada, stands as the global leader in market value. This dominance is attributed to high consumer spending power, deep penetration of smartphones, extensive venture capital funding supporting innovation, and a growing acceptance of telemedicine and digital health solutions, especially within corporate wellness and private insurance schemes. The presence of major industry players and a regulatory environment (FDA approval processes for DTx) that, while rigorous, provides clear pathways for commercialization, further solidifies its leading position. Demand is consistently high due to the elevated rates of workplace stress and clinical burnout.

Europe represents a mature yet highly regulated market, with growth driven largely by public healthcare systems seeking cost-effective, scalable solutions to manage long waiting lists for traditional therapy. Countries like the UK (NHS) and Germany are actively piloting and integrating digitally prescribed apps into their formal care pathways, focusing heavily on security and multilingual localization to cater to diverse national populations. The stringent data protection requirements under GDPR necessitate high investment in compliance technology, which sometimes slows market entry but ultimately fosters greater consumer trust. Adoption is strong in Western and Northern Europe, while Southern and Eastern European markets are emerging, constrained by lower digital healthcare infrastructure investment.

Asia Pacific (APAC) is anticipated to be the fastest-growing market globally, presenting immense untapped potential driven by demographic size and the relatively underdeveloped state of traditional mental health infrastructure across many nations, creating a necessity for digital alternatives. Rapid urbanization, increasing disposable incomes, and the widespread adoption of 5G technology accelerate the use of mobile health solutions. Key growth markets include China, Japan, and India, where localized content, culturally sensitive therapeutic models, and strategic partnerships with local telecommunications and healthcare groups are essential for success. Governments in the region are increasingly investing in digital public health programs to mitigate the massive societal cost of untreated mental health issues, viewing apps as a primary tool for population-level resilience building and basic psychological support.

- North America: Market leader; driven by strong VC funding, high consumer adoption, favorable reimbursement landscape, and increasing corporate wellness investment. Key focus on regulated Digital Therapeutics (DTx) and advanced AI integration.

- Europe: High regulatory scrutiny (GDPR); growth driven by integration into national healthcare systems (e.g., NHS, Germany's DiGA framework); focus on clinical validation and multilingual content localization.

- Asia Pacific (APAC): Fastest growing region; high potential due to massive underserved populations, increasing smartphone penetration, and government support for digital health initiatives in countries like China and India.

- Latin America (LATAM): Emerging market; growth constrained by economic instability but driven by high need for accessible mental healthcare; focused on basic stress/anxiety apps and telehealth integration.

- Middle East and Africa (MEA): Nascent stage; fragmented market; localized growth in Gulf Cooperation Council (GCC) countries focusing on premium services and enterprise wellness programs for expatriate and high-income populations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wellness and Mental Health Apps Market.- Calm

- Headspace

- BetterUp

- Ginger (Headspace Health)

- Talkspace

- Woebot Health

- Happify Health

- Mindstrong Health

- Lyra Health

- Teladoc Health (myStrength)

- SilverCloud Health

- Wysa

- Sleep Cycle

- Sanvello

- Youper

- Moodpath

- Insight Timer

- Endel

- Feel

- Neuroflow

- Quilt

- Breethe

- Lazarus 3.0

- Meru Health

- Big Health

Frequently Asked Questions

Analyze common user questions about the Wellness and Mental Health Apps market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Wellness and Mental Health Apps Market?

The Wellness and Mental Health Apps Market is forecasted to demonstrate robust expansion, projected to achieve a Compound Annual Growth Rate (CAGR) of 15.5% between the years 2026 and 2033, driven by increasing mental health awareness and technology integration.

How are AI and Machine Learning impacting the effectiveness of mental health applications?

AI significantly enhances app effectiveness by enabling hyper-personalization of therapeutic content, providing predictive analytics to anticipate psychological distress, and powering therapeutic chatbots (NLP) for scalable, immediate emotional support, moving toward clinically validated digital therapeutics.

What is the primary difference between wellness apps and Digital Therapeutics (DTx) in this market?

Wellness apps offer general self-improvement tools (e.g., meditation, sleep tracking) and are unregulated consumer products. Digital Therapeutics (DTx) are regulated software programs that deliver evidence-based therapeutic interventions to treat specific medical conditions, requiring stringent clinical trials and regulatory approval (e.g., FDA clearance).

Which geographical region holds the largest market share in the global mental health apps sector?

North America currently holds the largest market share due to high consumer spending, strong technological infrastructure, and a well-established ecosystem of private insurance coverage and venture capital investment supporting rapid innovation in digital health solutions.

What are the main concerns regarding data privacy and security for mental health app users?

Primary concerns involve the security and use of highly sensitive personal health information (PHI), including potential data breaches, algorithmic bias in treatment recommendations, and compliance with strict global privacy regulations such as HIPAA and GDPR, demanding transparency in data handling policies.

Are mental health apps being integrated into formal corporate wellness programs?

Yes, integration into corporate wellness is a major growth driver. Enterprises are increasingly adopting premium, subscription-based mental health apps as Employee Assistance Programs (EAPs) to reduce absenteeism, combat burnout, and demonstrably improve workforce productivity and overall mental resilience, often demanding B2B customized platforms.

What role do wearables and IoT play in advancing mental health app capabilities?

Wearables and IoT devices provide critical, objective biometric data (e.g., heart rate variability, sleep quality) that is integrated into mental health apps. This passive data collection allows for more accurate mood tracking, stress detection, and tailored intervention delivery, enhancing the clinical relevance of the applications beyond self-reported measures.

What challenges does the market face concerning clinical validation and credibility?

Many consumer-grade apps lack rigorous clinical trials to support their efficacy claims, leading to skepticism among healthcare providers. The challenge lies in standardizing validation processes and securing regulatory clearances necessary for insurers and clinicians to prescribe and reimburse the apps as legitimate healthcare interventions.

How is the segmentation by subscription model evolving in the market?

The market is shifting predominantly toward paid subscription and freemium models. While freemium attracts initial users, premium subscriptions offering extensive features, personalized coaching, and clinically validated content are increasingly preferred, ensuring a more stable and high-value revenue stream for developers.

Which demographic segment is showing the highest adoption rate for digital mental health tools?

Millennials and Generation Z exhibit the highest adoption rates, driven by their comfort with technology, proactive approach to mental wellness, and willingness to seek help through accessible, non-traditional, and non-stigmatized digital channels compared to older generations.

What opportunities exist for market expansion in the Asia Pacific region?

Opportunities in APAC are driven by large, underserved populations, increasing internet and smartphone penetration, and government initiatives prioritizing digital public health. Success requires strong content localization, cultural sensitivity, and strategic partnerships with local telecommunication and healthcare providers.

How important is interoperability with Electronic Health Records (EHRs) for market growth?

Interoperability is crucial for securing clinical acceptance and integrating apps into the formal healthcare ecosystem. Seamless data flow between apps and EHRs supports hybrid care, remote patient monitoring, and enables clinicians to leverage app-generated data for informed decision-making and patient management.

What is the role of the pharmaceutical industry in the mental health apps market?

Pharmaceutical companies are actively investing in mental health apps, often through strategic partnerships or acquisitions, to develop companion digital therapeutics that complement their drug treatments, improve patient adherence, or gather real-world evidence (RWE) related to drug efficacy and patient outcomes.

How are providers addressing user churn and low long-term engagement in wellness apps?

Providers address churn by leveraging AI for hyper-personalized content scheduling, utilizing gamification techniques to maintain motivation, and evolving into hybrid models that incorporate periodic human coaching or check-ins to foster accountability and long-term therapeutic engagement beyond basic self-help features.

What kind of technological advancements are expected in the next few years in this sector?

Expected advancements include more sophisticated predictive ML models, wider adoption of generative AI for personalized conversational therapy, clinical-grade passive biomarker monitoring through advanced sensor fusion, and seamless integration of virtual and augmented reality (VR/AR) for immersive therapeutic experiences.

How does the regulatory environment in Europe (GDPR) specifically impact app development?

GDPR mandates stringent requirements for data minimization, security, and obtaining explicit consent for processing sensitive mental health data. This forces developers to invest heavily in robust encryption and privacy-by-design architecture, increasing development costs but significantly strengthening user trust and regulatory compliance for European market entry.

Is there a noticeable shift toward B2B or B2C models in the current market landscape?

While B2C remains the largest volume segment, there is a distinct, profitable shift toward B2B models (corporate wellness) and B2B2C (healthcare system integration) as developers seek more stable, large-scale contracts with higher revenue certainty, driven by the demand for clinically verifiable outcomes.

How do mental health apps contribute to addressing the global shortage of licensed therapists?

Apps offer a scalable solution by providing immediate, accessible, and asynchronous support, effectively triaging low-to-moderate severity cases and offering preventative tools. They free up human therapist time to focus on complex, high-acuity patients, thereby expanding the overall capacity and reach of the mental healthcare infrastructure.

What specific applications are leading the growth in the current market segmentation?

The most rapid growth is observed in the Digital Therapeutics (DTx) segment due to increased regulatory recognition and the Anxiety and Depression Management segment, reflecting the high global prevalence of these conditions and the consumer demand for evidence-based coping tools.

Why is clinical validation critical for the future success of mental health apps?

Clinical validation is essential for moving mental health apps from discretionary consumer purchases to reimbursed medical interventions. Validation builds trust with clinicians, proves therapeutic efficacy, secures acceptance by payers (insurance), and is mandatory for regulatory clearance, ensuring long-term market credibility and revenue growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager