Wet Strength Kraft Paper Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433142 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Wet Strength Kraft Paper Market Size

The Wet Strength Kraft Paper Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 21.3 Billion by the end of the forecast period in 2033.

Wet Strength Kraft Paper Market introduction

Wet Strength Kraft Paper is a highly specialized form of packaging and industrial paper engineered to retain a significant percentage of its mechanical integrity and tensile strength when exposed to moisture, high humidity, or direct liquid contact. This unique characteristic is achieved through the incorporation of specific chemical additives, primarily urea-formaldehyde (UF) or melamine-formaldehyde (MF) resins, during the pulping or paper manufacturing process, which create strong cross-linkages between cellulose fibers. The base material, Kraft pulp, is inherently robust due to its long cellulose fibers, and the subsequent wet strength treatment enhances its performance profile, making it indispensable in demanding applications where durability under adverse environmental conditions is paramount. The product serves as a vital component in preserving product quality and ensuring supply chain resilience, especially for moisture-sensitive goods or applications involving cryogenic conditions.

The primary applications of Wet Strength Kraft Paper span several critical industries, notably in food and beverage packaging (such as ice bags, fresh produce wraps, and beverage carriers), construction (as concrete curing paper or protective layers), and agriculture (for seed packaging and fertilizer bags). Beyond these traditional uses, it finds extensive application in industrial sacks, protective overwraps, and specialized medical sterilization packaging where resistance to water, steam, or handling fluids is essential. The demand for sustainable yet functional packaging solutions is driving innovation in this market, focusing on developing environmentally friendly wet strength chemistries that maintain high performance while facilitating repulpability and biodegradability. This evolution caters to increasing consumer and regulatory preference for reduced environmental footprints.

The key benefits driving market adoption include enhanced product protection against spoilage and tearing, improved stackability and load-bearing capacity in humid environments, and cost-effectiveness compared to alternative materials like plastic films or treated textiles. Major driving factors include the booming e-commerce sector requiring robust secondary packaging, the global shift towards paper-based packaging alternatives replacing single-use plastics, and stringent regulations governing food safety and material integrity during transportation and storage. Furthermore, advancements in coating and barrier technologies applied to wet strength paper are expanding its utility into liquid packaging and oil-resistant applications, positioning the market for sustained, robust growth across various segments globally.

Wet Strength Kraft Paper Market Executive Summary

The Wet Strength Kraft Paper Market is poised for substantial expansion, underpinned by converging trends in sustainable packaging mandates, burgeoning global demand from the fresh produce and frozen goods sectors, and technological improvements in manufacturing efficiency. Business trends highlight a strong emphasis on backward integration by major packaging converters to secure stable raw material (pulp) supply and forward integration into specialized printing and converting services, thereby offering end-to-end solutions. Key market players are prioritizing investments in research and development to substitute traditional formaldehyde-based resins with bio-based or non-toxic wet strength agents, aligning with circular economy principles and increasingly strict health and safety standards in developed economies. Mergers and acquisitions remain a consistent feature, enabling companies to quickly expand geographic reach, diversify product portfolios, and acquire specialized coating expertise, crucial for maintaining a competitive edge.

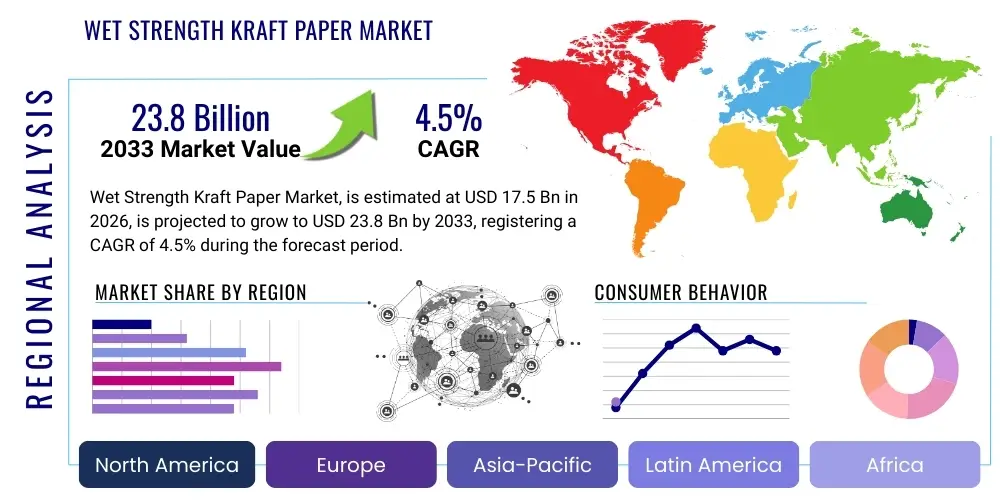

Regionally, the Asia Pacific (APAC) continues to lead the market in terms of volume consumption, driven by rapid urbanization, massive infrastructural development, and the expansion of organized retail and cold chain logistics, particularly in China and India. North America and Europe, while mature, are characterized by high-value growth focused on premium applications and sustainability compliance. European regulations, specifically concerning the reduction of plastic packaging (e.g., the EU Packaging and Packaging Waste Regulation), are accelerating the conversion from plastic films to paper sacks and specialized wraps, creating robust demand for high-performance wet strength variants. Latin America and the Middle East and Africa (MEA) represent high-potential growth markets, fueled by increasing industrialization and rising consumer spending power, necessitating improved protective packaging for exports and domestic distribution.

Segment trends indicate that the Bleached Wet Strength Kraft Paper segment is experiencing faster revenue growth, particularly in applications requiring aesthetic appeal and high printability, such as branded food packaging and specialty shopping bags. However, the Unbleached segment maintains dominance by volume due to its cost-effectiveness and utilization in heavy-duty industrial applications like cement bags and large agricultural sacks. In terms of end-use, the Food and Beverage sector remains the undisputed leader, with specific acceleration seen in the frozen foods and quick-service restaurant (QSR) industries, where moisture resistance is non-negotiable for consumer convenience and hygiene. The market is also witnessing a trend toward lighter basis weights without compromising strength, driven by efforts to reduce material consumption and lower transportation costs across the entire supply chain.

AI Impact Analysis on Wet Strength Kraft Paper Market

User queries regarding the impact of Artificial Intelligence (AI) on the Wet Strength Kraft Paper market frequently center on three core themes: optimization of complex manufacturing processes, forecasting volatile pulp prices and demand fluctuations, and enhancing quality control systems. Users are concerned with how AI can address the high energy consumption associated with paper production and the consistency challenges inherent in applying wet strength chemicals. The core expectations revolve around utilizing machine learning (ML) algorithms for predictive maintenance of highly specialized machinery, optimizing chemical dosing to reduce material waste while maximizing wet strength performance, and employing advanced analytics to better manage global supply chain risks related to sourcing wood pulp and specialty additives.

The immediate influence of AI is being felt in production efficiency and process control. AI-driven predictive maintenance systems analyze sensor data from paper machines (speed, temperature, vibration, moisture content) to anticipate equipment failures, minimizing expensive downtime and increasing overall equipment effectiveness (OEE). Furthermore, ML models are being deployed to optimize the pulp refining process and the precise application of wet strength additives. By analyzing real-time data on fiber composition, moisture content, and chemical formulation, AI ensures tighter quality tolerances, reducing variability in the final product’s tensile strength and water resistance. This automated quality assurance is critical for high-stakes applications like cement bags and medical wraps, where product failure is unacceptable.

On the strategic and commercial front, AI algorithms are revolutionizing demand forecasting and inventory management for Wet Strength Kraft Paper producers. Given the long lead times for sourcing pulp and the cyclical nature of demand from construction and agriculture sectors, accurate forecasting is paramount. AI analyzes vast datasets, including historical sales, macroeconomic indicators, seasonal weather patterns, and commodity price trends, to generate highly accurate demand predictions, enabling producers to optimize production schedules, manage raw material procurement efficiently, and minimize costly inventory holding. Additionally, AI-powered systems are crucial in optimizing logistics and distribution routes for large, bulky paper products, leading to reduced fuel consumption and lower carbon emissions across the supply chain, which is a significant selling point in the increasingly green-conscious market.

- AI enhances predictive maintenance, reducing machine downtime by up to 30%.

- Machine learning optimizes chemical dosing for precise wet strength resin application, minimizing material waste.

- Advanced analytics improves accuracy in forecasting volatile pulp prices and segment-specific demand.

- Computer vision systems enhance automated quality control, ensuring strict adherence to tensile strength standards.

- AI algorithms optimize supply chain logistics and routing for bulky paper rolls, cutting transportation costs and emissions.

DRO & Impact Forces Of Wet Strength Kraft Paper Market

The Wet Strength Kraft Paper market’s trajectory is heavily influenced by a delicate balance of robust sustainability drivers and persistent material and cost restraints, tempered by significant growth opportunities arising from evolving global consumer habits and regulatory landscapes. Key drivers include the pervasive global push to replace single-use plastics, creating an inherent demand pull for functional paper-based packaging, particularly in moist or frozen applications where standard paper fails. However, the market is restrained by the inherent volatility and increasing cost of high-quality wood pulp, coupled with the capital intensity of specialized paper manufacturing infrastructure, which poses barriers to entry for new players. The ongoing search for effective, non-toxic, and repulpable wet strength chemicals presents both a challenge and a massive opportunity for innovation, allowing companies that successfully transition to sustainable chemistries to capture significant market share.

Major driving forces include the sustained growth in the construction and infrastructure sector globally, necessitating durable paper sacks for cement, plaster, and other building materials that often endure damp storage conditions. Concurrently, the burgeoning global cold chain logistics for perishable goods, particularly frozen meat, produce, and seafood, mandates packaging that can withstand condensation and temperature fluctuations without physical degradation. The opportunity landscape is expanding through the development of multi-layer paper structures incorporating wet strength properties alongside enhanced barrier coatings (e.g., grease or oxygen barriers), enabling the penetration of new, higher-value food service and industrial applications previously dominated solely by plastic or foil composites. Furthermore, emerging markets are industrializing rapidly, adopting more sophisticated packaging standards for both domestic consumption and export purposes, providing a fertile ground for volume growth.

Restraining factors primarily involve regulatory scrutiny surrounding traditional wet strength agents, specifically the formaldehyde-based resins, leading to compliance complexities and investment needs for developing safer alternatives. Moreover, the recyclability concern remains a technical hurdle; while many modern wet strength treatments allow for repulping, the process is often more energy-intensive than recycling standard paper, sometimes leading waste management facilities to categorize it differently. Impact forces currently favoring market growth include strong societal preferences for biodegradable materials and sustained government incentives promoting bio-based packaging solutions across North America and Europe. Counteracting these positive forces are the periodic supply chain disruptions and inflationary pressures on energy and chemical input costs, which directly influence the profitability and final pricing of Wet Strength Kraft Paper products globally.

Segmentation Analysis

The Wet Strength Kraft Paper market segmentation is meticulously structured based on chemical treatment type, basis weight, end-use application, and color (bleached/unbleached). This analytical framework allows market participants to accurately gauge demand heterogeneity and tailor product offerings to specific industry requirements. The segmentation by chemical treatment, differentiating between traditional UF/MF resins and modern Polyamide-Epichlorohydrin (PAE) resins and emerging bio-based alternatives, is critical for understanding future regulatory compliance and innovation trends, particularly regarding food contact materials. Basis weight classification, ranging from lightweight (<70 GSM) used in specialized wraps and bags to heavyweight (>120 GSM) used in multi-wall industrial sacks, dictates the material’s primary application suitability and cost per unit area, providing insights into purchasing patterns across industrial and retail segments.

The most significant differentiation in the market stems from the end-use application segments, which reveal the functional diversity and strategic importance of wet strength paper. Key sectors such as Food and Beverage, Construction, and Agriculture possess distinct demand characteristics regarding moisture resistance, mechanical durability, and printability requirements. For instance, the Food and Beverage sector prioritizes high hygiene standards and non-toxic treatments, driving demand for bleached paper treated with FDA-approved agents, whereas the Construction industry focuses on maximum tear strength and durability for bulk materials. This deep segmentation allows manufacturers to allocate production capacity effectively and focus R&D efforts on performance characteristics that deliver the highest value in target verticals.

Future growth analysis within these segments suggests that the PAE-treated segment will continue to dominate due to its favorable performance-to-cost ratio and regulatory acceptance, although bio-based segments are forecasted to experience the highest proportional growth rates from a smaller base. Geographically, the segmentation confirms that high-volume, low-cost unbleached applications remain concentrated in APAC and MEA, while the North American and European markets drive the demand for premium, highly printed, bleached, and sustainably certified Wet Strength Kraft Paper variants. Understanding these segmented dynamics is crucial for formulating effective market entry strategies and maximizing return on capital investment in new manufacturing capacity.

- By Treatment Type:

- Urea-Formaldehyde (UF) Resins

- Melamine-Formaldehyde (MF) Resins

- Polyamide-Epichlorohydrin (PAE) Resins (Most Dominant)

- Bio-based/Starch-based Wet Strength Agents

- By Basis Weight:

- Lightweight (< 70 GSM)

- Medium Weight (70 – 120 GSM)

- Heavyweight (> 120 GSM)

- By Grade:

- Bleached Wet Strength Kraft Paper

- Unbleached Wet Strength Kraft Paper

- By End-Use Application:

- Food and Beverage (Ice Bags, Frozen Food Wraps, Beverage Carriers)

- Construction (Cement Sacks, Plaster Bags, Curing Paper)

- Agriculture and Horticulture (Seed Bags, Fertilizer Sacks, Plant Sleeves)

- Industrial Packaging (Multi-wall Sacks, Protective Wraps)

- Consumer Goods (Retail Bags, Floral Packaging)

- Healthcare (Sterilization Wraps)

Value Chain Analysis For Wet Strength Kraft Paper Market

The value chain for the Wet Strength Kraft Paper market is complex, beginning with highly concentrated upstream raw material sourcing and extending through specialized conversion processes and varied downstream distribution channels. The upstream segment is dominated by the procurement of virgin wood pulp, primarily softwood, which is essential for achieving the long fiber length required for high mechanical strength. Chemical suppliers, providing crucial wet strength resins (PAE, UF, MF) and specialized coatings, form the other critical upstream component. High energy costs associated with pulp processing and paper manufacturing represent a significant cost driver at this stage, placing continuous pressure on producers to maximize operational efficiencies. Global commodity price fluctuations of wood fiber dictate the initial cost structure of the final product, necessitating strong long-term sourcing contracts and robust inventory management practices.

Mid-stream activities encompass the core manufacturing of the wet strength paper, involving integrated pulp and paper mills utilizing advanced Fourdrinier machines to ensure quality and consistency, followed by precise application of wet strength agents either at the wet end or through surface sizing. This stage is capital-intensive, requiring specialized machinery and high technical expertise to manage chemical reactions and drying processes. Following production, the paper is supplied in large rolls to converters. These converters constitute the immediate downstream segment, specializing in transforming the paper rolls into final products such as multi-wall sacks, retail bags, printed wraps, or specialized industrial liners through cutting, printing, gluing, and forming processes. Converters often employ direct distribution channels when supplying large industrial end-users like cement manufacturers.

Distribution channels for Wet Strength Kraft Paper are bifurcated into direct and indirect routes. Direct distribution is prevalent for high-volume, standardized products supplied to major industrial consumers (e.g., global construction companies or large food processing plants), offering benefits in terms of tailored specifications and bulk pricing. Indirect channels involve wholesalers, distributors, and specialized packaging brokers, which are vital for reaching smaller enterprises, regional agricultural producers, and diverse retail segments that require smaller order quantities and localized inventory support. Effective management of the distribution logistics, particularly for heavy paper rolls and finished sacks, is crucial, emphasizing the need for regional distribution hubs and efficient transportation networks to maintain competitive pricing and responsiveness across the extensive global customer base.

Wet Strength Kraft Paper Market Potential Customers

The primary potential customers for Wet Strength Kraft Paper are industrial entities and specialized packaging users who prioritize material resilience against moisture, high humidity, or direct contact with liquids, where the structural integrity of the packaging is paramount to product safety and supply chain efficiency. Key buying criteria for these customers include verifiable tensile strength metrics (both dry and wet), certified resistance to tearing and puncture, consistency in runnability on high-speed conversion equipment, and increasingly, certifications regarding food contact safety and environmental sustainability (such as FSC or PEFC certification). The sheer volume requirements of major industrial segments, particularly those involved in global trade of commodities, make them consistently high-value targets for Wet Strength Kraft Paper manufacturers.

The Food and Beverage industry represents the largest and most dynamic segment of buyers, ranging from large multinational frozen food producers and quick-service restaurant chains to regional agricultural cooperatives supplying fresh produce. These customers require materials for applications like secondary packaging for refrigerated goods, ice cube bags, beverage multi-packs, and specialized grease-resistant wraps where moisture or condensation is unavoidable. Their purchasing decisions are heavily influenced by regulatory compliance (e.g., FDA/EU food safety standards) and the material's ability to maintain a premium brand image, driving demand for bleached and highly printable grades. The reliance on paper for sustainable branding in this sector ensures ongoing high demand and fosters customer loyalty towards reliable suppliers.

Beyond the food sector, significant potential customers reside in the Construction and Infrastructure industries, requiring durable multi-wall sacks for bulk materials like cement, tile adhesive, and dry mortar mixes, which are frequently stored in non-climate-controlled environments. Agricultural customers, including large seed producers and fertilizer distributors, also form a core buyer base, needing moisture-resistant packaging to preserve product efficacy and extend shelf life under challenging field conditions. Furthermore, the burgeoning growth in e-commerce, specifically for protective packaging materials utilized for shipping durable goods that might encounter adverse weather during transit, solidifies a rapidly growing customer segment prioritizing barrier properties and cost-effective, sustainable protection.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 21.3 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | WestRock, International Paper, Mondi Group, Smurfit Kappa, BillerudKorsnäs, Domtar, Twin Rivers Paper Company, KapStone Paper and Packaging (a subsidiary of WestRock), Packaging Corporation of America (PCA), Stora Enso, Daio Paper Corporation, Resolute Forest Products, KRPA Holding, Segezha Group, Nordic Paper, Shanying International, Nippon Paper Industries, Cascades Inc., Georgia-Pacific, Verso Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Wet Strength Kraft Paper Market Key Technology Landscape

The technological landscape of the Wet Strength Kraft Paper market is continuously evolving, primarily focusing on enhancing functional performance, improving sustainability metrics, and optimizing manufacturing efficiency. A core technological advancement revolves around the shift from traditional wet-end chemistry (using UF/MF) to more environmentally benign and high-performance cross-linking agents, specifically Polyamide-Epichlorohydrin (PAE) resins. PAE-based technologies offer superior wet strength retention and are generally considered safer for food contact applications. Current research is heavily invested in developing fully biodegradable and bio-based wet strength polymers derived from natural sources, such as modified starches or cellulose derivatives, addressing regulatory pressure and market demand for circular packaging solutions while maintaining necessary performance standards, particularly in challenging environments.

Pulping and refining technologies also play a crucial role, ensuring the consistent quality of the long cellulose fibers necessary for robust Kraft paper. Continuous digesters and advanced oxygen delignification processes are optimized to yield high-strength pulp with lower environmental impact. In the paper machine section, sophisticated process control systems, often integrated with AI, are used to precisely monitor and control sheet formation, fiber orientation, and moisture profile across the width of the paper web. Techniques like surface sizing and specialized coating applications are being refined to not only apply the wet strength agent but also to incorporate additional barrier layers (e.g., mineral coatings, extrusion coatings) for enhanced grease or vapor resistance, expanding the paper's utility into previously inaccessible packaging applications like oil-resistant wraps or moisture-vapor barrier sacks.

Furthermore, technology related to converting and finishing is highly significant. High-speed, multi-wall bag-making machinery must be capable of handling the stiffness and abrasive nature of high-grammage wet strength paper, requiring robust machinery and specialized gluing systems that maintain integrity under humid conditions. Digital printing technologies are increasingly integrated into the converting process, allowing for high-resolution branding and variable data printing on customized wet strength sacks and wraps, meeting the sophisticated marketing demands of key end-users in the food and consumer goods sectors. Innovations in repulpability testing and verification also form a critical technological focus, ensuring that these high-performance materials can be effectively reintroduced into the recycling stream, fulfilling the circular economy mandate.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market by volume, driven primarily by massive infrastructural investments in countries like China, India, and Southeast Asia, leading to soaring demand for cement and construction materials packaged in multi-wall wet strength sacks. The rapid expansion of e-commerce, particularly in cold chain logistics for packaged foods, further fuels the consumption of moisture-resistant wraps and bags. Manufacturing capacity is rapidly expanding here, focused on achieving economies of scale for both bleached and unbleached industrial grades.

- North America: This region is characterized by high demand for premium, bleached Wet Strength Kraft Paper utilized heavily in the Food and Beverage sector, particularly for frozen foods, fast food, and specialized industrial packaging. Growth is significantly influenced by stringent environmental regulations and consumer preference favoring bio-based and sustainable packaging. Key drivers include robust demand from the US agricultural sector for seed and fertilizer packaging, alongside sophisticated industrial applications requiring high consistency and quality control.

- Europe: Europe exhibits high-value growth, heavily regulated by EU directives pushing for drastic reductions in plastic packaging, thereby accelerating the substitution process in retail, consumer, and industrial segments. The region leads in the adoption of innovative, non-toxic, and repulpable wet strength chemistries (bio-based agents), focusing on certified sustainable sourcing (FSC, PEFC). Germany, France, and the Nordic countries are central hubs for advanced paper manufacturing and converting technologies aimed at premium, high-barrier applications.

- Latin America (LATAM): LATAM is an emerging market showing steady growth, supported by urbanization and the expansion of the formal retail sector. Demand is concentrated in agricultural exports (requiring robust packaging for fresh produce) and domestic construction activities. The market here relies heavily on imported technology and materials, though local manufacturing capacity is growing, aiming to meet regional demand for basic and medium-weight industrial packaging solutions.

- Middle East and Africa (MEA): This region is heavily dependent on imports for high-quality specialized paper, but local demand is surging due to large-scale infrastructure projects (especially in the GCC states) and increasing food security initiatives. The challenging climate (high heat and humidity) necessitates particularly robust wet strength performance, making quality specifications critical. Opportunities exist for suppliers capable of providing cost-effective, durable packaging for commodities like cement, sugar, and grains.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Wet Strength Kraft Paper Market.- WestRock

- International Paper

- Mondi Group

- Smurfit Kappa

- BillerudKorsnäs

- Domtar

- Twin Rivers Paper Company

- KapStone Paper and Packaging (a subsidiary of WestRock)

- Packaging Corporation of America (PCA)

- Stora Enso

- Daio Paper Corporation

- Resolute Forest Products

- KRPA Holding

- Segezha Group

- Nordic Paper

- Shanying International

- Nippon Paper Industries

- Cascades Inc.

- Georgia-Pacific

- Verso Corporation

Frequently Asked Questions

Analyze common user questions about the Wet Strength Kraft Paper market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for Wet Strength Kraft Paper globally?

The primary driver is the widespread governmental and consumer-led regulatory shift away from single-use plastic packaging toward sustainable, fiber-based alternatives. This transition is amplified by the exponential growth of cold chain logistics and the frozen food sector, which requires packaging that maintains structural integrity under high moisture and condensation conditions, a core competence of wet strength paper.

How does the use of Polyamide-Epichlorohydrin (PAE) resins influence the market and product quality?

PAE resins have become the industry standard for high-performance wet strength paper due to their superior cross-linking efficiency, resulting in excellent wet tensile strength retention. Furthermore, PAE is generally preferred over older urea-formaldehyde treatments because it complies better with modern food contact regulations, ensuring the safety and high quality required for sensitive applications like food and medical packaging.

Is Wet Strength Kraft Paper recyclable, and what are the associated environmental challenges?

Yes, modern Wet Strength Kraft Paper, particularly that treated with PAE or bio-based agents, is recyclable (repulpable). However, the recycling process requires specialized mechanical and chemical treatment to break the resin cross-linkages. The environmental challenge lies in ensuring that recycling facilities can process these materials efficiently without excessive energy consumption, encouraging ongoing innovation in developing easily detachable or dispersible wet strength chemistries.

Which end-use industry represents the largest revenue share in the Wet Strength Kraft Paper Market?

The Food and Beverage industry consistently holds the largest revenue share due to the diverse and critical applications spanning fresh produce packaging, ice bags, frozen food wraps, and beverage carriers. The necessity for protective, moisture-resistant packaging in this sector, coupled with stringent hygiene standards, mandates the use of specialized, often bleached, high-grade wet strength products.

What role does technological innovation play in mitigating raw material price volatility for manufacturers?

Technological innovation mitigates price volatility primarily through process optimization and material substitution. Advanced AI/ML systems optimize pulp utilization and minimize chemical waste during production, lowering the overall cost per ton. Additionally, R&D focused on using alternative fiber sources or lightweighting the paper without compromising strength helps reduce reliance on expensive, volatile virgin softwood pulp commodities, stabilizing manufacturing costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager